UNIT – 4

Economics

Economics Discussion

International Trade & Economic Development of a Country

The following points highlight the four main roles of International trade in Economic development of a country.

Role # 1. Slow Pace of Primary Commodities:

The foremost difficulty that comes in the path of foreign trade is that the growth of primary commodities which forms principal exports of developing countries has been very slow as compared to world trade.

In 1955, primary commodities accounted for 50% of the total exports which in 1977 came down to 35% and again to 28% in 1990 and so on. The causes responsible for this are the increasing tendency of market economies to protect their agriculture, inadequate increase in demand for primary commodities, development of synthetic substitutes etc.

Role # 2. Less Share in World Trade:

It has been noticed that exports of developing economies have been slow to develop. Consequently, the share of developing economies in the total world trade has maintained a downward trend.

Its share which was 31 percent in 1950 came down to 13.9 percent in 1960 and again 5% in 1990. This decline is caused by factors like emergence of trade blocks, restrictive commercial policies and growth of monopolies etc. These trends reflect the fact that developing economies have to face foreign trade as a barrier in the way of development.

Role # 3. Worse Terms of Trade:

In developed markets, the low demand for primary products has led the problem of balance of payment on worse trend in developing economies. Whereas prices of manufactured goods have been on the upward trend in the world market, the prices of primary products are gradually declining.

In this regard, UN report advocated that in the past developing countries could got a tractor by exporting two tones of sugar, now the time is that they have to export seven tones of sugar to get the same tractor. According to another estimate 1 to 3 percent of the GNP was lost by the developing countries due to decreasing prices of non-oil raw materials during 1990s.

Role # 4. Restrictive Trade Policies:

Restrictive trade policies adopted by industrial countries affect prospects for developing country exports of manufacturers. This is due to the fact that for developing countries markets in industrial countries have become increasingly more important.

For instance, in 1965, industrial countries took 41 percent of developing country exports of manufacturers, by 1990 this had grown to -75%. In 1990 only 3% of world trade in manufacturers was between developing countries.

In short, we may conclude that developing economies face several difficulties in their path of foreign trade. The various multinational initiatives having been mounted to tackle these problems have left them largely resolved. Therefore, in given circumstances, the developing economies have to evolve a suitable trade policy mix that may create export outlets and as well may assure supplies of essential imports.

David Ricardo agreed that absolute difference in cost gives a clear reason for trade to take place. He, however, went further to argue that even when a country has absolute advantage in the production of both commodities it is beneficial for that country to specialise in the production of that commodity in which it has a greater comparative advantage. The other country can be left to specialise in the production of that commodity in which it has less comparative advantage. According to Ricardo the essence for international trade is not the absolute difference in cost but comparative difference in cost. Ricardian theory is based on the following assumptions.

Assumptions

- There are two countries and two commodities.

- There is perfect competition both in commodity and factor markets.

- Cost of production is expressed in terms of labour i.e. value of a commodity is measured in terms of labour hours/days required to produce it. Commodities are also exchanged on the basis of labour content of each good.

- Labour is the only factors of production other than natural resources.

- Labour is homogeneous i.e., identical in efficiency, in a particular country.

- Labour is perfectly mobile within a country but perfectly immobile between countries.

- There is free trade i.e., the movement of goods between countries is not hindered by any restrictions.

- Production is subject to constant returns to scale.

- There is no technological change.

- Full employment exists in both countries.

- There is no transport cost.

On the basis of the above assumptions, David Ricardo explained his comparative cost difference theory, taking England and Portugal as two countries and wine and cloth as two countries.

Country | 1 unit of wine | 1 unit of cloth |

England | 120L | 100L |

Portugal | 80L | 90L |

Portugal requires is less hours of labour for both wine and cloth. One unit of wine in Portugal is produced with the help of 80 labour hours as against 120 labour hours required in England. From this it could be argued that there is no need for trade as Portugal produces both commodities at a lower cost. Ricardo however, tried to prove that Portugal stands to gain by specializing in the commodities in which it has a greater comparative advantage. Comparative cost advantage of Portugal can be expressed in terms of cost ratio.

Cost ratios of producing wine and cloth can be expressed as:

Portugal | England | ||

Wine | Cloth | Wine | Cloth |

|   | ||

0.66 < 0.9 | 1.5 > 1.11 | ||

Portugal has advantage of lower cost of production both in wine and cloth. However the difference in cost, that is the comparative advantage is greater in the production of wine (1.5-0.66=0.84) than in cloth (1.11-0.9-0.21).

Even in terms of absolute number of days of labour Portugal has a larger comparative advantage in wine, that is, 40 labourers less than England as compared to cloth where the difference is only 10, (40>10). Accordingly Portugal specializes in the production of cloth where its comparative disadvantage is lesser than in wine.

Comparative Cost Benefits Both : Let us explain Ricardian contention that comparative cost benefits both the participants, though one of them had clear cost advantage in both commodities. To prove its, let us work out the internal exchange ratio.

Country | Wine | Cloth | Domestic exchange rate | International exchange rate |

| W : C | W : C | ||

England Portugal | 120 80 | 100 90 | 1 : 1.2 1 : 0.89 | 1 : 1 1 : 1 |

Let us assume these two countries enter into trade at an international exchange rate (Terms of Trade) 1:1.

At this rate, England specializing in cloth and exporting one unit of cloth gets in turn one unit of wine. At home it is required to give 1.2 units of cloth for unit of wine. England thus gains 0.2 of cloth i.e. wine is cheaper from Portugal by 0.2 unit of cloth.

Similarly Portugal gets one unit of cloth from England for its one unit of wine as against 0.89 of cloth at home thus gaining extra cloth of 0.11. Here both England and Portugal gain from the trade i.e. England gives 0.2 less of cloth to get one unit of wine and Portugal gets 0.11 more of cloth for one unit of wine.

In this example, Portugal specializes in wine where it has greater comparative advantage leaving cloth at home for England in which it has less comparative disadvantage. The example also validates Ricardian Argument that the base for international trade is the comparative difference in cost and not the absolute difference in cost.

Introduction:

The drawbacks of the classical theory of international trade induced the Swedish economist Prof. Heckscher (1919) to develop an alternate explanation of comparative advantage theory. His theory was further improved by his pupil Bertil Ohlin(1933). Hence it is known as Heckscher-Ohlin (H-O)theory.

Hecksher-Ohlin (H-O) theory argues that there is no need for a separate theory to explain international trade. According to it, international trade is but a special case of interregional trade. Factor immobility which was the base for a separate explanation of international trade by classical economists, does not hold true as factors are mobile or immobile even between two regions of the same country and also between the two countries. It is difference in degree rather than in nature.

The Modern or Hecksher-Ohlin (H-O) Theory explains the new approach to comparative advantage on the basis of general value theory. From all the forces that work together in general equilibrium, H-O theory isolates the differences in physical availability or supply of factors of production among the nations to explain the difference in relative commodity prices and trade between the countries. According to this theory “a nation will export the commodity whose production requires the intensive use of the nation’s relatively abundant and cheap factor and import the commodity whose production requires the intensive use of the nation’s relatively scarce and expensive factor”.

H-O theory explains the modern approach to international theory on the basis of the following assumptions:

- There are two countries, each having two factors ( Labour and capital ) and producing two commodities.

- There is perfect competitions in both commodity and factor markets.

- All production functions are homogeneous of the first degree i.e. production is subject to constant returns to scale.

- Factors are mobile within the country and immobile between countries. In international trade commodities move between the countries instead of factors.

- The two countries differ in factor supply.

- Each commodity differs in factor intensity.

- Factor intensity differ between the commodities but are same in both countries for each commodity i.e. if goods X is labour intensive, it will be so in both countries. However goods X and Y differ in factor intensity in the same country.

- Full employment of factor exists in both economies.

- Trade is free i.e. there are no trade restrictions in the form of tariffs or non-tariff barriers.

- No transport cost.

On the basis of the above assumptions it can be stated that (i) each commodity differ in factor intensity (ii) each country differs in factor endowments leading to differences in factor prices. It is therefore necessary to understand the above terms factors intensity and factor abundance in order to explain H-O theory.

(A) Factor Intensity

In our two country commodity model, commodity Y is capital intensive if the capital-labour ratio (K/L) in the production of Y is greater than K/L used in the proportion of X. To explain with an example, if commodity Y requires 2 units of capital (2K) and 2 units of labour (2L), the capital-labour ratio (K/L) for producing commodity Y is 2/2 = 1. For commodity X, if the required inputs are 1K and 4L, the capital-labour (K/L) ratio ¼.

The ratios can be stated as :

For commodity Y, the K/L = 2K /2L = 1

For commodity X, the K/L = 1K/4L =1/4

Here commodity Y is capital intensive and X is labour intensive

Commodity | Capital | Labour | K/L Ratio |

Y X | 2 3 | 2 12 | 1 1/4 |

Capital or labour intensity is not measured in absolute terms but by the ratio i.e. units of capital per labour or units of labour per capital. In our example, K/L ratio for Y is 1 and for X is ¼.

Instead, if units of capital and labour used in the production of Y are 2K and 2L where as for X, 3K and 12L, commodity Y still remains capital intensive through X requires more capital in absolute terms i.e. 3K. Capital used per labour in the production of X is 3K/2L i.e. 3/12 = ¼. Where as for Y it is 2K/2L = 1 as shown in table.

Commodity | Capital | Labour | K/L Ratio |

Y X | 2 3 | 2 12 | 1 1/4 |

Factor intensity, therefore is measured by the factor ratios and not by absolute units.

In our example of two commodities, two factors and two countries, we say commodity Y is capital intensive if capital-labour ratio (K/L) of Y is greater than the K/L ratio of X. To illustrate the point let us say that production ofone unit of Y requires two units of capital (2K) and 2 unit labour (2L).the capital-labour ratio (K/L) of Y is2/2 =1. Similarly, if the production of X requires 3K and 12L, the capital-labour ratio of X is ¼. Here we say Y is capital intensive and X is labour intensive.

It is to benoted that goods are not not categorized based on absolute quantity or units of capital and labour used in the production of a unit of good Y or X but the ratio of capital-labour of each c6K and 24L, here good X requires more capital in absolute number than Y. Yet in terms of ratio, it is Y which is capital intensive (5/5 =1) where as X is labour intensive (6/24 = ¼).

(B) Factor Abundance

Factor Abundance in Physical Terms

Nations differ in factor endowments. Some have more natural resources, some have more of labour and others more of capital. A given county’s factor abundance can be defined either in physical terms or in terms of relative factor prices. In our two country model, country I is capital abundant, if in physical terms the ratio of total amount of capital (TK) to the total amount of labour (TL) that is (TK/TL) in nation 1 is greater than nation 2 i.e.  >

>  . It should be noted that it is not the absolute amount of capital and labour but the ratio of the total amount of capital to the total amount of labour. Country 1 may have a lesser quantity of capital than country 2, yet country 1 will be capital abundant if TK to TL in country 1 is greater than in country 2.

. It should be noted that it is not the absolute amount of capital and labour but the ratio of the total amount of capital to the total amount of labour. Country 1 may have a lesser quantity of capital than country 2, yet country 1 will be capital abundant if TK to TL in country 1 is greater than in country 2.

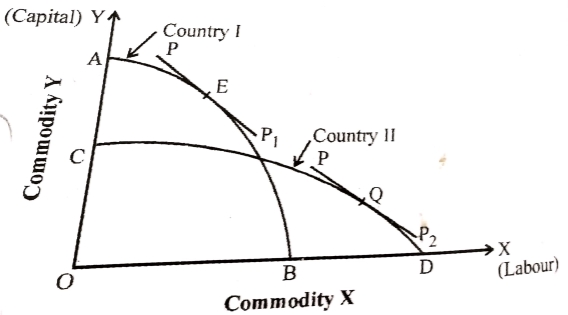

Factor abundance in physical terms can also be explained with the help of production possibility curve OR production frontier, as shown in fig.

In the diagram below, country I is capital abundant, therefore, its production possibility curve is skewed towards Y-axis. Country II is labour abundant, accordingly its production possibility curve is skewed towards X-axis.

- Commodity Y is capital intensive.

- Commodity X is labour intensive.

Country I can produce OA of Y i.e. CA quantity more than country II. Similarly country II can produce OD of X, i.e. BD quantity more than country I. Country II can produce more of X which is labour intensive because it is capital intensive due to its abundant capital.

The domestic price lines are PP1 and PP2 in countries I and II. The points E and Q are the respective equilibrium points of production and consumption. The price lines P1 and P2 indicate that commodity Y is cheaper in country I and X in country II, providing the basis for trade.

Factor Abundance in Terms of Factor Price

The cause of international trade is the difference in commodity prices. Price of commodity differs because of cost of production which in turn depends on factor prices. It is therefore necessary to explain factor abundance theory in terms of factor prices.

A nation is capital abundant if the ratio of the capital price to the labour price (PK/PL) is lower in it than in the other.

It can be stated as :

<

<

The two definitions give us the same meaning. The physical abundance explains the supply side. The price ratios are based on the price of factors determined by the demand for and supply of factors. The demand for factors derived demand i.e. derived from the demand for commodities produced with the help of factors. In our two nations model, demand is assumed to be the same in both the nations. In a country where the supply of physical units of capital (K) is more, its price has to be lower in comparison to the other factor(L). If in nation 1, the price of capital i.e. interest (r) is less than the price of labour i.e. wage (w) and in nation 2, r is more than w, then we have  . Here nation 1 is a capital abundant country.

. Here nation 1 is a capital abundant country.

From our above analysis we can derive the following conclusions:

- Each country differs in factors endowments, some have abundant labour, some possess plenty of land and others have huge amount of capital and so on.

- Each country specializes in the production of that commodity which requires more of its abundant factor.

- Abundance of a factor makes it cheaper in terms of its price.

- Low factor prices result in low cost of production and in turn low commodity prices.

- Low commodity price is the basis of international trade.

A. Gains From Terms of Trade

The terms of trade refer to the exchange ratio of export and import of goods or their price ratio. It is the ratio of prices of a country’s exports and its imports. The terms of trade determine the gain from trade. On the other hand, an increase in import prices and a stationary or declining export prices will worsen the terms of trade and accordingly the gains from trade too.

Let us discuss the relationship between terms of trade and grains from trade with the following example shown in table.

In our table we express the cost in terms of labour. To produce any particular commodity cost remains the same in a given country but not the same between different countries. In our example, 10 days labour can produce machines or 1 units of cloth in USA but only 2 machines and 8 units of cloth in India.

Labour | Country | Machines | Cloth | Domestic Exchange Rate | |

|

|

|

| Machines | Cloth |

10 days Labour | USA | 10 | 10 | 1 | 1 |

10 days Labour | India | 2 | 8 | 1 | 1 |

Let us suppose that the international exchange rate is 1 unit of machine for 2 units of cloth (1M: 2C). At this rate both countries gain, as U.S.A gets 2C against 1M instead of 1C against 1M that it gets at home. Similarly, India saves 2 units of cloth, since it gets 1 machine by giving 2C against 4C within the country. At the rate 1M: 3.5C, USA’s gain is 2.5C.If the terms of trade settle at 1M: 1.5C, India’s gain in terms of cloth saved its maximum or price paid in terms of cloth is very low.

The gain from trade is maximum if the international terms of trade prevailing are nearer to the country’s internal terms of trade. If the international terms of trade are, for example1:15 which is nearer to the internal terms of trade of USA, then India’s gain is maximum. If they are somewhere nearer to India’s internal terms of trade, say 1:35 USA will gain the most. Thus, the gains from trade are measured with the help of terms of trade.

B. Offer Curves- Terms of Trade – Gains From Trade

Economists Alfred Marshall and Francis Edgeworth presented the terms of trade and gains from trade with the help of offer curves. The concept of offer curves is based on J.S Mills reciprocals demand which explains mutual demand for each other country’s commodity in exchange for various quantities of imports at a succession of possible terms of trade.

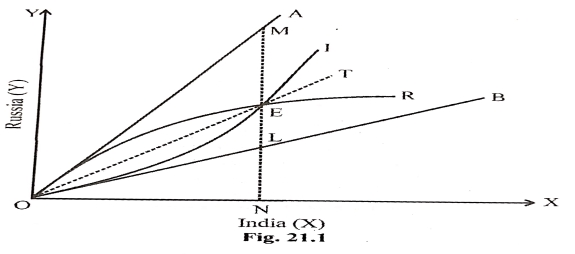

In diagram 21.1 we have India’s offer curve OI and Russia’s offer curve OR. The diagram explains the domestic rate of exchange the domestic rate of exchange, international terms of trade and gains from trade.

C. Increase in World Production

Each country specializes in the production of those commodities for which it is better suited in terms of cost of production. If a country attempts to produce everything what it requires then it may do so at a higher cost and lower production. International trade which is based on international division of labour leads to more production due to international trade with the help of table no 21.2.

Country | Inputs Labour days | Production in Units | Total Output | |

|

| Cloth | Machines |

|

India | 10 | 20 | 4 | 24 |

USA | 10 | 20 | 20 | 40 |

TOTAL |

| 40 | 24 | 64 |

The total production of both countries is 40 cloth and 24 machines, a sum total of 64 units. India, as we can see has a comparative advantage in the production of cloth and USA in machines. If they go for complete specialization applying the labour for producing only one commodity, then India will produce 40 units of cloth and USA 40 units of machines, a sum total of 80 units.

India - 4o units of cloth

USA - 40 units of machines

Total - 80 units

D. Increase in Consumption

With the increase in production as discussed earlier, the increase in consumption of the people of the countries which participate in international trade would also increase. Such positive changes enhance the economic welfare of the people. International trade begins in cheaper and a variety of new goods. Without trade a country will have limited domestic produced goods, that too at a higher price. Internal contact also bring a change in lifestyle. A positive effect of international demonstration effect will results in increased income and consumption.

E. Higher Economic Welfare

International trade, results in increased production due to specialization. As discussed earlier, trade results in additional production and consumption, cheaper and varieties of goods and services resulting in an increase in level of economic welfare. Trade also generates more jobs hence more income. Trade acts as ‘engine of growth’ bringing in all the benefits of growth. All these benefits make people better-off with trade than without.

F. Dynamic Gains

The gains that we discussed so far accrue to the trading countries in a given or static economic situation. There are many other gains which are termed as dynamic gains since the economies undergo changes in terms of technology, production function and finally an outward shift in the that simulates innovation. New ways of producing and organizing production are spread to the local economy through trade and the competitive force of trade simulates adoption of cost-saving techniques. Trade also makes possible economical production of many goods that would otherwise be prohibitive locally.

BALANCE OF PAYMENTS, DISEQUILIBRIUM AND CORRECTIVE MEASURES

Most of the exports and imports involve finance, i.e., receipts and payments in money. An account of all receipts and payments is termed, balance of payments. “The balance of payments of a country is a systematic record of all economic transactions between the residents of the reporting country and residents of foreign countries during a given period of time” The term ‘residents’ is broadly interpreted as all individuals, businesses and governments and their agencies. International organizations are classified as foreign residents. Economic transactions which enter into the balance of payments record, involve transfer of goods and assets, or rendering services from residents of one country to the residents of the rest of the world.

The balance of payments record is maintained in a standard double-entry book-keeping method. International trade transactions enter into the record as credit and debit. The payments received from foreign countries entry as credit and payments made to other countries as debit. The balance of payments record is shown in table.

Receipts (Credits) | Payments (Debits) |

|

|

Trade Account Balance | |

2. Export of services | 2. Imports to services |

3. Interest, profits and dividends received | 3. Interest, profits and dividends paid

|

4. Unilateral receipts | 4. Unilateral payments |

5. Current Account Balance (1 to 4) | |

6. Foreign investment | 6. Investment abroad |

7. Short term borrowing | 7. Short term lending |

8. Medium and long term borrowing | 8. Medium and long term lending |

9. Statistical discrepancy (Errors and omissions) | |

10. Capital Account Balance (6 to 9) | |

11. Overall Balance = Current Account + Capital Account Balance (5 + 10) | |

12. Change in reserves (-) | 12. Change in reserves (+) |

Total receipts = Total payments | |

The balance of payments account is traditionally dividend into (i) trade account (ii) current account and (iii) capital account. However it can be vertically divided into many more components as per the requirements.

A. Trade Account Balance

It is the different between exports and imports of goods, usually referred as visible or tangible items. Till recently, goods dominated international trade. Trade account balance tells as whether a country enjoys a surplus or comprising consumer and capital goods always had an advantageous position. Developing countries with its exports of primary goods most of the time suffered from a deficit in their trade account except most of the OPEC countries. The balance of trade is also referred as the balance of visible trade or balance of Merchandise trade.

B. Current Account Balance

Current account includes Nos. 1,2,3 and 4 in table no.24.1. They comprise

- Export and import of goods which are traditionally referred as visible or tangible exports and imports.

- Export and import of services, also known as invisibles. Services include insurance, transport, banking, income from tourism, etc.

- Income received and paid in the form of interest, profits and dividends for lending or investing in other countries.

- Unilateral receipts or payments which are also referred as transfer payments include gifts, donations, private remittances etc, received by the residents or paid to residents of other countries. Such receipts and payments do not have any counter obligation i.e. they are received free.

C. Capital Account Balance

The capital account records all receipts and payments that involve the residents of a country changing either their assets or liabilities to residents of other countries. The transactions under this title involve direct investment, portfolio investment and borrowings and lendings from and to other countries.

Foreign Investments

Direct investment

Portfolio investment

Short term investment

Short term borrowing

Medium and Long Term Borrowings

Financial Accounts

D. Statistical Discrepancy (Errors and Omissions)

Statistical discrepancy (errors and omissions) reflects transactions that have not been recorded for various reasons and so cannot be entered under a standard hearing but must appear since the full balance of payments account must sum to zero.

E. Overall Balance

Overall balance is obtained by adding up current account and capital account balances.

F. Foreign Exchange Reserves

Foreign exchange reserves in item no.12 shows the reserves which are held in the form of foreign currencies usually in hard currencies like dollar, pound etc., gold and Special Drawing Rights (SDRs). Foreign exchange reserves are analogous to an individual’s holding of cash. They increase he has a deficit. When a country enjoys a net surplus in current and capital accounts combined, it results in a positive balance in overall balance is negative, it leads to decrease in reserves.

G. The Basic Balance

The basic balance is the sum of the current account and capital account, when the two sides of the current and capital accounts are equal i.e. when the difference between the two is equal to zero, the basic balance is achieved. An increase in deficit or reduction in surplus or a move from surplus to deficit is considered worsening of the basic balance.

H. Deficits and Surpluses

The balance of payments always balance in a technical or accounting sense(in a double entry record) The balance in the balance of payments implies that a net credit in any one of the items must have a counter part net debit in another.When the total credits and debits of all accounts balance, we say the balance of payments balances.

I. Autonomous and Accommodating Capital Flows.

Autonomous flows take place in the ordinary course of foreign trade and they are independent of other items in the balance of payments. Accommodative flows take place to equalize the balance of payments.

Credits $ | Debits $ |

|

|

a) Autonomous exports (visible and invisible) 800 | a) Autonomous imports (visible and invisible) 1300 |

b) Autonomous unilateral receipts 100 | b) Autonomous unilateral payments 50 |

c) Autonomous capital receipts 300 | c) Autonomous capital payments 150 |

2. Accommodating receipts 1500 | 2. Accommodating payments Nil |

1500 | 1500 |

DISEQUILIBRIUM

A disequilibrium in the balance of payments is the result of imbalance between receipts and payments for exports and imports.

A. Causes of Disequilibrium

Increase in Imports

- Import of essential goods and services

- Development Programmes

- Population Growth

- Demonstration Effect

Low or Decline in Exports

5. Low income Elasticity of demand

6. Discovery of substitutes

7. Protectionist trade policy

8. Modernisation

CORRECTIVE MEASURES

Measures to control deficit in Balance of payments

A. Devaluation

Devaluation aims at influencing the prices of only traded goods and not the general price level. Devaluation refers to an official announcements or an act of monetary authority through which the exchange rate is changed i.e. the value of domestic currency is reduced vis-à-vis foreign currency. For example, if the existing rate is Rs 60 = $1.

B. Depreciation

Depreciation like devaluation lowers the value of domestic currency or increases the value of the foreign currency. Depreciation of a currency takes place in free or competitive foreign exchange market due to market forces. An existing exchange rate, say Rs 60 = $1 may depreciate to Rs70 or more.

C. Deflation

Deflation refers to the process of decline in general price level. It was a method adopted under gold standard.

Deflation leads to expenditure adjustment that is, people in that country spend money mainly on domestic goods and services and less on imports.

D. Direct Controls

- Tariffs:

Tariffs are the duties (taxes) imposed on imports. When tariffs are imposed the prices of imports would increase to the extent of tariff The increased prices will reduce the demand for imported goods and at the same time induce domestic producers to produce more of import substitutes. Non- essential imports can be drastically reduced by imposing a very high rate of tariff.

2. Quotas:

To reduce imports for correcting the deficit in the balance of payments, the government may introduce restrictions on the quantity or volume of goods imported. Quotas may be different types: i) the tariff or custom quota, ii) the unilateral quota iii) the bilateral quota iv) the mixing quota and v) import licensing.

3. Export Promotion:

The government is required to devise special policy measures to promote exports. Some of the important incentives than the government usually offers are: i) subsidies ii) Tax concessions iii) grants iv) other monetary or non-monetary incentives.

4. Import Substitution:

Industries which produce import substitutes require special attention in the form of various concessions, which includes i) tax concession ii) technical assistance iii) subsidies iv) providing scarce inputs etc.