UNIT I

Preparation of Final Accounts of Companies

|

Meaning

The final account is the account prepared by the Joint Stock Company at the end of the fiscal year. The purpose of creating a final account is to provide a clear picture of the financial situation of the organization to its management, owners or other users of such accounting information.

Final account preparation involves preparing a set of accounts and statements at the end of the fiscal year.

- Trading and profit and loss accounts

- Balance sheet

- Profit and loss appropriation account

- Purpose of Final Account preparation

The final account is prepared for the following purposes:

- To determine the profit and loss incurred by the company within a certain financial period

- To determine the financial status of the company

- To serve as a source of information to inform users of accounting information (owners, creditors, investors and other stakeholders) about the solvency of the company.

Trading account

The results of the purchase and sale of goods are known as the trading account. This sheet is provided to show the difference between the sales price and the cost price. It is prepared to show the trading results of the business i.e. The total profit or total loss maintained by the business. It records the direct costs of the business company.

According to Batliboi Jr

The trading account shows the results of buying and selling goods. When we prepare this account, the general establishment costs are not taken into account and only the transaction of goods is included."

Profit and loss accounts

This account is prepared to check the net profit/loss and fiscal year expenses of the business during the fiscal year. It records the indirect expenses of the business company like rent, salary, and advertising expenses. Profit and loss a/C includes expenses and losses and gains and losses incurred in business other than the production of goods and services.

Balance sheet

The balance statement shows the financial status of the business at a specific date. The financial status of a business is discovered by aggregating its assets and liabilities on a specific date. The excess of assets over liabilities represents the capital sunk into the business and reflects the financial health of the enterprise.

Now it is known as a statement of the financial status of the company.

- Trading account

Trade and manufacturing operating companies deal with the sale and purchase of goods. Therefore, only the manufacturing and trading entities prepare the trading account. Service providers do not prepare for this.

Advantages of preparing a trading account format

- It is a very important statement from the point of view of the cost of goods. By preparing a trading account, an entity may take a decision to continue or discontinue a particular product, which helps to obtain maximum profit or reduce losses.

- With the help of a trading account, the sales tax authority can, in accordance with the sales tax declaration filed by the business. It also helps the excise duty authorities to assess the excise duty of a business enterprise.

- The management, having in mind the market competition, determines the price of the product with the help of a trading account.

Items in trading account format

The trading account contains the following details:

- Details of raw materials, semi-finished goods and finished products, opening stock.

- Close inventory details of raw materials, semi-finished products, and finished products.

- Total purchase of goods less purchase return.

- Total sales of goods less sales return.

- All direct costs associated with the purchase or sale or manufacture of goods.

Item of income (Cr.Side)

- Less sales return than total sales of goods

- Close the stock of the product.

- Expenditure item (Doctor) side

Item of expenditure (Dr.Side)

- Opening stock

- Total purchase of goods less purchase return

- All the direct cost like carriage interior & freight cost, rent, electricity and power cost, wages for godown or factory, packing cost, etc. for workers and supervisors.

Notes

- The trial count will not be displayed on the close. But, firstly, we need to show the amount of closing shares on the income side of the trading account, and secondly, on the balance sheet under current assets.

- We value closing inventory at either lower cost or market price.

- On the day of preparation of the trading account, we value the physically available closed shares.

- However, the trading account can also be prepared in horizontal form, but the content remains the same.

Trading Account Format

Particulars | Amount | Particulars | Amount |

To opening stock | xxx | By sales | xxx |

To purchase | xxx | Less: Returns | xxx |

Less: returns | xxx | By Closing stock | xxx |

To direct expenses: | xxx | By Gross loss c/d |

|

Freight & carriage | xxx |

|

|

Custom & insurance | xxx |

|

|

Wages | xxx |

|

|

Gas, water & fuel | xxx |

|

|

Factory expenses | xxx |

|

|

Royalty on production | xxx |

|

|

To Gross profit c/d | xxx |

|

|

2. Profit and loss A/C

All companies generally prepare profit and loss accounts/statements at the end of the year to gain visibility of income, revenue, expenses, and losses incurred in a certain range of periods. It is important to prepare a profit and loss statement because this information helps organizations make the right business decisions, such as where to cut costs, from where the business can generate more profit, and which parts of the business are suffering from losses.

- Profit and loss accounts / statements

- Types of profit and loss

- Gross profit/gross loss

- Profit / loss

Trading account is prepared to check gross profit/loss while profit and loss account is created to check profit and loss/net loss.

Profit and loss accounts are made to check the annual profit or loss of a business. This account only shows overhead. All items of income and expenses, whether cash or non-cash, are considered in this account.

Only revenue or expenses related to the current period are debited or credited to the profit and loss account. The profit and loss account starts with gross profit on the credit side and, if there is a total loss, appears on the debit side. Items not displayed in the profit and loss account format

Drawing: the drawing is not the company's expense. Therefore, we debit it to capital a/c, and not to profit and loss a/c.

Income tax: for a company, income tax is an expense, but for a sole proprietor, it is his personal expense. Therefore, we debit it to the capital A/C.

Discounts: as we know, discounts are of two types–trade discounts and cash discounts. We deduct the trade discount from the amount charged and therefore do not show it in the account books. On the other hand, if the customer pays the amount on a certain date, a cash discount will be possible. We view cash discounts in account books. Therefore, we debit it to the profit and loss account.

Bad debt: it is because of the customer and the amount he does not pay it. We debit this amount to profit and loss a/c in the event that preparations have already been made for a bet that is worse than it is initially written off from it. When bad loans are recovered, it is again. Now it is not credited to the account of the party, but recovered account should be credited to the bad debt and is written on the credit side of the profit and loss account

Profit and Loss Account Format

Particulars | Amount | Particulars | Amount |

To Gross loss b/d | xxx | To Gross profit b/d | xxx |

Management expenses: | xxx | Income: | xxx |

To salaries | xxx | By Discount received | xxx |

To office rent, rates, and taxes | xxx | By Commission received | xxx |

To printing and stationery | xxx | Non-trading income: | xxx |

To Telephone charges | xxx | By Bank interest | xxx |

To Insurance | xxx | By Rent received | xxx |

To Audit fees | xxx | By Dividend received | xxx |

To Legal charges | xxx | By Bad debts recovered | xxx |

To Electricity charges | xxx | Abnormal gains: | xxx |

To Maintenance expenses | xxx | By Profit on sale of machinery | xxx |

To Repairs and renewals | xxx | By Profit on sale of investments | xxx |

To Depreciation | xxx | By Net Loss (transferred to Capital A/c) | xxx |

Selling distribution expenses: |

|

|

|

To Salaries | xxx |

|

|

To Advertisement | xxx |

|

|

To Godown | xxx |

|

|

To Carriage outward | xxx |

|

|

To Bad debts | xxx |

|

|

To Provision for bad debts | xxx |

|

|

To Selling commission | xxx |

|

|

Financial expenses: |

|

|

|

To Bank charges | xxx |

|

|

To Interest on loan | xxx |

|

|

To Discount allowed | xxx |

|

|

Abnormal losses: | xxx |

|

|

To Loss on sale of machinery | xxx |

|

|

To Loss on sale of investments | xxx |

|

|

To Loss by fire | xxx |

|

|

To Net Profit (transferred to capital a/c) | xxx |

|

|

TOTAL |

| TOTAL |

|

3. Balance Sheet

A balance sheet (also known as a financial statement) is a financial statement that shows the Assets, Liabilities and ownership interests of a business at a specific date. The main purpose of drawing up a balance sheet is to disclose the financial status of the enterprise at a certain date. The balance sheet can be prepared at any time, but it is prepared mainly at the end of the accounting period.

Most of the information about Assets, Liabilities and owner's equity items is taken from the company's adjusted trial balance. Retained earnings are the part of the owner's equity section which is provided by the retained earnings statement.

Section of the balance sheet

To be widely considered about the balance sheet of the division part of assets part of liabilities main capital. For each department:

Assets section

In the balance sheet, assets with similar characteristics are grouped. The mainly adopted approach is to divide assets into current and non-current assets. Liquid assets include cash and all assets that can be converted into cash or expected to be consumed in a short period of time–usually one year. Examples of current assets include cash, cash equivalents, accounts receivable, prepayment costs or prepayment, short-term investments and inventories.

All assets that aren't listed as current assets are grouped as non-current assets. A common feature of such assets is that they continue to provide profit for a long time-usually more than one year. Examples of such assets include long-term investments, equipment, plants and machinery, land and buildings, and intangible assets.

Debt Division

A debt is an obligation to a party other than the owner of the business. They are grouped as current and long-term liabilities in the balance sheet. Current liabilities are obligations that are expected to be met within a one-year period by using current assets of the business or by providing goods or services.

Owner's equity division

The owner's interest is the obligation of the business to its owner. The term owner's equity is mainly used in the balance sheet of a business in the form of a sole proprietor and partnership. In the balance sheet of the company the term “ownership interest “is often replaced by the term "shareholder interest".

When the balance sheet is created, the liabilities section appears first, and the owner's equity section appears later.

Assets | $ | Liabilities & Stockholder’s equity | $ |

Current assets : Cash Account receivable Prepaid building rent Unexpired insurance Supplies

Total current assets

|

85,550 4,700 1,500 3,600 250

| Liabilities: Notes payable Accounts payable Salaries payable Income tax payable Unearned service revenue

Total liabilities |

5,000 1,600 2,000 3,000 4,400

|

95.600 | 16,000 | ||

Non-current assets: Equipment 9,000 Acc. dep. –Equipment 3,600

Total assets |

5,400

| Stockholder’s equity: Capital stock 50,000 Retained earnings 35.000

Total liabilities & stockholder’s equity

|

85,000

|

101,200 | 101,000 | ||

|

|

|

|

Balance sheet format there are two formats on the balance sheet that present Assets, Liabilities and owner's ' equity–the account format and the report format.

In the account form, the balance sheet is divided into the left and right, like the t-account. Both liabilities and the owner's capital are listed on the right side of the balance sheet, while assets are listed on the left. If all the elements of the balance sheet are listed correctly, then the sum on the asset side (that is, on the left) is equal to the sum on the debt and the capital side of the owner (that is, on the right).

BUSINESS CONSULTING COMPANY

BALANCE SHEET

As at December 31, 2015

In reporting format, the balance table element is displayed vertically, the asset section is displayed at the highest, and therefore the liabilities and owner's equity sections are displayed below the asset section.

The example below shows both formats.

Assets Current assets:

Cash Account receivable Prepaid building rent Unexpired insurance Supplies

Total current assets

|

85,500 4,700 1,500 3,600 250

|

95,600

| |

Non-current assets: Equipment 9000 Acc. Dep- Equipment 3600

Total assets

|

5,400

|

101,000

| |

Liabilities & Stockholder’s Equity Liabilities Notes payable Accounts payable Salaries payable Income tax payable Unearned service revenue

Total liabilities

|

5,000 1,600 2000 3000 4,400

|

16,000 | |

Stockholder’s equity: Capital stock Retained earning

Total stockholder’s equity

Total liabilities and stockholder’s equity |

50,000 35,000

|

85,000

| |

101,00 |

Types of adjustment entry for the final account

- Closing stocks:

The value of the closing stock is checked at the end of the fiscal year, so it is displayed as an adjustment. It must be credited to the transaction a/c and displayed on the asset side of b/S.

The adjustment entry is:

Closing stock a/c ------ Dr.

To trade A / c

Trading account and balance sheet

Rs | |

| By Sales |

| By Trading Stock |

Balance Sheet

Liabilities | Rs | Assets | Rs |

|

| Closing Stock |

|

2. Unpaid expenses:

These are expenses incurred in the fiscal year, but no payments have been made. Any unpaid or unpaid expenses will be added to such expense a/c in P&L a/c and will be displayed as current liability in b/S.

For example, monthly rent in May 2002 Rs. 1,000 remains unpaid. A calendar year is an accounting year.

Adjusting entries:

Rent account Dr. Rs.1000

To Outstanding Rent a/c Rs. 1,000

Profit and loss accounts

|

|

| Rs |

TO Rent Account Add: Outstanding | [11 month rent] [December] | 11,000 1,000 |

12,000 |

Balance Sheet as on 31st December 2002

Liabilities | Rs | Assets |

|

Outstanding Expenses: Rent |

1,000 |

|

|

3. Prepaid Expenses

These are the costs paid, but part of the amount paid extends to the next year. It is also called" expiring expenses". The prepaid amount paid should be deducted from such expenses and displayed as current assets in the B/S.

For example, Rs premium a total of 2,400 people were paid on July 1, 2002. A calendar year is an accounting year. The annual premium is paid for 1 month, so the 6-month premium concerns half of the current year and the other half the following year.

Hence Rs. 1,200 must be treated as an upfront payment, deducted from the premium paid and displayed as an asset on b/S.

Adjusting entries:

Prepaid insurance a / c Dr Rs. 1, 200

To Premium A / c Rs. 1, 200

Profit and Loss Account

| Rs | Rs |

|

To Insurance Premium a/c Less: Prepaid insurance | 2,400 1,200 | 1,200 |

|

Balance Sheet

Liabilities | Rs | Assets | Rs |

|

| Prepaid Insurance | 1,200 |

4. Accrued income:

It is an income that has already been earned [i.e. the service has already been rendered], but no money has been received. For example, interest on investments accrued Rs. 1,200.

Interest in the current year is due to the end of the year. That amount can actually be received in the next year. Currently, it represents income, which has become accounts receivable or accrued. Therefore, P&L is credited to a/c, IS accounts receivable and appears as an asset in b/S.

Adjusting entries:

Accrued interest a / c Dr. Rs. 1,200

To be interested in a / c Rs. 1,200

Profit and Loss Account

| By Interest on investment Add: Interest accrued | …… 1,200 |

|

Balance Sheet

Liabilities | Rs | Assets | Rs |

|

| Interest accrued | 1,200 |

5. Income received in advance:

These are the income received during the current year, but part of the amount received is related to the following year. Such amounts must be deducted from the total amount received in P & L A / C and displayed on the debt side of B / S, which represents the amount that the business is obliged to return.

For example, business concerns have received a three-year apprenticeship premium equivalent to Rs.6, 000. Rs in this amount.2, 000 IE, 1/3 of Rs.6, 000 is for the current year and must be credited to P&L a/c as income. And balance Rs. As business is obliged to return 4, 000 represents responsibility.

Adjusting entries:

Apprentice premium A / c Dr Rs. 4000

To Apprentice premium received in advance Rs. 4000

Profit and Loss Account

|

| Rs | Rs |

| By Apprentice Premium Less: Received in advance | 6,000 4,000 |

2,000 |

Balance Sheet

Liabilities | Rs | Assets | Rs |

Apprentice Premium received in advance | 4,500 |

|

|

6. Depreciation of assets:

Depreciation implies a decrease or decrease in the value of an asset due to its constant use. It may also occur due to wear and tear, the passage of time and obsolescence. It's a loss to business.

It is usually calculated at a certain percentage to the value of the asset, and so the amount obtained is shown first on the debit side of the P & L A/C, and then subtracted from the original value of the asset of B/s.

For example, a business has furniture worth Rs. At the end of the year 50, 000 it is depreciated by 5%.

Adjusting entries:

Depreciation A / c Dr Rs. 2,500

To Furniture A / c to Rs. 2,500

[5% Rs 50,000 = 2,500]

Profit and Loss Account

| Rs. |

|

To Depreciation a/c Furniture | 2,500 |

|

Balance Sheet

Liabilities | Rs | Assets |

| Rs |

|

| Furniture Less: Depreciation | 50,000 2,500 |

47,500 |

7. Bad debts

Debt represents money from the debtor [i.e., the uncollected portion of the credit sale]. When a debt becomes irretrievable, it becomes a bad debt and is treated as a loss. The amount of non-performing loans is debited to P&L a/c and deducted from the various debtors of B/S.

For example, a trader's ledger balance on sundry debtors shows Rs with 20,000. 1,000 are estimated to be unrecoverable.

Adjusting entries:

Bad debts a / c Dr Rs. 1,000

To Sundry debtor a / c to Rs. 1,000

a) Provision for bad and doubtful debt:

Every business has a lot of trading through margin trading. This gives rise to a significant amount of book debts or debtors. But 100% of these debts are rarely recovered.

Therefore, it would be necessary to bring down the balance of the debtor to it true position. The usual practice is to calculate such a bad debt at a certain rate, based on the past experience of the debtor. It is called reserves or reserves for doubtful debts.

However, the allowance for bad loans and bad debt is calculated on good debt, that is, after deducting previously unadjusted bad loans.

For example:

At the end of the year the sundries debtors of traders stood in the Rs.21, 000. It is estimated to be Rs. 1,000 is written off as bad loans and a 5% allowance is created for bad debt.

Adjusting entries:

Bad Debts a/c Dr. Rs. 1,000

To Sundry Debtors a/c Rs. 1,000

To Profit and Loss a/c Dr. Rs. 2,000

To Bad Debts a/c Rs. 1,000

To Provision for Doubtful Debts 1,000

Profit and Loss Account

| Rs |

|

TO Bad Debts To Reserve for doubtful Debts | 1,000 1,000 |

|

If there is an old provision for doubtful debts, it should be adjusted [deducted] against the new provision.

Balance Sheet

Liabilities | Rs | Assets | Rs |

|

|

| Sundry Debtors Less: Bad Debts

Less: Provision for Doubtful Debts | 21,000 1,000 |

19,000 |

20,000 | ||||

1,000 |

b) Provision for discounts to debtors:

Cash discounts are allowed to debtors to prompt quick payments. After providing bad loans and bad debts, the debtor's balance represents the debt from a healthy party.

They may pay their dues on time and try to take advantage of the acceptable cash discounts themselves. Therefore, this discount should be expected and offered. It is, therefore, the usual practice in business is to offer debtors discounts at a certain percentage on good debt.

For example:

Suppose a trader has various debtors equivalent to rs.20, 000 and he estimates that a provision for a discount of 5% is desirable, after a provision of 2% for bad debts. Then about healthy debt, i e a provision of 19,000 at 2% has been made as a reserve for debtors ' discounts.

Adjusting entries:

Profit and Loss a/c Dr. Rs.380

To Reserve for Discount on Debtors a/c Rs.380

Profit and Loss Account

| Rs |

|

To ad Debts To Reserve for Doubtful Debts To Reserve for Discount on Debtors |

1,000 380 |

|

Balance Sheet

Liabilities | Rs | Assets |

| Rs |

|

| Sundry Debtors Less: Provision for Doubtful on Debts

Less: Provision for Doubtful Debts | 20,000 1,000

19,000 380 |

18,620 |

8. Provision for discounts to creditors:

The creditor represents the amount paid by the business to the supplier of goods on credit. A healthy business concern is the creditor's goodwill and the practice of settling accounts with creditors in time to get the discounts allowed by them.

In that case, the liability for various creditors can be reduced to the extent of the expected discount. Based on past practice, a certain percentage of the balance of receivables is calculated as a reserve for discounts and subtracted from the balance of receivables of B/S, and the same amount is calculated as the gain of P&L A/C.

For example:

Traders had various creditors at Rs. 10,000on31th December2002. It is desirable to *provide 3% for this amount for discounts.

Adjusting entries:

Discounts on creditors for Reserve a /c Dr Rs. 300

To Profit and loss a / c Rs. 300

Profit and Loss Account

| Rs |

| Rs |

|

| By Reserve for Discount on Creditors | 300 |

Balance Sheet

Liabilities | Rs |

|

|

|

Sundry Debtors Less: Reserve for Discount | 10,000 300 |

9,700 |

|

|

9. Interest on capital:

Often, interest at the usual rate is allowed to the owner's capital, which is adopted in the business. This is necessary in order to assess the efficiency of the business. Otherwise, the profit will include interest and will be displayed at a higher rate.

So, the interest charged is a loss to the business and a profit to the owner. Thus, it is debited to profit and loss a/c and added to the capital of the balance sheet.

Adjusting entries:

a) Interest on Capital a/c Dr.

To Capital a/c

b) Profit and Loss a/c Dr.

To Interest on Capital a/c

10. Interest in drawing:

The drawing is the money that the owner has withdrawn from the capital. It charge interest on the drawing so that it allows business interest on capital. It's a profit to the business and a loss to the owner. Thus, it is credited to profit and loss a/c and deducted from the capital on the balance sheet.

Profit and Loss Account

| Rs |

| Rs |

To Interest on Capital |

| By Interest on Drawings |

|

Balance Sheet

|

|

|

|

Capital Add: Interest on Capital Less: Drawings Interest on Drawings |

|

|

|

Adjustment of special items:

1. Products distributed as free samples:

To promote the products, free samples are supplied to experts in the field. For example, distributed a free sample of a book to a professor, a free sample of medicine to a doctor, etc.

Since it is a promotional activity, the cost of such a sample should be treated as promotional costs, for example, advertising. Free sample distribution is equivalent to a decrease in purchase or sale without a monetary return.

Thus, the adjusted entry is:

Particulars | Dr Rs | Cr Rs |

Advertising A/c To Purchase A/c or To Trading A/c | ********* |

****** ****** |

The transfer entry is as follow:

Particulars | Dr Rs | Cr Rs |

Profit and Loss A/c To Advertisement A/c | ******** |

******* |

The net effect will be the reduction of purchases as promotional costs and the charge to the profit and loss account

2. Goods sold or sold on an approval basis: sometimes goods are sold on an approval basis in order to gain the trust of customers about the quality of the goods. If the customer approves it, it becomes a sale. If the customer does not approve it, the sale is not completed and therefore cannot be treated as a sale. Suppose that at the end of the fiscal year, you have a specific product with the customer that was sent on an approval basis, and you need to pass the necessary entries for reconciliation.

The adjustment entry is as follows: the treatment is as follows:

Particulars | Dr Rs | Cr Rs |

Sales A/c To Debtors A/c (at sales price of the goods) | ******** |

******* |

Particulars | Dr Rs | Cr Rs |

Stock A/c To Trading A/c (at cost price of goods) | ******** |

******* |

(A) As a deduction from sales at the selling price on the credit side of the trading account, and in addition to closing the shares at the cost price.

(h) As a deduction from debtors on the asset side, and as the total inventory displayed at the cost on the asset side of the balance sheet (cost+finished stock in stock with authorized customers).

3. About shipping of products by consignment sale:

Since consignment transactions are not sales transactions, they do not directly affect transactions and profit and loss accounts. Another consignment account is opened, and the goods sent to the consignment are debited to the consignment account. When an account sale is received, it is treated as a consignment sale, credited to the consignment account and debited to the consignment account.

The consignment inventory remaining at the consignment is deposited into the consignment account, and after invoicing the consignment cost, the consignment fee, etc., the consignment profit is confirmed. However, the closing stock of the deposit is displayed on the asset side of the balance sheet, and the profit and loss of the deposit is credited to the profit and loss account (if there is a loss of the deposit, it is cancelled).

The transfer input of consignment profit and loss is as follows:

(a) If it is a profit

Particulars | Dr Rs | Cr Rs |

Consignment A/c To Profit and Loss A/c | ******** |

******* |

(b) If it is a loss

Particulars | Dr Rs | Cr Rs |

Profit and Loss A/c To Consignment A/c | ******** |

******* |

Note: (i) The above transfer entry becomes necessary only where the consignor is also running a trading business.

(ii) The working of consignment account is almost similar to trading account which Is not shown here.

4. Loss of stock due to fire:

If the stock is destroyed by fire, the losses incurred will be treated differently under the following three possible circumstances:

- if the stock is not insured-the entire value of the stock destroyed by fire is treated as a loss, at the entry –

Particulars | Dr Rs | Cr Rs |

Profit and Loss A/c To Trading A/c | ******** |

******* |

Note: (i) The value of stock destroyed is credited to trading account as ‘stock destroyed’ (had it not been destroyed, it would have appeared as closing stock).

(ii) Entire value of the stock destroyed id treated as loss and charged to profit and loss account.

B. If the stock is fully insured-when the fully insured stock is destroyed, the company has a claim to the insurance company for the recovery of losses due to the goods destroyed by fire. Therefore, the claim takes precedence in the entry –

Particulars | Dr Rs | Cr Rs |

Insurance Co. A/c To Trading A/c | ******** |

******* |

In practice, claims against the insurance company are treated as "debtors" and are indicated on the asset side of the balance sheet as payments from the insurance company.

If the insurance company settled the dues, the entry would be

In fact, the account of the insurance company does not appear on the balance sheet, since the cash/bank balance on the balance sheet increases with the settled claims.

C. if the shares are partially insured-in this case, the total value of the destroyed shares will be credited to the trading account, that portion of the claim settled by the insurance company will be debited to the insurance company account, and the difference between the destroyed shares and the accepted insurance claim will be debited to the profit and loss account as a loss. The entries are as follows –

Particulars | Dr Rs | Cr Rs |

Insurance Co. A/c (part of the claims accepted) Profit and Loss A/c (loss which cannot be recovered) To Trading A/c | ******** |

*******

****** |

5. Deferred appropriations: A huge expenditure of the nature of the revenue generated at the initial stage of a business enterprise with the belief that it derives profit from such expenditure during subsequent years is considered a deferred revenue expenditure if the charge of such expenses is spread over the number of years in which the profit is expected to be derived.

Part of such expenditure is charged as revenue for each year, and the rest is capitalized on the basis of the matching concept. For example, huge expenditures on "advertising" occur in the first year of the business and derive profits over an estimated period of ten years. Then one-tenth of that expenditure each year is charged to income over a decade period. The Important point here is that the expenditure that is not charged to the revenue is capitalized and appears as a fictitious asset on the balance sheet.

For example, suppose that the ad cost incurred Rs.2, 00,000 will be able to bring benefits over five year’s term. Then a fifth of two, 00,000, i.e., Rs.40, 000 are going to be charged on revenue for the primary year and therefore the remaining Rs.1,60,000 are shown as fictitious assets. In the second year Rs.40, 000 are charged for earnings and 1,20,000 outstanding are shown as fictitious assets. This process lasts for five years until the full expenditure is written off. Entries passed in the first year are –

Particulars | Dr Rs | Cr Rs |

Advertisement A/c To Bank A/c (For Advertisement Expenditure) | 2,00,000 |

2,00,000 |

Particulars | Dr Rs | Cr Rs |

Profit and Loss A/c Dr Deferred Revenue expenditure A/c Dr To Advertisement A/c (For charging one fifth of advertising expense to revenue and treating the rest as deferred revenue expenditure) | 40,000 1,60,000 |

2,00,000 |

6. Creation of reserve funds: To strengthen the financial situation of the enterprise, a part of the net profit can be transferred to the reserve account by appropriation. The entries for creating a reserve fund are –

Particulars | Dr Rs | Cr Rs |

Profit and Loss Appropriation A/c Dr To Reserve Fund A/c | ******** |

******* |

Note: (i) Reserve fund will appear on the liabilities side of the balance sheet.

(ii) In the case of sole trading and partnership organizations, it is customary to charge this directly to profit and loss account instead of profit and loss appropriation account.

7. Committee of managers:

Business companies sometimes offer profit incentives to managers in the form of commissions to motivate people to increase business profits. This fee is given as a percentage of net profit. There are two ways to provide this percentage of net profit.

(a) The percentage of the commission against net profit before charging such fees;

(b) The percentage of fees to net income after invoicing such fees;

8. Specific hidden tweaks:

The adjustments are not given explicitly under the array of adjustments, but they need to be placed and adjusted. For example, the balance displays the subsequent items alongside other items at the top of Dec31, 2009:

DR Cr

10% loan January 1, 2009 - -

Interest on loan 3,000 -

(Paid during the year)

If we carefully observe loans are obtained in March 1, 2009 at a rate of interest of 10%. That is, the interest paid on a one-year loan in December31, 2009 (Rs.50, 000×10/100) rupees.5, 000. But the interest paid is only Rs.3, 000 as shown in the trial balance. This indicates that interest is not paid (Rs.5, 000-3,000-2,000. Therefore, this should be considered as an adjustment. The entry is –

Profit and Loss A/c Dr 2,000

TO Interest payable A/c 2,000

Here, the total interest charged to the profit and loss account is Rs. Will you be given 3,000 trial balances plus interest expense? 2,000, which is completely equivalent to Rs.5,000. Interest expense Rs.2,000 will appear as liabilities on the balance sheet.

Please note that there are many adjustments to different types of courses and preparations for the final. Their treatment is explained when they appear.

Worksheet

When all the necessary information for financial reporting is ready (that is, information on the trial balance and adjustment, officially aggregated without errors), the accountant prefers to draft a work sheet. The worksheet is a rough work and is not part of the financial statements.

The worksheet is provided for convenience to ensure that the financial statements prepared in the debit and credit columns representing the trial balance, adjusted, adjusted trial balance, trading account, profit and loss account and balance sheet are in order.

|

Overview

The provisions concerning the accounts of the company are contained in sections 128-137 (except 135) of the Companies Act, under Chapter IX of the 2013 (CA, 2013) and 2014 (Accounts) rules. A similar provision of the Company Act of 1956 (CA, 1956) was contained in Section 209-220 under Chapter I of Section VI of the act. CA, Section 2 (13) 2013 gives a comprehensive definition, but CA, 1956 does not have a separate definition of "book". Accounting books Section 2 (13), 2013 (CA, 2013) of the Companies Act gives a comprehensive definition. "Account book”

Contains records maintained with respect to—

- matters relating to all amounts received and disbursed by the company and receipts and expenditures to be made;

- All sales and purchases of goods and services by US; (III) our assets and liabilities; and

- In the case of a company belonging to one of the classes of companies specified in that section, the item of expenses prescribed under Section 148;

The Company Act of 1956 (CA, 1956) did not have a separate definition of “books", but Section 209 of the Act required all companies to maintain proper books –

a) All amounts received and disbursed by the company and the matters to which it receives and disburses;

b) All sales and purchases of goods by US;

c) Our assets and liabilities

CA, 2013, covers the “sale and purchase of services" in the book range of accounts.

Appropriate number of accounts

Section 128 of the CA(1),2013 must be prepared by all companies and kept in their registered offices, accounts books and other relevant books and papers and financial statements, for every fiscal year that gives a true and fair view of the state of the affairs of the company including that of its branches, if any, explaining the transactions that have affected both the Registered office and its branches, occurring we maintain such books in accordance with the double-filling system of accounting based on the following criteria.

Section 209(3), 1956 of the CA stipulated that appropriate books were not kept with respect to the matters specified therein if(a)there were no books necessary to truly and fairly grasp the status of the company or branch and explain the transaction, or(B)they were not kept on an accrual basis according to the accounting double entry system.

Books and papers

Section 2 (12)of CA,2013 defines “book and paper" and" book and paper "to include accounts books ,acts, vouchers, sentences ,documents, minutes and registers maintained in paper or electronic form. Meanwhile, Section 2 (8), 1956 of CA defines" book and paper "and" book or paper "to include accounts, acts, vouchers, sentences, and documents. So "minutes and registers" is now part of "book and paper." Section 128 of CA (1), 2013 requires all companies to prepare other relevant books and papers along with accounting books and keep them in their registration offices,CA,1956, books and papers have only references to Section 209A dealing with corporate inspections.

Maintenance of books in electronic mode

The second note to Section 128 of the CA, 2013, allows the company to store such account books or other relevant papers in electronic mode in a prescribed manner Rule 3 of the company (account) rules stipulates the way accounts are held in electronic mode in 2014.

According to the rules:

- Account books and other related books and papers maintained in electronic mode will remain accessible in India for further reference.

- the account books and other related books and papers contained in sub-rule(1) shall be fully retained in the form originally generated, transmitted or received, or in a form that accurately presents the information generated, transmitted or received, and the information contained in the electronic records shall be complete and unaltered.

- The information received from the branch must be kept in a manner that does not change and indicates the information received from the branch

- Information in electronic records of documents may be displayed in an easy-to-read format.

- if an appropriate system exists as the Audit Committee for the storage, retrieval, display or printing of electronic records, or as the board of Directors deems appropriate, such records shall be disposed of or unavailable unless permitted by law.

- The company must be faithful with the registrar on an annual basis at the time of submission of financial statements:

(a) Name of the service provider;

(B) Internet Protocol address service provider;

(C) Location of the service provider, if applicable)

In 1956, there was no specific provision for the maintenance of electronic mode books. However, in the Registrar of the enterprise there were provisions for the submission of electronic records containing financial statements in electronic mode. Section 610E provided that all provisions of the Information Technology Act 2000 on electronic records, including the manner and form in which electronic records are filed, apply or relate to electronic records under Section 610B, unless they are inconsistent with this law.

Financial statements

In accordance with Section 2 (40) of the CA 2013 the "financial statements" relating to the company are as follows—

- balance sheet at the end of the current consolidated fiscal year;

- Profit and loss accounts for the fiscal year, if the company is performing activities that are not for profit;

- Statement of cash flows for the consolidated fiscal year under review;

- Statement of change in equity (where applicable)

- Any description that accompanies, or forms part of, any document from sub-clause (I) to Sub-Clause (IV) ;):

However, Financial Statements for one company, a small company, and a dormant company may not include cash flow statements.

Such a definition of "financial statements" was not available under CA in 1956, nor was it a term used in any section of that law. According to the definition, all companies, except one company, a small company and a dormant company, are required to prepare a cash flow statement. Previously, the Corporate (Accounting Standards) rule, 2006, exempted "small businesses "from the preparation of cash flow statements. As not specified in Schedule III in CA, 2013, the cash flow statement shall be prepared in the form specified only in the AS-3 cash flow statement.

Fiscal year results

According to Section 2(41) of the CA, in 2013, a "fiscal year" for any company or entity means a period that ends on the 31st day of the month each year, and if it is incorporated after the 1st day of the month of the year, it means a period that ends on the 31st day of the month of the following year.:

Provided that it is an application made by a company or body Company, a holding company or a subsidiary of a company established outside of India and is a subsidiary of a company established outside of India.

Further, the enterprise of the company or entity present at the time of the commencement of this law shall, within two years of such commencement, adjust the fiscal year in accordance with the provisions of this provision.

Under California, 1956-217 and 210-3 and 4 was dealing with "fiscal year." According to Section 2(17)of the CA, the "fiscal year “of 1956 means the period in which the profit and loss account of an entity placed before it at the annual meeting is composed, regardless of whether the period is a year, in relation to the enterprise of any entity. However, for insurance companies, “fiscal year" shall mean the calendar year as described in the subsection of Article 11, paragraph 1938 of the Insurance Act.

Section 210 of CA (3), 1956 provided that the profit and loss account shall be relevant:

- in the case of the company's first annual meeting, the period beginning with the establishment of the company and ending with a date that shall not exceed nine months before the date of the meeting;

- in the event of a subsequent annual meeting of the company, such extension shall be granted for a period of more than six months from the date immediately following the period in which the account was last submitted, or if an extension of the time for the meeting to be held under the second provision of Paragraph 1, paragraph 166 is permitted, at least six months.

Section 210 of CA(4),1956 provided that the period in which the account above relates is referred to as the "fiscal year" in this act; it may be a calendar year or less, but it must not exceed 15 months. However, it can be extended up to 18 months, when a special permit is granted instead by the Registrar.

Now, under CA, in 2013, all companies must have their financial year as a period ending on 31 March each year. The exemption only applies to holding companies/subsidiaries of foreign companies that have been approved by the government. All existing companies do not close the financial year on 31st March, so they must have the latest by 31st March, 2016. The period of the first accounting year of the company is also defined in the section, and there are no available options.

Form and content of financial statements

Section 129 of the CA (1), 2013 requires that the financial statements of the Company shall be

- a true and fair understanding of the company's situation;,

- Obeying with the rules of accounting standards notified under Section 133;

- a form or form provided to a company of a different class or class of Schedule III;

This subsection shall not apply to insurance companies or banking companies or companies engaged in generating or supplying electricity, or to any other class of companies whose forms of financial statements are specified in or under the law governing such class of companies.

Section subsection(5)129 further provides that, if the company's financial statements do not comply with the accounting standards set out in Subsection (1), without compromising the subsection-

In Paragraph (1), the Company shall disclose any deviations from financial statements, accounting standards, the reasons for such deviations, and any financial impact arising from such deviations.

Subsection (6) Section 129 prohibits the class from complying with the requirements of any of the rules made in this section or on its basis if the central government believes it is necessary to grant such exemptions in the public interest, on its own or by notice, for applications by the class or class of companies. Such exemption may be unconditionally or subject to the conditions specified in the notice.

A similar provision was in CA, 1956. Section 211 (1) all the company's balance sheets shall be true and fair to the company's situation at the end of the fiscal year, and in accordance with the provisions of this section, shall be in the form set forth in part I of Schedule VI, or in any form in which circumstances close to it are permitted, or in any other form that may be approved by the central government in general or in particular cases. if you do not agree to the terms of this agreement, you will be bound by the terms of this agreement. And in the preparation of the balance sheet must have, as far as possible, in the general instructions for the preparation of the balance sheet under the heading "notes" at the end of that part. :

Subsection (2) all profit and loss accounts of the Company shall give a true and fair view of the company's profit and loss for the fiscal year and, as mentioned above, shall be included in Part II of Schedule VI.

Nothing contained in this sub sections (1) and (2)does not apply to insurance companies or banking companies or companies engaged in generating or supplying electricity, or to companies of any other class whose forms of balance sheet and profit and loss accounts are set forth in the laws governing such classes of companies.

Subsection (3) the central government authorized to exempt any class of companies that comply with any of the requirements of Schedule VI, if it is deemed necessary to grant an exemption for the public interest, unconditionally or in accordance with the conditions specified in the notice by the Official Gazette.

Subsection (3A) mandated that all of the company's profit and loss accounts and balance sheets comply with accounting standards, and that if the company's profit and loss accounts and balance sheets do not comply with accounting standards, the company would disclose in its profit and loss accounts and balance sheets any deviations from accounting standards, the reasons for such deviations and any financial effects resulting from such deviations.

Subsection (4) the central government, with the consent of the board of Directors of the company, has authorized, by order, any of the requirements of this law to change in relation to the company in relation to the matters listed on the balance sheet or profit and loss account of the company for the purpose of adapting to the situation of the company.

Accounting standards

Section 129, 2013 of the CA requires that financial statements comply with accounting standards notified under Section 133 and Section 133 stipulates that the central government may prescribe accounting standards or an addendum to it, recommended by the Association of CPAs of India, after consultation with and consideration of recommendations made by the National Financial Reporting body.

Article 7 of the Company (Accounting Standards) Regulation (2014) stipulates that, as a transition provision, the accounting standards under the Company Act 1956 (i.e., the Company (Accounting Standards) Regulation, 2006) shall be considered as accounting standards until established by the central government under Article 133.

Similar provisions were provided in subsections of sections (3A), (3B) and (3C) 211, 1956 of CA.

Format of financial statements

Section 129, 2013 of the CA requires that financial statements must be in a form or form that is provided to companies of different classes or classes of Schedule III.

Subsection (6) Section 129 prohibits the class from complying with the requirements of any of the rules made in this section or on its basis if the central government believes it is necessary to grant such exemptions in the public interest, on its own or by notice, for applications by the class or class of companies. Such exemption may be unconditionally or subject to the conditions specified in the notice.

Schedule III to the CA, 2013 provides that the disclosure requirements set out in this schedule are not replaced, in addition to the disclosure requirements set out in the accounting standards set out in the Companies Act, 2013. The additional disclosures specified in the accounting standard shall be made by a note to the account or an additional statement unless it is required to be disclosed on the surface of the financial statements. Similarly, all other disclosures required by the Companies Act shall be described in the account notes in addition to the requirements set out in this schedule. Such provisions were also found in Section 211 of the Companies Act and in Schedule VI, 1956.

However, Schedule III of the Companies Act 2013 also includes general instructions for the preparation of consolidated financial statements, and where the preparation of consolidated financial statements, i.e., consolidated balance sheets and consolidated income statements, is required, the Company shall comply with the requirements of this schedule that apply to the company in the preparation of the balance sheet and income statement. The consolidated financial statements shall also disclose information in accordance with the requirements set forth in the applicable accounting standards. It is also necessary to disclose certain additional information in the consolidated financial statements.

Section of Section(3)of the CA Section 129,2013 in addition to the financial statements it is provided on the basis of subsection(2)if the company has one or more subsidiaries, another statement containing in such a form that the salient features of the financial statements of its subsidiaries or subsidiaries may be prescribed. The central government may provide consolidation of the company's accounts by the prescribed method. Subsection description stipulates that for the purposes of this subsection, the word "Subsidiary" shall include quasi-company and joint venture.

Sub section (4)Section 129 applies to the preparation, adoption and audit of the financial statements of the holding company the provisions of this law stipulate that mutatis mutandis shall apply to the consolidated financial statements described in Subsection (3).

Rule 5, 2014 of the company (accounting) rules shall be in the form of a statement containing prominent features of the financial statements of subsidiaries or subsidiaries, affiliates or companies and joint ventures or ventures of the company under the first provision of Paragraph 3 of paragraph 129 of the Aoc-1.

Rule 6 stipulates the method of consolidation of accounting; it requires that the consolidation of the financial statements of the company must be carried out in accordance with the provisions of Schedule III of the law and the applicable accounting standards.

In 1956, there was no such provision in CA, which mandated the compulsory consolidation of financial statements by companies with subsidiaries.

However, Section 212 required a balance sheet of the holding company that contains certain matters relating to its subsidiaries and a sheet of the holding company for attachment to the balance sheet of the holding company

a) copy of the subsidiary's balance sheet,

b) Another set of the profit and loss account,

c) a copy of the board's report,

d) a copy of the auditor's report and

e) A statement of the interests of the holding company to the subsidiaries specified in Sub section(3).

However, subsection (2) (A), where it had subsidiaries, affiliates and joint ventures, was required to produce the balance sheet, income statement, auditor report and director report of the subsidiary in accordance with the requirements of CA, 2013. What is worth mentioning here is that CA, 2013 includes the definitions of "subsidiary" and "affiliate".

Account authentication

Section 134(1), 2013 of the CA requires that financial statements, including consolidated financial statements, must be approved by the board of directors by the chairman of the company or by two directors who are authorized by the board of directors at least before being signed on behalf of the board of directors, if any in addition to the submission to the auditor for his report on the accounts of the company.

Section 215,1956 of CA they are signed on behalf of the board of directors in accordance with the provisions of this section and provided that the balance sheet and profit and loss accounts are approved by the board of directors before they are submitted to the auditor for their reporting on it.

Company's balance sheets and all profit and loss accounts should be signed on behalf of the board of directors:

- in the case of a banking company, by the person specified in Paragraph(A)or (B), in some cases, by the person specified in Section 2, paragraph 29, of the Banking Companies Act, sub-section 1949 (10of1949).)

- In the case of any other company, if its manager or secretary is present, and if two or more directors of the company, one of whom must be a managing director, are present.

In the case of a company that is not a banking company, if for the time being only one of its directors is in India, the balance sheet and profit and loss accounts must be signed by the director, in which case the balance sheet and profit and loss accounts must be accompanied by a statement signed by him explaining the reason for the violation of the provisions of Paragraph 1.

Certification of financial statements by the chairman (if approved by the board of directors) and the CFO and the company secretary (if appointed) is a new provision.

Account circulation

Section 134(7) CA, 2013 requires that a signed copy of all financial statements, including consolidated financial statements, be issued, circulated or published, along with

a) notes that form an annex to or part of such financial statements,

b) the auditor's report and

c) The respective copies of the board of directors ' reports as set forth in Subsection (3).

Section 210 of CA (1), 1956 at all annual meetings of the company also held in the pursuit of Section 166, the board of Directors of the company requested to be put before the company

a) balance sheet at the end of the period specified in Subsection (3) and

b) Profit/loss accounts for that period.

Section 216, 1956 of the CA requires that the Audit & Supervisory Board report be attached (including if there is a special or supplementary report by the Audit & Supervisory Board), and Section 217 (1) does not change the two acts with respect to the circulation of accounts, therefore, by the board of directors.

Revision of accounts

CA, 2013, Section 130 stipulates that the Company shall not resume the account books and shall not recast

Unless an application in this regard is made by the central government, the Income Tax Authority, the Securities and Exchange Commission, or any other statutory regulatory body or authority or party, and an order is made by a court or Court of competent jurisdiction, its financial statements shall be deemed to be non-binding unless an application in this regard is made.、

- The Associated previous account was created in an unauthorized manner;

- The company's operations were mismanaged during the period, casting doubt on the reliability of the financial statements. Subsection (2) provides that the modified or recast account shall be final under Subsection (1) without prejudice to the provisions contained in this law.

Another section 131, 2013 of the CA provides that if it appears to the directors of the company

(A) The financial statements of the company; or

(B) The reporting of the board of directors does not comply with the provisions of Article 129 (the financial statements cannot truly and fairly view the status of the company or the company, or fail to comply with the accounting standards notified under Article 133, or the financial statements of Article 134 are not in compliance with the provisions of Article 129). if not properly signed, or the auditor's report is not attached, or the director's report containing the required disclosures is not attached), the company may prepare revised financial statements or revised reports for any of the previous three consolidated fiscal years after obtaining court approval for applications made in the form and manner prescribed by the company.

The court, the Central government and income tax authorities to notify under this section in any order before going through, then the government or authorities made by the Express consideration of this account modification, the revised financial statements or report, fiscal year more than once created are submitted not in compliance with the terms and conditions set forth in such financial statements or the report of the revision of the detailed reasons, The revisions have been made to the fiscal year of the Board of Directors Report be disclosed to anyone.

In subsections of Section 131, if copies of the previous financial statements or reports are sent to members, delivered to the registrar, or placed before the company at the general meeting, amendments shall be limited to (a) amendments in which the previous financial statements or reports are not in accordance with the provisions of articles 129 or 134 and (B) the preparation of necessary consequential alternations. It is also possible to obtain a license to use the software.

The Company Law of 1956 did not provide a specific provision to allow the revision of accounts. There was no provision prohibiting revising accounts after they were adopted.

The corporate department (then the corporate department) clarified its Notice No. 17/75/2002CL-V dated 13th January,2003, and clarified that the company could comply with the technical requirements of other laws to achieve the purpose of presenting a true and fair view, even after it was adopted at the annual meeting and submitted to the Registrar of the company.

The revised annual account must be adopted either at the Extraordinary General Meeting or at the subsequent annual meeting and submitted to the Registrar of the company.

The problem was further revealed by the Ministry vide its general circular no.5/2010 date 22nd November, 2010 maintaining the provisions of Section 220 of the act in view, the Ministry of general 1/2003 may not lay multiple sets of annual accounts for a particular fiscal year, unless the relevant annual accounts are reopened or revised after being adopted at the annual meeting for the reasons set out in the ministry's circular 1/2003.

As far as the auditor's report on the revision of accounting is concerned, the same is dealt with by SA560 (revision)–subsequent events. The standard visualizes two situations in this regard.

One is when facts are known to the auditors after the reporting date of the Audit & Supervisory Board members and before the date of the issuance of the financial statements, and the other is when facts are known to the Audit & Supervisory Board members after the issuance of the financial statements. This standard obliges auditors to take appropriate action in both situations in case management decides whether to revise accounting or not.

Persons responsible for maintaining accounting books and penalties for violations

Section 128(6)of CA,2013 provides that the managing director, the director of the entire time in charge of finance ,the Chief Financial Officer or any other person in the company charged by the board with an obligation to comply with the provisions of this section violates such provisions, for a period that such person of the company may extend to one year imprisonment or must be less than R50,000 but must be punished with a fine that can be extended to r5lakh or both.

Sections 209 (6) and (7) of the CA, 1956, made the following persons responsible for maintaining the account books:

- if the company has a managing director or manager, such managing director or manager, and all officers and other employees of the company;

- if the company does not have a managing director and manager, all directors of the company,

- in some cases, the person charged by the Managing Director, Manager or board of directors with an obligation to ensure that the requirements of this section are complied with;

Section 209 (5) CA,1956 may be extended up to six months for each offence if any of the persons listed in subsection (6) fail to take all reasonable steps to ensure our compliance with the requirements of this section, or if his own willful conduct caused the default by the company under it. A fine that can be extended up to R10, 000, or both, provided that a person must be sentenced to imprisonment for such offence.

Therefore, CA, 2013 brings the responsibility of keeping the accounting books of the director (treasurer) and Chief Financial Officer for the entire time.

Account submission

It becomes mandatory to submit a copy of the financial statements, including consolidated financial statements, along with all documents, if any, which must be attached to such financial statements under such law, be duly adopted at the company's annual meeting and submitted to the registrar within 30 days from the date of the annual meeting, with a prescribed fee or additional fee within the time set forth in Article 403."Section 137, 2013 of the CA"

In addition, if such financial statements were not adopted at the annual general meeting or the adjourned general meeting, such non-performing financial statements, along with the necessary documents under Paragraph 1, must be submitted to the registrar within 30 days from the date of the annual general meeting, and the Registrar shall record them as provisional records, after being adopted at the adjourned general meeting for that purpose, until the financial statements are submitted with him. The Company shall not be liable for any loss, damage, loss, or damage to any of its products or services.

Further, the section stipulates that the financial statements adopted at the Annual General Meeting of the recess shall be submitted to the registrar within 30 days from the date of the Annual General Meeting of the recess, with the fees or surcharges prescribed within the time set out in Article 403.

In addition, one company stipulates that a copy of the financial statements officially adopted by its members, as well as all documents that must be attached to the financial statements, must be submitted within 180 days of the closing of the fiscal year.

Further, it stipulates that the financial statements duly signed with a statement of fact and reason for not holding the annual general meeting, along with the documents that must be attached under Paragraph 1, must be submitted to the registrar within 30 days from the last day when the annual general meeting should be held, with the fees or additional charges set out within the time specified under paragraph 403.

Section 220 of CA (1), 1956 after the balance sheet and profit and loss accounts have been laid before the company at the annual meeting as mentioned above these shall be provided that the balance sheet and profit and loss accounts shall be submitted to the registrar within 30 days from the date on which the balance sheet and profit and loss accounts have been laid so, or if the annual meeting of the company for any year has not been held, in the case of a private company a copy of the balance sheet and profit and loss accounts in accordance with the provisions of this law, it shall be submitted to the registrar within thirty days from the date on which the meeting should have been held or earlier.

It also stipulated that if the annual meeting of the company before the balance sheet was installed, as mentioned above, did not adopt the balance sheet, or was postponed, or the annual meeting of the company for any year was not held, a statement about the fact and the reasons would be annexed to the balance sheet, which must be submitted to the Registrar.

The provisions for the submission of financial statements are the same except for the separate submission of profit and loss accounts by private limited companies under the provisions of CA, 1956, and no place was found in CA, 2013.

Period of holding accounting books

Section 128(5)CA,2013 requires that all company account books related to a period less than eight financial years immediately before the fiscal year, or if the company was present for a period less than eight years, be kept in good order with respect to all previous years, along with vouchers related to the entry of such account books:

If an investigation is ordered with respect to a company under Chapter XIV, the central government may instruct the account books to be kept for a long period as deemed appropriate.

There is a similar provision in Section 209 (4A), 1956 of the CA.

Examination of accounts

Section 209A of CA, 1956, provided that all company accounting books and other books and papers are open to inspection during business hours

- by the registrar or

- by an officer of the government that may be approved by the central government on its behalf, or

- may be approved by such officers of the Indian securities and Exchange Commission

Such inspections may have been conducted without prior notice to the company or its officers. In CA, 2013, such provisions are contained in articles 206 to 209 of Chapter xiv-inspection, inquiry and investigation. Section 206 of the Act provides the authority to seek information, inspect books and make inquiries. Sub section (3)206 of Section shall not be satisfied with the company if the information or description is not provided to the registrar within the time specified in Sub section (1), or if the registrar is of the opinion that the information or description provided is insufficient for the examination of the submitted document, or if the registrar is satisfied with the examination of the submitted document. It provides that the state does not present and disclose a full and fair statement of the necessary information. The Registrar shall record in writing his reasons for issuing such notice before a notice is provided under this subsection.

Subsection (5) 206 of section stipulates that the central government may conduct a direct inspection of the company's books and papers by inspectors appointed by it for the purpose, if such circumstances meet the guarantees. And under subsection(6), the central government may grant the statutory authority to conduct an inspection of the account books of the company or the class of the company on the situation by general or special order.

|

How to prepare financial statements

The preparation of monetary statements involves the method of aggregating accounting information into a uniform financial set. The completed financial statements are distributed to management, lenders, creditors and investors who use them to assess the performance, liquidity, and cash flow of the business.

Step 1: confirm receipt of vendor invoices

Compare and receive logs payable to all suppliers that may be charged. Comparing Accounts for expenses on invoices that have not been received.

Step 2: confirm the issue of customer invoices

Compare the shipment log to accounts receivable to ensure that all customer invoices have been issued. Issue an invoice that has not yet been prepared.

Step 3: generate unpaid wages

Accrues expenses for wages earned at the end of the reporting period, but not yet paid.

Step 4: calculate depreciation

To calculate depreciation and amortization for all fixed assets in accounting records.

Step 5: value stock

Perform a field inventory count to close, or use an alternative method to estimate the closing inventory balance. Use this information to derive the cost of the goods sold and record their amounts in accounting records.

Step 6: adjust your bank account

Perform bank adjustments, create journal entries, and record all the adjustments required to match accounting records to bank statements.

Step 7: post the account balance

Post all sub ledger balances to the general ledger.

Step 8: verify your account

Review the balance table account and use journal entries to adjust the account balance to match the corresponding details.

Step 9: check your finances

Print preliminary versions of financial statements and check them for errors. Repeat until all errors are corrected.

Step 10: generating income tax

Based on the corrected income statement, you will accrue income tax expenses.

Step 11: close the account

Close all sub ledgers for that period and open during the next reporting period.

Step I2: issue financial statements

Print the final version of the financial statement. Based on this information, write a footnote that accompanies the statement. Finally, prepare a cover letter explaining the key points of the financial statements. This information is then assembled into packets and distributed to a standard list of recipients.

Financial statements are the way companies tell their stories. Thanks to GAAP, there are four basic financial statements that everyone needs to prepare.

Together they represent the profitability and strength of the company. Financial statements that reflect the profitability of the company are income statements.

Retained earnings statement-also called the statement of the owner's shares, indicates the change in retained earnings between the beginning and end of the period (for example, month or year).

The balance sheet reflects the solvency and financial situation of the company.

The cash flow statement shows the cash inflow and outflow of the enterprise over a period of time.

There are several accounting activities that occur before the financial statements are prepared. Financial statements are created in the following order:

- Income statement

- Retained earnings statement-also known as the owner's statement of stock

- Balance sheet

- Cash flow statement (income statement)

An income statement, sometimes called an income statement or an income statement, reports the profitability of a business organization for a certain period of time. Accounting measures the profitability of a period, such as a month or year, by comparing revenue and expenses incurred to generate revenue. This is the first financial statement prepared because you will need information from this statement for the rest of the statement. The Income Statement includes:

- Revenue is the influx of cash resulting from the sale of products or the provision of services to customers. We measure revenue at prices agreed on the exchanges where the business offers goods or services.

- Cost is the cost incurred to produce income. Expense is the cost of doing business (usually identified as an account that ends with the word” expense").

- Revenue-expense=net profit. Net profit is often called the profit of the company. If expenses exceed income, the business has a net loss. Statement of retained earnings (or ownership interest))

The retained earnings statement describes the change in retained earnings between the two balance sheet dates. We start by starting the retained earnings (in our example, the business started in January, so we start with zero balance) and from the earnings report , then subtract the declared dividend (or the withdrawal of the owner in a partnership or sole proprietor) to the end of the balance sheet of retained earnings (or non-corporate capital).

The balance sheet lists the Assets, Liabilities and capital (including amounts) of the company at a certain point in time. That particular moment is the end of the business on balance sheet day. Note how the headline on the balance sheet differs from the headline on the Income Statement and the statement of retained earnings. The balance sheet is like a picture, capturing the financial situation of the enterprise at a certain point in time. The other two statements are for a certain period of time. When studying the Assets, Liabilities and equity of shareholders contained within the record, it's important to know why this budget provides information about the solvency of the business.

|

How to get started

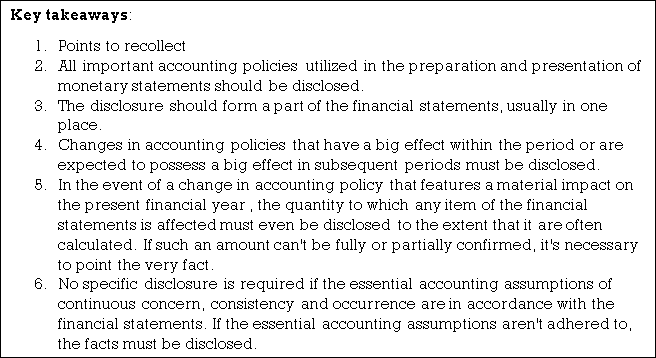

The information that appears in the financial statements of an organization is that of its financial status. Profit or loss can be affected to a great extent by the accounting policies that you follow. The accounting policy to follow depends on the organization. To make the financial statements easier to understand, it is important to disclose the important accounting policies that follow. In certain cases, disclosure is required by law.

In recent years, Indian organizations have adopted the practice of including a separate statement of accounting policy followed by an annual report back to shareholders.

Many organizations include accounting policies and subsequent accounting policies in their financial statement notes, but there is no consistency in cross-organizational disclosure. In other words, disclosure forms part of an account in some cases and is given as supplemental information in others.

The purpose of this standard is therefore to market a far better understanding of monetary statements by establishing the practice of disclosure of important accounting policies and therefore the methods disclosed in financial statements such disclosures would also facilitate a more meaningful comparison between financial tables of different organizations.

Basic accounting assumptions

Certain assumptions are utilized in the preparation of monetary statements. They are usually not particularly indicated because they are supposed to be abided. Disclosure is only necessary if they are not followed.

The following are generally accepted as basic accounting assumptions:

Ongoing concern

Organizations are usually considered to be of continuous concern, that is, to be in continuous operation in the near future. It is assumed that the organization has no intention, no need to stop operations or scale down.

Consistency

It is assumed that the accounting policy follows consistently from one period to another. Frequent changes are not expected.

Axial

Revenues and expenses are recorded when they are earned or incurred in the relevant period (not when money is received or paid).

Nature of accounting policy

Accounting policy refers to the method of applying these principles adopted by the organization in the preparation of accounting principles and financial statements.

There is no single list of accounting policies that apply in all situations. The different circumstances in which the organization operates make alternative accounting principles acceptable. The choice of the right accounting principles calls for a greater degree of judgment by the management of the organization.

The various standards of the Association of Certified Public Accountants of India, combined with the efforts of the government and other regulatory bodies, reduce the number of acceptable alternatives in recent years, especially in the case of legal entities, the continued efforts in this regard in the future may further reduce the number, but the availability of alternative accounting principles is not likely to be completely eliminated, with the different situations faced by the organization in mind.

Areas where different accounting policies are possible

Below are examples of areas in which different accounting policies may be adopted by organizations.

Methods of depreciation, depletion and amortization

Processing spending during construction

How to convert or convert foreign currency-denominated products

Valuation of inventories

Treatment of goodwill

Valuation of investments

About the handling of severance payments

Recognition of profits in long-term contracts

Valuation of fixed assets

Handling contingent debt

The list of examples above is not exhaustive.

Considerations in choosing an accounting policy

For this purpose, the most considerations governing the choice and application of accounting policies are:

Prudence

Given the uncertainty of future events, the profit is not expected and is not always cash, but is recognized only when it is earned. However, the amount can not be reliably determined, it is only an estimate, but reserves are made for all known liabilities and losses.

Substance on Form

Accounting and presentation of transactions and events in the financial statements should be governed by their content, and simply by the legal form.