Unit 4

Financial Management

Financial Management is a critical topic in business. The reason is that a corporation cannot function without the proper use of funds. It’d even suffer stunted growth. To understand and apply the right management practices in the handling and use of funds, one must know how valuable financial management is to a business.

Meaning of financial Management

Before dividing into the function and objectives of financial management, let’s define what the term means. Through the definition, one would appreciate the importance of the concept and why it must be considered in the business environment.

The most popular and acceptable definition of financial management as given by S.C.Kushal is that “Financial Management deals with procurement of funds and their effective utilization within the business”.

Weston and Brigham: Financial Management “is an area of financial decision-making, harmonizing individual motives and enterprise goals”.

Joshep and Massie: Financial Management “is the operational activity of a business that is responsible for obtaining and effectively utilizing the funds necessary for efficient operations”

Financial Management is critical to any company, whether small or big. It's like the lifeline of the business. It’s also a vital activity that must be performed in any organization.

However, financial management entails the process of planning, organizing, monitoring, and also controlling the financial resources of a corporation. The idea for doing such is to be able to achieve the vision or goals of the company at the stipulated time-frame.

Financial Management is a regular practice in a business environment. It involves managing a company’s financial resources to make sure there's little or no wastage.

It controls every single thing regarding the company’s financial activities which includes the procurement of funds, use of funds, payments, accounting, risk assessment, and other things that are related to finances.

And that is one of the reasons it's considered to be an integral part of the company because, without proper use of funds, the business can go down. It might also not have what it takes to hold out production or activities.

The general principles of management are applied to the financial management of the corporate too. But the main focus shouldn’t be to make principles or department to manage the finances of the business.

They must be set up to follow the best practices, use the required financial management tools, and also deploy the right strategies to reduce cost, and ensure production or business activities function smoothly.

In other words, the utilization of business funds matters. It’s the reason financial management is like the engine room of the company and may affect every other department if not handled properly.

So in order to eliminate any sort of barrier that may hinder the growth of the business, firms must make sure that the right financial management mechanism is put in place.

There are objectives or reasons firms implement these management strategies to grow their business.

1. Profit Maximization

One of the reasons a company employs a financial manager is to maximise profit while managing the finance of the corporate.

The gain can be in the short or long-term. But the main focus is that the individual or department handling the financial issues of the company must make sure that the company in question is making sufficient profit.

2. Proper Mobilization of Finance

The collection of funds to run the business is also an integral part of financial management that the manager must handle appropriately.

Once the manager concludes the estimation of the amount needed for a business process, the specified amount can then be requested from any legal sources like debenture, shares, or perhaps request for a loan . But the point is that there should be a correct balance between the money the firm has and therefore the amount borrowed.

3. The Company’s Survival

The survival of the company is crucial. That's one of the reasons the management considers hiring financial managers in the first place. The manager must make adequate financial decisions to make sure the company is successful.

4. Proper Coordination

There must be a proper understanding and cooperation among the varied departments. The finance department must understand and agree with other departments within the corporate for the business to function smoothly.

5. Lowers Cost of Capital

Financial managers also try their very best to reduce the cost of capital, which is something that's vital to the business. They ensure money borrowed attracts little interest rates therefore the company can maximize profit.

These are the duties of a fiscal manager. They’re there to make sure that everything concerning finances within a company is in order.

Following are Functions of Financial Management

1. Financial Planning and Forecasting

It is the financial manager’s responsibility to plan and estimate the business’s financial needs. He must provide details regarding the amount of money that might be required to purchase different assets for the corporate.

The management through the financial manager has to know what they have to spend on working capital and fixed assets for the business too.

Another vital duty of the financial manager is to make futuristic plans for funds that the company would need. And therefore the manner in which the funds are realized and used is also of utmost importance to the financial manager.

2. Determination of capital composition

Once the planning and Forecasting are made, the capital structure has to be decided. The mix of debt and equity used to finance the company’s future profitable investment opportunities is stated as capital structure.

3. Fund Investment

The financial manager has to make sure that funds made available to the business are used adequately to grow the business. The cost of acquiring the said fund and value of the returns need to be compared and balanced.

The financial manager also needs to check out the channels of the business that's yielding higher returns and improve them.

4. Maintain Proper Liquidity

Cash is the best source for maintaining liquidity. The business requires it to buy raw materials, pay salaries, and tackle other financial needs of the corporate .

However, the financial manager has got to determine if there's a demand for liquid assets. He also must arrange these assets in a manner that the business won’t experience scarcity of funds.

5. Disposal of Surplus

Selling surplus assets and investing in more productive ways will increase profitability and thus increase the ROCE.

6. Financial Controls

Financial control could also be construed as the analysis of a company’s actual results, approached from different perspectives at different times, compared to its short, medium, and long-term objectives and business plans.

Executive and routine functions of financial management are discussed in short . ↓

1. Raising the Funds Required

Executive functions of financial management are raising the required funds. Funds are often raised from various sources like issue of shares, debentures, fixed deposits, bonds, borrowings, etc. The finance executive has to decide the proportion in which the various sources should be raised.

2. Assessing Total Capital Requirement

Executive functions of financial management are assessing the total capital requirement. The basic responsibility of the financial executive is to prepare the monetary plan of the company. At the promotion stage, every firm must estimate its capital needs. Funds may be required for working capital, promotional capital and development capital. To avoid over-capitalization and under-capitalization the finance executive has got to access these needs of funds properly.

3. Deciding the Capital Structure

Capital Structure refers to the composition of various securities that comprises the capital of the business. There should be a proper composition of varied securities to avoid an imbalance in capital structure.

4. Estimating the cost of capital

Executive functions of financial management are estimating the cost of capital. Cost of capital is the rate at which a corporation may pay to the suppliers of capital for the utilization of their funds. For E.g. It's expected to pay a dividend on equity shares, etc.

5. Management of Fixed Capital

Executive functions of financial management are managing the fixed capital. Investments should be made in those assets which might satisfy this also as future needs of the corporate. For correct, a replacement of fixed assets, convenient depreciation policies should be adopted.

6. Management of working capital

The finance executive has to make sure that the company maintains adequate working capital. Inadequate working capital may bring work of the corporate to a standstill. Excessive amount in working capital will block the funds.

7. Control of Funds

Executive functions of financial management are controlling the funds. The finance executive has to make sure that cash is utilized as per the plan and in case of any deviation, corrective measures should be taken.

8. Allotment of Excess Profit

In distribution of Excess Profit, a firm has two options: To pay dividend or to retain earnings for expansion and diversification. A firm must strike a balance between the 2 choices else distribute the surplus.

9. Planning Tax

Executive functions of financial management are proper planning of taxes. In every budget, different schemes are announced, which offer tax rebates, deductions, etc. so as to reduce the tax liability the finance executive has got to properly-study the schemes then invest accordingly.

10. Performance Evaluation

Evaluating financial performance is an important executive function of financial management. For evaluation, the finance executive may use techniques like ratio analysis, fund flow statements, etc.

11. Helps Management

The finance executive helps the management in decision-making as he's well experienced with the financial aspects of the corporate.

Routine Functions of financial Management

Routine functions of financial management are given in the diagram below. ↓

Routine functions of financial management are: ↓

1. Maintaining various books of accounts of the businesses.

2. Administration of money receipts and payments.

3. Maintaining cash balances of the corporate.

4. Routine functions of financial management are to preserve securities, insurance policies and other valuable papers.

5. Preparing for ultimate accounts.

6. Interacting with banks.

7. Keeping record and reporting.

8. Assisting a finance executive within the performance of their roles.

Capital budgeting is the process of making investment decisions in long term assets. It's the method of deciding whether or not to invest in a particular project as all the investment possibilities might not be rewarding.

Thus, the manager has got to choose a project that provides a rate of return more than the cost financing such a project. That’s why he has got to value a project in terms of cost and benefit.

Following are the categories of projects which will be examined using capital budgeting process:

• The decision to buy new machinery

• Expansion of business in other geographical areas

• Replacement of obsolete equipment

• New product or market development etc

Thus, capital budgeting is the most vital responsibility undertaken by a financial manager. This is often because:

1. It involves the acquisition of long term assets and such decisions may determine the future success of the firm.

2. These decisions help in maximizing shareholder’s value.

3. Principles applicable to capital budgeting also apply to other corporate decisions like capital management.

Capital expenditures are huge and have a long-term effect. Therefore, while performing a capital budgeting analysis a corporation must keep the subsequent objectives in mind:

1. Selecting profitable projects

An organization comes across various profitable projects frequently. But because of capital restrictions, a corporation must select the proper mix of profitable projects which will increase its shareholders’ wealth.

2. Capital expenditure control

Selecting the most profitable investment is the main objective of capital budgeting. However, controlling capital costs is also a vital objective. Forecasting capital expenditure requirements and budgeting for it, and ensuring no investment opportunities are lost is that the crux of budgeting.

3. Finding the proper sources for funds

Determining the quantum of funds and therefore the sources for procuring them is another important objective of capital budgeting. Finding the balance between the cost of borrowing and returns on investment is a crucial goal of Capital Budgeting.

Importance of Capital Budgeting

Long-term Goals

For the growth & prosperity of the business, long-term goals are vital for any organization. A wrong decision is disastrous for the long-term survival of the firm. Capital budgeting has its effect in a long time span. It also affects companies future cost & growth.

Involvement of a large Number of Funds

Capital Investment requires a large number of funds. Because the companies have limited resources, the corporate has to make a wise & correct investment decision. The wrong decision would harm the sustainability of the business. The large investment includes the purchase of an asset, rebuilding or replacing existing equipment.

Irreversible Decision

The capital Investment decisions are generally irreversible because it requires large amounts of funds. It’s difficult to find the marketplace for that asset. The sole way remains with the company is to scrap the asset & incur heavy losses.

Monitoring & Controlling the Expenditure

Capital budget carefully identifies the required expenditure and R&D required for an investment project. Since a good project can turn bad if expenditures aren’t carefully controlled or monitored, this step could be a crucial advantage of the capital budgeting process.

Transfer of information

The time that project starts off as an idea, it's accepted or rejected; numerous decisions need to be made at a various level of authority. The capital budgeting process facilitates the transfer of information to appropriate decision makers within a corporation .

Difficulties of Investment Decision

The long-term investment decisions are difficult because it extends several years beyond the present period. Uncertainty indicates a higher degree of risk. Management loses his flexibility and liquidity of funds in making investment decisions so it must consider each proposal very thoroughly.

Maximization of Wealth

Long-term investment decision of the organization helps in safeguarding the interest of the shareholder in the organization. If the organization has invested during a planned manner, the shareholder would even be keen to take a position therein organization. This helps within the maximization of wealth of the organization. Any expansion is fundamentally associated with further sales and future profitability of the firm and assets acquisition decisions are based on capital budgeting.

Process of Capital Budgeting

Following are the steps of capital budgeting process:

• Idea Generation

The most important step of the capital budgeting process is generating good investment ideas. These investment ideas can come from a variety of sources like the senior management, any department or functional area, employees, or sources outside the company.

• Analyzing Individual Proposals

A manager must gather information to forecast cash flows for each project so as to determine its expected profitability. This is because the decision to accept or reject a capital investment relies on such an investment’s future expected cash flows.

• Planning Capital Budget

An entity must give priority to profitable projects as per the timing of the project’s cash flows, available company resources, and a company’s overall strategies. The projects that look promising individually are also undesirable strategically. Thus, prioritizing and scheduling projects is vital because of the financial and other resource issues.

• Monitoring and Conducting a Post Audit

It is important for a manager to follow up or track all the capital budgeting decisions. He should compare actual with projected results and give reasons as to why projections didn't match with actual performance. Therefore, a systematic post-audit is important in order to find out systematic errors in the forecasting process and hence enhance company operations.

Definition: Capital structure refers to an arrangement of the various components of business funds, i.e. shareholder’s funds and borrowed funds in proper proportion. A business utilizes the funds for meeting the everyday expenses and also for budgeting high-end future projects.

Computation of capital structure involves plenty of analytical thinking and strategic approach.

The calculation consists of various ratios and formulae like the cost of capital, the weighted average cost of capital, debt to equity ratio, cost of equity, etc.

Components of Capital Structure

The capital structure of the corporate is nothing but decision-related to the acquisition of funds from various sources and composition of debts and equity.

Followings are the multiple sources of funds which the corporate takes into consideration while determining its capital structure:

Components of Capital Structure

Shareholder’s Funds

The owner’s funds refer to generating capital by issuing new shares or utilizing the retained earnings to satisfy up the company’s financial requirement. However, it's an upscale means of acquiring funds. The three sources of capital acquisition through shareholder’s funds are as follows:

Equity Capital: The new shares are issued to the equity shareholders who enjoy the ownership of the corporation and are liable to get dividends in proportion to the profits earned by the corporate. They’re also exposed to the risk of loss associated with the corporate.

Preference Capital: The preference shareholders enjoy a fixed rate of dividends alongside preferential rights of receiving the return on capital in case of the company’s liquidation, over the equity shareholders. However, they have limited rights of voting and control over the corporate.

Retained Earnings: the company sometimes utilizes the funds available with it as retained earnings accumulated by keeping aside some a part of the profit for business growth and expansion.

Borrowed Funds

The capital which is acquired in the form of loans from the external sources is known as borrowed funds. These are external liabilities of the firm, which results in the payment of interests at a fixed rate. However, there's a tax deduction on such borrowings; it creates a burden on the corporate. Following are the various sorts of borrowed funds:

Debentures: it's a debt instrument which the companies and the government issue to the public. Though the rate of interest is quite high on debentures, they're not by any collateral or security.

Term Loans: The fund acquired by the company from the bank at a floating or fixed rate of interest is understood as a term loan. This is an appropriate source of funds for the businesses which have a good and strong financial position.

Public Deposits: The management invites the public through advertisements to make deposits in the company. It facilitates meeting up the medium or future financial needs of the corporate, like working capital requirements and enjoys a fixed rate of interest on that.

Importance of Capital Structure

Capital structuring is an important function of the management to maintain a sound financial position of the business and fulfil the financial requirements.

Significance of Capital structure

• Return Maximisation: A well-designed capital structure provides a scope of accelerating the earnings per share, which ultimately maximizes the return for equity shareholders and recover the value of borrowings.

• Flexibility: It also facilitates the expansion or contraction of the debt capital to suit the business strategies and conditions.

• Solvency: A sound capital structure helps to maintain liquidity in the firm because an unplanned debt capital results in the burden of interest payments, ultimately reducing the cash in hand.

• Increases Firm’s Value: Investors prefer to put in their money in the company, which has a sound capital structure. Thus, resulting in a rise in the market value of the firm’s shares and securities

• Reduces Financial Risk: Balancing the proportion of debt and equity in the business through capital structure assists the business firms in managing and minimizing risk.

• Minimizes Cost of Capital: It provides for planning the long term debt capital of the company strategically and thus reducing the cost of capital.

• Tax Planning Tool: For the corporate opting for debt funds, the capital structure provides them with a benefit tax deduction and saving, decreasing the cost of borrowing.

• Optimum Utilization of Funds: A well planned, strategically designed and systematically arranged capital structure assists the companies in generating maximum output from the available funds.

Value Maximization:

Capital structure maximizes the market value of a firm, i.e. in the firm having a properly designed capital structure the aggregate value of the claims and ownership interests of the shareholders are maximized.

Cost Minimization:

Capital structure minimizes the firm’s cost of capital or cost of financing. By determining a correct mix of fund sources, a firm can keep the overall cost of capital to the lowest.

Increase in Share Price:

Capital structure maximizes the company’s market price of share by increasing earnings per share of the normal shareholders. It also increases dividend receipt of the shareholders.

Investment Opportunity:

Capital structure increases the power of the company to find new wealth- creating investment opportunities. With proper capital gearing it also increases the confidence of suppliers of debt.

Growth of the Country:

Capital structure increases the country’s rate of investment and growth by increasing the firm’s opportunity to engage in future wealth-creating investments.

By the term Capital market we mean a marketplace for long term funds, whereas the money market constitutes the marketplace for short term funds. Capital market includes all existing facilities and institutional arrangements developed for borrowing and lending medium and long term funds available within the market.

This is not a marketplace for capital goods; rather it's a marketplace for raising and advancing money capital for investment purposes. According to V.A. Avadhani, “Capital market is a wide term used to comprise all operations in the New issues and stock exchange. New issues made by the businesses constitute the primary market, while trading in the existing securities relates to the secondary market. While we can only stock the primary market, we are able to buy and sell securities in the secondary market.”

In a capital market, the demand for long term funds mostly arises from private sector manufacturing industries, agricultural sector and also from the govt., which are again largely utilised for the economic development of the country. Even the consumer goods industries usually need substantial support from the capital market.

Similarly, both the State and Central Governments which are engaged in developing infra- structural facilities viz., transport, power, irrigation, communications etc. alongside the development of basic industries also need substantial support from the capital market.

In a capital market, the supply of funds usually comes from individual savers, corporate savings, various banks, insurance companies, specialised financial agencies and also the government .

Capital Market and Its Structure and Constituents

Capital market deals with medium term and long term funds. It refers to all or any facilities and therefore the institutional arrangements for borrowing and lending term funds (medium term and long term). The demand for long term funds comes from private business corporations, public corporations and therefore the government. The availability of funds comes largely from individual and institutional investors, banks and special industrial financial institutions and Government

STRUCTURE I CONSTITUENTS I CLASSIFICATION OF CAPITAL MARKET:-

Capital market is classified in two ways

1) CAPITAL MARKET IN INDIA

Gild – Edged Market | Industrial Securities Market | Development Financial Institutions | Financial Intermediaries |

a) Gilt – Edged Market: - Gilt – Edged market refers to the marketplace for government and semi-government securities, which carry fixed rates of interest. RBI plays a vital role during this market.

b) Industrial securities market: - It deals with equities and debentures in which shares and debentures of existing companies are traded and shares and debentures of latest companies are bought and sold) Development Financial Institutions :-

C) Development financial institutions were set up to satisfy the medium and long-term requirements of industry, trade and agriculture. These are IFCI, ICICI, IDBI, SIDBI, IRBI, UTI, LIC, GIC etc. of these institutions are called Public Sector Financial Institutions.

D) Financial Intermediaries:-

Financial Intermediaries include merchant banks, mutual funds, Leasing companies etc. they assist in mobilizing savings and supplying funds to the capital market.

2) The Second way in which capital market is assessed is as follows :-

CAPITAL MARKET IN INDIA

Primary market Secondary market

A) Primary Market:-

Primary market is the new issue market of shares, preference shares and debentures of non-government public limited companies and issue of public sector bonds.

B) Secondary Market

This refers to old or already issued securities. It’s composed of the industrial security market or stock market and gilt-edged market.

Functions of Capital Market

While from a broader perspective, Capital Markets is viewed as a market of financial assets with long or infinite maturity, it actually plays a really important role in mobilizing resources and allocating them to productive channels. So it can be said that the economic process of a country is facilitated by the Capital Markets. The important functions and significance of the markets are discussed below: –

1. Economic Growth: The Capital Markets help to accelerate the process of economic growth. It reflects the overall condition of the economy. Capital Market helps in the proper allocation of resources from the people that have surplus capital to the people that are in need of capital. So, we can say that it helps in the expansion of industry and trade of both public and private sectors resulting in a balanced economic growth within the country.

2. Promotes saving Habits: After the development of Capital Markets, the taxation system, and the banking institutions provide facilities and provisions to the investors to save more. In the absence of Capital Markets, they could have invested in unproductive assets like land or gold or may have indulged in unnecessary spending.

3. Stable and Systematic Security prices: aside from the mobilization of funds, the Capital Markets helps to stabilize the prices of stocks. Reduction within speculative activities and providing capital to borrowers at a lower interest rate help in the stabilization of the security prices

4. Availability of Funds: Investments are made in Capital Markets on a continual basis. Both the buyers and sellers interact and trade their capital and assets through an online platform. Stock Exchanges like NSE and BSE provide the platform for this and thus the transactions within the capital market become easy.

More Functions of Capital Market:

• It acts in linking investors and savers

• Facilitates the movement of capital to be used more profitability and productively to boost the national income

• Boosts economic growth

• Mobilization of savings to finance long term investment

• Facilitates trading of securities

• Minimization of transaction and information cost

• Encourages an enormous range of ownership of productive assets

• Quick valuations of financial instruments

• Through derivative trading, it offers insurance against market or price threats

• Facilitates transaction settlement

• Improvement within the effectiveness of capital allocation

• Continuous availability of funds

Fundamental analysis refers to analyzing the factors that contribute to a futures contract’s supply and demand. For instance , a trader might review crude oil Inventories to make an assumption about whether supply will increase or decrease in the future, causing the price of crude oil to move up or down in the future. This trader might prefer to buy oil now with the assumption that prices will move higher on the basis of his fundamental analysis from the inventories report.

There are many factors which will increase demand and supply for a market. These factors are complex, interrelated and their effect on price can change over time. a detailed model and analysis is required to form a complete fundamental picture of the market. Supply and demand is usually slow to react as supply and demand are with a technique which protects them from shocks to the market either in the sort of supply or demand. These shocks can come from events like natural disasters, supply chain issues or product defects. For instance, if there is a natural disaster and a major port for unloading of petroleum is damaged so ships cannot unload their cargo, creating a surprise and immediate reduction in supply, that wasn't forecast or predicted in a supply and demand model.

Fundamental Analysis

Fundamental analysis evaluates stocks by attempting to measure their intrinsic value. Fundamental analysts study everything from the overall economy and industry conditions to the financial strength and management of individual companies. Earnings, expenses, assets and liabilities all come under scrutiny by fundamental analysts.

Pros of fundamental analysis

Fundamental analysis helps traders and investors to collect the right information to make rational decisions about what position to require . By basing these decisions on financial data, there's limited room for personal biases.

Rather than establishing entry and exit points, fundamental analysis seeks to understand the value of an asset, in order that traders can take a much longer-term view of the market. Once the trader has determined a numerical value for the asset, they will compare it to the current market price to assess whether the asset is over- or under-valued. The aim is to then profit from the market correction.

Cons of fundamental analysis

Fundamental analysis is time consuming; it requires multiple areas of study which can make the method extremely complicated.

As fundamental analysis takes a much longer-term view of the market, the results of the findings aren't suitable for quick decisions. Traders looking to create a strategy for entering and exiting trades in the short-term could be better suited to technical analysis.

It is also important to think about the best and the worst-case scenario. While fundamental analysis provides a more well-rounded view of the market, it's possible for negative economic, political or legislative changes to surprise markets.

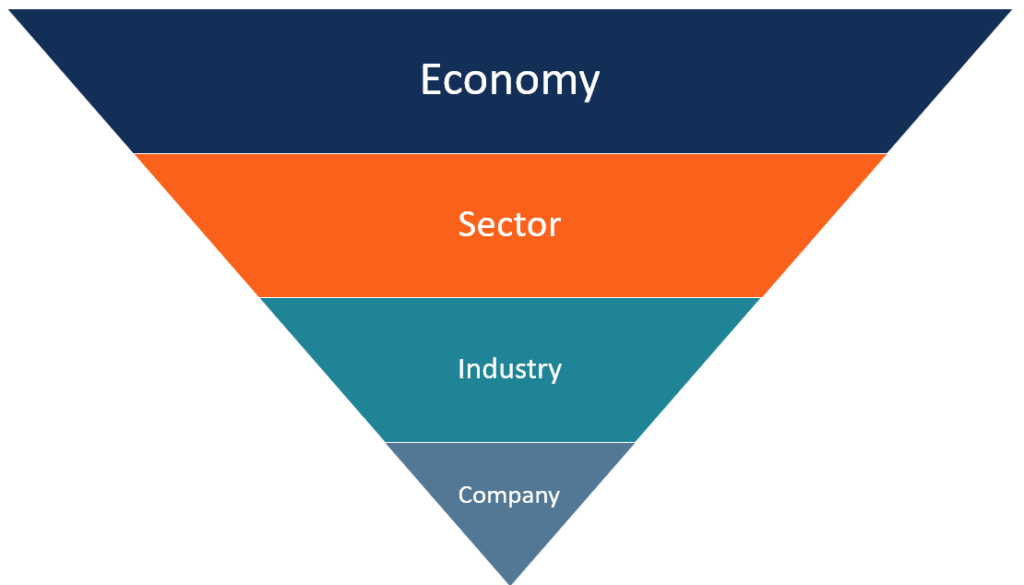

Top-down vs. Bottom-up Fundamental Analysis

Fundamental analysis is often either top-down or bottom-up. An investor who follows the top-down approach starts the analysis with the consideration of the health of the overall economy. By analyzing various macroeconomic factors like interest rates, inflation, and GDP levels, an investor tries to determine the direction of the economy and identifies the industries and sectors of the economy offering the simplest investment opportunities.

Afterward, the investor assesses specific prospects and potential opportunities within the identified industries and sectors. Finally, they analyze and choose individual stocks within the foremost promising industries.

Figure 1 Top-down approach

Alternatively, there's the bottom-up approach. Rather than starting the analysis from the larger scale, the bottom-up approach immediately dives into the analysis of individual stocks. The rationale of investors who follow the bottom-up approach is that individual stocks may perform far better than the overall industry.

The bottom-up approach is primarily targeting various microeconomic factors like a company’s earnings and financial metrics. Analysts who use such an approach develop a thorough assessment of each company to achieve a better understanding of its operations.

Figure 2 Bottom-up approach

Qualitative Components to Fundamental Investment Analysis

There are three components to fundamental analysis of a stock: financial statement analysis, valuation and qualitative factors. Each of these is vital for a distinct reason and no factor can stand alone to support an investment decision. Financial statements help identify how strong a corporation is, compare it to peers and help forecast future earnings. The valuation analysis determines what price an investor should pay for those future earnings. Qualitative research is probably the most important therein it provides a variety of important information that factors into both the financial statement analysis and valuation. It also often identifies the important catalysts for the stocks upward or downward movements in the future.

Company level Qualitative Research

First there are different factors to identify at the company level that have a major bearing on fundamental analysis: the business model, competitive advantage, customer base and management also as corporate governance.

• Business model: Understand what the company does and the way it generates value for its customers. For some firms, this is easy because they sell food or manufacture something simple. Other times, it's more complicated. For instance, some firms that lease long-lived assets like railcars make a modest amount on the lease above the cost of capital. The real profit comes from remarketing the assets and selling them later in their lives. It’s important to dive in and understand this. Discussions with people in the industry can help which is why channel checks are a vital part of your market research.

• Customers and Geographic exposure: Identify if the firm has a few large customers or a really fragmented customer base. Also, know how the firm is viewed by these customers, as a value or premium brand, consistent quality product, on time delivery, fairly priced etc. Second, know the geographic sales breakdown; each economy has different growth rates and important factors that may require additional research.

• Competitive Advantage: this is important because without a competitive advantage competition increases and profit margins decrease or disappear. For Intel, their R&D and size is their advantage and for Wal-Mart it’s their industry leading logistics alongside size that gives them leverage over suppliers.

• Management: a good management team can make an enormous difference especially when a business is in a challenging environment or still developing industry. Checking conference calls and management comments in the financials can reveal if a team is hitting targets and has had successful strategy within the past.

Industry level research

These are the important internal factors but there are key external and industry qualitative factors that are a part of stock analysis.

• Industry growth & cycle: If an industry is predicted to decline by 5% it's hard to forecast a company in it to grow 10%. Knowing the industry trends and cycle are critical factors in modelling company growth. Consider historic data together with forecasts from competitors and trade groups.

• Market share: a company might be the largest player in an industry, a small, up and coming firm or a niche player. Gaining or losing market share is a growth factor to think about, know what trends are driving the stocks gains or losses. Good market research helps uncover these trends.

• Competition: Identifying the closest competitor is vital . Oftentimes the competitive position determines pricing power and margins. Also, conduct market research to trace competitors and look for actions that are disruptive like a new product launch, discounting or strategic shift.

• Regulatory authorities: External regulators are impactful for a few firms. Knowing who plays key roles and should issue critical legislation or rulings is critical. For instance , FDA oversight is vital to understand if the analysis is on a pharmaceutical firm.

Quantitative Fundamentals:

These are the measurable factors that influence the value of a firm. The most important source of quantitative data is Financial Statements, analyzing which helps investors to make better investment decisions.

The three most significant financial statements are:

1. The Balance Sheet:

This statement records a company’s assets, liabilities, and equity at a particular point in time.

It shows investors the financial structure of a corporation, listing down what a corporation owns and owes, thus helping to see a company’s real worth.

Investors can determine the growth of a corporation by comparing its balance sheet over a period of time. It helps to know a company’s worth like its Equity, debt, liquidity, asset base and working capital position, among others.

2. Income Statement-

It reports the financial performance of a corporation over a period of time. Publicly listed companies present their income statement quarterly or annually.

It provides investors with an insight into how the net revenues realized by a corporation are transformed into net earnings (profit or loss).

Income Statement should be analyzed on a year-on-year and quarter-on-quarter basis, to understand a company’s operations, the efficiency of its management, and its performance as compared to its peers.

Investors should also check areas like high expenses, depreciation, finance cost or any exceptional loss that erodes a company’s profitability.

Thus, it helps an investor to understand whether the company will be ready to sustain its earnings growth and whether its performance will surpass its peers in the coming times.

3. Cash flow Statement-

This is a really important financial statement, because it shows the true cash or liquidity position of a company.

It provides information on the cash inflows and outflows over a period of time.

It is difficult to manipulate the cash position of a company; therefore it's used as a concrete measure of a company’s performance. The statement focuses on three cash related activities:

I. Cash from Operations (CFO):

This includes transactions from all the core or operational activities of a business.

Companies that manage their working capital requirements efficiently manage to get positive cash from operations.

This helps them to plan for Capex or Acquisitions for future wealth creation.

II. Cash from Investing (CFI):

This shows the cash flows that arise from investing gains or losses; It also provides information on changes within the company’s capital expenditure (CAPEX).

If CFI is negative then that means the corporate is on a growth path and investing in future potential and the other way around.

III. Cash from Financing (CFF):

This reflects the cash required to fund the company’s work. This could always be positive as this gives us a thought that the company is taking funds and utilizing it properly.

But this comes with a caveat that its Fund requirement shouldn't be more than the Industry requirement. If it's then it’s a reason for concern

Technical analysis is a means of examining and predicting price movements within the financial markets, by using historical price charts and market statistics. It's based on the idea that if a trader can identify previous market patterns, they will form a fairly accurate prediction of future price trajectories.

It is one of the 2 major schools of market analysis, the other being fundamental analysis. Whereas fundamental analysis focuses on an asset’s ‘true value’, with the meaning of external factors and intrinsic value both considered, technical analysis is based purely on the worth charts of an asset. It's solely the identification of patterns on a chart that's used to predict future movements.

Examples of technical analysis tools

Technical analysts have a wide range of tools that they can use to seek out trends and patterns on charts. These include moving averages, support and resistance levels, Bollinger bands, and more. All of the tools have the same purpose: to form understanding chart movements and identifying trends easier for technical traders.

Pros and cons of technical analysis

Pros of technical analysis

Being able to identify the signals for price trends in a market is a key component of any trading strategy. All traders need to work out a strategy for locating the best entry and exit points in a market, and using technical analysis tools could be a very popular way of doing so.

In fact, technical analysis tools are so commonly used, that many believe they have created self-fulfilling trading rules: As more and more traders use the same indicators to seek out support and resistance levels, there'll be more buyers and sellers congregated round the same price points, and therefore the patterns will inevitably be repeated.

Cons of technical analysis

There will always be an element of market behaviour that's unpredictable. There's no definitive guarantee that any sort of analysis – technical or fundamental – will be 100% accurate. Although historical price patterns give us an insight into an asset’s likely price trajectory, that's no promise of success.

Traders should use a range of indicators and analysis tools to get the highest level of assurance possible, and have a risk management strategy in situ to protect against adverse movements.

The different kinds of charts

As we discussed in the previous section, there are four kinds of stock charts that are principally utilized in technical analysis. These are:

• Line charts: A line chart is the figure that, perhaps, automatically comes to mind when you consider a chart. The line chart has the stock price or trading volume information on the vertical or y-axis and the corresponding time period on the horizontal or x-axis). Trading volumes refer to the number of stocks of a corporation that were bought and sold in the market on a specific day. The closing stock price is often used for the construction of a line chart.

Once the 2 axes are labelled, preparation of a line chart is a two-step process. In the first step, you take a specific date and plot the closing stock price as thereon date on the graph. For this, you’ll put a dot on the chart in such a way that it's above the concerned date and alongside the corresponding stock price.

Let’s suppose that the closing stock price on december 31, 2014 was Rs 120. For plotting it, you’ll put a dot in such a way that it's simultaneously above the marking for that date on the x-axis, and alongside the mark that says Rs 120 on the y-axis. You will do that for all dates. In the second step, you'll connect all the dots plotted with a line. That’s it! You have your line chart.

• Bar charts: A bar graph is similar to a line chart. However, it's far more informative. Instead of a dot, each marking on a bar graph is in the shape of a vertical line with two horizontal lines protruding out of it, on either side. The top end of each vertical line signifies the highest price the stock traded at during a day while the bottom point signifies the lowest price at which it traded at during a day. The horizontal line to the left signifies the price at which the stock opened the trading day. The one on the right signifies the price at which it closed the trading day. As such, each mark on a bar graph tells you four things. An illustration of the marks used on a bar graph is given below:

A bar graph is more advantageous than a line chart because in addition to prices, it also reflects price volatility. Charts that show what kind of trading happened that day are called intraday charts. The longer a line is, the higher is the difference between opening and closing prices. This suggests higher volatility. You should be interested in knowing about volatility because high volatility means high risk. After all, how comfortable would you be about investing in a stock whose price changes frequently and sharply?

• Candlestick charts: Candlestick charts give similar information as bar charts. They only offer it in a better way. Like a bar graph is formed up of different vertical lines, a candlestick chart is formed from rectangular blocks with lines coming out of it on both sides. The line at the upper end signifies the day’s highest trading price. The road at the lower end signifies the day’s lowest trading price. The day’s trading can be shown in Intraday charts. As for the block itself (called the body), the upper and the lower ends signify the day’s opening and closing price. The one that's higher of the 2, is at the top, while the other one is at the bottom of the body.

What makes candlestick charts an improvement over bar charts is that they give information about volatility throughout the period under consideration, Bar charts only display volatility that occurs within each trading day. Candles on a candlestick chart are of two shades-light and dark. On days when the opening price was greater than the closing price, they're of a lighter shade (normally white). On days when the closing price was above the opening price, they're of a darker shade (normally black).A single day’s trading is represented by intraday charts. Higher the variation in colour, more volatile was the price during the period. The looks of candles on a candlestick chart are as follows:

• Point and figure charts: a point and figure chart bears no resemblance with the other three sorts of charts discussed above. It had been used extensively before the introduction of computers to stock analysis. Lately, however, it's used by a very limited number of individuals . This is chiefly because it's complex to understand and provides limited information. a point and figure chart essentially displays the volatility in a stock’s price over a selected period of time. On the vertical axis, it displays the number of times stock prices rose or fell to a particular extent. On the horizontal axis, it marks time intervals. Markings on the chart are exclusively within the sort of X’s and O’s. X’s represent the number of times the stock rose by the required limit, while O’s represent the amount of times it fell by it. The specified amount used is called box size. It's directly related to the difference between markings on the y-axis.

HOW TO ANALYSE TECHNICAL CHARTS

Charting techniques in technical analysis will vary depending on the strategy and market being traded. It’s important to be familiar and comfortable with a technique to then implement that strategy accurately. Analysing charts supported the strategy will allow for consistency in trading.

Questions to ask before selecting a technical analysis chart type:

1. What's the trading strategy being adopted?

2. Is the trading strategy targeting short, medium or long-term trades?

Once the above questions are often answered, the chart type may then be selected using the respective information provided.

It is a private or institutional investment made into early-stage / start-up companies (new ventures). As defined, ventures involve risk (having uncertain outcome) within the expectation of a sizable gain. Venture capital is money invested in businesses that are small; or exist only as an initiative, but have huge potential to grow. The people that invest this money are called venture capitalists (VCs). The venture capital investment is formed when a venture capitalist buys shares of such a corporation and becomes a financial partner in the business.

Venture Capital investment is additionally mentioned risk capital or patient risk capital, because it includes the risk of losing the money if the venture doesn’t succeed and takes a medium to long term period for the investments to fructify.

Venture Capital typically comes from institutional investors and high net worth individuals and is pooled together by dedicated investment firms.

It is the cash provided by an outside investor to finance a new, growing, or troubled business. The venture capitalist provides the funding knowing that there’s a major risk related to the company’s future profits and cash flow. Capital is invested in exchange for an equity stake in the business instead of given as a loan.

Venture Capital is the best suited option for funding a costly capital source for companies and most for businesses having large up-front capital requirements which haven't any other cheap alternatives. Software and other intellectual property are generally the foremost common cases whose value is unproven. That’s why; venture capital funding is most widespread in the fast-growing technology and biotechnology fields.

Features of venture capital investments

1. It's basically financing of new companies which are finding it difficult to go to the capital market at their early stage of existence.

2. This finance also can be loan-based or in-convertible debentures so that they carry a fixed yield for the providers of venture capital.

3. Those who provide venture capital aim at capital gain thanks to the success achieved by the concern that borrows.

4. It's a long-term investment and made in companies which have high growth potential. The provision of venture capital will bring rapid growth for the business.

5. The venture capital provider also will take part in the business of borrowing concern whereby, the venture capital financier not merely confines themselves to finance, but also provides managerial skill.

6. Not all the capitalists will experience high risk. But venture capital financing contains risks. But the risk is compensated with a higher return.

7. Not much of technology is involved in venture capital; it involves financing mainly small and medium size firms, which are in their early stages. With the help of venture capital, these firms will stabilize and later can enter for traditional finance.

• High Risk

• Lack of Liquidity

• Long term horizon

• Equity participation and capital gains

• Venture capital investments are made in innovative projects

• Suppliers of venture capital participate within the management of the corporate

Methods of venture capital financing

• Equity

• Participating debentures

• Conditional loan

THE FUNDING PROCESS: Approaching a venture capital for funding as a company

The venture capital funding process typically involves four phases within the company’s development:

• Idea generation

• Start-up

• Ramp up

• Exit

Step 1: Idea generation and submission of the Business Plan

The initial step in approaching a venture capital is to submit a business plan. The plan should include the below points:

• There should be an executive summary of the business proposal

• Description of the chance and the market potential and size

• Review on the existing and expected competitive scenario

• Detailed financial projections

• Details of the management of the corporate

There is detailed analysis done of the submitted plan, by the venture capital to decide whether to require up the project or not.

Step 2: Introductory Meeting

Once the preliminary study is done by the VC and they find the project as per their preferences, there's a one-to-one meeting that's called for discussing the project in detail. After the meeting the VC finally decides whether or to not move forward to the due diligence stage of the process.

Step 3: Due Diligence

The due diligence phase varies depending upon the character of the business proposal. This process involves solving queries associated with customer references, product and business strategy evaluations, management interviews, and other such exchanges of information during this time period.

Step 4: Term Sheets and Funding

If the due diligence phase is satisfactory, the VC offers a term sheet, which is a non-binding document explaining the basic terms and conditions of the investment agreement. The term sheet is usually negotiable and must be approved by all parties, after which on completion of legal documents and legal due diligence, funds are made available.

Types of venture capital funding

The various sorts of risk capital are classified as per their applications at various stages of a business. The three principal sorts of risk capital are early stage financing, expansion financing and acquisition/buyout financing.

The venture capital funding procedure gets complete in six stages of financing like the periods of a company’s development

• Seed money: Low level financing for proving and fructifying a brand new idea

• Start-up: New firms needing funds for expenses related with marketingand development

• First-Round: Manufacturing and early sales funding

• Second-Round: Operational capital given for early stage companies which are selling products, but not returning a profit

• Third-Round: Also referred to as Mezzanine financing, this is often the money for expanding a newly beneficial company

• Fourth-Round: Also called bridge financing, 4th round is proposed for financing the "going public" process

A) Early Stage Financing:

Early stage financing has three subdivisions: seed financing, start up financing and first stage financing.

• Seed financing is defined as a little amount that an entrepreneur receives for the aim of being eligible for a start-up loan.

• Start up financing is given to companies for the aim of finishing the development of products and services.

• First Stage financing: Companies that have spent all their starting capital and wish finance for beginning business activities at the full-scale are the main beneficiaries of the first Stage Financing.

B) Expansion Financing:

Expansion financing is also categorized into second-stage financing, bridge financing and third stage financing or mezzanine financing.

Second-stage financing is provided to companies for the aim of beginning their expansion. It's also referred to as mezzanine financing. It's provided for the aim of assisting a specific company to expand in a major way. Bridge financing may be provided as a short term interest only finance option also as a sort of monetary assistance to companies that employ the Initial Public Offers as a significant business strategy.

C) Acquisition or Buyout Financing:

Acquisition or buyout financing is categorized into acquisition finance and management or leveraged buyout financing. Acquisition financing assists a company to accumulate certain parts or an entire company. Management or buyout financing helps a specific management group to obtain a selected product of another company.

Advantages of venture capital

• They bring wealth and expertise to the corporate

• Large sum of equity finance are often provided

• The business doesn't stand the requirement to repay the cash

• In addition to capital, it provides valuable information, resources, technical assistance to form a business successful

Disadvantages of venture capital

• As the investors become part owners, the autonomy and control of the founder is lost

• It may be a lengthy and complex process

• It is an uncertain sort of financing

• Benefit from such financing are often realized in long run only

Exit route

There are various exit options for venture capital to cash out their investment:

• IPO

• Promoter buyback

• Mergers and Acquisitions

• Sale to other strategic investor

Meaning:

Dematerialisation (“Demat” in concise form) signifies conversion of a share certificate from its physical form to electronic form. The term Demat, in India, refers to a dematerialised account for individual Indian citizens to trade in listed stocks or debentures, as needed by The Securities Exchange Board of India (SEBI). In a Demat account, shares and securities are held electronically rather than the investor taking physical possession of certificates.

An investor will have to first open an account with a Depository Participant then request for the dematerialisation of his share certificates through the Depository Participant so the dematerialised holdings is credited into that account. This is often very almost like opening a bank account. The Demat account number is quoted for all transactions to enable electronic settlements of trades to take place.

Process of Dematerialization

The Dematerialization starts with opening a Demat account. So, let’s first see the way to create an account.

• Select a depository participant (DP): Most financial institutions and brokerage service firms are mentioned as Depository Participants.

• Fill an account opening form: One needs to fill an account opening form to open a Demat account. This includes basic contact information.

• Submit documents for verification: you need to submit a duplicate of your income proof, identity proof, address proof, active bank statement as a proof and one passport-sized photograph for verification. All copies of documents got to be duly attested.

• Sign a standardized agreement with the DP: a standardized agreement will contain the principles and regulations, charges you'll incur and the terms and conditions of the agreement between you and the depository participant.

• Verification of documents: An employee from the DP will verify all the documents that you have submitted in your application.

• Demat account number and ID are generated: Once all of your documents are verified, your Demat account number and ID are generated. You'll use this information to access your online Demat account.

A futures contract is an agreement between two parties – a buyer and a seller – wherein the former agrees to get from the latter, a fixed number of shares or an index at a selected time in the future for a pre-determined price. These details are approved when the transaction takes place. As futures contracts are standardized in terms of expiry dates and contract sizes, they will be freely traded on exchanges. A buyer might not know the identity of the seller and vice versa. Further, every contract is guaranteed and honoured by the stock market, or more precisely, the clearing house or the clearing corporation of the stock market, which is an agency designated to settle trades of investors on the stock exchanges.

Futures contracts are available on different sorts of assets – stocks, indices, commodities, currency pairs so on. Here we'll look at the 2 commonest futures contracts – stock futures and index futures.

The following is a list of key differences:

1. Futures contracts are traded on an exchange while forward contracts are privately traded.

2. Since they're traded on exchange, futures contracts are highly standardized. Forward contracts, on the opposite hand, are customized as per the requirements of the counterparties.

3. A single clearinghouse acts because the counterparty for all futures contracts. This implies that the clearinghouse is the buyer for every seller and seller for every buyer. This eliminates the risk of default, and also allows traders to reverse their positions at a future date.

4. Futures contracts require a margin to be posted at the contract initiation, which fluctuates as the futures prices fluctuate. There’s no such margin requirement in a forward contract.

5. The govt. Regulates the futures market while the forward market isn't regulated.

Features of Future Market:

1. Future contracts are traded on an exchange during the private trading of forwarding contracts.

2. Future agreements require a margin to be released at contract initiation, steadily rising with fluctuating futures prices. In a forward contract, there's no such margin requirement.

3. Since they're traded on an exchange, there is high standardization of futures contracts. On the opposite side, forward contracts are customized consistent with counterparty requirements.

4. While the forward market isn't controlled, the state controls the futures market.

Advantages of the future market:

1. Margin requirements are well established in the futures market for many commodities and currencies. A trader thus knows what proportion margin a contract should bring up with.

2. Most futures markets offer increased liquidity, especially in currencies, indexes, and commodities that are widely traded. This enables traders once they want to join and exit the market.

3. The value of assets decreases over time in choices and significantly decreases the trader’s profitability. This is often called time decline. A futures trader must not worry about declining time.

4. In industries with high price changes, forward contracts are used as a hedging tool, farmers, as an example, use these contracts to safeguard themselves from the danger of falling crop prices.

5. For better risk management, many of us enter into forwarding contracts. Companies regularly use these contracts to limit the danger of foreign currency exchange.

Disadvantages:

1. Some brokers may insist that customers close their positions before delivery.

2. Not as flexible when it comes to accounting.

3. Trade-in predetermined quantities that are inflexible for an accurate accounting

4. Traded mainly on US exchange

5. To get the complete advantages, you need to be an expert trader.

Options are a kind of derivative, and hence their value depends on the value of an underlying instrument. The underlying instruments are often a stock, but it can also be an index, a currency, a commodity or the other security.

Now that we've understood what options are, we'll look at what an options contract is. An option contract is a financial contract which provides an investor a right to either buy or sell an asset at a pre-determined price by a selected date. However, it also entails a right to buy, but not an obligation.

When understanding option contract meaning, one must understand that there are two parties involved, a buyer (also called the holder), and a seller who is cited as the writer.

When the Chicago Board Options Exchange was established in 1973, modern options came into being. In India, the National stock exchange (NSE) introduced trading in index options on June 4, 2001.

Features of an option contract

1. Premium or down payment: The holder of this sort of contract must pay a particular amount called the ‘premium’ for having the proper to exercise an options trade. In case the holder doesn't exercise it, s/he loses the premium amount. Usually, the premium is deducted from the entire payoff, and the investor receives the balance.

2. Strike price: This refers to the rate at which the owner of the option can buy or sell the underlying security if s/he decides to exercise the contract. The strike price is fixed and doesn't change during the entire period of the validity of the contract. It’s important to recollect that the strike price is different from the market price. The latter changes in the life of the contract

3. Contract size: The contract size is the deliverable quantity of an underlying asset in an options contract. These quantities are fixed for an asset. If the contract is for 100 shares, then when a holder exercises one option contract, there'll be a buying or selling of 100 shares.

4. Expiration date: Every contract comes with an outlined expiry date. This remains unchanged until the validity of the contract. If the option isn't exercised within this date, it expires.

5. Intrinsic value: An intrinsic value is that the strike price minus the current price of the underlying security. Money call options have an intrinsic value.

6. Settlement of an option: There is no buying, selling or exchange of securities when an options contract is written. The contract is settled when the holder exercises his/her right to trade. In case the holder doesn't exercise his/her right till maturity, the contract will lapse on its own, and no settlement is going to be required.

7. No obligation to buy or sell: In case of option contracts, the investor has the option to buy or sell the underlying asset by the expiration date. But he's under no obligation to get or sell. If an option holder doesn't buy or sell, the option lapses.

Types of options

Now that it's clear what options are, we'll take a look at two different types of option contracts- the call option and also the put option.

Call option

A call option is a sort of options contract which provides the call owner the right, but not the obligation to buy a security or any financial instrument at a specified price (or the strike price of the option) within a specified time-frame.

To buy a call option one must pay the price in the sort of an option premium. As mentioned, it's upon the discretion of the owner on whether he wants to exercise this option. He can let the option expire if he deems it unprofitable. The seller, on the opposite hand, is obliged to sell the securities that the buyer desires. In a call option, the losses are limited to the options premium, while the profits are often unlimited.

Let us understand a call option with the help of an example. Let us say an investor buys a call option for a stock of XYZ company on a particular date at Rs 100 strike price and the expiry date is a month later. If the price of the stock rises anywhere above Rs 100, say to Rs 120 on the expiration day, the call option holder can still buy the stock at Rs 100.

If the price of a security is going to rise, a call option allows the holder to buy the stock at a lower cost and sell it at a higher price to make profits.

Call options are further of two types

In the money call option: in this case, the strike price is less than the current market price of the security.

Out of the money call option: When the strike price is more than the current market price of the security, a call option is taken into account as an out of the money call option.

Put options

Put options give the option holder the right to sell an underlying security at a selected strike price within the expiration date. This lets investors lock a minimum price for selling a certain security. Here too the option holder is under no obligation to exercise the right. Just in case the market price is higher than the strike price, he can sell the security at the market price and not exercise the option.

Let us take an example to know what a put option is. Suppose an investor buys a put option of XYZ Company on a certain date with the term that he can sell the security any time before the expiration date for Rs 100. If the worth of the share falls to below Rs 100, say to Rs 80, he can still sell the stock at Rs 100. In case the share price rises to Rs 120, the holder of the put option is under no obligation to exercise it.

If the price of a security is falling, a put option allows a seller to sell the underlying securities at the strike price and minimise his risks.

Like call options, put options can further be divided into the money put options and out of the money put options.

In the money put options: A put option is considered in the money when the strike price is more than the current price of the security.

Out of the cash put options: A put option is out of the money if the strike price is less than the current market price.

Straddle strategy

There is another options strategy known as the straddle. This strategy is employed by an investor when the price movement of the stock isn't apparent. The straddle option consists of two options contracts, a call option and a put option. For the straddle option to be used correctly, both the call and the put options need to have the same expiration date and the same strike price. As we've seen the call option gives you the right to buy the stock at a set strike price any time before the expiration date. The put option gives you the right to sell the stock at the same strike rate before the date of expiration. You’d need to pay the premium to buy both these options and therefore the total premium you pay equals the maximum loss you're exposed to. In volatile markets, only one of the options will have intrinsic value when the expiration date arrives. However, the investor bets that the value of that option will give him enough profits to create up for the option premiums he has paid.

Let us take an example to see how a straddle option works. Allow us to say an investor exercises a straddle option for a strike price of Rs 100 and pays Rs 20 as premium. In a scenario where the stock price remains at Rs 100 at the end of the expiration period, both the options expire without any value, and he loses Rs 20. But if the market moves, either way, there are chances of making profits. Allow us to say that the stock price rises to Rs 130. In this scenario, the put option expires with no value, but the call option has a value of Rs 30. If the stock price falls to Rs 70, the opposite happens. In this case, the call option expires worthless, but the put option is worth Rs 30. Straddles make the most sense when the markets are most volatile and can move either way, especially in events when a stock goes to announce its earnings figures.

Options can also be classified on the exercising style into American and European options.

American options: These are options that can be exercised at any time up to the expiration date. Select security options available at NSE are American style options.

European options: These options are often exercised only on the expiration date. All index options traded at NSE are European options.