Unit - 1

Introduction and overview of the strategic cost management process

Concepts of cost

Types of cost are as follows

- Nominal and real cost –

- Nominal cost is the money value of cost of production. It is also called expenses of production. The expenses paid to the factors he employs in the process of production.

- The real cost are the pain and sacrifices of labour involved in the process of production.

2. Explicit and implicit cost –

- Explicit cost is the cost made to other owner for the purchase or hiring of various other factors in the course of running a business. It is also called as accounting cost. Examples of explicit costs include wages, lease payments, utilities, raw materials, and other direct costs.

- An implicit cost has already occurred but not necessarily shown as separate expense. It is also called as opportunity cost

3. Accounting cost and Economic cost –

- Accounting cost are those where the entrepreneur pay direct cash for procuring the factors of production. This cost is treated as expenses and recorded in the books. Ex - wages paid to workers, electricity charges, etc.

- Economic cost is implicit cost where the factors or resources of production are used by the entrepreneur in his own business. Ex – a business man has a land. He uses the land for his business purpose instead of giving it for rent

4. Opportunity cost –

- Opportunity costs are incomes from the next best alternative that is foregone when the entrepreneur makes certain choices.

- Ex – a manufacturing company has a factory. He uses the factory for his business purpose instead of giving it for rent. These costs calculate the missed opportunity and calculate income that we can earn.

5. Business cost and full cost –

- Business costs include all the expenses which are incurred in carrying out a business. The concept of business cost is similar to the accounting or actual cost.

- Full cost includes the opportunity cost and normal profit. Normal profit is minimum earning which a firm earns to remain in its present occupation.

6. Total, Average and Marginal cost –

- Total cost refers to the total expenditure, both explicit and implicit on the resources used to produce a given output.

- Average cost is the cost per unit of output which is obtained by dividing the total cost (TC) by the total output (Q), i.e., Average cost = TC/Q

- Marginal cost is the addition made to the total cost as a result of producing one additional unit of the product.

7. Fixed cost and variable cost –

- Fixed costs are the expenditure incurred on the factors such as capital, equipment, plant, factory building which remain fixed in the short run and cannot be changed. Fixed costs are independent of output i.e., these costs will have to be incurred, if no output is produced in the short run.

- Variable costs are costs incurred by the firms on the employment of variable factors such as labour, raw materials, etc., whose amount can be easily increased or decreased in the short run. Variable costs will not be incurred, if the firm decided not to produce any output,

8. Direct and indirect cost –

- Direct costs are those cost which id directly used in a particular product and process. Ex – manufacturing cost relating to production.

- Indirect cost – indirect cost is not directly related to production. E.g. – office expense, salary

9. Incremental and sunk cost

- These costs are incurred when the business makes a policy decision. For example, change of product line, acquisition of new customers, upgrade of machinery to increase output are incremental costs.

- Suck costs are costs which the entrepreneur has already incurred and he cannot recover them again now. These include money spent on advertising, conducting research, and acquiring machinery.

A relevant cost is any cost that will be different among various alternatives. Decisions apply to future, relevant costs are the future costs rather than the historical costs. Relevant cost describes avoidable costs that are incurred to implement decisions.

For example, a company truck carrying some goods from city A to city B, is loaded with one more ton of goods. The relevant cost is the cost of loading and unloading the additional cargo, and not the cost of the fuel, driver salary, etc. It is due to the fact that the truck was going to the city B anyhow, and the expenditure was already committed on fuel, drive salary, etc. It was a sunk cost even before the decision of sending additional cargo.

Relevant costs are also referred to as differential costs. They differ among different alternatives. They are expected future costs and relevant to decision making.

Types of Relevant Costs

Future Cash Flows

Cash expense, which will be incurred in future because of a decision, is a relevant cost.

Avoidable Costs

Only the costs, which can be avoided if a particular decision is not implemented, are relevant for decision making.

Opportunity Costs

Cash inflows, which would have to be sacrificed as a result of a decision, are relevant costs.

Incremental Costs

Only the incremental or differential costs related to the different alternatives, are relevant costs.

Differential cost

Differential cost is the change in the costs which may take place due to increase or decrease in output, change in sales volume, alternate method of production, make or buy decisions, change in product mix etc. So, differential cost is the result of an alternative course of action.

For example, difference in costs may arise because of replacement of labour by machinery and difference in costs of two alternative courses of action will be the differential cost.

Characteristics of Differential Cost:

The following are the essential characteristics of differential costs:

1. Differential cost analysis is not made within the accounting records rather it is made outside the accounting records, Differential costs may, however, be incorporated in the flexible budgets because they budget costs at various levels of activity.

2. Total differential costs are considered in differential cost analysis. Cost per unit is not taken into consideration.

3. Total differential revenues are compared with total differential costs before advocating an alternate course of action. A change in course of action is recommended only if differential revenues exceed differential costs.

4. The items of cost which do not change for the alternatives under consideration are ignored, only the difference in items of costs are considered because differential costs analysis is concerned with changes in costs.

5. The changes in costs are measured from a common base point which may be a present course of action or present level of production.

6. Differential cost analysis is related to the future course of action or future level of output, so it deals with future costs. Historical costs or standard costs may be used but they should be suitably adjusted to future conditions.

7. For making a choice among the various alternatives, the alternative which gives the maximum difference between the incremental revenue and incremental cost is recommended to be adopted.

Incremental cost

Incremental cost is the additional cost incurred by a company if it produces one extra unit of output. The additional cost comprises relevant costs that only change in line with the decision to produce extra units.

Certain costs will be incurred whether there is an increase in production or not, which are not computed when determining incremental cost, and they include fixed costs. However, care must be exercised as allocation of fixed costs to total cost decreases as additional units are produced.

Therefore, incremental cost may involve more than the change in variable cost. It is also known as differential cost.

Opportunity cost

Opportunity cost is the amount of potential gain an investor misses out on when they commit to one investment choice over another. Consider, for example, the choice between whether to sell stock shares now or hold onto them to sell later. While it is true that an investor could secure any immediate gains they might have by selling immediately, they lose out on any gains the investment could bring them in the future.

Key takeaways

Relevant cost describes avoidable costs that are incurred to implement decisions.

1. Ascertainment of Cost

This is the key objective of cost accounting to track and analyze the per unit cost of the product produced by the company. It helps to ascertain cost of each activity such as process, operation, job etc.

2. Fix Selling Price

Cost accounting provides base for determination of selling price of company's product by ascertaining the cost of each product. It helps the management to fix the selling price of products and services.

3. Cost Control

Cost accounting helps the organization to control the cost of production by taking necessary steps to reduce wastage of materials, time and expense while carrying out the operation.

4. Assisting in Decision Making

Cost accounting helps management in decision making such as make or buy decision, drop or continue decision, future expansion policies etc. It helps to make a choice out of two or more courses of action.

5. Ascertainment of Profit

Cost accounting helps in tracking and ascertaining profitability of the product by preparing profit and loss account and balance sheet periodically.

6. Formulating Policies

Cost accounting play’s important role to formulate policies of the organization. It provides necessary information and data to the top-level management which are essential for framing marketing policies of the company.

7. Basis of Financial Statement

Cost accounting is the foundation for the preparation of different financial statements (profit and loss account, balance sheet, trial balance etc.) of the company.

Inventory valuation is an accounting practice which is followed by companies at the time they are preparing their financial statements to find out the value of unsold inventory stock. Inventory stock is an asset for an organization, and it needs to have a financial value to record it in the balance sheet. This value helps in determining the inventory turnover ratio, which in turn will help to plan your purchasing decisions.

Inventory valuation method is the total cost associated with the current inventory. In other words, it is the total amounts of money have been spent on acquiring the inventory and storing it.

Techniques of inventory control

- First in – First Out Method:

It is a method of pricing the issue of materials in the order in which they are purchased. In other words, the materials are issued in the order in which they arrive in the store. This method is considered suitable in times of falling price because the material cost charged to production will be high while the replacement cost of materials will be low. In case of rising prices this method is not suitable.

Advantages of FIFO:

- It is simple and easy to operate.

- In case of falling prices, this method gives better results.

- Closing stocks represents the market prices.

Disadvantages:

- If the prices fluctuate frequently, this method may lead to clerical errors.

- In case of rising prices this method is not advisable.

- The material costs charged to same job are likely to show different rates.

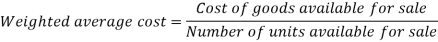

2. Weighted Average Price Method:

This method removes the limitation of Simple Average Method in that it also takes into account the quantities which are used as weights in order to find the issue price. This method uses total cost of material available for issue divided by the quantity available for issue.

Advantages

- It is more scientific and smoothens the fluctuations in purchase price

- Inventory is valued at one rate

Disadvantages

- It is tedious – requires the issue price to be computed each time a consignment is received

3. LIFO (Last in first out method):

Under this method most recent purchase will be the first to be issued. It means the most recently items produced are sold first. The issues are priced out at the most recent batch received and continue to be charged until a new batch received is arrived into stock. It is a method of pricing the issue of material using the purchase price of the latest unit in the stock.

Advantages:

- Based on the replacement cost Stocks issued at more recent price represent the current market value

- It is simple to understand and easy to apply.

- Since material cost is charged at more recent price, product cost will tend to be more realistic

- It minimizes unrealized inventory gains and tends to show the conservative profit.

Disadvantages:

- Valuation of inventory under this method is not acceptable in preparation of financial accounts.

- It renders cost comparison between jobs difficult.

- It involves more clerical work and sometimes valuation may go wrong.

Key takeaways

Inventory valuation methods includes LIFO, FIFO, weighted average cost

Operational database management systems (also referred to as OLTP On Line Transaction Processing databases), are used to update data in real-time. These types of databases allow users to do more than simply view archived data. Operational databases allow you to modify that data (add, change or delete data), doing it in real-time. [1] OLTP databases provide transactions as main abstraction to guarantee data consistency that guarantee the so-called ACID properties. Basically, the consistency of the data is guaranteed in the case of failures and/or concurrent access to the data.

The key attributes of an operational database are:

(1) Consistency of related information elements: Operating personnel are alert for information that is in consistent with information they already possess. If information from different source about the transaction is consistent, this information, as well as the information system, has greater validity.

(2) Timeliness: of transactions information and of managerial reports. Because of simultaneous updating of all records affected by a transaction and the frequent use of on-line transactions entry, database records are more likely than conventional files.

(3) Back-up: detail provided by inquiry capability: Operations personnel refer to backup details to answer customer questions about account status. Also, all managers can cite many instances when they have received highly summarized unexplained circumstances such as a production cost variance. Frequently the data needed exists in the computer system.

(4) Data sharing: The sharing of a large pool of operations data among multiple user departments is possible with a database. Without a database, information about other department’s activities probably would be available only several days after the end of each accounting period, if at all.

The characteristic features of a data-base created for operational control and decision making are as under:

i. There should be a file structure that facilitates the association of one internal record with other internal records.

Ii. There should be cross functional integration of files.

Iii. Independence of program / data file for ease of updating and maintenance of data base.

Iv. There must be common standards throughout with respect to data definitions, record formats and other data descriptions.

v. A data dictionary should be available.

Key takeaways

Operational database management systems (also referred to as OLTP On Line Transaction Processing databases), are used to update data in real-time.

References:

- Cost Accounting a Managerial Emphasis, Prentice Hall of India, New Delhi

- Charles T. Horngren and George Foster, Advanced Management Accounting

- Robert S Kaplan Anthony A. Alkinson, Management and Cost Accounting

- Ashish K. Bhattacharya, Principles and Practices of Cost Accounting A. H. Wheeler publisher

- D. Vohra, Quantitative Techniques in Management, Tata McGraw Hill Book Co. Ltd.