UNIT – 1

FORMS OF BUSINESS ORGANIZATIONS

Introduction: Business means production & distribution of goods & services to the society with earning profit. Any firm which engaged in the conduct of business activities is known as a Business organization.

Business organization may be defined as, “An organization formed with Activity of Production and Distribution and the object of earning profit and providing services to the members of the society.”

Business Organization (Commercial Organization)

Business Organization (Commercial Organization)

Private Joint Sector Public Sector Sector

• Sole Trading Concern *Departmental undertaking

• Partnership Firm *Public corporation

• Joint Hindu Family Firm *Government Company

• Joint Stock Company

• Co-operative Society

A] SOLE TRADING CONCERN

INTRODUCTION: Sole Trading Concern is the oldest type of business organization.

A business organization which is owned and controlled by one person, with or without the help of his family members or a few employees, is called Sole trading concern. It also called as one-man show business and the owner is called Sole Proprietor or Sole Trader.

Sole trader is a person who invests capital and acts as owner, organizer, manager and supervisor of his business and who shares entire profits or losses of the business.

Sole proprietorship is a form of business organization in which an individual introduces his own capital, uses his own skill and intelligence and is solely responsible for results of its operations.

According to Prof. James L. Lundy, “The sole proprietorship is an informal type of business owned by one person”.

FEATURES OF SOLE TRADING CONCERN:

1) Minimum Government Regulations: This is the only form of business which is not governed by any specific Act. The sole trader has to observe the general law of the country. There are no legal formalities required at the time of formation. They only follow the local govt. Rules. E.g. Gumasta license, Labour laws.

2) Unlimited Liability: The Liability of the trader is unlimited, which means, there is no distinction between Private and business property. For payment of business liabilities even private property is taken away in case the business property is not sufficient to pay off business liabilities.

3) Freedom in Selection of Business: A Sole Trader can select any business as per his desire. There is no restriction on the type of business, which may be conducted by a proprietary concern. Any legal business can be conducted by the concern. Any method of keeping of books of accounts may be followed by him.

4) Secrecy: Secrecy plays the most important role in the sole trading concern. The information about all the important matters concerning the business rests only the owner and no outside party can take any undue advantage out of it. The proprietor can ensure maximum business secrecy.

5) Single Ownership: The business is owned by a single person. All the property and assets of the business is owned by him. There is no another owner or partner in his business.

6) Direct contacts with customers and Employees: Since a proprietor usually deals directly with his customers and employees, he can maintain good relations with his employees and provide personal attention to his customers.

7) Suitable for some special Business: There are some special business concern and trades which requires individual attention and service and can only be started as a sole trade for example, Beauty Parlour, Cake shop and Agricultural Product.

8) No sharing of profits and risks: A sole trader enjoys entire profit of the business. He also bears the full responsibility in the business. Therefore, he alone has to bear all the risks and losses of the business. The risk of the sole trading is entirely bear by the sole trader. If there is any loss that will bear by sole trader only.

9) Local Business: A sole trading concern operates in a local market. Sole trader normally runs the business in residential location.

10) Complete Control: In sole trading concern, the owner, manager and controller is the same. The sole trader has to control and supervise the working of his own organization. He is the sole planner and executor.

MERITS OF SOLE TRADING CONCERN:

1) Easy Formation: It is very simple to form a sole proprietorship. There are no legal formalities to be followed. Anyone having an interest, finance skill and ability can form a sole trading concern. Due to simple formation, there is a direct relationship between efforts and rewards.

2) Business secrecy: secrecy is must for success in business. In sole trading, business secrecy regarding future plan, etc. can be maintained. Sole trader is not sharing any secrets with anyone, neither does he need to publish his accounts, nor is he answerable to third party.

3) Direct Motivation: Since Profit is not shared with anybody, he will work hard to get more profit, because there is direct relation between efforts and profit (reward). Since all the profit or losses are directly vested with him, the sole trader is more aware of the efforts put in and thus grows very fast.

4) Quick Decision: A Sole trader, being a single owner. Can take quick decisions because he need not take the consent of any other person.

5) Lower costs: The sole trader has a complete control over the business and he is also manager himself. He controls all aspects of the business Organization, so he ensures that there is less waste and better control on the expenses incurred as all expenses goes out his own pocket.

6) Development: The risk and rewards are directly connected with only one person and due to the reason that he is completely responsible and involved with every aspect of his business. The sole trader takes extra efforts to update his skills and learns through his experience constantly. He tries to keep improving his personality, leadership qualities and take better decisions.

7) Flexibility of Operations: Flexibility in business is essential. Any changes can be made without consulting anybody. Sole trader is capable to make any changes in his business because he does not need any suggestions. Sole trader can make any changes at any time.

8) Limited Government control: The activities of a sole trader are regulated by government and law to the minimum extent. Sole Trading business is not required to get registered. There are no laws for operation, functioning or dissolution of sole trading concern. It has only to follow the routine tax rules and general laws, otherwise government interference is minimum.

9) Credit Standing: Close contacts with customers help sole trader to build up goodwill for himself. Banks and institutions can give loans easily due to the unlimited liability of the owner depend on his assets.

10) Efficiency: As he is directly gaining from profits and is direct liable & responsible for losses, the proprietor runs his business with maximum efficiency with least wastage of time, efforts and resources. He also makes sure that productivity and profitability is maximum with minimum costs.

LIMITATION OF SOLE TRADING CONCERN:

1) Limited Managerial Ability: A sole trader manages his own business and takes all the decisions. He only co-ordinates and controls the activities. An individual may not be an expert in all matters; therefore his decisions may be unbalanced.

2) Limited amount of capital: A sole trader has to depend only on his own efforts to raise funds. Therefore, he has to face financial problems because his sources are limited. The owner can get in his own money or borrow from various sources. Such as, banks or friends and relatives, but still he cannot expand his business.

3) Unlimited Liability: The liability of a sole trader is unlimited. His private property may also be taken for payment of business liabilities. Therefore, he is always worried about this. Under this condition, he may not be able to take bold decision which may yield (earn) higher profits.

4) Not Suitable for large scale operations: Sole proprietorship is not suitable for large scale business operations. Due to small scale, the business cannot be extended beyond a certain limit. Thus a proprietor has to conduct business on a small scale. He cannot fully utilize adequate resources.

5) Lack of Stability: The continuity and the life or the existence of business depends on the wish and will of the sole trader. Death, insolvency and lunacy of the sole trader affect the continuity of the sole trading concern.

6) Absence of Specialization: A sole trader himself is the owner, manager, supervisor and controller of his business. Moreover, due to small scale business and division of labour and specialization, he cannot conduct business efficiently.

7) Unprofessional Decisions: As a sole owner he is not answerable to any person. He may end up taking decisions which may be based on limited knowledge. This can result in poor business policies likely to fluctuate without any reason and result into huge losses.

8) No Legal Status: In the eyes of the law, a sole trader and sole trading business are one and the same. The business does not have any separate entity. Therefore, he has to face certain problems while doing business.

9) Uneconomical Size: The size of the sole trading is such that it cannot expand its activities due to limited funds and managerial ability. Even due to the small size, it cannot take the benefits of large scale opportunities.

10) Absence of Division of Labour: A sole trader cannot introduce the principle of division of labour. Therefore he cannot get the benefits of division of labour such as efficiency, specialization, etc.

*******

B] PARTNERSHIP FIRM

* Meaning: - A partnership firm as a form of business organization has developed due to limitation of sole trading concern. Limited capital, limited managerial ability.

Definition: -

According to section 4 of the Indian partnership Act, 1932, “Partnership is the relation between persons who have agreed to share the profits of a Business, carried on by all or any of them acting for all.”

Partnership is form of business which is carried on by two or more persons. The persons enter into an agreement to conduct a lawful business of common interest in order to make a profit persons who have entered into a partnership are individually known as partners’ and collectively as a ‘partnership firm’

FEATURES OF PARTNERSHIP FIRM:

1) Agreement: A partnership is the outcome of an agreement, which is the base of a partnership business. Agreement is known as a partnership Deed, which includes the terms & conditions, rights and duties of each partner.

2) Plural Membership: An agreement can be made by more than one person. A partnership firm can be formed with minimum two members and maximum 10 for banking and 20 for non-banking or general business.

3) Sharing of Profit: The object of partnership is to earn the profit and share it. The sharing ratio is agreed by the partners. If there is no agreement, the sharing ratio equal. Even though the definition says about the profit- sharing, it is implied that one who is sharing profit must also share the losses too. However, if a partner is admitted into the business only for profits, then he has no obligation to share the losses.

4) Lawful Business: The main purpose of a partnership is to do some business which must be lawful. Any association formed without the motive of profit-making is not a partnership. Hence, the existence of lawful business is must.

5) Joint Ownership and Management: As per the provisions of the partnership Act, every partner has a right to take part in the management of the business. For convenience, however, the right of management may assign (give) to a particular partner.

6) Agency Principal Relationship: The partners enjoy double relationship in the firm. Every partner acts as an owner (principal) as well as an agent of the other partner while dealing with third parties.

7) Unlimited Liability: The partners are all jointly as well as severally liable for the debts of the firm. The liability of every partner is unlimited. If the assets of business are found insufficient to pay off the debts and liabilities the personal property of the partner is taken to discharge (paid) the business liability.

8) Absence of Legal Status: Partners and firm are one and same. The firm does not have a separate legal existence, because registration of partnership firm is optional.

9) Dissolution: The death, insolvency or insanity of any partner results into dissolution of partnership unless specified. Otherwise the remaining partners may continue to conduct business on the basis of a fresh agreement among them. The partnership at will compulsorily dissolved when any partner serves at 14 days notice to other partners regarding his unwillingness to continue the business.

10) Mutual Trust and Confidence: Partnership is based on mutual trust and confidence. Every partner must work in the interests of the entire firm. He should not make any secret profits and must disclose all material facts to the other partners.

MERITS OF PARTNERSHIP FIRM:

1) Easy Formation: There is no need to fulfill many legal formalities for the establishment of partnership. Only written agreement is necessary to start any lawful business on partnership basis. Registration of partnership firm is compulsory in Maharashtra from April 1985.

2) Higher Capital: Partnership has higher capacity to raise the capital than that of a sole trading concern. More members can take more and more sources of capital which helps to expand the capacity of the firm.

3) Higher Managerial Ability: Partnership is formed by two or more persons. Partners with different skill, knowledge, talent and experience can manage the firm more efficiently. As a result, the business can be conducted more efficiently.

4) Sound Decision: Partners can take sound and correct decisions collectively. They can be more balanced than the sole trader. The decisions taken are based in the consultations among all the partners.

5) Secrecy: Partnership firms are not required to publish their annual accounts like profit and loss account and balance sheet. Therefore, the third parties including competitors cannot take undue advantage of the inner information of the firm.

6) Flexible Organization: There is no strict rule on the management of business; changes can be brought in the terms and conditions of the partnership deed. Moreover the business activities can be expanded or decline or diversified as per the changing business circumstances ( situation) easily and quickly.

7) Division of Risk: Risk of each partner is reduced, when losses are shared by all the partners. Thus, partners can do business without fear.

8) Simple or Easy Dissolution: Similar to its formation, the dissolution of a firm is also easy. Any partner can give 14 days’ notice for dissolution. The only statutory condition is that they must pay off all the third party’s liabilities or debts.

9) Personal Contact with Customers: A partnership business can maintain personal contact with the customers and supply them goods and services as per their needs and requirements. This helps in customers’ satisfaction and the firm earns goodwill in the market similarly good relations can be maintained with employees.

DEMERITS OF PARTNERSHIP FIRM:

1) Unlimited Liability: The liability of all the partners is unlimited, which adversely affects the expansion of the firm. In case the business runs into loss, he has to pay from his personal property. This discourages people from becoming partners.

2) Limited Resources: A partnership has a limited capacity of raising capital, In comparison with a Joint stock company due to a limited number of members, unlimited liability, etc. Due to limited number of partners, a partnership firm can have limited financial and managerial resources.

3) Risk of Implied Authority: In a partnership, every partner is a principal and also the agent. He is bound by the actions of other partners in the ordinary conduct of the business. Therefore, honest and efficient partners suffer for the efficiency, irresponsibility and faults of other partners.

4) No succession: Not being a legal entity the firm is dependent on the mutual undertaking of the partners and the death or insolvency of the partners can lead to an end of the firm. If all the partners except one dies, retires, becomes insane or insolvent, the partnership is compulsorily dissolved.

5) No separate legal status: The Indian partnership Act 1932 does not give an independent legal status to partnership firms distinct from the partners. They will enjoy separate legal status after registration of partnership firm.

6) Disputes among the Partners: There can be constant conflicts and disputes among partners. Some partners prefer working for self interest at the cost of the interest of the firm. Partners often put the blame on other partners for wrong decision. Thus mutual conflicts and lack of team spirit among partners may lead to loss of reputation and finally to dissolution of the firm.

7) Lack of Public Confidence: As the partnership firm does not have a legal status or separate entity, there is less public confidence in its & its accounts are not published either. The continuity or existence is doubtful because of disputes and other limitations of a partnership firm.

8) Limitations on Expansion: A partnership cannot expand its business because of its limited number of partners, limited managerial skills, technical knowledge, funds, etc.

TYPES OF PARTNERS:

1) Active or Working Partner: Though all the partners have the right to take part in the management but there are one or two partners who take active interest in the day to day management or activities of the firm. Such partners are called active partners. They have full voice in the management. They may or may not invest any capital but are liable for the debts of the firm.

2) Dormant or Sleeping Partner: He is such a partner who contributes capital but does not take part in the management. He has no voice in the management. But, like others he shares the profits and bears the losses of the firm.

3) Nominal Partner: He does not contribute any capital nor take any part in the management but just gives his name and reputation to the firm. On the basis of his name and credit, the firm can expand the business. He may or may not share the profits but have to bear the losses of the firm.

4) Partner in profits only: As the name indicates, such a partner only shares the profits of the firm but, not the losses. He does not have the right to interfere in the management. But, he is liable to the third parties for the debts of the firm.

5) Sub-Partner: He is a partner of the partner. He is not the partner of the firm i.e. he cannot share the profits of the firm but, the profits of the partner. A sub-partner is not liable to the third parties for the debt of the firm.

6) Minor Partner: A minor is a person below the age of 18 years. Legally, he is not allowed to enter into a contract. But with the consent of all the partners he may be admitted for the benefit of the firm. His liability is limited upto the extent of his share in the firm. He has right to get profits, inspect the copy but, not the books of account.

7) Limited Partners: A person whose liability of the firm is limited to the extent of his investment is called limited partner. He has no right to take part in day to day work. But such partnership must have at least one partner having unlimited liability.

8) Partner by Holding out: A person who is not a partner in the firm but he represents himself to be a partner by word spoken or written or by his conduct is called a partner by holding out. If the other person acting on the faith of such representation and have given loan to the firm, then he will be liable to discharge debts in the same manner as other partners will be.

9) Secret Partner: when the relation of the partner with the firm is unknown to the general public is known a secret partner. Secret partners have all the features like other partners. His liability is unlimited and he has to invest capital into firm and also get the shares in profit. He also takes part in daily working or management.

TYPES OF PARTNERSHIP FIRM: On the basis of duration and the nature of partnership, it can be divided in the following types –

1) Partnership at will and Particular Partnership: When there is no provision in partnership agreement for the duration of the partnership is called ‘Partnership at will’. A partnership firm at will may be dissolved by any partner by giving notice in writing to all partners of his intention.

Some partnership firm formed for some specific object or for a particular period the partnership is called a “particular partnership”. Such partnership comes to an end on the completion of the venture or on the expiry of the period.

2) General and Limited Partnership: In a partnership when the liability of partners is unlimited is called general partnership. There are two types of partners, General partner and the special partner. The General partner’s liability is unlimited whereas special partner’s liability is limited.

3) Registered and unregistered Partnership: Initially it is not compulsory to get the partnership registered under Indian partnership Act, 1932, except in Maharashtra State. In Maharashtra State registration of partnership firm is compulsory since April, 1985. Partnership which works according to the partnership Act is called registered partnership.

When a partnership is established for general purpose, it may not be registered then it is called unregistered partnership.

REGISTRATION OF A PARTNERSHIP FIRM:

According to the Indian Partnership Act, 1932, it is not necessary to get the firm registered for its formation. Registration of a partnership firm is not compulsory under any law or no any penalty for non registration of partnership firm. But it is always useful to get the firm registered. In Maharashtra, registration of partnership firms is compulsory with effect from 1st April 1985.

Procedure for Registration: An officer is appointed for a registration of a partnership firm is called Registrar of firms. The steps involved in the registration of a firm are given below.

Obtain all prescribed forms from the office of the Registrar of firms of the area in which the place of business of the firm is situated. Then fill up the forms with the following information.

- The name of the firm.

- The principal place of the firm (Head Office).

- Name of the other places where the firm has business (Branches).

- The date when each partner joins the firm.

- The name in full and addresses of the partners.

- The duration of the firm (In case of partnership at will / for particular period)

Then get the statement fully signed by all partners and then this form along with prescribed fee has to be deposited in the office of Registrar. After proper scrutiny of the forms, if Registrar is satisfied, he enters the information in the register and sanctions it. Then Registrar issues a certificate which is called the Certificate of Registration.

Effects of Non-Registration: Under the Indian partnership Act, 1932, the registration of a firm is not compulsory. But an unregistered firm suffers the consequences. Following are the effects of non registration of partnership firm.

- A partner of an unregistered firm cannot file a suit against the firm or any other partner of the firm.

- An unregistered firm cannot file a suit against a third party to enforce any right arising from contract, but third party can file a suit in the court of law against the partnership firm.

- Firm also cannot start proceeding against any partner.

Benefits of Registration: Registered firm gets the right of filing a suit against third party in the court. The partners of the firm can also file a suit against the firm or outside parties. Registered firm is useful for incoming partner for his rights. On the death or retirement of a partner registered firm is benefited.

*******

C] JOINT STOCK COMPANY

A Joint Stock Company is a voluntary association of members formed for the purpose of undertaking a business. It is called a Joint Stock Company, because the shares or stock of the company are jointly owned by its members.

A Joint stock company undertakes different business activities like manufacturing, marketing and servicing. The funds required by the company are contributed by its members called shareholders. The company also borrows funds from banks and financial institutions. The shareholders are the Co-owners and they share in the profits of the company in the form of dividend.

The company is managed by Board of Directors. The Board is a group of elected representatives of the shareholders. The Board frames a plans and policies of the company. The Board in turn appoints several other managers and subordinate staff to look after day-to-day aspects of the Organization.

Definition: -

According to section 566 Indian Company Act, 1956, Company may be defining as “An incorporated voluntary association which act as an artificial person, created by Law, having common seal & perpetual succession.”

Section 566 of the Indian Companies Act, 1956 has defined Joint stock company as, “A company which is having a permanent paid-up or nominal share capital of fixed amount divided into shares, also of fixed amount or held and transferable as stock, or divided and held partly in one way and partly in the other and formed on the principle of having for its members, only the holders of those shares or that stock and no other persons”.

TYPES OF COMPANIES:-

(A) On the Basis of Incorporation (i.e. Registration)

(A) On the Basis of Incorporation (i.e. Registration)

Chartered Statutory Registered Foreign

Company Company Company Company

(B) On the Basis Liabi1ity of Members

Company Limited Company Limited Unlimited

By Shares by Guarantee Liability Company

(C) On the Basis of Ownership

Private Public Government Holding Subsidiary

Limited Company Limited Company Company Company Company

COMPANY LIMITED BY SHARES CAN BE OF TWO TYPES:

1] Private limited Company: According to Sec 3(I)(iii) of the Companies Act, 1956.

“A private company is a company which by its articles, restricts the right to transfer its shares, if any limits the number of its members to 50 and prohibits any invitation to the public to subscribe for any shares or debentures of the company”.

- Restrict the number of its members up to 2 to 50.

- Restrict the right of members to transfer its shares if any.

- Put a ban on inviting to the public to subscribe for any shares in or debentures of the company.

- Prohibits any invitation or acceptance of deposits from persons other that its members, directors or their relatives.

- Must have a minimum paid up share capital of one lakh rupees.

It is important that all the above said condition should be in order to remain a private company. If any one of the condition is not fulfilled by the company, shall be considered as public company. In the case of private company is a limited company, then it must add the words ‘Private Limited’ at the end of its name. A private company may be a company limited by shares or a company limited by guarantee or an unlimited company.

2] Public Company: According to Sec 3(I)(iv) public company means a company which is not a private company. A public company may be said an association which –

- Has no restriction on the transfer of its shares.

- There should be a minimum number of members are seven.

- Has a minimum paid up shares capital of Rs. 5, 00,000/- or such higher paid up capital as may be prescribed.

- Does not prohibit any invitation or acceptance of deposits.

There are minimum 7 members required for establishment of public company but there is no restriction of the maximum number of members. In the case of a public company is limited company, and then it must be ‘Limited’ word at the name of company. The public company must have at list 3 directors.

FINANCING OF JOINT STOCK COMPANY

FINANCING OF JOINT STOCK COMPANY

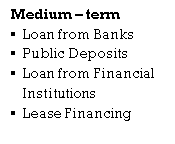

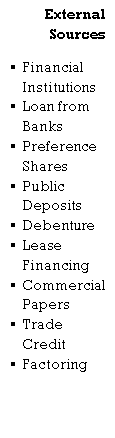

Long Term Sources: Sources through which funds are raised for long term use in the business are termed as long sources. These are explained as below:

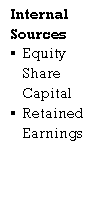

Shares: Funds raised from Issue of shares constitute the Ownership Fund of the company. Those who invest in shares are known as shareholders. A public company can issue two types of shares:

1. Equity Shares

2. Preference Shares

Equity Shares

They are the real owners of the company. Full voting rights are guaranteed to equity shareholders. They participate in the meetings of the shareholders, elect directors and approve major changes in the policies and programmers of the company. Equity shares are listed at the stock exchange and are freely transferable.

The rate of dividend is not fixed. It is decided by the board of directors on the basis of profits left after making payments of preference shares dividend. Therefore, the investors bear the maximum risk but may enjoy the maximum profits if the company’s performance is good.

Preference Shares:

These are those types of shares on which a fixed rate of dividend is paid, and

1. Dividend on preference shares is paid in priority to equity shares dividend, i.e., the preference dividend is paid before dividend is paid on equity shares.

2. Return of Capital: Preference share capital is paid back (returned) in priority to equity share capital in the event of or at the time of winding up (closing of) of the company.

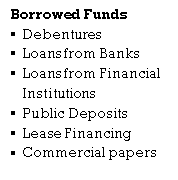

Debentures:

Meaning:- Debentures represent borrowed fund and is a loan capital. Debenture holders are the creditors of the company.

Debenture is a document or a certificate issued by the company as an acknowledgement of debt.

Interest on debentures is paid at a fixed rate. Debentures carry no voting rights but they generally involve a charge on the assets of the company.

Characteristics:-

Debentures represent borrowed fund

A fixed rate of interest is paid on debentures.

Interest is payable every year irrespective whether there are profits or not.

Debentures generally carry no voting rights.

Debentures generally involve a charge on the assets of the company.

Debentures are generally redeemable and repayable after a fixed period of time.

Public Deposits:-

Non-banking companies are allowed to raise money from the public including employees and shareholders. It is a kind of unsecured loan and the assets of the company are not required to be mortgaged for accepting deposits from public. Public deposits can be accepted for a period not less than six months, but not exceeding three years at a time. Depositors get a fixed rate of interest which is usually more than that available on bank deposits. At the same time, companies find it cheaper than loans from banks and financial institutions.

Short Sources:

Meaning: That portion of profits which is not distributed but is retained and reinvested in the business is known as retained profits. The retained profits are an internal source of finance. This method is also known as reinvestment of profits or Ploughing back of profits or self-financing or internal financing.

Under this method of financing, a certain proportion of profits is transferred to reserves which are shown under the heading ‘Reserves and surplus’

Since retained earnings actually belong to the shareholders of the company, these are treated as part of shareholders funds.

Use-The retained earnings may be used to meet long-term, medium-term and short-term financial needs of the company. Therefore retained earnings can be used by the company for the following purposes (Need) :-

For the replacement of old assets which have become obsolete.

For the expansion and growth of the business.

For contributing towards the fixed as well as working capital of the company.

For making the company self-dependent for finances.

For redemption of loans and debentures.

Capitalisation:

1. It is a quantitative aspect of an enterprise’s financial planning.

2. It refers to the total amount of securities issued by a firm.

Capital Structure:

1. It is concerned with the qualitative aspect.

2. It refers to the types of securities and their proportionate amounts which makes up capitalisation. A firm can issue three types of securities. They are Debentures, Equity shares and Preference shares. The capital structure of an enterprise refers to the decision about the proportion of these securities.

Some people include even the proportion of short – term debt in capital structure. They refer to the capital structure as financial structure.

Financial Structure:

1. It refers to the entire liabilities side of the balance sheet.

2. It consists of a specified percentage of short – term debt, long – term debt and shareholder’s funds.

Economic Features of Different Classes of Shares and Securities:

Equity Shares:

These are the shares that are traded on the stock exchange and also called ordinary shares. Bulk of the shares that are traded on the stock exchanges, comprise equity shares. The owners of these equity shares are entitled to dividends, voting rights and all other benefits that share holders have. Equity shares are issued at different face values.

Shares with Differential Voting Rights:

The Tata Motors shares with Differential Voting Rights is traded along with equity shares. More popularly known as DVR, these come with voting rights, that may not be the same as equity share holders. In fact, they could be just 10 percent of the voting rights of normal equity shareholders. However, investors tend to get compensated by higher dividends. Shares with Differential Voting Rights, tend to trade at a lower value as compared to ordinary shares.

Preference Shares:

These are those types of shares on which a fixed rate of dividend is paid, and

1. Dividend on preference shares is paid in priority to equity shares dividend, i.e., the preference dividend is paid before dividend is paid on equity shares.

2. Return of Capital: Preference share capital is paid back (returned) in priority to equity share capital in the event of or at the time of winding up (closing of) of the company.

Features of shares:

The main features of equity shares are:

1. They are permanent in nature.

2. Equity shareholders are the actual owners of the company and they bear the highest risk.

3. Equity shares are transferable, i.e. ownership of equity shares can be transferred with or without consideration to other person.

4. Dividend payable to equity shareholders is an appropriation of profit.

5. Equity shareholders do not get fixed rate of dividend.

6. Equity shareholders have the right to control the affairs of the company.

7. The liability of equity shareholder is limited to the extent of their investment.

PATTERNS OF CAPITAL STRUCTURE

Let us make an in-depth study of the pattern of capital structure of a company.

A company may begin with the simple type of capital structure i.e., by the issue of equity shares only, but gradually this becomes a complex type, i.e., along with the issue of equity share, it may make a financing-mix with debt.

The patterns of capital structure are:

With the issue of equity share only;

(b) With the issue of both equity share and preference shares.

(c) With the issue of equity shares and debentures, and

(d) With the issue of equity shares, preference shares and debentures.

But the best method of choosing the composition of capital structure depends on many factors, the most significant is to choose the alternative which gives the highest EPS or rates of return on equity capital.

To raise fund through debt is cheaper than to raise funds through equity—due to tax factor as interest on debenture is an allowable deduction. On the other hand, payment of dividend is an appropriation of profit, hence, the same is not allowed as deduction for computation of taxable income.

In short, if a company having 50% tax bracket pays debenture interest @ 10% the ultimate effective cost comes to 5%. That is not applicable also in case of preference shares.

If a firm raises its funds by the issue of 10% preference shares, the dividend so paid to the preference shareholders is also not allowed as deduction for income tax purposes i.e., the cost of raising funds would be @ 10%. So it can safely be stated that to raise fund by the issue of debt capital or borrowings is cheaper which result in a higher profit available to the equity shareholders which, in other words, increase the EPS.