UNIT I

Budgeting and Budgetary Control

Meaning of Budget

Preface:

The budget is an accounting plan. This is a formal monetary action plan. You can think of this as a statement of expected income and expenses under certain expected operating conditions. This is a quantified plan for future activities and a quantitative blueprint for action. All organizations achieve their goals by coordinating various activities.

For Goal Execution Efficient planning of these activities is so important that management plays an important role in planning the business. Various activities within the company need to be synchronized by creating a future action plan. These comprehensive plans are commonly referred to as budgets. Budgeting is a management device used for short-term planning and management. It's more than just accounting practice.

Meaning and definition: Budget:

According to the Chartered Institute of Management Accountants (CIMA) UK, budgets are "plans quantified on financial terms prepared and approved prior to a defined period of time, usually with planned income generated and during the period. Shows the expenditure incurred in. The capital employed to achieve a given purpose. "

In Keller & Ferrara's view, "Budget is an action plan to achieve a defined purpose, based on a set of pre-determined related assumptions."

"A budget is a plan that covers the expected activity of a company over a period of time," said G.A. Wales.

After observing the above definition, you can draw out the clear characteristics of your budget. They are…

- This is primarily a forecasting and control device.

- Is it prepared in advance before the actual operation of the company?

- It is related to a clear future period.

- Must be approved by the administrator before implementation.

- Also shows the capital used during the period.

- In addition to allocating resources, budgets also help you set goals, measure results, and plan contingencies.

Budgeting:

Budgeting is the process of planning to spend your money. This spending plan is called a budget. Creating this spending plan allows you to decide in advance if you have enough money to do what you need or what you want to do.

What is a budgeting?

It's an important planning and forecasting process to help you manage your money by balancing your expenses with your income. Budgeting is simply balancing expenses and income. If they are unbalanced and you spend

You will have more problems than you make. Many people are unaware that they will use more. They sink deeper into debt more slowly each year than they earn.

If you don't have enough money to do everything you want to do, you can use this planning process to prioritize your spending and focus your money on what matters most to you.

Why is budgeting so important?

Budgeting allows you to create a spending plan for your money, so it means that you always have enough money for what you need and what is important to you. I guarantee. Adhering to your budget and spending plans can also help you get rid of debt and get out of debt if you are currently in debt.

Key points of effective budgeting:

1) Support from top management: In order for a successful budget structure, not only the consideration of all management teams is fully supported, but also the impulses and directions of management teams are required. Control systems are not effective unless the organization is convinced that management considers the system important.

2) Teamwork: This is an essential requirement if the budget is prepared "bottom-up" in a grassroots way. Top management needs to understand the system and provide enthusiastic support. You need to market the benefits of budgeting to everyone.

3) Realistic Goals: Budget figures should be realistic and represent logically achievable goals. Responsible executives must agree that budget goals are reasonable and achievable.

4) Good reporting system: You need to quickly create a report that compares your budget with actual results, and pay particular attention to important exceptions: numbers that are significantly different from your expectations. An effective budgeting system also requires the existence of an appropriate feedback system.

5) Budget Team Composition: This team receives forecasts and goals for each department, as well as regular reports, and reviews the final acceptable goals in the form of a master budget. The team also approves the department's budget.

6) Well-defined business policy: All budgets reveal business policies developed by higher level managers. In other words, the budget should always be after considering the policies set for a particular department or feature. However, for this purpose, the policy must be accurately and clearly defined and unambiguous.

7) Integration with standard costing system: If a standard costing system is also used, it should be fully integrated with the budgeting program from both budgetary readiness and variance analysis perspectives.

8) Inspirational approach: All non-executive employees or staffs needs to be strongly and appropriately inspired by the budgeting system. Humans essentially hate pressure; they hate what they are forced to do, or even rebel

Budgetary control

Meaning and definition:

Budgetary management is the process of preparing budgets for various activities, comparing budget figures, and achieving any deviations that will be eliminated in the future. Therefore, budget is a means and budget management is the end result. Budget management is an ongoing process that helps you plan and coordinate. It also provides a control method.

Budget management is a cost that includes budget preparation, coordination of departmental work, establishment of responsibilities, comparison of actual performance with budget, and results-based actions to achieve maximum profitability. It's a system of coordination. Brown and Howard

Weldon characterizes budget management as planning ahead of various functions of the business so that the entire business is managed.

ICMA defines budget control as follows: “Continuing actual and budget results to set budgets, associate executive responsibilities with policy requirements, and ensure the objectives of the policy through individual actions, or provide the basis for the policy. Its revision to compare with. "

The budget management features as defined above are:

1. A prerequisite for budget management is to set different types of budgets and modify the responsibility of the person responsible for the successful implementation of the policy.

2 Compare actual performance to budget and reveal deviations for cost control purposes.

3. Corrective action will be initiated to correctly set the unwanted deviations.

The budget management process includes:

- Preparing various budgets.

- A continuous comparison of actual performance and budget performance.

- Budget revision based on changes in the situation.

- Budget management systems should not be strict.

You need a flexible personal initiative and a good range of momentum. Budgetary control is an important tool for making an organization an important tool for cost control and achieving overall goals.

Objectives, Merits and limitations of budgetary control

What is Budget Control?

Budgeting is the process in which budgets are prepared for future periods and, if there are differences, are compared with actual performance to find differences. Comparison of budget figures with actual figures will help management to find out the differences and take corrective actions without delay. Objectives of Budget Control

The main objectives of Budget Control are:

- Define the purpose of the enterprise

- So provide a plan for achieving a defined goal

- Increasing profitability by eliminating waste.

- Centralization of the control system.

- Correction of differences from the Sit standard.

- Fixing the responsibilities of various individuals in the enterprise.

- Coordinate the activities of different departments.

- Sales departments and cost centers economically and efficiently

Benefits of budgeting

Budget Control has become an important tool for organizations to manage costs and maximize profits. Some of the benefits of Budget Control include:

- Budget Control fixes goals. Each department is forced to work efficiently to reach its goals. Therefore, it is an effective way to control the activities of various departments of business units.

- It secures better coordination between various departments.

- When performance falls short of expectations, Budget Control helps management find responsibility.

- It helps to reduce production costs by eliminating wasteful spending.

- By promoting cost awareness among employees, budget management brings efficiency and economy.

- Budget Control facilitates centralized control through decentralized activities.

- Everything is planned and provided in advance, so it will help the smooth operation of the business enterprise.

- It tells Management where action is necessary to solve the problem without delay.

Disadvantages or limitations of Budget Control

The limits of Budget Control are as follows:

1. It is really difficult to accurately prepare the budget under inflation.

2. The budget involves heavy spending that small business care cannot afford.

3. The budget is always prepared for future periods that are uncertain. In the future, the conditions that disrupt the budget may change. Therefore, uncertainty in the future minimizes the usefulness of the Budget Control System.

4. Budget Control is just an administrative tool. Management cannot be replaced in decision-making because it is not a substitute for management.

5. The success of Budget Control depends on the support of top management. This will fail if there is insufficient support from top management.

Types of budget: Fixed and flexible

Fixed budget:

This budget is employed for one level of activity and one set of conditions. It’s defined as a budget designed to stay unchanged no matter the quantity of production or sales achieved. This is often a decent budget and is drawn on the idea that the budgeted activity level won't change. Changes in spending thanks to changes in activity levels aren't taken under consideration.

Therefore, changes in spending resulting from changes in expected conditions and activities aren't specified. Therefore, a hard and fast budget is merely useful if the particular activity level corresponds to the budget activity level.

A typical example of a hard and fast budget may be a master budget tailored to one output level of (for example) 20,000 sales units. However, actually , the extent of activity and set conditions change as a results of internal and external factors like changes in supply and demand, shortages of materials and electricity, and fierce competition.

It is almost useless as a budget management mechanism because it doesn't distinguish between fixed costs, variable costs, and semi-variable costs, and there's no adjustment of the budget amount thanks to changes in costs thanks to changes in levels activity. It doesn't provide a meaningful basis for comparison and control. It also does nothing to repair prices or violate submissions.

Flexible budget:

The UK Association of Certified Management Accountants recognizes flexible budgets (also referred to as sliding-scale budgets), the difference in fixed and variable cost behaviour related to fluctuations in production, sales, or other variable factors. It’s defined as a budget. The amount of employees is meant to vary appropriately in response to such fluctuations. Therefore, flexible budgets offer different budget costs for various levels of activity.

Flexible budgets are created after intelligently classifying all fixed, semi-variable and variable costs. The usefulness of such a budget depends on the accuracy with which costs are often classified.

Such budgets are begun within the following cases:

- The annual activity level varies from period to period, either thanks to the seasonal nature of the industry or fluctuations in demand.

- When the business is new and it's difficult to forecast demand.

- The business suffers from a shortage of production factors like materials, labor and plant capacity. The extent of activity depends on the supply of such factors of production.

- When the industry is suffering from changes in fashion.

- When there's a general change in sales.

- When a business unit continues to introduce new products or changes product design frequently.

- When the industry is engaged during a make-to-order business like shipbuilding.

Flexible Budget Utility (or Importance):

- Flexible budgets provide a logical comparison of budget allowances and actual costs, that is, comparisons with similar criteria.

- Flexible budgets streamline management functions and profit planning, taking under consideration operational realities. It gives a balanced perspective on comparisons. With a versatile budget, the particular cost of the particular activity is compared to the budget cost of the particular activity. That is, the 2 criteria are an equivalent.

- Flexible budgeting allows you to line budget costs for any range of activities.

- A versatile budget is extremely useful for budget management purposes because it responds to changing activity levels.

- The performances of the head are often judged in reference to the extent of activity achieved by the organization, which helps to gauge the performance of the head.

- Flexible budgets for various levels of activity allow you to ascertain the prices of various levels of activity.

- Useful for price fixing and sending quotes.

In conclusion, a versatile budget is more useful, elastic and practical.

Functional budget / operating budget:

A functional budget is a budget related to a particular function of your business, such as a sales budget or a production budget. These budgets are prepared for each function and contribute to the master budget. The number of functional budgets depends on the size and nature of your business

i. Production budget:

The production budget is prepared during the budget period to create a production plan such as production volume, production cost, product type, plant capacity, and operation cycle, input availability, manufacturing or purchasing policy. The production manager is responsible for creating and executing the production budget.

Ii. Sales budget:

A sales budget is a statement of sales planned in terms of both quantity and value. The sales budget predicts sales during the budget period. The sales manager is responsible for preparing this budget.

Iii. Purchase budget:

This budget is provided for all purchased items purchased in each department. The purchase manager is responsible for making this budget. This budget allows the purchasing department to make bulk purchases.

Iv. Manufacturing cost budget:

The production cost budget is provided to show the production cost of the budget production unit. This is also known as the manufacturing or working cost budget and includes material costs, labor costs, direct costs, and factory overhead costs.

v. Overhead:

a. Factory overhead budget: The budget includes overhead estimates, overhead costs, and overhead costs.

b. Management overhead budget: This budget is set aside to manage the expenses of all administrative staff. Examples: Managing Director salary, office rent, staff salary, printing and stationery, postage, telephone charges, etc. These costs are usually fixed in nature. This budget is created with the help of past experience and expected changes. Management overhead budgets are created and executed by the management manager.

c. Sales and distribution budget:

In this budget, all costs associated with the sale and distribution of various products are estimated during the budget period. This budget is a closely related sales budget. Sales and distribution expenses are divided into fixed costs and variable costs according to the sales volume. These costs are office rent, sales staff salaries, bad debts, shipping costs, and sales staff fees.

Vi. Capital investment budget:

This budget estimates the purchase of capital or fixed assets during the budget period. For eg land and buildings, plants and equipment.

Vii. Plant utilization budget:

This budget is provided to know the plant equipment required for production. The purpose of this budget is to determine the (requirements) of each process in the plant, the cost of machinery, overtime, increased production and the use of surplus capacity.

Viii. R & D budget:

In general, all businesses incur R & D expenses to prevent their products from

Becoming obsolete. In addition to this, research and development is also required to expand the business.

Ix. Cash budget (financial budget):

The cash budget is of utmost importance as it controls cash. This is a detailed statement of cash receipts, cash payments, and cash balances for the budget period. Cash budgets coordinate and control the financial aspects of your business. This budget is created after the preparation of all other functional budgets. This budget is created by the company's chief accountant.

Example:

The expenses budget for production of 10,000 units in a factory is furnished below:

| Per unit |

Material | 70 |

Labour | 25 |

Variable Factory Overheads | 20 |

Fixed Factory Overheads (Rs. 1,00,000) | 10 |

Variable Expenses(10% fixed) | 5 |

Selling Expenses (10% fixed) | 13 |

Distribution Expenses (20% fixed) | 7 |

Administrative Expenses (Fixed – Rs. 50,000 ) | 5 |

Total cost of sales per unit | 155 |

You are required to prepare a budget for the production of 6000 units and 8,000 units.

SOLUTION FLEXIBLE BUDGET

Particulars

| Output 6000 units | Output 8000 units | ||

Per unit Rs. | Amount Rs. | Per unit Rs. | Amount Rs. | |

Variable or production expense : |

|

|

|

|

Material Labour Direct Variable Expenses Prime cost | 70.00 25.00 5.00 100.00 | 4,20,000 1,50,000 30,000 6,00,000 | 70.00 25.00 5.00 100 | 5,60,000 2,00,000 40,000 8,00,000 |

Factory Overheads : Variable Overheads Fixed Overheads |

20.00 16.67 |

1,20,000 1,00,000 |

20.00 12.50 |

1,60,000 1,00,000 |

Work Cost Administrative Expense Fixed | 136.67 8.33 | 8,20,000 50,000 | 132.50 6.25 | 10,60,000 50,000 |

Cost of Production | 145.00 | 8,70,000 | 138.75 | 11,10,000 |

Selling Expense : Fixed 10% of Rs. 13 Variable – 90% of Rs. 13 Distribution Expense : Fixed 20% of Rs. 7 Variable – 80% of Rs. 7 |

2.17 11.70

2.33 5.60 |

13,000 70,200

14,000 33,600 |

1.63 11.70

1.75 5.60 |

13,000 93,600

14,000 44,800 |

Total Cost of Sales | 166.80 | 10,00,800 | 159.43 | 12,75,400 |

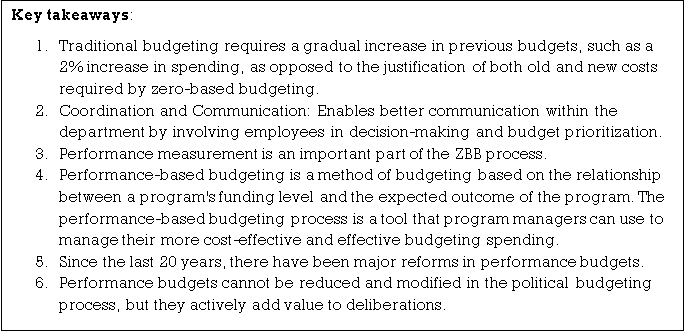

- Budget - Zero base Budget; Performance budgeting

Zero-based budgeting (ZBB) is an approach that allocates funds supported program efficiency and wishes instead of budget history, as companies struggle to scale back costs and compete in an increasingly complex environment. It’s slowly gaining attention again. ZBB isn't a budgeting methodology, but a philosophy of cost justification and frequent monitoring that gives fine-grained support for spending transparency and allows companies to adapt to changing markets.

Overall adoption of ZBB remains low (a recent Deloitte LLP survey shows that only 16% of Fortune 1000 companies have used it within the last 24 months), but consumer packaged product (CPG) companies We use ZBB at a better rate (22%). They face industry turmoil with evolving consumer preferences, volatile commodity prices, the increase of their own brands, and competition within the digital market.

For CMOs of CPG companies, one area where ZBB are often applied is commercial spending. This is often the value owned by the sales and marketing features. Samples of commercial spending include costs related to advertising, trade promotions, and discounts. Commercial spending may be a good candidate for ZBB for the subsequent reasons:

- It's pretty big- Commercial spending typically accounts for 15% to twenty of total sales within the commodity industry.

- Can be measured -The ROI of a performance trade (expenditure linked to a private promotion or promotion calendar) are often calculated with acceptable accuracy.

- Fragmentation -Most commercial spending is fragmented by trade class, customer, and other categories, producing different levels of revenue.

- Advances in data and analytics allow marketers to ascertain which programs are successful and shift resources accordingly. ZBB can provide easy and repeatable thanks to manage your commercial spending.

How does ZBB work?

- The team collects data to assess the drivers of a specific spending activity. ROI guidelines are set for every category and validated by cost owners.

- Budgets and implementation plans are then created for specific spending categories. Once the budget is implemented, the organization tracks performance and creates incentives for cost owners within established ROI guidelines.

- The team sets budget levels for the amount, tracks the ROI of every spending category, and makes adjustments as required.

- Operationally, commercial ZBB programs require dedicated monitoring and planning. Establishing a governance structure and building a team to manage the program is often an efficient tactic.

Responding to ZBB issues

- While ZBB are often a strong tool, it also comes with some notable challenges. Organizations can use a spread of methods to effectively address these.

- ZBBs typically consume more resources than traditional budgeting and need regular reviews, analysis, and reporting. Leaders can leverage advances in analytics and digital technology to accelerate processes, automate analytics, and focus conversations on the foremost important spending factors.

- ZBB must start the budgeting process from scratch and justify all spending, which may generate short-term thinking. To counter this, organizations can adopt long-term performance measurements as required, but with frequent measurement windows and detailed data (such as social sentiment), long-term initiatives work. Show early that you simply are.

- Moving a corporation from traditionally targeted cost savings to ZBB requires a serious cultural change. To deal with this challenge, senior executives can involve business leaders, especially those that manage brand teams and key customers, in conversations about ZBB. Showing your commitment to ZBB and providing a rationale for it'll help ensure success.

- Changes in commercial spending have an immediate impact on retailers. Within the commercial arena, it's more important than other features to determine ROI metrics that are well-tuned for retailers, channels, and segments. Organizations can enjoy a comprehensive view of the speed of return on investment and therefore the use of metrics like volume, growth and share as required.

Channel partners and retailers are often sceptical of ZBB due to the trouble required and therefore the impact it's on their business. You’ll get approval by being as transparent as possible and participating within the decision-making process for these groups.

With the digitization of consumer purchasing channels, the road between marketing and promotional spending is becoming increasingly blurry. It’s important for sales and marketing teams to urge obviate silos that separate various commercial spending program.

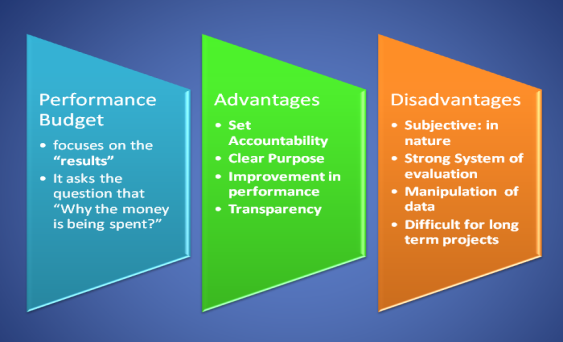

What is a performance budget?

Performance budgeting, also known as performance-based budgeting, is a way to prepare your budget based on an assessment of the productivity of various operations within your organization. The businesses that contribute the most to profitability are allocated a larger share of the budget to that department. It leads to optimal use of resources such as finance, staff skills, and productive use of time.

Basically, a performance budget requires an assessment of performance and productivity from one budget period to another. Therefore, it is the process of identifying the results achieved by each department of the organization.

In addition, the performance budget does not focus on the individual activities required to develop the strategy. Instead, the central focus is on achieving the department's overall goals. This helps managers formulate departmental strategies. Therefore, performance budgeting is based on the concept of zero-based budgeting.

In general, government departments, not commercial organizations, use performance budgets. It is used to justify the application of money. A non-profit organization that the government earns through taxes levied on its citizens and lacks the right information can result in ineffective performance budgets that affect the entire project.

Approach

Performance budgets focus on "results." The final result will be analysed. Performance budgeting is a motivational tool for staff.

Performance-based budgeting process

- Set goals

The organization shall create a list of goals. The goal here shows the final result. Goals need to be clear to each employee in the organization. By communicating the same results as your clear goals, you can successfully implement a performance-based budget.

Therefore, this step is planning and budgeting.

2. Regular evaluation

The next step is a regular assessment of performance to achieve your organization's desired goals. The organization shall develop a systematic, step-by-step approach to evaluation. Performance measurements are subjective and vary from person to person. Therefore, organizations try to quantify results based on them.

Therefore, this step is a measurement of the result.

3. Performance indicators

Performance indicators help you assess the effectiveness and efficiency of your program. Performance indicators are the standard of measurement. The selection is based on the following range:

It's relevance

Cost-effectiveness

Comparability

Representative

Accountability

The organization is accountable for one or more results. The main focus of a performance budget is results, not inputs. Similarly, staffs are responsible for the goals of the organization. In addition, performance-based budgeting is expected to achieve a certain level of results based on a particular level of resources.

Therefore, this step is called result evaluation and communication.

Performance-based budget and traditional budget

Amounts spent for specific purposes, such as staff salaries, office supplies, and equipment, are included in the traditional budget. However, what you can achieve with a $ 1 spending is indicated by your performance budget. Previously, organizations did not follow a performance-based approach. However, organizations are now following a performance-based approach.

Performance budget example

- By the end of 2020, the mortality rate of HIV-positive patients will be reduced by 30%.

- Monthly staff training increased production in 2018 by 20%.

- By 2022, we will reduce infant mortality by 50% by introducing strong immunization centers in all different parts of the country.

Performance budget benefits

In developed countries, money management is one of the key factors for any organization. Performance budgets play an important role in achieving efficiency.

- Set accountability

For public sector organizations rather than commercial organizations, performance budgets can help increase accountability. Employees need to quantify specific goals based on priorities and taxpayer money. Undoubtedly, taxpayers and donors are interested in knowing where the money is spent. Evaluate the benefits to citizens and society.

2. Clear purpose

The performance budget clearly shows the purpose for which the money is spent. Clarifying the purpose makes it easier to evaluate performance and correct deviations.

Performance Improvements Performance budgets continuously improve the performance of your programs. In addition, it leads to the overall operational efficiency of the organization. It also overcomes traditional budgeting limitations.

3. Transparency

Performance-based budgeting helps provide transparency in budget preparation. Performance budgets help you get better finances financial decisions regarding resource allocation. Check the operational efficiency of the project. Therefore, it links the entire process of planning, porting, and evaluating results.

Performance budget disadvantages

Subjective

Performance budgets are subjective in nature, causing disagreements among management. Social projects also have a long-term vision. It is difficult to quantify with money. Costs may vary from government agency to agency. Therefore, using more of the results-based approach helps improve budgeting processes, accountability, and organizational control.

Powerful evaluation system

Performance budgets require a strong accounting system. Therefore, the reporting system must be powerful for its successful implementation.

Manipulating data

Staff may work with the data. In addition, the calculation of financial information is unreliable due to mispreparation. Therefore, a proper internal control system can help maintain the accuracy of your data.

Long-term difficulty

The time between resource allocation to a project and results can be more than a year. Without a doubt, it is difficult to measure project results in the long run.

Therefore, dividing your project into smaller pieces can help simplify the evaluation process. Undoubtedly, over a period of time, performance budgets have become popular throughout the industry.

Problem 1

The expense budgeted for production of 10,000 units in a factory are furnished below:

| Per unit |

Material | 70 |

Labor | 25 |

Variable Factory Overheads | 20 |

Fixed Factory Overheads (Rs. 1,00,000) | 10 |

Variable Expenses(10% fixed) | 5 |

Selling Expenses (10% fixed) | 13 |

Distribution Expenses (20% fixed) | 7 |

Administrative Expenses (Fixed – Rs. 50,000 ) | 5 |

Total cost of sales per unit | 155 |

You are required to prepare a budget for the production of 6000 units and 8,000 units.

Solution:

SOLUTION FLEXIBLE BUDGET

Particulars

| Output 6000 units | Output 8000 units | ||

Per unit Rs. | Amount Rs. | Per unit Rs. | Amount Rs. | |

Variable or production expense : |

|

|

|

|

Material Labour Direct Variable Expenses Prime cost | 70.00 25.00 5.00 100.00 | 4,20,000 1,50,000 30,000 6,00,000 | 70.00 25.00 5.00 100 | 5,60,000 2,00,000 40,000 8,00,000 |

Factory Overheads : Variable Overheads Fixed Overheads |

20.00 16.67 |

1,20,000 1,00,000 |

20.00 12.50 |

1,60,000 1,00,000 |

Work Cost Administrative Expense Fixed | 136.67 8.33 | 8,20,000 50,000 | 132.50 6.25 | 10,60,000 50,000 |

Cost of Production | 145.00 | 8,70,000 | 138.75 | 11,10,000 |

Selling Expense : Fixed 10% of Rs. 13 Variable – 90% of Rs. 13 Distribution Expense : Fixed 20% of Rs. 7 Variable – 80% of Rs. 7 |

2.17 11.70

2.33 5.60 |

13,000 70,200

14,000 33,600 |

1.63 11.70

1.75 5.60 |

13,000 93,600

14,000 44,800 |

Total Cost of Sales | 166.80 | 10,00,800 | 159.43 | 12,75,400 |

Problem 2: The monthly budget for manufacturing overhead of a concern for two levels of activity were as follows:

Capacity Budgeted Production (units) | 60 % 600 | 100 % 1,000 |

| Rs. | Rs. |

Wages | 1,200 | 2,000 |

Consumable Stores | 900 | 1,500 |

Maintenance | 1,100 | 1,500 |

Power and Fuel | 1,600 | 2,000 |

Depreciation | 4,000 | 4,000 |

Insurance | 1,000 | 1,000 |

9,800 | 12,000 | |

You are required to:

- Indicate which of the item are fixed, variable and semi-variable;

- Prepare a budget for 80 % capacity and;

- Find the total cost, both fixed and variable, per unit of output at 60%, 80% and 100% capacity.

Solution

- Fixed – Depreciation and insurance.

Variable- Wages at Rs. 2.00 per unit

Consumable Stores at Rs. 1.50 per unit

Semi-Variable Costs:

Maintenance = Rs 1,500 – Rs. 1100 / 400 = Rs. 400/400 = Rs. 1 per unit variable and Rs. 500 (i.e, Rs. 1,100 – Rs. 600) fixed.

Power and fuel = Rs. 2,000 – Rs. 1,600/400 = Rs. 400/400 = Rs.1 per unit variable and Rs.1,000(i.e, Rs. 1,600 – Rs. 600) fixed.

(ii) Budget for 80 % Capacity (output 800 units)

Wages @ Rs. 2 per unit | 1,600 |

Consumable stores @ Rs. 1.50 per unit | 1,200 |

Maintenance: Rs. 500 + Rs.1 per unit for 800 units | 1,300 |

Power and Fuel Rs. 1,000 + Rs. 1 per unit for 800 units | 1,800 |

Depreciation | 4,000 |

Insurance | 1,000 |

Total Cost | 10,900 |

(iii)

Capacity | 60% | 80% | 100% | |||

Units Fixed Costs | 600

Total Rs. |

Per unit Rs. | 800

Total Rs. |

Per unit Rs. | 1,000

Total Rs. |

Per unit Rs. |

Depreciation Insurance Maintenance Power and Fuel | 4,000 1,000 5,00 1,000 |

| 4,000 1,00 500 1,000 |

| 4,000 1,000 500 1,000 |

|

| 6,500 | 10.83 | 6,500 | 8.125 | 6,500 | 6.50 |

Variable Costs |

|

|

|

|

|

|

Wages @ Rs. 2 per unit | 1,200 |

| 1,600 |

| 2,000 |

|

Consumable stores @ Rs. 1.50 per unit | 900 |

| 1,200 |

| 1,500 |

|

Maintenance @ Rs. 1 per unit | 600 |

| 800 |

| 1,000 |

|

Power and Fuel @ Rs. 1 per unit | 600 |

| 800 |

| 1,000 |

|

| 3,300 | 5.50 | 4,400 | 5.50 | 5,500 | 5.50 |

| 9,800 | 16.33 | 10,900 | 13.625 | 12,000 | 12.00 |

Problem 3:

Create a flexible overhead budget based on the information below to determine overhead costs with 70%, 80%, and 90% plant capacity.

Particulars | 70% Capacity | 80% Capacity Rs | 90% Capacity |

Variable Overheads |

------------------------------- |

24,000 |

------------------------------- |

Indirect Labour | |||

Stores including spares | ------------------------------- | 8,000 | ------------------------------- |

Semi-variable overheads |

------------------------------- | 40,000 |

------------------------------- |

Power (30% fixed, 70%) | |||

Repairs and maintenance 80% fixed and 20% variable | ------------------------------- | 4,000 | ------------------------------- |

Fixed Overheads |

------------------------------- | 22,000 |

------------------------------- |

Depreciation | |||

Insurance | ------------------------------- | 6,000 | ------------------------------- |

Salaries | ------------------------------- | 20,000 | ------------------------------- |

Total overheads |

| 1,24,000 |

|

Particulars | 70% Capacity | 80% Capacity Rs | 90% Capacity |

Variable Overheads Indirect Labour |

21,000 |

24,000 |

27,000 |

Stores including spares | 7,000 | 8,000 | 9,000 |

Semi-variable Expenses - Power* 30% ** Variable |

8,000 |

8,000 |

8,000 |

28,000 | 32,000 | 36,000 | |

Repairs and maintenance ** Fixed 80% **Variable 20% |

3,200 |

3,200 |

3,200 |

700 | 800 | 900 | |

Fixed Overheads Depreciation |

22,000

|

22,000 |

22,000

|

Insurance | 6,000 | 6,000 | 6,000 |

Salaries | 20,000 | 20,000 | 20.000 |

Total overheads | 1,15,900 | 1,24,000 | 1,32,100 |

Problem 4:

The cost of budget production of 10,000 units at the factory is as follows:

Particular | Per unit |

Material | 70 |

Labour | 25 |

Variable overheads | 20 |

Fixed overheads (1,00,000) | 10 |

Variable expenses (Direct) | 5 |

Selling expenses (10% fixed) | 13 |

Distribution expenses (20% fixed) | 7 |

Administration expenses (Rs. 50,000) | 5 |

Total cost per unit | 155 |

Prepare a budget for production

8,000 units

6,000 units

Calculate the cost per unit at both levels

Assume management costs are fixed for all levels of production

Solution:

| 10,000 units | 8,000 units | 6,000 units | |||

| Per unit Rs | Amount Rs | Per unit Rs | Amount Rs. | Per unit Rs | Amount Rs |

Production Expenses : Material | 70.000 | 7,00,000 | 70.00 | 5,60,000 | 70.00 | 4,20,000 |

Labour | 25 | 2,50,000 | 25.00 | 2,00,000 | 25.00 | 1,50,000 |

Overheads | 20 | 2,50,000 | 20.00 | 1,60,000 | 20.00 | 1,20,000 |

Direct Variable Expenses | 5 | 50,000 | 5 | 40,000 | 5 | 30,000 |

Fixed overheads Rs. 1,00,000 | 10 | 1,00,000 | 12.5 | 1,00,000 | 16.667 | 1,00,000 |

Selling Expenses : Fixed | 1.3 | 13,000 | 1.625 | 13,000 | 2.167 | 13,000 |

Variable | 11.7 | 1,17,000 | 11.7 | 93,600 | 11.7 | 70,200 |

Distribution Expenses Fixed | 1.4 | 14,000 | 1.75 | 14,000 | 2.334 | 14,000 |

Variable | 5.6 | 56,000 | 5.6 |

| 5.6 | 30,600 |

Administration Expenses | 5.0 | 50,000 | 6.25 | 50,000 | 8.333 | 50,000 |

Total Cost | 155.00 | 15,50,000 | 159.425 | 12,75,400 | 166.801 | 10,00,800 |

Problem 5:

Create a 1964 budget from the following information about the conditions expected to become widespread in 1963 and 1964.

State the assumption you have made, 1963 actuals

Sales | 1,00,000 (40,000 units ) |

Raw Materials | 53,000 |

Wages | 11,000 |

Variable overheads | 16,000 |

Fixed overheads | 10,000 |

Sales | 1,50,000 |

Raw materials | 5 per cent rise increase |

Wages | 10 per cent increase in wage rates 5 per cent increase in productivity |

Additional Plant | One lathe Rs. 25,000 One drill Rs.12,000 |

Budget for the year 1964 Rs Rs

Sales for 60,000 units @ Rs. 2.50 |

| 1,50,00 |

Less : Cost production |

|

|

Raw Materials | 83,475 |

|

Wages | 17,286 |

|

Variable overhead | 24,000 |

|

Fixed overhead | 13,700 |

|

|

| 1,38,461 |

Estimated Profit |

| 11,539 |

References:

- Https://www.accountingtools.com/articles/2017/5/11/budgetary-control

- Https://www.accountingtools.com/articles/2017/5/11/budgetary-control

- Https://www.economicsdiscussion.net/accounting/types-of-budget-in-accounting/31733

- Https://www.iedunote.com/budget

- Https://www2.deloitte.com/content/dam/Deloitte/us/Documents/risk/us-risk-zbb.pdf

- Https://en.wikipedia.org/wiki/Performance-based_budgeting