Unit II

Contract of Indemnity and Guarantee

Contract of Indemnity

According to Section 124 of the Indian Contract Act, 1872, a contract of indemnity means “a contract by which one party promises to save the other from the loss caused to him by the conduct of the promissory himself or by the conduct of any other person”.

Thus, indemnity means a compensation for the loss incurred.

The person who promises to indemnify the other is called the indemnifier and the person whose loss is to be made good or to whom such promise is made by the indemnifier is known as the indemnified or indemnity holder.

For example, X, a shareholder of a company lost his share certificate. He applied for the duplicate. The company agreed to issue the same on the term that X will compensate the company against the loss where any holder produces the original certificate. Here there is a contract of indemnity between X and the company.

Essentials of a valid Contract of Indemnity

The essential elements of a contract of indemnity are stated below-

Rights of Indemnity Holder

Section 125 of the Act deals with the following rights of indemnity holder when sued upon:

Contract of Guarantee

According to section 126 of the Indian Contract Act, 1872, a contract of guarantee is a contract to perform the promise, or discharge the liability of a third person in case of his default. The person who gives the guarantee is called the surety/guarantor, the person in respect of whose default the guarantee is given is called the principal debtor and the person to whom the guarantee is given is called the creditor. The contract of guarantee may be oral or written.

For example, an employer agrees to keep Ramu as his peon on the guarantee given by his manager Mr. Verma. Later Ramu committed breach of his duties due to which the employer incurred losses. Hence, Mr. Verma was liable for such losses so suffered by the employer.

Essentials of a Contract of Guarantee

i) Existence of a debt: The contract of guarantee exists to secure the payment of a debt. Existence of a debt is primary for a contract of guarantee to arise.

ii) Tripartite agreement: There exist three agreements in a contract of guarantee- one between the creditor and the principal debtor, one between the debtor and the surety and one between the surety and the creditor.

iii) Nature of liability: The liability of the principal debtor is primary and that of the surety is secondary and conditional, as it arises only in case of default by the debtor.

iv) Consideration: There need not be direct consideration between the surety and the creditor. Some benefit accruing to the debtor from the creditor is sufficient consideration for the guarantor/surety.

v) No misrepresentation: The creditor should disclose and should not conceal any facts which are likely to affect the surety’s liability.

Difference between Contract of Indemnity and Guarantee

| Contract of Indemnity | Contract of Guarantee |

1. | Defined U/S 124 of the Indian Contract Act, 1872. | Defined U/S 126 of the Indian Contract Act, 1872. |

2. | Two parties are involved- Indemnity Holder and Indemnifier. | Three parties are involved- Creditor, Principal Debtor and Surety. |

3. | There exists only one contract. | There exist three contracts. |

4. | Indemnifier’s liability is primary. | Surety’s liability is secondary. |

5. | Liability arises on happening of contingency. | Liability arises on existence of debt. |

6. | All parties must be competent. | Principal debtor may be a minor. |

7. | No Right of Subrogation | There is right of subrogation available to the surety. |

Liabilities of Surety

The liability of the surety arises in case of default of the principal debtor. The extent of the surety’s liability is discussed below:

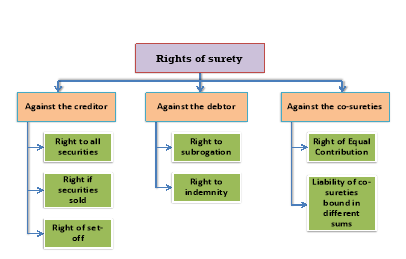

Rights of surety

The surety has the following rights against the Creditor, Principal Debtor and against co-sureties:

B. Rights of surety against the Debtor

C. Rights of surety against co-sureties

Meaning of Bailment

The word ‘bailment’ is derived from the French word ‘bailer’ meaning ‘deliver’. A bailment is the delivery of commodities by an individual to another for specific purpose, on the condition that after the purpose is accomplished, the commodities have to be returned. Common examples of bailment are- hiring of commodities, furniture, or cycle etc. delivering of cloth to a tailor for making suit, delivering of car or scooter for maintenance, depositing luggage etc.

According to Section 148 of the Indian Contract Act, a bailment is the delivery of commodities by one individual to another for some purpose, upon a contract, that they shall, when the purpose is accomplished, be returned or otherwise disposed of according to the direction of the person delivering them. The person delivering the goods is called the ‘Bailor’ and the one to whom they are delivered is called the ‘Bailee’. The transaction is called ‘bailment’. Bailment involves change of possession & not transfer of ownership.

Characteristics of Bailment

Classification of bailment

Gratuitous and non-gratuitous bailment

Bailment for benefits

Voluntary and involuntary bailment

Voluntary bailment is the result of express contract between bailor and bailee whereas involuntary bailment is the result of operation of law.

Rights of Bailor

The rights enjoyed by the bailor are:

Duties of Bailor

The bailor has the following duties:

Rights of Bailee

The rights enjoyed by a bailee are as follows:

2. Right to deliver goods to one of the several joint bailers: when goods have been bailed by several joint owners, the bailee has a right to deliver the goods to one of the several joint owner without the consent of all, in the absence of any agreement to the contrary.

3. Right to deliver goods, in good faith, to bailor: If the bailor has no title to the goods, and the bailee delivers them back to the bailor in good faith, the bailee is not responsible to the true owner in respect of such delivery.

4. Right of action against third party: if a third party wrongfully deprives bailee of the use or possession of the goods bailed, he ha s a right of action against such third party in the same manner as the true owner has against the third person.

5. Right of lien: The bailee has a right to claim his lawful charges and if they are not paid, he is given the right to retain the goods until the charges due in respect of them are paid.

Duties of Bailee

The bailee owes the following duties:

Termination of Bailment

A contract of bailment terminates under the following circumstances:

Pledge

According to Sec. 172 of the Indian Contract Act, 1872, pledge means the bailment of goods as security for payment of a debt or performance of a promise. In this case the bailor is called the ‘Pledger’ or ‘Pawnor’ and the bailee is called the ‘Pledgee’ or the ‘Pawnee’.

This is a special type of bailment where both moveable and immovable properties are pledged.

Pledge by non-owners

The general rule is that it is the owner who ordinary can create a valid pledge. But in the following even non-owner can make a valid pledge.

(a) Pledge by mercantile representative: Where a mercantile mediator is in possession of commodities or the credentials of the title of the commodities, any pledge made by him with the approval of the owner, will be valid and will bind the owner. (Sec. 178).

(b) Pledge by seller in possession after sale: A seller left in possession of commodities after sale can make a valid pledge. The original buyer can obtain damages from the seller but cannot recover the goods from the pledge.

(c) Pledge by co-owner in possession: One of the co-owners in sole possession of the goods may make a valid pledge of the goods with the consent of other co-owners.

(d) Pledge by person in possession under a voidable contract: Pledge created by a person who obtains possession of goods under a voidable contract, is valid, provided the contract has not been rescinded at the time of the pledge and the pledgee acts in good faith.

Rights of pawnee

The rights enjoyed by a pawnee may be enumerated as follows:

2. Right of retainer for subsequent advances: When the Pawnee borrows money to the same pawnor after the time of the pledge, it is assumed that the right of retainer over the pledge of goods extends to subsequent advances also. (Sec174).

3. Rights to extraordinary express: The Pawnee is to receive from the pawnor extraordinary expenses incurred by him for the preservation of the goods pledged but he has no right to retain the goods. (Sec. 175)

4. Right against true owner, when the pawnor’s title is defective: When the pawnor obtained possession of the goods pledged by him under avoidable contract i.e. (by fraud, undue influence, coercion) but the contract has not been rescinded at the time of the pledge, the Pawnee acquires a good title to the commodities (Sec178-A)

5. Pawnee’s right’s where pawnor makes default: Where the pawnor fails to pay debt or performance of the promise, the Pawnee may exercise the following rights:

Rights of pawner:

An agency is a comprehensive word which is used to describe the relationship that arises where one person is employed by another in order to bring the latter into legal relations with a third person.

The terms ‘agent’ and ‘principal’ are contained in Section 182 of the Indian Contract Act, 1872. Accordingly, an agent is a person employed to do any act for another or to represent another in dealings with third persons. The person for whom such act is done, or who is represented, is called the principal.

Characteristics of Agency

A contract of agency has all the essentials of a contract with some special features of its own. They are as follows:

Test of agency

To determine whether agency relationship exist between the parties, following questions may be answered:

If both the questions are answered ‘yes’ then he is an agent otherwise he is not.

Difference between Agent and Servant:

Classification of agents

Classification according to extent of authority:

2. Non-mercantile agent: Non-mercantile agents include legal practitioners, attorneys, insurance persons, clearing and forwarding agents and wife etc.

Modes of Creation of Agency

An agency may be created in different ways. It need not be created expressly. It is created from circumstances and conduct of the parties.

(a)Agency by estoppel: In many cases an agency may be implied from the conduct of the party, though no express authority has been given. Where the principal knowingly permits a person to act in a certain business on his behalf, such principal is stopped from denying the authority of the agent.

(b)Agency by holding out: This agency is based on the ‘doctrine of holding out’ which is a part of the law of estoppels. In this case also the alleged principal is bound by the acts of the supposed agent, if he has induced third parties to believe that they are done with his authority. But unlike an ‘agency by estoppel’, this kind of agency requires some positive act or conduct by the principal to establish agency subsequently.

(c)Agency by necessity: In certain urgent circumstances, the law confers an authority on a person to act as an agent for the benefit of another, there being no opportunity of communicating with the other. Such agency is called an ‘agency of necessity’.

3. Agency by Ratification: Ratification means subsequent adoption and acceptance of an act originally done without instruction or authority. Thus, where a principal affirms or adopts the unauthorized act of his agent, he is said to have ratified that act and there comes into existence an agency by ratification.

4. Agency by operation law: Sometimes an agency arises by operation of law. For example, partners of firm, promoters of a company.

Duties of an Agent

Rights of an agent

Rights of the Principal

The duties of the agent are the rights of the principal, such as:

Duties of Principal

The duties of the principal are the rights of the agent, such as:

Liabilities of the principal and agent towards third parties

B. When agent is acting for unnamed principal: Where the agent does not disclose the name of his principal to the third party, such principal is known as unnamed principal and is liable for all lawful acts of the agent.

C. When agent is acting for an undisclosed principal: Where a third party enters into a contract with the agent without knowing that he is merely an agent of some principal, then the agent will be personally liable to the third party. The principal may intervene any time and demand the third party to perform.

Liability of agent towards third party

An agent working in good faith, on behalf of the principal, and disclosing that he is merely an agent, cannot be held liable towards third parties. However, the agent is liable for any criminal acts done by him.

According to Sec. 201, the various modes of termination of agency are as follows:

a) Agreement: The relation of principal and agent, like any other agreement, may be terminated at any time and at any state by the mutual agreement between the principal and agent.

b) Revocation by the principal: A principal has an authority to terminate the agency at any time before the agent has exercised his authority, so as to bind the principal unless the agency is irrevocable.

c) Revocation by the agent: An agency may also be terminated by the agent after giving a reasonable notice to the principal.

2. Termination of organization by operation of law:

a) Performance of the contract: The most obvious mode of terminating the agency is to do what the agent has undertaken to do. An agency is terminated when the object of the appointment of agent is accomplished.

b) Death and insanity: When the agent or the principal dies or becomes insane, the agency is terminated.

c) Destruction of subject matter: An agency which is created to deal with a certain subject matter comes to an end by the destruction of the subject matter.

d) Principal becoming an alien enemy: When the agent and the principal are alien enemies, the contract of agency is void until the countries of the principal and the agent are at peace. If war breaks out between the two countries, the contracts of agency are terminated.

e) Termination of sub-agents’ authority: The termination of an agent’s authority puts an end to the sub-agent’s authority.

f) Dissolution of a company: If the principal or agent is an incorporated company, the agency automatically ceases to exist on dissolution of the company.

g) Termination by subsequent impossibility: When the implication of an agency becomes unlawful due to subsequent change of law, the agency automatically gets terminated.

Key Takeaways

Democracy requires an informed citizenry and transparency of information which are vital to its functioning and also to contain corruption and to hold governments and their instrumentalities accountable to the governed, says the preamble of the Indian Right to Information (RTI) Act, 2005.

Information as a term has been derived from the Latin words ‘formation’ and ‘forma’ which means giving shape to something, and forming a pattern respectively. Information is needed by human beings to realize their full social, political and economic potential. It is the key which helps make decisions. It is also a public resource collected and stored by government in trust for people.

The Right to Information Act, 2005 (RTI) is a Central Legislation “to provide for setting out the particular regime of right to information for citizensâ€. The right to Information Bill, 2005 was passed by the Lok Sabha on May 11, 2005 and by the Rajya Sabha on May 12, 2005 and received the assent of the President of India on June 15, 2005 and came to force on October 12, 2005.It has replaced the Freedom of Information Act, 2002.

This act is applicable throughout India except the state of Jammu and Kashmir. (Jammu and Kashmir has a similar act which was enacted in 2009.) This law is very comprehensive and covers almost all matters of governance and has the widest possible reach, being applicable to Government at all levels- Union, State and Local as well as recipients of government grants.[1]

The Right to Information Act is in accord with Article 19 of the Constitution of India, which enables Indians to exercise their fundamental Right of Speech, Expression and – as often interpreted by the Supreme Court – “the inalienable Right to receive and impart Informationâ€. Currently, the RTI Act in India is passing through a decisive phase, much more needs to be done to facilitate its growth and development.

Objectives of RTI

Good governance has four elements- transparency, accountability, predictability and participation and RTI helps in achieving the same

Right to Information is just like oxygen for democracy. It stands for transparency. Information would lead to openness, accountability and integrity. Besides, apart from ensuring greater transparency it also acts as a deterrent against the arbitrary exercise of public powers. A culture of individual action, political consciousness and public spirit is the basis for the success of democracy.

“Open Government is the new democratic culture of an open society towards which every liberal democracy is moving and our country should be no exception. In a country like India which is committed to socialistic pattern of society, right to know becomes a necessity for the poor, ignorant and illiterate masses.â€[4]

Objective of the Act is to establish “the practical regime of right to information for citizens to secure access to information under the control of public authorities, in order to promote transparency and accountability in the working of every public authority, the constitution of a Central Information Commission and State Information Commission and for matters connected therewith and incidental thereto.â€[2]

Greater Accountability: One of the brilliant features of RTI is that it makes public authorities answerable to the general public, which strengthen the participatory democracy. Every public authorities is required to provide reasons for its administrative and quasi-judicial decisions to the affected persons u/s 4(1)(d) of the Act, and hence the possibility of arbitrariness reduce to the great extent.

# The worldwide accepted indicators of good governance over the period of time are:

Greater Transparency: Rights which are provided in various sections of the Act certainly facilitates the greater transparency in work of public authorities. For instance, under section 2(j), of the Act, a citizen has the right to:

The commission u/s 20(1) has power to impose penalties or to recommend disciplinary action against the information providers, if held for being stone in path of the free flow of information. In other words, intention of the framers of this Act is that there should not be any bottle neck in the process of free flow of information to the citizens. The citizens are thus better informed about the performance and contributions of the elected representatives, which augurs well for a healthy democracy and democratic governance of projects.

Right To Information: A Global View

Over 50 countries now have freedom of information laws and another 15-20 are actively considering adopting one. These nations are joined by a growing number of inter-Governmental bodies – including the World Bank, European Union and UNDP – that have established FOI policies. It provides that all citizens enjoy rights of freedom of opinion and expression, including the right to “seek, receive, and impart information and ideas, a guarantee now generally considered to include an obligation of openness on the part of Government.[8]

The UN’s Universal Declaration of Human Rights of 1948 had a catalytic effect on movements for open government, worldwide. Many democratic countries have taken legislative action to give its citizens a right of access to information in the possession of the government and its agencies. USA passed the Freedom of Information Act, 1966, which was extensively amended in 1974, and again 1976, 1983. Canada enacted Access to Information Act in 1982. Australia and New Zealand also passed similar legislation in 1982 and 1983, respectively. In keeping with the spirit of the Universal Declaration of 1948 and its Article 19, the Preamble of the Constitution of India, adopted in 1950, has in its Article 19(1)(a) provides exactly similar guarantees to the citizens, the right to ‗freedom of speech and expression‘ as one of the fundamental rights listed in Part III of the Constitution.

More than 50 countries now have guaranteed their citizens the right to know. However, freedom of information legislation is not a new concept. It has been into existence since 18th century as evident in the case of Sweden. The history of RTI is a struggle between the power of the state and that of the civil society. The degree of success has invariably been determined by their relative strengths, although external factors may have sometimes played a role. In many regions enactment of RTI had resulted from the fall of authoritarian regime.

Important Features of Right To Information Act, 2005

1) All citizens possess the right to information

2) The term Information includes any mode of information in any form of record, document, e-mail, circular, press release, contract sample or electronic data etc.

3) Rights to information covers inspection of work, document, record and its certified copy and information in form of diskettes, floppies, tapes, video cassettes in any electronic mode or stored informations in computer etc.

4) Applicant can obtain Information within 30 days from the date of request in a normal case

5) Information can be obtained within 48 hours from time of request. If it is a matter of life or liberty of a person.

6) Every public authority is under obligation to provide information on written request or request by electronic means.

7) Certain information is prohibited.

8) Restrictions made for third party information Appeal against the decision of the Central Information Commission or State Information Commission can be made to an officer who is senior in rank.

9) Penalty for refusal to receive an application for information or for not providing information is Rs. 250/- per day but the total amount of penalty should not exceed Rs. 25,000/-.

10) Central Information Commission and State Information Commission are to be constituted by the Central Government and the respective State Governments.

11) No Court can entertain any suit, application or other proceedings in respect of any order made under the Act.

The aforesaid mentioned promote transparency in government organisations, makes them function more objectively thereby enhancing predictability. In a fundamental sense, right to information is a basic necessity of good governance.[9]

Other Legal Provisions

Prior to the enactment of a comprehensive law on access to information in 2005 several Indian laws provided for the right to access information in a specific context. • Section 76 of the Indian Evidence Act, contains what has been termed as freedom of information in embryonic form. This provision requires public officials to provide copies public documents to anyone who has a right to inspect them. • The Factories Act, 1948 provides for compulsory disclosure of information to factory workers regarding dangers, including health hazards, and also the measures to overcome such hazards. • The Environment (Protection) Act, 1986 and environmental Impact Assessment Regulations provide for instances of public consultation and allow access to information about the pollution caused by industries covered by the regulations. Recently, the Commission to review the Constitution of India in its report recommends explicit inclusion of right to information including freedom of press and other media as a fundamental right.

Introduction to Consumer Protection

Consumer Protection is a term given to an exercise wherein we need to protect the consumer from the unfair practice, teaching them about their rights and responsibilities and also redressing their grievances.

In today’s world, the protection of the consumer is regarded to be of utmost importance. All around the world, mechanisms have been pondered upon in order to uphold the satisfaction of the consumer.

The main objectives of the Consumer Protection Act are:

(a) Providing better and all-round protection to consumer.

(b) Providing machinery for the speedy redressal of the grievances.

(c) Creating framework for customers to seek redressal.

(d) Providing rights to consumers.

(e) Safeguarding rights of Consumers.

Other objectives can be:

REASON FOR ENACTING CONSUMER PROTECTION ACT

The Consumers were the worst affected out of a trade cycle procedure as they could be effortlessly duped by the sellers or producers of products. Before the enactment of this act the consumers were easy targets as victims of the producers in the following ways-

1. Non-awareness regarding the market price of a particular product: A consumer who's no longer used to the duping techniques of sellers could be easily fooled by means of some clever sellers making easy money through demanding higher price for the same exact being sold at a much cheaper rate somewhere else. The price of a commodity in a perfectly competitive market is bound to be the same everywhere, sellers demanding higher fees will lose customers. But people who are not aware of the prevailing market price of the commodity they want to buy might be fooled.

2. Quality of the product- The quality of the good is a very important fact affecting the price of the commodity. If the quality is not equivalent to the price asked for the good, then the buyer's interests will be toyed with towards which the government should be considerate towards.

3. Adulteration of goods: To protect the consumer's rights from being hampered severely stringent steps must be taken in order to protect the goods from being tampered with through adulteration. Adulteration might have an effect on health due to the harmful substances mixed to get the desired apparent appearance.

4. Forum for the redressal of the grievances of the consumers: The act also helped in establishing a permanent forum where the aggrieved consumers could lodge cases against sellers and goods sold.

Who is a Consumer? [Sec 2(1)(d)]

A "consumer" means any person who

1. Buys any goods for a consideration. Any user of such goods when 1 such use is made with the approval of a person who buys goods for consideration.

2. Hires or avails of any services for a consideration. Any beneficiary of such services when such services are availed of with the approval of the person who hires or avails of any services for a consideration.

3. But does not include a person who avails of such services for any commercial purpose. (Commercial purpose does not include purchase of goods or hiring of services for earning livelihood by means of self. employment.)

Consideration has been paid or promised or partly paid and partly promised, or under any system of deferred payment. There has to be a sale transaction for consideration.

Who is not a Consumer?

A person is not a consumer if he -

1. Buys any goods without a consideration. Any user of such goods when such use is made without the approval of person who buys goods for consideration.

2. Hires or avails of any services without a consideration. Any beneficiary of such services for consideration when such services are availed of, without the approval of the person who hires such services for consideration.

3. Obtains the goods for resale or commercial purpose.

4. Obtains the service under a contract of personal service.

Who is a Person? [Sec. 2(1)(m)]

A person includes -

A firm whether registered or not

A Hindu undivided family

A Co-operative society

Every other association of persons whether registered under the Societies Registration Act, 1860 or not,

The definition of a "person" is inclusive. It includes both individual and legal person. Any company or association or body of individuals whether registered or not, means a "person".

What are Goods? [Sec. 2(1)(i)]

What is Service? [Sec. 2(1)(o)]

"Service" means service of any description which is made available to potential users and includes, but not limited to, the provisions of facilities In connection with banking, financing insurance, transport, processing supply of electricity or other energy, boarding or lodging or both, housing construction, entertainment, amusement or the purveying of news or other information, but does not include the rendering of any service free of charge or under a contract of personal service.

CONSUMER PROTECTION COUNCIL AND REDRESSAL AGENCIES

(1) The Central Government may, by notification, establish with effect from such date as it may specify in such notification, a council to be known as the Central Consumer Protection Council (hereinafter referred to as the Central Council). (2) The Central Council shall consist of the following members, namely, -

(a) The Minister in charge of 1[consumer affairs] in the Central Government, who shall be its Chairman, and

(b) Such number of other official or non-official members representing such interests as may be prescribed.

(1) The Central Council shall meet as and when necessary, but 1[at least one meeting] of the council shall be held every year.

(2) The Central Council shall meet at such time and place as the Chairman may think fit and shall observe such procedure in regard to the transaction of its business as may be prescribed.

(a) The right to be protected against the marketing of goods 2[and services] which are hazardous to life and property;

(b) The right to be informed about the quality, quantity, potency, purity, standard and price of goods 1[or services, as the case may be], so as to protect the consumer against unfair trade practices;

(c) The right to be assured, wherever possible, access to a variety of goods and services at competitive prices;

(d) The right to be heard and to be assured that consumers' interests will receive due consideration at appropriate forums;

(e) The right to seek redressal against unfair trade practices 1[or restrictive trade practices] or unscrupulous exploitation of consumers; and

(f) The right to consumer education.

(2) The State Council shall consist of the following members, namely, -

(a) the Minister in-charge of consumer affairs in the State Government who shall be its Chairman;

(b) Such number of other official or non-official members representing such interests as may be prescribed by the State Government.

(3) The State Council shall meet as and when necessary but not less than two meetings shall be held every year.

(4) The State Council shall meet at such time and place as the Chairman may think fit and shall observe such procedure in regard to the transaction of its business as may be prescribed by the State Government.

The objects of every State Council shall be to promote and protect within the State the rights of the consumers laid down in clauses (a) to (f) of section 6.

(a) The collector of the district, who shall be its chairman, and

(b) Search number of other official and non-official members representing such interest as may be prescribed by the State Government.

The District Council shall meet as and when necessary but not less than two meetings shall be held every year. the District Council shall meet at such time and place within the district as the chairman may think fit and shall observe search procedure in regard to the transaction of its business as may be prescribed by the State Government.

1. District Forum:

District forum consists of a president and two other members. The president can be a retired or working judge of District Court. They are appointed by using state government. The complaints for goods or services worth Rs 20 lakhs or less can be filed in this agency. The agency sends the goods for testing in laboratory if required and gives decisions on the basis of facts and laboratory report. If the aggrieved party is not cosy by the jurisdiction of the district forum then they can file an appeal against the judgment in State Commission inside 30 days by depositing Rs 25000 or 50% of the penalty amount whichever is less.

2. State Commission:

It consists of a president and two other members. The president must be a retired or working decide of high court. They all are appointed by state government. The complaints for the goods really worth more than Rs 20 lakhs and less than Rs 1 crore can be filed in State Commission on receiving complaint the State commission contacts the party against whom the complaint is filed and sends the goods for testing in laboratory if required. In case the aggrieved party is not satisfied with the judgment then they can file an appeal in National Commission within 30 days by depositing Rs 3500 or 50% of penalty amount whichever is less.

3. National Commission:

The national commission consists of a president and four members one of whom shall be a woman. They are appointed by Central Government. The complaint can be filed in National Commission if the value of goods exceeds Rs 1 crore.

If aggrieved party is not satisfied with the judgment then they can file a grievance in Supreme Court within 30 days.

District Commission | State Commission | National Commission | |

Composition | It consists of a president and two other members. | It consists of a president and two other members. | It consists of a president and four other members. |

Who can be a President | A working or retired judge of District Court. | A working or retired judge of High Court. | A working or retired judge of Supreme Court. |

Appointment of President | The president is appointed by the state government on the recommendation of the selection committee. | The president is appointed by the state government after consultation with the chief justice of the High Court. | The president is appointed by the central government after consultation with the chief justice of India, |

Jurisdiction | In 1986, it had jurisdiction to entertain complaints where the value of goods or services does not exceed Rs 5, 00,000 but now the limit is raised to 20 lakhs. | In 1986, it had jurisdiction to entertain complaints when the value of goods or services exceeds Rs 5,00,000 and does not exceed Rs 20,00,000 but now it is raised to more than Rs 20,00,000 and up to Rs1 crore. | In 1986, it had jurisdiction to entertain complaints where the value of goods or services exceeds Rs 20 lakhs but now the limit is raised and it entertains the complaints of goods or services where the value exceeds Rs 1 crore. |

Appeal against orders | Any person who is aggrieved by the order of District Forum can appeal against such order to State Commission within 30 days and by depositing Rs 25000 or 50% of the penalty amount whichever is less. | Any person who is aggrieved by the order of State Commission can appeal against such order to National Commission within 30 days and by depositing Rs 35000 or 50% of penalty amount whichever is less. | Any person who is aggrieved by the order of the National Commission can appeal against such order to Supreme Court within 30 days and by depositing 50% of penalty amount but only cases where value of goods or services exceeds Rs 1 crore can file appeal in Supreme Court. |

In order to get a remedy on the Consumer Protection Act a person by himself has no locus standi under the Consumer Protection Act. A person has to be a consumer as per the definition of consumer given under the Act. There has to be a dispute between the consumer and the trader, many tax or service provider against whom he has a complaint and he seeks his relief provided under the Consumer Protection Act.

According to Section 2 (1) (b) complainant means

References