UNIT 2

Issue and redemption of debentures

A debenture is a document evidencing debt to the debenture holder, generally secured by a fixed or floating charge.

The definition of ‘debentures’ as contained in section 2(12) of the Companies Act does not explain the term. It simply reads “debenture includes debenture stock, bonds and any other securities of a company whether constituting a charge on the assets of the company or not.”

Issue of debentures

The procedure for the issue of debentures is the same as that for the issue of shares. The intending investors apply for debentures on the basis of the prospectus issued by the company. The company may either ask for the entire amount to be paid on application or by means of installments on application, on allotment and on various calls. Debentures can be issued

Issue of Debentures for Cash

Debentures are said to be issued at par when their issue price is equal to the face value. The journal entries recorded for such issue are as under:

(a) If whole amount is received in one instalment:

Bank A/c Dr.

To Debenture Application & Allotment A/c

Debenture Application & Allotment A/c Dr.

To Debentures A/c

(b) If debenture amount is received in two instalments:

Bank A/c Dr.

To Debenture Application A/c

Debenture Application A/c Dr.

To Debentures A/c

Debenture Allotment A/c Dr.

To Debentures A/c

Bank A/c Dr.

To Debenture Allotment A/c

(c) If debenture money is received in more than two instalments

Additional entries:

Debenture First Call A/c Dr.

To Debentures A/c

Bank A/c Dr.

To Debenture First Call A/c

Debentures issued at different terms

A company may issue debentures at different terms. These terms may not only relate to the issue of debentures but also to their redemption. For example, just as the issue can be made at par, at a premium or at a discount, the redemption can also be stipulated at par, at a premium or at a discount. In practice, however, the redemption is never made at a discount. Thus, combining such terms of issue and redemption of debentures, the following five possibilities are commonly found in practice.

a. Debentures issued a par and redeemable at par

b. Debentures issued at a premium and redeemable at par.

c. Debentures issued at a discount and redeemable at par.

d. Debentures issued at par and redeemable at a premium.

e. Debentures issued at a discount and redeemable at a premium.

Let us now see how journal entries he passed at the time of the issue in these five situations.

Issued at par, redeemable at par

Bank A/c Dr.

To Debentures A/c.

Issued at a premium, redeemable at par

Bank A/c Dr.

To Debentures A/c

To Premium on Issue of Debentures A/c

Issued at a discount, redeemable at par

Bank A/c Dr.

Discount on Issue of Deb. A/c Dr.

To Debentures A/c

Issued at par, redeemable at a premium

Bank A/c Dr.

Loss on Issue of debentures A/c. Dr.

To Debentures A/c

To Premium on Redemption of Deb. A/c

Issued at a discount, redeemable at premium

Bank A/c Dr.

Loss on Issue of Debentures A/c. Dr.

To Debenture A/c

To Premium on Redemption of Deb. A/c

Note: Loss on Issue of Debentures in the last entry includes the amount of discount on issue of the debentures as well as premium on redemption.

Redemption of debentures

Redemption of debentures refers to payment of the amount of debentures by the enterprise. The amount of capital needed for redemption of debentures is large and, therefore, economic enterprises make adequate provision out of gains and accrue capital to reclaim debentures.

It involves repayment of the number of debentures to the debenture holders. Debentures can be redeemed either at par or at a premium.

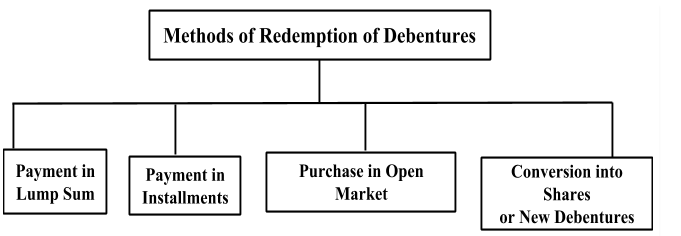

Methods of redemption of debentures

|

Redemption of debentures refers to extinguishing or discharging the liability on account of debentures in accordance with the terms of issue. In other words redemption of debentures means repayment of the amount of debentures by the company. There are four ways by which the debentures can be redeemed.

These are :

1. Payment in lump sum

2. Payment in installments

3. Purchase in the open market

4. By conversion into shares or new debentures.

1. PAYMENT IN LUMPSUM:-

The company redeems the debentures by paying the amount in lump sum to the debenture holders at the maturity thereof as per terms of issue.

When the company pays the whole amount in lump sum, the following journal entries are recorded in the books of the company:

1. If debentures are to be redeemed at par

(a) Debentures A/c Dr.

To Debenture holders

(b) Debenture holders Dr.

To Bank A/c

2. If debentures are to be redeemed at premium

(a) Debentures A/c Dr.

Premium on Redemption of Debentures A/c Dr.

To Debenture holders

(b) Debenture holders Dr.

To Bank A/c

2. PAYMENT IN INSTALLMENTS:-

Under this method, normally redemption of debentures is made in installments on the specified date during the tenure of the debentures. The total amount of debenture liability is divided by the number of years. It is to note that the actual debentures redeemable are identified by means of drawing the requisite number of lots out of the debentures Outstanding for payment.

When, as per terms of the issue, the debentures are to be redeemed in installments beginning from a particular year, the actual debentures to be redeemed are selected usually by draw of lots, and the redemption to be made either out of profits or out of capital.

The entries will be:

1. If redeemed out of profits

(a) Profit and Loss Dr.

To Debenture Redemption Reserve A/c

(b) Debentures A/c Dr.

To Debenture holders

(c) Debenture holders Dr.

To Bank A/c

2. If redeemed out of capital

(a) Debentures A/c Dr.

To Debenture holders

(b) Debenture holders Dr.

To Bank A/c

3. PURCHASE IN OPEN MARKET:-

When a company purchases its own debentures for the purposes of cancellation, such an act of purchasing and cancelling the debentures constitutes redemption of debentures by purchase in the open market.

When a company purchases its own debentures in the open market for the purpose of immediate cancellation, the purchase and cancellation of such Debentures are termed as redemption by purchase in the open market. The advantage of such an option is that a company can redeem the debentures at its convenience whenever it has surplus funds. Secondly, the company can purchase them when they are available in market at a discount.

When the debentures are purchased from the market at a discount and cancelled, the journal entries are recorded as follows :

1. On purchase of own debentures for immediate cancellation

Debentures A/c Dr.

To Bank A/c

To Profit on Redemption of Debentures A/c

2. On transfer of Profit on Redemption

Profit on Redemption of Debenture A/c Dr.

To Capital Reserve A/c .

In case, the debentures are purchased from the market at a price which is above the nominal value of debenture, the excess will be debited to loss on redemption of debentures.

The journal entry in that case will be

1. Debentures A/c Dr.

Loss on Redemption of Debentures A/c. Dr.

To Bank A/c

2. Profit and loss A/c. Dr.

To Loss on Redemption of Debentures A/c.

4. CONVERSION METHOD:-

A company can redeem its Debentures by converting them into shares or new class of debentures. If Debenture holders find that the offer is beneficial to them, they can exercise their right of converting their debentures into shares or new class of debentures. These

new shares or debentures can be issued at par, at a discount or at a premium. It should be noted that only the actual proceeds of debentures are to be taken into account for ascertaining the number of shares to be issued in lieu of the debentures to be converted. If debentures were originally issued at discount, the actual amount realised from them at the time of issue would be used as the basis for computing the actual number of shares to be issued. It may be noted that this method is applicable only to convertible debentures.

5. SINKING FUND METHOD:-

Sufficient funds are required to redeem debentures at the end of a specified period. To meet this requirement, the company may decide to create a sinking fund and invest adequate amount in marketable securities or bonds of other business entities. Normally, a company ensures that an equal amount is set aside every year to arrange the necessary funds at the time of redemption. This is called Sinking Fund method according to which the company makes necessary arrangements is sets aside a part of divisible profit every year and invest the same outside the business in marketable securities.

An appropriate amount is calculated by referring to on Sinking Fund Table depending upon the rate of return on investments and the number of years for which investments are made. The amount thus ascertained is transferred from profits every year to Debenture Redemption Fund and its investment is termed as Debenture Redemption Fund Investment. These investment earn certain amount of income (call it interest) which is reinvested together with the fixed appropriated amount for the purpose in subsequent years. In last year, the interest earned and the appropriated fixed amount are not invested. In fact, at this stage the Debenture Redemption Fund Investments are en-cashed and the amount so obtained is used for the redemption of debentures. Any profit or loss made on the encashment of Debenture Redemption Fund investments is also transferred to Debenture Redemption Fund Account. The creation of Debenture Redemption Fund Account serves the purpose of Debenture Redemption Reserve as required by law and the SEBI guidelines, and is, after redemption is transferred to general reserve.

Thus, the steps involved in the working of sinking fund method are :

1. Calculate the amount of profit to be set aside annually with the help of

sinking fund table.

2. Set aside the amount of profit at the end of each year and credit to

Debenture Redemption Fund (DRF) Account.

3. Purchase the investments of the equivalent amount at the end of first

year and debit Debenture Redemption Fund Investment (DRFI)

Account.

4. Receive interest on investment at the end of each subsequent year.

5. Purchase the investments equivalent to the fixed amount of profit set

aside and the interest earned every year except last year (year of

redemption).

6. Receive interest on investment for the last year.

7. Set aside the fixed amount of profit for the last year.

8. Enchased the investments at the end of the year of redemption.

9. Transfer the profit/loss on sale of investments reflected in the balance

of Debenture Redemption Fund Investment Account to Debenture

Redemption Fund Account.

10. Make payment to debenture holders

11. Transfer Debenture Redemption Fund A/c balance to General Reserve.

The sinking fund method is used for redemption of debentures by payment

in lump sum on maturity, and the journal passed from year to year are as

follows:

1. At the end of First Year

(a) For setting aside the fixed amount of profit for redemption

Profit and Loss A/c Dr.

To Debenture Redemption Fund A/c

(b) For investing the amount set aside for redemption

Debenture Redemption Fund Investment A/c Dr.

To Bank A/c

2. At the end of second year and subsequent years other than last year

(a) For receipt of interest on Debenture Redemption Fund Investments

Bank A/c Dr.

To Interest on Debenture Redemption A/c

(b) For transfer of Interest on Debenture Redemption Fund Investment to

Debenture Redemption Fund Account

Interest on Debenture Redemption Fund Investment A/c. Dr.

To Debenture Redemption Fund A/c

(c) For setting aside the fixed amount of profit for redemption

Profit and Loss A/c. Dr.

To Debenture Redemption reserve A/c

(d) For investments of the amount set aside for redemption and the interest

earned on DRFI

Debenture Redemption Fund Investment A/c. Dr.

To Bank A/c

3. At the end of Last Year

(a) For receipt of interest

Bank A/c. Dr.

To Interest on DRFI A/c

(b) For transfer of interest on Debenture Redemption Fund Investment to

Debenture Redemption Fund Investment A/c

Interest on DRFI A/c. Dr.

To Debenture Redemption Fund A/c

(c) For setting aside the fixed amount of profit for redemption

Profit and Loss A/c. Dr.

To Debenture Redemption Fund A/c

(d) For encashment of Debenture Redemption Fund Investments

Bank A/c. Dr.

To DFRI A/c

(e) For the transfer of profit/loss on realisation of Debenture Redemption

Fund Investments

(i) In case of Profit

Debenture Redemption Fund Investment A/c Dr.

To Debenture Redemption Fund A/c

(ii) In case of Loss

Debenture Redemption ReserveA/c. Dr.

To Debenture Redemption Fund Investment A/c

(f) For amount due to debenture holders on redemption

Debenture A/c. Dr.

To Debenture holders A/c

(g) For payment to debenture holders

Debenture holders A/c. Dr.

To Bank A/c

(h) For transfer of Debenture Redemption Reserve Account balance to

General Reserve

Debenture Redemption Reserve A/c. Dr.

To General Reserve A/c

Key takeaways –

Q1) On January 1, 1988, Akash Ltd. offered 2,000 Debentures of Rs. 1,000 each at a discount of. It50 per debenture The amount was paid Rs, 200 on application, Rs. 400 on allotment and the balance on 1st and final call on May 30, 1988. Interest was payable half yearly @ 6% p.a.

The first coupon payable on June 30, 1988 being for 2%. The issue was fully taken up. Journalise the above transactions in the book of Akash Ltd.

SOLUTION: -

IN THE BOOKS OF AKASH Ltd.

DATE | PARTICULARS | LF | Dr. (Rs.) | Cr. (Rs.) |

1-1-98 | Bank A/c Dr To 6% Debenture Application A/c |

| 4,00,000 |

4,00,000 |

1-1-98 | 6% Debenture Application A/c Dr To 6% Debenture A/c |

| 4,00,000 |

4,00,000 |

1-1-98 | 6% Debenture Allotment A/c Dr Discount on issue of Debenture A/c Dr To Debentures A/c |

| 8,00,000 1,00,000 |

9,00,000 |

1-1-98 | Bank A/c Dr To 6% Debenture Allotment A/c |

| 8,00,000 |

8,00,000 |

30-5-98 | Debenture First &Final Call A/c Dr To 6% Debenture A/c |

| 7,00,000 |

7,00,00 |

30-5-98 | Bank A/c Dr To Debenture First &Final Call A/c |

| 7,00,000 |

7,00,000 |

30-6-98 | Debenture Interest A/c Dr To Bank A/c |

| 40,000 |

40,000 |

31-12-98 | Debenture Interest A/c Dr To Bank A/c |

| 60,000 |

60,000 |

31-12-98 | Profit &Loss A/c Dr To Debenture Interest A/c |

| 1,00,000 |

1,00,000 |

Note: Since the money on debentures was received on different dates, the interest on June 30 is calculated for first six months at a flat rate of 2% as given and not on different amounts received on different dates.

Q2).Kapil Ltd. issued 10,000, 12% Debenture of Rs. 100 each at a premium of 10% payable in full on application by 1st March, 2017. The issue was fully subscribed and debenture were allotted on 9th March, 2017.

Pass the necessary Journal Entries

SOLUTION: -

IN THE BOOKS OF KAPIL Ltd.

DATE | PARTICULARS | LF | Dr. (Rs.) | Cr. (Rs.) |

1-3-17 | Bank A/c Dr. To 12% Debenture Application A/c |

| 11,00,000 |

11,00,000 |

9-3-17 | Debenture Application A/c Dr. To 12% Debenture A/c To Debenture Premium A/c |

| 11,00,000

|

10,00,000 1,00,000 |

9-3-17 | Debenture Premium A/c Dr. To Capital Reserve A/c |

| 1,00,000 |

1,00,000 |

Q3)Simmons Ltd. issued 10,000. 8% Debenture of Rs. 100 each par payable in full on Application by 1st April, 2007. Application were received for 11,000 Debenture. Debentures were allotted on 7th April, 2007. Excess money were refunded on same date.

You required to pass necessary Journal Entries in the books of the company.

SOLUTION: -

IN THE BOOKS OF SIMMONS Ltd.

DATE | PARTICULARS | LF | Dr. (Rs.) | Cr. (Rs.) |

1-4-07 | Bank A/c Dr. To 8% Debenture Application A/c |

| 11,00,000 |

11,00,000 |

7-4-07 | Debenture Application A/c Dr. To 8% Debenture A/c To Bank A/c |

| 11,00,000

|

10,00,000 1,00,000 |

Q4) The following balance appeared in the books of Y Ltd. as on 1st January 2014.

9% Debentures | 2,50,000 |

10 % Debentures Redemption Reserve (represented by Rs. 2,00,000, 10% Govt. Stock) | 1,80,000 |

The annual contribution to the Debenture Redemption Reserve was Rs.50,000 made on 31st December each year. On 31st December, 2014, Balance at bank before the receipt of interest was Rs. 70,000. On the date all the investments were sold at 95% and the debentures were duly redeemed.

Required :

SOLUTION :-

IN THE BOOKS OF Y Ltd.

DATE | PARTICULARS | LF | Dr. (Rs.) | Cr. (Rs.) |

31-12-14 | Bank A/c. Dr. To Interest DRRI A/c |

| 20,000 |

20,000 |

31-12-14 | Interest on DRRI A/c Dr. To Debenture Redemption Reserve |

| 20,000 |

20,000 |

31-12-14 | Profit and loss A/c. Dr. To Debenture Redemption Reserve A/c |

| 50,000 |

50,000 |

31-12-14 | Bank A/c. Dr. To DRRI A/c |

| 1,90,000 |

1,90,000 |

31-12-14 | DRRI A/c Dr. To DRR A/c |

| 10,000 |

10,000 |

31-12-14 | 9%Debenture A/c. Dr. To Debenture holders A/c |

| 2,50,000 |

2,50,000 |

31-12-14 | Debenture holders A/c. Dr. To Bank A/c |

| 2,50,000 |

2,50,000 |

31-12-14 | Debenture Redemption Reserve A/c. Dr. To General Reserve A/c |

| 2,60,000 |

2,60,000 |

Dr. DEBENTURE REDEMPTION RESERVE A/c. Cr.

DATE | PARTICULAR | AMOUNT | DATE | PARTICULAR | AMOUNT |

31-12-14 | To General Reserve A/c | 2,60,000 | 1-1-14 | By Balance b/d | 1,80,000 |

|

|

| 31-12-14 | By Interest on DRRI A/c | 20,000 |

|

|

| 31-12-14 | By Profit and Loss A/c | 50,000 |

|

|

| 31-12-14 | By DRRI A/c | 10,000 |

| TOTAL | 2,60,000 |

| TOTAL | 2,60,000 |

Dr. DEBENTURE REDEMPTION RESERVE INVESTMENT A/c. Cr.

DATE | PARTICULAR | AMOUNT | DATE | PARTICULAR | AMOUNT |

1-1-14 | To Balance b/d | 1,80,000 | 31-12-14 | By Bank A/c (95% of 2,00,000) | 1,90,000 |

31-12-14 | To DRR A/c (Profit) | 10,000 |

|

|

|

| TOTAL | 1,90,000 |

| TOTAL | 1,90,000 |

Dr. 9% DEBENTURE A/c. Cr.

DATE | PARTICULAR | AMOUNT | DATE | PARTICULAR | AMOUNT |

31-12-14 | To Debenture holder’s | 2,50,000 | 1-1-14 | By Balance b/d | 2,50,000 |

| TOTAL | 2,50,000 |

| TOTAL | 2,50,000 |

Dr. DEBENTURE HOLDER'A/c. Cr.

DATE | PARTICULAR | AMOUNT | DATE | PARTICULAR | AMOUNT |

31-12-14 | To Bank | 2,50,000 | 31-12-14 | By 12% Debenture A/c | 2,50,000 |

| TOTAL | 2,50,000 |

| TOTAL | 2,50,000 |

Dr. BANK A/c Cr.

DATE | PARTICULAR | AMOUNT | DATE | PARTICULAR | AMOUNT |

31-12-14 | To Balance b/d | 70,000 | 31-12-14 | By Debenture holder’s | 2,50,000 |

31-12-14 | To Interest on DRRI A/c | 20,000 | 31-12-14 | By balance b/d | 30,000 |

31-12-14 | To Debenture Redemption Reserve Investment A/c | 1,90,000 |

|

|

|

| TOTAL | 2,80,000 |

| TOTAL | 2,80,000 |

Q5)MASAN Ltd. has 6,000, 8% of debentures of Rs. 100 each due for redemption in four equal annual installments starting from March 31, 2013. Debenture Redemption Reserve has a balance of Rs. 70,000 on that date. Record necessary journal entries. The company complied with the requirements with respect to investment made in government Securities on 30th April,2012.

SOLUTION :-

IN THE BOOKS OF MASAN Ltd.

DATE | PARTICULARS | LF | Dr. (Rs.) | Cr. (Rs.) |

30-4-12 | Debenture Redemption Fund Investment A/c Dr. To Bank A/c |

| 22,500 |

22,500 |

31-3-13 | Profit and Loss A/c. Dr. To Debenture Redemption Reserve A/c |

| 80,000 |

80,000 |

31-3-13 | 8%Debenture A/c. Dr. To Debenture holders A/c |

| 1,50,000 |

1,50,000 |

31-3-13 | Debenture holders A/c. Dr. To Bank A/c |

| 1,50,000 |

1,50,000 |

31-3-14 | 8%Debenture A/c. Dr. To Debenture holders A/c |

| 1,50,000 |

1,50,000 |

31-3-14 | Debenture holders A/c. Dr. To Bank A/c |

| 1,50,000 |

1,50,000 |

31-3-15 | 8%Debenture A/c. Dr. To Debenture holders A/c |

| 1,50,000 |

1,50,000 |

31-3-15 | Debenture holders A/c. Dr. To Bank A/c |

| 1,50,000 |

1,50,000 |

31-3-16 | Bank A/c. Dr. To DFRI A/c |

| 22,500 |

22,500 |

31-3-16 | 8%Debenture A/c. Dr. To Debenture holders A/c |

| 1,50,000 |

1,50,000 |

31-3-16 | Debenture holders A/c. Dr. To Bank A/c |

| 1,50,000 |

1,50,000 |

31-3-16 | Debenture Redemption Reserve A/c. Dr. To General Reserve A/c |

| 1,50,000 |

1,50,000 |

NOTE :- In case of redemption in installments, investment is made for first installment and it remains invested till the last installment. In this question, the Company has made investment on 30th April, 2012 which remains invested till the last installment i.e. up to 31st March, 2016.

The functions of an underwriter refers to underwriting. An under-writer performing the under-writing function may be an individual, firm or a joint stock company.

Definition

Under-writing may be defined as a contract entered into by the company with persons or institutions, called under-writers, who undertake to take up the whole or a portion of such of the offered shares or debentures as may not be subscribed for by the public. Such agreements are called ‘Under-writing agreement’.

Underwriting

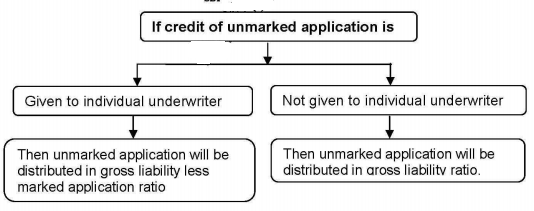

STATEMENT SHOWING LIABILITY OF UNDERWRITERS

GROSS LIABILITY BASIS

Particulars | No. of shares |

Gross liability of each underwriters | Xxx |

(-) unmarked application in the ratio of gross liability | Xxx |

Balance left | Xxx |

(-) marked application | Xxx |

Net liability of the underwriter | Xxx |

Underwriting commission

It may be paid in cash or in fully paid-up shares or debentures or a combination of all these. Companies Act, 2013 provides that payment of commission should be authorized by Articles of

Association and the maximum commission payable will be as under:

Underwriting commission is not payable on the amounts taken up by the promoters, employees, directors, their friends and business associates. Commission is payable on the whole issue underwritten irrespective of the fact that whole of the issue may be taken over by the public. Commission is calculated on issue price unless otherwise mentioned.

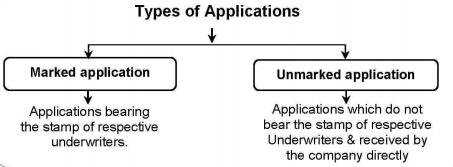

Types of application

|

|

Types of underwriting

2. Partial underwriting – partial underwriting refers to the part of the issue of shares or debenture of a company is underwritten. Partial underwriting may be done by one underwriter or by a number of underwriters. The company is treated as ‘underwriter’ for the remaining part of the issue, in case of partial underwriting.

3. Firm underwriting - Irrespective of the number of shares or debentures subscribed by the public, it is an underwriting agreement where the underwriter or underwriters agree to buy a certain number of shares or debentures. Thus, in firm underwriting, whether or not the issue is over subscribed, the underwriters agree that a certain number of shares be allotted to them.

Concept of sub underwrites – an underwriter may appoint several underwriters to work under him. Such underwriters are termed as sub underwriters. They have no contract with the company. They get their remuneration from the underwriters who are responsible to them.

Accounting entries in the books of the company

Application Money received towards firm Underwriting

Bank A/c Dr.

To Underwriter’s Personal A/c

2. Underwriter’s Liability [Application + Allotment money]

Dr.

Underwriter’s Personal A/c Dr.

To Equity Share Capital A/c

To Share premium A/c

3. Commission due

Underwriting Commission A/c Dr

To Underwriter’s Personal A/c

4. Settlement of Account

(a) Receipt of money due from underwriters

Bank A/c Dr.

To Underwriter’s Personal A/c

(b) Payment to underwriters

Underwriter’s Personal A/c Dr.

To Bank A/c

Key takeaways –

Example 1

Gemini ltd came up with public issue of 30,00,000 equity shares of Rs. 10 each at rs. 15 per share. A, B and C took underwriting of the issue in 3:2:1 ratio.

Applications were received for 27,00,000 shares.

The marked application was received as under:

A 8,00,000 shares

B 7,00,000 shares

C 6,00,000 shares

Commission payable to underwriter is at 5% on the face value of shares

Solution

(i) Computation of liability of underwriters in respect of shares

| (In shares) | |||

| A | B | C | |

Gross liability (Total Issue of 30,000 equity shares) in agreed ration of 3 : 2 : 1 Less: Unmarked applications (Subscribed shares – marked shares) in 3 : 2 : 1 Marked shares as per agreed ratio Less: Marked application actually received Shortfall / surplus in marked shares Surplus of C distributed to A & B in 3:2 ratio Net liability for underwriting shares |

15,00,000

(3,00,000) 12,00,000 (8,00,000) 4,00,000 (1,20,000) 2,80,000 |

10,00,000

(2,00,000) 8,00,000 (7,00,000) 1,00,000 (80,000) 20,000 |

5,00,000

(1,00,000) 4,00,000 (6,00,000) (2,00,000) 2,00,000 Nil | |

(ii) Journal Entries in the books of Gemini Ltd.

| A | B |

A’s Account (2,80,000 x 15) Dr. B’s Account (20,000 x 15) Dr. To Share Capital Account (3,00,000 x 10) To Securities Premium Account (3,00,000 x 5) (Being the shares to be taken up by the underwriters) | 42,00,000 3,00,000 |

30,00,000 15,00,000 |

Underwriting Commission Account Dr. To A’s Account (15,00,000 x 10 x 5%) To B’s Account (10,000 x 10 5%) To C’s Account (5,00,000 x 10 x5%) (Being the underwriting commission due to the underwriters) | 15,00,000 |

7,50,000 5,00,000 2,50,000 |

Bank Account Dr. To A’s Account (Being the amount received from underwriters A for the shares taken up by him after adjustment of his commission) B’s Account Dr. To Bank Account (Being the amount paid t underwriter B after adjustment of the share taken by him against underwriting commission due to him) | 34,50,000

2,00,00

|

34,50,000

2,00,000 |

C’s Account Dr. TO Bank Account (Being the underwriting commission paid to C) | 2,50,000 |

2,50,00 |

Note: C has sold in excess of the underwriting obligation and hence he will not be required to purchase any shares but will get commission for underwriting.

Example 2

A company issued 10,000 shares of which 75% was underwritten by an underwriter. Applications for 6,000 shares were received out of which 4,800 shares were marked by the underwriter. Determine the net liability of the underwriter.

Solution

Gross Liability = 75% of 10,000 = 7,500 shares

Less: Marked Applications = 4,800

Net Liability = 2,700

Example 3

A Company issued 1, 00,000 shares of Rs. 100 each.

These shares were underwritten as follows:

X — 30,000 shares and Y — 50,000 shares.

The public applied for 70,000 shares. Determine the liability of X, Y and the Company.

Solution

Marked applications are not given in the problem. Therefore, applications be credited to underwriters including the Company on the basis of gross liability. The Company itself to be treated as an underwriter for 20,000 shares.

ALTERNATIVELY: Unsubscribed shares = 1,00,000 – 70,000 = 30,000 Thus the net liability of X = 30,000 x 30/100 = 9,000 shares Y = 30,000 x 50/100 = 15,000 shares Company = 30,000 x 20/100 = 6,000 shares

|

Example 4

The Bharat Ltd. issued 10,000 shares of Rs. 100 each. The entire issue was underwritten as follows:

A — 50%; B – 30% and C — 20%

In addition, there was firm underwriting as follows:

A — 1,000 shares; B — 750 and C — 500 shares

The total subscription including firm underwriting was 8,000 shares and the subscription included the following marked applications:

A — 1,500; B — 2,000 and C — 750 Find the liability of underwriters.

Solution

Statement showing Individual Underwriters Liability

| A | B | C | Total |

Gross Liability Less: Credit for unmarked forms (8,000 – 4,250) in 5 : 3 : 2

Less: Relief for Marked forms

Less: Division of surplus of B to A and C in 5 : 2

Add: Firm underwriting Final Liability | 5,000

1,875 | 3,000

1,125 | 2,000

750 | 10,000

3,750 |

3,125 1,500 | 1,875 2,000 | 1,250 750 | 6,250 4,250 | |

1,625

-89 | -125

+125 | 500

-36 | 2,000

| |

1,536 1,000 | - 750 | 464 500 | 2,000 2,250 | |

2,536 | 750 | 964 | 4,250 |

An acquisition is defined as a corporate transaction where one company purchases a portion or all of another company’s shares or assets. Acquisitions are typically made in order to take control of, and build on, the target company’s strengths and capture synergies. There are several types of business combinations: acquisitions (both companies survive), mergers (one company survives), and amalgamations (neither company survives).

The acquiring company buys the shares or the assets of the target company, which gives the acquiring company the power to make decisions concerning the acquired assets without needing the approval of shareholders from the target company.

Purchase consideration

The Vendor firm (which sells the business) and the purchasing company will have to agree about the price to be exchanged for the acquisition of a business. The purchase price or the purchase consideration is the price payable by the purchasing company to the Vendor concern as a consideration for the business taken over. Such price is determined by an agreement between the Vendor and the Vendee. The price can be paid by the purchasing company in cash or in shares or in debentures.

Methods to calculate the purchase consideration

There are mainly two methods to calculate the purchase consideration:

(A) Net Asset Method

Under this method, the purchase price arrived at by adding up the value of all assets taken over less the amount of liabilities taken over by the vendee i.e., purchasing company. For instance, X and Y a firm whose tangible assets are valued at $2,00,000 and liabilities at $45,000, then the net assets or net tangible assets is $1,55,000. Normally, the purchase price and the net assets may be equal. But in many cases, the two figures may be different.

(B) Net Payment Method

By this method, the purchase price is arrived at by adding up the various payments made by the purchasing company. For instance, a purchasing company discharges the purchase price by the issue of 1,000 shares of $100 each, 200 debentures of $100 each and a cash payment of $30,000. Then the purchase price is $1,50,000 ($1,00,000 + $20,000 + $30,000).

Goodwill or Capital Reserve

The purchase price must be compared with the net assets acquired. If the amount paid is excess of net assets acquired, then the excess amount is to be debited to Goodwill. In certain cases the amount paid may be less than the net assets acquired, and then the excess amount i.e., the capital profit is to be credited to Capital Reserve.

Goodwill = [Purchase Price – (Assets Taken – Liabilities Assumed)] |

Capital Reserve = [(Assets Taken – Liabilities Assumed) – Purchase Price] |

Method of accounting treatment in the acquisition of a business

The following are the entries recorded by the purchasing company:

| Business Purchase Account Dr. To Vendor Account |

2. Acquiring various assets and liabilities at agreed value | Various Assets Account Dr. To Various Liabilities Account To Business Purchase Account |

Note: If the purchase price exceeds the net assets, the excess amount is debited to Goodwill Account; and if the net assets exceeds the purchase price, the excess amount is credited to Capital Reserve.

3. On payment of purchase price in kinds | Vendor Account Dr. To Share Capital Account (When shares issued) To Debenture Account (When Debenture Issued) To Cash/Bank Account |

Alternatively: The following entries can also be passed:

| Various Assets Account Dr To Various Liabilities Account To Vendor Account |

Note: Any difference between the totals of debit and credit is debited to Goodwill Account or credited to Capital Reserve Account.

2. On payment of purchase price | Vendor Account Dr. To Share Capital Account To Debentures Account To Cash/Bank Account |

b. Acquisition of business by continuing the same set of books

Sometimes on the conversion of a business into a Company, no new set of books is opened but the purchasing company decides to continue with the same set of books. In such a case, the books of the old business are converted into the books of the Company by passing certain adjustments and transfer entries. There will be no closing entries in the books of the old firm nor opening entries in the books of the company.

Key takeaways –

Example 1

B.K. Limited registered with a capital of $10,00,000 in Equity shares of $10 each, acquired the business of John Brothers. The Balance Sheet of the firm at the date of acquisition was as under.

Liabilities | $ | Assets | $ |

Bank Loan Sundry Creditors Reserve Fund Capital | 10,000 36,000 14,000 140,000

| Cash Bills Receivable Investments Sundry Debtors Stock

Furniture Machinery Premises

| 29,000 10,000 3,000 48,000 18,000

2,000 40,000 50,000 |

200,000 | 200,000 |

The assets and liabilities were subject to the following revaluation:

(a) Machinery and Furniture to be depreciated at 10% and 15% respectively.

(b) Premises should be appreciated by 20%.

(c) Make provision for bad debts on debtors at 2.5%.

(d) Goodwill of the firm valued at $24,000.

(e) The purchase consideration was to be discharged as follows:

(i) Allotment of 10,000 Equity shares of $10 each at $12 each.

(ii) Allotment of 500 10% Debentures of $100 each at a discount of $10 each.

(iii) Balance in cash.

You are required to show journal entries in the books of the Company and prepare the Balance Sheet.

Solution

Computation of purchase consideration

Assets taken over: | $ |

Cash Bills Receivable Investments Sundry Debtors (less 2.5%) Stock Furniture (Less 15%) Machinery (Less 10%) Premises (Add 20%) Goodwill (Balancing Figure) | 29,000 10,000 3,000 46,800 18,000 1,700 36,000 60,000 24,000 |

228,500 |

Less: Liabilities take over:

Bank Loan 10,000

Creditors 36,000 46,000

182,500

Journal Entries in the books of B.K Limited

Dr. Cr.

Business Purchase Account Dr. To John Brothers Account (Being purchase consideration agrees) |

| $ 1,82,500 | $

1,82,500

|

Cash Account Dr. Bills Receivable Account Dr. Investment Account Dr. Sundry Debtors Account Dr. Stock Account Dr. Furniture Account Dr. Machinery Account Dr. Premises Dr. Goodwill (Balancing Figure) Dr. To Bad Debts Reserve Account To Bank Loan Account To Sundry Creditors Account To Business Purchase Account (Being assets and liabilities of vendors taken over at agreed valuation) |

| 29,000 10,000 3,000 48,000 18,000 1,700 36,000 60,000 24,000 |

1,200 10,000 36,000 1,82,500 |

John Brothers Account Dr. Discount on Issue of Debentures Dr. To Equity Share Capital Account To Share Premium Account To 10% Debentures Account To Bank Account (Being discharge of purchase price) |

| 1,82,500 5,000 |

1,00,000 20,000 50,000 17,500 |

Share Premium Account Dr. To Discount on Issue of Debentures (Being capital loss written off against Share Premium Account) |

| 5,000 |

5,000 |

Balance Sheet B.K Limited as on………

Liabilities | $ | Assets | $ |

Authorized Share Capital 10,000 shares of $10 each Issued and Paid up: 10,000 Equity Shares of $10 each Share Premium 10% Debentures Bank Loan Sundry Creditors |

100,000 | Fixed Assets Goodwill Premises Machinery Furniture Investment Current Assets Stock Debtors 48,000 Less: 2.5% 1,200 Bills Receivable Cash |

24,000 60,000 36,000 1,700 3,000

18,000

46,800 10,000 11,500 |

100,000 15,000 50,000 10,000 36,000

| |||

211,000 | 211,000 |

Example 2

A and B carrying on business in partnership, sharing profits and losses in the ratio of 3:2, wish to dissolve the firm and sell the business to a limited company on 31st December when the firm’s Balance Sheet as under:

Liabilities | $ | Assets | $ |

Capital Account A B Reserve Sundry Creditors | 70,000 | Furniture Auto Stock Debtors | 8,000 12,000 81,000 60,000 |

50,000 20,000 25,000 | |||

165,000 | 161,000 |

A Limited Company with an authorized capital of $3,00,000 in Equity shares of $10 each, is registered to purchase the above business on the following terms:

Goodwill is valued at $30,000.

Furniture and stock are evaluated at $6,000 and $85,000 respectively.

Debtors are subject to 5% provision.

The auto is not required by the company and A takes over it at an agreed valuation of $8,000.

The purchase consideration is satisfied by the issue of Equity shares of $10 each at par.

Show the journal entries and Balance Sheet of the company assuming that the same set of books is continued.

Solution

Dec. 31 |

Reserve Account Dr To A Account To B Account |

| $ 20,000 | $

12,000 8,000 |

| (Being transfer of accumulated profits to Capital Account) Goodwill Account Dr. To A Account To B Account (Being Goodwill raised in the books) |

| 30,000 |

18,000 12,000 |

| A Capital Account Dr. To Auto Account (Being auto taken over by A) |

| 8,000 |

8,000 |

| Stock Account Dr. To Revaluation Account (Being increase in stock value) |

| 4,000 |

4,000 |

| Revaluation Account Dr. To Furniture Account To Auto Account To Bad Debts Provision Account (Being decrease in value of assets and creation of bad debts reserve) |

| 9,000 |

2,000 4,000 3,000 |

| A Account Dr. B Account Dr. To Revaluation Account (Being loss on Revaluation Account transferred) |

| 3,000 2,000 |

5,000 |

| A Capital Account Dr. B Capital Account Dr. To Equity Share Capital A/c (Being discharge of purchase price by issue of 15,700 equity shares of $10 each at par) |

| 89,000 68,000 |

1,65,000 |

Balance Sheet as on 31st December

Liabilities | $ | Assets | $ |

Authorized Share Capital 30,000 Equity shares of $10 each Issued and Paid up 15,700 Equity shares of $10 fully paid (All these shares have been issued for consideration other than cash) Sundry Creditors |

3,00,000 | Fixed Assets Goodwill Furniture

Current Assets Stock Debtors 60,000 Less: Reserve 3,000 Cash |

30,000 6,000

85,000

57,000 4,000 |

1,57,000

25,000 | |||

1,82,000 | 182,000 |

When a running business is taken over from a date prior to its incorporation/commencement, the profit earned up to the date of incorporation/commencement (incorporation, in case of private company; and commencement, in case of public company) is known as ‘Pre-incorporation profit’.

The same is to be treated as capital profit since these are profits which have been earned before the company came into existence. In short, the profit earned after the date of purchase of business is called ‘Post-incorporation or Post-acquisition profit’ and the profit earned before the date of purchase of business is termed as ‘Pre-incorporation profit’.

In order to ascertain the profit prior to incorporation a Profit and Loss Account is to be prepared at the date of incorporation. But in practice, the same set of books of accounts is maintained throughout the accounting year.

A Profit and Loss Account is prepared at the end of the year and thereafter the profits (or losses) between the two periods are allocated:

(i) From the date of purchase to the date of incorporation or pre-incorporation period;

(ii) From the date of incorporation to the closing of the accounting year or post-incorporation period.

Method of Accounting of Profit/Loss Prior to Incorporation:-

Steps may be suggested for ascertaining profit or loss prior to incorporation:

Step I:

A Trading Account should be prepared at first for the whole period, i.e., between the date of purchase and the date of final accounts, in order to calculate the amount of gross profit.

Step II:

Calculate the following two ratios:

i) Sales Ratio:

Amount of sales should be calculated for the pre-incorporation and post-incorporation periods.

(ii) Time Ratio:

It is calculated after considering the time period, i.e., one is required to calculate the period falling between the date of purchase and the date of incorporation and the period between the date of incorporation and the date of presenting final accounts.

Step III:

A statement should be prepared for calculating the amount of net profit before and after incorporation separately on the following principle:

(i) Gross Profit should be allocated for the two periods on the basis of sales ratio which will present the gross profit for the two separate periods, viz. pre-incorporation and post- incorporation.

(ii) Fixed Expenses or expenses incurred on the basis of time, viz., Rent, Salary, Depreciation, Interest, etc. should be allocated for the two periods on the basis of time ratio.

(iii) Variable Expenses or expenses connected with sales should be allocated for the two periods on the basis of sales ratio.

(iv) Certain expenses, viz., partners’ salary, directors’ salary, preliminary expenses, interest on debentures, etc. are not apportioned since they relate to a particular period. For example, partners’ salary is to be charged against pre-acquisition profit whereas directors’ remuneration, debenture interest, etc. are to be charged against post-acquisition profit.

Application/Accounting Treatment of Profit/Loss Prior to Incorporation:-

(a) Pre-incorporation Profit:

Since “Profit prior to Incorporation” is a Capital Profit the same should be written off against:

(i) Preliminary Expenses Account

(ii) Formation Expenses Account

(iii) Liquidation Expenses Account

(iv) Write down the value of Fixed Assets, if any

(v) Goodwill Account

(vi) Balance, if any, transferred to Capital Reserve.

(b) Pre-incorporation Loss:

Since “Pre-incorporation Loss” is a Capital Loss the same is adjusted against

(i) Any Capital Profit

(ii) Debited to Goodwill Account

(iii) Writing-off Fictitious Assets

(iv) Capital Reserve.

Post incorporation profit /Loss

The post incorporation profit is a revenue profit available at company’s disposal. This can be used for distribution of dividend to shareholders. It can be used to write off revenue losses. If there is post incorporation loss it is taken to profit & loss account. The final balance of profit & loss account will be shown in balance sheet. Debit balance is shown on asset side and credit balance on liabilities side.

Basis of distribution of expenses

Basis | Items |

Time ratio | Rent, Salaries, Insurance Premium, Tax, Rates, Printing, Stationery, Postage, Depreciation, fixed expenses, General expenses, sundry expenses, Bank charges, Repairs, Electricity expenses, Office expenses, Administrative expenses etc. |

Sales ratio | Selling expenses, Advertisement, Discount allowed, Bad debts etc. |

Prior to incorporation | Salary and commission to vendor. |

Post incorporation | Expenses and discount on issue of shares and debentures, underwriting Commission, Preliminary expenses, formation expenses, Audit fees, Interest on debentures, Directors fees, Managing director’s remuneration, Subscription to political party by the company, Goodwill written off. |

Key takeaways

Q1) The Promoters of the ITC Company Ltd. Purchased a running business on 1st January,2018 from Mr. Dhaval. The new company was incorporated on 1st May,2018. The Profit and Loss Account for the year ended 31st December, 2018 was as under:

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

Rent, Rates, Insurance, Electricity | 24,000 | Gross Profit | 3,00,000 |

Directors sitting Fees | 7,200 | Discount Received | 12,000 |

Preliminary Expenses | 9,800 |

|

|

Selling Expenses | 11,000 |

|

|

Interest paid to Vendors | 20,000 |

|

|

Net Profit | 2,40,000 |

|

|

TOTAL | 3,12,000 | TOTAL | 3,12,000 |

Following further information available:

Sales up to 30th April, 2018 was Rs.6,00,000 out of total sales of Rs.30,00,000 for the year. Purchase up to 30th April, 2018 was Rs.6,00,000 out of total purchase of Rs.18,00,000 of the year. Interest paid to vendors was @ 12% on Rs.2,00,000 p.a. till the payment was made.

From the above information, prepare Statement of Profit & Loss for the year ended 31st December, 2018. Showing the pre and post- incorporation profits and how it will be treated in accounts.

SOLUTION: -

STATEMENT OF PROFIT & LOSS FOR THE YEAR ENDING 31st December, 2015.

PARTICULARS | TOTAL | BASIS OF ALLOCATION | PRE-INC (AMOUNT) | POST-INC (AMOUNT) |

INCOME |

|

|

|

|

Gross Profit | 3,00,000 | Sales | 60,000 | 2,40,000 |

Discount Received | 12,000 | Purchase | 4,000 | 8,000 |

TOTAL INCOME | 3,12,000 |

| 64,000 | 2,48,000 |

LESS : EXPENSES |

|

|

|

|

Rent, Rates, Insurance, Electricity | 24,000 | Time | 8,000 | 16,000 |

Directors sitting Fees | 7,200 | Post |

| 7,200 |

Preliminary Expenses | 9,800 | Post |

| 9,800 |

Selling Expenses | 11,000 | 1:4 | 2,200 | 8,800 |

Interest paid to Vendors | 20,000 | Actual | 8,000 | 12,000 |

TOTAL EXPENSES | 72,000 |

| 18,200 | 53,800 |

|

|

|

|

|

NET PROFIT | 2,40,000 |

| 45,800 | 1,94,200 |

Notes to Accounts: Net profit for pre-incorporation period will be transferred to Capital Reserve and the post-incorporation period will be transferred to Profit and Loss A/c

WORKING NOTES:

Q2) Thoriya Ltd. Was incorporated to take over the running business of Sharma Bros. w.e.f. 1st April,2014. The company was incorporated on 1st August, 2014. And it commenced its business on 1st October, 2014. The following information was available from the books of accounts which were closed on 31st March, 2015.

PARTICULARS | AMOUNT | AMOUNT |

Gross Profit |

| 3,50,000 |

Less : Office Salaries | 1,35,000 |

|

Office Expenses | 45,000 |

|

Travelling Expenses | 24,600 |

|

Office Rent | 48,000 |

|

Salesman’s Commission | 24,500 |

|

Depreciation | 10,500 | 2,87,600 |

NET PROFIT |

| 62,400 |

ADDITIONAL INFORMATION: -

From the above information, prepare Statement of Profit & Loss for the year ended 31st March, 2015. Showing the pre and post- incorporation profits and how it will be treated in accounts.

SOLUTION: -

IN THE BOOKS OF THORIYA Ltd.

STATEMENT OF PROFIT & LOSS FOR THE YEAR ENDING 31st March, 2015.

PARTICULARS | TOTAL | BASIS OF ALLOCATION | PRE-INC (AMOUNT) | POST-INC (AMOUNT) |

INCOME |

|

|

|

|

Gross Profit | 3,50,000 | Sales | 1,00,000 | 2,50,000 |

TOTAL INCOME | 3,50,000 |

| 1,00,000 | 2,50,000 |

LESS : EXPENSES |

|

|

|

|

Salaries (Partner’s) | 30,000 | Pre- Inc. | 30,000 |

|

Salaries | 1,05,000 | Time | 35,000 | 70,000 |

Office Expenses | 45,000 | Time | 15,000 | 30,000 |

Travelling Expenses (Office) | 3,600 | Time | 1,200 | 2,400 |

Travelling Expenses (Sales) | 21,000 | Sales | 6,000 | 15,000 |

Office Rent | 48,000 | WN3 | 14,000 | 34,000 |

Salesman’s Commission | 24,500 | Sales | 7,000 | 17,500 |

Depreciation (Post Period) | 3,000 | Post-Inc | - | 3,000 |

Depreciation | 7,500 |

| 2,500 | 5,000 |

TOTAL EXPENSES | 2,87,600 |

| 1,10,700 | 1,76,900 |

NET PROFIT/ (LOSS) | 62,400 |

| (10,700) | 73,100 |

Notes to Accounts: Net Loss for pre-incorporation period will be transferred to Goodwill and the post-incorporation period will be transferred to Profit and Loss A/c.

WORKING NOTES:

4 months : 8 months

1 : 2

2. Sales Ratio (SR) = (Total Sales = Rs.35,00,000)

A M J J A S O N D J F M

2.5 2.5 2.5 2.5

Pre- Inc. 10,00,000 Post Inc. 25,00,000

Sales Ratio= 2:5

3. Office Rent : 48,000

A M J J A S O N D J F M

3.5 3.5 3.5 3.5

Pre- Inc. 14,000 Post Inc. 34,000

Q3) Ramesh & Rajesh working in partnership, registered a joint Stock company under the name of Sad Ltd. On May 31st 2017 to take over their existing business. The summarized Profit and Loss A/c are given by Sad Ltd. For the year ending 31st March,2018 as under.

PROFIT AND LOSS A/c FOR THE YEAR ENDING MARCH 31, 2018

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Salaries | 1,44,000 | By Gross Profit | 4,50,000 |

To Int on Debenture | 36,000 |

|

|

To Sales Commission | 18,000 |

|

|

To Bad Debts | 49,000 |

|

|

To Depreciation | 19,250 |

|

|

To Rent | 38,400 |

|

|

To Audit Fees | 12,000 |

|

|

To NET PROFIT | 1,33,350 |

|

|

TOTAL | 4,50,000 | TOTAL | 4,50,000 |

SOLUTION: -

Pre-Inc period is for Two months, from 1st April,2017. To 31st May,2017. 10 months’ period (from 1-6-2017 to31-3-2018) is Post- Incorporation.

STATEMENT OF PROFIT & LOSS FOR THE YEAR ENDING 31st March, 2018.

PARTICULARS | TOTAL | BASIS OF ALLOCATION | PRE-INC (AMOUNT) | POST-INC (AMOUNT) |

Gross Profit | 4,50,000 | Sales | 50,000 | 4,00,000 |

Bad Debts Recovery | 14,000 | Pre | 14,000 |

|

TOTAL INCOME | 4,64,000 |

| 64,000 | 4,00,000 |

LESS : EXPENSES : |

|

|

|

|

Salaries | 1,44,000 | Time | 24,000 | 1,20,000 |

Int on Debenture | 36,000 | Post | - | 36,000 |

Sales Commission | 18,000 | Sales | 2,000 | 16,000 |

Bad Debts (49,000 + 14,000) | 49,000 |

| 7,000 | 56,000 |

Depreciation | 19,250 | Note | 3,000 | 16,250 |

Rent | 38,400 | Time | 4,000 | 34,400 |

Audit Fees | 12,000 | Post | - | 12,000 |

TOTAL EXPENSES | 3,11,400 |

| 40,000 | 2,90,650 |

NET PROFIT | 1,52,600 |

| 24,000 | 1,09,350 |

Notes to Accounts: Net profit for pre-incorporation period will be transferred to Capital Reserve and the post-incorporation period will be transferred to Profit and Loss A/c.

WORKING NOTE: -

Sales from April to September = 6,00,000 (1,00,000 p.m. on avg basis)

October to March = 12,00,000 (2,00,000 p.m. on an avg basis)

Thus, sales for pre-incorporation period = 2,00,000

Post – incorporation period = 16,00,000

Sales are in the Ratio of 1:8

[38,400-14,400 (2,400 * 6)] = 24,000

1-4-17 – 31-5-17 (2,000*2) = 4,000

1-6-17 – 31-3-18 – (2,000*10) + 14,400 = 34,400

TOTAL = 38,400

Q4). From the given information, ascertain the profit for the pre incorporation and post incorporation period separately.

Net Profit before making adjustment given below:

pre incorporation profit Rs. 76,000

post incorporation profit Rs.1,07,000

Sales Ratio = 4:5

Time Ratio = 1:1

Transaction to be recorded:

SOLUTION: -

REVISED PRE AND POST PROFITS

PARTICULARS | BASIS OF ALLOCATION | PRE-INC (PROFITS) | POST-INC (PROFITS) |

Profit Before Transaction | Given | 76,000 | 1,07,000 |

LESS : Debenture Interest | Post | - | (20,000) |

LESS : Discount Allowed | Sales | (2,000) | (2,500) |

LESS : Depreciation | Post |

| (10,000) |

Depreciation | Time | (20,000) | (20,000) |

ADD : Share Transfer Fees | Post |

| 5,000 |

NET PROFIT |

| 54,000 | 59,500 |

Notes to Accounts: Net profit for pre-incorporation period will be transferred to Capital Reserve and the post-incorporation period will be transferred to Profit and Loss A/c.

Q5) Krishna Ltd. Was incorporated on August 1,2015. It had acquired a running business of Rama & Co. with effect from April 1, 2015. During the year 2015-2016 the total sales were Rs.36,00,000. The sales p.m. in the first half of year were half of what they were in the latter half year. The net profit of the company Rs.2,00,000 was worked out after charging the following list of expenses.

PARTICULARS | AMOUNT |

Depreciation | 1,08,000 |

Audit fees | 15,000 |

Director’s fees | 50,000 |

Preliminary Expenses | 12,000 |

Office expenses | 78,000 |

Selling Expenses | 72,000 |

Interest to vendors up to 31-08-2015 | 5,000 |

Please ascertain pre – incorporation and post – incorporation profit for the year ended 31st March,2016.

SOLUTION: -

STATEMENT OF PROFIT & LOSS FOR THE YEAR ENDING 31st March, 2016.

PARTICULARS | TOTAL | BASIS OF ALLOCATION | PRE-INC (AMOUNT) | POST-INC (AMOUNT) |

INCOME |

|

|

|

|

Gross Profit | 5,40,000 | Sales | 1,20,000 | 4,20,000 |

TOTAL INCOME | 5,40,000 |

| 1,20,000 | 4,20,000 |

LESS : EXPENSES |

|

|

|

|

Depreciation | 1,08,000 | Time | 36,000 | 72,000 |

Audit fees | 15,000 | Time | 5,000 | 10,000 |

Director’s fees | 50,000 | Post | - | 50,000 |

Preliminary Expenses | 12,000 | Post | - | 12,000 |

Office expenses | 78,000 | Time | 26,000 | 52,000 |

Selling Expenses | 72,000 | Sales | 16,000 | 56,000 |

Interest to vendors | 5,000 | Actual | 4,000 | 1,000 |

TOTAL EXPENSES | 3,40,000 |

| 87,000 | 2,53,000 |

NET PROFIT/ (LOSS) | 2,00,000 |

| 33,000 | 1,67,000 |

Notes to Accounts: Net profit for pre-incorporation period will be transferred to Capital Reserve and the post-incorporation period will be transferred to Profit and Loss A/c.

WORKING NOTES: -

A M J J A S O N D J F M

0.5 0.5 0.5 0.5 0.5 0.5 1 1 1 1 1 1

Pre-incorporation = 0.5 X 4 = 2

Post – incorporation = (0.5 X 2) + (1 X 6) = 7

SALES RATIO = 2 :7

1-4-2015 to 31-7-2015: 1-8-2015 to 31-3-2016

4 months : 8 months

1 : 2

Gross profit = Net Profit + All Expenses

= 2,00,000 + (1,08,000 + 50,000 + 12,000 + 78,000 + 72,000 + 5,000)

= 2,00,000 + 3,40,000

=5,40,000

Q6).A firm which was carrying on business from 1st January, 2009 gets itself incorporated as a company on 1st May, 2009. The first accounts are drawn up to 30th September, 2009. The gross profit for the period is Rs.56,000. The general expenses are Rs.14,220, directors’ fee Rs.12,000 p.a.; formation expenses Rs.1,500. Rent up to 30th June is Rs.1,200 p.a., after which it is increased to Rs.3,000 per annum. Salary of the manager, who upon incorporation of the company was made a director, is Rs.6,000 p.a. His remuneration thereafter is included in the above figure of fee to directors. Give Profit and Loss Account showing pre-and post-incorporation profits. The net sales are Rs.8,20,000, the monthly average of which, for the first four months of 2009 is half of that of the remaining period, the company earned a uniform profit. Interest and tax may be ignored.

SOLUTION:

Profit and Loss Account for 9 months ended on 30th September, 2009

PARTICULARS | Total (Rs.) | Pre-incorporation 1.1.2009 to 30.4.2009 | Post-incorporation 1.5.2009 to 30.9.2009 | PARTICULARS | Total (Rs.) | Pre-icorporation 1.1.2009 to 30.4.2009 | Post-incorporation 1.5.2009 to 30.9.2009 |

To General Expenses | 14,220 | 6,320 | 7,900 | By Gross profit | 56,000 | 16,000 | 40,000 |

To Directors fees | 5,000 | - | 5,000 |

|

|

|

|

To Formation expenses | 1,500 | - | 1,500 |

|

|

|

|

To Rent | 1,350 | 400 | 950 |

|

|

|

|

To Managers salary | 2,000 | 2,000 | - |

|

|

|

|

To Net profit – Capital reserve – P n L Appropriation | 31,930

- | 7,280

- | -

24,650 |

|

|

|

|

| 56,000 | 16,000 | 40,000 |

| 56,000 | 16,000 | 40,000 |

Working Notes:

(1) Let the average monthly sales of first four months be Rs.100. Then the average monthly sales of next five months will be Rs.200.

Total sales of first four months = Rs.100 4 = Rs.400 and that of next five months = Rs.200 5 = Rs.1,000. The ratio of sales = 400:1000 or 2:5 The gross profit is apportioned on the basis of sales, i.e., 2:5.

Therefore, the gross profit is apportioned as:

Pre-Rs.56,000/7x2=Rs.16,000 ; Post-Rs.56,000/7x5=Rs.40,000

(2) General expenses accrue evenly throughout the period and are, therefore, divided on the basis of time.

Pre-Rs.14,220/9x4=Rs.6,320 ; Post-Rs.14,220/9x5=Rs7,900

(3) Directors’ fees payable @ Rs.1,000 per month. It is to be found in company only. So Rs.5,000 (5 × Rs.1,000) must naturally be shown in post-period incorporation period.

(4) Formation expenses though incurred in point of time, before the company was in incorporated, are charge against the post incorporation profit.

(5) Rent for first four months = Rs.100 × 4 = Rs.400. For next five months = (Rs.100 × 2) + (Rs.250 × 3) = Rs.950.

(6) Salary to manager is related to pre-incorporation period only. Salary to be charged = Rs.500 × 4 = Rs.2,000.

References