Unit 1

INDIAN COMPANIES ACT – 2013 PART -1

A company follows the provisions mentioned in the Companies Act 2013, which says that a – “Company” means a company incorporated under this Act or any previous company law; In other words, a company is a legal entity which is formed by different individuals to generate profits through their commercial activities.

A company is a legal entity formed by a group of people to engage in and operate a business—commercial or industrial—enterprise. A company may be organized in various ways for tax and financial liability functions depending on the corporate law of its jurisdiction.

The line of business the corporation is in will generally determine which business structure it chooses such as a partnership, proprietorship, or corporation. These structures also denote the ownership structure of the company.

They can also be distinguished between private and public companies. Both have different ownership structures, regulations, and financial reporting requirements.

A company is a legal entity formed by a group of people to engage in and operate a business enterprise in a commercial or industrial capacity.

A company's business line depends on its structure, which can range from a partnership to a proprietorship, or even a corporation.

A business enterprise is generally organized to earn a profit from business activities.

A company is essentially an artificial person—also known as corporate personhood—in that it is an entity separate from the people who own, manage, and support its operations. Companies are generally organized to earn a profit from enterprise activities, though some may be structured as nonprofit charities. Each country has its own hierarchy of company and corporate structures, though with many similarities.

A company has many of the same prison rights and responsibilities as a person does, like the ability to enter into contracts, the right to sue (or be sued), borrow money, pay taxes, own assets, and hire employees.

The benefits of starting a company include income diversification, a strong correlation between effort and reward, creative freedom and flexibility. The disadvantages of starting a company include increased financial responsibility, extended legal liability, long hours, responsibility for employees and administrative staff, regulations, and tax issues. Many of the world's greatest personal fortunes have been amassed by people who have started their own company.

Companies can be either public or private, both of which have different ownership structures, rules, and regulations.

Based on the above definitions, given below are the main features of company structure of ownership:

1. Artificial Legal Person:

A company is an artificial person. Negatively speaking, it is not a natural person. It exists in the eyes of the law and cannot act on its own. It has to act through a board of directors elected by shareholders. It was rightly pointed out in Bates V Standard Land Co. that: “The board of directors are the brains and the only brains of the company, which is the body and the company can and does act only through them”.

But for many purposes, a company is a legal person like a natural person. It has the right to acquire and dispose of the property, to enter into contract with third parties in its own name, and can sue and be sued in its own name.

2. Separate Legal Entity:

As a company is a legal person distinct from its members, it is capable of owning, enjoying and disposing of property in its own name. Although its capital and assets are contributed by its shareholders, they are not the private and joint owners of its property. The company is the real person in which all its property is vested and by which it is controlled, managed and disposed of.

3. Common Seal:

As was pointed out earlier, a company being an artificial person has no body similar to natural person and as such it cannot sign documents for itself. It acts through natural person who are called its directors. But having a legal personality, (8) it can be bound by only those documents which bear its signature. Therefore, the law has provided for the use of common seal, with the name of the company engraved on it, as a substitute for its signature. Any document bearing the common seal of the company will be legally binding on the company.

4. Perpetual Existence:

Unlike partnership, the existence of a company is not affected by the death, lunacy, insolvency or retirement of its members or directors. This is because the organisation enjoys a separate legal existence from that of its members. It is said, “Members may come, members may go but the company goes for ever”. It is created by law and is dissolved by regulation itself.

5. Limited Liability:

The liability of the members of a company is normally limited to the amount of shares held or guarantee given by them. A company may be company limited by shares or a company limited by guarantee. In company limited by shares, the liability of members is limited to the unpaid value of the shares. For example, if the face value of a share in a company is Rs. 10 and a member has already paid Rs. 7 per share, he can be called upon to pay not more than Rs. 3 per share during the lifetime of the company. In a company limited by guarantee the liability of members is limited to such amount as the member may undertake to contribute to the assets of the company in the event of its being wound up.

6. Transferability of Shares:

In a public company, the shares are freely transferable. The right to transfer shares is a statutory right and it cannot be taken away by a provision (9) in the articles. However, the articles shall prescribe the manner in which such transfer of shares will be made and it may also contain bona fide and reasonable restrictions on the right of members to transfer their shares. But absolute restrictions on the rights of members to transfer their shares shall be ultra vires. However, in the case of a private company, the articles shall restrict the right of member to transfer their shares in companies with its statutory definition. In order to make the right to transfer shares more effective, the shareholder can apply to the Central Government in case of refusal by the company to register a transfer of shares.

7. Separation of Ownership from Management:

The shareholders, i.e., owners being scattered all over country provide right the directors to manage the affairs of the company. The directors are the representatives of the shareholders. Thus, possession is separated from management.

8. Number of Members:

In case of a public limited company, the minimum number is seven and there is no maximum limit. But, for a personal limited company, the minimum number of members is two and the maximum number is fifty.

Promoters are ‘pioneers’ and Creators’ of company. They are men of imagination and resources. The idea of starting a new company comes first in the minds of promoters. They devote time and bear risk to set up a company.

According to Guttmann and Douglas:

“Promoters is a character who prepare the plan for formation of company and brings company into existence, as an artificial person”.

Function of Promoters:

- Promoters initiate scheme of formation of company.

- They arrange for requisite number of person, i.e. 2 in case of private organisation and 7 in case of public.

- Promoters decide name of company, amount of capital, location of registered office etc.

- Promoters appoint banker, broker, legal adviser, auditors etc.

- Promoters appoint first Directors.

- Promoters get Memorandum and Articles drafted and printed.

- They arrange for preparation of prospectus, its advertisement and issue of capital.

- Promoters arrange for loans and other financial assistance from financial institutions’.

Duties of Promoter:

The duties of promoters are as follows

1. To disclose the secret profit:

The promoter should not make any secret profit. If he has made any secret profit, it is his responsibility to disclose all the money secretly obtained by way of profit. He is empowered to deduct the real looking expenses incurred by him.

2. To disclose all the material facts:

The promoter ought to disclose all the material facts. If a promoter contracts to sell the company a property barring making a full disclosure, and the property was acquired by him at a time when he stood in a fiduciary position toward the company, the company may either repudiate the sale or affirm the contract and recover the profit made out of it by the promoters.

3. The promoter must make good to the company what he has obtained as a trustee:

A promoter stands in important position in the company. It is the duty of the promoter to make good to the company what he has obtained as trustee and not what he may get at any time.

4. Duty to disclose private arrangements:

It is the duty of the promoter to disclose all the private association resulting him profit by the promotion of the company.

5. Duty of promoter against the future allotters’:

When it is said the promoters stand in a fiduciary position towards the company then it does no longer mean that they stand in such relation only to the company or to the signatories of memorandums of company and they will also stand in this relation to the future allottees of the shares.

Liabilities of Promoter:

The liabilities of promoters are given below:

1. Liability to account in profit:

As we have already discussed that promoter stands in a fiduciary position to the company. The promoter is liable to account to the company for all secret earnings made by him without full disclosure to the company. The company may adopt any one of the following two courses if the promoter fails to disclose the profit.

(i)The company can sue the promoter for an amount of profit and recover the same with interest.

(ii) The company can rescind the contract and can recover the cash paid.

2. Liability for misstatement in the prospectus:

Section 62(1) holds the promoter liable to pay compensation to every person who subscribes for any share or debentures on the faith of the prospectus for any loss or harm sustained by reason of any untrue statement included in it. Sec. on 62 also provides certain grounds on which a promoter can avoid his liability. Similarly, Sec. 63 provides for criminal liability for misstatement in the prospectus and a promoter may additionally also become liable under this section.

The promoter may additionally also be imprisoned for a term which may extend to two years or might also be punished with the fine up to Rs. 5,000 for untrue statement in the prospectus. (Section 63).

3. Personal liability:

The promoter is personally in charge for all contracts made by him on behalf of the company until the contracts have been discharged or the company takes over the liability of the promoter.

The death of promoter does not relieve him from liabilities.

4. Liability at the time of winding up of the company:

In the course of winding up of the company, on an application made with the aid of the official liquidator, the court may make a promoter liable for misfeasance or breach of trust. (Sec. 543).

Further where fraud has been alleged by the liquidator against a promoter, the court may order for his public examination. (Sec. 478).

Preliminary contracts are those contracts which are made by the promoters with different parties on behalf of the company yet to be incorporated. Such contracts are generally entered into by promoters to acquire some property or right for and on behalf of the company to be formed.

The promoters enter into preliminary contracts, generally as agents or trustees of the company. Such contracts are not legally binding on the company because two consenting parties are necessary to a contract whereas the company is nonentity earlier than incorporation.

- The company has no legal existence until it is incorporated. It therefore follows:

1. That when, the company is registered, it is not bound by the preliminary contract.

2. That the company when registered cannot ratify the agreement. The company was not a principal with contractual potential at the time of contract. A contract can be ratified only when it is made by an agent for a principal who is in existence and who is competent to contract at the time when the contract is made.

3. That if the agent undertook any liability under the agreement, he would be personally liable notwithstanding that he is described in the agreement as an agent and that the company may have attempted to ratify the agreement.

4. The company can't enforce the preliminary agreement.

- Specific performance of pre incorporation contract

where the contract has been entered into the promoters for the purpose of the company before its incorporation and such contract is warranted by the terms of incorporation, specific performance may be obtained by or enforce against the company provided the company has accepted the contract and communicated its acceptance to the other contacting party.

The preliminary contracts made by promoters generally provided that if the company adopts the agreement the promoter’s liability shall cease and if the company does now not adopt the agreement within a certain time either party may rescind the contract. In such a case promoter’s liability would cease after the lapse of fixed time.

- Effect of the Pre incorporation contract:

The effects of the pre-incorporation contracts are as follows: -

- The company cannot be sued on the preliminary Contracts even though when it comes into existence and takes the benefit thereof. The company cannot be sued for those expenses, which are incurred before its incorporation because it was not in existence when the expenses were sincerely incurred.

- The company is also not a position to sue on the preliminary Contract.

- The character who acts for the intended company will be presently liable to the vendor, even if the company purports to ratify the agreement, unless the agreement provides that:

- His liability will come to a stop it the company adopts the agreement.

- Either party may cancel the agreement if the company does not adopt it within a specified time.

- As per section 15 and 16 of the specific relief Act, 1963, a pre-incorporation contract can be enforced against the company, if it is warranted through the terms of incorporation and it is adopted by the company. In such a type of cases the director has no discretion in the matter.

Section 69 of the Indian Partnership Act, 1932 offers a detailed explanation of the consequences of no longer opting for firm registration. These are:

1] No suit in a civil court by the firm or other co-partners against any third party

If the firm registration is not done, then the firm or any other person on its behalf cannot file a go well with against a third party for breach of contract which the firm has entered into. Further, the character filing the suit on behalf of the firm should be in the register of the association as a partner.

2] No relief to partners for set-off of claim

Without firm registration, any action delivered against the firm by a third celebration having a value of more than Rs. 100 cannot be set-off by the firm or any of its partners. Pursuance of other proceedings to enforce rights bobbing up from the contract cannot be done either.

3] An aggrieved partner cannot carry legal action against other partner or the firm

A partner of the firm or any person on his behalf cannot bring legal action against the firm or in opposition to any partner (or alleged to be a partner) if firm registration is not done. However, if the firm is dissolved, then such a individual can sue the firm for dissolution it accounts and realization of his share in the firm’s property.

4] A third party can sue the firm

Even if the firm registration is not done a third party can bring legal action against the firm.

It is also, necessary to note that despite these disabilities, the non-registration of a firm does not have an effect on the following rights:

- The right of a third party to sue the firm or any partner

- Partners’ right to sue the firm for dissolution or settlement of accounts (in case of dissolution)

- The power of the Official Assignees, Receiver of Court to release the property of the insolvent partner and bring an action

- The right of the company and partners to sue or claim set-off of the value of the suit does no longer exceed Rs. 100.

A company is a legal person distinct from its members [Saloman V. Salomon & Co. Ltd. (1897) A.C. 22]. This principle may be referred to as "the veil of incorporation". The effect of this principle is that there is a fictional veil between the company and its members. That is, the company has a corporate personality which is distinct from its members.

It became necessary for the Courts to break through or lift the corporate veil or crack the shell of corporate personality and look at the persons behind the company who are the real beneficiaries of the corporate fiction. Exceptions: The various cases in which corporate veil has been lifted are as follows:

(1) Protection of Revenue: The Courts may ignore the corporate entity of a company where it is used for tax evasion. Sir Dinshaw Maneckjee Petit, Re A. I. R. (1927) Bom. 371. D, an assessee, who was receiving huge dividend and interest income, transferred his investments to 4 private companies formed for the purpose of reducing his tax liability. These companies transferred the income to D as a pretended loan. Held, the companies were formed by D purely and simply as a means of avoiding tax obligation and the companies were nothing more than the assessee himself.

2. Prevention of Fraud or Improper Conduct: The legal personality of a company may also be disregarded in the interest of justice where the machinery of incorporation has been used for some fraudulent purpose like defrauding creditors.

Jones V. Lipman, (1962) All E.R. 442. L agreed to sell a certain land to J. He subsequently changed his mind and to avoid the specific performance of the contract, he sold it to a company which was formed specifically for the purpose. The company had L and a clerk of his solicitors as the only members. J brought an action for the specific performance against L and the company. The Court looked to the reality of the situation, ignored the transfer and ordered that their company should convey the land to J.

3. Determination of Character of a Company: A company may assume an enemy character when persons in de facto control of its affairs are residents in an enemy country. In such a case, the Court may examine the character of persons in real control of the company and declare the company to be an enemy company.

Daimler Co. Ltd. v. Continental Tyre & Rubber Co. Ltd. (1916) 2 A.C. 307. A company was incorporated in England for the purpose of selling in England tyres made in Germany by a German company which held the bulk of shares in the English company. The holders of the remaining shares, except one, and all the directors were Germans, resident in Germany. During the First World War, the English company commenced an action for recovery of a trade debt. Held, the company was an alien company and the payment of debt to it would amount to trading with the enemy, and therefore the company was not allowed to proceed with the action.

4. Where the company is a Sham: The Courts also lift the veil where a company is a mere cloak or sham.

5. Company Avoiding Legal Obligations: Where the use of an incorporated company is being made to avoid legal obligations, the Court may disregard the legal personality of the company and proceed on the assumption as if no company existed.

6. Company Acting as Agent or Trustee of the Shareholders: Where a company is acting as agent for its shareholders, the shareholders wil be liable for the acts of the company. It is a question of fact in each case whether the company is acting as agent for its shareholders.

7. Protecting Public Policy: The Courts invariably lift the corporate veil to protect the public policy and prevent transactions contrary to public policy

- Statutory Exceptions:

1. Allotment of Securities by Company (Sec. 39): No allotment of any securities of a company offered to the public for subscription shall be made unless the amount stated in the prospectus as the minimum subscription is received and paid to the company. If the minimum amount has not been subscribed and sum payable on application is not received within a period of thirty days from the date of issue of prospectus, and if the company has not filed a return of allotment. In case of default the company and its officer who is in default shall be liable to a penalty for each day of default, of one thousand rupees for each day during which the default continues or one lakh rupees whichever is less.

2. Name of the Company (Sec. 12): Every company shall paint or affix its name and address to its registered office, have its name engraved in legible letters on it's seal. If any default is made in complying with these requirements of this section, the company and every officer who is in default shall be liable to a penalty of one thousand rupees for every day during which the default continues but not exceeding one lakh rupees.

- They were of three types:

(i) Company Limited by Shares [Sec. 12(2)(a)];

(ii) Company Limited by Guarantee [Sec. 12(2)(b)]; and

(iii) Unlimited Company [Sec. 12(2)(c)].

(i) Company Limited by Shares [Sec. 12(2)(a)]:

In these companies, the liability of the shareholders is limited up to the extent of the face value of shares owned by each of them, i.e., the member is not liable to pay anything more than the fixed value of the shares, whatever may be the liability of the company.

It is interesting to note that the liability can be maintained either during the existence of the company or during the period of winding-up. Needless to mention, if the shares are fully paid, the liability of the shareholders are nil with the exception to the rule as laid down in Sec. 45. The type of company may be a Private Company or a Public Company.

(ii) Company Limited by Guarantee [Sec. 12(2)(b)]:

In these companies, the liability of the shareholders is limited to a specified amount as provided in the memorandum, i.e., each member provides to pay a fixed sum of money in the event of liquidation of the company.

It has a legal entity distinct from its members. The liability of its members is limited. According to Sec. 27(2), the Article of Association of the company must express the number of members by which the company is actually registered.

It is interesting to note that these types of companies are not formed for the purpose of earning revenue/profit but for the purpose of promoting arts, sciences, commerce, culture, sports etc., and, as such, they may or may not have any share capital. So, the amount which has been guaranteed by the members is like reserve capital.

If the company has a share capital, it must conform to Table D in Schedule I, and, if it has no share capital, it must conform to Table C in Schedule I. It is also mentioned here that if it has a share capital, it is governed by the same provisions as governed by the company limited by shares. It cannot purchase its own shares [Sec. 77(1)]. This type of company may be a Private Company or a Public Company.

According to Sec. 426, if the company limited by guarantee is being wound-up, every member is liable to contribute to the assets of the company for:

(a) Payment of the liabilities,

(b) Cost, charges and expenses of winding-up, and

(c) For adjustment of rights of the contributories among themselves.

(iii) Unlimited Company [Sec. 12(2)(c)]:

In these companies, every shareholder is liable for all the liabilities of the company like ordinary partnership in proportion to his interest. According to Sec. 12, any seven or more persons (two or more in case of private company) may form a company with or without limited liability and a company without limited liability is actually known as unlimited company. It may or may not have any share capital. It will be a private or a public company if it has a share capital. Its Articles of Association will provide the number of members by which the company is registered.

3. Statutory Company:

These companies are created by the Special Act of the legislature, e.g., the State Bank of India, the Life Insurance Corporation of India, the Reserve Bank of India, etc. These are actually concerned with public utility services, e.g., railways, gas and electric companies, etc. which require special powers to function.

4. Private Company:

According to Sec. 3(1)(iii) of the Indian Companies Act, 1956, a private company is one which, by its Articles:

(i) Restricts the rights to transfer its shares, if any;

(ii) Limits the number of the members to fifty not including

(a) Persons who are in the employment of the company, and

(b) Persons who, having been formerly in the employment of the company, were members of the company while in that employment, and have continued to be members after the employment ceases; and

(iii) Prohibits any invitation to the public to subscribe for any shares in or debentures of, the company.

A private company must have its own Articles of Association which will contain the provisions laid down in Sec. 3(1)(iii).

This type of company is in the nature of partnership with mutual confidence among them.

5. Public Company:

Sec. 3(1)(iv) of the Indian Companies Act, 1956, states that public companies are “all companies other than private companies.” It is a company of seven or more persons which offers its shares to the public for subscription. Since its shares are offered to the public, scope for investment by a large number of- people is possible.

Its Articles do not contain provisions restricting the number of its members or excluding generally the offer or transfer of shares or debentures to the public. Accordingly, any public who is interested to purchase shares or debentures may acquire the same. In this company, there is no maximum limit of members like private company.

6. Foreign Company:

The companies which are incorporated outside India but which had a place of business in India prior to commencement of the new Companies Act, 1956, and continue to have the same or which establishes’ a place of business in India after the commencement of the Companies Act, 1956, is called a foreign company. These companies are registered in a country outside India and under the law of that country.

At present Sec. 591(2) added by the Companies (Amendment) Act, 1974, informs that where not less than 50% of the paid-up share capital (whether equity or preference or partly equity or partly preference) of a foreign company, (i.e., a company incorporated outside India having an established place of business in India) is held by one or more citizens of India and/or by one or more Indian companies, singly or jointly, such company shall comply with such provisions as may be prescribed as if it was an Indian company.

If a company has an established place of business in India and if it has a specified or identified place where it carries on business, e.g., an office, store-house, godown or other premises.

7. Government Company:

According to Sec. 617, a Government company is a company in which not less than 51% of the paid-up share capital is held by the Central Government and/or any State Government or partly by Central and partly by State Governments. The subsidiary of a Government company is also a Government company.

8. Holding and Subsidiary Company:

According to the Companies Act, 1956, a holding company may be defined as “any company which directly or indirectly, through the medium of another company, holds more than half of the equity share capital of other companies or controls the composition of the board of directors of other companies. Moreover, a company becomes a subsidiary of another company in those cases where the preference shareholders of the latter company are allowed more than half of the voting power of the company from a date before the commencement of this Act”.

In other words, a holding company is one which controls one or more other companies—either by means of holding shares in that company or companies or by having powers to appoint directly or indirectly the whole or majority of the Board of Directors of those companies. A company controlled by a holding company is known as a subsidiary company. Actually, it is a part and parcel of the combination movement in business.

The private company has a core advantage that is mentioned below:-

- Members: You can start a private limited company with a minimum of only 2 members (maximum of 200), as per the provisions of the Companies Act 2013.

2. Limited liability: In the private company, the liability of each shareholder or member becomes limited. This means that if the company runs into a loss, the company shareholders are liable to sell their company shares to clear the debt or liability. The individual assets of shareholders or members are not at risk as a member are not themselves responsible.

3. Perpetual succession: Perpetual succession means that the company will be continued even if any owner or member dies or goes bankrupt, or even exits from the business or transfers his shares to another person.

4. Prospectus: Prospectus is a written detailed statement is issued by a company that goes public which means Public Company. However, there is no need for private limited companies to issue a prospectus because the general public is not invited to subscribe for the shares of the private company.

5. A number of directors: In the case of the private limited company there is a need for only a minimum number of only 2 directors. At least one director on the board of directors must have stayed in India for a total period of not less than 182 days in the previous calendar year. The directors and the shareholders can be the same people.

6. Capital: Although, under the companies act, 2013, there is a minimum paid-up share capital requirement of Rs.100000 however, this requirement has been deleted in the Companies amendment act, 2015.

So, currently, there is no minimum paid-up share capital requirement in the case of a private company. However, Private company must have minimum Authorized share capital of Rs.1,00,000.

The following are the disadvantages are as mentioned in brief that is: -

- Private limited company restricts transferability of its shares by its articles as per prescribed rules of company act, 2013

- The number of members, in any case, cannot exceed 50 in the private ltd company.

- Moreover, it cannot issue prospectus to the general public as it is restricted to issue shares in the General Public.

- So Concluding, In stock exchange shares cannot be quoted.

Other Disadvantages for Private Company: -

- Smaller resources

- Lack of transferability of shares

- Poor protection to members

- No valuation of investment

- Lack of public confidence

Formation of a company [Section 3(1)]: A company may me formed for any lawful purpose by –

- Seven or more person, where the company to be formed is to be public company;

- Two or more persons, where the company to be formed is to be a private company; or

- One person, where the company to be formed is to be one-person company that is to say, a private company,

by subscribing their names or his name to a memorandum and complying with the requirements of this act in respect of registration.

|

Section 7- Procedure for Registration of Company There shall be filed with the Registrar within whose jurisdiction the registered office of a company is proposed to be situated, the following documents and information for registration, namely:

- the memorandum and articles of the company, duly signed by all the subscribers to the memorandum in such manner as may be prescribed;

- a declaration in the prescribed form by an advocate, a chartered accountant, cost accountant or company secretary in practice, who is engaged in the formation of the company, and by a person named in the articles as a director, manager or secretary of the company, that all the requirements of this Act and the rules made thereunder in respect of registration and matters precedent or incidental thereto have been complied with;

- an affidavit from each of the subscribers to the memorandum and from persons named as the first directors, if any, in the articles that he is not convicted of any offence in connection with the promotion, formation or management of any company, or that he has not been found guilty of any fraud or misfeasance or of any breach of duty to any company under this Act.

- The address for correspondence till its registered office is established;

- The particulars of name, including surname or family name, residential address, nationality and such other particulars of every subscriber to the memorandum along with proof of identity, as may be prescribed, and in the case of a subscriber being a body corporate, such particulars as may be prescribed;

- The particulars of the persons mentioned in the articles as the first directors of the company, their names, including surnames or family names, the Director Identification Number, residential address, nationality and such other particulars including proof of identity as may be prescribed; and

- The particulars of the interests of the persons mentioned in the articles as the first directors of the company in other firms or bodies corporate along with their consent to act as directors or the company in such form and manner as mar be prescribed.

2. The Registrar on the basis of documents and information filed under sub-section (1) shall register all the documents and information referred to in that sub-section in the register and issue a certificate o incorporation in the prescribed form to the effect that the proposed company is incorporated under this Act.

3. On and from the date mentioned in the certificate of incorporation issued under sub-section (2), the Registrar shall allot to the company a corporate identity number, which shall be a distinct identity for the company and which shall also be included in the certificate.

4. The company shall maintain and preserve at its registered office copies of all documents and information as originally filed under sub-section (1) till its dissolution under this Act.

5. If any person furnishes any false or incorrect particulars of any information or suppresses any material information, of which he i aware in any of the documents filed with the Registrar in relation the registration of a company, he shall be liable for action under section 447.

Where, at any time after the incorporation of a company, it is proved that the company has been got incorporated by furnishing any false or incorrect information or representation or by suppressing any material fact, the promoters, the persons named as the first directors of the company shall each be liable for action under section 447.

Where a company has been got incorporated by furnishing any false or incorrect information or representation of by suppressing any material fact, the Tribunal may, on an application made to it, on being Satisfied that the situation so warrants, -

pass such orders, as it may think fit, for regulation of the management of the company including changes, it any, in its memorandum and articles, in public interest or in the interest of the company and its members and creditors. The company registered under this section shall enjoy all the privileges and be subject to all the obligations of limited company, A company registered shall not alter the provisions of its memorandum and articles except with the previous approval of the Central Government

Section 2(56) of the companies act 2013 defines Memorandum as “Memorandum of association of a company as originally framed or as altered from time to time in pursuance of any previous company law or of this Act”

Lord Cairns defines Memorandum as, “The Memorandum of Association of the company is its charter and defines the limitation of the powers of the company”

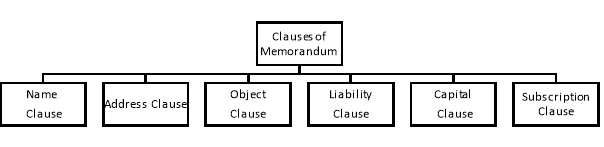

Clauses of Memorandum of Association and Provisions to alter it:

|

1. The Name Clause

This clause mentions the name of the company. As a Company is a legal entity distinct from its members, it has to have its own name to establish its separate identity. The promoters choose a name for the Company.

Following points should be kept in mind while choosing the name of the company:

i) The name should not be identical or resemble the name of an already existing company registered under this Act or any previous Company Law.

ii) The name should not contain any words which will constitute an offence under any Law.

iii) The name or words in the name shall not offend any section of people.

iv) The name shall not violate the provisions of Emblems and Names (Prevention of Improper Use Act, 1950)

v) The name shall not resemble any registered Trade Mark.

vi) The name should not have any word that gives an impression that the company is connected with or has the support of Central or State Government or any Local authority.

vii) In case of a Public company Limited by shares or Guarantee, the last word of the name should be ‘Limited’. e.g. ‘Tata Steel Ltd’

Similarly, for a Private Company Limited by Shares or Guarantee, the last word of the name should be ‘Private Limited’ e.g. ‘Posco India Pvt. Ltd’ And in case of One Person Company, the words ‘One Person Company’ must be mentioned in the name of the Company in bracket. e.g. ‘Smart services Pvt. Ltd’ (OPC)

The Companies Act states that every company shall paint or affix its name and the address of its registered office outside its place of business.

- Alteration of Name Clause:

A company may change its Name anytime -

a) On its own

b) On its conversion from Public company to Private or vice-versa.

c) On the direction of the Central Government if it is of the opinion that the name is similar to the name of an already existing company or similar to a registered Trade Mark.

Name clause can be altered by passing a special resolution in the General Meeting of a Company.

2. The Address Clause (Registered office Clause)

The clause states the name of the State in which the Registered Office of the Company will be located. Every company must have its Registered office within 30 days of its Incorporation.

A Registered office is a must as

i) It establishes the domicile (location) of a company.

ii) It is the address to which all communications, notices, etc. will be sent.

iii) It is also the place where all statutory books, records and documents of the company will be kept.

iv) The address clause also indicates the jurisdiction of the court where cases can be filed by the company against others.

- Alteration of Address Clause

A company may change its Registered office from-

a) One place to another place within the same city or town.

In this case, no alternation is made in the Memorandum

b) One Town or city to another Town or city within the same state.

c) One state to another state.

In both these cases (b) and (c), a special resolution is to be passed in the General Meeting to alter the Address clause. In case of (c) above, approval of Regional Director is required.

3. The Object Clause:

This clause defines the objects for which a company is formed. It indicates the range of activities a company can undertake. This clause states in detail the Main Objects for which the company is to be incorporated and also describes any other activities it may undertake if necessary, in achieving its main objects.

The Objects of the company must not be illegal, immoral, against the public policy or in contravention of the Companies Act or any other Laws.

A company cannot do anything beyond or outside the scope of its objects. It can do anything which is incidental to and consequential upon the objects specified in this clause.

Any act done by a company beyond the scope of its objects, will be ‘Ultra-Vires’ and will be void and have no legal validity.

- Alteration of Object Clause

A Company may change its object clause as and when it feels it is necessary to do so for its survival or growth.

A special Resolution must be passed in the General Meeting for altering the object clause.

4. The Liability Clause

This clause states the extent of liability of the members of the company.

In case of a company limited by shares, this clause states that the liability of the member is limited to the extent of the amount unpaid on the Face Value of Shares held by the member.

Similarly, in case of a company limited by Guarantee, this clause states the amount which every member guarantees to pay towards the assets of the company at the time of winding up or towards the cost or expenses at the time of winding up.

In case of Unlimited liability company with or without share capital, this clause states that the liability of its members is unlimited.

- Alternation of Liability Clause:

The Companies Act, 2013 or any Rules made thereunder, does not contain any provision regarding alteration of liability clause. Legally speaking, the relationship between a member and the company is a contractual relationship. Hence, if any changes is to be made in the liability of a member, it has to be with the consent of the member and that too in writing.

5. The Capital Clause

This clause states the amount of capital with which the company is registered. This capital is hence called as Registered Capital. This is the maximum capital which the company is authorized to raise, hence it is also called as Authorized Capital.

In case of a company with share capital, this clause states the total amount of share capital in terms of total number of shares and the fixed value per share called as Face Value of the share.

If a company wants to issue more shares to raise more funds than the amount of Authorized Capital, then the Company has to alter the capital clause.

- Alteration of Capital Clause

The Articles of Association of a Company authorizes the alteration in the capital clause. Capital clause is altered for reasons like increasing the Authorized capital by issuing new shares, convert fully paid up shares into stock etc.

Capital clause is altered by passing an Ordinary Resolution in the General Meeting of the Company.

6. The Association or Subscription clause

This is the last clause of the Memorandum of Association and it is placed at the end. In this clause, the subscribers to the Memorandum make a declaration stating that they are desirous of forming a company as per the Memorandum and agree to take a certain number of shares in the capital of the company.

In case of a public company, the Memorandum must be signed by at least seven subscribers whereas for a Private Company - by at least two subscribers and one subscriber in case of One Person Company.

Each subscriber has to put his name, address and occupation in the presence of at least one witness who shall also put in his details.

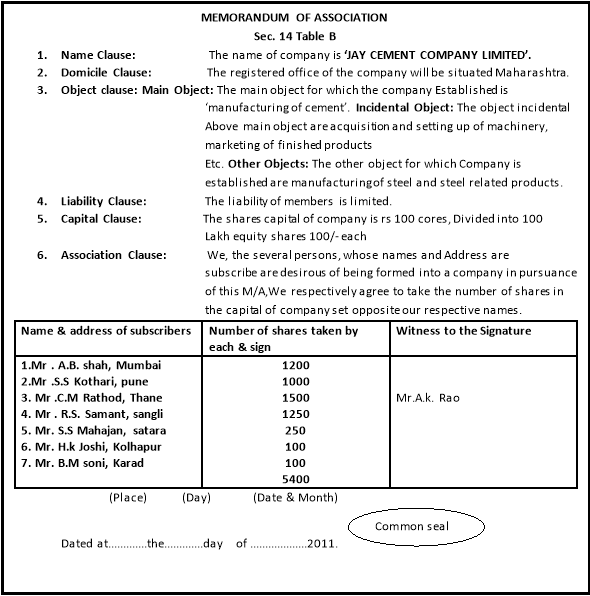

FORM OF MEMORANDUM OF ASSOCIATION

Articles of Association is the second most important document which needs to be filed with the ROC along with the Memorandum at the time of incorporation of a Company. This document is subordinate (secondary) to the Memorandum. It is like the Bye-Laws of the company as it contains rules and regulations that governs the internal management of the company. It defines the powers, rights and duties of the Board of Directors and officers and also the manner in which the business of the company will be carried on. It establishes relationship between the company and its members and also between the members.

- DEFINITION

As per Section 2(5) of the Companies Act, 2013, ‘Articles’ means the “Articles of Association of a Company as originally framed or as altered from time to time in pursuance of any previous Company law or of this Act.”

Thus, Articles is a legal document in writing which contains rules and regulations which helps in internal management of a company. As every company may be managed differently, the Companies Act, 2013 does not specify the exact contents of the Articles. However, the regulations given in the Articles should not exceed the power of the Company as laid down by its Memorandum or contradict the Companies Act, 2013 or any other Laws.

Articles of Association usually includes rules and regulations regarding powers, rights and duties of governing body, issue of shares, calls on shares, forfeiture of shares, procedure for transfer and transmission of shares and debentures, etc. Companies Act has given the format in the form of Model Articles i.e. Table F, G, H, I and J for preparing the Articles of Association for different types of Companies.

- Contents of Articles of Association

A Company may adopt the Model Articles as given by the Companies Act, 2013 or add additional matters as per its requirements.

The Articles of Association usually contain rules and regulations related to the following matters -

i) Share Capital - Shares and their value and their division into different types of shares.

ii) Rights of each class of shareholders and procedure for variation of their rights.

iii) Procedure relating to allotment of shares, making of calls and forfeiture of shares.

iv) Rules relating to transfer and transmission of shares and the procedure to be followed.

v) Lien of the company on shares allotted to the members for the amount unpaid by them.

vi) Increase, alteration or reduction of Share Capital.

vii) Appointment, remuneration, power, duties, etc. of the Directors and officers of the Company.

viii) Procedure for conversion of shares into stock and vice versa.

ix) Provisions related to Board, Committee and General Meetings, Voting rights of members, proxy, quorum, poll, adjournment of meeting etc.

x) Audit of accounts, transfer of money to Reserves, declaration of Dividend, etc.

xi) Borrowing powers of the Company and the mode of borrowings.

xii) Issue of Share Certificates including procedure for issue of duplicate share certificate.

xiii) Constitution and composition of Audit committee, Remuneration Committee, Corporate Social Responsibility Committee

xiv) Provision for winding up of company

xv) Arbitration

xvi) Indemnity

The memorandum and articles of association of every company are registered with the registrar of the company, the office of the Registrar is a public office and consequently the documents become public documents. They are accessible to all. It is therefore the duty of every person dealing with the company to inspect the public documents and make sure that his contract with the company is in conformity with the company’s provisions. But whether a person actually reads them or not, he is to be in a same position as if he has read them. He will be presumed to know the content of the company's documents. This kind of presumed notice about the contents of the company's documents is called Constructive Notice. Another effect to this rule is that a person dealing with the company is taken not only to have read those documents but to have understood them with proper meaning. He is also presumed to have understood the powers of the company's officers. There is a constrictive notice not only of the memorandum and articles, ut also of all the documents such as special resolutions that are required by the Act to be registered with the Registrar of the company. The documents that are required to be disclosed in public office, this is the public effect of it.

- Statutory reform of constructive notice

It is more or less an unreal doctrine. It does not take notice of the realities of business life. People know a company through its officers not through its documents.

Section 399 allows any person to electronically inspect, make a record, or get a copy/extracts of any document of any company which the Registrar maintains. There is a fee applicable for the same. The documents consist of the certificate of incorporation of the company.

By now we know that the Memorandum and Articles of Association are public documents. This section confers the right of inspection to all.

Before any individual deals with a company he must inspect its files and establish conformity with the provisions. However, even if a person fails to read them, the law assumes that he is aware of the contents of the documents. Such an implied or presumed notice is called Constructive Notice.

In simpler words, if a person enters into a contract which is beyond the powers of a company, then he has no right under the said contract against the company. The Memorandum of Association defines the powers of the company. Also, if the contract is past the authority of the directors as defined in the Articles, the person has no rights.

A Memorandum of Association of a company is a basic charter of the company. It is a binding document which describes the scope of the company among different things. If a company departs from its MOA such an act is ultra vires. Let us further understand the Doctrine of Ultra Vires.

The Doctrine of Ultra Vires

The Doctrine of Ultra Vires is a fundamental rule of Company Law. It states that the objects of a company, as specified in its Memorandum of Association, can be departed from only to the extent permitted by the Act. Hence, if the company does an act, or enters into a contract beyond the powers of the directors and/or the company itself, then the said act/contract is void and not legally binding on the company.

The term Ultra Vires means ‘Beyond Powers’. In legal terms, it is applicable solely to the acts performed in excess of the legal powers of the doer. This works on an assumption that the powers are limited in nature. Since the Doctrine of Ultra Vires limits the company to the objects specified in the memorandum, the company can be:

• Restrained from using its funds for functions other than those specified in the Memorandum

• Restrained from carrying on trade distinctive from the one authorized.

The company cannot sue on an ultra vires transaction. Further, it cannot be sued too. If an employer supplies goods or offers service or lends money on an ultra vires contract, then it cannot obtain payment or get better the loan.

However, if a lender loans money to a company which has not been extended yet, then he can cease the company from parting with it via an injunction. The lender has this right because the company does not become the owner of the money as it is extremely vires to the company and the lender remains the owner.

Further, if the company borrows money in an extremely vires transaction to repay a legal loan, then the lender is entitled to recover his loan from the company.

Sometimes an act which is ultra vires can be regularized by means of the shareholders of the company.

- Consequences of ultra vires transactions

When a company gets involved in ultra vires transactions the following are the effects:

1. Injunction: The members are entitled to hold a registered company to its registered objects hence whenever an ultra vires act has been or is about to be under taken by the company, any member of the company can get an injunction to restrain the company from proceeding with an ultra vires act.

2. Personal liability of directors: It is one of the duties of the directors to see that the corporate capital is used only for the legitimate business of the company. If any part of the company's capital is used for any purposes, which is outside the company's memorandum, the directors will be personally liable to replace it.

3. Breach of warranty of authority: It is the duty of an agent to act within the scope of his authority. For if he goes beyond he will be personally liable to the third party for breach of warranty of authority. The directors of the company are its agent's. As such it is their duty to keep within limits of the company's powers. If the directors induce an outsider to contract with the company in a matter in which the company does not have the power to act they will be personally liable to him for his loss.

4. Ultra vires acquired property: If a company's money is spent ultra vires in purchasing some property, the company's right over that property must be held secured for that asset, though wrongly acquired represents the corporate capital.

5. Ultra vires contracts i.e. to say outside the objects is wholly void and of no legal effect. An ultra vires contract being toid-ab-initto cannot become intra vires by reason of estoppel, lapse of time ratification, acquiescence or delay.

6. Ultra vires torts-when a company can be made liable for the torts (Civil wrong) committed by a servant of the company while acting beyond the company powers. In the following cases company is held liable -

(a) The act is within the scope of company's memorandum.

(b) That the servant committed the tort while in company employment.

DOCTRINE OF INDOOR MANAGEMENT/ TURQUAND RULE

The role played by the doctrine of indoor management is opposed to that of the rule of constructive notice. The rule of constructive notice protects company against the outsider, whereas the doctrine of indoor management protects outsider against the company.

The rule had its genesis in Royal British Bank Vs Turquand. Facts: The directors of a company borrowed a sum of money from the plaintiff. The company's articles provided that the directors might borrow

on bonds such sums as may time to time be authorised by a resolution passed at a general meeting of the company.

The shareholders claim that there had been no such resolution authorising e loan and therefore loan was taken without authority.

Held: The company was held bound by the loan. Once it was stated in the articles that the directors could borrow subjects to a resolution, the plaintiff had the right to infer that the necessary resolution must have been passed.

- Exceptions

1. Knowledge of irregularity: The rule had no applications where the party affected by an irregularity had the actual notice about the irregularity. Knowledge of the irregularity may arise from the fact that the person contracting was himself a party to the inside procedure.

2. Suspicion of irregularity: The protection of the "Turquand rule" is also not available where the circumstances surrounding the contract are suspicious and therefore invite inquiry for example that an officer of a Company acts in a manner which is apparently outside the scope of his authority.

3. Forgery: The Turquand rule is not applicable to forgery, as any forged document is null and void. This doctrine applies to irregularities which otherwise might affect a genuine transaction. It cannot apply to forgery.

4. Knowledge of the Articles: The doctrine is applicable in the place where a person has inspected the public documents and entered into a contract with the company. But if he has no knowledge of the articles he does not get the protection against the internal irregularities of their company.

5. Acts outside the Apparent Authority: If the act of an officer of ai company is one which would ordinarily be beyond the powers of such an officer; the outsider cannot get the protection

When a Public company, is collecting capital by issuing shares to the public has to issue a document called ‘Prospectus.’ Prospectus is a document which contains information about various aspects about the company and invites the investors to buy the securities offered by the company.

Section 2 (70) of Companies Act, 2013 defines prospectus as “any document described or issued as a prospectus and includes Article 32a Red Herring Prospectus or shelf prospectus or any notice, circular, advertisement or other document inviting offers from the public for the subscription or purchase of any securities of a body corporate.”

The prospectus must contain true and factual disclosures as investors decide to invest based on the information given in the prospectus.

- STATUTORY REQUIREMENTS IN RELATION TO PROSPECTUS

1 Draft Prospectus to be made Public

A draft prospectus filed with SEBI by the company should be made available to the Public and to the Stock Exchanges where the company wants to list its shares.

2. Signed by Directors

Prospectus must be signed by all Directors or by the duly authorized attorney.

3. Registration of Prospectus

A copy of the prospectus must be registered (filed) with the ROC before issuing it to the public.

4. Dating of prospectus

A prospectus has to be dated. The date on the prospectus is considered as the date of publication of the prospectus.

5. Issuing prospectus to the Public

Prospectus must be issued to the public within 90 days from the date of registering a copy with the ROC.

- Penalty for non-compliance

If a Prospectus is issued in contravention of the above mentioned provisions, the penalty is as follows -

1) The company shall be liable to pay a fine between Fifty Thousand and Three Lacs, and

2) Every person who has knowingly involved in issuing such a prospectus, will be punishable with imprisonment for upto 3 years or with fine between Fifty Thousand and three Lacs or with both.

- MIS-STATEMENTS IN A PROSPECTUS

As the investors make their decision to invest based on the information given in the prospectus, care should be taken to ensure all information is accurate and no material fact is omitted. An untrue statement or mis-statement means -

i) The statement is misleading in form or content, or

ii) Where any inclusion of a statement or its omission is likely to mislead the reader.

If an investor has bought shares of a company based on a prospectus which had misleading information or suppressed material information, then he can take action against the Company.

If there is any untrue or mis-statements in the prospectus, the company and persons responsible for issuing such prospectus will have to face following liability.

According to companies Act, 2013, Private Placement means any offer of securities or invitation to subscribe securities to A select group of persons bi a company (other than by way of public offer) through issue of a private placement offer letter and which satisfies the conditions specified in section 42.

Explanation (ii) to Section 42 (2) : The offer of securities or invitation to subscribe securities, shall be made to such number of persons not exceeding fifty or such higher number as may be prescribed, excluding qualified institutional buyers and employees of the company being offered securities under a scheme of employees stock opinion as per provisions of clause (b) of sub-section (1) of section 62, in a financial year and on such conditions (including the form and manner of private placement) as may be prescribed.

Both private and public companies can issue securities (e.g. equity or preference shares, debentures, convertible instruments) in private placement mode.

- Private Placement Process

A company can issue securities in the private placement mode by issuing private placement offer letter in Form 3.4. It is permitted to invite or make offer to maximum 50 persons in financial year [Draft Rule 3.12(2) (b) proposes a higher number of 200]. The Central Government is empowered to increase the numbers. The NBFCs are not exempt from this requirement. A private company has to essentially issue securities in the private Placement route in compliance with the requirements of section 42 as it cannot invite public to subscribe any securities. A public company can opt for both public offer and private placement routes. However, for listing of the securities raised through private placement would require compliance with clause 20 of the Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations, 2008. Provisions applicable for issue of shares or debentures as per Chapter IV is applicable to private placement as well. For example, for issue of debentures in private placement route a company has to comply with the requirements of section 71.

The restriction of 50 persons [200 as per Draft Rule 3.12(2)(b)] does not apply to

(1) Qualified institutional buyer

(ii) Employees stock option

Qualified institutional buyer means the qualified institutional buyer as defined in the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2009.

- Main Points

- Provision of Section 42 of the Companies Act, 2013 has set at rest all controversies as regards public issue versus private placement. Any offer or invitation for issuing securities to more than 50 persons or such higher number as may be prescribed in a financial year shall not be treated as private placement.

This number excludes Qualifies Institutional Buyer (QIB) and shares issued under ESOP

Draft Rule proposes higher number' as 200. This matches with the maximum number (which is increased from 50 to 200 by Draft Rule) of members of a private company.

2. In case an issue of securities is classified as public offer, provisions of Part I of Chapter 3 shall be satisfied which inter alia require listing of securities. Therefore, unlisted public company and private company would require to ensure compliance with section 42.

3. Private placement under section 42 is carried out through offer letter as compared to public issue through prospectus under section 26.

4. Simultaneously two private placements cannot be carried out.

5. Securities offered under private placement shall be allotted within 60 days. There is no restriction as regards minimum subscription.

References

- Business Law 1 Essentials by Mirande Valbrun,

- The Legal and Regulatory Environment of Business by O. Lee Reed