UNIT – 1

THE INDIAN CONTRACT ACT,1872

The Indian Contract Act, 1872 prescribes the law relating to contracts in India and is the key act regulating Indian contract law.

The Act is based on the principles of English Common Law. It is applicable to all the states of India. It determines the circumstances in which promises made by the parties to a contract shall be legally binding.

Under Section 2(h), the Indian Contract Act defines a contract as an agreement which is enforceable by law.

The objective of the Contract Act is to ensure that the rights and obligations arising out of a contract are honored and that legal remedies are made available to an aggrieved party against the party failing to honor his part of agreement. The Indian Contract Act makes it obligatory that this is done and compels the defaulters to honor their commitments.

EXTENT AND COMMENCEMENT

- It extends to the whole of India except the State of Jammu and Kashmir

- It came into force on the first day of September, 1872.

- The sale of Goods was repealed from this Indian Contract Act in 1930. Contracts relating to partnership were repealed in 1932.

DEVELOPMENT

The Act as enacted originally had 266 Sections, it had wide scope

- General Principles of Law of Contract – Sections 01 to 75

- Contract relating to Sale of Goods – Sections 76 to 123

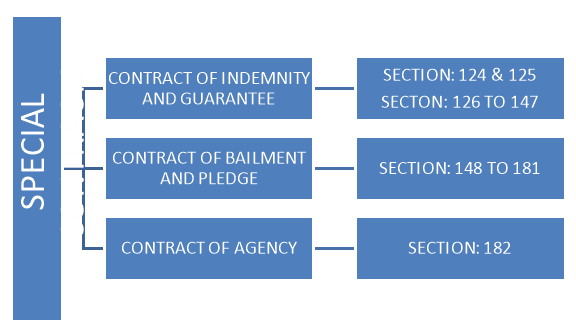

- Special Contracts- Indemnity, Guarantee, Bailment & Pledge and Agency – Sections 124 to 238

- Contracts relating to Partnership – Sections 239 to 266

At present the Indian Contract Act may be divided into two parts:

- Part 1: deals with the General Principles of Law of Contract Sections 1 to 75

- Part 2: deals with Special kinds of Contracts such as Contract of Indemnity and Guarantee and Contract of Bailment and Pledge

1. Offer section 2(a):

When one person signifies to another his willingness to do or to abstain from doing anything, with a view to obtaining the assent of that other to such act or abstinence, he is said to make a proposal.

- May be express or implied

- May be positive or negative

- Must intend to create legal relationship

- Terms of offer must be certain

- May be made to a specific person or class of persons or to any one in the world at large

- Must be communicated to the offeree

- Must be made with a view to obtain the assent

- May be conditional

2. Acceptance section 2(b):

When the person to whom the proposal is made, signifies his assent there to, the proposal is said to be accepted.

3. Promise section 2(b):

When the person to whom the proposal is made signifies his assent thereto, the proposal is said to be accepted. A proposal when accepted, becomes a promise.

The person making the proposal is called the “Promisor” and the person accepting the proposal is called the “Promisee”.

4. Promisor and promise section 2(c):

When the proposal is accepted, the person making the proposal is called as promisor and the person accepting the proposal is called as promisee.

5. Consideration section 2(d):

When at the desire of the promisor, the promise or any other person has done or abstained from doing, or does or abstains from doing, or promises to do or to abstain from doing something, such act or abstinence or promise is called a consideration for the promise.

6. Agreement section 2(e):

Every promise and every set of promises, forming the consideration for each other is an agreement.

An agreement not enforceable by law is said to be void.

7. Contract

An agreement enforceable by law is a contract.

STEPS INVOLVED IN THE CONTRACT

- Proposal and its communication

- Acceptance of proposal and its communication

- Agreement by mutual promises

- Contract

- Performance of Contract

ESSENTIAL REQUIREMENTS OF A VALID CONTRACT

- Offer and its acceptance

- Free consent of both parties

- Mutual and lawful consideration for agreement

- It should be enforceable by law. Hence, intention should be to create legal relationship. Agreements of social or domestic nature are not contracts

- Parties should be competent to contract

- Object should be lawful

- Certainty and possibility of performance

- Contract should not have been declared as void under Contract Act or any other law

ESSENTIALS OF A VALID ACCEPTANCE

- Acceptance must be absolute and unconditional

- Acceptance by usual mode as desired by the offer or

- Acceptance cannot precede the offer

- Acceptance may be express or implied

- Acceptance must be given within a reasonable time

- Acceptance must be by an ascertained person (offeree)

- Offer cannot be accepted after it was rejected unless it is renewed

- Silence does not imply acceptance

- Acceptance must be made before the lapse or revocation of the offer

- Acceptance of offer means acceptance of all terms attached to the offer

8. Reciprocal Promises 2(f):

Promises which form the consideration or part of the consideration for each other are called 'reciprocal promises'.

9. Void agreement 2(g):

An agreement not enforceable by law is void.

10. Void and Voidable Contract

An agreement which is enforceable by law at the option of one or more of the parties thereto, but not at the option of the other or others, is a voidable contract

A contract which ceases to be enforceable by law becomes a void contract.

TERMINATION OF OFFER

- By notice of revocation

- By lapse of time

- By failure of the acceptor to fulfil a condition precedent to acceptance

- By failure to accept according to the mode prescribed

- By death or insanity of the offeror

- By rejection

1. On the basis of Validity

Valid contract: An agreement which has all the essential elements of a contract is called a valid contract. A valid contract can be enforced by law.

Void contract [Section 2(g)]: A void contract is a contract which ceases to be enforceable by law. A contract when originally entered into may be valid and binding on the parties. It may subsequently become void. -- There are many judgments which have stated that where any crime has been converted into a "Source of Profit" or if any act to be done under any contract is opposed to "Public Policy" under any contract— than that contract itself cannot be enforced under the law-

Voidable contract [Section 2(i)]: An agreement which is enforceable by law at the option of one or more of the parties thereto, but not at the option of other or others, is a voidable contract. If the essential element of free consent is missing in a contract, the law confers right on the aggrieved party either to reject the contract or to accept it. However, the contract continues to be good and enforceable unless it is repudiated by the aggrieved party.

Illegal contract: A contract is illegal if it is forbidden by law; or is of such nature that, if permitted, would defeat the provisions of any law or is fraudulent; or involves or implies injury to a person or property of another, or court regards it as immoral or opposed to public policy. These agreements are punishable by law. These are void-ab-initio.

“All illegal agreements are void agreements but all void agreements are not illegal.

Unenforceable contract: Where a contract is good in substance but because of some technical defect cannot be enforced by law is called unenforceable contract. These contracts are neither void nor voidable.

2. On the basis of Formation

Express contract: Where the terms of the contract are expressly agreed upon in words (written or spoken) at the time of formation, the contract is said to be express contract

Implied contract: An implied contract is one which is inferred from the acts or conduct of the parties or from the circumstances of the cases. Where a proposal or acceptance is made otherwise than in words, promise is said to be implied.•

Quasi contract: A quasi contract is created by law. Thus, quasi contracts are strictly not contracts as there is no intention of parties to enter into a contract. It is legal obligation which is imposed on a party who is required to perform it. A quasi contract is based on the principle that a person shall not be allowed to enrich himself at the expense of another.

3. On the basis of Performance

Executed contract: An executed contract is one in which both the parties have performed their respective obligation.

Executory contract: An executory contract is one where one or both the parties to the contract have still to perform their obligations in future. Thus, a contract which is partially performed or wholly unperformed is termed as executory contract.

Unilateral contract: A unilateral contract is one in which only one party has to perform his obligation at the time of the formation of the contract, the other party having fulfilled his obligation at the time of the contract or before the contract comes into existence.

Bilateral contract: A bilateral contract is one in which the obligation on both the parties to the contract is outstanding at the time of the formation of the contract. Bilateral contracts are also known as contracts with executory consideration.

BAILMENT AND PLEDGE

INRTRODUCTION

According to Sec 148 of the Contract Act, 1872, ‘A bailment is the delivery of goods by one person to another for some purpose, upon a contract that they shall, when the purpose is accomplished, be returned or otherwise disposed of according to the directions of the person delivering them.

The person delivering the goods is called the bailor, the person to whom they are delivered is called the bailee and the transaction is called the bailment.

ESSENTIALS OF BAILMENT

It is a delivery of movable goods by one person to another (not being his servant). According to Section 149 the delivery of goods may be actual or constructive.

The goods are delivered for some purpose. When they are delivered without any purpose there is no bailment as defined under Sec 148

The goods are delivered subject to the condition that when the purpose is accomplished the goods are to be returned in specie or disposed of according to the directions of the bailor, either in original form or in altered form.

DUTIES OF THE BAILEE

- Duty to take reasonable care of goods delivered to him [Sec 151]

- Duty not to make unauthorized use of goods entrusted to him [ sec 154]

- Duty not to mix goods bailed with his own goods [ Sec 155]

- Duty to return the goods [ Sec 165]

- Duty to deliver any accretion to the goods [Sec 163]

DUTIES OF THE BAILOR

- Duty to disclose fault in the goods bailed [Sec 150]

- Duty to repay necessary expenses in case of gratuitous Bailment [Sec 158] eg bailment of horse and expenses incurred towards feeding and medical care of the horse to keep it alive.

- Duty to repay any extraordinary expenses in case of non-gratuitous expenses

- Duty to indemnify bailee [Sec 164]

RIGHTS OF BAILEE

- Enforcement of Bailor’s Duties

- Right to deliver goods to one of several joint owners

- Right to deliver goods, in good faith, to bailor without title, without incurring any liability to the true owner

- Right of Lien

RIGHTS OF THE BAILOR

- Enforcement of Bailee’s Duties

- Right to terminate bailment if the bailee uses the goods wrongfully [ Sec 153]

- Right to demand return of the goods at any time in case of gratuitous bailment [Sec 159]

INTRODUCTION

According to Sec 172, Contract Act, 1872, ‘The bailment of goods for repayment of a debt or performance of a promise is called ‘pledge’. The Bailor in this case is called the pawnor, the bailee is called the Pawnee.

DIFFERENCE

Pledge | Bailment |

Pledge is the bailment for a specific purpose ie to provide security for a debt or for fulfillment of object | Bailment is for a purpose a specific purpose ie to other than two under provide security for a pledge ie for repairs, safe debt or for fulfillment of custody etc. object. |

The pledge has right to sale on default after giving notice thereof to the pledger | No right to sale. The Bailee may either retain the goods or the Bailor for non-payment of the dues |

ESSENTIAL FEATURES OF A VALID PLEDGE

- Delivery of possession

- Delivery should be upon a contract

- Delivery should be for the purpose of security

- Delivery should be upon condition to return

DUTIES OF A PAWNOR

- Duty to repay the loan

- Duty to pay expenses in case of default

DUTIES OF A PAWNEE

- Duty not use of pledged goods

- Duty to return the goods

RIGHT OF PAWNOR

- Right to redeem the goods pledged

- Right to receive the increase

RIGHT OF PAWNEE

- Right to retain the pledged goods

- Right to extra ordinary expenses

- Right in case of default of the pawnor

- Right to sell the goods

LAW OF AGENCY

MEANING & DEFINITION OF AGENCY

Section 182,

“An agent is a person employed to do any act for another or to represent another in dealing with third persons. The person for whom such act is done or who is so represented is called the principal”.

- The person who delegates the authority is known as principal.

- To whom the power is delegated is known as agent.

- The relationship that is created is known as agency.

- A person who act in place of another – Agent

- The person on whose behalf he acts - Principal

FEATURES OF THE CONTRACT OF AGENCY

- Principal is answerable to third parties for the acts of agent

- Consideration not necessary – Section 185 of the act clearly lays down , “ No consideration is necessary to create an agency”

- Principal must be competent to employ an agent – Only a person who is competent to contract can employ an agent. (Major, Sound Mind )

- Agent may not have contractual capacity – A minor or a person of unsound mind may act as an agent & bind the principal to the third persons.

TEST OF AGENCY

A person does not become an agent on behalf of another merely because he gives him advice in matters of business.

Every person who acts for another cannot be agent. Cobbler mending shoes of a man, servant rendering services for us – are not agents.

To test whether a person is or not an agent

- The essential condition is that whether he is clothed with a necessary authority by another (principal) to bind him & make him (principal) answerable to the third persons & thus establishing a privity contract between that third person & the principal.

- If this condition is satisfied then a person is considered as an agent.

Special Agents – who is employed to do some particular act or represent his principal in some particular transaction? As soon as the act is performed the authority of agent comes to an end. E.g. An agent engaged to sell a house.

General Agent – who is employed to do all such acts which are connected with the business of trade of his employer. If principal limits authority secretly, he himself will be bound

Universal Agent – is one who is employed to all such act which a principal can lawfully do & can delegate. Agent has unlimited authority.

FROM THE POINT OF VIEW OF NATURE OF WORK TO BE PERFORMED:

1. Factors – is a mercantile agent to whom the possession of goods are given for the purpose of selling them. He usually sells the goods in own name. He can exercise a general right of lien on the goods delivered to him for balance of payment if any.

2. Auctioneer – is an agent who is appointed by the principal to sell the goods on his behalf at a public auction for a reward in form of commission. Eg reserve price

3. Broker – is an agent appointed by the principal for the purpose of selling or buying goods on his behalf. He do not have possession of goods nor he can contract in his own name. He bring seller & buyer together to bargain. He gets commission ( brokerage ).

4. Commission Agent – is a mercantile agent who is employed to buy & sell goods for his principal on best possible terms. He transact in his own name. He is entitled to commission. He may or may not have possession.

5. Del credere Agent – is one who guarantees to his principal, the performance of the financial obligation by party with whom he enters into a contract on principal behalf, in consideration of an extra commission. He becomes surety & become liable on the default of third party.

6. Banker – act as a mercantile agent on behalf of his customer when he collects cheques, drafts, bills & pay insurance premium & buy or sell securities.

CREATION OF AGENCY

By express agreement – authority is given to agent in written or by words of mouth. He can bind the principal to the third parties by his acts to the extent he is delegated with the authority .

By implied agreement

1. Agency by Estoppel – Where a person permit another to act on his behalf. Principal is estopped from denying his agent’s authority. E.g. A tell B in the presence of P that A is the agent of P. P does not contradict the statement. B enter into the contract with P on the belief that A is P’s agent. In such case P would be bound by the contract. He is not the agent. He ceases to be an agent

2. Agency by holding out – Some positive conduct of the principal indicates that a particular person is his agent.

P sends A to buy goods on credit from C. A buys goods on credit for himself & refuses to pay. C sue P. P cannot plead that A had no authority.

3. Agency by necessity – When an agency is created by the circumstances. The impossibility of getting the instructions from the principal is the basis of creation of agency by necessity.

E.G. X sent some horses to Y through a railway company. But Y did not take the delivery of the horses at the destination with the result the railway company had to feed the horses. Held, the railway co. Was an agent of necessity & could recover the amount spent on feeding the horses.

4. Agency by ratification – Ratification means subsequent adoption or acceptance by a person of an unauthorized act done by another on his behalf without any authority. X buys 5 bags of wheat on behalf of Y without his knowledge or authority. Y would be bound by the contract, if he ratify or accept the same. It can be expressed or implied.

Essentials of a valid ratification

1. Act must have been done as agent on behalf of principal identifiable – Only the person on whose behalf the act is done can ratify it. If the agent act in his own name, his act cannot be ratified by any other person. e.g. X was authorised by Y to buy wheat at certain price. X exceeded his authority & purchased wheat from Z at a higher price in his own name. He did not profess to buy wheat on behalf of Y. Subsequently Y ratified the act of X but later refused to take delivery of the wheat. Z sue Y. Held, the contract could not be ratified because X did not purport to act as an agent of Y.

2. The principal must be in existence. Eg company and promoters

3. The principal must be competent to ratify the act – must have contractual capacity. A minor cannot ratify the contract a contract on attaining the age of majority.

4. The principal must have the full knowledge of all the material facts – X bought certain goods for Y at the price greater than the market value in the name of Y. Y ratified the transaction without knowing the same ( high price ) . The ratification is invalid.

5. The principal must ratify the whole transaction.

6. Ratification must be made within reasonable time.

7. Act to be ratified must not be void or illegal.

8. Ratification must be communicated.

DUTIES OF AN AGENT

- To follow principal’s directions – An agent must act within the scope of the authority conferred on him. An agent was instructed to insure goods. He failed to do so. The goods were destroyed. He was held liable to the extent of loss.

- To follow the customs in the absence of instructions – B, a broker, in whose business, it is not the custom to sell on credit , sell goods of A on credit to C, whose credit at the time was very high. C, before payment, becomes insolvent. B must make good the loss to A.

- To conduct business with reasonable care skill & diligence – A, an agent for the sale of goods, having authority to sell on credit, sells to B on credit, without making the proper & usual enquires as to the solvency of B. B at the time of such sale, is insolvent. A must make compensation of his principal in respect of any loss thereby sustained.

- To keep & render accounts to principal when demanded.

- To communicate with principal.

- Not to deal on his own account – If an agent wants to deal on his own account, he must seek the consent of the principal first & must acquaint him with all the material facts. ( Purchase )

- Not to make secret profits ( Bribe )– Agency is a fudiciary relation.

- To pay sum received – he can deduct his remuneration & all expenses incurred in conducting business.

RIGHTS OF AN AGENT

Right of retainer – The agent has a right to retain, out of any sums received all money due to him in respect of remuneration, advance made, expenses incurred in conducting business.

Right to receive remuneration if he has completed his task. He is not entitled to any remuneration for part transaction.

Right of lien – he has right to exercise particular lien over the goods, paper, property until the amount due to him for commission, expenses has been paid.

DUTIES & RIGHTS OF THE PRINCIPAL

- To pay remuneration to agent

- To recover compensation for breach of duty by the agent

- To forfeit agent’s remuneration where he is guilty of misconduct

- To receive any extra profit made by agent.

- To enforce the various duties of the agent.

- To receive all sums.

TERMINATION OF AGENCY

- By act of parties

- By agreement – mutual consent

- By revocation of authority by the principal – The principal can revoke the authority of an agent at any time before the authority has been exercised as to bind the principal.

- By renunciation by the agent – by giving reasonable notice.

- By performance of contract of agency.

- By death of principal or agent.

- By expiry of time – where agency is for fixed time period.

- By insolvency of the principal.

- By destruction of subject matter – agency was created to sell a house & house destroys.

- By becoming alien enemy – where principal & agent are from different countries.

IRREVOCABLE AGENCY

- The agency which a principal cannot revoke is known as irrevocable agency.

- Where the agency is coupled with interest – A gives authority to B to sell A’s land & to pay himself out of the proceeds, the debt due to him from A. A cannot revoke this authority.

- Where the agent has incurred personal liability – Where the agent has bought goods in his own name principal cannot refuse to pay.

- Where the authority has been exercised party – X authorizes Y to buy 10 bags of wheat on his account. Y buys 10 bags of wheat in the name of X. X cannot revoke the authority.

- In law, the relationship that exists when one person or party (the principal) engages another (the agent) to act for him, e.g. To do his work, to sell his goods, to manage his business. The law of agency thus governs the legal relationship in which the agent deals with a third party on behalf of the principal. The competent agent is legally capable of acting for this principal vis-à-vis the third party. Hence, the process of concluding a contract through an agent involves a twofold relationship. On the one hand, the law of agency is concerned with the external business relations of an economic unit and with the powers of the various representatives to affect the legal position of the principal. On the other hand, it rules the internal relationship between principal and agent as well, thereby imposing certain duties on the representative (diligence, accounting, good faith, etc.)

INTRODUCTION

CHART:

CONTRACT OF INDEMNITY:

DEFINITION:

As per Section 124, A contract by which one party is promises to another to save him from loss caused to him by the conduct of the promisor himself , or by the conduct of any other person.

ESSENTIAL ELEMENTS OF INDEMNITY CONTRACT:

- Two parties.

- Legal relationship.

- Free consent.

- Competence.

- Consideration.

- Lawful objective.

- Express or implied.

- Compensation of loss.

PARTIES OF CONTRACT OF INDEMNITY:

1. Indemnity holder:

- Who bears loss.

- Who is promisee.

- Who receive compensation?

2. Indemnifier:

- Who pay compensation for indemnity’s loss?

- Who is promisor.

Indemnifier (Promisor) Indemnity holder (Promisee) Contract Compensation paid Contract for compensation

RIGHTS OF INDEMNITY HOLDER:

Damages:

- In this indemnity holder take his compensation for loss.

Cost:

- Sometimes indemnifier refuses to paid compensation. In this situation indemnity holder sue case for compensation.

- In sued the case the overall expenses incurred is taken by indemnifier also with claim money.

Sums:

- Sometimes indemnity holder may compromise due to damage. In this situation compromisation money also taken from indemnifier. Sec.125

RIGHTS OF INDEMNIFIER:

The ICA,1872 is silent for rights of indemnifier. The rights of indemnifier is similar has rights of surety.

- Right of Sub-rogation: Sub-rogation is a process where rights will get shifted from one person to the other. It means that after compensating indemnity holder for his loss, the indemnifier has right to sue third party who is liable for that.

- Right to refuse indemnity: Sometimes loss suffered by indemnity holder is beyond the contract, in this case indemnifier has right to refuse for compensation.

CONTRACT OF GUARANTEE:

A contract of guarantee is a contract to perform the promise, or discharge the liability, of a third person in case of his default. A guarantee may be either oral or written. [section 126]

ESSENTIALS OF CONTRACT OF GUARANTEE:

- Existence of a principal debt.

- Consideration for a contract of guarantee.

- There should be no misrepresentation or concealment.

- Contract of guarantee must contain all the essential elements of valid contract.

- Contract of guarantee is a complete and separate contract by itself.

PARTIES TO CONTRACT OF GUARANTEE :

- Surety ( Who gives guarantee )

- Principal debtor ( for whom guarantee is given)

- Creditor ( to whom guarantee is given)

TYPES OF GUARANTEE

- Special guarantee:

A guarantee is a “specific guarantee”, if it is intended to be applicable to a particular debt and thus comes to an end on its repayment.

- Continuing guarantee A guarantee which extends to a series of transactions is called a “continuing guarantee”, e.g., (i) fidelity guarantee, (ii) overdraft.

ESSENTIAL ELEMENTS OF CONTRACT OF GUARANTEE:

- Three parties.

- Three contract.

- Express or implied.

- Legal relationship.

- Free consent (Sec.13).

- Competent (not compulsory for principal debtor).

- Consideration[Sec.2(d)].

- Legal objective.

TYPES OF CONTRACT OF GUARANTEE

- Unilateral contract of commercial credit ( for trade transaction)

- Bank guarantee(for contract of tender)

- Letter of credit(for international trade)

- Absolute performance bonds

- Retrospective guarantee( for existing obligation)

- Prospective guarantee (for future obligation)

- Specific guarantee9for single transaction)

- Continuing guarantee( for more than single debt)

RIGHTS OF SURETY

Against the principal debtor

- Right of subrogation

- Right to indemnity

Against the creditor

- Right Of Securities

- Right To Claim Set Off

AGAINST THE CO-SURETIES

When several co-sureties have given guarantee for the same debt with their maximum limits, they are liable to pay equally but subject to the limits they have fixed

DISCHARGE OF SURETY

- Revocation by notice.

- Revocation by death.

- Discharge of surety by variance in terms of contract.

- Discharge of surety by release or discharge of principal debtor.

- Discharge of surety when creditor compounds with, gives time to, or agrees not to sue, principal debtor.

- Creditor's forbearance to sue does not discharge surety.

- Release of one co-surety does not discharge other.

- Discharge of surety by creditor's act or omission impairing surety's eventual remedy.

- By the creditor losing his security.

- By concealment or misrepresentation.

DIFFERENCE BETWEEN CONTRACT OF INDEMNITY AND CONTRACT OF GUARANTEE

No. | Basis | Contract of Indemnity | Contract of Guarantee |

1 | Meaning | There is a contract between two parties for the compensation of loss | There are contracts between three parties for paying liability |

2 | Section | Sec.124 & 125 | Sec.126 |

3 | No. Of parties | Two parties | Three parties |

4 | No. Of contract | One contract | Three contract |

5 | Related with | It is related with damage | It is related with payment of liability |

SALES OF GOODS ACT 1930

HISTORY

- Sale of goods act was enacted in 1930.

- Borrowed from the English Sales of Goods Act,1893.

- Came into force in July 01, 1930.

- Prior to the act, the law of sale of goods was contained in chapter VII of the Indian contract act,1872.

- It extends to whole India except J& K.

FORMATION OF CONTRACT OF SALE

DEFINITION:

As per Sec 4(1) of the Indian Sale of Goods Act, 1930 defines the contract of sale of goods in the following manner: “ A contract of sale of goods is a contract whereby the seller transfers or agrees to transfer the property in goods to the buyer for a price”.

ESSENTIALS OF CONTRACT OF SALE

From the above definition, the following essentials of a contract of sale may by noted:

- There must be at least two parties

- Transfer or Agreement to transfer the ownership of goods.

- The subject matter of the contract must necessarily be 'goods'. Sale of immovable property is not covered under this act.

- The consideration is Price.

- A Contract of sale may be in writing or by words

- All other essentials of a valid contract must be present

GOODS

Definition of GOODS under the Act

- 'Goods' means every kind of moveable property and includes stock and shares, growing crops, grass, and things attached to or forming part of the land, which are agreed to be severed before sale or under the contract of sale.

- Actionable claims and money are not included in the definition of goods.

- Thus, goods include every kind of moveable property other than actionable claim or money. Example - goodwill, copyright, trademark, patents, water, gas, and electricity are all goods and may be the subject matter of a contract of sale.

- The test is if the property on shifting its situation, does not lose its character, the said property shall be movable and fall within the definition of Goods.

TYPES OF GOODS

- Existing goods

- Future goods

- Contingent goods

1. Existing goods:

Goods which are physically in existence and which are in seller's ownership and/or possession, at the time of entering the contract of sale are called 'existing goods.' Where seller is the owner, he has the general property in them.

2. Future goods:

Goods to be manufactured, produced or acquired by the seller after the making of the contract of sale are called 'future goods' [Sec. 2(6)]. These goods may be either not yet in existence or be in existence but not yet acquired by the seller. Ex:- A agrees to sell to B all the milk that his cow may yield during the coming year. This is a contract for the sale of future goods.

3. Contingent goods:

Though a type of future goods, these are the goods the acquisition of which by the seller depends upon a contingency, which may or may not happen [Sec. 6 (2)].

Ex:- (a) A agrees to sell to B a specific rare painting provided he is able to purchase it from its present owner. This is a contract for the sale of contingent goods. (b) X agrees to sell to 25 bales of Egyptian cotton, provided the ship which is bringing them reaches the port safely. It is a contract for the sale of contingent goods. If the ship in sunk, the contract becomes void and the seller is not liable.

The term “Contract of sale of goods’ is a generic term and it includes:

a. Sale

b. An agreement to sell

Where the seller transfers the ownership rights to the buyer immediately on making the contract, it is the contract of sale, but where the ownership rights are to pass on some future date upon the fulfillment of certain conditions then it is called an agreement to sell.

SALE:

- It is a contract where the ownership in the goods is transferred by seller to the buyer immediately at the conclusion contract. Thus, strictly speaking, sale takes place when there is a transfer of property in goods from the seller to the buyer. A sale is an executed contract.

- It must be noted here that the payment of price is immaterial to the transfer of property in goods.

- Ex - A sells his Yamaha Motor Bicycle to B for Rs. 10,000. It is a sale since the ownership of the motorcycle has been transferred from A to B.

AGREEMENT TO SELL

- It is a contract of sale where the transfer of property in goods is to take place at a future date or subject to some condition thereafter to be fulfilled..

- Ex- A agreed to buy from B a certain quantity of nitrate of soda. The ship carrying the nitrate of soda was yet to arrive. This is an agreement to sale. In this case, the ownership of nitrate of soda is to be to transferred to A on the arrival of the ship containing the specified goods (i.e. nitrate of soda)

- On 1st March 1998, A agreed to sell his car to B for Rs. 80,000. It was agreed between themselves that the ownership of the car will transfer to B on 31st March 1998 when the car is got registered in Bs name. It is an agreement to sell and it will become sale on 31st March when the car is registered in the name of B. Other points of distinction between a sale and an agreement to sell are:

DIFFERENCE BETWEEN

SALE | AGREEMENT TO SELL |

Ownership remains with the buyer | Ownership remains with the seller |

It is a executed contract | It is a executor contract |

Risk of loss falls on the buyer | Risk of loss falls on the seller |

Seller cannot re sell the goods | Seller can sell goods to third party |

It can be in case of existing and specific goods | It can be in case of future and unascertained goods |

In case of breach of a contract, seller can sue for the price of the goods | In case of breach of a contract, seller can sue only for damages not for the price |

The seller is only entitled to the ratable dividend of the price due if the buyer becomes insolvent | The seller may refuse to sell the goods to the buyer w/o payments if the buyer becomes insolvent |

WHICH DOCUMENTS ARE CONSIDERED AS DOCUMENTS OF TITLE TO GOODS

A document of title to goods may be described as any document used as proof of the possession or control of goods, authorising or purporting to authorise, either by endorsement or by delivery, the possessor of the document to transfer or receive goods thereby represented.

The following are documents of title to goods:

- Bill of Lading;

- Dock Warrant;

- Warehouse keeper's Certificate;

- Warfinger's Certificate;

- Railway Receipt;

- Warrant or order for the delivery of goods; etc.

MEANING OF CONDITION

Sec 12(2) of Sales Of Goods Act, 1930 has defined Condition as: “A condition is a stipulation essential to the main purpose of the contract, the breach of which gives rise to a right to treat the contract as repudiated”.

- A condition is a stipulation –

(a) which is essential to the main purpose of the contract

(b) the breach of which gives the aggrieved party a right to terminate the contract.

- It goes to the root of the contract.

- Its non-fulfillment upsets the very basis of the contract.

Example :-

By charter party( a contract by which a ship is hired for the carriage of goods), it was agreed that ship m of 420 tons “now in port of Amsterdam” should proceed direct to new port to load a cargo. In fact at the time of the contract the ship was not in the port of Amsterdam and when the ship reached Newport, the charterer refused to load. Held, the words “now in the port of Amsterdam” amounted to a condition, the breach of which entitled the charterer to repudiate the contract.

WARRANTY

Sec 12(3) of Sale Of Goods Act, 1930 has defined Warranty as : “A warranty is a stipulation collateral to the main purpose of the contract, the breach of which gives rise to only claim for damages but not to a right to reject the goods and treat the contract as repudiated”.

- It is a stipulation collateral to the main purpose of the contract

- It is of secondary importance

- If there is a breach of a warranty, the aggrieved party can only claim damages and it has no right to treat the contract as repudiated.

DISTINCTION BETWEEN CONDITION AND WARRANTY

CONDITION | WARRANTY |

A condition is a stipulation (in a contract), which is essential to the main purpose of the contract. | A warranty is a stipulation, which is only collateral or subsidiary to the main purpose of the contract. |

A breach of condition gives the aggrieved party a right to sue for damages as well as the right to repudiate the contract. | A breach of warranty gives only the right to sue for damages. The contract cannot be repudiated. |

A breach of condition may be treated as a breach of warranty in certain circumstances. | A breach of warranty cannot be treated as a breach of condition |

EXPRESS AND IMPLIED CONDITIONS AND WARRANTIES (TYPES)

- Conditions and Warranties may be either express or implied.

- They are said to be "express" when they are expressly provided by the parties.

- They are said to be 'implied' when the law deems their existence in the contract even without their actually having been put in the contract. Sec(14 to17)

IMPLIED CONDITIONS :

- Conditions as to title [Sec.14(a)] [Rowland v. Divall,(1923)]

- Sale by description [Sec.15] [Bowes v.shand,(1877)]

- Condition as to quality or fitness.[Sec.16(1)]

- Conditions as to Merchantability [Sec.16(2)] [R.S.Thakur v. H.G.E. Corp., A.I.R.(1971)]

- Conditions implied by custom[Sec.16(3)].

- Sale by Sample (Sec.17)

- Condition as to wholesomeness.

- Warranty of Quiet possession-Sec.14(6)

- Warranty against encumbrances-Sec.14(c)

- Warranty to disclose dangerous natures of goods.

- Warranty as to quality or fitness by usage of trade – Sec.16(4).

DOCTRINE OF CAVEAT EMPTOR

- Caveat Emptor is a fundamental principle of the law of sale of goods

- It means "Caution Buyer", i.e. "Let the buyer beware".

- It is the duty of the buyer to be careful while purchasing goods of his requirement and in the absence of the enquiry from the buyer, the seller is not bound to disclose every defect in the goods of which he may be cognizant.

EXCEPTIONS TO THE DOCTRINE OF CAVEAT EMPTOR (SEC16)

- In case of misrepresentation by the seller

- In case of concealment of latent defect

- In case of sale by description

- In case of sale by sample

- In case of sale by sample and description

- Fitness for a particular purpose

- Merchantable quality

PASSING / TRANSFER OF PROPERTY

- Transfer of property in goods from the seller to the buyer is the main object of a contract of sale.

- “property in goods” means the ownership of goods

- An article may belong to A although it may not be in his possession. B may be in possession of that article although he is not its owner.

- It is important to know the precise moment of time at which the property in goods passes from the seller to the buyer for the following reasons

- Significance – Time of transfer of ownership of goods decides various rights and liabilities of the seller and buyer.

- Risk – Owner to bear the risk and not the person who merely has the possession

- Action against third party – Owner can take action and not the person who merely has possession.

RIGHTS OF UNPAID SELLER

UNPAID SELLER (SEC.45)

A seller of goods is deemed to be an unpaid seller when:-

- The whole of the price has not been paid or tendered;

- A bill of exchange or other negotiable instrument has been received as a conditional payment, and the condition on which it was received has not been fulfilled by reason of the dishonor of the instrument or otherwise.

CONDITIONS:

- The term "seller" includes any person who is in the position of a seller, as, for instance, an agent of the seller to whom the bill of lading has been endorsed or agent who has himself paid, or is directly responsible for, the price.

- The seller shall be called an unpaid seller even when only a small portion of the price remains to be unpaid.

- It is for the non payment of the price and not for other expenses that a seller is termed as an unpaid seller.

- Where the full price has been tendered by the buyer and the seller refused to accept it, the seller cannot be called as unpaid seller.

- Where the goods have been sold on credit, the seller cannot be called as an unpaid seller. Unless

- If during the credit period seller becomes insolvent, or

- On the expiry of the credit period, if the price remains unpaid, Then, only the seller will become an unpaid seller.

RIGHTS OF AN UNPAID SELLER

- Against goods : Where the property in goods has passed to the buyer: Right of lien , right of stoppage in transit, right of resale

- Against buyer personally : Where the property in goods has not passed to the buyer: Withholding delivery, Stoppage in transit, Resale

Right of lien (sec.47-49)

- The right of lien means the right to retain the possession of the goods until the full price is received.

- Circumstances under the right of lien can be exercised

- Where the goods have been sold without any stipulation to credit

- Where the goods have been sold on credit, but the term of credit has expired

- Where the buyer becomes insolvent

Right of stoppage of goods in transit (sec.50-52)

- Right of stoppage in transit means the right of stopping the goods while they are in transit, to regain possession and to retain them till the full price is paid.

- Conditions under which Right of stoppage in transit can be exercised

(i) Seller must have parted with the possession of goods,ie, the goods must not be in the possession of the seller

(ii) the goods must be in course of transit

(iii) buyer must have become insolvent

Right of resale (sec.54)

An unpaid seller can resell the goods under the following circumstances:

Where the goods are of a perishable nature

- Where the seller expressly reserves the right of resale if the buyer commits a default in making payment

- Where the unpaid seller who has exercised his right of lien or stoppage in transit gives a notice to the buyer about his intention to resell and buyer does not pay or tender within a reasonable time.

SUITS FOR BREACH OF THE CONTRACT

- Suit for price.-

- Where under a contract of sale the property in the goods has passed to the buyer and the buyer wrongfully neglects or refuses to pay for the goods according to the terms of the contract, the seller may sue him for the price of the goods.

- Where under a contract of sale the price is payable on a day certain irrespective of delivery and the buyer wrongfully neglects or refuses to pay such price, the seller may sue him for the price although the property in the goods has not passed and the goods have not been appropriated to the contract

Ii. Damages for non-acceptance.- Where the buyer wrongfully neglects or refuses to accept and pay for the goods, the seller may sue him for damages for non-acceptance.

Iii. Damages for non-delivery.- Where the seller wrongfully neglects or refuses to deliver the goods to the buyer, the buyer may sue the seller for damages for non-delivery.

SALE BY AUCTION (SECTION 64)

- In the case of sale by auction the following rules apply:

- At an auction, the sale is complete when the auctioneer announces its completion by the fall of the hammer

- A bidder is at liberty to withdraw his bid at any time before it is accepted by auctioneer

- Advertisement to auction is not an offer but mere invitation

- Auctioneer has right to make any condition he likes

- Biddings can be withdrawn before acceptance

- Pretended bidding by seller to raise price is voidable at option of buyer

- No seller or any person who has advertised can bid at an auction sale – unless right is notified