Unit – 2

Final Accounts for Co-Operative Society

|

The extraordinary highlights of accounting of co-operative society:

- Examination of late obligations

- Overdue interest

- Certification of awful obligations

- Valuation of resources and liabilities

- Adherence to agreeable standards

- Observation of the arrangements of acts and rules

- Furtherance to public government assistance and protecting of public assets

- Assessment of harms

- Adherence to bookkeeping arrangements, bookkeeping and reviewing guidelines

- Special report to Registrar

- Audit Classification of society

- Discussion of report with the Managing Committee

- Thus, we find that reviewer is acting in double limit of free just as examining the report with those overseeing the general public.

- This component of double limit and the assumptions from reviewer makes the coop soc review unconventional and not quite the same as organization review.

Appropriation Accounts implies the records which show the consumption (both Voted and Charged) of the Government for each monetary year contrasted and the measures of casted a ballot gives and charged appointments for various purposes, as determined in the Schedules affixed to the Appropriation Act passed by Parliament. These Accounts are submitted to Parliament under Article151 of the Constitution and are proposed to reveal:-

(a) that the funds showed in that as having been dispensed, were legitimately accessible for and appropriate to the assistance or reason to which they had been applied or charged;

(b) That the use adjusts to the power which administers it (exemptions being rattled off in the Appendix, alluded to in the declaration referenced in para 11.3.4(a) beneath);

(c) the impacts of re-appropriations requested by the Ministry/Department.

11.1.2 If any cash has been spent during a monetary year in abundance of the measures of casted a ballot awards/charged assignments (independently under the income and capital segments), the conditions prompting a particularly overabundance will be uncovered through these records empowering Parliament to regularize it or something else. Such regularization of abundance will be made by Additional Grants submitted to Parliament under Article 115 of the Constitution of India after receipt of proposals of the Public Accounts Committee in regard of the consumption brought about in overabundance of the casted a ballot awards/charged apportionments for that year in Parliament and Budget Division.

Note 1: according to proposals of the Public Accounts Committee (Third Lok Sabha 1965-66) contained in passage 4.26 of their 45th Report, an overabundance of use over the award in a year which is only because of an oversight to represent such consumption in a prior year (when the award/allotment really remained unutilised in that year) doesn't need regularization by Parliament under Article 115 of the Constitution of India.

Note 2: Cases of "New Service/New Instrument of Service" can be regularized uniquely in the following year after the first Demands for Grants are introduced in February going before and not after that resulting year through the Supplementary Demands for Grants (For assurance of instances of New Service/New Instrument of Service - Annexure "A" to Chapter 4, Ministry of Finance O.M.No.F.7(15)- B(RA)/82 dt.13-4-82 might be alluded to). Regularization of cases identifying with New Service/New Instrument of Service might be submitted as appropriate to the instances of illustrative notes for abundance.

11.1.3 Schedule to the Appropriation Act containing the Charged and Voted wholes (Gross) for Revenue and Capital consumption depends on the Part I (Main) of the Demands for Grants introduced to Parliament under Article 113(3) of the Constitution. Part I is developed from the subtleties encapsulated in Part II for example grantwise and major headwise subtleties of similar Demands for Grants and Detailed Demands for Grants introduced in this manner to Parliament for conversation on the Budget. Since the Union Govt. Appointment Accounts (Civil) are an enhancement to the Union Government Finance Accounts arranged on a net premise (viz. Net use short recuperations), the connection between the two is masterminded by beneath the line recuperations showed as Note underneath Part II on the same page at the hour of compromise (Expenditure Budget Volume II demonstrating net consumption and minor headwise subtleties of Major Heads/awards as well as allotments in Part II of Demands for Grants).

Any ten people who are able to agreement may document an application to the Registrar of Co-employable Societies according to Section 6 of the Co-usable Societies Act, 1912. By law, might be outlined by every general public and ought to be enlisted with the Co-employable Societies.

Adequacy of progress by the law of social orders is relevant just when changes are endorsed by the Registrar of Society.

Sorts of Society

There are two sorts of society –

- Restricted liabilities society

- Limitless liabilities society

Any part isn't at risk to pay more than the ostensible estimation of the offer held by him and no part can possess over 20% of the portions of society.

Today, government is urging co-employable social orders to help society on the loose. Helpful social orders are usable in different areas like customer, modern, administrations, promoting, and so on.

Under bookkeeping arrangement of Co-usable social orders, the term Receipt and Payment is utilized for two crease parts of twofold passage framework.

Accounts

Following records typically kept up by the Co-usable social orders –

- Day Book (Journal)

- Day Book (Cash Account)

- Day Book (Cash Book with Adjustment Column)

Day Book (Journal)

Day book is a book of unique sections. In a day book, a wide range of money or non-money exchanges are recorded, as per the guideline of twofold passage framework.

According to the training continued in the co-usable social orders, a different diary book isn't arranged rather all exchanges are straightforwardly recorded in the day book. Day book has different sides Receipt (charge) and installment (credit) and there are two sections in each side of a day book, one for the money exchanges and second for the change.

Exchange for the money receipt and money installment are recorded in real money section and installment side separately. Also, sections are done in charge and credit side of a day book in the change segment.

Day Book (Ledger for Cash Account)

Since, all the money exchanges are recorded straightforwardly in a day book, it very well may be called as record of money book.

Ledgers

In the co-usable social orders, posting of record isn't done right this minute section situation. Receipt side of the day book on charge side of the record and installment side of the day book posted on the credit side of the record account.

Shutting of Ledgers

In the co-employable social orders, adjusting of an individual record is done when any part clear his record or another record is opened. Sums of any remaining records (receipt and installments) are kept all things considered. Adjusting of receipt and installment accounts are not needed.

Receipt and Payment Account

A receipt and installment account is the rundown of a day book and arranged for a predetermined period. Receipt and installment account is set up from the sums of receipts and installment sides of the record accounts.

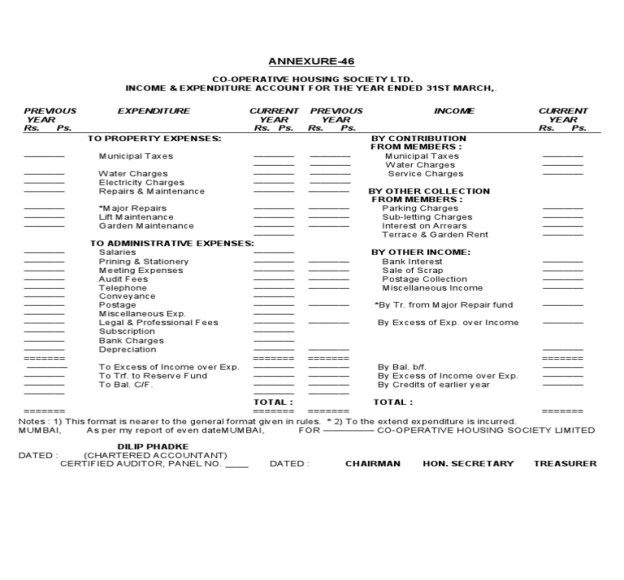

Last Accounts

Exchanging and Profit and Loss record and Balance sheet are set up from the receipt and installment bookkeeping after thought of the change sections. Things show up under the receipt side are treated as pay, and things of the installment side are as consumption.

Rules Appropriated as –

- First 25% of the net benefit ought to be moved to the save reserve account.

- According to area 35 of Co-employable Societies Act, 1912, circulation of the benefit ought not be over 6.25%.

- Commitment to magnanimous assets as characterized in area 2 of Charitable Endowment Act, 1890, which says that commitment might be finished with the earlier authorization of the Registrar. Top level input is confined to 10% of the accessible benefit, in the wake of moving benefit to save account.

- Limitless liabilities, co-usable society may disperse benefit exclusively after broad or unique request of the State Government.

|

2.4 ILLUSTRATIONS

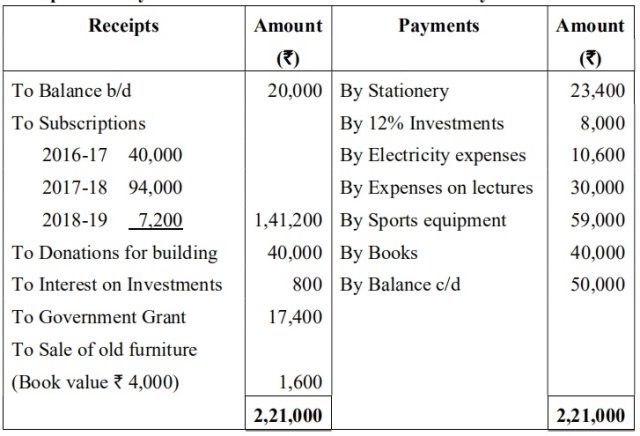

1.From the following Receipts and Payments Account and additional information, prepare Income and Expenditure Account and Balance Sheet of Sears Club, Noida as on March 31, 2018.

Receipts and Payments & Account of Sears Club for the year ended 31-3-2018

Additional Information :

(i) The club has 200 members each paying an annual subscription of Rs. 1,000. Rs. 60,000 were in arrears for last year and 25 members paid in advance in the last year for the current year.

(ii) Stock of stationery on 1-4-2017 was Rs. 3,000 and on 31-3-2018 was Rs. 4,000.

Soln

Solution:

Dr. Income and Expenditure A/c for the year ended March 31, 2018 Cr.

Particulars | Amount | Particulars | Amount |

To Stationery consumed To loss on sale of old furniture To electricity expenses To expenses on lectures To surplus

| 22,400 2,400 10,600 30,000 1,52,960

| By Subscriptions By Interest on investments 800 Add interest accrued 160 By Government Grant

| 2,00,000 960 17,400

|

| 2,18,360 |

| 2,18,360 |

Balance Sheet of Sears Club as on 31st March 2018

Liabilities | Amount | Assets | Amount |

Subscriptions received in advance Donations for building Capital Fund 62,000 Add Surplus 1,52,960

| 7,200 40,000 2,14,960

| Outstanding Subscriptions Stock of Stationery Cash Investments Interest accrued on investments Sports Equipment Books

| 1,01,000 4,000 50,000 8,000 160 59,000 40,000

|

| 2,62,160 |

| 2,62,160 |

Interest on 12% Investments In case, a candidate has credited Income and Expenditure Account byRs.800 on account of Interest on 12% Investments, it may be marked correct.

Working Notes:

Balance Sheet of Sears Club as on 31st March 2017

Liabilities | Amount | Assets | Amount |

Subscriptions received in advance Capital Fund

| 25,000 62,000

| Outstanding Subscriptions Stock of Stationery Cash Furniture

| 60,000 3,000 20,000 4,000

|

| 87,000 |

| 87,000 |

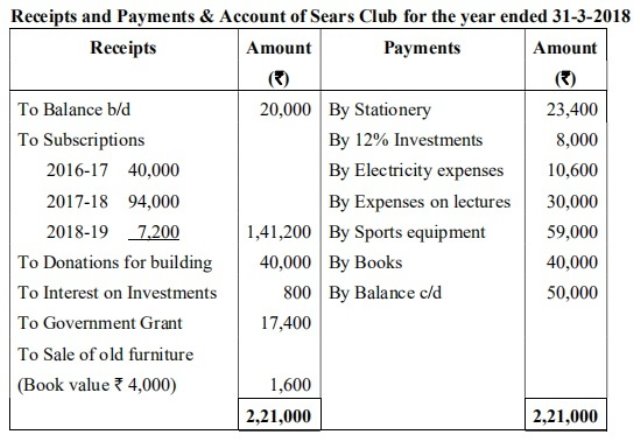

2. From the following Receipts and Payments Account and additional information, prepare Income and Expenditure Account and Balance Sheet of Sears Club, Noida as on March 31, 2018.

Additional Information :

(i) The club has 200 members each paying an annual subscription of Rs. 1,000. Rs. 60,000 were in arrears for last year and 25 members paid in advance in the last year for the current year.

(ii) Stock of stationery on 1-4-2017 was 3,000 and on 31-3-2018 was Rs. 4,000.

Solution:

Dr. Income and Expenditure A/c for the year ended March 31, 2018 Cr.

Particulars | Amount | Particulars | Amount |

To Stationery consumed To loss on sale of old furniture To electricity expenses To expenses on lectures To surplus

| 22,400 2,400 10,600 30,000 1,52,960

| By Subscriptions By Interest on investments 800 Add interest accrued 160 By Government Grant

| 2,00,000 960 17,400

|

| 2,18,360 |

| 2,18,360 |

Balance Sheet of Sears Club as on 31st March 2018

Liabilities | Amount | Assets | Amount |

Subscriptions received in advance Donations for building Capital Fund 62,000 Add Surplus 1,52,960

| 7,200 40,000 2,14,960

| Outstanding Subscriptions Stock of Stationery Cash Investments Interest accrued on investments Sports Equipment Books

| 1,01,000 4,000 50,000 8,000 160 59,000 40,000

|

| 2,62,160 |

| 2,62,160 |

Interest on 12% Investments

In case, a candidate has credited Income and Expenditure Account byRs.800 on account of Interest on 12% Investments, it may be marked correct.

Working Notes:

Balance Sheet of Sears Club as on 31st March 2017

Liabilities | Amount | Assets | Amount |

Subscriptions received in advance Capital Fund

| 25,000 62,000

| Outstanding Subscriptions Stock of Stationery Cash Furniture

| 60,000 3,000 20,000 4,000

|

| 87,000 |

| 87,000 |

3. Following is the information given in respect of certain items of a Sports Club. Show these items in the Income and Expenditure Account and the Balance Sheet of the Club:

Particulars | Rs |

Sports Fund as on 1.4.2015 | 35,000 |

Sports Fund Investments | 35,000 |

Interest on Sports Fund | 4,000 |

Donations for Sports Fund | 15,000 |

Sports Prizes awarded | 10,000 |

Expenses on Sports Events | 4,000 |

General Fund | 80,000 |

General Fund Investments | 80,000 |

Interest on General Fund Investments | 8,000 |

ANSWER:

Books of Sports Club Income and Expenditure Account | |||

Dr. |

|

| Cr. |

Expenditure | Amount Rs | Income | Amount Rs |

|

| Interest on General Fund Investments | 8,000 |

|

|

|

|

Balance Sheet | ||||

Liabilities | Amount Rs | Assets | Amount Rs | |

Sports Fund | 35,000 |

| Sports Fund Investments | 35,000 |

Add: Interest on Sports Fund | 4,000 |

| General Fund Investments | 80,000 |

Add: Donations for Sports Fund | 15,000 |

|

|

|

| 54,000 |

|

|

|

Less: Expenses on Sports Event | (4,000) |

|

|

|

Less: Prize Awarded | (10,000) | 40,000 |

|

|

General Fund | 80,000 |

|

| |

|

|

|

| |

Key Takeaways:

- Cooperative societies are operative in various sectors like consumer, industrial, services, marketing, etc.

- Under accounting system of Co-operative societies, the term Receipt and Payment is used for two-fold aspects of double entry system.

References

1. Financial Accounting by B.B Dam

2. Financial Accounting by K.R Das