Unit 1

Basic concepts

Income

According to section 2(24) of the Income Tax act 1961, income includes—

(i) profits and gains;

(ii) dividend;

(iii) voluntary contributions received by a trust created wholly or partly for charitable or religious purposes or by an institution established wholly or partly for such purposes or by an association or institution referred to in clause (21) or clause (23), or by a fund or trust or institution referred to in sub-clause (iv) or

(iv) the value of any benefit or perquisite, whether convertible into money or not, obtained from a company either by a director or by a person who has a substantial interest in the company, or by a relative of the director or such person, and any sum paid by any such company in respect of any obligation which, but for such payment, would have been payable by the director or other person aforesaid;

(v) any sum chargeable to income-tax under clauses (ii) and (iii) of section 28 or section 41 or section 59;

(vi) any capital gains chargeable under section 45;

(vii) the profits and gains of any business of insurance carried on by a mutual insurance company or by a co-operative society, computed in accordance with section 44 or any surplus taken to be such profits and gains by virtue of provisions contained in the First Schedule;

(viii) any winnings from lotteries, crossword puzzles, races including horse races, card games games and other games of any sort or from gambling or betting of any form or nature whatsoever.

Total Income

According to section 2(45) total income means the total amount of income referred to in section 5, computed in the manner laid down in this Act. Section 5 of the act provides scope of total Income-

(1) Subject to the provisions of this Act, the total income of any previous year of a person who is a resident includes all income from whatever source derived which-

(a) is received or is deemed to be received in India in such year by or on behalf of such person; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year; or

(c) accrues or arises to him outside India during such year:

Provided that, in the case of a person not ordinarily resident in India within the meaning of sub-section (6) of section 6, the income which accrues or arises to him outside India shall not be so included unless it is derived from a business controlled in or a profession set up in India.

(2) Subject to the provisions of this Act, the total income of any previous year of a person who is a non-resident includes all income from whatever source derived which—

(a) is received or is deemed to be received in India in such year by or on behalf of such person; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year.

Agricultural income

According to section 2(1A) of the income tax act 1961, agricultural income means—

(a) any rent or revenue derived from land which is situated in India and is used for agricultural purposes;

(b) any income derived from such land by—

(i) agriculture; or

(ii) the performance by a cultivator or receiver of rent-in-kind of any process ordinarily employed by a cultivator or receiver of rent-in-kind to render the produce raised or received by him fit to be taken to market; or

(iii) the sale by a cultivator or receiver of rent-in-kind of the produce raised or received by him, in respect of which no process has been performed other than a process of the nature described in paragraph (ii) of this sub-clause ;

(c) any income derived from any building owned and occupied by the receiver of the rent or revenue of any such land, or occupied by the cultivator or the receiver of rent-in-kind, of any land with respect to which, or the produce of which, any process mentioned in paragraphs (ii) and (iii) of sub-clause (b) is carried on.

Casual income

Casual income means income in the nature of winning from lotteries, crossword puzzles, races including horse races, card games and other games of any sort, gambling, betting etc.

Where the total income of an assessee includes any income by way of winnings from any lottery or crossword puzzle or race including horse race (not being income from the activity of owning and maintaining race horses) or card game and other game of any sort or from gambling or betting of any form or nature whatsoever, the income-tax payable shall be the aggregate of—

(i) the amount of income-tax calculated on income by way of winnings from such lottery or crossword puzzle or race including horse race or card game and other game of any sort or from gambling or betting of any form or nature whatsoever, at the rate of 1 [thirty per cent.]; and

(ii) the amount of income-tax with which the assessee would have been chargeable had his total income been reduced by the amount of income referred to in clause (i).

Assessment year

According to section 2(9), assessment year means the period of twelve months commencing on the 1st day of April every year.

Previous year

Section 2(3) previous year means the financial year immediately preceding the assessment year:

Provided that, in the case of a business or profession newly set up, or a source of income newly coming into existence, in the said financial year, the previous year shall be the period beginning with the date of setting up of the business or profession or, as the case may be, the date on which the source of income newly comes into existence and ending with the said financial year.

Gross total income

Gross Total Income is the aggregate of all the income earned by the individuals during a specified period. According to Section 14 of the Income Tax Act 1961, the income of a person or an assessee can be categorised under these five heads,

- Income from Salaries

- Income from House Property

- Profits and Gains of Business and Profession

- Capital Gains

- Income from Other Sources

Specimen of calculation of gross total income

Income From Salary | Xx |

Add: Income Under the Head House Property | Xx |

Add: Profits and Gains of Business and Profession | Xx |

Add: capital gains Income | Xx |

Add: Income from Other Sources | Xx |

Gross Total Income | Xxx |

Less: Deductions under Section 80C to 80U | Xx |

Total Income | Xxx |

Total income

According to section 2(45) total income means the total amount of income referred to in section 5, computed in the manner laid down in this Act. Section 5 of the act provides scope of total Income-

(1) Subject to the provisions of this Act, the total income of any previous year of a person who is a resident includes all income from whatever source derived which-

(a) is received or is deemed to be received in India in such year by or on behalf of such person; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year; or

(c) accrues or arises to him outside India during such year:

Provided that, in the case of a person not ordinarily resident in India within the meaning of sub-section (6) of section 6, the income which accrues or arises to him outside India shall not be so included unless it is derived from a business controlled in or a profession set up in India.

(2) Subject to the provisions of this Act, the total income of any previous year of a person who is a non-resident includes all income from whatever source derived which—

(a) is received or is deemed to be received in India in such year by or on behalf of such person; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year.

Person

According to section 2(31) of person includes:

- Partnership Firms

- Company

- Association of person or body of individuals whether incorporated or not

- Local authorities

- Any other artificial judicial person not falling under any of the above sub sections.

Tax evasion

Tax avoidance is an act of using legal methods to minimize tax liability. In other words, it is an act of using tax regime in a single territory for one’s personal benefits to decrease one’s tax burden. Although Tax avoidance is a legal method, it is not advisable as it could be used for one’s own advantage to reduce the amount of tax that is payable. Tax avoidance is an activity of taking unfair advantage of the shortcomings in the tax rules by finding new ways to avoid the payment of taxes that are within the limits of the law. Tax avoidance can be done by adjusting the accounts in such a manner that there will be no violation of tax rules. Tax avoidance is lawful but in some cases it could come in the category of crime.

Tax Avoidance

Tax avoidance is an act of using legal methods to minimize tax liability. In other words, it is an act of using tax regime in a single territory for one’s personal benefits to decrease one’s tax burden. Although Tax avoidance is a legal method, it is not advisable as it could be used for one’s own advantage to reduce the amount of tax that is payable. Tax avoidance is an activity of taking unfair advantage of the shortcomings in the tax rules by finding new ways to avoid the payment of taxes that are within the limits of the law. Tax avoidance can be done by adjusting the accounts in such a manner that there will be no violation of tax rules. Tax avoidance is lawful but in some cases it could come in the category of crime.

Tax planning

Tax Planning means reducing tax liability by taking advantage of the legitimate concessions and exemptions provided in the tax law. It involves the process of arranging business operations in such a way that reduces tax liability. Tax planning is process of analyzing one’s financial situation in the most efficient manner. Through tax planning one can reduce one’s tax liability. It involves planning one’s income in a legal manner to avail various exemptions and deductions. Under Section 80C, one can avail tax deduction if specific investments are made for a specific period up to a limit of Rs 1, 50,000. The most popular ways of saving tax are investing in PPF accounts, National Saving Certificate, Fixed Deposit, Mutual Funds and Provident Funds. Tax planning involves applying various advantageous provisions which are legal and entitles the assesse to avail the benefit of deductions, credits, concessions, rebates and exemptions. Or we can say that Tax planning is an art in which there is a logical planning of one’s financial affairs in such a manner that benefits the assesse with all the eligible provisions of the taxation law. Tax planning is an honest approach of applying the provisions which comes within the framework of taxation law.

Example,

a) Investments Under Section 80C i.e. payment related deductions,

b) Under Section 80CCD i.e. contribution to Pension Fund of LIC or other insurance company

c) Reinvestment Under Section 54, 54EC etc.

Key Takeaways

- According to section 2(45) total income means the total amount of income referred to in section 5, computed in the manner laid down in this act.

Scope of total income

Scope of total income is provided under section 5 of the income tax act-

(1) Subject to the provisions of this Act, the total income of any previous year of a person who is a resident includes all income from whatever source derived which—

(a) is received or is deemed to be received in India in such year by or on behalf of such person; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year; or

(c) accrues or arises to him outside India during such year:

Provided that, in the case of a person not ordinarily resident in India within the meaning of subsection (6) of section 6, the income which accrues or arises to him outside India shall not be so included unless it is derived from a business controlled in or a profession set up in India.

(2) Subject to the provisions of this Act, the total income of any previous year of a person who is a non-resident includes all income from whatever source derived which—

(a) is received or is deemed to be received in India in such year by or on behalf of such person; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year

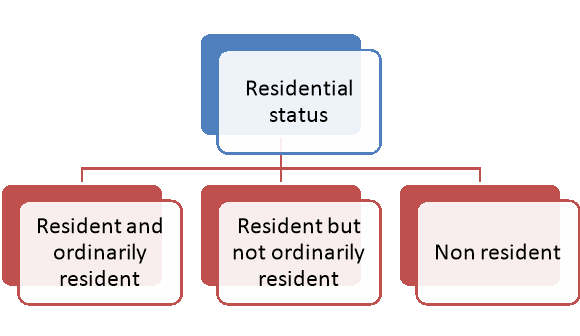

Residence and tax liability

Section 4(6) of the income tax act provides provisions for residential status of person in India. According to the Income Tax Act, 1961, residential status of a person is one of the important criteria in determining the tax implications. The residential status of a person can be categorised into-

a) Resident and Ordinarily Resident (ROR)

b) Resident but Not Ordinarily Resident (RNOR)

c) Non- Resident (NR)

Figure: Residential status

Such types are discussed below-

a) Resident and Ordinarily Resident (ROR)

A resident taxpayer is an individual who satisfies any one of the following conditions:

- Resides in India for a minimum of 182 days in a year, or

- Resided in India for a minimum of 365 days in the immediately preceding four years and for a minimum of 60 days in the current financial year.

b) Resident but Not Ordinarily Resident (RNOR)

If an individual qualifies as a resident, the next step is to determine if he/she is a Resident ordinarily resident (ROR) or an RNOR. He will be a ROR if he meets both of the following conditions:

- Has been a resident of India in at least 2 out of 10 years immediately previous years and

- Has stayed in India for at least 730 days in 7 immediately preceding years

c) Non- Resident (NR)

An individual satisfying neither of the conditions stated above conditions would be an non-resident for the year.

Taxability of residential status

The tax liability of persons according to residential status are discussed below-

- Resident:

A resident will be charged to tax in India on his global income i.e. income earned in India as well as income earned outside India.

2. Non-resident and Resident but not ordinarily resident:

Their tax liability in India is restricted to the income they earn in India. They need not pay any tax in India on their foreign income. Also note that in a case of double taxation of income where the same income is getting taxed in India as well as abroad, one may resort to the Double Taxation Avoidance Agreement (DTAA) that India would have entered into with the other country in order to eliminate the possibility of paying taxes twice.

Income which does not form part of total income

Exempted income is that income on which income tax is not chargeable. Such

Incomes are classified as under:

i) Incomes which do not form part of total income nor is income tax payable on them. They are called fully exempted incomes.

Ii) Incomes which are included in the total income but are exempt from income tax at the average rate of income tax applicable to the total income. They are called partially exempted incomes.

Iii) Incomes of certain Institutions or authorities are exempted subject to fulfilment of the required conditions.

List of exempted income

The list of exempted income is highlighted below-

1) Agricultural income [Sec.10 (1)]

Agricultural income from the land situated in India is fully exempted from

Income tax (Agricultural income definition given under Income Tax Act.)

2) Sum received by a member from Hindu undivided family [Sec.10 (2)]

Any sum received by a member of Hindu undivided family at the time of division is tax free.

3) Share of a partner in firm’s income [Sec.10 (2A)]

The share of a partner in firms profit is fully tax free.

4) Profit of newly established industrial undertaking in free trade zone [Sec.10AA].

5) Compensation received by victims of Bhopal gas leak disaster [Sec.10

(10BB)]

Any compensation paid under any Plan of Bhopal Gas Leak Disaster (Processing of claims Act, 1985) is exempted from tax.

6) Sum received from life insurance [Sec.10 (10D)]

Any sum received from life insurance Corporation as the maturity of insurance policy is fully exempt from tax, even bonus received is also fully exempted. But, Keyman Insurance Policy and any sum received under u/s 80DD(3) will not be exempted.

7) Sum received from Public Provident Fund [Sec.10 (11)]

Any sum received from public provident fund (in state bank and head offices) is fully exempted.

8) Payment from Sukanya Samridhi account [Sec.10 (11A)]

Any sum received from Sukanya Samridhi Account rules, 2014 made under Government saving bank Act, 1873 is fully exempt from tax.

9) Payment from National Payment System Trust [Sec.10 (12A)] Exempted Incomes

Any payment from national payment system trust u/s 80(CCD), if it does not exceed 40% of total amount, payable to assessee at time of closure of the scheme is exempt from tax.

10) Partial withdrawal from National Pension System Trust [Sec.10 (12B)]

Any withdrawal by the assessee from national pension system trust, upto 25% of it is tax free.

11) Interest, premium or bonus on specified investments [Sec.10(15)]

Like Annuity certificates, National Saving Certificates, Post Office Savings, Bank Account, Interest on relief Bonds, Post office cash certificates etc. are fully exempt from tax.

12) Scholarships [Sec.10 (16)]

Any fellowship or scholarship granted by Government for education and research work will be exempted.

13) Allowances of M.Ps and MLA’s [Sec.10 (17)]

For example daily allowances, constituency allowance, shall be exempt fully.

14) Award or reward [Sec.10 (17A)]

Any award in form of cash or kind granted by Central or State Government for work of literature or scientific shall be exempted. Any award from any other institution apart from Government, shall be exempted from tax provided, such exemption is approved by Central Government.

15) Pension to an individual awarded by ‘Vir Chakra’ [Sec.10 (18)]

Any amount in form of pension received by an individual or family who had been a central or state Government employee and was awarded ‘ParamVeer Chakra, Vir Chakra, Mahavir Chakra, shall be exempted.

16) Family pension to family members of armed forces [Sec.10 (19)]

Family pension to widow or children or nominated pension of a member of the armed forces died during operational duty shall be exempted.

17) Annual value of a palace of the Ex-rulers [Sec.10 (19A)]

18) Incomes of scheduled tribes [Sec.10 (26)]

Any income accrued to scheduled tribes living in tribal areas (as given in VI schedule of constitution) of State of Manipur, Sikkim, Tripura, Mizoram, Nagaland and Arunachal Pradesh shall be exempted.

19) Subsidy received from tea board [Sec.10(30)]

Any subsidy from tea Board, to the assessee, carrying on the business of growing and manufacturing tea in India, received shall be exempt from tax, provided, the certificate of exemption, has been presented to Income Tax officers.

20) Subsidy received by planters [Sec.10(31)]

Any subsidy from Rubber Board office or spice board, to the assessee, under any scheme for replantation of rubber plants or coffee plants etc. shall be exempt.

21) Income of minor child [Sec.10 (32)]

Income upto Rs.1,500/- in respect of minor is exempt from tax and any excess of that amount is included in parent’s income whose income is greater.

22) Capital gain on transfer of units of US-64 [Sec.10(33)]

Any capital gain on transfer of units US-64 shall be exempted provided such transfer is done on or after 1/4/2002.

23) Dividend from domestic company [Sec.10 (34)]

Any dividend declared by a domestic company is exempt from tax (with effect from AY 2004-05). It does not include dividend u/s 2(22) (e).

24) Any income received in respect of units of a mutual fund, Units from

The administrator of the specified undertaking or units from the specified

Company [Sec.10 (35)]

This income is exempt with effect from AY 2004-05.

25) Long term capital gain on eligible equity shares [Sec.10(36)]

This exemption is applicable only when shares have been held for at least 12 months and when investment have been made on or after 1/3/2003 and not later on 31st March, 2004.

26) Exemption of capital gains on compensation received on compulsory acquisition of agricultural land situated within specified urban cities [Sec.10 (37)].

Such exemption is available to an individual or Hindu undivided family, on short or long term capital gain, provided such compensation should be received on or after 1/4/2004 and land is used in agriculture preceding 2 years from compulsory acquisition.

27) Exemption of long term capital gain arising from sale of shares and units (With effect from 1-10-2004) [Not applicable W.e.f. AY 2019-20] [Sec.10 (38)].

28) Exemption of specified income from international sporting event held in India (with effect from assessment year 2006-07) [Sec.10 (39)].

29) Exemption in respect of grant etc. received by a subsidiary company from its holding company engaged in business of distribution of power [Sec.10 (40)] (with effect from AY 2006-07).

30) Exemption of capital gain to undertakings engaged in business of generation of power (with effect from assessment year 2006-07) [Sec.10 (41)].

31) Exemption of specified income of certain bodies or authorities (with Exempted Incomes effect from assessment year 2006-07) [Sec.10 (42)].

32) Exemption of amount received by an individual as loan under reserve mortgage scheme [Sec.10 (43)]

Such exemption is available to senior citizen, who does not make payment

Of principal amount and interest throughout his life under the scheme.

33) Exemption of sum received by an individual on behalf of new pension scheme trust [Sec.10 (44)].

34) Perquisites and allowances to chairman and members of Union Public

Service Commission [Sec.10 (45)]

If chairman and members of UPSC have not been retired, then the following allowances and perquisites are exempted, rent free official residence, transport allowance, and leave travel concession. If retired, then Rs.14, 000 pm for meeting expenses and Rs.1,500 pm for residential telephone.

35) Exemption of a specified income of notified body or authority or trust or board or commission [Sec.10 (46)].

36) Income of infrastructure debt fund [Sec.10 (47)]

Such exemption can be availed, only if return of income is filed as per section 139.

37) Income of foreign company [Sec.10 (48)]

Such exemption is allowed to a foreign company in India, only if any income is received by sale of crude oil (in Indian currency).

38) Income of foreign company on account of storage of crude oil [Sec.10 (48A)].

39) Income of National Financial Holdings Company Limited [Sec.10 (49)].

Such company must have been set up by central Government relating to the AY on or before 1st April, 2014.

Key Takeaways

- Section 4(6) of the income tax act provides provisions for residential status of person in India. According to the income tax act, 1961, residential status of a person is one of the important criteria in determining the tax implications.

References:

1. Singhanai V.K.: Student’s Guide to Income Tax; Taxmann, Delhi.

2. Prasad, Bhagwati: Income Tax Law & practice: Wiley Publication, New Delhi.

3. Dinker Pagare: Income Tax Law and Practice; Sultan Chand & Sons, New Delhi.

4. Girish Ahuja and Ravi Gupta; Systematic approach to income tax; Sahitya Bhawan Publications, New Delhi.

5. Chandra Mahesh and Shukla D.C.: Income Tax Law and Practice; Pragati Publications, New Delhi.