UNIT 5

Hire purchase

If you purchase a TV for cash, you pay, say, Rs.15,000. But if you wish to make the payment by installments of say, Rs.3,000 each, every year, you may be required to pay four installments, that is Rs.20,000 in all. The extra amount of Rs.3,000 is for interest. If you choose the latter mode of the payment, you should debit Rs.5,000 to interest and treat the TV as valued at Rs.15,000 (and not at Rs.20,000). In case payment is to be made by installments, there may be two kinds of arrangements. Each installment may be treated as a ‘hire’ the purchaser becoming the owner only if he pays all the instalments. In other words ,property does not pass to him even if one installment remains unpaid. The seller will have the right to take away the goods in case of default in respect of any installment. This is known as ‘Hire Purchase ‘system.

According to J.R. Batliboi, ‘‘Under the Hire Purchase System, goods are delivered to a person, so agrees to pay the owners by equal periodical instalments, such instalments to be treated as hire of those goods, until a certain fixed amount has been paid, when these goods become the property of the hirer.

Important Terms in Hire Purchases system

Hire purchase price=Cash price + Interest

5. Interest-Interest is the amount which is payable in addition to the actual cash price of the goods. It is the amount paid by the buyer for the delayed and postponed payment.

6. Hire Installment-It is the amount payable periodically by the hirer or the buyer, installment may be an equal amount or different amounts which are based on the agreement.

7. Down Payment or initial amount-The amount is a lump-sum out of the total Hire purchase price, payable to the vendor in advance while the agreement is signed, which does not carry any interest on it.

Features of hire purchase system

Installment purchase system

It is a system where the buyer is given the ownership as well as the possession of the goods at the same time of signing the contract. The buyer has the facility to pay the price in installment.

According to J.B Batliboi, installment purchase system is a system under there is an agreement to purchase and pay by installment, the goods which become the property of the purchaser immediately when he receives the delivery of the same.

Features of installment purchase system

Calculation of interest

Interest: In either case (hire purchase or instalment) interest must be separated from the principal sum due. Since payments continue over two or more financial year’s interest must be calculated for each year separately. Usually information is available regarding cash price and the rate of interest. Calculation of interest then becomes easy. Just prepare the account of one of the parties on ordinary lines and charge interest on the balance due. Suppose on 1st January, 2000 A purchases from B machinery whose cash price is Rs.15,000; Rs.5,000 is to be paid down, that is on signing of the contract, and Rs.4,000 is to be paid at the end of each year for 3 years. Rate of interest is 10% p.a. If we prepare B’s account (on a memorandum basis) in A’s books, we shall know the interest for each year.

A’s Books

Dr. |

|

| B’s Account |

| Cr. |

|

| Rs. |

|

| Rs. |

2000 |

|

| 2000 |

|

|

Jan.1 | To Cash | 5,000 | Jan.1 | By Machinery A/c | 15,000 |

Dec.31 | To Cash | 4,000 | Dec.31 | By Interest A/c | 1,000 |

’’ | To balance c/d | 7,000 |

| (10% on Rs.10,000) |

|

|

| 16,000 |

|

| 16,000 |

2001 |

|

| 2001 |

|

|

Dec.31 | To Cash | 4,000 | Jan.1 | By Balance b/d | 7,000 |

| To Balance c/d | 3,700 | Dec.31 | By Interest A/c |

|

|

|

|

| (10% on Rs.7,000) | 700 |

|

| 7,700 |

|

| 7,700 |

2002 |

|

| 2002 |

|

|

Dec.31 | To Cash | 4,000 | Jan.1 | By Balance b/d | 3,700 |

|

|

| Dec.31 | By Interest A/c* | 300 |

|

| 4,000 |

|

| 4,000 |

* As it is the last year of installment, interest amount will be the difference between the Outstanding balance and the actual amount of installment. [Students should note that if you calculate interest for the last year as per the given percentage on the O/S amount (3700 x 10%=370), total amount payable becomes (3700+370=4070) which is greater than the installment paid. So there will be again Rs. 70 payable even after the last installment being paid.]

If the rate of interest is not given, the interest for each year will be in proportion to amount outstanding in each year. In the example given above, the total sum payable is Rs.17,000 out of which Rs.5,000 is paid immediately. This leaves Rs.12,000 as outstanding throughout the first year at the end of which Rs.4,000 is paid. In the second year Rs.8,000 is outstanding and in the third year Rs.4,000 is due. The total interest is Rs.2,000. i.e., Rs.17,000. minus Rs.15,000. The interest should be apportioned over the 3 years in the ratio of amounts outstanding, that Rs.12,000; Rs.8,000 and Rs.4,000 or in the ratio of 3 : 2 :1. The interest for the first year is Rs.1,000 : for the second year it is Rs.670 and for the third year it is Rs.333. Note that the amount cannot be the same as worked out when the rate of interest isgiven.

To ascertain Cash Price, rate of interest and instalments being given. Sometimes the cash price is not given. Since the asset cannot be debited with more than the cash price, it must be ascertained. The process is to take the last year first and separate interest from principal out of the total sum due. In the example given above, Rs.4,000 is due at the end of 2002. The rate of interest is 10%. If in the beginning of 2001 Rs.100 was due, Rs.10 would be added making Rs.110 as due at the end of 2002. Thus, out of the sum due at the end of the year, one-eleventh is interest; rest is principal. We can proceed year by year likethis.

Thus: —

| Rs. |

Amount due on 31-12-2001 | 4,000 |

Interest @ 1/11 | 364 |

Amount due on 1-1-2002 or 31-12-2001 | 3,636 |

Paid on 31-12-2001 | 4,000 |

Total amount due on 31-12-2001 | 7,636 |

Interest @ 1/11 | 694 |

Amount due on 1-1-96 or 31-12-2000 | 6,942 |

Paid on 31-12-2000 | 4,000 |

Total amount due on 31-12-2000 | 10,942 |

Interest @ 1/11 | 995 |

Amount due on 1-1-2000 | 9,947 |

Paid Cash down on 1-1-2000 | 5,000 |

Cash Price | 14,947 |

The interest for three years is Rs.995, Rs.694 and Rs.364 respectively. | |

Key takeaways:

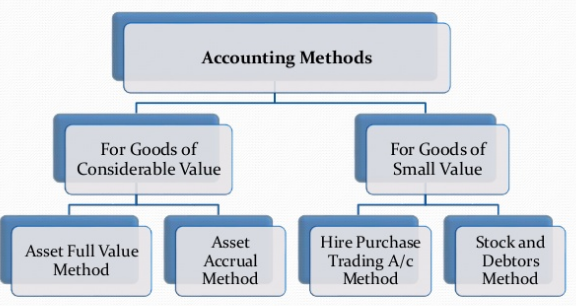

Accounting arrangement for hire purchase transaction

|

For such high value goods, two methods of records can be maintained.

First method - Capitalising only the portion of cash price paid or asset accrual method.

Second method - Capitalising the full cash price or credit purchase with interest method.

In this method cash price paid is alone capitalized. The asset account is debited with the amount of cash price paid in that instalment. This method as use that the title pages two the buyer only after the last instalment is paid. Unit then the seller is the owner. So as and when the instalment amount is paid the case price in the instalment is capitalized. In this method the goods are consider to the acquired only gradually when the cash price is paid each time.

Assets A/c Dr. To Vendor’s A/c |

- With the amount of down payment |

Vendor’s A/c To Bank A/c |

Do |

Assets A/c Dr. Interest A/c Dr. To Vendor’s A/c |

- With the amount of Principal - With the amount of Interest - With the amount of Instalment |

Vendor’s A/c Dr. To Bank A/c |

- With the amount of Instalment |

Depreciation A/c Dr. To Assets A/c |

- With the amount of Depreciation |

Profit & Loss A/c Dr. To Interest A/c “ Depreciation A/c |

|

In the subsequent years (b), (c), (d) and (e) with their respective amounts will appear in the books.

2. Credit purchase with interest

In this method the full case price is capitalised. The hire purchaser debits the Asset account A/c with full case price and credits the higher vendor A/c. this method assumes that the assets are consider to be acquired immediately when the position is taken. The purchaser enters into an agreement with the intention of fulfilling it.

Journal entry in the books of hire purchase

Assets A/c Dr. To Vendor’s A/c |

- With the amount of Total Cash Price |

Vendor’s A/c To Bank A/c |

- With the amount of Down Payment |

Interest A/c Dr. To Vendor’s A/c |

- With the amount of Interest

|

Vendor’s A/c Dr. To Bank A/c |

- With the amount of Instalment |

Depreciation A/c Dr. To Assets A/c |

- With the amount of Depreciation |

Profit & Loss A/c Dr. To Interest A/c “ Depreciation A/c |

|

In the subsequent years (b), (c), (d) and (e) with their respective amounts will appear in the books.

Journal entry in the books of hire vendor

(a) On delivery Purchase A/c Dr. To Hire-Purchase Sales A/c |

- With the amount of Total Cash Price |

Bank A/c Dr. To Purchase A/c |

- With the amount of down payment |

Purchaser A/c Dr. To Interest A/c |

- With the amount of Interest

|

Bank A/c Dr. To Purchase A/c |

- With the amount of Instalment |

Interest A/c Dr. To Profit & Loss A/c |

- With the amount of Interest |

In the subsequent years (c), (d) and (e) with their respective amounts will appear in the books.

Accounting records for goods of small values

Hire Purchase Trading Account

To Stock with customers on hire purchase price (opening)

To Goods sold on hire purchase account

To stock reserve on closing stock |

| By Hire purchase sales - Cash received from customers - Instalments due but received By Stock Reserves

By Stock with customers at hire price at end |

|

2. stock and debtor method

In this method, hire purchase stock, hire purchase debtor and hire purchase adjustment account are maintained. Following entries will pass in the books of vendor

a) When goods are sold on hire purchase

hire purchase stock account Dr. ( Hire purchase price)

stock account Cr. ( Actual cost of sale of goods )

hire purchase adjustment account Cr. ( difference between hire purchase price and actual cost )

b)When installments become due for payment

hire purchase debtors account Dr.

hire purchase stock account Cr.

c) When cash is received

Cash account Dr.

Hire purchase debtor account Cr.

d) Stock reserve account on opening stock

stock reserve account Dr.

hire purchase adjustment account Cr.

e) Stock reserve on closing stock

Hire purchase adjustment account Dr.

Disclosure in balance sheet under actual cash price method

Stock reserve account Cr. At the end each accounting period, the relevant accounts appear in the Balance Sheet as shown below:

Disclosure In Balance Sheet Under Actual Cash Price Paid Method

Balance Sheet of Hire Purchaser |

| Balance Sheet of Hire Vendor | |||

Liabilities | Rs.Assets | Rs. | Liabilities | Rs.Assets | Rs. |

| Fixed Assets : |

|

|

| |

| Asset (at actual cash) |

|

| No disclosure is | |

| price paid) | xxx |

| Required |

|

| Less : Depreciation till date | xxx |

|

|

|

|

| xxx |

|

|

|

|

|

|

|

|

|

Hire Purchase: Books of the Vendor

Books of the Vendor: The vendor follows no special method for recording sales on hire purchase, especially in case of sale of large items. He debits the purchaser with the cash price and credits him with the amount received. Every year the interest due is debited. We illustrate this below.

Illustration-1

Based on particulars given below calculate Interest under the hire purchase system

(a) X & Co.—purchaser Y & Co.-Seller Date of purchase—Jan. 1,1999

cash price—Rs.74,500.

Installments Rs.20,000 on signing of the agreement. Rest in three instalments of Rs.20,000 each. Rate of Interest—5%. Depreciation 10% on the diminishing Balance.

(b) All particulars as above except that the rate of interest is notgiven.

(c) All particulars as in (a) above except that the cash price is notgiven.

Solution :

(a) Calculation of Interest | ||

|

| Rs. |

Jan.1, 1999 | Cash Price | 74,500 |

| Less-Cash down | 20,000 |

| Balance Due | 54,500 |

| Interest @ 5% for 1999 | 2,725 |

Dec.31, 1999 | Total | 57,225 |

| Amount paid | 20,000 |

Jan.1, 2000 | Balance Due | 37,225 |

| Interest for 2000 @ 5% | 1,861 |

Dec.31, 2000 | Total | 39,086 |

| Amount paid | 20,000 |

Jan.1,2001 | Balance due 2001 | 19,086 |

| Interest for (balancing figure) 2001 | 914 |

Jan.1,2002 | Amount paid | 20,000 |

(b) Calculation of interest when the rate of interest is not given:

Hire Purchase Price | 80,000 | ||||

Cash Price | 74,500 | ||||

Total interest | 5,500 | ||||

|

|

|

|

|

|

Year | Amount Outstanding | Ratio | Interest | Rs. | |

1 | 60,000 |

| 3 | 3/6 x 5,500 | 2,750 |

2 | 40,000 |

| 2 | 2/6 x 5,500 | 1,833 |

3 | 20,000 |

| 1 | 1/6 x 5,500 | 917 |

(c) Calculation of cash price, rate of interest being given:

Instalment | Amount due at the end of the year (after payment of Installment) | Instalment paid | Total amount due at the end of the Year (before payment of instalment) | Interest @ 1/21 | Principal due in the beginning | |

| Rs. | Rs. |

| Rs. | Rs. | Rs. |

3 | Nil | 20,000 |

| 20,000 | 952 | 19,408 |

2 | 19,048 | 20,000 |

| 39,048 | 1,859 | 37,189 |

1 | 37,189 | 20,000 |

| 57,189 | 2,723 | 54,466 |

|

|

|

|

| 5,534 |

|

Cash Price: 54,466 + cash down, Rs.20,000 or Rs.74,466.

Illustration-2

Y & Co. sold machinery whose cash price is Rs.74,500. to X and Co., on hire purchase basis on 1st January, 2000. Payment was to be made as Rs.20,000 down and Rs.20,000 every year for three years. Rate of interest was 5%& Co. charged depreciation @ 10% p.a. on the diminishing balance. Give ledger accounts in the books of Y &Co.

Ledger of Y & Co. | |||||

Dr. |

|

| X & Co. |

| Cr. |

|

| Rs. |

|

| Rs. |

2000 |

|

| 2000 |

|

|

Jan.1 | To Sales | 74,500 | Jan.1 | By Cash | 20,000 |

Dec.31 | To Interest A/c |

| Dec.31 | By Cash | 20,000 |

| (5% on Rs.54,500) | 2,725 |

| By Balance c/d | 37,225 |

|

| 77,225 |

|

| 77,225 |

2001 |

|

| 2001 |

|

|

Jan.1 | To Balance b/d | 37,225 | Dec.31 | By Cash | 20,000 |

Dec.31 | To Interest A/c | 1,861 |

| By Balance c/d | 19,086 |

|

| 39,086 |

|

| 39,086 |

2002 |

|

| 2002 |

|

|

Jan.1 | To Balance b/d | 19,086 | Dec.31 | By Cash | 20,000 |

Dec.31 | To Interest A/c | 914 |

|

|

|

|

| 20,000 |

|

| 20,000 |

Dr. | Sales Account | Cr. | ||

|

| 2000 |

|

|

|

| Jan. 1 | By X & Co. | Rs. 15,000. |

Interest Account | ||||

Dr. |

|

|

| Cr. |

2000 |

| 2000 |

|

|

Dec.31 to P & L A/c | 2,725 | Dec.31 | By X & Co. | 2,725 |

2001 |

| 2001 |

|

|

Dec.31 to P & L A/c | 1,861 | Dec.31 | By X & Co. | 1,861 |

2002 |

| 2002 |

|

|

Dec.31 to P & L A/c | 914 | Dec.31 | By X & Co. | 914 |

Hire Purchase: Books of Purchaser

Books of Purchaser—First Method. The purchaser can also follow the system adopted by the vendor and make entries like ordinary purchase of an asset. Only, he should credit the vendor with interest due every year and debit him with cash as and when paid. The above given example can be worked out in the following way (ledger accounts.) :—

Dr. |

| Machinery account |

| Cr. | |

|

| Rs. |

|

| Rs. |

2000 |

|

| 2000 |

|

|

Jan.1 | To Y & Co. | 74,500 | Dec.31 | By Depreciation A/c | 7,450 |

|

|

|

| By Balance c/d | 67,050 |

|

| 74,500 |

|

| 74,500 |

2001 |

|

| 2001 |

|

|

Jan.1 | To Balance b/d | 67,050 | Dec.31 | By Depreciation A/c | 6,705 |

|

|

|

| By Balance c/d | 60,345 |

|

| 67,050 |

|

| 67,050 |

2002 |

|

| 2002 |

|

|

Jan.1 | To Balance b/d | 60,345 | Dec.31 | By Depreciation A/c | 6,035 |

|

|

|

| By Balance c/d | 54,310 |

|

| 60,345 |

|

| 60,345 |

2003 |

|

|

|

|

|

Jan.1 | To Balance b/d | 54,310 |

|

|

|

Y & Co. A/c | |||||

2000 |

| Rs. |

2000 |

| Rs. |

Jan.31 | To bank A/c | 20,000 | Jan.1 | By Machinery A/c | 74,500 |

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Interest A/c | 2,725 |

’’ | To Balance c/d | 37,225 |

|

|

|

|

| 77,225 |

|

| 77,225 |

2001 |

|

| 2001 |

|

|

Dec.31 | To Bank A/c | 20,000 | Jan.1 | By Balance b/d | 37,225 |

’’ | To balance c/d | 19,086 | Dec.31 | By Interest A/c | 1,861 |

|

| 39,086 |

|

| 39,086 |

2002 Dec.31 |

To Bank A/c |

20,000 | 2002 Jan.1 |

By Balance b/d |

19,086 |

|

|

| Dec.31 | By Interest A/c | 914 |

|

| 20,000 |

|

| 20,000 |

The student should prepare accounts relating to Interest and Depreciation.

Second Method. Under the second method, entries are passed only when payment is due or made. At this time, the vendor is credited with the amount due. Interest for the period is debited to interest Account and the balance (principal) is debited to the Asset Account. On payment, of course, the vendor is debited and Cash (or Bank) credited. The two entries are:

Depreciation has to be charged according to the cash price of theasset

We give below the journal entries and ledger accounts in the books of X & Co., the purchaser, in the example given above.

Journal of X & Co.

|

|

| Debit (Rs) | Credit (Rs) |

2000 |

|

|

|

|

Jan.1 | Machinery Account | Dr. | 20,000 | |

| To Y & Co. |

| 20,000 | |

| (Amount due to Y & Co. as down payment for purchase of machinery on hire purchase basis.) |

|

| |

|

|

|

| |

Jan.1 | Y & Co. | Dr. | 20,000 | |

| To Bank Account |

| 20,000 | |

| (Payment made to Y & Co. down) |

|

| |

|

|

|

| |

Dec.31 | Machinery Account | Dr. | 17,275 | |

| Interest Account | Dr. | 2,725 | |

| To Y & Co. |

| 20,000 | |

| (The amount due to Y & Co. under the hire purchase Contractfor interest (and debited as such) andthe balance treated as payment for machinery) |

|

| |

| ||||

Dec.31 | Y & Co. | Dr. | 20,000 | |

| To Bank A/c |

| 20,000 | |

| (Payment made to Y & Co.) |

|

| |

|

|

|

| |

Dec.31 | Depreciation Account | Dr. | 7,450 | |

| To Machinery Account |

| 7,450 | |

| (Depreciation for 1st year-10% on Rs.74,500) |

|

| |

|

|

|

| |

Dec 31 | Profit & Loss Account | Dr. | 10,175 | |

| To Interest Account |

| 2,725 | |

| To Depreciation Account |

| 7,450 | |

| (Being interest and depreciation transferred to P/L A/c) |

|

| |

2001 | ||||

Dec.31 | Machinery Account | Dr. | 18,139 | |

| Interest Account | Dr. | 1,861 | |

| To Y & Co. |

| 20,000 | |

| (Amount due to Y & Co. for interest the balance charged to Machinery A/c.) |

|

| |

| ||||

Dec.31 | Y & Co. | Dr. | 20,000 | |

| To Bank Account |

| 20,000 | |

| (Payment made to Y & Co.) |

|

| |

|

|

|

| |

Dec. 31 | Depreciation | Dr. | 6,705 | |

| To Machinery Account |

| 6,705 | |

| (Depreciation for the second year 10% on Rs.67,050; i.e. Rs.74,500 - Rs.7,450). |

|

| |

|

|

|

| |

Dec 31 | Profit & Loss Account | Dr. | 8,566 | |

| To Interest Account |

| 1,861 | |

| To Depreciation Account |

| 6,705 | |

| (Being interest and depreciation transferred to P/L A/c) |

|

| |

2002 | ||||

Dec.31 | Machinery Account | Dr. | 19,086 | |

| Interest Account | Dr. | 914 | |

| To Y & Co. |

| 20,000 | |

| (Amount due to Y & Co. in respect of interest and the principal sum.) |

|

| |

| ||||

Dec.31 | Y & Co. | Dr. | 20,000 | |

| To Bank Account |

| 20,000 | |

| (Payment made to Y & Co.) |

|

| |

|

|

|

| |

Dec.31 | Depreciation Account | Dr. | 6,035 | |

| To Machinery Account |

| 6,035 | |

| (Depreciation @ 10% of the diminishing balance charged for the third years). |

|

| |

|

|

|

| |

Dec 31 | Profit & Loss Account | Dr. | 6,949 | |

| To Interest Account |

| 914 | |

| To Depreciation Account |

| 6,035 | |

| (Being interest and depreciation transferred to P/L A/c) |

|

| |

Ledger Accounts | |||||

Dr. |

| Machinery Account |

| Cr. | |

2000 |

| Rs. | 2000 |

| Rs. |

Jan.1 | To Y & Co. | 20,000 | Dec.31 | By Depreciation | 7,450 |

Dec.31 | To Y & Co. |

| Dec.31 | By Balance c/d | 29,825 |

| (20,000—2,725) | 17,275 |

|

|

|

|

| 37,275 |

|

| 37,275 |

2001 |

|

| 2001 |

|

|

Jan.1 | To balance b/d | 29,825 | Dec.31 | By Depreciation A/c | 6,705 |

Dec.31 | To Y & Co. |

| Dec.31 | By Balance c/d | 41,259 |

| (20,000—1,861) | 18,139 |

|

|

|

|

| 47,964 |

|

| 47,964 |

2002 |

|

| 2002 |

|

|

Jan.1 | To Balance b/d | 41,259 | Dec.31 | By Depreciation A/c | 6,035 |

Dec.31 | To Y & Co. | 19,086 | Dec.31 | By Balance c/d | 54,310 |

|

| 60,345 |

|

| 60,345 |

2003 |

|

|

|

|

|

Jan.1 | To Balance b/d | 54,310 |

|

|

|

Dr. |

| Interest Account | Cr. | ||

2000 |

| Rs. | 2000 |

| Rs. |

Dec.31 | To Y & Co. | 2,725 | Dec.31 | By P & L A/c | 2,725 |

2001 |

|

| 2001 |

|

|

Dec.31 | To Y & Co. | 1,861 | Dec.31 | By P & L A/c | 1,861 |

2002 |

|

| 2002 |

|

|

Dec.31 | To Y & Co. | 914 | Dec.31 | By P & L A/c | 914 |

Dr. |

|

| Y & Co. |

|

| Cr. |

2000 |

| Rs. |

| 2000 |

| Rs. |

Jan.1 | To Bank A/c | 20,000 | Jan.1 | By Machinery A/c | 20,000 | |

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Sundries— |

|

|

|

|

|

| Machinery | 17,275 |

|

|

|

|

| Interest | 2,725 | 20,000 |

|

| 40,000 |

|

| 40,000 | |

2001 |

|

| 2001 |

|

|

|

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Machinery A/c | 18,139 | |

|

|

|

| By Interest A/c | 1,861 | |

|

| 20,000 |

|

| 20,000 | |

2002 |

|

| 2002 |

|

| |

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Machinery A/c | 19,086 | |

|

|

|

| By Interest A/c | 914 | |

|

| 20,000 |

|

| 20,000 | |

Depreciation Account

2000 |

| Rs. | 2000 |

| Rs. |

Dec.31 | To Machinery A/c | 7,450 | Dec.31 | By P & L A/c | 7,450 |

2001 |

| 2001 |

|

| |

Dec.31 | To machinery A/c | 6,705 | Dec.31 | By P & L A/c | 6,705 |

2002 |

| 2002 |

|

| |

Dec.31 | To Machinery A/c | 6,035 | Dec.31 | By P & L A/c | 6,035 |

Solved example

Q1) Cash Price, Rate of Interest and Amount of Installments are given)

Om Ltd. purchased a machine on hire purchase basis from Kumar Machinery Co. Ltd. on

the following terms:

You are required to calculate the total interest and interest included in cash instalment.

Solution:

Calculation of interest

| Total (Rs.) | Interest in each instalment (1) | Cash price in each instalment (2) |

Cash Price Less: Down Payment Balance due after down payment Interest/Cash Price of 1st instalment

Less: Cash price of 1st instalment Balance due after 1st instalment Interest/cash price of 2nd instalment

Less: Cash price of 2nd instalment Balance due after 2nd instalment Interest/Cash price of 3rd instalment

Less: Cash price of 3rd instalment Balance due after 3rd instalment Interest/Cash price of 4th instalment

Less: Cash price of 4th instalment Balance due after 4th instalment Interest/Cash price of 5th instalment

Less: Cash price of 5th instalment Total | 80,000 (21,622) 58,378 -

(9,562) 48,816 -

(10,518) 38,298 -

(11,570) 26,728

-

(12,728) 14,000 -

(14,000) Nil |

Nil

Rs. 58,378 x10/100 = Rs. 5,838

Rs. 48,816 x 10/100 = Rs. 4,882

Rs. 38,298x10/100 = Rs. 3,830

Rs. 26,728 x10/100 = Rs. 2,672

Rs. 14,000 x10/100 =Rs. 1,400

Rs. 18,622 |

Rs. 21,622

Rs. 15,400 – Rs. 5,838 = Rs. 9,562

Rs. 15,400 - Rs. 4,882 = Rs. 10,518

Rs. 15,400 - Rs. 3,830 = Rs. 11,570

Rs. 15,400 - Rs. 2,672 = Rs. 12,728

Rs. 15400 – Rs. 1,400 = 14,000

Rs. 80,000 |

Total interest can also be calculated as follow:

(Down payment + instalments) – Cash Price = Rs. [21,622+(15400 x 5)] – Rs. 80,000 = Rs. 18,622

Q2)Cash Price and Amount of Installments are given; Rate of Interest is not given)

Happy Valley Florists Ltd. acquired a delivery van on hire purchase on 01.04.2011 from Ganesh Enterprises. The terms were as follows:

Particulars | Amount (Rs.) |

Hire Purchase Price | 180,000 |

Down Payment | 30,000 |

1st installment payable after 1 year | 50,000 |

2nd installment after 2 years | 50,000 |

3rd installment after 3 years | 30,000 |

4th installment after 4 years | 20,000 |

Cash price of van Rs. 1,50,000. You are required to calculate Total Interest and Interest included in each instalment.

Solution: Calculation of total Interest and Interest included in each installment Hire Purchase Price (HPP) = Down Payment + instalments= 30,000 + 50,000 + 50,000 + 30,000 + 20,000 = 1,80,000

Total Interest = 1,80,000 – 1,50,000 = 30,000

Computation of IRR (considering two guessed rates of 6% and 12%)

Year | Cash Flow | DF @6% | PV | DF @12% | PV |

0 | 30,000 | 1.00 | 30,000 | 1.00 | 30,000 |

1 | 50,000 | 0.94 | 47,000 | 0.89 | 44,500 |

2 | 50,000 | 0.89 | 44,500 | 0.80 | 40,000 |

3 | 30,000 | 0.84 | 25,200 | 0.71 | 21,300 |

4 | 20,000 | 0.79 | 15,800 | 0.64 | 12,800 |

|

| NPV | 1,62,500 | NPV | 1,48,600 |

Interest rate implicit on lease is computed below by interpolation:

Interest rate implicit on lease= 6% + 1,62,500-1,50,000 x (12-6) = 11.39%

1,62,500-1,48,600

Thus, repayment schedule and interest would be as under:

Installment no. | Principal at beginning | Interest included in each installment | Gross amount | Installment | Principal at end |

Cash down | 1,50,000 |

| 1,50,000 | 30,000 | 1,20,000 |

1 | 1,20,000 | 13,668 | 1,33,668 | 50,000 | 83,668 |

2 | 83,668 | 9,530 | 93,198 | 50,000 | 43,198 |

3 | 43,198 | 4,920 | 48,118 | 30,000 | 18,118 |

4 | 18,118 | 2,064 | 20,182 | 20,000 | 182* |

|

| 30,182* |

|

|

|

* the difference is on account of approximations. | |||||

On January 1, 2011 HP M/s acquired a Pick-up Van on hire purchase from FM M/s. The

terms of the contract were as follows:

(a) The cash price of the van was Rs. 1,00,000.

(b) Rs. 40,000 were to be paid on signing of the contract.

(c) The balance was to be paid in annual instalments of Rs. 20,000 plus interest.

(d) Interest chargeable on the outstanding balance was 6% p.a.

(e) Depreciation at 10% p.a. is to be written-off using the straight-line method.

You are required to:

(a) Give Journal Entries and show the relevant accounts in the books of HP M/s from January 1, 2011 to December 31, 2013; and

(b) Show the relevant items in the Balance Sheet of the purchaser as on December 31, 2011 to 2013.

Solution:

Journal Entries in the books of HP M/s

Date | Particulars | Dr. | Cr. | |

2011 |

| Rs. | Rs. | |

Jan. 31 | Pick-up Van A/c To FM M/S A/c (Being the purchase of a pick-up van on hire purchase from FM M/s) | Dr. | 1,00,000 |

|

|

|

| 1,00,000 | |

“ | FM M/S A/c To Bank A/c (Being the amount paid on signing the H.P. contract) | Dr. | 40,000 |

|

|

|

| 40,000 | |

Dec. 31 | Interest A/c To FM M/s A/c (Being the interest payable @ 6% on Rs. 60,000) | Dr. | 3,600 |

|

|

|

| 3,600 | |

“ | FM M/s A/c (Rs. 20,000+Rs. 3,600) To Bank A/c (Being the payment of 1st instalment along with interest) | Dr. | 23,600 |

|

|

|

| 23,600 | |

“ | Depreciation A/c To Pick-up Van A/c (Being the depreciation charged @ 10% p.a. on Rs. 1,00,000) | Dr. | 10,000 |

|

|

|

| 10,000 | |

“ | Profit & Loss A/c To Depreciation A/c To Interest A/c (Being the depreciation and interest transferred to Profit and Loss Account) | Dr. | 13,600 |

|

|

|

| 10,000 3,600 | |

2012 Dec. 31 | Interest A/c To FM M/s A/c (Being the interest payable @ 6% on Rs. 40,000) | Dr. | 2,400 |

2,400 |

“ | FM M/s A/c (Rs. 20,000 + Rs. 2,400) To Bank A/c (Being the payment of 2nd instalment along with interest) | Dr. | 22,400 |

|

|

|

| 22,400 | |

“ | Depreciation A/c To Pick-up Van A/c (Being the depreciation charged @ 10% p.a.) | Dr. | 10,000 |

|

|

|

| 10,000 | |

“ | Profit & Loss A/c To Depreciation A/c To Interest A/c (Being the depreciation and interest charged to Profit and Loss Account) | Dr. | 12,400 |

|

|

|

| 10,000 2,400 | |

2013 Dec. 31 | Interest A/c To FM M/s A/c (Being the interest payable @ 6% on Rs. 20,000) | Dr. | 1,200 |

1,200 |

“ | FM M/s A/c (Rs. 20,000 + Rs. 1,200) To Bank A/c (Being the payment of final instalment along with interest) | Dr. | 21,200 |

|

|

|

| 21,200 | |

“ | Depreciation A/c To Pick-up Van A/c (Being the depreciation charged @ 10% p.a. on Rs. 1,00,000) | Dr. | 10,000 |

|

|

|

| 10,000 | |

“ | Profit & Loss A/c To Depreciation A/c To Interest A/c (Being the interest and depreciation charged to Profit and Loss Account) | Dr. | 11,200 |

|

|

|

| 10,000 1,200 |

Ledgers in the books of HP M/s

Pick-up Van Account

Date | Particulars | Rs. | Date | Particulars | Rs. |

1.1.2011 | To FM M/s A/c | 1,00,000 | 31.12.2011 | By Depreciation A/c | 10,000 |

|

|

| 31.12.2011 | By Balance c/d | 90,000 |

|

| 1,00,000 |

|

| 1,00,000 |

1.1.2012 | To Balance b/d | 90,000 | 31.12.2012 | By Depreciation A/c | 10,000 |

|

|

| 31.12.2012 | By Balance c/d | 80,000 |

|

| 90,000 |

|

| 90,000 |

1.1.2013 | To Balance b/d | 80,000 | 31.12.2013 | By Depreciation A/c | 10,000 |

|

|

| 31.12.2013 | By Balance c/d | 70,000 |

|

| 80,000 |

|

| 80,000 |

FM M/s Account

Date | Particulars | Rs. | Date | Particulars | Rs. |

1.1.2011 | To Bank A/c | 40,000 | 1.1.2011 | By Pick-up Van A/c | 1,00,000 |

31.12.2011 | To Bank A/c | 23,600 | 31.12.2011 | By Interest c/d | 3,600 |

31.12.2011 | To Balance c/d | 40,000 |

|

|

|

|

| 1,03,600 |

|

| 1,03,600 |

31.12.2012 | To Bank A/c | 22,400 | 1.1.2012 | By Balance b/d | 40,000 |

31.12.2012 | To Balance c/d | 20,000 | 31.12.2012 | By Interest A/c | 2,400 |

|

| 42,400 |

|

| 42,400 |

31.12.2013 | To Bank A/c | 21,200 | 1.1.2013 | By Balance b/d | 20,000 |

|

|

| 31.12.2013 | By Interest A/c | 1,200 |

|

| 21,200 |

|

| 21,200 |

Depreciation Account

Date | Particulars | Rs. | Date | Particulars | Rs. |

31.12.2011 | To Pick-up Van A/c | 10,000 | 31.12.2011 | By Profit & Loss A/c | 10,000 |

31.12.2012 | To Pick-up Van A/c | 10,000 | 31.12.2012 | By Profit & Loss A/c | 10,000 |

31.12.2013 | To Pick-up Van A/c | 10,000 | 31.12.2013 | By Profit & Loss A/c | 10,000 |

Interest Account

Date | Particulars | Rs. | Date | Particulars | Rs. |

31.12.2011 | To FM M/s A/c | 3,600 | 31.12.2011 | By Profit & Loss A/c | 3,600 |

31.12.2012 | To FM M/s A/c | 2,400 | 31.12.2012 | By Profit & Loss A/c | 2,400 |

31.12.2013 | To FM M/s A/c | 1,200 | 31.12.2013 | By Profit & Loss A/c | 1,200 |

Balance Sheet of HP M/s as at 31st December, 2011

Liabilities | Rs. | Assets | Rs. |

FM M/s | 40,000 | Pick-up Van | 90,000 |

Balance Sheet of HP M/s as at 31st December, 2012

Liabilities | Rs. | Assets | Rs. |

FM M/s | 20,000 | Pick-up Van | 80,000 |

Balance Sheet of HP M/s as at 31st December, 2013

Liabilities | Rs. | Assets | Rs. |

|

| Pick-up Van | 70,000 |

Q3) 1st January, 2000 Mr. A purchases from Mr. B machinery whose cash price is Rs. 15,000; Rs. 5,000 is to be paid down, that is on signing of the contract, and Rs. 4,000 is to be paid at the end of each year for 3 years. Rate of interest is 10% p.a. Prepare B’s account in the books of Mr. A

Solution:

A’s Books

Dr. |

|

| B’s Account |

| Cr. |

|

| Rs. |

|

| Rs. |

2000 |

|

| 2000 |

|

|

Jan.1 | To Cash | 5,000 | Jan.1 | By Machinery A/c | 15,000 |

Dec.31 | To Cash | 4,000 | Dec.31 | By Interest A/c | 1,000 |

’’ | To balance c/d | 7,000 |

| (10% on Rs. 10,000) |

|

|

| 16,000 |

|

| 16,000 |

2001 |

|

| 2001 |

|

|

Dec.31 | To Cash | 4,000 | Jan.1 | By Balance b/d | 7,000 |

| To Balance c/d | 3,700 | Dec.31 | By Interest A/c |

|

|

|

|

| (10% on Rs. 7,000) | 700 |

|

| 7,700 |

|

| 7,700 |

2002 |

|

| 2002 |

|

|

Dec.31 | To Cash | 4,000 | Jan.1 | By Balance b/d | 3,700 |

|

|

| Dec.31 | By Interest A/c* | 300 |

|

| 4,000 |

|

| 4,000 |

Q4) Based on particulars given below calculate Interest under the hire purchase system

X & Co.—purchaser Y & Co.-Seller Date of purchase—Jan. 1,1999, Cash price—Rs. 74,500.

Installments Rs. 20,000 on signing of the agreement. Rest in three instalments of Rs. 20,000 each. Rate of Interest—5%. Depreciation 10% on the diminishing Balance.

Solution:

Calculation of Interest | ||

|

| Rs. |

Jan.1, 1999 | Cash Price | 74,500 |

| Less-Cash down | 20,000 |

| Balance Due | 54,500 |

| Interest @ 5% for 1999 | 2,725 |

Dec.31, 1999 | Total | 57,225 |

| Amount paid | 20,000 |

Jan.1, 2000 | Balance Due | 37,225 |

| Interest for 2000 @ 5% | 1,861 |

Dec.31, 2000 | Total | 39,086 |

| Amount paid | 20,000 |

Jan.1,2001 | Balance due 2001 | 19,086 |

| Interest for (balancing figure) 2001 | 914 |

Jan.1,2002 | Amount paid | 20,000 |

Q5) Based on particulars given below calculate Interest under the hire purchase system

X & Co.—purchaser Y & Co.-Seller Date of purchase—Jan. 1,1999, Cash price—Rs. 74,500.

Installments Rs. 20,000 on signing of the agreement. Rest in three instalments of Rs. 20,000 each. Depreciation 10% on the diminishing Balance.

Solution:

Calculation of interest when the rate of interest is not given:

Hire Purchase Price | 80,000 | ||||

Cash Price | 74,500 | ||||

Total interest | 5,500 | ||||

|

|

|

|

|

|

Year | Amount Outstanding | Ratio | Interest | Rs. | |

1 | 60,000 |

| 3 | 3/6 x 5,500 | 2,750 |

2 | 40,000 |

| 2 | 2/6 x 5,500 | 1,833 |

3 | 20,000 |

| 1 | 1/6 x 5,500 | 917 |

AS – 2 Valuation of inventories

Purpose: - The purpose of this standard is to formulate the method of computation of cost of stock, determine the value of closing stock to be shown in the Balance Sheet.

Definition

I. Definition of the Inventory includes the following:

A. Held for sale in the normal course of business i.e finished goods

B. Goods which are in the production process i.e work in progress

C. Raw materials which are consumed during production process or rendering of services (including consumable stores item)

II. Net Realisable Value (NRV):

“Net realizable value is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale”

Valuation of Inventories

Inventories should be valued at lower of cost and net realizable value. Following are the steps for valuation of inventories:

A. Cost of Inventories

The cost of inventories includes the following

ii) Purchase cost

iii) Conversion cost

iv) Other costs which are incurred in bringing the inventories to their present location and condition.

B. Cost of Purchase

While determining the purchase cost, the following should be considered:

i) Purchase cost of the inventory includes duties and taxes (except those which are subsequently recoverable from the taxing authorities)

ii) Freight inwards

iii) Other expenditure which is directly attributable to the purchase

iv) Trade discounts, rebates, duty drawbacks and other similar items are deducted in determining the costs of purchase

C. Cost of Conversion

Cost of conversion includes all cost incurred during the production process to complete the raw materials into finished goods.

Cost of conversion also includes a systematic allocation of fixed and variable overheads incurred by the enterprise during the production process.

Following are the categories of conversion cost:

i) Direct Cost - All the cost directly related to the unit of production such as direct labor

ii) Fixed Overhead Cost- Fixed overheads are those indirect costs which are incurred by the enterprise irrespective of production volume. These are the cost that remains relatively constant regardless of the volume of production, such as depreciation, building maintenance cost, administration cost etc.

iii) Variable Overhead Cost- Variable overheads are those indirect costs of production that vary directly with the volume of production. These are the cost that will be incurred based on the actual production volume such as packing materials and indirect labor.

D. Other Cost

All the other cost which are incurred in bringing the inventories to the current location and condition. For (eg) design cost which is incurred for the specific customer order.

Cost of Purchase: - Cost of purchase includes Purchase Price, Duties and Taxes, Freight Inward and other expenditure directly attributable to the acquisition. Less Duties and Taxes recoverable by enterprises from taxing authorities, Trade Discount, Rebate, Duty drawback.

Disclosure in Financial Statement: - The financial statement should disclose the following:

a) Accounting policy adopted in measuring inventories.

b) Cost formula used.

c) Classification of inventories i.e. finished goods, work in progress, raw materials etc.

Insurance claim

Insurance claim for loss of stock and loss of profit

Steps to claim of loss

Step 1: Create Trading Account (i.e. Account related to previous year)

Trading Account

for the year ended____

Dr. Cr.

Particulars | Amount | Particulars | Amount |

To opening stock To Purchase To Wages To Carriage Inwards To Gross Profit (balancing figure) | xxx xxx xxx xxx xxx

| By Sales By closing stock | xxx xxx

|

xxxx | xxxx |

Create Memorandum Trading Account (i.e. Account related to current year till the date of fire)

for the year ended____

Dr. Cr.

Particulars | Amount | Particulars | Amount |

To opening stock To Purchase To Gross Profit (@__% on sales) | xxx xxx xxx

| By Sales By closing stock (Stock on the date of fire) (Balancing figure | xxx xxx

|

xxxx |

| xxxx |

Step 3: Prepare the following working notes:

Gross Profit Rate = Gross Profit / Sales × 100 |

2. Prepare statement of claim

Amount (Rs.) Estimated Stock on the date of fire = xxx Less: Stock saved/ salvaged = xxx Value of Stock destroyed by fire = xxxx |

3. Calculate Average Clause: (if policy amount is given)

Value of stock on the date of fire |

Claim for loss of profit

The short sales are calculated as under

Particulars Rs.

Estimated sales during the period of indemnity xxx

Add: Increase in price (if any) xxx

Less: Actual sales during the period of indemnity xxx

Short Sales xxxx

Short Sales xxxx

Indemnity period = Period during which sales are expected to be affected due to fire, this period is mentioned in policy. The usual period is one year.

2. Calculate Gross Profit Rate:

Annual Sales |

Standing charges = These are the expenses required to be incurred irrespective of the fact whether the business activities are suspended or not. They includes wages & salary, rent, rates, taxes, insurance, directors fees, auditors fees, interest on loan, etc

3. Calculate Loss of Profit:

Loss of Profit = Short Sales × Gross Profit Rate

4. Calculate increase in cost of working (Working Expenses):

Net profit + All standing charges |

5. Average Clause:

If the amount of the policy is less than the Gross Profit in the standard sales, the amount of claim is reduced in the ratio of amount of policy to Gross Profit in standard sales.

6. Insurance Claim:

Gross Profit in standard sales |

Key takeaways –

Example

A fire occurred in the business premises of Rajesh Traders on 15th October, 2010. from the following particulars, ascertain the loss of stock and prepare a claim for insurance.

Stock on 1-1-2009 Rs.15,300

Purchases from 1-1-2009 to 31-12-2009 Rs.61,000

Sales from 1-1-2009 to 31-12-2009 Rs.90,000

Stock on 31-12-2009 Rs.13,500

Purchases from 1-1-2010 to 14-10-2010 Rs.73,500

Sales from 1-1-2010 to 14-10-2010 Rs.75,000

The stock were always valued at 90% of cost. The stock saved was worth Rs.9,000. The amount of the policy was Rs.31,500, there was an average clause in the policy.

Solution

trading account | |||

particulars | amount | particulars | amount |

To opening stock | 17,000 | By sales | 90,000 |

To purchase | 61,000 | By closing stock | 15,000 |

To Gross profit | 27,000 |

|

|

| 1,05,000 |

| 1,05,000 |

Memorandum Trading Account

for the year ended 15-10-2010

Dr. Cr.

Particulars | Amount | Particulars | Amount |

To opening stock To Purchase To Gross Profit (75,000 × 30 / 100) | 15,000 73,500 22,500 | By Sales By closing stock (Stock on the date of fire)

| 75,000 36,000

|

1,11,000 |

| 1,11,000 |

Working Notes:

(1) Calculation of Stock:

Stock is always valued at 90% of cost

(A) Opening Stock = Rs.15,300 – (90%)

=15,300× 10/90

= 1,700 – (10%)

= 15,300 + 1,700 = 17,000

Opening Stock = Rs.17,000

(b) Closing Stock – Rs.13,500 – (90%)

13,500 ×10/90

= 1,500

13,500 + 1,500 = 15,000

Closing Stock = Rs.15,000.

(2) Calculation of Gross Profit Rate:

(Take the values of previous year i.e. Trading Account)

Gross Profit Rate = Gross Profit / Sales x 100 |

=

27,000/90,000 × 100

= 30%

Gross Profit Rate = 30%

(3) Statement of Claim:

Estimated stock on the date of fire = 36,000

Less: Stock saved = 9,000

Value of stock destroyed by fire = Rs.27,000

(4) Calculation of Average Clause:

(As there is policy value given so we have to calculate average clause)

Average Clause =

Value of stock on the date of fire |

31,500/ 36,000 × 27,000

= 23,625

Average Clause = Rs.23,625

example 2

A fire occurred on 15th December, 2011 in the premises of D Co. Ltd. From the following figures, calculate the amount of claim to be lodged with the insurance company for loss of stock:

Rs. Stock at cost as on 1st April, 2010 2,00,000 Stock at cost as on 1st April, 2012 3,00,000 Purchase for the year ended 31st March, 2011 4,00,000 Purchase from 1st April, 2011 to 15th December, 2011 8,80,000 Sales for the year ended 31st March, 2011 6,00,000 Sales from 1st April, 2011 to 15th December, 2011 10,50,000 During the accounting year 2011-2012, cost of purchase rose by 10% above the previous year’s levels while selling prices went up by 5% The value of stock salvaged was Rs. 20,000 |

Solution:

Trading Account for the year ended 31st March, 2011

Dr. Cr.

To Stock as on 1st April, 2010 To Purchase To Gross Profit (balancing Figure) | Rs 2,00,000 4,00,000 3,00,000 |

By Sales By Stock as on 31st March, 2011 | Rs 6,00,000 3,00,000

|

9,00,000 | 9,00,000 |

Rate of gross profit = 3,00,000 / 6,00,000 × 100 = 50%

Memorandum Trading Account

for the period from 1st April, 2011 to 15th December, 2011

Dr. Cr.

Particulars | Actuals | At last year’s rates | Particulars | Actual | At last year’s rates |

To Stock as on 1st April, 2011 To Purchase To Gross Profit (at last year’s rates = Rs. 10,00,000 × 50/100) (Actual, balancing figure) | Rs 3,00,000 8,80,000

5,30,000 | Rs 3,00,000 8,00,000

5,00,000

|

By Sales By Stock on 15th Dec. 2011 (At last year’s rates -balancing figure) (Actual -on FIFO basis Rs.6,00,000 × 110 × 100) | Rs 10,50,000

6,60,000

| Rs 10,00,000

6,00,000

|

17,10,000 | 16,00,000 | 17,10,000 | 16,00,000 |

Rs.

Value of closing Stock on 31st December, 2011 at current rates 6,60,000

Less: Value of goods salvaged 20,000

Amount of the claim to be lodged 6,40,000

Example 3

On 15th June

2015, the premises and stock of a firm was destroyed by fire but the accounting records were saved from which the following particulars are available:

Stock on 1.1.2014 73,500

Stock on 31.12.2014 81,900

Purchases for the year 2014 3,98,000

Sales for the year 2014 4,87,000

Purchases from 1.1.2015 to 15.6.2015 1,62,000

Sales from 1.1.2015 to 15.6.2015 2,31,200

The stock salvaged was 5,300. Show the amount of claim.

Solution:

Step 1: Preparation of Last Year Trading Account

trading account for the year ending 31st dec 2014 | |||

particulars | amount | particulars | amount |

To opening stock | 73,500 | By sales | 487,000 |

To purchase | 398,000 | By closing stock | 81,900 |

To Gross profit | 97,400 |

|

|

| 568,900 |

| 568,900 |

Step 2: Calculation of Rate of Gross Profit on Sales

Rate of G/P = Net Sales/Gross Profit × 100 = 4,87,000/97,400 × 100 = 20%

Step 3: Preparation of Memorandum Trading Account

Memorandum trading account | |||

particulars | amount | particulars | amount |

To opening stock | 81,900 | By sales | 231,200 |

To purchase | 162,000 | By closing stock | 58,940 |

To Gross profit | 46,240 |

|

|

| 290,140 |

| 290,140 |

Step 4: Calculation of Actual Amount of Loss

particulars | amount |

Stock on the date of fire | 58940 |

less: salvaged stock | 5300 |

Actual amount of loss | 53640 |

Step 5: Calculation of Amount of Claim

The problem does not provide any information about the policy amount. Hence, the amount of claim will be the same as actual amount of loss.

The amount of claim = 53,640.

Example 4

A fire broke out in the warehouse of Merchantile Traders Ltd. on 30th Sep., 15. The company desires to file a claim with the insurance company for loss of stock. From the following information prepare a statement showing the amount of claim. The last account of company were prepared on 31.12.14.

Stock on 31.12.14 1,20,000

Sundry debtors on 31.12.14 3,20,000

Sundry debtors on 30.9.15 2,40,000

Cash received from debtors 11,52,000

Purchases from 1.1.15 to 30.9.15 10,00,000

Rate of Gross Profit on sales 25%

Solution

Total debtors account | |||

particulars | amount | particulars | amount |

To opening balance b/d | 320,000 | By cash received | 1,152,000 |

To credit sales | 1,072,000 | By closing balance c/d | 240,000 |

|

|

|

|

| 1,392,000 |

| 1,392,000 |

|

|

|

|

Memorandum trading account | |||

particulars | amount | particulars | amount |

To opening stock | 120,000 | By sales | 1,072,000 |

To purchase | 1,000,000 | By closing stock | 316,000 |

To Gross profit | 268,000 |

|

|

| 1,388,000 |

| 1,388,000 |

Statement of claim |

|

|

|

particulars | amount |

|

|

Closing stock | 316000 |

|

|

less: salvaged | - |

|

|

Amount of claim | 316000 |

|

|

|

|

|

|

References