Unit 3

Banking Operations

A Collecting banker is one who undertakes to collect cheques, drafts, bill, pay order, traveller’s cheque, letter of credit, documents such as lottery chits, dividend warrants, debenture interest, etc., on behalf of the customer. For undertaking this collection, the collecting banker will be charging commission.

While collecting the instrument on behalf of the customer, the collecting banker acts

Figure: Capacity of collecting banker

(a) As holder for value:

The collecting banker is said to be acting as holder for value.

(i) When the collecting banker advances money to the customer before the realization of the cheques given for collection.

(ii) When the collecting banker settles the loan amount due from the customer with the cheque amount given for collection, even before its realization.

(iii) Where a collecting banker reduces an overdraft with the amount for collection before its realization.

(iv) Where a part of the amount is given by the collecting banker to the customer even before the realization of the cheque.

(v) By allowing the customer to draw the full amount of the cheque before its realization

(b) As agent for collection:

When the banker undertakes to collect the cheques and credits the account of the customer only on realization. Thus, in acting as agent for collection, there is no risk for the collection, there is no risk for the collecting banker whereas in the case of holder for value, the collecting banker has enormous risks, especially when the cheque is dishonored or payment has been made to the wrongful owner of the cheque. Statutory protection to collecting banker under Section 131 of the Negotiable Instrument Act According to this Section, ―A Banker who has in good faith received payment for a customer of a cheque crossed generally or specially to himself shall not, in case the title to the cheque proves defective incur any liability to the true owner of the cheque by reason only of having received such payment

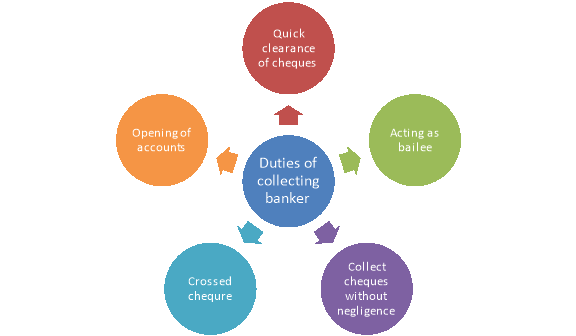

Duties and responsibilities of collecting banker

A Collecting banker has three major duties to perform towards the customer:

Figure: Duties of collecting banker

- Quick clearance of cheques or other instruments given for collection

Whenever the customer gives any instrument for collection, the collecting banker should immediately send the same for collection. Any delay on the part of the collecting banker may lead to either the drawer declaring insolvent or the winding up of the paying banker.

2. Acting as bailee

When a cheque is given for collecting banker is bailee until the cheque is realized and the proceeds are credited to the account of the customer. Sometimes, the cheque given for collection may bounce and gets dishonored due to insufficient funds. In such a case, the collecting banker has a duty to return the cheque which has been dishonored to the customer and by doing so he discharges his duty as a bailee.

3. To Collect cheques without negligence

Negligence of a collecting banker is of different nature. We can state the following negligence of collecting banker.

(i) Negligence while opening account for a customer where in the banker has failed to obtain letter of introduction and has opened the current account.

(ii) A cheque crossed but payment made across the counter by oversight.

(iii) A cheque crossed account payee and payment credited to the account of a person other than the payee. For example, a cheque is drawn in the name of pay to Mr. And crossed account payee. The bank should credit the account of only Mr. But if the bank credits the account of Mr. Or Z, it is negligence.

(iv) A Cheque crossed not negotiable.

Here, the collecting banker should take due precaution before making any payment. But if a collecting banker makes payment without any precaution, it amounts to negligence.

(v) Opening of accounts without proper enquiry.

As stated already in the two case laws, where banker has not made proper enquiries with the employer of the intending customer.

(vi)A cheque belonging to a partnership firm endorsed to the personal account of the customer and if the banker, without proper enquiries, credited the personal account of the partner it is ground for negligence

Key Takeaways

A collecting banker is one who undertakes to collect cheques, drafts, bill, pay order, traveller’s cheque, letter of credit, documents such as lottery chits, dividend warrants, debenture interest, etc., on behalf of the customer.

Section 9 of the Act defines ‘holder in due course’ as any person who

(i) for valuable consideration,

(ii) becomes the possessor of a negotiable instrument payable to bearer or the indorsee or payee thereof,

(iii) before the amount mentioned in the document becomes payable, and

(iv) without having sufficient cause to believe that any defect existed in the title of the person from whom he derives his title.

The essential qualification of a holder in due course may, therefore, be summed up as follows:

1. He must be a holder for valuable consideration.

Consideration must not be void or illegal, e.g. a debt due on a wagering agreement. It may, however, be inadequate. A donee, who acquired title to the instrument by way of gift, is not a holder in due course, since there is no consideration to the contract. He cannot maintain any action against the debtor on the instrument. Similarly, money due on a promissory note executed in consideration of the balance of the security deposit for the lease of a house taken for immoral purposes cannot be recovered by a suit.

2. He must have become a holder (passessor) before the date of maturity of the negotiable instrument.

A person who takes a bill or promissory note on the day on which it becomes payable cannot claim rights of a holder in due course because he takes it after it

Becomes payable, as the bill or note can be discharged at any time on that day.

3. He must have become holder of the negotiable instrument in good faith.

Good faith implies that he should not have accepted the negotiable instrument after knowing about any defect in the title to the instrument. But, notice of defect in the title received subsequent to the acquisition of the title will not affect the rights of a holder in due course. Besides good faith, the Indian Law also requires reasonable care on the part of the holder before he acquires title of the negotiable instrument. He should take the instrument without any negligence on his part. Reasonable care and due caution will be the proper test of his bona fides. It will not be enough to show that the holder acquired the instrument honestly, if in fact, he was negligent or careless. Under conditions of sufficient indications showing the existence of a defect in the title of the transferor, the holder will not become a holder in due course even though he might have taken the instrument without any suspicion or knowledge.

4. A holder in due course must take the negotiable instrument complete and regular on the face of it.

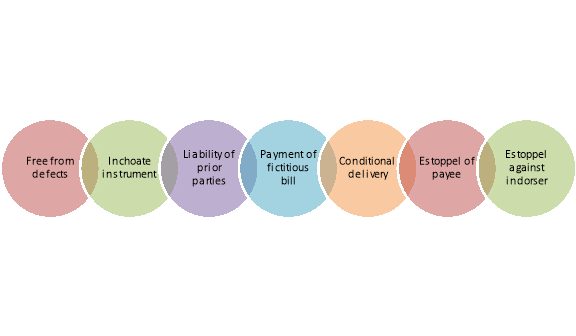

Privileges of a holder in due course

Figure: Privileges of holder in due course

- Instrument free of all defects:

A holder in due course who gets the instrument in good faith in the course of its currency is not only himself protected against all defects of title of the person from whom he has received it, but also serves, as a channel to protect all subsequent holders. A holder in due course can recover the amount of the instrument from all previous parties although, as a matter of fact, no consideration was paid by some of the previous parties to instrument or there was a defect of title in the party from whom he took it. Once an instrument passes through the hands of a holder in due course, it is purged of all defects. It is like a current coin. Who-so-ever takes it can recover the amount from all parties previous to such holder (Sec. 53). It is to be noted that a holder in due course can purify a defective title but cannot create any title unless the instrument happens to be a bearer one.

2. Rights not affected in case of an inchoate instrument:

Right of a holder in due course to recover money is not at all affected even though the instrument was originally an inchoate stamped instrument and the transferor completed the instrument for a sum greater than what was intended by the maker. (Sec. 20)

3. All prior parties liable:

All prior parties to the instrument (the maker or drawer, acceptor and intervening indorers) continue to remain liable to the holder in due course until the instrument is duty satisfied. The holder in due course can file a suit against the parties liable to pay, in his own name (Sec. 36)

4. Can enforce payment of a fictitious bill:

Where both drawer and payee of a bill are fictitious persons, the acceptor is liable on the bill to a holder in due course. If the latter can show that the signature

Of the supposed drawer and the first indorser are in the same hand, for the bill being payable to the drawer’s order the fictitious drawer must indorse the bill before he can negotiate it. (Sec. 42).

5. No effect of conditional delivery:

Where negotiable instrument is delivered conditionally or for a special purpose and is negotiated to a holder in due course, a valid delivery of it is conclusively

Presumed and he acquired good title to it. (Sec. 46) “bearer”, even the holder in due course cannot recover the money. Similarly, a minor cannot be prevented from taking the defence of minority. Also, there is no liability if the signatures are forged. (Sec. 120).

6. Estoppel against denying capacity of the payee to indorsee:

No maker of promissory note and no acceptor of a bill of exchange payable to order shall, in a suit therein by a holder in due course, be permitted to resist the claim of the holder in due course on the plea that the payee had not the capacity to indorse the instrument on the date of the note as he was a minor or insane or that he had no legal existence (Sec 121)

7. Estoppel against indorser to deny capacity of parties:

An indorser of the bill by his endorsement guarantees that all previous endorsements are genuine and that all prior parties had capacity to enter into valid contracts. Therefore, he on a suit thereon by the subsequent holder, cannot deny the signature or capacity to contract of any prior party to the instrument.

Key Takeaways

Section 9 of the act defines ‘holder in due course’ as any person who for valuable consideration, becomes the possessor of a negotiable instrument payable to bearer or the indorsee or payee thereof, before the amount mentioned in the document becomes payable, and without having sufficient cause to believe that any defect existed in the title of the person from whom he derives his title.

The baker who undertakes to collect cheques, drafts, bill, pay order, traveller cheque, letter of credit, dividend, debenture interest, etc., on behalf of the customer is known as a Collecting banker.

Under Section 131 of the Negotiable Instruments Act the collection banker is secured as under:

Section 131: Non-liability of a banker receiving payment of cheque

A banker who, in reasonable care and without fault, has accepted money for the customer of a cheque crossed in particular or expressly for himself shall not incur any liability for the true owner of the cheque, in the event that the title to the cheque appears to be faulty, solely on the ground that he has received such payment.

Statutory Protection to the Paying Banker

Paying banker is a banker, who actually pays a cheque to his customer or to the order of his customer. Sec. 85 of the Negotiable Instruments Act, 1881 gives statutory protection to the paying banker.

The banker before honouring the cheques presented to him/her for payment should look into the following points in order to safeguard himself/herself against the risk of losing the customer’s money. They are,

Figure: Statutory protection to paying banker

1) Open or crossed cheques:

When a cheque is presented for payment, the banker should verify as to whether it is an open cheque or a crossed one and whether the cheque is in printed form. There is no provision in the Banking Regulations Act, preventing a customer from drawing his own cheque. But the banks prefer the printed form as it is easy for verification and filing. An open cheque, if it is otherwise valid, can be paid across the counter. If it is crossed, the holder is required to present it only through another banker. The specific instruction in case of a crossed cheque is that, it should be paid through an account and not across the counter.

2) Drawn on the specific branch:

Cheques should be drawn on the particular branch at which they are presented. In olden days a cheque can not be presented at a different branch, even of the same bank, where account is not maintained. Because the banker will refuse payment, as he doesn’t know the state of the drawer’s account and can not verify the signature of the customer.

This was the position, upto the period, where all bank works were done manually. Then banks were computerized one after one.

At the initial stage of computerization also, only partial (or) no inter-branch transactions taken place. Then the banks switched over to CBS (Core Banking Solutions) system. The CBS system allowed inter-branch transactions (i.e Transaction between the branches of the same bank). The accounts opened in one branch were made accessible by all branches so that any branch can know the account balance of any customer of any branch. Then Inter-Bank (i.e from one bank to another Bank) transactions, electronic money transfers were made possible through use ofsome uniform code practices as agreed upon by all bankers, whether private, public or otherwise. Some example are, IFSC (Indian Financial System Code) followed by Society for Worldwide Interbank Financial Telecommunication (SWIFT) UTR (Unique Transaction Reference) this is the transaction identification number in the electronic transfer of money vide NEFT (National Electronic Fund Transfer) RTGS (Real Time Gross Settlement) IMPS (Instant Money Payment System) etc

3) Mutilated Cheque

If the banker finds the cheque presented to him is already mutilated or torn, the banker is having a right to return the cheque, with the remark “Mutilated Cheque”. When a cheque is torn accidentally, the banker can pass it for payment after obtaining the drawer’s confirmation on the cheque.

4) Date of the Cheque

Date of a cheque is the most material matter in the cheque, as the legal validity of the cheque, itself is decided by the date. As per law, a cheque is valid for payment, for three months from the date written on the cheque i.e from the date of the cheque.

Rules Regarding Date:-

• A cheque should bear a date in the column meant for it on the cheque

• Date should not be incomplete

• It should contain the day, month and year in a proper form

• It should not be ambiguous in any manner

• A post-dated cheque can’t be paid by the banker, although presented properly.

5) Words and figures differ:

A banker can return a cheque if the amount in words and amount in figures differ. If so, he has to return it with a remark that “Amount in words and figures differ”. If, the banker decides to pay the amount in words, he has no risk. But if the amount is written in figures only, then the banker should confirmly return the cheque.

6) Material Alteration

Material alteration means changing the date, amount, name of the payee, removal of crossing etc. All these things affect the credibility of the instrument. So, the banker should refuse payment of a materially altered cheque. If the drawer confirms the alteration by putting his full signature near the alteration, banker can entertain payment of cheque. But now Reserve Bank of India does not allow alteration of any part of cheque, except date.

7) Specimen Signature

Specimen signature is a signature of the customer, got by the banker at the time of account opening. Banker keeps the specimen signature, in manual records as well as in computer (The scanned signature of the account holder is uploaded to the computer for future reference). Whenever a banker receives his customer’s cheque presented for payment, he should verify the signature in the cheque, with that ones in his records. If the signature of the customer on cheque differs from the specimen signatures furnished to him, the banker should return the cheque.

Rules regarding Specimen Signature:

a) A Bank customer is supposed to adopt same style of signature as per his/her specimen signature. Later, if he adopts a different style of signature other than that of specimen signature, it is his duty to inform the bank about the change and has to give new specimen signature records, and also the effective date of the new specimen signature. Otherwise, banker can return the cheque with the remark “Signature Differs”.

b) The signature on the cheque, should not be followed by date. If the signature bears a date below it the banker has right to return it.

8) Proper Endorsement

Before paying the cheque presented to him, the banker should see whether there is any endorsement on it and if so, whether it is regular or not.

9) Insufficient Funds

The banker is under an obligation to pay his customer’s cheque, provided there is sufficient or enough funds in customer’s account to meet out the cheque. But if there is no sufficient funds, the banker is not bound to honour the cheque.

Rules to decide availability of funds:

1. The minimum balance required to maintain a savings bank or current account is deemed to be available for honouring the cheques of the account holder. Though the actual balance gets reduced below the prescribed minimum amount, the banker should honour the cheque and may recover charges from the customer, for the non-maintenance of minimum balance.

2. In case a banker already granted an overdraft or cash credit limit to a current account holder, the amount available for passing a cheque includes the original balance in the account plus the amount sanctioned as overdraft or cash credit.

10) Chronological Order of Payment

Normally, Banker follow “First in, First Served”, method in passing a customer’s cheques. It means payment of cheque will be made in the order of their receipt. The first received cheque should be first paid out, the second – received cheque secondly and so on. Availability of account balance for passing a cheque will be assessed as such.

11) Garnishee order

A Garnishee order is a court order, directing a third party (i.e Garnishee) to pay money of a judgement debtor with him, to a judgement creditor. Here the banker is the “Garnishee”. If he received a Garnishee order against a bank customer, the banker has to lock the customer’s account upto the amount mentioned in the Garnishee order. So, in this situation, banker can not pay other cheques, even if there is sufficient balance in the customer’s account. The banker also gets the statutory protection for a dishonor of cheque, in obliging a Garnishee order from court.

12) Inchoate Cheque

If a cheque is incomplete with regard to date, amount payee or drawer’s signature, then it is called an “Inchoate Cheque”. If a banker receives an “Inchoate Cheque”, presented for payment, he has to dishonor the same for want of details to be filled. In this situation, the banker is not liable, for dishonour of the cheque, even if sufficient balance is available in the account. So, in all the above – discussed occasions, the banker gets statutory protection, even though he dishonours a customer’s cheque (for there is a genuine reason in all situations, for the cheque dishonour).

Key Takeaways

The baker who undertakes to collect cheques, drafts, bill, pay order, traveller cheque, letter of credit, dividend, debenture interest, etc., on behalf of the customer is known as a collecting banker.

A cheque is said to be dishonoured when it is refused to be accepted or paid when presented to the bank. It is a condition in which the paying banker does not pay the amount of the cheque to the payee.

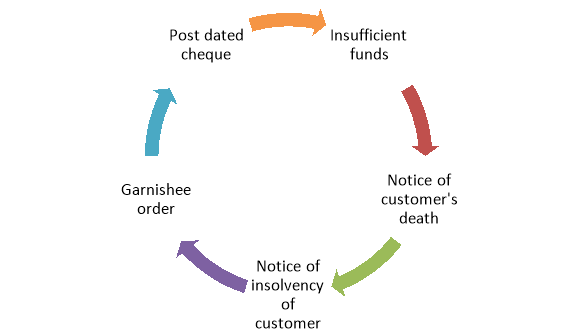

Grounds for dishonour of cheque

A paying banker may refuse payment on cheques, issued by its customers due to the following reasons:

Figure: Grounds of dishonour of cheque

- Insufficiency of funds

When sufficient funds are not available in a customer’s account, the cheque may be dishonoured. If the banker pays a counterclaimed cheque, he will not only be obliged to cancel the application but will also be held liable for damages for dishonouring the cheques actually submitted, which would otherwise have been honoured.

2. Notice of the Customer’s Death

The banker should not make payments on cheques presented after the death of the customer. He should return the cheque with the remark ‘Drawer Deceased’.

3. Notice of the Customer’s Insolvency

A banker must refuse payment on the cheques immediately after the consumer has been deemed insolvent.

4. Receipt of the Garnishee Order

Where Garnishee order is received adding the entire amount, after receiving such an order, the banker will stop payment on cheques received. But if the order is for a specific amount, leaving the specified amount, cheques should be honoured if the remaining amount is sufficient to satisfy them.

5. Presentation of a post-dated cheque

The banker may refuse the cheque when the cheque is presented before the valid date.

- Stale Cheques:

When the cheque is presented after a period of three months from the date it bears, the banker may refuse to make payment.

- Material Alterations:

When there is material alteration in the cheque, the banker may refuse payment.

- Drawer’s Signature:

If the drawer’s signature on the cheque doesn’t match the signature of the specimen, the banker can refuse to pay.

Consequences of wrongful dishonour of cheque

Dishonour of cheque by the banker due to negligence or carelessness by its employees. The drawer may bring an action against the bank for losses suffered by him. The payee has no action against the banker in this case.

A banker has the statutory obligation to honour his customer’s cheques unless there are valid reasons for refusing payment of the same. In case, he dishonours a cheque, intentionally or by mistake, he is liable to compensate the customer for the loss suffered by him. According, to section 31 of the negotiable instruments act 1881 the banker is liable to compensate the drawer for any loss and damage caused by a default on his part in dishonouring the cheques without sufficient reason. The word loss and damage include: The monetary loss suffered by the customers.

The loss of credit or reputation in the market.

Assessment of loss or damages: The loss or damage suffered by the customer as a result of dishonoring his cheques by the banker can be assessed in the following ways;

(1) The monetary loss; first is the monetary loss suffered by the customer for dishonouring cheque by the banker. It is the actual loss due to the dishonor of a cheque.

(2) The loss of credit or reputation: Reputation or credit is a foundation of trading business. If the customer lost his credit or reputation, it may result from a loss of a profitable contract or business.

Risks of unwarranted and unjustifiable disclosure: If a banker discloses information unjustifiable, he shall be liable to his customer and the third party as follows:

(1) Liability to the customer: the customer may be the banker for the damages suffered by him as a result of such disclosure. A substantial amount may be charged if the customer suffered material damage. Liability to the third party: the banker is, responsible to the third parties also to whom such information is given if the banker furnishes such information as the knowledge that it is false. Or such party relies on the information and suffers losses.

(2) Banker rights: The rights of a banker that the banker can enjoy are as follows: Rights of general lien: one of the important rights of a banker is the right of general lien. Lien means the right of the creditor to retain the goods or securities own by debtor until the debt due from him is repaid. There are some exceptional cases in which the right of general lien is not applicable. These are:

Safe custody deposit,

Documents deposited for a special purpose,

Security held in trust.

The right of the set off: A banker posses the right of set-off which enables him to combine two accounts in the name of the same customer and to adjust the debit balance in one account with the credit balance in the other.

(3) Banker’s right of appropriation: if the customer has more than one account or he has • taken more than one loan from the banker, the banker has the right to appropriation these loans by the accounts.

(4) Right to charge interest, incidental charges: as a creditor, a banker has the implied right to charge interest on the loans granted to the customer. In the same way, incidental charges like service charges, processing fees, appraisal charges, panel charges may be imposed by the banker to the customer.

(5) Period of limitation: Deposit is repayable on a term and made by the customer but the period limitation for the refund of bank deposit is three years with effect from the date a customer made a demand for his money.

Key Takeaways

A cheque is said to be dishonoured when it is refused to be accepted or paid when presented to the bank. It is a condition in which the paying banker does not pay the amount of the cheque to the payee.

Lending is the main function of banking and banks can fail if their loans are bad. Moreover, banks can lose profits if they do not seize opportunities for good lending. Security protects the lender in case things go wrong. The assets commonly charged as security are mainly land (including buildings), stocks and shares, and life assurance policies.

While granting advances on the basis of securities offered by customers, a banker should observe the following basic principles:

- Adequacy of margin-

The word ‘margin’ has special meaning and significance in the banking business. In banking terminology, ‘margin’ means the difference between the market value of the security and the amount of the advance granted against it. For example, if a

Banker sanctions an advance of Rs. 80 against the security of goods worth Rs. 100, the difference between the two (Rs. 100 – Rs. 80 = Rs. 20) is called margin.

2. Marketability of securities-

Advances are usually granted for short periods by the commercial banks because their deposit resources (except term deposits) are either repayable on demand or at short notice. If the customer defaults in making payment, the banker has to liquidate the security. It is, therefore, essential that the security offered by a borrower may be disposed of without loss of time and money. A banker should be very cautious in accepting assets which are not easily marketable.

3. Documentation-

Documentation means that necessary documents, e.g., agreement of pledge or mortgage, etc., are prepared and signed by the borrower at the time of securing a loan from the bank. Though it is not necessary under the law to have such agreements in writing and mere deposit of goods or securities will be sufficient to

Constitute a charge over them, but it is highly desirable to get the documents signed by the borrower. These documents contain all the terms and conditions on which a loan is sanctioned by the banker and hence misunderstanding or dispute later on may easily be avoided.

4. Realisation of the advance-

If the borrower defaults in making payment on the specified date, the banker may realise his debt from the sale proceeds of the securities pledged to him. As discussed in the previous lesson, a pledgee may sell the securities. In case of loans repayable on demand a reasonable period is to be permitted by the banker for such repayment. This period may be a shorter one if there is urgency of selling the commodities immediately in view of the falling trend in their prices. If a banker is unable to recover his full dues from the security he shall file a suit for its recovery within the period of three years from the date of the sanction of the advance. In case of term loans repayable after a fixed period, the period of limitation (i.e., 3 years) shall be counted from the expiry of that fixed period.

Key Takeaways

Lending is the main function of banking and banks can fail if their loans are bad. Moreover, banks can lose profits if they do not seize opportunities for good lending. Security protects the lender in case things go wrong. The assets commonly charged as security are mainly land (including buildings), stocks and shares, and life assurance policies.

Different types of lending facility of banks are discussed below-

- Loans

It refers to credit facility that is repayable in a definite period. (e.g. Term Loan, Demand Loan)

2. Cash Credit

It refers to credit facility in which borrower can borrow any time with in the agreed limit for certain period for their working capital need. It secured by way of Hypothecation of Stock(goods) and Debtors and all other current Assets of the business generated during the course of business. Cash credit can also be secured by way of mortgage of immovable properties (as collateral security).

3. Overdraft

An overdraft allows a current account holder to withdraw in excess of their credit balance up to a sanctioned limit. It secured by way of Mortgage of immovable properties and pledge of F.D., Bonds, Shares securities, Gold & silver and any physical asset and Hypothecation of Stock and Debtors and all other current Assets of the business generated during the course of business.

4. Bills Discounting

Bill Discounting is a discount/fee which a bank takes from a seller to release funds before the credit period ends. This bill is then presented to seller's customer and full amount is collected. This scenario is beneficial to all the parties involved in the process. Bill Discounting is mostly applicable in scenarios when a buyer buys goods from the seller and the payment is to be made through letter of credit

5. Letters of Credit

When a buyer or importer wants to purchase goods from an unknown seller or exporter. He can take assistance of bank in such buying or importing transactions. Bank issues a letter of credit in addressed to the supplier or exporter after it, supplier or exporter will supply the goods to such unknown buyer or importer. A signed Invoice with Letter Of Credit is presented to the bank of buyer/importer and the payment is made to the seller/exporter directly by the bank.

A non performing asset (NPA) is a loan or advance for which the principal or interest payment remained overdue for a period of 90 days.

Types of NPA’s:

Banks are required to classify NPAs further into Substandard, Doubtful and Loss assets:

Figure: Types of NPA

- Substandard assets: An assets which has remained NPA for a period less than or equal to 12 months.

- Doubtful assets: An asset would be classified as doubtful if it has remained in the substandard category for a period of 12 months.

- Loss assets: As per RBI, “Loss asset is considered uncollectible and of such little value that its continuance as a bankable asset is not warranted, although there may be some salvage or recovery value.”

Circumstances of NPA

Different circumstances of NPA are discussed below-

Figure: Circumstances of NPA

- Governance Issues:

- Diversion of funds by companies for purposes other than for which loans were taken.

- Due diligence not done in initial disbursement of loans.

- Inefficiencies in post disbursement monitoring of the problem.

- Restructuring of loans done by banks earlier to avoid provisioning. Post crackdown by RBI, banks are forced to clear their asset books which has led to sudden spurt in NPAs

- During the time of economic boom, overt optimism shown by corporates was taken on face value by banks and adequate background check was not done in advancing loan

- In the absence of adequate governance mechanism, double leveraging by corporates, as pointed out by RBI’s Financial Stability Report.

2. Economic Reasons

- Economic downturn seen since 2008 has been a reason for increasing bad loan

- Global demand is still low due to which exports across all sector has shown a declining trend for a long

- In the case of sectors like electricity, the poor financial condition of most SEBs is the problem; in areas like steel, the collapse in global prices suggests that a lot more loans will get stressed in the months ahead

- Economic Survey 2015 mentioned over leveraging by corporate as one of the reasons behind rising bad loans

- Another factor that can contribute to the low level of expertise in many big public sector banks is the constant rotation of duties among officers and the apparent lack of training in lending principles for the loan officers

- Poor recovery and use of coercive techniques by banks in recovering loans

3. Political reasons

- Policy Paralysis seen during the previous government affected several PPP projects and key economic decisions were delayed which affected the macroeconomic stability leading to poorer corporate performance.

- Crony capitalism is also to be blamed.

- Under political pressure banks are compelled to provide loans for certain sectors which are mostly stressed

Impacts of NPAs

The impacts of NPA are stated below-

- The higher is the amount of non-performing assets (NPA) the weaker will be the bank’s revenue stream.

- Indian Banking sector has been facing the NPA issue due to the mismanagement in the loan distribution carried by the Public sector banks.

- As the NPAs of the banks will rise, it will bring a scarcity of funds in the Indian markets. Few banks will be willing to lend if they are not sure of the recovery of their money.

- The shareholders of the banks will lose of money as banks themselves will find it tough to survive in the market.

- This will lead to a crisis situation in the market.

- The price of loans, interest rates will shoot up badly. Shooting of interest rates will directly impact the investors who wish to take loans for setting up infrastructural, industrial projects etc.

- It will also impact the retail consumers, who will have to shell out a higher interest rate for a loan.

- All these factors hurt the overall demand in the Indian economy.

- Finally, it will lead to lower growth and higher inflation because of the higher cost of capital.

Key Takeaways

A non performing asset (NPA) is a loan or advance for which the principal or interest payment remained overdue for a period of 90 days.

Priority Sector means those sectors which the Government of India and Reserve Bank of India consider as important for the development of the basic needs of the country and are to be given priority over other sectors. The banks are mandated to encourage the growth of such sectors with adequate and timely credit.

The categories under priority sector are as follows:

(i) Agriculture

(ii) Micro, Small and Medium Enterprises

(iii) Export Credit

(iv) Education

(v) Housing

(vi) Social Infrastructure

(vii) Renewable Energy

(viii) Others

Targets for scheduled commercial banks

The targets and sub-targets set under priority sector lending for all scheduled commercial banks operating in India are furnished below:

Categories | Domestic scheduled commercial banks and foreign banks with 20 branches and above | Foreign banks with less than 20 branches |

Total Priority Sector | 40 per cent of Adjusted Net Bank Credit or Credit Equivalent Amount of Off-Balance Sheet Exposure, whichever is higher. | 40 per cent of Adjusted Net Bank Credit or Credit Equivalent Amount of Off-Balance Sheet Exposure, whichever is higher; out of which up to 32% can be in the form of lending to Exports and not less than 8% can be to any other priority sector |

Agriculture | 18 per cent of ANBC or Credit Equivalent Amount of Off-Balance Sheet Exposure, whichever is higher. Within the 18 per cent target for agriculture, a target of 8 percent of ANBC or Credit Equivalent Amount of Off-Balance Sheet Exposure, whichever is higher is prescribed for Small and Marginal Farmers.## | Not applicable |

Micro Enterprises | 7.5 per cent of ANBC or Credit Equivalent Amount of Off-Balance Sheet Exposure, whichever is higher | Not applicable |

Advances to Weaker Sections | 10 percent of ANBC or Credit Equivalent Amount of Off-Balance Sheet Exposure, whichever is higher | Not applicable |

RBI guidelines for priority sector lending of RRBs

RRBs will have a target of 75 per cent of their outstanding advances for priority sector lending and sub-sector targets as indicated in table below-

Categories | Targets |

Total Priority Sector | 75 per cent of ANBC or CEOBE whichever is higher; However, lending to Medium Enterprises, Social Infrastructure and Renewable Energy shall be reckoned for priority sector achievement only up to 15 per cent of ANBC. |

Agriculture | 18 per cent ANBC or CEOBE, whichever is higher; out of which a target of 10 percent is prescribed for SMFs |

Micro Enterprises | 7.5 per cent of ANBC or CEOBE, whichever is higher |

Advances to Weaker Sections | 15 per cent of ANBC or CEOBE, whichever is higher |

Target for priority sector lending of Urban co-operative banks -

- Total Priority Sector - 40 per cent of ANBC or CEOBE, whichever is higher, which shall stand increased to 75 per cent of ANBC or CEOBE, whichever is higher, with effect from March 31, 2024.

- Micro Enterprises - 7.5 per cent of ANBC or Credit Equivalent Amount of Off-Balance Sheet Exposure, whichever is higher.

- Advances to Weaker Sections -12 per cent of ANBC or credit equivalent amount of Off-Balance Sheet Exposure, whichever is higher.

Key Takeaways

Priority sector means those sectors which the government of India and reserve bank of India consider as important for the development of the basic needs of the country and are to be given priority over other sectors. The banks are mandated to encourage the growth of such sectors with adequate and timely credit.

Case studies

- Canara Bank vs Canara Sales Corporation and Others [(1987) 2 Supreme Court Cases 666]

In this case, the Supreme Court ruled that the bank is not allowed to pay when the customer signs the check. Since such a banker has no right to debit the account of the customer on such falsified cheque. Since the customer-bank link is between the borrower and the debtor, a cheque that has a forged signature has no authority on the bank to pay.

- Bank of Bihar vs Mahabir Lal (AIR 1964 Supreme Court 397)

In this case, the Supreme Court held that only where payment was made to the holder or to his agent, i.e. in due course, a banker would claim cover under Section 85. Payment to an individual without a business or to a bank’s agent is not a payment to a corporation

References:

1. Gordon & Natarajan: Banking Theory Law and Practice, HPH

2. S. P Srivastava; Banking Theory & Practice, Anmol Publications

4. M. Prakash, Bhargavi VR: Banking law & Operation, Vision Book House.

5. Tannan M.L: Banking Law and Practice in India, Indian Law House