UNIT I

Generally Accepted Accounting Principles (GAAP)

Accounting Standards: Concept, Meaning, Nature and Purpose

Accounting Standard Concept:

We know that generally accepted accounting principles (GAAP) aim to bring uniformity and comparability to financial statements. In many places, you can see that GAAP allows different alternative accounting treatments for the same item. For example, different stock valuations result in different financial statements.

Such practices can lead the intended user in the wrong direction when making decisions related to his or her field. Given the problems faced by many accounting users, the need to develop common accounting standards has increased.

To this end, the Institute of Chartered Accountants of India (ICAI), which is also a member of the International Accounting Standards Committee (IASC), formed the Accounting Standards Committee (ASB) in 1977. ASB needed accounting. After detailed investigation and discussion, a draft was prepared and submitted to ICAI. After proper review, ICAI finalized them and notified them of their use in the financial statements.

Meaning of accounting standards:

Accounting standards are written statements consisting of rules and guidelines issued by accounting institutions for the preparation of unified and consistent financial statements and other disclosures that affect different users of accounting information. is.

Accounting standards set the conditions for accounting policies and practices with codes, guidelines, and adjustments that facilitate the interpretation of items contained in financial statements and even their handling in the books.

Nature of accounting standards:

Based on the discussion above, accounting standards can be said to be guides, dictators, service providers, and harmonizers in the field of accounting processes.

(I) Useful as a guide to accountants:

Accounting standards serve accountants as a guide to the accounting process. They provide the basis for the account to be prepared. For example, they provide a way to value inventory.

(II) Act as a dictator:

Accounting standards act as a dictator in the field of accounting. In some areas, like dictators, accountants have no choice but to choose practices other than those listed in accounting standards. For example, the cash flow statement must be prepared in the format specified by accounting standards.

(III) Act as a service provider:

Accounting standards constitute the scope of accounting by defining specific terms, presenting accounting issues, specifying standards, and explaining numerous disclosures and implementation dates. Therefore, accounting standards are descriptive in nature and act as a service provider.

(IV) Functions as a harmonizer.

There is no bias in accounting standards and there is uniformity in accounting methods. They remove the effects of various accounting practices and policies. Accounting standards often develop and provide solutions to specific accounting problems. Therefore, whenever there is a contradiction in the accounting problem, it is clear that the accounting standard acts as a harmonizer and facilitates the accountant's solution.

Purpose of Accounting Standards:

Previously, accounting was used to record business transactions of a financial nature. Currently, its main focus is on providing accounting information during the decision-making process.

Accounting standards are required for the following purposes:

(I) To bring unity to accounting methods:

Accounting standards brings equality to accounting methods by proposing standard treatments for accounting issues. For example, AS-6 (revised edition) describes depreciation accounting methods.

(II) To improve the reliability of financial statements:

Accounting is the language of business. The information provided by accountants is often based solely on the information contained in the financial statements, and many users make various decisions about their field. In this regard, financial statements need to provide a true and fair view of business concerns. Accounting standards bring credibility and credibility to different users.

They also help potential users of the information contained in financial statements with disclosure standards that make it easier for even the layperson to interpret the data. Accounting standards provide a concrete theoretical basis for the accounting process. They provide accounting uniformity, make financial statements for different business units comparable in different years, and again facilitate decision making.

(III) Simplify accounting information:

Accounting standards prevent users from reaching misleading conclusions and make financial data easy for everyone. For example, AS-3 (revised edition) clearly classifies cash flows in terms of "sales activities," "investment activities," and "finance activities."

(IV) Prevent fraud and manipulation:

Accounting standards prevent management from manipulating data. By systematizing accounting methods, fraud and operations can be minimized.

(V) Assist auditors:

Accounting standards set the conditions for accounting policies and practices with codes, guidelines, and adjustments for creating and interpreting the items that appear in financial statements. Therefore, these terms, policies, guidelines, etc. are the basis for auditing the books.

Accounting standard formulation procedure

Let's take a quick look at the procedure setup process that ASB follows:

Salient features of Accounting Standard (AS): 1 (ICAI)

The characteristics of accounting standards:

1. Recognize financial events.

2. Measure financial transactions.

3. Presentation of financial statements in a fair manner.

4. Corporate disclosure requirements to prevent erroneous information from being provided to stakeholders.

5. Improve the reliability of financial statements.

6. Check your company's progress and market position with comparability.

7. Required disclosure requirements and valuation methods for various financial transactions.

International Financial Reporting Standards (IFRS): - Need and Procedures

Need of IFRS range

Proper procedure of IFRS

Proper procedures for standards typically include: (* The following means required by the IFRS Foundation's Constitution):

The IASB deliberates at publicly open meetings.

Effective date

Each IFRS and interpretation sets its own effective date and transition policy.

Language

English is the official language of the IASB's discussion documents, exposure drafts, IFRS, and interpretation. If the process guarantees the quality of a translation, the IASB may approve the translation and the IASB may license other translations.

Overview:

Accounting concepts defines the assumption on the basis of which financial statement of a business entity is prepared. Concepts are those basic assumption and condition which form the basis upon which the accountancy has been laid.

Accounting principles

Accounting convention emerges out of accounting practices, commonly known as accounting principle, adopted by various organizations over a period of time. Accounting bodies may change any of the convention to improve the quality of accounting information.

The basic accounting concept is as follows:

A unit of exchange and measurement is required to uniformly account for a company's transactions. The common denominator chosen in accounting is the currency unit. Money is the lowest common denominator for measuring the exchangeability of goods and services such as labor, natural resources and capital.

The concept of monetary measurement considers accounting to be a process of measuring and communicating financially measurable company activity. Obviously, the financial statements should show the money spent.

The concept of measuring money means two limitations of accounting. First, accounting is limited to the generation of information expressed in monetary units. It does not record and convey other relevant but non-monetary information. Second, the concept of monetary measurement concerns the limitation of the monetary unit itself as a unit of measurement.

There are concerns about purchasing power, which is the main characteristic of currency units, or the amount of goods and services that money can obtain. Traditionally, financial accounting has addressed this issue by stating that the concept assumes that the purchasing power of a currency unit is stable over the long term or that price changes are not significant. Although still accepted in current financial reporting, the concept of stable monetary units is subject to continuous and permanent criticism.

2. Entity concept:

The concept of an entity assumes that its financial statements and other accounting information belong to a particular company that is different from its owner. Therefore, an analysis of business transactions, including costs and revenues, is expressed in terms of changes in the company's financial position.

Similarly, the assets and liabilities devoted to business activities are the assets and liabilities of the entity. The company's transaction is reported, not the company's owner's transaction. Therefore, this concept allows accountants to distinguish between personal and commercial transactions. This concept applies to sole proprietorships, partnerships, businesses, and small businesses. It may also apply to multiple companies, such as when a segment of a company, such as a department, or an interrelated company is merged.

3. Dual aspect concept:

This concept is at the guts of the whole accounting process. Accountants record events that affect the wealth of a specific entity. The question is which aspect of this wealth is vital. Accounting entities are artificial creations, so it's essential to understand who their resources belong to or what purpose they serve.

It's also important to understand what sorts of resources you manage, like cash, buildings, and land. Therefore, the accounting record system was developed to point out two main things: (a) the source of wealth and (b) the shape it takes. Suppose Mr. X decides to line up a business and transfers Rs. 100,000 from his personal checking account to a different business account.

He may record this event as follows:

Obviously, the source of wealth must be numerically adequate to the shape of wealth. S (source) must be adequate to F (form) because they're simply different aspects of an equivalent thing, that is, within the sort of equations.

In addition, transactions or events that affect a company's wealth got to record two aspects so as to take care of equality on each side of the accounting equation.

If a corporation acquires an asset, it must be one among the following:

(A) Other assets are abandoned.

(B) There was an obligation to pay it.

(C) Profitable and increased amount of cash the operator has got to pay to the owner.

(D) The owner funded the acquisition of the asset.

This doesn't mean that the transaction affects both the source and sort of wealth.

There are four categories of events that affect accounting equations:

(A) Both the source and sort of wealth are increased by an equivalent amount.

(B) Both the source and sort of wealth are reduced by an equivalent amount.

(C) Some increase without changing the source of wealth, others decrease.

(D) Some sources of wealth increase and a few decreases without changing the shape of wealth retention.

The above example shows category (a) because once you start a transaction for an entity, the source of wealth and therefore the sort of wealth, cash, increases from zero to rupees. 1,00,000. In contrast, X may plan to withdraw Rs. 20,000 cash from business.

In that case, the financial position of the entity would be:

It is essential to know why each side of the equation are reduced. By withdrawing cash, X automatically reduces the availability of personal funds to the business by an equivalent amount. Now suppose Mr. X buys a listing of products for Rs. 30,000 in cash available. His capital supply remains an equivalent, but the composition of his business assets does.

The two aspects of this transaction aren't within the same direction, but are compensatory and are increasing stocks that set a cash reduction. Similarly, sources of wealth are often suffering from transactions. So, if X gives his son Y, it becomes Rs. 20,000 shares of the business by transferring some of his own profits, the consequences are:

However, if X gives YR. He personally receives $ 20,000 in cash, and when Y puts it into the business, each side of the equation are affected. Y capital Rs. 20,000 is balanced by additional Rs. 20,000 in cash, X capital remains rupees. 80,000.

4. Periodicity Concept:

According to this concept, accounting should be created after all periods, not at the end of the entity's lifetime. This period is usually one calendar year. In India, it lasts from April 1st of the year to March 31st of the following year.

This is also known as the concept of fixed accounting periods. According to the concept of "going concern", an entity is expected to have an indefinite life. It is inconvenient for an entity to measure the performance it has achieved in the normal course of its business.

If a spinning mill lasts for 100 years, it is not desirable to measure its performance and financial position only at the end of its life.

Therefore, a small but feasible portion of the entity's life cycle is selected to measure performance and confirm financial position. A year is usually spent measuring performance and assessing financial position. However, it can be 6 months, 9 months, or 15 months.

According to this concept, accounting should be created after all periods, not at the end of the entity's lifetime. This period is usually one calendar year. In India, it lasts from April 1st of the year to March 31st of the following year.

Therefore, you do not need to look at revenues and expenses over an excessively long time frame for performance evaluation. This concept makes the accounting system work and makes the term "occurrence" meaningful. Given the infinite time frame, nothing happens. There can be no unpaid expenses or unreceived income. Accrued expenses or income accrued only occurs when you refer to a finite time frame called the accounting period.

Therefore, the concept of periodicity is simplified in the following ways:

(I) Comparison of financial statements for different periods

(II) Unified and consistent accounting to identify business profits and assets

(III) Matching costs and regular income to obtain correct results of business operations

This concept is derived from the concept of going concern. As we have seen, companies are expected to continue their business indefinitely unless they know the opposite. However, investors and other users of corporate accounting information cannot afford to wait forever for the information they need for their diverse needs. To meet their needs, the "lifetime" of an entity is divided into any specified time period that is shorter than the lifespan of the enterprise. The normal reporting period is 12 months (1 year). Companies also report financial information summarized on an interim basis: semi-annually, quarterly, and even monthly. This is a concept called periodicity, period assumptions, or simply accounting periods. Periods are usually identified in the financial statements.

Periodicity allows report users to compare information over specific time periods and between companies in the same industry (as a basis for decision making). Aside from these advantages, the concept of periodicity has certain drawbacks. For example, this concept assumes that you can identify a business transaction over a specific time period, even if you know that some transactions (such as the purchase of fixed assets) will affect many periods. Also, as the concept implies, determining income on a regular basis leads to a comparison of the results of consecutive periods. Such comparisons can be misleading as the patterns of business activity change over time. In addition, recurring accounts require arbitrary allocation and allocation methods.

5. Realization or Cognitive concept:

The concept of realization or recognition indicates the amount of revenue that should be recognized from a particular sale. Realization rules help accountants determine if revenues or expenses have been incurred. This allows accountants to measure, record, and report on financial reports.

Realization refers to the inflow of cash or cash charges (accounts receivable, accounts receivable, etc.) resulting from the sale of goods or services. Therefore, if the customer purchases Rs. If you pay 500 worth of goods in cash at a grocery store, the store will realize Rs. 500 from the sale.

If the clothing store sells Rs suits. 3,000, if the buyer agrees to pay within 30 days, the store will realize Rs. From sale to 3,000 (accounts receivable) (conservative concept), provided the buyer has a good credit record and the payment is reasonably secure.

The concept of realization states that the amount perceived as revenue is reasonably certain to be realized, that is, reasonably certain to be paid by the customer. Of course, there is room for difference in judgment as to whether or not it is "reasonably certain."

However, this concept explicitly acknowledges that the perceived revenue amount is lower than the selling price of the goods and services sold. The obvious situation is the discounted sale of goods at a price lower than the normal selling price. In such cases, the revenue will be recorded at a lower price rather than the normal price.

6. Matching concept:

The concept of matching in financial accounting is the process of matching (associating) performance or revenue (measured at the selling price of goods and services offered) with labour or expense (measured at the cost of goods and services used) over a specific period of time. is. Targets for which income has been determined.

This concept emphasizes which item of expense in a particular accounting period is expense. That is, expenses are reported as expenses for the accounting period in which revenue related to those expenses is reported. For example, if the sales of some products are reported as revenue for one year, the costs for those products are reported as expenses for the same year.

The concept of matching only needs to be met after the accountant has completed the concept of realization. First measure the revenue according to the concept of realization, then associate the costs with these revenues. Cost matches revenue, but not the other way around.

Therefore, the reconciliation process requires significant cost allocation in acquisition cost accounting. Past (history) costs are investigated and steps are taken to assign a cost element that is considered to have expired service potential or to match it with the associated revenue.

The remaining component of the cost, which is considered to have continued potential for future services, is carried over to the past balance sheet and is called an asset. Therefore, the balance sheet is just a report of unallocated past costs waiting for the estimated future service potential to expire before it matches the appropriate revenue.

7. The concept of accrual accounting:

According to the Financial Accounting Standards Board (USA):

"Accrual accounting is that the financial impact of transactions and other events and situations that affect a corporation on cash, not only during the amount during which it had been received, but also during the amount during which those transactions, events and situations occur. Accrual accounting is paid to the corporate as more (or perhaps less) cash spent on resources and activities, also because the start and end of the method. it's associated with the method of being returned. We recognize that purchases, production, sales, other operations, and other events that affect a company's performance during a period often do not match the receipt or payment of cash for that period. "

Realization and matching concepts are central to accrual accounting. Accrual accounting measures revenue for a period of time as the difference between the revenues recognized during that period and the costs that match those incomes. In accrual accounting, the period revenue is usually not the same as the period cash receipt from the customer, and the period cost is usually not the same as the period cash payment.

Cash Basis Accounting:

In cash-basis accounting, sales are not recorded until the period in which they are received in cash. Similarly, costs are deducted from sales during the period in which the cash payment was made. Therefore, neither realization nor matching concepts apply to cash basis accounting.

In reality, "pure" cash-basis accounting is rare. This is because the pure cash basis approach requires the acquisition of inventory to be treated as a reduction in profit when paying the acquisition cost, not when selling the inventory. Similarly, the cost of acquiring plant and equipment items is treated as a reduction in profit if these long-lived items are paid in cash rather than after they have been used.

Obviously, such a pure cash basis approach would result in a balance sheet and income statement with limited usefulness. Therefore, what is commonly referred to as cash-basis accounting is actually a mixture of cash-basis for some items (especially cost of goods sold and period costs) and accrual-based for others (especially product costs and long-term assets). This mix is sometimes referred to as modified cash-basis accounting to distinguish it from the pure cash-basis method.

Cash-basis accounting is most often seen in small businesses that do not have large inventories because they provide services. Examples include restaurants, hairdressers, hairdressers, and income tax filing companies.

Most of these establishments do not provide credit to their customers, so cash-basis profits may not differ dramatically from accrual income. Nevertheless, cash basis accounting is not permitted by GAAP for any type of entity.

8. Consistency concept:

In this concept, once an organization has decided on one method, it should be used for all subsequent transactions and events of the same nature unless there is a good reason to change it. Frequent changes in accounting methods make it difficult to compare financial statements for one period with financial statements for another period.

Consistent use of accounting methods and procedures over the long term checks income statement and balance sheet distortions, and possible operations on these statements. Consistency is needed to help external users compare the financial statements of a particular company over time and make sound economic decisions.

9. Conservatism concept:

This trait can be considered a reactive version of the Minimax management philosophy. That is, it minimizes the potential for maximum loss.

The concept of accounting conservatism suggests that accounting should be cautious and cautious until the opposite evidence emerges, where and when uncertainty and risk exposure are legitimate. Accounting conservatism does not mean intentionally underestimating income and assets. It applies only to situations where there is reasonable doubt. For example, inventories are valued at the lower end of cost or market value.

In its application to the income statement, conservatism encourages recognition of all losses incurred or may occur, but does not recognize profits until they are actually realized. Early depreciation of intangible assets and restrictions on recording asset valuations have also been motivated, at least to some extent, by conservatism. Not recognizing revenue until the sale is made is another sign of conservatism.

10. Materiality concept:

The law has a doctrine called de minimis non curat lex. This means that the court does not consider trivial issues. Similarly, accountants do not attempt to record events that are not so important that the task of recording them is not justified by the usefulness of the results.

The concept of materiality means that transactions and events that have a non-significant or non-significant impact must not be recorded and reported in the financial statements. Recording of non-essential events is claimed to be unjustifiable in terms of their low usefulness to subsequent users.

For example, conceptually, a brand-new paper pad is an asset of an entity. Each time someone writes on the pad's page, some of this asset is exhausted and retained earnings are reduced accordingly. Theoretically, it is possible to see how many partially used pads the company owns at the end of the accounting period and display this amount as an asset.

However, the cost of such efforts is clearly unreasonable, and accountants are not willing to do this. The accountant took a simpler action, albeit inaccurate, that the asset was exhausted (expenditure) when the pad was purchased or when the pad was issued to the user from the consumable inventory. Treat as.

Unfortunately, there is no consensus on what it means to be important and the exact line that distinguishes between important and non-important events. Decisions depend on judgment and common sense. The accounting creator is meant to interpret what is important and what is not.

Perhaps the importance of an event or transaction can be determined in terms of financial position, performance, changes in an organization's financial position, and its impact on user evaluations or decisions.

11. Going Concern Concept:

An entity is considered to be in business unless there is evidence of opposition. Because companies are relatively permanent, financial accounting is designed with the assumption that the business will survive indefinitely in the future.

The Going Concern concept justifies the valuation of assets on a non-clearing basis and requires the use of acquisition costs for many valuations. In addition, fixed and intangible assets are amortized over their useful lives, rather than in shorter periods, in the hope of early liquidation.

This further means that the data transmitted is tentative and that the current statement should disclose adjustments to the statement over the past year revealed by more recent developments.

12. Historical Cost Concept

The concept of cost is that the asset should be recorded at the exchange price, that is, the acquisition cost or the acquisition cost. Acquisition costs are recognized as an appropriate valuation criterion for recognizing the acquisition of all goods and services, costs, expenses and capital.

For accounting purposes, business transactions are usually measured in terms of the particular price or cost at which the transaction occurred. That is, financial accounting measurements are based on exchange prices, where economic resources and obligations are exchanged. Therefore, the quantity of an asset listed during a company's account doesn't indicate what the asset could also be sold for.

The concept of acquisition cost means there's little point in revaluing an asset to reflect its current value, because the company has no plans to sell its asset. Additionally, for practical reasons, accountants like better to report actual costs over market values that are difficult to verify.

Accounting Principles

The basic assumptions and concepts mentioned above have been modified to make accounting information useful to a variety of stakeholders. The principles of these changes are as follows:

Principles are:

1. Cost-benefit

2. Importance

3. Consistency

4. Be cautious

This amended principle states that the cost of applying the principle must not exceed the benefits obtained from it. If the cost is greater than the profit, then the principle needs to be changed.

2. Materiality Principle

The principle of materiality requires that all relatively relevant information be disclosed in the financial statements. Important non-essential information is omitted or merged with other items.

3. Principle of Consistency

The purpose of the principle of consistency is to maintain the comparability of financial statements. The rules, practices, concepts and principles used in accounting should be continuously adhered to and applied annually. Comparing the financial results of a business between different accounting periods is important and meaningful only if you follow consistent practices in reviewing them. For example, asset depreciation can be provided in a variety of ways, but whichever method you choose, you must do it on a regular basis.

4. Principle of Prudence (conservatism)

The principle of prudence takes into account all expected losses, but leaves all expected benefits. For example, when valuing a stock in trade, the lower of the market price and cost is taken into account.

What is accounting software?

Accounting software is a useful tool for recording the flow of funds in a company and examining its financial position. You can use it to record transactions, generate reports, manage customer and vendor contacts, create purchase orders, track inventory levels, bill customers, and monitor account balances. [Check out the best accounting software and invoice generator recommendations.]

“Accounting packages help us organize our records and' force' to a systematic structure,” Ken Stalcup, senior director of Houlihan Valuation Advisors, told business.com. "

What are the features of accounting software?

Now that you understand what accounting software is and why you need to use it, it's important to know the tools and features you're looking for when choosing a system. Almost all online accounting software uses double-entry bookkeeping to ensure accuracy and includes accounts receivable, accounts payable, banking and reporting capabilities. Some also include inventory management, project management, time tracking, and payroll tools, but these features are typically included in higher-tier plans or add-ons that cost extra. Here are some core elements of accounting software.

1. Accounts receivable

It needs to be able to proceed the bill and track what the consumer is borrowing (accounts receivable, or A / R) and their payments. Here are a number of the most A / R features to seem for:

Invoice processing

At a minimum, your accounting software must be able to process your bill. When money is borrowed from you, you need to know from whom, how much, and when to expect payment. All accounting systems allow you to print invoices, but in most cases, you can email invoices. The system must remember basic customer data like name, address, account number, and standard terminology. Most software systems today also remember standard prices for a variety of products and services.

Automatic billing

This ensures that your revenue isn't delayed because you forget to send your invoice. In addition, with automated statements and delayed reminders, the accounting software acts as a collection department to notify customers of invoice payments.

Payment procedure

Many accounting systems allow customers to pay invoices online by clicking the button on the electronic invoice to send. There are many benefits to vendors, including reduced staff time spent processing checks and making bank deposits, increased payment security, and reduced processing time. However, it costs money. Expect to pay the same fees as a credit card processing company to get your accounting system to process your debit and credit card payments.

Some systems allow you to deposit ACH payments directly into your checking account. Also, there is no such thing as automatically paying your checking account every month without waiting for a check by mail or sending money to a bank. This also costs money in many cases, but is usually cheaper than accepting card payments.

2. Accounts payable

No one likes to pay invoices, but tracking what you owe is essential for any business. There are many ways the accounting system handles the outflow side of funds. Here are a number of the foremost useful accounts payable (A / P) features:

Purchase order

Processing and borrowing purchases is one of the main tasks of accounting software, but its features range from creating simple purchase orders to following quotes, purchasing and paying.

Vendor credit memo

It's easy for businesses to lose track of all the credits that vendors frequently distribute, either as rewards or returns. However, credit notes are as valuable as cash, so a system that can track them can help keep costs down.

Automatic payment

From scheduling bank payments and direct deposits to printing checks, many A / P modules fully automate the payment process and keep you up to date.

IRS tax form

Having a database of the most common tax returns, such as 1099 and 1096, can save you a lot of time. This is especially true if the accounting system can fill out all the required data on the form and submit them electronically to the IRS. Electronic tax payments and form submissions can help prevent penalties for late payments.

3. Salary

In some accounting systems, the payroll module is very sophisticated and provides a complete payroll service that does everything from time calculation and wage processing to payroll tax payments and 401 (k) deductions. some characteristics are:

Fluctuating wage schedule

A system that can accurately calculate the amount to be paid to an employee, whether paid to the employee or paid on an hourly basis, is essential. Problems occur when there are many intermittent ones.

Workers or part-time staff. Many of them are paid on weekly basis or biweekly. The software needs to be able to handle different payroll schedules, along with different types of rewards (commissions, salaries, profit sharing, bonuses, etc.) and benefits (health insurance, severance pay plans, and even paid parking benefits).

Direct deposit

This is essential for accounting software's recent support, as most people expect their salaries to be deposited directly into their bank accounts. With decent accounting software, you should be able to set up scheduled direct deposit payments.

Automatic tax calculation

This ranges from basic deduction-only processing to providing sophisticated tax rates and printing relevant forms. Check if your system supports new employee reporting, expense tracking, W-4 and W-9. Would you like to process monthly federal tax deposits and quarterly federal tax reports, such as Form 941? Would you like to process annual reports and returns for W-2, W-3, Form 940, 1099, etc.? Can I file a tax return for income tax or unemployment insurance? Can you handle workers' accident compensation insurance calculations and payments?

Expense refunds and deductions

If employees bear tax-deductible expenses such as travel and entertainment expenses, they need a system that can handle these refunds and ensure that payments meet the tax deadline.

4. Bank

At the very least, accounting software needs some form of link to your bank account. This allows you to make direct payments and import real-time data from your bank into your accounting system. Some software can go even further.

Account adjustment

If you have multiple bank accounts, software that can track and adjust all of them is essential. Make sure your program includes the General Ledger feature and the check book reconciliation.

Bank deposit preparation

These days, accounting packages that can't handle basic electronic deposit settings are unheard of, but you need to know what types of electronic payments you can handle.

Please check the handling

If you pay a lot of money with a check, you can save a lot of time by using a system that can print and process your check. Also be aware of other features such as check invalidation and notification of duplicate check payments.

What reporting options does accounting software offer?

In addition to the set of features available in accounting software, the quality and quantity of reports that a system can generate vary greatly. Some systems offer a wide range of reporting options in virtually unlimited categories. Others only provide basic reports: depositing and withdrawing money. Here are some better options.

Standard report

The accounting system must be able to generate the usual reports used in business, such as income statements (income statements), balance sheets (assets and liabilities), cash flow statements, accounts receivable, accounts payable, and salary summaries.

Customizable report

A system that enables customizable reporting options allows you to create and compile selected reports. Look for a system that allows you to easily add or remove columns from standard reports, resize column widths, and remember custom reports for future replication.

Graph summary

Long lists of numbers can be difficult to interpret, so software that can convert data to image formats such as pie charts and bar charts can help you understand where your money is going. Look for the ability to display the previous year on the same graph as the colour coding feature for easy comparison.

Cost forecast

All reports help identify trends, but systems that can interpret data, perform statistical analysis, and make forecasts help make financial decisions based on facts rather than guesses. Look for a system that includes budgeting, quoting, and other cost features.

Subsidiary report

If you have multiple businesses, a system that can integrate certain financial aspects can provide a better view of your entire portfolio than you can estimate from individual reports.

Accounting software is employed to gather and report information about the financial viability of a business. This software is vital for correct management of your organization. Before deciding which software package to use, it's important to know the various sorts of accounting software and therefore the situations during which you would like to use each. the subsequent list shows the overall classification of accounting software.

You can run a really small business just by using electronic spreadsheets in your accounting software. Spreadsheet software is inexpensive and therefore the system is often configured in any way. However, spreadsheets are error-prone because the knowledge are often entered within the wrong place, incorrectly entered, or not entered in the least, leading to inaccurate financial statements. Therefore, spreadsheets are typically used only in organizations with very low transaction volumes.

2. Commercial software

Commercial off-the-shelf (COTS) software is that the leading accounting software used round the world. it's reasonably configurable for your business needs, contains multiple layers of error detection to stop misinformation entry, and typically produces standard reports which will be configured for your needs. There are COTS packages that are specific to a specific industry and have additional features to satisfy the requirements of the target market. COTS software may require the services of a consultant to put in and should require a lengthy installation process also as onsite staff to take care of the software. A variation of this idea is accounting software available as a web service, which needs users to log in to the vendor's site to access the software. The latter approach requires you to pay a monthly fee for every user instead of pre-purchasing the software.

3. Enterprise Resource Planning Software (ERP)

ERP software consolidates information from all parts of your business into one database. This approach eliminates the issues related to using independent department-specific software that doesn't share information. However, it's very expensive and may take a year or more to put in. This software is typically only needed within the largest and most complex organizations.

4. Custom accounting software

This software is custom developed for your organization. This approach is typically only taken when the requirements of the entity are very specific and can't be met by the COTS or ERP package. However, custom software is buggy and requires more maintenance than off-the-shelf packages, so this approach is never adopted.

Accounting is that the first and most crucial skill for SMEs to survive.

It helps you track the situation of money flow and whether your start-up will achieve it by the top of the year. Therefore, if you actually want to enhance your accounting and finance skills, accounting software may be a good way to enhance your financial skills as an SMB. When well-integrated, it becomes a crucial a part of the system and may significantly improve all of your company's finances, from bookkeeping to tax accounting.

If the start-up is running effectively, accounting will help track take advantage all operating activities. As a result, if you would like to proportion, your business must exceed your budget.

This is where accounting software comes in. Benefits include time savings, cost savings, and increased productivity.

Below are just a couple of the various benefits of using online software tailored specifically for little businesses.

1. Saving time, money and expenses with accounting software

This is one among the simplest things about using accounting software to drive your business operations. the very fact that you simply can automate some, if not all, accounting tasks are often very helpful.

For example, consider paying an invoice. Most folks automatically pay your phone and internet bills monthly, except for businesses, you add a monthly fee. Also, if you pay manually, you're wasting tons of the time you'll have spent somewhere good.

By using Invoice Berry to trace your expenses, you'll basically track your expenses on the pass category. this suggests you'll create reports to ascertain where and the way you spend most of your money. Of course, this is often all done automatically.

2. Convenience of accounting software

This is directly linked to the above. Today, convenience is everything.

Ideally, the simplest sort of accounting software is straightforward and straightforward to line up. When a corporation decides on software, it are often distracted by the flashy features that it's going to need just just in case and pay quite it must.

On the opposite hand, if your small business needs software to process invoices, you would like something that's quick and straightforward to line up.

Invoice Berry is meant with accessibility in mind for both you and your clients. All the tools you would like are online, which may prevent tons of billing time. It doesn't waste time downloading and fixing unwanted software, so it's easily accessible to both parties.

Accounting Convenience-Software

The name of the sport here is User Experience.

Invoicing are going to be easier than ever when everything is already available online.

3. Customize

Customization is another important a part of accounting software.

Because, actually, your operational activities are unique to you and you. Sure, you would possibly find someone within the same industry who is more or less doing an equivalent number – but your income is exclusive to you.

Do you know where I'm going with this?

Customization is vital because it tailors your accounting needs specifically to your company. Not the opposite way around.

By customizing your invoice, you'll give life and personality to your business. With Invoice Berry's invoice template, you'll add logos, specific terms of use, payment methods and more to form your invoice really yours.

With this feature, you'll send professional yet crisp invoices, bespoke up to T, designed to satisfy all of your needs.

4. Tracking is simpler

One of the foremost important financial goals for a corporation is tracking and analysis.

However, it is often difficult to succeed in that goal without managing your invoices. you ought to always closely monitor your income and invoices to seek out areas for improvement.

For example, are invoices paid on time? Is there how to hurry up the process? the way to bear with late clients?

Accounting-Software-Tracking-Data

Data and analytics are an excellent thanks to determine if your business is occupation the proper direction.

Fortunately, you'll use Invoice Berry to simply track your expenses and invoices and save them for later reference. With Invoice Berry, it can take up to 60 seconds to line up your online invoice. 60 seconds to pay with regular payments with holding clients.

5. Tax assistance

Tax accounting can always look complicated, especially for SMBs. After all, there are numerous sorts of taxes that it is often difficult to trace them.

Fortunately for you, this is often where accounting software can prevent many sleepless nights. When subsequent tax season comes, you would like to start out producing financial statements and tax summary reports.

But when this happens, you're ready. Method is as follows.

Fortunately, Invoice Berry also can assist you create invoices, with or without taxes. for instance, you'll add nuisance tax or VAT options to.

An invoice to save you the trouble of billing individually.

6. Create a business plan If you're just getting started, your business plan is everything.

7. Multi-currency

If you are managing a remote work team, it may seem difficult at first to process invoices in different currencies. However, the problem of converting international currencies to each other is a thing of the past.

Today, most accounting software is equipped to process multi-currency invoices coming from all over the world.

With the ability to customize invoices and add payments, handling international currencies has never been easier. Invoice Berry personally handles invoices in over 200 currencies.

Put everything together

Overall, there are many benefits to using accounting software, and Invoice Berry can save you a lot of time and money based on how easy it is to set up.

Best of all, you can customize your invoices specifically as needed, or use one of many business plans and invoice templates for free.

If that sounds like something you're interested in, try Invoice Berry Billing Software for free and be aware that you can change your plan at any time.

Installation of Accounting Software

In reality, software providers are happy to involve software buyers as much as possible. This means that the more work you do, the lower your final software costs will be. However, keep in mind that some companies think they know more than the professionals they do every day. It's like self-diagnosing a serious illness and doing your own surgery! The best approach is to consider implementing new software as a team approach. You need to get involved as your software provider can't really do it alone.

Also consider that many of today's businesses, especially small businesses, do not have accountants or managers on staff. Your software provider may have an accountant who can ensure that your new system is properly configured for use. Before implementation, it's easy to think that things will go smoothly. A quick Google search for "accounting software configuration errors" (2.57 million results!) Unfortunately confirms that configuration errors occur very often.

For some things, you should actually do it yourself. However, many of these tasks are time consuming or error-prone, allowing software providers to perform their tasks better. How to import data from an existing system is determined by comparing the value of the time people spend manually entering information against the cost of importing the data.

At best, trying to go alone if done wrong means that the process needs to be restarted, and in the worst case, it can lead to incorrect data and increased costs and taxes. Your software provider is well aware of this. Instead of spending eight hours achieving one of these items, the software provider may be able to perform the same task in two hours. How much time can you save overall? Potentially pretty. According to a survey conducted by SAP, implementations of 3 months or more are common even in SMEs, and it took 9 months or more to complete 39% of all ERP implementations. So, yes, there is a lot of fat to trim.

It's also important to realize that no employee may simply be messing around with their thumbs. Employees have normal day-to-day tasks that they need to perform. It takes a lot of time to review, select, install software, collect accounting data, configure an accounting system, and learn how to use it properly. The time they are probably unavailable. If you think about it, you would say, "I have nothing else to do, so I can devote all my time to accomplishing this." In today's business environment, this is very rare.

Here is a brief list of the major steps that need to be completed to implement a new accounting software system.

2. Software installation

h. Configure the system documentation for your needs, such as:

i. Create a custom report to provide the information in the format you need. These reports include both operational and financial areas.

j. Establish the necessary "linkages" with other software, such as importing data from e-commerce applications and time clocks. Integration with other systems depends on the individual system. Pay attention to all security, backups, and the ability to recover from a failed import.

3. Accounting System Configuration

b. Load certain other information to support the actual business situation at the time of conversion

4. System Training

Other items

- Implementation plan

- Software installation

- Accounting system configuration

- System training

Advantages and Disadvantages of Accounting Software

Pros: Benefits of accounting software

These are the most advantages of why you ought to use such software to manage your business.

Cons: Disadvantages of accounting software

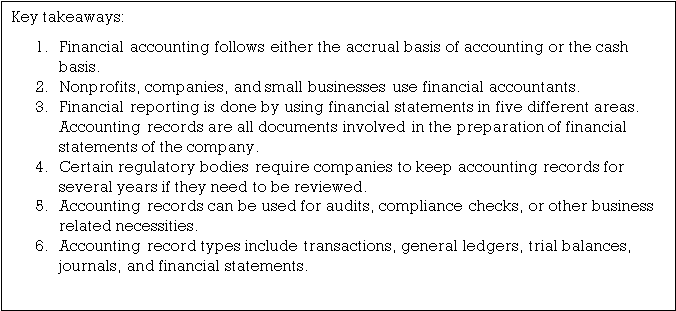

Key takeaways:

18. Task Automation-Examples: Payroll Calculation, Payroll Statement Creation, VAT Calculation, etc.

19. Integration with other systems such as online banking and electronic filing.

20. Accounting software can help you save time and money and provide valuable insights into your business. If you choose your package carefully, investing in a computerized accounting system can be one of the best decisions you can make for your business.

Meaning

The final account is the account prepared by the Joint Stock Company at the end of the fiscal year. The purpose of creating a final account is to provide a clear picture of the financial situation of the organization to its management, owners or other users of such accounting information.

Final account preparation involves preparing a set of accounts and statements at the end of the fiscal year.

The final account is prepared for the following purposes:

Trading account

The results of the purchase and sale of goods are known as the trading account. This sheet is provided to show the difference between the sales price and the cost price. It is prepared to show the trading results of the business i.e. The total profit or total loss maintained by the business. It records the direct costs of the business company.

According to J.R. Batliboi,

The trading account shows the results of buying and selling goods. When we prepare this account, the general establishment costs are not taken into account and only the transaction of goods is included."

Profit and loss accounts

This account is prepared to check the net profit/loss and fiscal year expenses of the business during the fiscal year. It records the indirect expenses of the business company like rent, salary, and advertising expenses. Profit and loss a/C includes expenses and losses and gains and losses incurred in business other than the production of goods and services.

Balance sheet

The balance statement shows the financial status of the business at a specific date. The financial status of a business is discovered by aggregating its assets and liabilities on a specific date. The excess of assets over liabilities represents the capital sunk into the business and reflects the financial health of the enterprise.

Now it is known as a statement of the financial status of the company.

Trading account

Trade and manufacturing operating companies deal with the sale and purchase of goods. Therefore, only the manufacturing and trading entities prepare the trading account. Service providers do not prepare for this.

Advantages of preparing a trading account format

Items in trading account format

The trading account contains the following details:

Item of income (Cr.Side)

Item of expenditure (Dr.Side)

Notes

Trading Account Format

Particulars | Amount | Particulars | Amount |

To opening stock | xxx | By sales | xxx |

To purchase | xxx | Less: Returns | xxx |

Less: returns | xxx | By Closing stock | xxx |

To direct expenses: | xxx | By Gross loss c/d |

|

Freight & carriage | xxx |

|

|

Custom & insurance | xxx |

|

|

Wages | xxx |

|

|

Gas, water & fuel | xxx |

|

|

Factory expenses | xxx |

|

|

Royalty on production | xxx |

|

|

To Gross profit c/d | xxx |

|

|

Profit and loss A/C

All companies generally prepare profit and loss accounts/statements at the end of the year to gain visibility of income, revenue, expenses, and losses incurred in a certain range of periods. It is important to prepare a profit and loss statement because this information helps organizations make the right business decisions, such as where to cut costs, from where the business can generate more profit, and which parts of the business are suffering from losses.

Trading account is prepared to check gross profit/loss while profit and loss account is created to check profit and loss/net loss.

Profit and loss accounts are made to check the annual profit or loss of a business. This account only shows overhead. All items of income and expenses, whether cash or non-cash, are considered in this account.

Only revenue or expenses related to the current period are debited or credited to the profit and loss account. The profit and loss account starts with gross profit on the credit side and, if there is a total loss, appears on the debit side. Items not displayed in the profit and loss account format

Drawing: the drawing is not the company's expense. Therefore, we debit it to capital a/c, and not to profit and loss a/c.

Income tax: for a company, income tax is an expense, but for a sole proprietor, it is his personal expense. Therefore, we debit it to the capital A/C.

Discounts: as we know, discounts are of two types–trade discounts and cash discounts. We deduct the trade discount from the amount charged and therefore do not show it in the account books. On the other hand, if the customer pays the amount on a certain date, a cash discount will be possible. We view cash discounts in account books. Therefore, we debit it to the profit and loss account.

Bad debt: it is because of the customer and the amount he does not pay it. We debit this amount to profit and loss a/c in the event that preparations have already been made for a bet that is worse than it is initially written off from it. When bad loans are recovered, it is again. Now it is not credited to the account of the party, but recovered account should be credited to the bad debt and is written on the credit side of the profit and loss account

Profit and Loss Account Format

Particulars | Amount | Particulars | Amount |

To Gross loss b/d | xxx | To Gross profit b/d | xxx |

Management expenses: | xxx | Income: | xxx |

To salaries | xxx | By Discount received | xxx |

To office rent, rates, and taxes | xxx | By Commission received | xxx |

To printing and stationery | xxx | Non-trading income: | xxx |

To Telephone charges | xxx | By Bank interest | xxx |

To Insurance | xxx | By Rent received | xxx |

To Audit fees | xxx | By Dividend received | xxx |

To Legal charges | xxx | By Bad debts recovered | xxx |

To Electricity charges | xxx | Abnormal gains: | xxx |

To Maintenance expenses | xxx | By Profit on sale of machinery | xxx |

To Repairs and renewals | xxx | By Profit on sale of investments | xxx |

To Depreciation | xxx | By Net Loss(transferred to Capital A/c) | xxx |

Selling distribution expenses: |

|

|

|

To Salaries | xxx |

|

|

To Advertisement | xxx |

|

|

To Godown | xxx |

|

|

To Carriage outward | xxx |

|

|

To Bad debts | xxx |

|

|

To Provision for bad debts | xxx |

|

|

To Selling commission | xxx |

|

|

Financial expenses: |

|

|

|

To Bank charges | xxx |

|

|

To Interest on loan | xxx |

|

|

To Discount allowed | xxx |

|

|

Abnormal losses: | xxx |

|

|

To Loss on sale of machinery | xxx |

|

|

To Loss on sale of investments | xxx |

|

|

To Loss by fire | xxx |

|

|

To Net Profit(transferred to capital a/c) | xxx |

|

|

TOTAL |

| TOTAL |

|

Balance Sheet

A balance sheet (also known as a financial statement) is a financial statement that shows the Assets, Liabilities and ownership interests of a business at a specific date. The main purpose of drawing up a balance sheet is to disclose the financial status of the enterprise at a certain date. The balance sheet can be prepared at any time, but it is prepared mainly at the end of the accounting period.

Most of the information about Assets, Liabilities and owner's equity items is taken from the company's adjusted trial balance. Retained earnings are the part of the owner's equity section which is provided by the retained earnings statement.

Section of the balance sheet

To be widely considered about the balance sheet of the division part of assets part of liabilities main capital. For each department:

Assets section

In the balance sheet, assets with similar characteristics are grouped. The mainly adopted approach is to divide assets into current and non-current assets. Liquid assets include cash and all assets that can be converted into cash or expected to be consumed in a short period of time–usually one year. Examples of current assets include cash, cash equivalents, accounts receivable, prepayment costs or prepayment, short-term investments and inventories.

All assets that aren't listed as current assets are grouped as non-current assets. A common feature of such assets is that they continue to provide profit for a long time-usually more than one year. Examples of such assets include long-term investments, equipment, plants and machinery, land and buildings, and intangible assets.

Debt Division

A debt is an obligation to a party other than the owner of the business. They are grouped as current and long-term liabilities in the balance sheet. Current liabilities are obligations that are expected to be met within a one-year period by using current assets of the business or by providing goods or services.

Owner's equity division

The owner's interest is the obligation of the business to its owner. The term owner's equity is mainly used in the balance sheet of a business in the form of a sole proprietor and partnership. In the balance sheet of the company the term “ownership interest “is often replaced by the term "shareholder interest".

When the balance sheet is created, the liabilities section appears first, and the owner's equity section appears later.

Balance sheet format there are two formats on the balance sheet that present Assets, Liabilities and owner's ' equity–the account format and the report format

In the account form, the balance sheet is divided into the left and right, like the t-account. Both liabilities and the owner's capital are listed on the right side of the balance sheet, while assets are listed on the left. If all the elements of the balance sheet are listed correctly, then the sum on the asset side (that is, on the left) is equal to the sum on the debt and the capital side of the owner (that is, on the right).

Assets | $ | Liabilities & Stockholder’s equity | $ |

Current assets : Cash Account receivable Prepaid building rent Unexpired insurance Supplies

Total current assets

|

85,550 4,700 1,500 3,600 250

| Liabilities: Notes payable Accounts payable Salaries payable Income tax payable Unearned service revenue

Total liabilities |

5,000 1,600 2,000 3,000 4,400

|

95.600 | 16,000 | ||

Non-current assets: Equipment 9,000 Acc. dep. –Equipment 3,600 |

5,400

| Stockholder’s equity: Capital stock 50,000 Retained earnings 35.000 Total liabilities & stockholder’s equity

|

85,000

|

101,200 | 101,000 | ||

|

|

|

|

BUSINESS CONSULTING COMPANY

BALANCE SHEET

As at December 31, 2015

In reporting format, the balance table element is displayed vertically, the asset section is displayed at the highest, and therefore the liabilities and owner's equity sections are displayed below the asset section.

The example below shows both formats.

Assets Current assets:

Cash Account receivable Prepaid building rent Unexpired insurance Supplies

Total current assets

|

85,500 4,700 1,500 3,600 250

|

95,600

| |

Non-current assets: Equipment 9000 Acc. Dep- Equipment 3600

Total assets

|

5,400

|

101,000

| |

Liabilities & Stockholder’s Equity Liabilities Notes payable Accounts payable Salaries payable Income tax payable Unearned service revenue

Total liabilities

|

5,000 1,600 2000 3000 4,400

|

16,000 | |

Stockholder’s equity: Capital stock Retained earning

Total stockholder’s equity

Total liabilities and stockholder’s equity |

50,000 35,000

|

85,000

| |

101,00 |

Types of adjustment entry for the final account

The value of the closing stock is checked at the end of the fiscal year, so it is displayed as an adjustment. It must be credited to the transaction a/c and displayed on the asset side of b/S.

The adjustment entry is:

Closing stock a/c ------ Dr.

To trade A / c

Trading account and balance sheet

Rs | |

| By Sales |

| By Trading Stock |

Balance Sheet

Liabilities | Rs | Assets | Rs |

|

| Closing Stock |

|

2. Unpaid expenses:

These are expenses incurred in the fiscal year, but no payments have been made. Any unpaid or unpaid expenses will be added to such expense a/c in P&L a/c and will be displayed as current liability in b/S.

For example, monthly rent in May 2002 Rs. 1,000 remains unpaid. A calendar year is an accounting year.

Adjusting entries:

Rent account Dr. Rs.1000

To Outstanding Rent a/c Rs. 1,000

Profit and loss accounts

|

|

| Rs |

TO Rent Account Add: Outstanding | [11 month rent] [December] | 11,000 1,000 |

12,000 |

Balance Sheet as on 31st December 2002

Liabilities | Rs | Assets |

|

Outstanding Expenses: Rent |

1,000 |

|

|

3. Prepaid Expenses

These are the costs paid, but part of the amount paid extends to the next year. It is also called" expiring expenses". The prepaid amount paid should be deducted from such expenses and displayed as current assets in the B/S.

For example, Rs premium a total of 2,400 people were paid on July 1, 2002. A calendar year is an accounting year. The annual premium is paid for 1 month, so the 6-month premium concerns half of the current year and the other half the following year.

Hence Rs. 1,200 must be treated as an upfront payment, deducted from the premium paid and displayed as an asset on b/S.

Adjusting entries:

Prepaid insurance a / c Dr Rs. 1, 200

To Premium A / c Rs. 1, 200

Profit and Loss Account

| Rs | Rs |

|

To Insurance Premium a/c Less: Prepaid insurance | 2,400 1,200 | 1,200 |

|

Balance Sheet

Liabilities | Rs | Assets | Rs |

|

| Prepaid Insurance | 1,200 |

4. Accrued income:

It is an income that has already been earned [i.e. the service has already been rendered], but no money has been received. For example, interest on investments accrued Rs. 1,200.

Interest in the current year is due to the end of the year. That amount can actually be received in the next year. Currently, it represents income, which has become accounts receivable or accrued. Therefore, P&L is credited to a/c, IS accounts receivable and appears as an asset in b/S.

Adjusting entries:

Accrued interest a / c Dr. Rs. 1,200

To be interested in a / c Rs. 1,200

Profit and Loss Account

| By Interest on investment Add: Interest accrued | …… 1,200 |

|

Balance Sheet

Liabilities | Rs | Assets | Rs |

|

| Interest accrued | 1,200 |

5. Income received in advance:

These are the income received during the current year, but part of the amount received is related to the following year. Such amounts must be deducted from the total amount received in P & L A / C and displayed on the debt side of B / S, which represents the amount that the business is obliged to return.

For example, business concerns have received a three-year apprenticeship premium equivalent to Rs.6, 000. Rs in this amount.2, 000 IE, 1/3 of Rs.6, 000 is for the current year and must be credited to P&L a/c as income. And balance Rs. As business is obliged to return 4, 000 represents responsibility.

Adjusting entries:

Apprentice premium A / c Dr Rs. 4000

To Apprentice premium received in advance Rs. 4000

Profit and Loss Account

|

| Rs | Rs |

| By Apprentice Premium Less: Received in advance | 6,000 4,000 |

2,000 |

Balance Sheet

Liabilities | Rs | Assets | Rs |

Apprentice Premiu received in advance | 4,500 |

|

|

6. Depreciation of assets:

Depreciation implies a decrease or decrease in the value of an asset due to its constant use. It may also occur due to wear and tear, the passage of time and obsolescence. It's a loss to business.

It is usually calculated at a certain percentage to the value of the asset, and so the amount obtained is shown first on the debit side of the P & L A/C, and then subtracted from the original value of the asset of B/s.

For example, a business has furniture worth Rs. At the end of the year 50, 000 it is depreciated by 5%.

Adjusting entries:

Depreciation A / c Dr Rs. 2,500

To Furniture A / c to Rs. 2,500

[5% Rs 50,000 = 2,500]

Profit and Loss Account

| Rs. |

|

To Depreciation a/c Furniture | 2,500 |

|

Balance Sheet

Liabilities | Rs | Assets |

| Rs |

|

| Furniture Less: Depreciation | 50,000 2,500 |

47,500 |

7. Bad debts

Debt represents money from the debtor [i.e., the uncollected portion of the credit sale]. When a debt becomes irretrievable, it becomes a bad debt and is treated as a loss. The amount of non-performing loans is debited to P&L a/c and deducted from the various debtors of B/S.

For example, a trader's ledger balance on sundry debtors shows Rs with 20,000. 1,000 are estimated to be unrecoverable.

Adjusting entries:

Bad debts a / c Dr Rs. 1,000

To Sundry debtor a / c to Rs. 1,000

a) Provision for bad and doubtful debt:

Every business has a lot of trading through margin trading. This gives rise to a significant amount of book debts or debtors. But 100% of these debts are rarely recovered.

Therefore, it would be necessary to bring down the balance of the debtor to it true position. The usual practice is to calculate such a bad debt at a certain rate, based on the past experience of the debtor. It is called reserves or reserves for doubtful debts.

However, the allowance for bad loans and bad debt is calculated on good debt, that is, after deducting previously unadjusted bad loans.

For example:

At the end of the year the sundries debtors of traders stood in the Rs.21, 000. It is estimated to be Rs. 1,000 is written off as bad loans and a 5% allowance is created for bad debt.

Adjusting entries:

Bad Debts a/c Dr. Rs. 1,000

To Sundry Debtors a/c Rs. 1,000

To Profit and Loss a/c Dr. Rs. 2,000

To Bad Debts a/c Rs. 1,000

To Provision for Doubtful Debts 1,000

Profit and Loss Account

| Rs |

|

TO Bad Debts To Reserve for doubtful Debts | 1,000 1,000 |

|

If there is an old provision for doubtful debts, it should be adjusted [deducted] against the new provision.

Balance Sheet

Liabilities | Rs | Assets | Rs |

|

|

| Sundry Debtors Less: Bad Debts

Less: Provision for Doubtful Debts | 21,000 1,000 |

19,000 |

20,000 | ||||

1,000 |

b) Provision for discounts to debtors:

Cash discounts are allowed to debtors to prompt quick payments. After providing bad loans and bad debts, the debtor's balance represents the debt from a healthy party.

They may pay their dues on time and try to take advantage of the acceptable cash discounts themselves. Therefore, this discount should be expected and offered. It is, therefore, the usual practice in business is to offer debtors discounts at a certain percentage on good debt.

For example:

Suppose a trader has various debtors equivalent to rs.20, 000 and he estimates that a provision for a discount of 5% is desirable, after a provision of 2% for bad debts. Then about healthy debt, i e a provision of 19,000 at 2% has been made as a reserve for debtors ' discounts.

Adjusting entries:

Profit and Loss a/c Dr. Rs.380

To Reserve for Discount on Debtors a/c Rs.380

Profit and Loss Account

| Rs |

|

To ad Debts To Reserve for Doubtful Debts To Reserve for Discount on Debtors |

1,000 380 |

|

Balance Sheet

Liabilities | Rs | Assets |

| Rs |

|

| Sundry Debtors Less: Provision for Doubtful on Debts

Less: Provision for Doubtful Debts | 20,000 1,000

19,000 380 |

18,620 |

8. Provision for discounts to creditors:

The creditor represents the amount paid by the business to the supplier of goods on credit. A healthy business concern is the creditor's goodwill and the practice of settling accounts with creditors in time to get the discounts allowed by them.

In that case, the liability for various creditors can be reduced to the extent of the expected discount. Based on past practice, a certain percentage of the balance of receivables is calculated as a reserve for discounts and subtracted from the balance of receivables of B/S, and the same amount is calculated as the gain of P&L A/C.

For example:

Traders had various creditors at Rs. 10,000on31th December2002. It is desirable to *provide 3% for this amount for discounts.

Adjusting entries:

Discounts on creditors for Reserve a /c Dr Rs. 300

To Profit and loss a / c Rs. 300

Profit and Loss Account

| Rs |

| Rs |

|

| By Reserve for Discount on Creditors | 300 |

Balance Sheet

Liabilities | Rs |

|

|

|

Sundry Debtors Less: Reserve for Discount | 10,000 300 |

9,700 |

|

|

9. Interest on capital:

Often, interest at the usual rate is allowed to the owner's capital, which is adopted in the business. This is necessary in order to assess the efficiency of the business. Otherwise, the profit will include interest and will be displayed at a higher rate.

So the interest charged is a loss to the business and a profit to the owner. Thus, it is debited to profit and loss a/c and added to the capital of the balance sheet.

Adjusting entries:

a) Interest on Capital a/c Dr.

To Capital a/c

b) Profit and Loss a/c Dr.

To Interest on Capital a/c

10. Interest in drawing:

The drawing is the money that the owner has withdrawn from the capital. It charge interest on the drawing so that it allows business interest on capital. It's a profit to the business and a loss to the owner. Thus, it is credited to profit and loss a/c and deducted from the capital on the balance sheet.

Profit and Loss Account

| Rs |

| Rs |

To Interest on Capital |

| By Interest on Drawings |

|

Balance Sheet

|

|

|

|

Capital Add: Interest on Capital Less: Drawings Interest on Drawings |

|

|

|

Adjustment of special items:

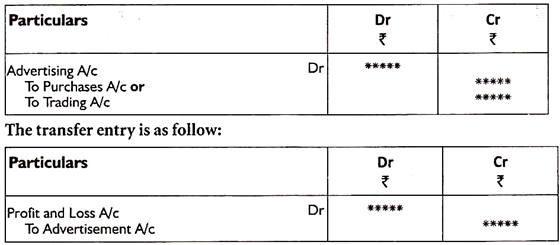

1. Products distributed as free samples:

To promote the products, free samples are supplied to experts in the field. For example, distributed a free sample of a book to a professor, a free sample of medicine to a doctor, etc.

Since it is a promotional activity, the cost of such a sample should be treated as promotional costs, for example, advertising. Free sample distribution is equivalent to a decrease in purchase or sale without a monetary return.

Thus, the adjusted entry is:

The net effect will be the reduction of purchases as promotional costs and the charge to the profit and loss account

2. Goods sold or sold on an approval basis: sometimes goods are sold on an approval basis in order to gain the trust of customers about the quality of the goods. If the customer approves it, it becomes a sale. If the customer does not approve it, the sale is not completed and therefore cannot be treated as a sale. Suppose that at the end of the fiscal year, you have a specific product with the customer that was sent on an approval basis, and you need to pass the necessary entries for reconciliation.

The adjustment entry is as follows: the treatment is as follows:

(A) As a deduction from sales at the selling price on the credit side of the trading account, and in addition to closing the shares at the cost price.

(h) As a deduction from debtors on the asset side, and as the total inventory displayed at the cost on the asset side of the balance sheet (cost+finished stock in stock with authorized customers).

3. About shipping of products by consignment sale:

Since consignment transactions are not sales transactions, they do not directly affect transactions and profit and loss accounts. Another consignment account is opened, and the goods sent to the consignment are debited to the consignment account. When an account sale is received, it is treated as a consignment sale, credited to the consignment account and debited to the consignment account.

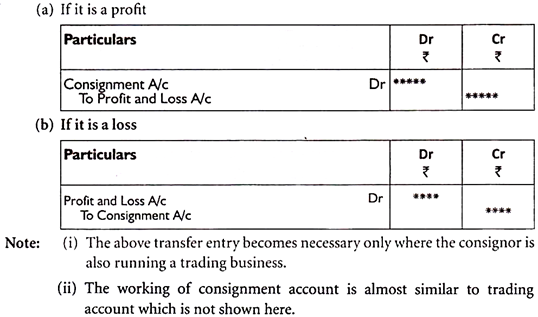

The consignment inventory remaining at the consignment is deposited into the consignment account, and after invoicing the consignment cost, the consignment fee, etc., the consignment profit is confirmed. However, the closing stock of the deposit is displayed on the asset side of the balance sheet, and the profit and loss of the deposit is credited to the profit and loss account (if there is a loss of the deposit, it is cancelled).

The transfer input of consignment profit and loss is as follows:

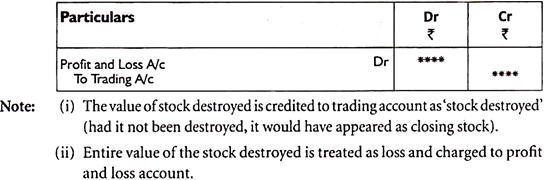

4. Loss of stock due to fire:

If the stock is destroyed by fire, the losses incurred will be treated differently under the following three possible circumstances:

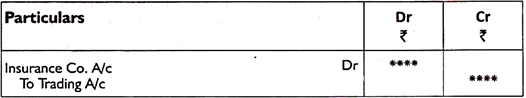

B. If the stock is fully insured-when the fully insured stock is destroyed, the company has a claim to the insurance company for the recovery of losses due to the goods destroyed by fire. Therefore, the claim takes precedence in the entry –

In practice, claims against the insurance company are treated as "debtors" and are indicated on the asset side of the balance sheet as payments from the insurance company.

If the insurance company settled the dues, the entry would be

In fact, the account of the insurance company does not appear on the balance sheet, since the cash/bank balance on the balance sheet increases with the settled claims.

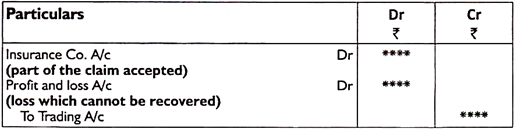

C. if the shares are partially insured-in this case, the total value of the destroyed shares will be credited to the trading account, that portion of the claim settled by the insurance company will be debited to the insurance company account, and the difference between the destroyed shares and the accepted insurance claim will be debited to the profit and loss account as a loss. The entries are as follows –

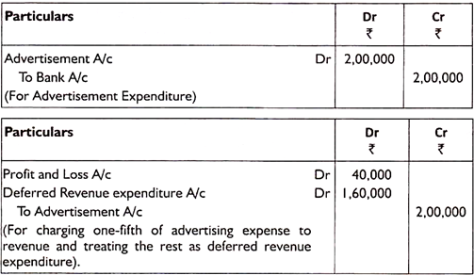

5. Deferred appropriations: A huge expenditure of the nature of the revenue generated at the initial stage of a business enterprise with the belief that it derives profit from such expenditure during subsequent years is considered a deferred revenue expenditure if the charge of such expenses is spread over the number of years in which the profit is expected to be derived.

Part of such expenditure is charged as revenue for each year, and the rest is capitalized on the basis of the matching concept. For example, huge expenditures on "advertising" occur in the first year of the business and derive profits over an estimated period of ten years. Then one-tenth of that expenditure each year is charged to income over a decade period. The Important point here is that the expenditure that is not charged to the revenue is capitalized and appears as a fictitious asset on the balance sheet.