Unit 2

Heads of income

Salaries

Salary is chargeable to tax either on ‘due’ basis or on ‘receipt’ basis, whichever is earlier. Hence, taxable salary includes:

- Advance salary (on ‘receipt’ basis)

Salary paid in advance is taxable under the head ‘Salaries’ in the year of receipt.

- Outstanding salary (on ‘due’ basis)

Salary falling due is taxable under the head ‘Salaries’ in the year in which it falls due.

- Arrear salary

Any increment in salary with retrospective effect which have not been taxed in the past, such arrears will be taxed in the year in which it is allowed. Arrear salary are taxable on receipt basis

In case Salary is received after deduction of following items... These are added back to get fully Salary:

(i) Own Contribution to Provident Fund.

(ii) Tax Deducted at Source (TDS)

(iii) Repayment of Loan etc.

(iv) LIC Premium, if deducted from salary.

(v) Group Insurance Scheme.

(vi) Rent of House provided by employer.

Salary U/s 17(1):

1.Wages. Fully Taxable.

2.Annuity or Pension. Fully Taxable

3.Gratuity. It has been treated separately.

4. (a) Any Fees -- Fully Taxable

(b) Commission -- Fully Taxable

(c) Bonus -- Fully Taxable

(d) Perquisites -- (Perks) These are treated separately u/s 17(2)

(e) Profit in lieu of Salary -- These are treated separately u/s17(3)

5.Salary in lieu of Leave / Leave Encashment. Fully Taxable.

6.Advance Salary. Fully Taxable

7.Arrears of Salary. Fully Taxable.

8.Refund of Provident Fund (PF)

(a) If SPF -- Fully exempted

(b) If RPF -- Fully exempted if service is more than 5 years.

(c) If URPF -- Taxable portion is added in salary income. Taxable portion is equal to employer’s contribution + interest on this part. Interest on own contribution to URPF is taxable under the head “Income from Other Sources.”

Allowances:

A. Fully Exempted Allowances:

Foreign Allowance given by Govt. To its employees posted abroad. HRA given to Judges of High Court & Supreme Court.

B. Fully Taxable Allowances:

(i) Dearness Allowance / Additional D.A. / High Cost of Living Allowance -- Fully Taxable.

(ii) City Compensation Allowances (CCA).

(iii) Capital Compensatory Allowance

(iv) Lunch Allowance

(v) Tiffin Allowance

(vi) Marriage / Family Allowance

(vii) Overtime Allowance

(viii) Fixed Medical Allowance.

(ix) Electricity and Water Allowance

(x) Entertainment Allowance. It is fully added in employee’s Salary.

In case of Government employees a deduction is allowed u/s 16(ii) at the rate of least of following:

(a) Statutory Limit Rs. 5,000 p.a.

(b) 1/5 (20%) th of Basic Salary ; or

(c) Actual Entertainment Allowance received.

Partly Taxable Allowances:

1. House Rent Allowance ( HRA)

(a) Fully Exempted, if received by the Judges of High Court and Supreme Court.

(b) Fully Taxable, if received by an employee who is living in his own house or in a house for which no rent is paid.

(c) Exempted upto least of following for those employees who are living in rented houses:

(i) Actual HRA received by the employee.

(ii) Rent paid - 10% of Salary; or

(iii) 40% of Salary in ordinary town; 50% of Salary in Mumbai, Kolkata, Chennai or Delhi.

Ø Taxable HRA = HRA Received - Least of Above.

Ø Salary = Pay + D.A. Which enters into Pay for Service or Retirement Benefits + Commission on Turnover Achieved by Him.

Following Allowances are Exempted upto actual expenditure incurred for employment. Excess, if any, shall be taxable...

2. Uniform Allowance

3. Conveyance Allowance

4. Traveling Allowance

Following Allowance are Exempted up to amount so notified.

5. Special Compensatory Allowance

6. Border Area Allowance

7. Tribal Area Allowance -- Exempted upto Rs. 200 p.m. If received in the States of M.P., Tamil Nadu, U.P., Karnataka, Tripura, Assam, West Bengal, Bihar, or Orissa.

8. Children’s Education Allowance -- Exempted up to Rs.100 p.m. Per child for education in India of own two children only.

9. Hostel Expenditure Allowance -- Exempted up to Rs. 300 p.m. Per child for Hostel expenditure on own two children only.

Perquisites:

A. Exempted Perquisites:

1. Leave Travel Concession subject to conditions & actual spent only for travels.

2. Computer/ Laptop provided for official / personal use.

3. Initial Fees paid for corporate membership of a club.

4. Refreshment provided by the Employer during working hours in office premises.

5. Payment of annual premium on Personal Accident Policy.

6. Subscription to periodicals and journal required for discharge of work.

7. Provision of Medical Facilities.

8. Gift not exceeding Rs. 5,000 p.a.

9. Use of Health Club, Sports facility.

10. Free telephones whether fixed or mobile phones.

11. Interest Free / concessional loan of an amount not exceeding Rs.20,000 (limit not application in the case of medical treatment)

12. Contribution to recognised Provident Fund / approved super annulation fund, pension or deferred annuity scheme & staff group insurance scheme.

13. Free meal provided during working hours or through paid non-transferable vouchers not exceeding Rs. 50 per meal or free meal provided during working hours in a remote area.

The value of any benefit provided free or at a concessional rate (including goods sold at concessional rate) by a company to the Employees by way of allotment of shares etc., under the Employees stock option plan as per Central Government Guidelines.

B. Taxable Perquisites:

1. Rent Free Accommodation

2. Provision of Motor Car or any other Conveyance for personal use of Employee.

3. Provision of Free or Concessional Education Facilities.

4. Reimbursement of Medical Expenditure.

5. Expenditure on Foreign Travel and stay during medical expenditure.

6. Supply of Gas, Electricity & Water.

7. Sale of an Asset to the Employee at concessioanal price including sale of Share in the Employer Company.

C. Perks Exempted for Employees but Taxable for Employer under Fringe Benefit Tax.

Value of the following benefits is not taxable in the hands of an employee. The employer has to pay tax on deemed income calculated as percentage of expenditure incurred.

- Any free or concessional ticket provided by the employer for private journeys of his employee or their family members

- Any contribution by the employer to an approved superannuation fund for employees;

- It includes-

- Expenditure incurred on entertainment;

- Expenditure incurred on provision of hospitality of every kind by the employer to any person.

- Expenditure incurred on conference like conveyance, tour & travel (including foreign travel), on hotel, or boarding and lodging in connection with any conference shall be deemed to be expenditure incurred for the purposes of conference.

- Expenditure incurred on sales promotions including publicity;

- Expenditure incurred on employee’s welfare;

- Expenditure incurred on conveyance

- Expenditure incurred on Hotel, Boarding & Lodging facilities;

- Expenditure incurred on Repair, Maintenance of Motor Cars and the amount of Depreciation there on.

- Expenditure incurred on use of telephone and Mobile Phones.

- Expenditure incurred on maintenance of any accommodation in the nature of Guest House other than used for Training purpose.

- Expenditure incurred on Festival Celebrations.

- Expenditure incurred on use of Health Club and similar facilities.

- Expenditure incurred on gifts;

Fringe Benefit Tax (FBT) is not applicable in case of following type of employers.

- An Individual or a sole Proprietor

- A Hindu Undivided Family

- Government

- A Political Party

- A person whose income is exempt u/s 10(23c)

- A Charitable Institution registered u/s 12AA.

- RBI

- SEBI

Profits in Lieu of Salary:

Receipts which are included under the head ‘Salary’ but Exempted u/s 10.

1. Leave Travel Concession (LTC) - Exempt upto rules.

2. Any Foreign Allowance or perks - If given by Govt. To its employees posted abroad are fully exempted.

3. Gratuity: A Govt. Employee or semi-Govt. Employee where Govt. Rules are applicable -- Fully Exempted.

A. For employees covered under Payment of Gratuity Act.--

Exempt up to least of following:

(a) Notified limit = Rs. 10,00,000

(b) 15 days Average Salary for every one completed year of

service (period exceeding 6 months =1 year)

1/2 month’s salary = (Average monthly salary or wages x 15/26

(c) Actual amount received.

B. Other Employees -- Exempted up to least of following provided service is more than 5 years or employee has not left service of his own :

(a) Notified limit = Rs. 10,00,000

(b) 1/2 month’s average salary for every one year of completed service (months to be ignored.)

(c) Actual amount received

Average Salary = Salary for 10 months preceding the month of retirement divided by 10.

4. Commutation of Pension:

In case commuted value of pension is received --

(a) If Govt. Employee -- is Fully Exempted.

(b) If other employee who receive gratuity also -Lump sum amount is exempted upto commuted value of 1/3rd of Pension.

If other employee who does not get gratuity -- Lump sum amount is exempted upto commuted value of 1/2 of pension.

5. Leave Encashment u/s 10(10AA)

(a) If received at the time of retirement by a Govt. Employee---Fully Exempted

(b) If received during service---Fully taxable for all employees

(c) If received by a private sector employee at the time of retirement exempted upto:

(i) Notified limit Rs. 3,00,000

(ii) Average salary x 10 months

(iii) Actual amount received.

(iv) Average Salary x No. Of months leave due.

6. Any Tax on perks paid by employer. It is fully Exempted.

7. Any payment received out of SPF Any payment received out of SPF is Fully Exempted.

8. Any payment received out of RPF Any payment received out of RPF is Fully Exempted, If service exceeds 5 years.

9. Any payment received out of an approved superannuation fund . is Fully Exempted

Deduction Out Of Gross Salary [ Sec. 16]

1. Entertainment Allowance [ U/s 16(ii)]

Deduction u/s 16(ii) admission to govt. Employee shall be an amount equal to least of following :

- Statutory Limit of Rs.5,000 p.a.

- 1/5 th of Basic Salary

- Actual amount of entertainment allowance received during the previous year.

2. Tax on Employment u/s 16(iii

In case any amount of professional tax is paid by the employee or by his employer on his behalf it is fully allowed as deduction.

Deduction U/S 80C Out Of Gross Total Income (GTI)

The following are the main provisions of the newly inserted Section 80C.:

- Under Section 80C, deduction would be available from Gross Total Income.

- Deduction under section 80C is available only to individual or HUF.

- Deduction is available on the basis of specified qualifying investments / contributions / deposits / payments made by the taxpayer during the previous year.

- The maximum amount deduction under section 80C, 80CCC, and 80CCD can not exceed Rs.1 lakh.

Deduction u/s 80C shall be allowed only to the following assessee:

- An Individual

- A Hindu Undivided Family (HUF)

![Computation of 'Salary' Income [Section 15-17]](https://glossaread-contain.s3.ap-south-1.amazonaws.com/epub/1649462853_1759655.jpeg)

Income from house property (Section 22)

The annual value of property consisting of any buildings or lands appurtenant thereto of which the assessee is the owner, other than such portions of such property as he may occupy for the purposes of any business or profession carried on by him the profits of which are chargeable to income-tax, shall be chargeable to income-tax under the head ―income from house property.

Annual value how determined (section 23)

(1) For the purposes of section 22, the annual value of any property shall be deemed to be—

(a) the sum for which the property might reasonably be expected to let from year to year; or

(b) where the property or any part of the property is let and the actual rent received or receivable by the owner in respect thereof is in excess of the sum referred to in clause (a), the amount so received or receivable; or

(c) where the property or any part of the property is let and was vacant during the whole or any part of the previous year and owing to such vacancy the actual rent received or receivable by the owner in respect thereof is less than the sum referred to in clause (a), the amount so received or receivable:

Provided that the taxes levied by any local authority in respect of the property shall be deducted (irrespective of the previous year in which the liability to pay such taxes was incurred by the owner according to the method of accounting regularly employed by him) in determining the annual value of the property of that previous year in which such taxes are actually paid by him.

(2) Where the property consists of a house or part of a house which—

(a) is in the occupation of the owner for the purposes of his own residence; or

(b) cannot actually be occupied by the owner by reason of the fact that owing to his employment, business or profession carried on at any other place, he has to reside at that other place in a building not belonging to him, the annual value of such house or part of the house shall be taken to be nil.

(3) The provisions of sub-section (2) shall not apply if—

(a) the house or part of the house is actually let during the whole or any part of the previous year; or

(b) any other benefit therefrom is derived by the owner.

(4) Where the property referred to in sub-section (2) consists of more than one house—

(a) the provisions of that sub-section shall apply only in respect of one of such houses, which the assessee may, at his option, specify in this behalf;

(b) the annual value of the house or houses, other than the house in respect of which the assessee has exercised an option under clause (a), shall be determined under sub-section (1) as if such house or houses had been let.

Deductions from income from house property (Section 24)

Income chargeable under the head ―Income from house property‖ shall be computed after making the following deductions, namely:—

(a) a sum equal to thirty per cent. Of the annual value;

(b) where the property has been acquired, constructed, repaired, renewed or reconstructed with borrowed capital, the amount of any interest payable on such capital:

Provided that in respect of property referred to in sub-section (2) of section 23, the amount of deduction shall not exceed thirty thousand rupees:

Amounts not deductible from income from house property (Section 25)

Interest chargeable under this Act which is payable outside India (not being interest on a loan issued for public subscription before the 1st day of April, 1938), on which tax has not been paid or deducted under Chapter XVII-B and in respect of which there is no person in India who may be treated as an agent under section 163 shall not be deducted in computing the income chargeable under the head ―Income from house property.

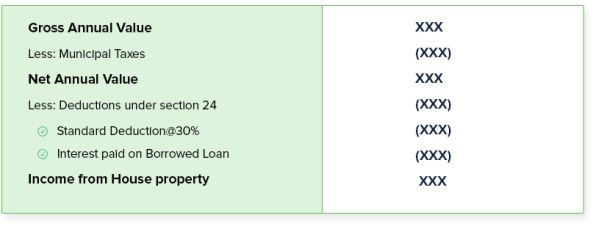

How to calculate Income from House Property for income tax purposes?

The income tax categorises your income under two categories for the purpose of taxability of house property income. These are:

Self-Occupied House Property | This is the type of property that is self owned and used for own residential purposes. This may be occupied by the owner’s family or relative or self. A property that is unoccupied is considered as a self-occupied property for the purpose of income tax. Before the Financial Year 2019-20 if taxpayer owns more than one house property, only one is considered as self-occupied property and rest are assumed to be let out. From 2019-20 onwards two properties are considered as self-occupied properties. |

Let Out House Property | Any house property that is rented for complete or part of the year is considered as a let out property for income tax purposes. |

Note : Inherited Property Any property inherited from parents, grandparents, etc, can be either considered as self-occupied or let out house property based on the usage as discussed above. | |

Steps to compute “Income from House Property”

The calculation of income from house property involves various steps. These steps are common to both the categories of house property Self-Occupied and Let Out. These are:

Calculation of Income from House property

Calculation/Assessment of “Income from House Property” in both cases – Self-occupied and Let Out

Type of House Property | Self-Occupied Property | Let Out Property |

Gross Annual Value

Income from House property | Nil | XXX |

Important Note: From the F.Y. 2017-18,set of loss of income from house property from other sources of income is restricted to Rs. 2,00,000. | ||

How to calculate the Gross Annual Value of House Property?

Assessment of Gross Annual Value of Self-Occupied House Property:

The annual value will be nil if the individual self-occupies the only property he or she owns. However, if the person has multiple properties with the purpose of self-occupation, only one property is considered as self-occupied and its annual value can be specified as nil. The assessment of the annual value of the remaining properties will be done according to the expected rent if the property was let out.

Assessment of Gross Annual Value of Let-Out House Property:

Step 1: Find out the Reasonable Expected Rent of the Property (A)

Reasonable Expected Rent is the amount for which the property can be reasonably be expected to be let out from year to year. It is higher of the Municipal Valuation or Fair Rent of the property, but cannot exceed the standard rent determined as per the Rent Control Act. Reasonable Expected Rent = Higher of Municipal Valuation or Fair Rent, subject to maximum Standard Rent

Step 2: Find out the Actual Rent Received or Receivable (B)

Step 3: Higher of (A) or (B), is the Gross Annual Value.

Section 28 highlights the following income shall be chargeable to income-tax under the head ―Profits and gains of business or profession,—

(i) the profits and gains of any business or profession which was carried on by the assessee at any time during the previous year;

(ii) any compensation or other payment due to or received by,—

(a) any person, by whatever name called, managing the whole or substantially the whole of the affairs of an Indian company, at or in connection with the termination of his management or the modification of the terms and conditions relating thereto.

(b) any person, by whatever name called, managing the whole or substantially the whole of the affairs in India of any other company, at or in connection with the termination of his office or the modification of the terms and conditions relating thereto;

(c) any person, by whatever name called, holding an agency in India for any part of the activities relating to the business of any other person, at or in connection with the termination of the agency or the modification of the terms and conditions relating thereto;

(d) any person, for or in connection with the vesting in the Government, or in any corporation owned or controlled by the Government, under any law for the time being in force, of the management of any property or business;

- Income derived by a trade, professional or similar association from specific services performed for its members;

- The value of any benefit or perquisite, whether convertible into money or not, arising from business or the exercise of a profession;

- Any interest, salary, bonus, commission or remuneration, by whatever name called, due to, or received by, a partner of a firm from such firm.

- (vi) any sum received under a Keyman insurance policy including the sum allocated by way of bonus on such policy.

- Any sum, whether received or receivable, in cash or kind, on account of any capital asset (other than land or goodwill or financial instrument) being demolished, destroyed, discarded or transferred, if the whole of the expenditure on such capital asset has been allowed as a deduction under section 35AD.

Income from profits and gains of business or profession, how computed (Section 29)

The income referred to in section 28 shall be computed in accordance with the provisions contained in sections 30 to 43D.

Rent, rates, taxes, repairs and insurance for buildings (Section 30)

In respect of rent, rates, taxes, repairs and insurance for premises, used for the purposes of the business or profession, the following deductions shall be allowed—

(a) where the premises are occupied by the assessee—

(i) as a tenant, the rent paid for such premises; and further if he has undertaken to bear the cost of repairs to the premises, the amount paid on account of such repairs;

(ii) otherwise than as a tenant, the amount paid by him on account of current repairs to the premises;

(b) any sums paid on account of land revenue, local rates or municipal taxes;

(c) the amount of any premium paid in respect of insurance against risk of damage or destruction of the premises.

Repairs and insurance of machinery, plant and furniture (section 31)

In respect of repairs and insurance of machinery, plant or furniture used for the purposes of the business or profession, the following deductions shall be allowed—

(i) the amount paid on account of current repairs thereto;

(ii) the amount of any premium paid in respect of insurance against risk of damage or destruction thereof.

Depreciation (Section 32)

(1) In respect of depreciation of—

(i) buildings, machinery, plant or furniture, being tangible assets;

(ii) know-how, patents, copyrights, trademarks, licences, franchises or any other business or commercial rights of similar nature, being intangible assets acquired on or after the 1st day of April, 1998 owned, wholly or partly, by the assessee and used for the purposes of the business or profession, the following deductions shall be allowed—

(i) in the case of assets of an undertaking engaged in generation or generation and distribution of power, such percentage on the actual cost thereof to the assessee as may be prescribed;

(ii) in the case of any block of assets, such percentage on the written down value thereof as may be prescribed:

(a) any motor car manufactured outside India, where such motor car is acquired by the assessee after the 28th day of February, 1975 but before the 1st day of April, 2001, unless it is used—

(i) in a business of running it on hire for tourists; or

(ii) outside India in his business or profession in another country; and

(b) any machinery or plant if the actual cost thereof is allowed as a deduction in one or more years under an agreement entered into by the Central Government under section 42.

Rates of depreciation

Rates of depreciation on the following assets:

- Building for residential use: 5%;

- Building for non-residential use: 10%;

- Furniture and fittings: 10%;

- Computers including software: 40%;

- Plant and machinery: 15%;

- Motor vehicles for personal use: 15%;

- Motor vehicles for commercial use: 30%;

- Ships: 20%;

- Aircraft: 40%;

- All intangible assets: 25%.

Condition for claiming depreciation under Income tax

For availing the deduction on depreciation, an assessee will have to fulfill some conditions. These conditions are as follows:

- Classification of Assets:

For availing the benefit of depreciation, the owner of the asset should be an assessee. The asset can be tangible or intangible. With respect to a tangible asset, the asset should be a building, machinery, plant or furniture. With respect to intangible assets, assets should be patent rights, copyrights, trademark, license, franchise or any similar nature which is acquired on or after 1.04.1998. While calculating the depreciation on the building, the income tax department calculates the depreciation only on the building. They don’t calculate the cost of the land on which the building is situated. The reason behind not including the cost of the land into the building is that land does not suffer any depreciation because of wear and tear or its usage.

2. Ownership vs lease:

An assessee can claim the depreciation only on those capital assets which are owned by him. If the assessee wants to avail the deduction on the depreciation of building then assessee should be the owner of those buildings. It is not necessary that an assessee should be the owner of that land. If an assessee has constructed the building but the land belongs to someone else then he has a right to claim the deduction of depreciation on buildings. If the assessee is a tenant or using the building then he can’t claim the deduction. If an assessee has taken the lease of the land and has constructed a building on that land, he is entitled to avail the allowances of depreciation. In the case of hire and purchase, if an assessee hires the machinery for a short period of time then, in that case, he is not entitled to claim the deduction. But, in case of purchase, if an assessee acquires the property and becomes the owner of the property he is entitled to claim the deduction.

3. Used for the purpose of profession or business:

For availing the allowance for depreciation, it is necessary that the asset has been used for the purpose of business or profession. However, it is not necessary for availing the allowance for depreciation, for which an assessee will have to use the asset throughout the accounting year. Thus, if the assessee has used the asset for a small period of time in an accounting year then he is entitled to avail the allowances for depreciation. You can take the example of any seasonal factory. Let’s take the example of sugar factories. Sugar factories don’t open for a whole year but if the asset has been used at any time during the accounting year in a factory then in such conditions factory owners are entitled to claim depreciation. Under Section 38 of the Income Tax Act 1961, the income tax officer has a right to determine the proportionate part of the depreciation.

4. Can’t claim the deduction on sold assets:

An assessee cannot claim the deduction on depreciable assets. If an asset is sold, destroyed or demolished in the same year when it was acquired then assessee cannot claim the deduction. If an asset has a co-owner then the co-owner can also claim the depreciation on the asset.

Gain arising on transfer of capital asset is charged to tax under the head “Capital Gains”. Income from capital gains is classified as “Short Term Capital Gains” and “Long Term Capital Gains”.

Capital asset is defined to include:

(a) Any kind of property held by an assessee, whether or not connected with business or profession of the assesse.

(b) Any securities held by a FII which has invested in such securities in accordance with the regulations made under the SEBI Act, 1992. However, the following items are excluded from the definition of “capital asset”:

(i) any stock-in-trade (other than securities referred to in (b) above), consumable stores or raw materials held for the purposes of his business or profession ;

(ii) personal effects, that is, movable property (including wearing apparel and furniture) held for personal use by the taxpayer or any member of his family dependent on him, but excludes—

(a) jewellery;

(b) archaeological collections;

(c) drawings;

(d) paintings;

(e) sculptures; or

(f) any work of art.

“Jewellery" includes—

a. Ornaments made of gold, silver, platinum or any other precious metal or any alloy containing one or more of such precious metals, whether or not containing any precious or semi-precious stones, and whether or not worked or sewn into any wearing apparel;

b. Precious or semi-precious stones, whether or not set in any furniture, utensil or other article or worked or sewn into any wearing apparel;

(iii)Agricultural Land in India, not being a land situated: a. Within jurisdiction of municipality, notified area committee, town area committee, cantonment board and which has a population of not less than 10,000;

b. Within range of following distance measured aerially from the local limits of any municipality or cantonment board:

i. Not being more than 2 KMs, if population of such area is more than 10,000 but not exceeding 1 lakh;

Ii. Not being more than 6 KMs, if population of such area is more than 1 lakh but not exceeding 10 lakhs; or

Iii. Not being more than 8 KMs, if population of such area is more than 10 lakhs. Population is to be considered according to the figures of last preceding census of which relevant figures have been published before the first day of the year. (iv)61/2 per cent Gold Bonds,1977 or 7 per cent Gold Bonds, 1980 or National Defence Gold Bonds, 1980 issued by the Central Government; (v) Special Bearer Bonds, 1991; (vi)Gold Deposit Bonds issued under the Gold Deposit Scheme, 1999 or deposit certificates issued under the Gold Monetisation Scheme, 2016.

Types of capital gain

It is of two types-

Figure: Types of capital gain

- Short term capital gain:

Any capital asset held by the taxpayer for a period of not more than 36 months immediately preceding the date of its transfer will be treated as short-term capital asset. However, in respect of certain assets like shares (equity or preference) which are listed in a recognised stock exchange in India (listing of shares is not mandatory if transfer of such shares took place on or before July 10, 2014), units of equity oriented mutual funds, listed securities like debentures and Government securities, Units of UTI and Zero Coupon Bonds, the period of holding to be considered is 12 months instead of 36 months.

2. Long term capital gain:

Any capital asset held by the taxpayer for a period of more than 36 months immediately preceding the date of its transfer will be treated as long-term capital asset. However, in respect of certain assets like shares (equity or preference) which are listed in a recognised stock exchange in India (listing of shares is not mandatory if transfer of such shares took place on or before July 10, 2014), units of equity oriented mutual funds, listed securities like debentures and Government securities, Units of UTI and Zero Coupon Bonds, the period of holding to be considered is 12 months instead of 36 months

Capital gains on distribution of assets by companies in liquidation (section 46)

(1) Notwithstanding anything contained in section, where the assets of a company are distributed to its shareholders on its liquidation, such distribution shall not be regarded as a transfer by the company for the purposes of section 45.

(2) Where a shareholder on the liquidation of a company receives any money or other assets from the company, he shall be chargeable to income-tax under the head ―Capital gains, in respect of the money so received or the market value of the other assets on the date of distribution, as reduced by the amount assessed as dividend within the meaning of sub-clause (c) of clause (22) of section 2 and the sum so arrived at shall be deemed to be the full value of the consideration for the purposes of section 48.

Capital gains on purchase by company of its own shares or other specified securities (section 46A)

Where a shareholder or a holder of other specified securities receives any consideration from any company for purchase of its own shares or other specified securities held by such shareholder or holder of other specified securities, then, subject to the provisions of section 48, the difference between the cost of acquisition and the value of consideration received by the shareholder or the holder of other specified securities, as the case may be, shall be deemed to be the capital gains arising to such shareholder or the holder of other specified securities, as the case may be, in the year in which such shares or other specified securities were purchased by the company.

Tax on long-term capital gain

Generally, long-term capital gains are charged to tax @ 20% (plus surcharge and cess as applicable), but in certain special cases, the gain may be (at the option of the taxpayer) charged to tax @ 10% (plus surcharge and cess as applicable). The benefit of charging long-term capital gain @ 10% is available only in following cases:

1) Long-term capital gains arising from sale of listed securities and it exceeds Rs. 1,00,000 (Section 112A);

2) Long-term capital gains arising from transfer of any of the following asset:

a) Any security (*) which is listed in a recognised stock exchange in India;

b) Any unit of UTI or mutual fund (whether listed or not) ($); and

c) Zero coupon bonds (*) Securities for this purpose means “securities” as defined in section 2(h) of the Securities Contracts (Regulation) Act, 1956. This definition generally includes shares, scrips, stocks, bonds, debentures, debenture stocks or other marketable securities of a like nature in or of any incorporated company or other body corporate, Government securities, such other instruments as may be declared by the Central Government to be securities and rights or interest in securities. ($) This option is available only in respect of units sold on or before 10-7-2014.

Long-term capital gains arising from sale of listed securities

The Finance Act, 2018 inserts a new Section 112A with effect from Assessment Year 2019-20. As per the new section capital gains arising from transfer of a long term capital asset being an equity share in a company or a unit of an equity oriented fund or a unit of a business trust shall be taxed at the rate of 10 per cent of such capital gains exceeding Rs. 1,00,000. This concessional rate of 10 per cent will be applicable if:

a) in a case of an equity share in a company, securities transaction tax has been paid on both acquisition and transfer of such capital asset; and

b) in a case a unit of an equity oriented fund or a unit of a business trust, STT has been paid on transfer of such capital asset. The cost of acquisitions of a listed equity share acquired by the taxpayer before February 1, 2018, shall be deemed to be the higher of following:

a) The actual cost of acquisition of such asset; or

b) Lower of following:

(i) Fair market value of such shares as on January 31, 2018; or

(ii) Actual sales consideration accruing on its transfer. The Fair market value of listed equity share shall mean its highest price quoted on the stock exchange as on January 31, 2018. However, if there is no trading in such shares on January 31, 2018, the highest price of such share on a date immediately preceding January 31, 2018 on which trading happens in that share shall be deemed as its fair market value.

In case of units which are not listed on recognized stock exchange, the net asset value of such units as on January 31, 2018 shall be deemed to be its FMV. In a case where the capital asset is an equity share in a company which is not listed on a recognised stock exchange as on 31-1-2018 but listed on the date of transfer, the cost of unlisted shares as increased by cost inflation index for the financial year 2017-18 shall be deemed to be its FMV.

Long-term capital gains arising from transfer of specified asset

A taxpayer who has earned long-term capital gains from transfer of any listed security or any unit of UTI or mutual fund (whether listed or not), not being covered under Section 112A, and Zero coupon bonds shall have the following two options: a. Avail of the benefit of indexation; the capital gains so computed will be charged to tax at normal rate of 20% (plus surcharge and cess as applicable). b. Do not avail of the benefit of indexation; the capital gain so computed is charged to tax @ 10% (plus surcharge and cess as applicable). The selection of the option is to be done by computing the tax liability under both the options, and the option with lower tax liability is to be selected.

Income from other sources has provided under section 56 of the income tax act, 1961-

(1) Income of every kind which is not to be excluded from the total income under this Act shall be chargeable to income-tax under the head ―Income from other sources‖, if it is not chargeable to income-tax under any of the heads specified in section 14, items A to E.

(2) In particular, and without prejudice to the generality of the provisions of sub-section (1), the following incomes, shall be chargeable to income-tax under the head ―Income from other sources‖, namely:—

(i) dividends;

(ii) income from machinery, plant or furniture belonging to the assessee and let on hire, if the income is not chargeable to income-tax under the head ―Profits and gains of business or profession;

(iii) where an assessee lets on hire machinery, plant or furniture belonging to him and also buildings, and the letting of the buildings is inseparable from the letting of the said machinery, plant or furniture, the income from such letting, if it is not chargeable to income-tax under the head ―Profits and gains of business or profession;

(iv) income referred to in sub-clause (xi) of clause (24) of section 2, if such income is not chargeable to income-tax under the head ―Profits and gains of business or profession‖ or under the head ―Salaries;

(v) where any sum of money exceeding twenty-five thousand rupees is received without consideration by an individual or a Hindu undivided family from any person on or after the 1st day of September, 2004 but before the 1st day of April, 2006, the whole of such sum: Provided that this clause shall not apply to any sum of money received—

(a) from any relative; or

(b) on the occasion of the marriage of the individual; or

(c) under a will or by way of inheritance; or

(d) in contemplation of death of the payer; or

(e) from any local authority as defined in the Explanation to clause (20) of section 10; or

(f) from any fund or foundation or university or other educational institution or hospital or other medical institution or any trust or institution referred to in clause (23C) of section 10; or

(g) from any trust or institution registered under section 12AA.

Vi) where any sum of money, the aggregate value of which exceeds fifty thousand rupees, is received without consideration, by an individual or a Hindu undivided family, in any previous year from any person or persons on or after the 1st day of April, 2006 but before the 1st day of October, 2009.

Provided that this clause shall not apply to any sum of money received—

(a) from any relative; or

(b) on the occasion of the marriage of the individual; or

(c) under a will or by way of inheritance; or

(d) in contemplation of death of the payer; or

(e) from any local authority

(f) from any fund or foundation or university or other educational institution or hospital or other medical institution or any trust or institution referred to in clause (23C) of section 10; or

(g) from any trust or institution registered under section 12AA.

(f) stamp duty value means the value adopted or assessed or assessable by any authority of the Central Government or a State Government for the purpose of payment of stamp duty in respect of an immovable property;

Other Sources of Income are Stated Below:

- Income From:

Lottery, Gambling, Batting, Horse Race, Cross Ward, Puzzle

Any other casual income

Interest other than interest on securities

Interest on Securities

Commission (If it is not a part of one’s main Business or Profession)

Family Pension

Royalty

Director’s Fee

Subletting of House

Dividend

Tuition Income

2. Casual Income: TDS is applicable @ 30% on this. It generally received after deduction of tax. Hence it always gross up while calculating the income under this head as given below:

Gross Income = Net Amount Received * 100/70

3. Lottery Income: If Lottery Income is less than Rs.5000/- then there will be no TDS. Hence no need to gross up.

4. Income from Horse Race: If Income from Horse Race is less than Rs.2500/- then there will be no TDS Hence no need to gross up.

5. Family Pension: Rs.15000/- or 1/3 of Actual Amount received, whichever is less, is exempt.

Taxable = Actual Amount Received – Exempted Amount

Dividend from Indian Co. Is fully exempted.

6. Taxable Dividend: a) Dividend from Foreign Co.

b) Dividend from Co-operative Society

7. Tax free in case of other sources: -

Interest from Capital Investment Bond

Interest on Post Office Savings

Interest on National Relief Bond

Income from UTI

Any Allowance to a M.P. (Member of Parliament)

Key Takeaways

• Income of every kind which is not to be excluded from the total income under this act shall be chargeable to income-tax under the head ―income from other sources‖, if it is not chargeable to income-tax under any of the heads specified in section 14, items a to e.

Case study

1. Mr. Kumar is a salaried employee. In the month of April, 2012 he purchased a piece of land and sold the same in December, 2020. In this case, land is a capital asset for Mr. Kumar. He purchased land in April, 2011 and sold in December, 2020 i.e. after holding it for a period of more than 24 months. Hence, land will be treated as long-term capital asset.

2. In April, 2020 Mr. Raja sold his residential house property which was purchased in May, 2002. Capital gain on such sale amounted to Rs. 8,40,000. In this case the house property is a long-term capital asset and, hence, gain of Rs. 8,40,000 will be charged to tax as long-term capital gain.

References:

1. Singhanai V.K.: Student’s Guide to Income Tax; Taxman, Delhi.

2. Prasad, Bhagwati: Income Tax Law & practice: Wiley Publication, New Delhi.

3. Dinker Pagare: Income Tax Law and Practice; Sultan Chand & Sons, New Delhi.

4. Girish Ahuja and Ravi Gupta; Systematic approach to income tax; Sahitya Bhawan Publications, New Delhi.

5. Chandra Mahesh and Shukla D.C.: Income Tax Law and Practice; Pragati Publications, New Delhi.