Unit 3

Financial services and its mechanism

Meaning

Lease/leasing/lease financing is a contract between lessee and lessor for hire of an asset on payment rent for a specific period generally for long duration. The assets covered under lease agreements are land, real estate, mines, quarries, plant and equipment, aircraft etc. the owner of the leased property is known as lessor and user of the property is known as lessee. Some examples of lease financing company in India are Mahindra finance, Bajaj finance, Shriram trans etc.

The essential characteristics of lease are-

Types of lease

The lease contract is classified under the following heads depending on nature of the contract-

Advantages and disadvantages of leasing

The benefits of leasing is highlighted under the following heads-

The disadvantages of lease financing is highlighted under the following points-

The lessee has no ownership right over the property. The contract only provides the right to use the property up to a specific limit.

2. Maintenance of asset:

In case of financial lease the maintenance expenses are incurred by the lessee like owner of the asset and it becomes a costly financial technique for lessee.

3. Lease expense: In financial lease, the expenses are incurred by the lessee although he is not the owner and in case of operating lease, the expenses are incurred by the lessor although he is not using the asset.

4. Limited tax benefit: The tax benefit is provided only over the depreciation which is considered as limited amount as compared to the expenses incurred in lease agreement.

5. Risk of obsolesce: The risk of obsolescence is transferred from lessee to the lessor but the lessor received a negligible amount as scrap value on sale of the asset.

Leasing in India

The leasing business in India is originated in the recent past. The first leasing business in India was started in India by ‘Leasing Company of India’ in 1973. From 1986 to 1996 there was significant boom in the industry. As per RBI’s record there were 339 leasing company in India by 31st March, 1886. Dahotre Committee provide recommendations for and accordingly RBI formed guidelines for commercial banks to enter into the lease financing. Later on commercial banks and other sector financial institutions like IDBI, IFCI, ICICI, SFC etc. has started providing leasing financing. The factors that contributed to growth of leasing in India are-

Some of the lease finance companies operating in India are-

Legal aspects of leasing

There is no specific act relating to leasing. The Indian Contract Act, 1872, provides guidelines relating to bailment which also governs the lease agreement. Since same provision governs the bailment and lease agreement, it is assumed that the rights and obligation of lessee and lessor are similar to bailor and bailee. The obligations are-

Definition of hire purchase

Hire purchase is an agreement between hire purchaser (hirer) and hire seller (hiree) where the later transfers the possession of property to former party, payment is made on instalment basis and on payment of last instalment the hirer get the right of ownership over the property. Hire purchase agreement is governed under the Hire Purchase Agreement Act, 1972.

Characteristics of hire purchase

The essential characteristics of Hire purchase are-

Hire purchase v/s leasing

Basis of difference | Hire purchase | Leasing |

| Hire purchase is an agreement between hire purchaser (hirer) and hire seller (hiree) where the later transfers the possession of property to former party, payment is made on instalment basis and on payment of last instalment the hirer get the right of ownership over the property | Lease financing is a contract between lessee and lessor for hire of an asset on payment rent for a specific period generally for long duration. |

2. Parties | Two parties- hirer and hiree. | Two parties- lessee and lessor. |

3. Consideration | Consideration is hire charge i.e instalment. | Consideration is rent. |

4. Transfer of ownership | Ownership is transferred from hiree to hirer on payment of last instalment. | Ownership cannot be transferred from lessor to lessee. |

5. Duration. | It is taken place for short and medium term. | It is taken place for long term. |

6. Risk of obsolescence | Risk of obsolescence is on the hirer. | Risk of obsolescence is on the lessor. |

7. Right to sell | The hirer has the right to sell the asset. | The lessee has no right to sell the asset. |

8. Governance | It is governed under the Hire Purchase Act, 1972. | It is governed under the companies act. |

Advantages of hire purchase

The advantages of hire purchase are mentioned below-

Problems of hire purchase

The disadvantages of hire purchase are mentioned below-

Key takeaways

Introduction

Housing finance refers to extension of loan to consumers for construction of residential house, purchase of house, purchase of flat, repayment of housing loan etc. National Housing Bank is the apex institution in housing finance sector.

Housing finance industry

The housing finance industry is composed of different hosing finance companies and customers. Some of the housing finance companies in India are-

Moreover, commercial banks also provide housing finance facilities to customers. Housing finance involves the following products-

Housing finance policy aspect

The Government of India formulated Housing finance policy with objectives to firstly to provide affordable housing finance system and to accommodate urban dwellers with subsidized rental programmes. Various aspects of housing finance policy are mentioned under the following heads-

2. It improves demand for houses by

3. It improves supply of housing finance at affordable rates through

|

Sources of funds

The different sources of fund for housing sector is broadly categorized under three heads-

2. Refinance institutions

3. Secondary Mortgage institutions

Housing finance in India

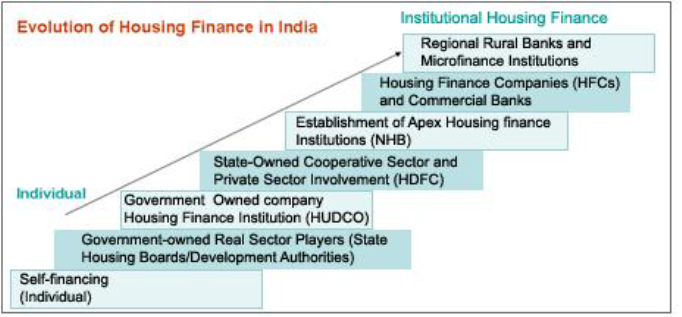

India is a developing country and suffers from lack of proper housing facility. To overcome this problem the Government adopted housing finance policy in the five year plan. Government formulated different plans and policies for development of housing sector in India. Housing and Development Corporation provides technical and financial assistance to government regarding housing finance. In 1977 HDFC was established as joint sector leading to establishment of many private sector housing finance companies. In 1988 National Housing Bank was established as the apex institution in housing sector. Gradually commercial banks, co-operative sector and other financial institutions also institutions enter into the housing finance sector.

There are two key regulatory bodies-

|

|

Source: National Housing Bank

National Housing Bank

The National Housing Policy, 1988 envisaged the setting up of NHB as the apex level institution for housing. Accordingly, NHB was established under the NHB Act, 1987. The entire paid up capital is contributed by the RBI. It was established to fulfil the objectives, namely-

Guidelines for asset liability management system in HFC

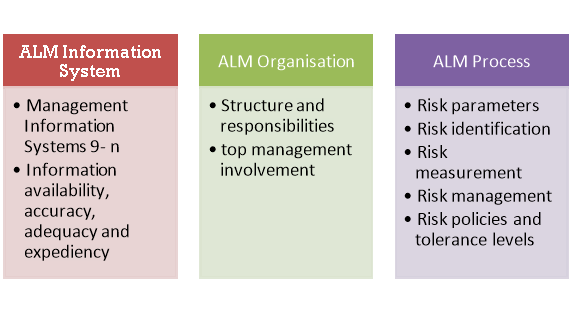

It is necessary to provide guidelines for asset liability management system in HFC because during the course of business it exposed to several major risks in like credit risk, interest rate risk, equity/commodity price risk, liquidity risk and operational risk. Asset Liability Management (ALM) is based on three pillars-

2. ALM Organisation: It consists of board members responsible for management of risks and to decide limits for liquidity, interest rate, exchange rate and equity price risks. The Asset-Liability Committee (ALCO) is formed consisting of the HFC's senior management including the Chief Executive Officer (CEO). He is responsible for ensuring adherence to the limits set by the Board as well as for deciding the business strategy of the HFC (on the assets and liabilities sides) in line with the HFC's budget and decided risk management objectives.

3. ALM Process: Measuring and managing liquidity needs are vital for effective operation of HFCs. By assuring an HFC's ability to meet its liabilities as they become due, liquidity management can reduce the probability of an adverse situation. The Gap or Mismatch risk can be measured by calculating Gaps over different time intervals as at a given date. Gap analysis measures mismatches between rate sensitive liabilities and rate sensitive assets including off-balance sheet positions.

Fair trade practice code for HFC’s

The National Housing Bank, has framed the Guidelines on Fair Practices Code for HFCs to serve as a part of best corporate practices and to provide transparency in business practices. The Code has been developed

1) to promote good and fair practices.

2) To increase transparency.

3) To encourage market forces.

4) To promote a fair and cordial relationship.

5) To foster confidence.

HFCs should act fairly and reasonably in all dealings with customers, by ensuring that:

a) They meet the commitments and standards in this Code for the products and services they offer and in the procedures and practices their staff follows.

b) Their products and services meet relevant laws and regulations in letter and spirit.

c) Their dealings with customers rest on ethical principles of integrity and transparency.

Housing finance agencies

Key takeaways

Introduction

Venture capital is a type financing where the financing company provides equity capital to the highly risky projects related to involvement of sophisticated technology. The Venture Capital Company makes equity participation with the project and provides all technical and financial guidance for the growth of the project. Once the project started earning profit it makes disinvestment from the project. Some examples of venture capital company are-Blume Ventures, IDG Ventures, Accel Partners etc.

Features of venture capital

Some of the essential features of venture capital are-

Types/stages of venture capital financing

The venture capitalists supply the funds to projects in every stages of progress instead of one time investment. Different stages of venture capital financing are as follows-

Disinvestment process/mechanism

The venture capitalist starts disinvesting from a project on attaining its maturity. The disinvestment mechanism of venture capitalist is discussed under the following heads-

2. Buyback by promoters: Buyback by promoter is another route for disinvestment where the promoter retains the power of management and control. The outside party will not share the controlling affairs of the company.

3. Management buyout: Management buyout enables the mangers or outsiders to acquire firm or part of its business. It takes place when the buyers incur debt to buy the business venture.

Indian scenario

In India the venture capital financing is started by IFCI in 1975. Later on different commercial banks, specialised institutions and NBFCs started providing venture capital financing. In India, venture capital is regulated by SEBI under the SEBI (Venture Capital Funds) 1996. It is still in its infant stage. It is gaining popularity in India because of the reasons like-

It mainly covers the areas like technology, consumer goods, pharmaceuticals, agricultural products, speciality chemicals etc. In 2019, VC investment investments activities reached a record of US $ 48 billion.

Key takeaways

References