Unit – 3

VOUCHING, VERIFICATION AND VALUATION

It is necessary to establish authenticity of the financial transactions which are entered in the books of accounts. It can be done by examining various vouchers which are prepared in support of the transactions.This practice of examining vouchers is referred as Vouching.

An auditor has to keep certain things in mind while vouching. These are:

- That the date of the voucher falls within the accounting period.

- That the voucher is duly authorised.

- That the voucher contains all the relevant documents.

General Points:

(1) Cash is a highly liquid asset. Hence it is necessary that the Auditor satisfy himself that the all the cash transactions entered in the books are genuine and correctly recorded in the books. Further the auditor has to ensure that every cash payment voucher has sufficient appropriate documentary evidence.

(2)Check the following

- Internal Control System

- Check the correctness of Book Keeping records

- Check whether accounting policies have been observed

- Check the documentary evidences of transactions

- Check the disclosures in the Financial Statements

(3) Casting (Totalling)

The totals of particular expenses may be inflated and this is a sign of fraud. Similarly, a cashier may misutilise the receipts by under-totalling the receipts column of the Cash Book. Such frauds may be detected only by checking the total columns of the cash columns and the respective ledgers.

(4) Bank Reconciliation Statement:

It is an important document for internal accounting control and it should be checked by the Auditor with due diligence and utmost care. Cheques issued but not presented for payment before the closing date, cheques deposited before the closing date but not cleared have to be appropriatelyinvestigated.

Audit of Payments:

While auditing the payments, following areas have to be audited:

(1) Purchase of Goods: Cash purchases should be verified with receipts issued by the suppliers. Evidence can be received by verifying Stock Ledger for the goods inward.

(2) Remuneration paid to Directors:Following points must be considered

- To verify the entitlement

- To examine adherence to legal provisions

(3) Payment for acquiring assets: Following points must be considered

- To check the receipt for the amount paid.

- To check the title of deed

- To verify the authority of purchasing an asset (Board of Directors in case of a company)

- To confirm whether no value for repairs have been capitalised.

(4) Payment of any expenses:As per the standard rules, every expenditure should be charged in the year for which the expenditure is incurred. It should be verified accordingly. Further, any expenditure personal in nature should not be charged in the business.

(5) Payment towards Taxes:Payment on account of Income Tax should be verified with the copy of the assessment Order and the receipt (Challan). Interest allowed on advance tax should be recorded as an Income while Interest or Penalty paid fornon-payment or late payment of the taxes should be debited as an expenditure.

(6)Travelling Expenses: There are generally approved rules regarding travelling allowances in business organisations. So, this expenditure should be vouched accordingly. In absence of the rules, the Auditor should verify the actual amount incurred with the help of bills, etc.

The auditor shouldalso satisfy himself that the expenditure were incurred in the interest of the company.

(7) Salaries and Wages: The payment of Salaries and Wages need tobe vouched carefully. Following internal checks should be done:

- Appointment and promotion of employees

- Attendance of the employees

- Wages sanction

- Confirm that all payments made to the workers and other employees have been acknowledged by them. This can be done by verifying that ‘receiver’s signature’ is present on the voucher making payment towards Salary.

(8) Petty Cash:Petty cash should be verified as follows:

- Trace the amount advanced to the petty cashier for meeting petty office expenses in the petty cash book

- Vouch the payments, wherever possible, by external evidence like Invoice or Cash Memo, etc.

- Check the column totals

- Verify the Cash balance in hand

(9) Advertisement expenses: Advertisement expenses will be vouched in the following manner:

- Obtain the complete list of advertisement, media wise, along with the amount paid in respect of each category

- To ascertain whether there is a regular contract with an advertising agency

- Check the receipt for amount paid for the advertisement expenses incurred

- Verify that outstanding advertising expenses have been properly disclosed on the liabilities side of the balance sheet

(10) Payment of Dividend:

- Examine the provisions in the memorandum and articles of association regarding payment of dividends

- Examine the boards minutes regarding rate of dividend

- Verify the shareholders register and ensure that the names of all shareholders for entitled to receive dividends have been included

- Check the computation of Dividend

- See the counterfoils of cheques of amounts paid to shareholders

Cash receipts:

(1) Cash Sales:

To vouch cash sales, the system of internal check should be examined with finding out loopholes there in, whereby cash sales could have been misappropriated.

Cash sales are usually verified with the carbon copies of cash memos.

Is a cash memo has been cancelled its original copy should be inspected it could be that the amount their off have been misappropriated

(2) Receipts from Account Receivables:

Receipts from account receivables should be checked with the counterfoils receipts issued to them. Comparison of the entries of Amount deposited in the bank account with closed on counterfoils of the pay in slip book should be made.

(3) Income from Investments:

If investments are many that light generally would have an investment register. In such a case the dividend income is first vouched by reference to the counter files of dividend warrant. In case of interest on deposits with banks, verification should be done by reference to the bank statement and the rate of interest.

(4) Rental receipts:

Copies of bills issued to the tenants should be checked by reference of tenancy agreements.

Verification of assets implies an enquiry; with a view to obtain and examine the evidences regarding an asset. The evidences proves the following:

- That the asset exists.

- That the asset exists in the name of the business entity.

- That the assets are classified and presented as per the requirements of the existing laws.

The process of Verification satisfies the Auditor about the valuationof the assets and liabilities by inspecting the documentary evidences available, which in return helps the Auditor to frame his opinion on the financial statements.

Verification involves confirmation that the assets are held in the name of business entity only for the purpose of business. Verification is a guard against improper use of assets and it exhibits true and fair view of the state of affairs of the business organisation.

Verification also involves proper valuation of assets. Valuation means critically examining and determining the fair value of various assets appearing in the Balance Sheet.

General Principles of Verification of Assets:

- Ascertain that the assets were purchased under appropriate authority.

- Ascertain that the assets were purchased for the purpose of business only.

- Ascertain that no unauthorised charge has been created against any asset.

- Ascertain that the assets have been disclosedin the Balance Sheet as per the relevant statutory requirements and Accounting Standards.

- Ascertain that the assets were existing as on the date of the Balance Sheet.

Distinction between Vouching and Verification:

‘Vouching’ means to check the Vouchers.‘Verification’ means to verify the Assets and Liabilities of the business.

Vouching involves checking the accuracy of the transactions recorded in the books of accounts whereas Verification means a process validating the position of Assets and Liabilities in the Balance Sheet.

By Vouching, items of Profit and Loss A/c are examined while Verification process examines the items of Balance Sheet.

Vouching is a year-round process. On the other hand, Verification can be conducted at the end of the year.

The basic purpose of Vouching are –

- To check the documentary evidence in support of the transactions.

- To verify the totalling and casting of the ledgers.

The basic purpose of Verification are –

- To verify the reliability of the financial statements.

- To verify that the assets are accurately recorded and disclosures are made therein.

Depreciation means the reduction in the value of an asset due to its use, leading its wear and tear, or due to obsolescence or due to general market trend. The prescribed rules state that the amount of depreciation of a depreciable asset must be allocated in every accounting period throughout the life of the asset.

There are two methods of depreciation – Straight Line Method (also known as Original Cost Method) and Written Down Value Method (also known as Reducing Balance Method).

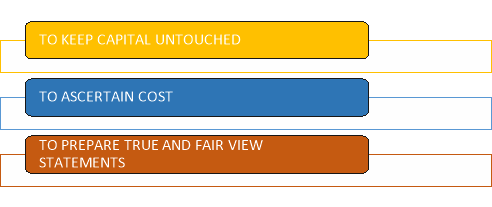

Purposes of Providing Depreciation:

Reserves are the amounts appropriated out of profits to equalise the amount of Dividend by the company or for expanding the business in the future. Provisions, on the other hand, are the amounts charged to provide for depreciation on or renewal of assets or to meet specific liability.

Reserves are of two types – Revenue Reserves and Capital Reserves

Revenue Reserves are those which are available for distribution amongst the shareholders. Whereas a Capital Reserve is the profit earned on a specific transaction – like Sale of fixed asset in excess of its book value or benefit gained at the time of re-issue of the forfeited shares.

Reserves may be retained in the business and can also be invested outside the business.

The Auditor needs to verify that all the applicable provisions of the relevant laws have been followed for making Provisions for Dividend. The Auditor also needs to check relevant agreements in this regard, if any. In case of Unclaimed Dividend, the Auditor needs to verify that the company has followed such rules as prescribed under Companies Act.

Further, the Auditor needs to verify that there is no such previous losses or depreciation that has been not provided for in the books. This is because the company cannot declare dividend, unless such losses or depreciation are set off against profits of the current year of the company.

Investments are the assets held by the business entity to earn dividend income or interest income or for capital appreciation. Generally, Investment constitutes a major portion of the total assets.Auditor should follow the following steps to verify Investments.

- Obtain the list of Investments held at the end of last year i.e. at the beginning of Current Year.

- Obtain a schedule containing - Date of purchase, Cost Price, Book Value, etc.

- Obtain the details about any additional purchase and/or any investment sold during the audit period.

- Verify that the purchase/sale transaction had been duly authorised.

- Verify that all the investments are properly classified and disclosed as per the various statutory requirements.

- Verify that the prescribed rules as per AS-13 – Accounting for Investments’ are followed.

- Obtain the list of Investments in the shares or debentures of its subsidiary company.

Reference

- Auditing – T. R. Sharma – SahityaBhawan Publications.

- Auditing – B. K. Mehta – SBPD.

- Auditing – N. L. Nadda.

- A Hand Book of Practical Auditing - B. N. Tandon, S. Sudharsanam& S. Sundharabahu – S. Chand.

- Auditing – O. P. Gupta, B. N. Ojha, B. K. Singh – S. Dinesh & Co.

- Auditing: Theory and Practice – G. D. Verma, Pradeep Kumar, BaldevSachdeva, Jagawant Singh – Kalyani Publisher