UNIT – 2

Utility

Utility Definition – It is a measure of satisfaction an individual gets from the consumption of the commodities. In other words, it is a measurement of usefulness that a consumer obtains from any good. A utility is a measure of how much one enjoys a movie, favourite food, or other goods. It varies with the amount of desire.

Utility Definition

Suppose you went to a restaurant and ordered your favourite food. What will you experience? Either the food satisfies your taste buds or not. Another day you went to another restaurant an ordered the same food. Is the experience the same? Maybe or may not be.

Similarly, if you eat your favourite ice-cream you will be happy. What will happen in the second round? Happy, Right? Will you be satisfied one after the other rounds? No!

The satisfaction of a consumer is the basis of the utility function. It measures how much one enjoys when he or she buys something. A utility is a measure of how much one enjoys a movie, favourite food, or other goods. It varies with the amount of desire. One can conclude the following conclusions

- A Utility of a good differs from one consumer to another.

- It keeps on changing for the same consumer due to change in the amount of desires.

- It should not be equated with its usefulness.

Characteristic of Utility

- It is dependent upon human wants.

- It is immeasurable.

- A utility is subjective.

- It depends on knowledge.

- Utility depends upon use.

- It is subjective.

- It depends on ownership.

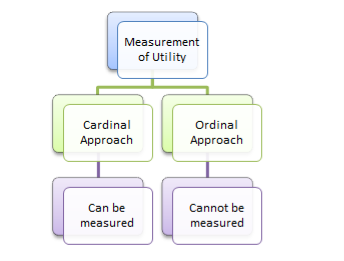

Measurement of Utility

Measurement of a utility helps in analyzing the demand behaviour of a customer. It is measured in two ways

Cardinal Approach

In this approach, one believes that it is measurable. One can express his or her satisfaction in cardinal numbers i.e., the quantitative numbers such as 1, 2, 3, and so on. It tells the preference of a customer in cardinal measurement. It is measured in utils.

Limitation of Cardinal Approach

- In the real world, one cannot always measure utility.

- One cannot add different types of satisfaction from different goods.

- For measuring it, it is assumed that utility of consumption of one good is independent of that of another.

- It does not analyze the effect of a change in the price.

Ordinal Approach

In this approach, one believes that it is comparable. One can express his or her satisfaction in ranking. One can compare commodities and give them certain ranks like first, second, tenth, etc. It shows the order of preference. An ordinal approach is a qualitative approach to measuring a utility.

Limitation of Ordinal Approach

- It assumes that there are only two goods or two baskets of goods. It is not always true.

- Assigning a numerical value to a concept of utility is not easy.

- The consumer’s choice is expected to be either transitive or consistent. It is always not possible.

Types of Utility

It is basically of three types

Total

The sum of the total satisfaction from the consumption of specific goods or services. It increases as more goods are consumed.

Total Utility (T.U.) = U1 + U2 + … + Un

Marginal

It is the additional satisfaction gained from each extra unit of consumption. It decreases with each additional increase in the consumption of a good.

Marginal Utility (M.U.) = Change in T.U. / Change in Total Quantity = Δ TU/ Δ Q

Average

One can obtain it by dividing the total unit of consumption by the number of total units. Suppose there are total n units, then

Average Utility (A.U.) = T.U. / Number of units = T.U. / n

Types of Economic Utility

- Form: It refers to the specific product or service that a company offers.

- Place: It refers to the convenience and readiness of the services available at a place to the customer

- Time: It refers to the ease of availability of products or services at the time when a customer needs.

- Possession: It refers to the benefit a customer derives from the ownership of a company’s product.

Consumer Surplus

The concept of consumer surplus is derived from the law of diminishing marginal utility. As per the law, as we purchase more of a commodity, its marginal utility reduces. Since the price is fixed, for all units of the goods we purchase, we get extra utility. This extra utility is consumer surplus.

Consumer Surplus

Alfred Marshall, British Economist defines consumer’s surplus as follows: “Excess of the price that a consumer would be willing to pay rather than go without a commodity over that which he actually pays.”

Hence, Consumer’s Surplus = The price a consumer is ready to pay – The price he actually pays

Further, the consumer is in equilibrium when the marginal utility is equal to the price. That is, he purchases those many numbers of units of a good at which the marginal utility is equal to the price. Now, the price is fixed for all units. Hence, he gets a surplus for all units except the one at the margin. This extra utility is consumer surplus.

Let us take a look at an example of consumer surplus.

No. Of units | Marginal Utility | Price (Rs.) | Consumer’s Surplus |

1 | 30 | 20 | 10 |

2 | 28 | 20 | 8 |

3 | 26 | 20 | 6 |

4 | 24 | 20 | 4 |

5 | 22 | 20 | 2 |

6 | 20 | 20 | 0 |

7 | 18 | 20 | – |

From the table above, we see that as the consumption increase from 1 to 2 units, the marginal utility falls from 30 to 28. This diminishes further as he increases consumption. Now,

- Marginal utility is the price the consumer is willing to pay for that unit.

- The actual price of the unit is fixed.

Therefore, the consumer enjoys a surplus on all purchases until the sixth unit. When he buys the sixth unit, he is in equilibrium, since the price he is willing to pay is equal to the actual price of the unit.

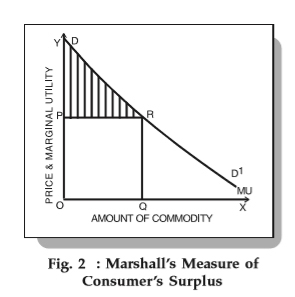

Graphical Representation

The concept of consumer surplus is illustrated graphically as follows:

In the figure, you can see that the X-axis measures the amount of commodity, while the Y-axis measures the price and marginal utility. Further, MU represents the marginal utility curve, sloping downwards. This indicates that as the marginal utility falls, the consumer purchases more units of the commodity and vice-versa.

Next, if OP is the price of a unit of the commodity, the consumer is in equilibrium only when he purchases OQ units. In other words, when marginal utility is equal to the price OP.

Further, the Qth unit does not yield any surplus since the price and marginal utility is equal. However, for the purchase of all units before the Qth unit, the marginal utility is greater than the price, offering a surplus to the consumer.

In Fig. 2 above, the total utility is equal to the area under the marginal utility curve up to point Q (ODRQ). However, for price = OP, the consumer pays OPRQ. Hence, he derives extra utility equal to DPR which is consumer surplus.

Limitations

- It is difficult to measure the marginal utilities of different units of a commodity consumed by a person. Hence, the precise meaurement of consumer’s surplus is not possible.

- For necessary goods, the marginal utilities of the first few units are infinitely large. Hence the consumer’s surplus is infinite for such goods.

- The availability of substitutes also affects the consumer’s surplus.

- Deriving the utility scale for prestigious goods like diamonds is very difficult.

- We cannot measure the consumer’s surplus in terms of money. This is because the marginal utility of money changes as a consumer makes purchases and his stock of money diminishes.

- This concept is acceptable only on the assumption that we can measure utility in terms of money or otherwise. Many modern economists are against the concept.

Meaning:

Ordinarily, DEMAND means a desire or want for something. In economics, however, demand means much more than that. Economics attach a special meaning to the concept of demand i.e. ‘Demand is the desire or want backed up by money.’ It means effective desire or want for a commodity, which is backed up the purchasing power and willingness to pay for it.

Demand, in economics, means effective demand for a commodity. It requires three conditions on the part of consumer.

Desire for a commodity

Capacity to buy or purchased

Willingness to pay its price.

In short,

In short,

Demand = Desire + Ability to pay + Willingness to spend

Demand is always related to Price & Time. Demand is not the absolute term. It is a relative concept. Demand for a commodity should always have a reference to Price & Time.

For e.g. – Price Grapes for house hold at a price of Rs. 20/- per Kg., Rs. 10/- per Kg

For e.g. – Price Grapes for house hold at a price of Rs. 20/- per Kg., Rs. 10/- per Kg

Time per day, per month, per year

Time per day, per month, per year

Definition:

The Demand for a commodity refers to the quantity of a commodity that a person is willing to buy at different prices during period of time.

Types of Demand:

1) Joint demand or complementary demand: That demand exists when two goods are demanded jointly to satisfy one demand. For e.g. - Car & Petrol, Bread & Butter, Shoes & socks, Pen & Ink.

2) Competitive demand: Competitive demand means substitutes demand or either or survival demand. That demand means if one commodity not exists then consumer demand the substitute commodity.

For e.g. – Tea or coffee, Rail transport or Road Transport.

3) Composite demand: When one commodity satisfies several purposes, that commodities demand is called Composite demand. For e.g. – Demand for steel, water, electricity.

4) Derived demand / Indirect Demand: Indirect demand is also known as derived demand. When goods demanded indirectly, i.e., to produce consumer goods, it is indirect demand. For example demand for factors of production is indirect demand.

5) Direct Demand: When a commodity demanded to satisfy human wants directly, it is direct or conventional demand. For example the demand for food, clothes, have direct demand. Consumer goods have direct demand.

Key Points: - Joint, Competitive, Derived, Direct, Composite.

|

Determination of Law of Demand OR Factors affecting Demand:

1) Price of product: Price of product is the main factor in determining the demand for a product. Consumers react to the level and change in price. Normally, a larger quantity is demand at lower price than at higher price. At a low market price, market demand for a product tends to be high and high market price, market demand for a product tends to be low.

2) Income: The average income of the consumer is an important determinant of market demand. As people’s income rise individuals find to buy more of almost everything, even if prices don’t change. Automatically purchased have risen sharply because of higher levels of income.

3) The price of substitutes: Demand for goods will change whenever the prices of its substitute goods change. In the case of substitutes, the demands for goods change with the price of substitute. For e.g. – If the price of coffee rises the demand for tea will rise.

4) Taste and preference: Demand for goods depends upon the consumer’s tastes and preference. The taste and preferences are influenced by fashion, style, likes, dislikes etc. Consumer’s tastes and preferences have great influence on the demand for goods.

5) Advertisement: Demand for goods is also influenced by advertisement. A significant change in tastes and preference can be caused by advertisements. Thus, an increase in advertisement is likely to increase the demand for goods.

6) Size and Composition of population: Demand for goods depends also on the size of population. Larger the number of people larger will be the demand for goods. Age composition also influences the demand for the goods. For e.g. – A larger number of children in the country will increase the demand for baby food and toys.

7) Future expectation: Demand for goods depends also on consumer’s expectation about the future changes. They may include expectations about changes in price, income, prices of related goods, availability of goods and so on. For e.g. – If consumers expect prices of essential goods to rise they will buy more of them now. On the other hand, expectation of decline in price will reduce the present demand.

8) Availability of credits: Demand for expensive and durable goods depends also an availability of credit. Greater the availability of credit, larger will be the demand. For e.g. – Availability of Loans for buying houses, cars, motorcycles etc. has influenced the demand for these goods.

9) Climatic condition: Demand for certain goods is also influenced by whether or climatic conditions. For e.g. Demand for umbrellas, woolen clothes etc. are seasonal in nature.

10) Social factors: Demand for goods is also influenced by social customs, traditions and practices. For e.g. – during Diwali there is greater demand for sweets and crackers.

Key Points: - Price, Income substitutes, Taste, Advertise, Population, Future Expectations, Credits, Climate Social, Factors. |

Individual Demand:

Individual demand means how a consumer is demanded the goods at different prices during given period of time. It may be presented with the help of individual demand scheduled.

Price per Kg. (Rs.) | Quantity Demanded in Kg. (Rice) |

10 | 2 |

8 | 4 |

6 | 6 |

4 | 8 |

2 | 10 |

Explanation of the Table:

In the above table, there is price per Kg. And Quantity demanded. When price is Rs. 10 Quantity demanded by consumer is 2 Kg. As price starts falling, a consumer buying more and more. It shows the inverse relationship between price and quantity demanded.

Market Demand:

Market demand shows the total quantity of commodity demanded by all the consumers in the market during a given period of time. It may be presented with the help of market demand scheduled.

Price per Kg. In Rs. | Demand of Consumers | Total Market Demand (Rice) | ||

A | B | C | ||

10 | 1 | 2 | 2 | 5 |

8 | 2 | 3 | 5 | 10 |

6 | 3 | 5 | 7 | 15 |

4 | 4 | 7 | 9 | 20 |

2 | 5 | 9 | 11 | 25 |

Explanation of the Table:

We assume A, B & C as different consumer in the market. This schedule shows different quantities demanded by consumers A, B & C. Total market demand column shows the sum of the total quantity demanded. When the price of Rice is Rs. 10, markets demand 5 Kg. As price falls further total demand goes on rising. Hence this table shows the inverse relationship between price and quantity demanded.

LAW OF DEMAND

1) INTRODUCTION: -

Law of demand is the very important law in economics. The Demand for a commodity refers to the quantity of a commodity that a person is willing to buy at different prices during period of time.

The Law of Demand given by Prof. Marshall. There is relationship between price and demand.

2) STATEMENT OF LAW:-

According to Alfred Marshall, “When other things being equal with rise in price demand is contract, with fall in price demand extends.”

3) EXPLANATION OF STATEMENT: -

3) EXPLANATION OF STATEMENT: -

Alfred Marshall had given the law of Demand. There is relationship between price and demand. When price falls demand rise and when price rises demand falls. When the price is high people purchase less commodities and when price is less people purchase more commodity. So there is inverse relationship between price & demand.

DD = f (P)

Here,

DD = Demand

f = Functional relation

P = Price

4) TABLE:-

Price (Rs.) | Total Quantity Demanded (Units) |

5 | 10 |

4 | 20 |

3 | 30 |

2 | 40 |

1 | 50 |

5) EXPLANATION OF TABLE:-

In the above table, there is Price and Total Quantity demanded. When the price is Rs. 5, the total Quantity demanded by consumer 10 units, when price falls the total Quantity demand rises. When the price is Re. 1 the quantity demand is 50 units. That means there is inverse relationship between price & demand. That schedule is explained with the help of following diagram

8) CONCLUSION: - Thus, Price and Demand have inverse relationship.

Why Demand curve slopes downwards from left to right?

The reasons for downward slopping demand curve are as follows:

1) The Law of diminishing marginal utility: we have seen that marginal utility goes on diminishing with increasing stock of a commodity. Therefore, a consumer tends to buy more when price falls.

2) Income effect: When price falls purchasing power of a consumer rises, which enables him to buy more of that commodity whose price falls. This is income effect.

3) Substitution effect: In case of substitute goods, when price of a commodity rises, its substitutes become relatively cheaper. Therefore, a consumer will purchase more of that commodity.

4) Multipurpose uses: When a commodity can be used for satisfying several needs, its demand will rise with a fall in its price and fall with a rise in its price.

Assumption of Law of Demand:

1) No change in consumer’s income: Throughout the operations of the law, the consumer’s income should remain the same. If the level of a buyer’s income changes, he may buy more even at a higher price and it is against the law.

2) No change in consumer’s preference: The consumer’s preference, taste and habits should remain the same throughout the operations of the law. If the consumer changes his taste then he buys another commodity even the price falling down of the commodity.

2) No change in consumer’s preference: The consumer’s preference, taste and habits should remain the same throughout the operations of the law. If the consumer changes his taste then he buys another commodity even the price falling down of the commodity.

3) No change in fashion: If the commodity concerned goes out of fashion, buyers may buy less of it, even at substantial price reduction. Therefore, Fashion remains constant.

4) No change in prices of related goods: Price of other goods like substitutes and complementariness remain unchanged. If the prices of other related goods change, the consumer’s preference would change which may against the law of demand.

5) No expectation of future change: The consumer should not expect or anticipate a further change in the price in the future, If he expects a further fall in the price of a commodity in the future, he will not buy more and it is the against the law.

6) No change in population: The size of population, its male-female ratio and age composition are assumed to remain constant, as such changes are sure to affect the demand.

7) No change in the range of goods available to the consumer: This implies that there is no innovation and arrival of new varieties of product in the markets, which may change in consumer’s preferences.

8) No change in government policy: The level of taxation and fiscal policy of the government remain the same throughout the operation of the law. Imposition of a new tax or removal of the existing tax by the government may change the size of disposable income of the consumer and thereby change the demand.

9) No change in weather conditions: It is assumed that climatic and weather conditions are unchanged in affecting the demand for certain goods like woolen clothes, umbrellas, etc.

Key Points: - No change Income, Fashion, Taste, Price of Substitute, Population, Weather, Government Policy. |

Exception to the Law of Demand:

1) Giffen goods: In the case of certain inferior goods called Giffen goods, when the price falls, quite offer less quantity will be purchased than before because of the negative income effect and people’s increasing preference for superior commodity with the rise in their real income. For e.g. – Cheap potatoes, cheap bread, veg. Ghee etc.

2) Articles of snob appeal: Snob appeal refers to consumption of prestige goods by the rich for simply to others. This type of goods purchased by the rich people for using them as a status symbol. Thus, when prices of such articles like say Diamonds, if price rise their demand also rises, similarly, expensive Cars are another outstanding example.

3) Ignorance: Sometimes, due to ignorance, people buy more of a commodity at higher price. This may happen when commodity in other places. This is called ignorance effect.

4) Speculation: When people speculate changes in the price of a commodity in future, they may act against the law of demand. For e.g. – If the consumer expect a further rise in the price of sugar, they board a large quantities at home, despite the high price.

5) Demonstration effect: When Indians try to imitate life style of foreign countries they demand foreign goods even at high prices. This may also happen when poor person imitate the life style of rich person.

6) Emergencies: The law is not applicable during emergencies like war, famine etc. The panic household purchase more medicine even at high price during emergencies. In such situation, the law of demand does not work.

7) Habitual Goods: Due to habit of consumption certain goods like tobacco, cigarettes etc. are purchased even if prices are rising. Thus it is an exception.

Key Emergencies Points: - Giffen Goods, Prestige Goods, Ignorance, Speculations, Demonstration, Habits. |

VARIATION IN DEMAND:

When the demand for a commodity falls or rises due to change in price & other things remaining same, it is called Variation in demand. Variation either extension or contraction.

A) Extension in demand: Extension refers to a rise in demand due to a fall in price. Other things like taste, preference, income of consumer, price of other goods, size of population, govt. Policy, etc. remain unchanged when extension take place. Extension is indicated by downward movement of the demand curve from one position to another.

B) Contraction in demand: Contraction refers to a fall in demand due to rise in price, other things remaining the same like above. Contraction is indicated by upward movement of the demand curve from one position to another. Contraction in demand we may show with the help of diagram.

|

CHANGE IN DEMAND:

Changes in demand refers to change in demand not because of change in price but because of several other factor influencing demand, such as taste, preferences, income, etc. A change in demand means Increase in demand and Decrease in demand.

A) Increase in demand: When more is demanded at the same price or same quantity at a larger price or more quantity at a higher price, then the condition is called as Increase in demand. The reasons for rise in demand are other than price.

1) There may be increase in the income.

2) Change in fashions

3) Changes in the structure of the population

4) Fall in the price of complementary goods etc.

B) Decrease in demand: Decrease in demand due to factor other than price. When less is demanded at the same price or same quantity is demanded at a lower price or less quantity is demanded at a lower price, the condition is called Decrease in demand.

The reasons for the decrease in demand may be –

1) Decrease in the income.

2) Change in tastes

3) Changes in the structure of the population

4) Change in fashion.

5) Rise in the price of complementary goods.

.

|

Sometimes, demand is greatly responsive to change in price, at other times; it may not be so responsive. The extent of variation in demand is technical expressed as ‘Elasticity of demand’.

Definition:-

According to Alfred Marshall, “The elasticity of demand is great or small according to the amount demanded which increases much or little for a given fall in price, and quantity demanded decreases much or little for a given rise in price.”

The concept of elasticity of demand refers to the responsiveness of demand for a commodity to changes in its determination. There are as many kinds of elasticity’s of demand as its determinants. Economists usually consider three important kinds of elasticity of demand.

1) Price elasticity of demand

2) Income elasticity of demand

3) Cross- elasticity of demand

1) Price Elasticity of demand:

It means the responsiveness of quantity demanded of a commodity to A CHANGE in its PRICE, The price elasticity of demand (Ep) is given by the percentage change in the quantity demanded of commodity divided by the percentage change in its price, it is stated as:

Proportionate change in quantity demanded

Price Elasticity of Demand (Ep) =

Price Elasticity of Demand (Ep) =

Proportionate change in price

Symbolically it can be written as follows:-

Ep =

Ep =

Ep =

Ep =

Q = Change in quantity Q = Original Quantity

Q = Change in quantity Q = Original Quantity

P = Change in price P = Original Price

P = Change in price P = Original Price

Types of Price elasticity of Demand:

Demand may be either elastic or inelastic. The demand which responds greatly to a change in price is called Elastic demand. The demand which not very sensitive to change in price is called inelastic demand.

The price elastic of demand is classified into five types:

1) Unit elastic demand: When change in price bring about exactly proportionate in quantity demand the demand is unit elastic demand, i.e. Elasticity of demand = 1.For e.g. – If price falls by 5% then demand rises by 5%. In this diagram when price falls OP to OP1, demand rises from OQ to OQ1 in the same proportion. ED =

1) Unit elastic demand: When change in price bring about exactly proportionate in quantity demand the demand is unit elastic demand, i.e. Elasticity of demand = 1.For e.g. – If price falls by 5% then demand rises by 5%. In this diagram when price falls OP to OP1, demand rises from OQ to OQ1 in the same proportion. ED =

2) Relatively elastic demand: When small change in price bring about more then proportionate change in quantity demanded, there is said to be relatively more elastic demand. Elasticity of demand >1. In this diagram when price falls from OP to OP1, demand extends from OQ to OQ1. This is relatively more in proportion to change in price. For e.g. - In case of fruits, milk, vegetable, etc.

2) Relatively elastic demand: When small change in price bring about more then proportionate change in quantity demanded, there is said to be relatively more elastic demand. Elasticity of demand >1. In this diagram when price falls from OP to OP1, demand extends from OQ to OQ1. This is relatively more in proportion to change in price. For e.g. - In case of fruits, milk, vegetable, etc.

3) Relatively inelastic demand: When small change in price bring about less then proportionate change in quantity demanded, there is said to be relatively less elastic demand. Elasticity of demand < 1 In this diagram when price falls from OP to OP1, demand extends from OQ to OQ1. This is relatively less in proportion to change in price. Ed < 1

3) Relatively inelastic demand: When small change in price bring about less then proportionate change in quantity demanded, there is said to be relatively less elastic demand. Elasticity of demand < 1 In this diagram when price falls from OP to OP1, demand extends from OQ to OQ1. This is relatively less in proportion to change in price. Ed < 1

4) Perfectly elastic demand: Demand is said to be perfectly elastic when at a given price, quantity demand goes on increasing infinitely. In such case demand curve is horizontal straight line and parallel toX – axis as shown in the diagram.Elasticity of demand = ∞In this diagram, when price is OP Quantity demand increase. It is shown by DD curve which is horizontal & parallel to X – axis. Ed = ∞

4) Perfectly elastic demand: Demand is said to be perfectly elastic when at a given price, quantity demand goes on increasing infinitely. In such case demand curve is horizontal straight line and parallel toX – axis as shown in the diagram.Elasticity of demand = ∞In this diagram, when price is OP Quantity demand increase. It is shown by DD curve which is horizontal & parallel to X – axis. Ed = ∞

5) Perfectly inelastic demand: when change in price has no effect on quantity demanded, the demand is perfectly inelastic demand. In such case demand curve is vertical straight line and parallel to Y – axis as shown in the diagram. Elasticity of demand = 0. For e.g. – Commodity like salt which is of absolute necessity has no effect which change in price. A 10% fall in price bring about no change in demand. In this diagram, when price is increasing OP to OP1 the demand for remain the same at OQ and hence demand curve is vertical straight line. Ed = 0

5) Perfectly inelastic demand: when change in price has no effect on quantity demanded, the demand is perfectly inelastic demand. In such case demand curve is vertical straight line and parallel to Y – axis as shown in the diagram. Elasticity of demand = 0. For e.g. – Commodity like salt which is of absolute necessity has no effect which change in price. A 10% fall in price bring about no change in demand. In this diagram, when price is increasing OP to OP1 the demand for remain the same at OQ and hence demand curve is vertical straight line. Ed = 0

Key Points: - Unit elastic, Relatively elastic, Relatively elastic, Relatively Inelastic, Perfectly Elastic, Perfectly Inelastic. |

Measurement of Price Elasticity of Demand:

There are three methods of measuring price elasticity of Demand:

1] Total Expenditure / Total Revenue method

2] Percentage / proportional method

3] Point / Geometric method

1] Total Expenditure / Total Revenue method:

We can know elasticity of demand by comparing the change in total expenditure due to change in price.

Total Expenditure = Price X Quantity Demanded

Marshall point out that:-

1) If because of fall in price, we buy more but total expenditure remains the same, elasticity of demand is said to be unit elastic or Ed = 1.

2) If because of fall in price, we buy more and total expenditure rises or vice versa, elasticity of demand is said to be greater than one or Ed > 1.

3) If because of fall in price, we buy more but total expenditure falls on vice versa, elasticity of demand is said to be less than one or Ed < 1.

This method can be explained with the help of following Table:

Case | Price (Rs.) | Quantity Demanded | Total Expenditure | Elasticity of Demand |

Case I | 4 | 5 | 20 | Ed = 1 |

1 | 20 | 20 | ||

Case II | 4 | 4 | 16 | Ed > 1 |

1 | 24 | 24 | ||

Case III | 4 | 8 | 32 | Ed < 1 |

1 | 16 | 16 |

2] Percentage or Proportional method:

It is based on the definition of demand Elasticity of Demand is equal to the ratio of percentage change in quality demanded to percentage change in the price. It is stated as:

Percentage change in quantity demanded

Percentage change in quantity demanded

Elasticity of Demand =

Elasticity of Demand =

Percentage change in price of commodity

In terms of symbol it is expressed as:

Ep =

Ep =

Ep =

Ep =

Q = Change in quantity Q = Original Quantity

Q = Change in quantity Q = Original Quantity

P = Change in price P = Original Price

P = Change in price P = Original Price

This can be explained with the help of following examples:

Price | Quantity |

50 | 10 |

40 | 15 |

Ep =

= 5 X 50

10 10

= 250

100

= 2.5

This answer is greater than one therefore,

This answer is greater than one therefore,

Ed > 1

3) Point or Geometric Method:

Marshall also suggested Geometrical method to measure price elasticity at a point on the demand curve. This is explained with respect to linear and non-linear demand curve.

a) Linear demand curve: In this method demand curve is linear curve which meets the two axis as follows:

For this following formula is used:

Lower segment of demand curve L PB

Elasticity of Demand = = =

Elasticity of Demand = = =

Upper segment of demand curve U PA

If PB = PA then Ed = 1

If PB > PA then Ed > 1

If PB < PA then Ed < 1

If PB = 0 then Ed = 0

If PA = 0 then Ed = ∞

Key Points: - Total expenditure, Percentage, Geometric Method. |

2) Income Elasticity of demand: In refers to the extent to which demand for a commodity changes due to changes in Income of the consumer, other factors including price remaining the same. It is expressed with the help of an equation as follows:

2) Income Elasticity of demand: In refers to the extent to which demand for a commodity changes due to changes in Income of the consumer, other factors including price remaining the same. It is expressed with the help of an equation as follows:

Percentage change in quantity demanded

Income Elasticity of Demand = Percentage change in Income

Income Elasticity of Demand = Percentage change in Income

3) Cross Elasticity of demand: It refers to change in the demand for a good as a result of change in price of other goods. If goods ‘X’ and ‘Y’ are substitutes goods when price of ‘X’ falls, demand for ‘X’ will rise and for ‘Y’ will fall without the rise in the price of ‘Y’.

There fare change in the demand for one goods due to the change in the price of other goods called Cross Elasticity of Demand. It is expressed with the help of an equation as follows:-

Percentage change in quantity demanded of ‘X’

Cross Elasticity of Demand = Percentage change in price of ‘Y’

Cross Elasticity of Demand = Percentage change in price of ‘Y’

Key Points: - Price, Income, Cross. |

Determinants of Price Elasticity of Demand:

1) Urgency of the want: Goods which are necessities of life will have relatively inelastic demand. Whereas less urgent wants are likely to have an elastic demand.

2) Nature of the commodity: Goods which are necessities of life will have relatively inelastic demand.

For e.g. – Food grains, cloths, salt etc. Whereas, luxury goods will have relatively elastic demand. For e.g. – Diamond, Jewellery, etc.

3) Availability of substitutes: A goods which has no substitutes will have relatively inelastic demand. For e.g. – Salt, Onion, Chalk etc. Whereas goods which have wide range of substitutes will have relatively elastic demand For e.g. – Demand for Mangola, Fanta, Limca, etc.

4) Number of uses of the commodity: If a commodity can be put to several uses, the demand for it is relatively elastic. For e.g. – Multipurpose goods like coal, electricity etc. will have relatively elastic demand.

5) Income: A consumer having high income has relatively inelastic demand for many goods, while a poor consumer has more elastic demand for the goods in general.

6) Proportion of Expenditure: Cheap or small expenditure items tend to have inelastic demand. For e.g. – Newspaper, whereas expensive items have elastic demand. For e.g. – TV

7) Influence of habit: When a person is habituated to consuming a certain commodity his demand for that commodity will be inelastic. For e.g. – Demand for cigarettes to a chain smoker is relatively inelastic.

8) Complementary of goods: Goods which are jointly demanded. For e.g. – Pen-Ink, Car-Petrol etc. have inelastic demand.

9) Element of time: In the short period demand for a commodity will be less elastic, whereas in the long period demand for a commodity will be more elastic because consumers may expect a further change in price so that they do not react immediately to a given change and also that people may not change their habits and preferences immediately.

Key Points: - Urgency, Nature of commodity, Substitute, Number of uses, Income, Proportion, Habit, Element of time. |

Significance or Importance of Price Elasticity of Demand:

1) Monopoly and Elasticity of Demand: The objective of a seller in monopoly market is profit maximization. Since he is a single seller in monopoly, market having total control over supply and price, he can take decisions about price policy and get more profit. If demand is inelastic for the product sold by monopolist, he will raise the price of that commodity and earn more profit.

2) Taxation Policy and Elasticity of Demand: The concept of Price Elasticity of Demand is useful to the government in the determination of taxation policy. The finance minister considers the Elasticity of Demand, while selecting goods and services for taxation. If government wants more revenue, those goods will be taxed more, for which demand is inelastic. Therefore, generally heavy taxes are imposed on goods like cigarettes, liquors and actual goods for which demand is inelastic.

3) Fixation of Wages and Elasticity of Demand: The concept of Elasticity of Demand is useful to trade unions in collective bargaining, for wage determination. When trade union leaders know that demand for their product is inelastic, they will insist for more wages to workers.

4) International Trade and Elasticity of Demand: The concept of Elasticity of Demand is useful to determine norms and conditions in international trade. The countries exporting commodities for which demand is inelastic can raise their prices. For instance, Organization of Petroleum Exporting Countries (OPEC) has increased the prices of oil several times. The concept is also useful in formulating export and import policy of a country.

5) Public Utilities: In case of public utilities like railways which have an inelastic demand, to avoid consumer’s exploitation government can either subsidize or nationalize them. This shows need government monopoly.

Question

- Explain concept of Utility.

- Explain Cardinal approach.

- Explain law of demand.

- Explain Types of Elasticity of Demand.

- Explain types of price elasticity of demand.