UNIT – 3

BUSINESS LAW

INTRODUCTION

- The Insolvency and Bankruptcy Code, 2016 (IBC) is the bankruptcy law of India which seeks to consolidate the existing framework by creating a single law for insolvency and bankruptcy.

- The Insolvency and Bankruptcy Code, 2015 was introduced in Lok Sabha in December 2015. It was passed by Lok Sabha on 5 May 2016 and by Rajya Sabha on 11 May 2016.

- The Code received the assent of the President of India on 28 May 2016. Certain provisions of the Act have come into force from 5 August and 19 August 2016.

- The bankruptcy code is a one stop solution for resolving insolvencies which previously was a long process that did not offer an economically viable arrangement. The code aims to protect the interests of small investors and make the process of doing business less cumbersome.

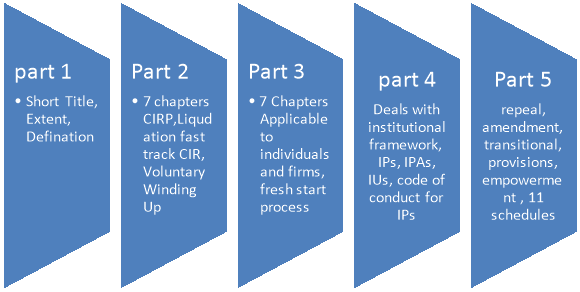

- The IBC has 255 sections and 11 Schedules.

BASIC TERMINOLOGIES

- Insolvency

- Bankruptcy

- Winding up

- Liquidation

- Dissolution

DEFINITION

INSOLVENCY

The condition of a person who is insolvent; inability to pay one’s debts; lack of means to pay one’s debts. Such a relative condition of a man’s assets and liabilities that the former, if all made immediately available, would not be sufficient to discharge the latter or the condition of a person who is unable to pay his debts as they fall due, or in the usual course of trade and business.

BANKRUPTCY

The state or condition of one who is a bankrupt; amenability to the bankruptcy laws; the condition of one who has committed an act of bankruptcy, and is liable to be proceeded against by his creditors therefore, or of one whose circumstances are such that he is entitled, on his voluntary application, to take the benefit of the bankruptcy laws

LIQUIDATION

The process of winding up a company

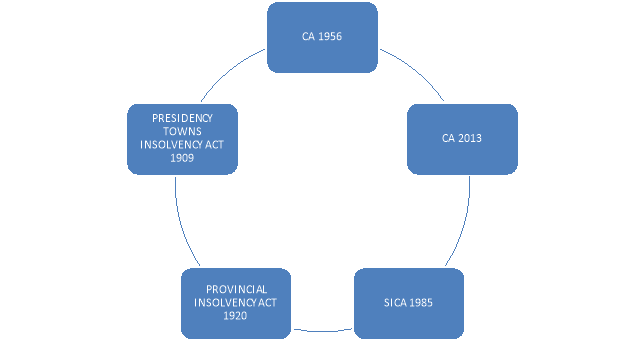

VARIOUS LAWS OF FOR INSOLVENCY AND BANKRUPTCY

Corporates

- 1956 – Companies Act, 1956

- 1985 – Sick Industrial Companies (Special Provisions) Act – SICA

- 1993 – Recovery of Debts Due to Bank and Financial Institutions Act – RDDB

- 2002 – Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act – SARFAESI

- 2013 – Companies Act – Chapter XIX & XX

- 2016 –The Insolvency and Bankruptcy Code – IBC

Individuals

- 1909 – Presidency Towns Insolvency Act

- 1920 – Provincial Insolvency Act

- 1932 – Partnership Act Various laws for Insolvency and Bankruptcy

IBC Code requirements

- To ensure revival before liquidation

- Reduce the mounting NPAs’ on banks

- Need of a unified Code

- To provide an easy exit for corporates

- Improve ‘Ease of Doing Business’ ranking for India.

- Heightened focus on the resolution of the problem by the Reserve Bank of India (RBI) and the Supreme Court.

- There is a dire need of capital today – not just for stressed companies but for growth in general.

- Doing away with a fragmented framework

- Long time for resolution and recovery

- Improve the confidence of the International investor in the debt market

CONSOLIDATION OF VARIOUS LAWS – IBC Code

JOURNEY OF THE CODE

DATES | FORMATION OF CODE |

August 22, 2014 | BLRC formed under the chairmanship of T.K.Vishwanathan |

February 05, 2015 | BLRC submitted its interim report to ministry of finance |

February 10, 2015 | MoF invited public comments on interim report of BLRC |

November 04, 2015 | Volume I – Final report of BLRC, Volume II- draft code |

November 04, 2015 | MoF invited comments on Vol I and Vol II reports by BLRC |

December 21, 2015 | Code introduced in the parliament |

December 23, 2015 | Code introduced in the joint parliament committee |

January 22, 2016 | Joint committee invited comments on the code |

May 05, 2016 | Bankruptcy code passed by Lok Sabha |

May 11, 2016 | Bankruptcy code passed by Rajya Sabha |

May 28, 2016 | Received President’s Assent |

Mandate of BLRC

- Setup by the Department of Economic Affairs, MoF, through office order dated August 22, 2014

- Chairman: Mr.T.K.Vishwanathan

Objective of BLRC

- To study the framework of Corporate bankruptcy in India

- To submit a report to the government for reforming the system

Reports

- Interim Report (February 2015)

- Served as an approach paper for the proposed new Code

- Reforms suggested for improving the insolvency regime in India

Final Report (November 2015)

- Two parts:

- Volume I: Rationale and Design model of theCode

- Volume II: Draft Insolvency and Bankruptcy Code

KEY CHANGES UNDER THE CODE

- Government dues take a backseat

- Fragmented status gets clubbed into one

- Scope of professionals like CS / CA / CWAs has been enhanced

- Individual bankruptcy gets included

- Financial creditors are voting at par as per their credit value

- Application under the Code can be made by financial creditor / operational creditors / debtor himself

- But decision making is in the hands of financial creditors

- Decentralisation on the part of government

KEY HIGHLIGHTS

- Resolution before Liquidation: If possible, the business should be revived before liquidation

- Time bound process: Unlike previous practice, now the entire insolvency resolution process shall complete in at max 270 days

- Information Utilities have been formed under the Code to provide timely dissemination of information to the concerned

- Automatic liquidation if revival process does not complete within 180 or 270 days

- Creditors Voluntary winding up done

- Shareholders have no say during the process of revival as well as resolution

- Operational creditors with more than 10 percent aggregate exposure may participate during the CoC meetings

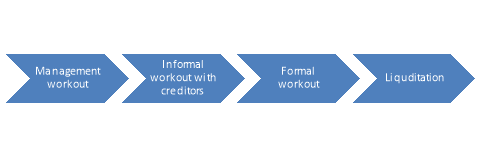

WHEN A ENTITY DOES INTO RED ZONE

WHY COLLECTIVE REMEDIES ARE BETTER SUITED?

- Individual remedy put the debtor under serious stress.

- This does not allow the debtor to focus on business and bring it back on track. Collective remedy ensures that business remains a going concern.

- The objective of insolvency is to ensure that equitable distribution takes place.

- Might is right might not always be right.

STRUCTURE OF THE CODE

WHAT ALL GETS AMENDED?

- The Indian PartnershipAct, 1932

- The Central ExciseAct, 1944

- The Income –TaxAct, 1961

- TheCustomsAct, 1962

- The Recovery of Debts Due to Banks and Financial InstitutionsAct, 1993

- The FinanceAct, 1964

- The Securitisation & Reconstruction of Financial Assets & EnforcementOf Security InterestAct, 2002

- The Sick IndustrialCompanies (Special Provisions) RepealAct, 2003

- The Payment and SettlementSystemsAct, 2007

- The Limited Liability PartnershipAct, 2008

- The CompaniesAct, 2013

APPLICABILITY OF THE CODE

- Applies to whole of India

Except for Part III [J&K excluded]

- Piecemeal commencement possible

- Persons covered

- Companies incorporated under the Companies Act, 2013

- Companies governed by any special Act, to the extent the provisions are consistent with that Act;

- LLPs

- Any other body corporate, incorporated under any Act for the time being in force, as the Central Government may specify

- Partnership firms

- Individuals

- Financial entities - Not covered

The IBBI had notified Insolvency and Bankruptcy Board of India (Insolvency Professionals) Regulations, 2016 . Salient features of the regulations are:

Insolvency Professionals Examination | The Board shall conduct a National Insolvency Examination and Limited Insolvency Examination . The syllabus, format and frequency of the Limited Insolvency Examination , including qualifying marks, shall be published on the website of the Board at least one month before the examination |

Eligibility and Qualification for registration of insolvency professionals (Reg 5) | Any person resident of India who:

|

Application for registration | An individual enrolled with an insolvency professional agency may make application to IPA with application fee of Rs 10,000 |

Registration for a limited period (Reg 9) |

|

Recognition of IP Entities (Reg 12) | LLP, partnership firm, or a company if: a majority of the partners of the LLP or partnership firm or a majority of whole time directors of the company are registered as insolvency professionals. |

IMPORTANT TERMS UNDER THE CODE

Section 2(7) Corporate person

- Company as defined in CA, 2013

- An LLP [As per LLP Act, 2008]

- Any other person incorporated with limited liability under any law for the time being in force

- Excludes - Financial service provider

2(10) Creditor

- Any person to whom debt is owed

- Financial or operational Creditor / Decree holder

2(11) Default

- Non-payment of debt – whole/part/installment

2 (27) Property

- Money, goods, actionable claims, every description of property

- Within & outside India

- Includes interest [present/future/vested/contingent] incidental to the property

4(6) Dispute

- Includes a suit or arbitration proceedings relating to

- The existence of the amount of debt;

- The quality of goods or service; or

- The breach of a representation or warranty

4(13) Insolvency commencement date

- Date of admission of application for Corporate Insolvency Resolution process by NCLT

4(14) Insolvency resolution process period

- Period of 180 days beginning from the insolvency commencement date and ending on 180th day

CORPORATE INSOLVENCY RESOLUTION PROCESS ( CIRP )

Applicability

- Minimum amount of default – Rs.1 lac

- CG may provide for higher minimum amount not beyond Rs. 1 Crore

Who can initiate CIR process

- Financial creditor

- Operational creditor

- Corporate debtor itself

CIRP: Snapshot

When can an application be filed?

- Occurrence of default

- Operational creditor to deliver 10 days demand notice to corporate debtor

After effects?

- NCLT either admits or rejects the application;

- If admitted, Corporate Insolvency Resolution commences and the date of admission of application is called the insolvency commencement date.

WHO CANNOT APPLY?

- A corporate debtor who is already undergoing CIR

- A corporate debtor who has completed CIR 12 months preceding the date of making of the application

- A corporate debtor or a financial creditor who has violated any of the terms of a resolution plan - approved 12 months before the date of making an application

- A corporate debtor in respect of whom a liquidation order has been made

CIRP PROCESS: KEY POINTS

- Sec 3(20), 3(21) - Operational Creditor includes employees, Central and State Governments -Needs to give a 10-day notice to the debtor for repayment before taking action

- Corporate Debtor - Defaulting company, its shareholder or management personnel can start proceedings by making a application to the NCLT upon occurrence of any default

- Creditors in possession approach as against Debtors in possession approach

- Potentially creates risk the minority creditors being mooted out

- Threat of automatic liquidation can create strange results –May push the recoverable companies into liquidation, thereby disrupting markets

- Suspended BoD or partners eligible to attend meetings of Committee of creditors, but not eligible to vote

CIRP: In brief

Chain of CIRP:

- Filing of application to NCLT

- Admission of application

- Appointment of IRP and declaration of moratorium

- 3 days Public announcement

- Appointment of IRP and declaration of moratorium

- 7 days Appoint 2 registered valuers

- 14 days Creditors to submit their claims

- 21 days IRP to verify claims

- 23 days Submission of records to NCLT

- 30 days First Committee of Creditors meeting

- 44 days Circulation of Information memorandum

- 150 days Submission of Resolution Plan to RP

- Approval of plan by Committee of creditors

- Submission of plan to NCLT

- 180 days Acceptance / Rejection of plan by NCLT

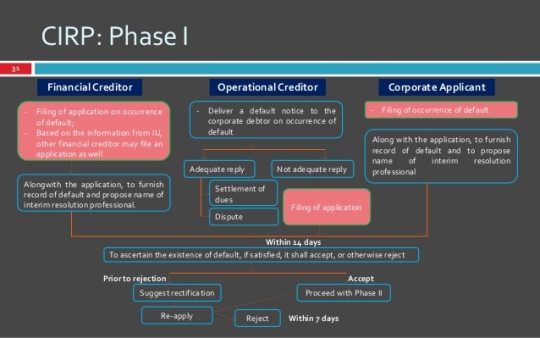

CIRP: Phase 1

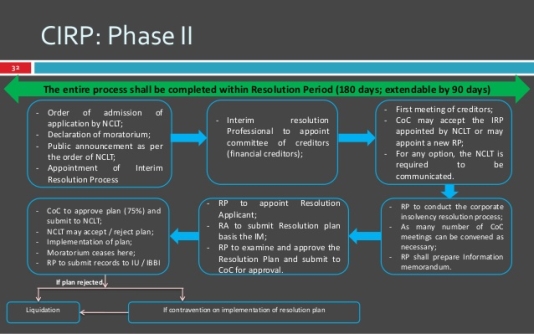

CIRP: Phase II

MORATORIUM

Moratorium till the completion of the Corporate Interim Resolution process institution of suits or continuation of pending suits or proceedings against the Corporate Debtor including execution of any judgment, decree or order in any court of law, tribunal, arbitration panel or other authority transferring, encumbering, alienating or disposing of any of its assets or any legal right or beneficial interest action to foreclose, recover or enforce any security interest created by the Corporate Debtor in respect of its property including any action under the SARFAESIAct, 2002 recovery of any property by an owner or lessor

DURING MORATORIUM

- Public announcement is done for the creditors to give the claim

- Creditors appoint Resolution Professional

- Resolution Professional to prepare Information Memorandum -- based on this the ResolutionApplicant will make the plan

CIRP INITIATION: OPERATIONAL CREDITOR AND CORPORATE DEBTOR

Documents to be furnished along with application –Operational Creditor

- To be furnished along with application

- a copy of the invoice demanding payment or demand notice delivered by the Operational Creditor to the Corporate debtor

- An affidavit to the effect that there is no notice given by the corporate debtor relating to a dispute of the unpaid operational debt

- a copy of the certificate from the financial institutions that there is no payment from debtor

Documents to be furnished along with application – Corporate debtor

- Books of account and such other documents relating to such period as may be specified; and

- May propose name of Resolution Professional to act as Interim Resolution Professional

PROCESS

STEP 1: After the rejection of resolution plan the liquidation process start

STEP 2: No suit or other proceeding shall be instituted by or against the corporate debtor

STEP 3: Appointment of liquidator or Resolution Professional

STEP 4; Formation of liquidation estate by liquidator

STEP 5: Consolidation and verification of claims

STEP 6: Admission or rejection of claim by liquidation

STEP 7: Determination of the assets value of claims

STEP 8: Distribution of assets Dissolution of corporate debtor

ORDER OF PRIORITY OF PAYMENT OF DEBTS

The code provides for priority with regard to distribution of proceeds following

Liquidation of the company or bankruptcy of individuals or partnership as below:

- Insolvency resolution cost and liquidation

- Workmen’s due (for 24 month before commencement) and debts to secured creditor.

- Wages and unpaid dues to employees(other than work men).

- Financial debts to unsecured creditors and workmen’s dues for earlier period

- Crown debts and debts to secured creditor following enforcement of security interest

- Remaining debts

- Preferences shareholders

- Equity shareholder or partners

Any surplus remaining after payment of debtor shall be applied in payment of interest accrued since commencement date.

WHO CAN INVOKE?

Financial Creditor (section 7)

- Any person to whom a financial debt is owned

- Includes a person to whom such debt legally assigned or transferred

Operational Creditor (section 9)

- A person to whom an operational debt is owned

- Includes any persons to whom such debt legally assigned transferred

Corporate Debtor (section 10)

- A corporate person who owned to any person

For offences committed by an individual(like providing false information):

- The fine will not exceed Five lakh rupees.

- The imprisonment will vary based on the offence.

For offences committed by a debtor under corporate insolvency(like concealing property, defrauding creditors, etc.):

- The imprisonment of up to Five years.

- With a fine of up to One core rupees.

CONCLUSION

- The code was enacted to consolidate & amend various laws relating to insolvency, bankruptcy & liquidation & further delete some in fructuous provisions due to change in the business complex, opening of economies & further participation of Foreign Investors in domestic area.

- A new chapter has been added in the history of insolvency, bankruptcy, liquidation litigation where a single window is given to the corporate litigants, individuals, LLP to adjudicate upon the matters .

INTRODUCTION

ARBITRATION:

- Form of Alternative Dispute Resolution

- Alternative to court room litigation

- Parties submit their disputes to a NEUTRAL third party called the Arbitrator (s) or Arbiter (s) for resolution

- Binding dispute resolution, equivalent to litigation in the courts

DEFINATION

Arbitration is “a legal technique for the resolution of disputes outside the courts, wherein the parties to a dispute refer it to one or more persons (the “arbitrators”, “arbiters” or “arbitral tribunal”), by whose decision (the “award”) they agree to be bound.”

In other words, arbitration is a form of dispute settlement, where parties can avoid resolving their dispute in the public litigation. It is used mainly in solving disputes arising out of commercial matters. Arbitration should not be confused with mediation. In the arbitration, the arbitrator obliged to determine the dispute by reference to certain rules, rather than to seek compromise which is mediator’s task.

WHY THIS AMENDENT NEEDED?

The Law Commission of India issued a report in 2014 (246thReport)which gave the comprehensive overview of the problem and also suggested the solution such as following-

- Encouraging institutional Arbitration

- Introducing a schedule of fees for arbitrators in ad-hoc arbitration

- Issuing guidance that hearings should be heard in continuous sittings, to avoid the "culture of frequent adjour e ts”

- Requiring that the courts refer disputes to arbitration as long as they are prima facie satisfied that there is a valid arbitration agreement;

- Restricting the use of "public policy" when challenging an award or resisting enforcement etc.

GENERAL OVERVIEW

- Government promulgated the Arbitration and Conciliation (Amendment) Ordinance, on 23rd October, 2015.

- The Arbitration and Conciliation (Amendment) Bill, 2015 (Amendment Bill) was introduced in both houses of Parliament in its recent session to replace the Arbitration and Conciliation (Amendment) Ordinance, 2015

- Passed by the Lok Sabha on 17th December, 2015.

- Passed by Rajya Sabha on 23rd December, 2015.

- Received the Preside t s assent on 31.12.2015

- Date of Enforcement : 23rd October, 2015

BENEFITS OF ARBITRATION

- Confidentiality

- Limited Discovery

- Speed

- Expert Neutrals

- Cost Savings

- Preservation of Business Relationships

DRAWBACKS OF ARBITRATION

- Arbitration agreements are sometimes misleading

- If arbitration is not mandatory parties waive their to access the courts.

TYPES OF ARBITRATION

- Ad-hoc Arbitration

- Institutional Arbitration

- Statutory Arbitration

- Domestic or International Arbitration

- Foreign Arbitration

SOURCES OF ARBITRATION

- State regulate arbitration through a variety of laws

- A number of national procedural laws may also contain provisions relating to arbitration

- Key international instrument – 1958 New York Convention on Recognition and Enforcement of Foeign Arbitral Awards

INTERNATIONAL INSTRUMENTS

- The Geneva Protocol of 1923

- The Geneva Convention of 1927

- The European Convention of 1961

- The Washington Convention of 1965 (governing settlement of international investment disputes)

- The UNCITRAL Model Law (providing a model for a national law of arbitration)

- The UNCITRAL Arbitration Rules (providing a set of rules for an ad hoc arbitration)

ARBITRAL DISPUTES

Some types of arbitral disputes are

- Property

- Insurance

- Contract (including employment contracts)

- Business / partnership disputes

- Family disputes (except divorce matters)

- Construction

- Commercial recoveries

NON ARBITRAL DISPUTES

The following cannot be resolved by arbitration

- Insolvency

- Matrimony

- Criminal matters

- Torts etc.

ARBITRATION AND CONCILIATION ACT, 1996

- It extends to the whole of India: Provided that Parts I, III and IV shall extend to the State of Jammu and Kashmir only in so far as they relate to international commercial arbitration or, as the case may be, international commercial conciliation.

- Explanation.—In this sub-section, the expression “international commercial conciliation” shall have the same meaning as the expression “international commercial arbitration” in clause (f) of sub-section (1) of section 2, subject to the modification that for the word “arbitration” occurring therein, the word “conciliation” shall be substituted.

- It shall come into force on such date1 as the Central Government may, by notification in the official Gazette, appoint.

ARBITRATION AGREEMENT

- In this Part, “arbitration agreement” means an agreement by the parties to submit to arbitration all or certain disputes which have arisen or which may arise between them in respect of a defined legal relationship, whether contractual or not.

- An arbitration agreement may be in the form of an arbitration clause in a contract or in the form of a separate agreement.

- An arbitration agreement shall be in writing.

- An arbitration agreement is in writing if it is contained in

- a document signed by the parties;

- An exchange of letters, telex, telegrams or other means of telecommunication which provide a record of the agreement; or

- An exchange of statements of claim and defence in which the existence of the agreement is alleged by one party and not denied by the other.

- The reference in a contract to a document containing an arbitration clause constitutes an arbitration agreement if the contract is in writing and the reference is such as to make that arbitration clause part of the contract.

REFERENCE TO ARBITRATION

- A judicial authority before which an action is brought in a matter which is the subject of an arbitration agreement shall, refer the parties to arbitration

- If the issue is pending before a judicial authority, arbitration may be commenced or continued and an arbitral award made

COMPOSITION OF ARBITRAL TRIBUNAL

Number of arbitrators.

- The parties are free to determine the number of arbitrators, provided that such number shall not be an even number.

- Failing the determination referred above the Arbitral Tribunal shall consist of a sole arbitrator.

APPOINTMENT OF ARBITRATORS

- A person of any nationality may be an arbitrator, unless otherwise agreed by the parties.

- The parties are free to agree on a procedure for appointing the arbitrator or arbitrators.

- An arbitration with three arbitrators, each party appoints one arbitrator, and the two appointed arbitrators appoints the third arbitrator who shall act as the presiding arbitrator.

- If the appointment procedure is not followed and the arbitrators not appointed then the appointment shall be made, upon request of a party, by the Chief Justice of the State High Court or any person or institution designated by him

- In the case of appointment of sole or third arbitrator in an international commercial arbitration, an arbitrator of a nationality other than the nationalities of the parties where the parties belong to different nationalities may be appointed

- Where the dispute with regards to appointment of arbitrators arise in an international commercial arbitration the reference to “Chief Justice of High Court shall be construed as a reference to the Chief Justice of India.”

GROUNDS FOR CHALLENGE

- When a person is approached in connection with his possible appointment as an arbitrator, he shall of his own accord disclose any circumstances likely to give rise to justifiable doubts about his impartiality or independence. From the time of his appointment and throughout the arbitral proceedings, an arbitrator shall immediately disclose any new such circumstances to the parties.

- An arbitrator may only be challenged if there are circumstances that give rise to justifiable doubts about his impartiality or independence or if he does not possess the qualifications agreed on by the parties. A party may challenge an arbitrator in whose appointment he has participated only for reasons of which he became aware after the appointment was made.

TERMINATION OF MANDATE

The mandate of an arbitrator shall terminate if

He becomes de jure or de facto unable to perform his functions or for other reasons fails to act without undue delay; and he withdraws from his office or the parties agree to the termination of his mandate.

CHALLENGE PROCEDURE

- Unless the parties have agreed to a different procedure, a challenge of an arbitrator shall state the reasons for the challenge and shall be submitted in writing to the arbitral tribunal within fifteen days after the party became aware of the appointment of the arbitrator and the circumstances on which the challenge is based. Unless the challenged arbitrator withdraws from his office or the other party agrees to the challenge, the arbitral tribunal shall decide on the challenge.

- If a challenge is unsuccessful and the parties have not agreed to a different procedure, the challenging party may bring the issue before the courts within one month after he received notice of the decision rejecting the challenge. The court shall determine the issue by way of interlocutory order. The interlocutory order shall not be subject to appeal. The challenge may not subsequently be invoked as grounds for invalidity or an objection to recognition and enforcement of the award. While such issue is pending before the courts, the arbitral tribunal, including the challenged arbitrator, may continue the arbitral proceedings and make an award.

Amended by Act 17 June 2005 No. 90 as amended by Act 26 January 2007 No. 3 (in force 1 January 2008)

FAILURE BY AN ARBITRATOR TO PERFORM HIS FUNCTIONS/ TERMINATION OF MANDATE

- If an arbitrator becomes de jure or de facto unable to perform his functions or if an arbitrator for other reasons fails to act without undue delay, his mandate shall terminate if he withdraws from his office or if the parties agree on the termination. Otherwise, any party may ask the courts to decide by way of interlocutory order whether the mandate shall terminate for one of the said reasons. The interlocutory order shall not be subject to appeal.

- The withdrawal by an arbitrator from his office or an agreement between the parties to terminate the mandate pursuant to subsection 1 or section 15 subsection 1 shall not imply acceptance of the validity of any challenge pursuant to subsection 1 or section 14 subsection 2.

- Amended by Act 17 June 2005 No. 90 as amended by Act 26 January 2007 No. 3 (in force 1 January 2008).

APPOINTMENT OF SUBSTITUTE ARBITRATOR

- Where the mandate of an arbitrator terminates pursuant to sections 15 or 16 or because of his withdrawal from office for any other reason or because of the revocation of his mandate by agreement of the parties or in any other case of termination of his mandate, a substitute arbitrator shall be appointed according to the rules that were applicable to the appointment of the arbitrator to be replaced.

- If a substitute arbitrator is appointed, all previous arbitral proceedings that form part of the basis for the ruling in the case shall be repeated.

- The parties may contract out of the provisions of this section.

ARBITRATION AND CONCILIATION AMNEDMENT 2015

A. Change in the definition of the term court defined in Section 2(1)(e)

Before Amendment

- Prior to the amendment the definition of the term court was ambiguous .

- It was ambiguous in the sense that it did not clearly demarcated the boundary between the jurisdiction of the district court and high court.

After Amendment

- After the amendment the word court to be referred as principal civil court of original jurisdiction in case of domestic arbitration and High court in case of international commercial Arbitration.

B. Application of some provisions of Part 1 of the act to International Commercial Arbitration, Section 2(2)

Before Amendment

- Prior the part 1 of the act i.e. domestic arbitration was only applicable to those arbitrations where the place of arbitration in India and it created a lot of confusions that when Part 1 shall be applicable to the international commercial arbitration and when it will not be applicable.

- Till the amendment the guiding principle was the decision of the Apex court in Bharat Aluminum Co. & Others v. Kaiser Aluminum Technical Services Inc., (2012) 9 SCC 552 wherein the constitutional bench of the Hon’ ble Supreme Court.

- Part I of the Arbitration & Conciliation Act is applicable only to arbitrations which takes place within the territory of India. Part I of Arbitration & Conciliation Act, 1996 would have no application to international commercial arbitration held outside India.

- Therefore, such awards would only be subject to the jurisdiction of the Indian courts when the same are sought to be enforced in India in accordance with the provisions contained in Part II of the Arbitration & Conciliation Act, 1996.

After Amendment

- After the 2015 amendment the position has been made clear.

- Sec 2(2) has been amended and now subject to an agreement to the contrary the provisions of section 9, 27 and clause (a) of sub section (1) and sub-section (3) of Section 37, this part shall also apply to international commercial arbitration i.e. where the place of arbitration is outside India.

C. Recognition of Communications through Electronic Means as an agreement in writing, Section 7 (4)(b)

- An agreement shall be considered in writing for the purpose of assuring the validity of arbitration agreement if the communication has been made or words have been exchanged between the parties through electronic means.

- Thus now if the parties have exchanged words through emails or even through messengers that can also be considered as agreement in writing.

D. Recognition of copy of arbitration agreement for referring the parties for arbitration in certain circumstances, Section 8

Before Amendment

- Party was required to produce original or duly certified copy of the Arbitration Agreement to the Court for referring the dispute to the Arbitral Tribunal.

- There used to be the situations frequently that one party used to be willing to refer the dispute for arbitration but the original or duly certified copy was retained with another party.

- That is why the court used to refuse the application on the ground of not producing original or duly certified copy.

After Amendment

- The amended section 8 of the act provides that the power of the judicial authority to refer the parties to arbitration notwithstanding any judgment, decree or order of the Supreme Court or any Court unless it finds that Prima facie no valid arbitration agreement exists.

- Further a proviso has been added to Sub section (2) which provides that if the original arbitration agreement or a certified copy thereof is not available with the party applying for reference to arbitration under sub sec (1),and the said agreement or certified copy is retained by the other party then the party so applying shall file such application along with a copy of the arbitration agreement and a petition praying the court to call upon the other party to produce the original arbitration agreement or its duly certified copy before the court.

- Thus most prevalent misuse of the earlier provision has been done away with amendment

E. Reduction in the Power of Court under Section 9

- The power of the court u/s 9 and arbitral tribunal u/s 17 has become almost equal by virtue of the amendment of 2015.

- Two sub sections (2 and 3) have been added to section 9 Sub Section (2) provides where before the commencement of the arbitral proceedings, a Court passes an order for any interim measures of protection under sub section (1), the arbitral proceedings shall be commenced within a period of 90 days from the date of such order or within such further time as the Court may determine.

- Further sub section (3) limits on the jurisdiction of the court from entertaining any application under sub section (1) where the arbitral tribunal has been constituted.

- Once the arbitration tribunal is constituted, the court shall not entertain any interim applications unless such circumstances exist which may render the remedy under section 17 of the Act not efficacious.

F. Amendments in the Procedure of Appointment of Arbitrators , Section 11

1. Appointment of arbitrator shall now be made by the Supreme Court or the High Court, as the case may be, instead of the Chief Justice of India or the Chief Justice of the High Court.

Before Amendment

- It provided for a default procedure i.e. appointment of arbitrator by the Chief Justice or any person or institution designated by him in case a party fails to appoint an arbitrator or the two appointed arbitrators fail to agree on the third arbitrator .

After Amendment

- It provides for a default procedure i.e. appointment of arbitrator by the Supreme Court or, as the case may be, the High Court or any person or institution designated by such Court in case a party fails to appoint an arbitrator or the two appointed arbitrators fail to agree on the third arbitrator.

2. Nature of the power excercised under section 11

Before Amendment

- There was a very big point of controversy that the appointment of arbitrator by the court will be considered as the exercise of judicial power or the administrative power .

- And if this is delegated to any person or institution designation by it, whether the exercise of such power by such person or institution will be considered as the judicial power or administrative power in nature.

- Till date the leading authority was the judgment of M/s. S.B.P v. M/s. Patel Engineering Ltd, in this case the seven judges bench of the Ho ble Supreme Court held the power under Sec 11 to be Judicial in nature. (2005)8 SCC 618

After Amendment

- The amendment act of 2015 has made the position crystal clear.

- Sub section 6(B) added by the amendment provides that the designation of any person or institution by the Supreme Court or, as the case may be, the High Court, for the purposes of this section shall not be regarded as a delegation of judicial power by the Supreme Court or the High Court.

- Thus if the power to appoint the arbitrator is exercised by the court itself it shall be considered as judicial power and when it is exercised by any designated person or institution , it shall be considered as the administrative power 2. Nature of the power exercised under section 11

3. Determination of the fees of the arbitrators

- Prior to the amendment, the fees of the arbitrators were determined by the parties to it and it was totally depended on the whims and fancy of the parties though subjected to the acceptance of the designated arbitrator.

- But now the High Court has been empowered to frame rules for the purpose of determination of fees of the arbitral tribunal and the manner of such payment and it shall take into account the rates of fee specified in the Fourth Schedule to the Act while framing such rules.

- The explanation added to Section 11(14) clarifies that it shall not apply to international commercial arbitration and in arbitrations (other than international commercial arbitration) in case where parties have agreed for determination of fees as per the rules of an arbitral institution.

- Section11A has been introduced which empowers the central Government to revise the fee in the 4th schedule by following the procedure prescribed therein.

CRITICISM :

- The model fees in the Fourth Schedule only vary according to the sum in dispute. Often, in practice, it can be very difficult to quantify the su in dispute . Further, even if the amounts claimed can be quantified, the question of whether the su in dispute relates only to the amount claimed by the Claimant or whether it will also include the amount counter-claimed by the Respondent is left open.

- The extent of the application of the Fourth Schedule is ambiguous. It is unclear whether the Fourth Schedule applies to (i) all arbitrations in India, (ii) all arbitrations initiated under Section 11, or (iii) all arbitrations initiated under Section 11 except fast-track arbitrations by a sole arbitrator under Section 29B.

- There is potential for the new Section 11(14) to be misused in ad hoc arbitrations. A party or parties to an arbitration agreement may intentionally fail to follow the relevant appointment procedure or to agree to on an arbitrator in order to take advantage of the Fourth Schedule fee structure, which may be significantly lower than the fee quotes by ad hoc arbitrators.

- The insertion of such provisions has been condemned by various judges of the High Courts. They are of the view that when the parties are willing to pay higher amount as fees, then why are the limitations has been imposed on the parties regarding fees.

- Thus this provision may become a barrier for the expert arbitrators from entering into this area and they will hesitate to be appointed as arbitrator for the matters for which earlier they have been paid higher amount.

4. Other Insertions

Section 11(7) provides that the decision regarding appointment of arbitrator through default procedure, of the Supreme Court or, as the case may be, the High Court or the person or institution designated by such Court is final and no appeal including Letters Patent Appeal shall lie against such decision.

Section 11(13) provides that an application for appointment of arbitrator shall be disposed of as expeditiously as possible and an endeavour shall be made to dispose of the matter within a period of sixty days from the date of service of notice on the opposite party.

G. New Measures introduced for ensuring impartiality and ability of Arbitrator, Section 12

- Now when a person is approached in connection with the possible appointment as arbitrator he is required : -

- To disclose in the writing the existence of any relationship or interest of any kind which is likely to give rise to justifiable doubts as to his neutrality

- To disclose any circumstances which are likely to affect his ability to devote sufficient time to the arbitration and complete the arbitration within the specified period.

- Schedule V and VI has been added to the act which provide for the circumstances exist which give rise to justifiable doubts as to the independence or impartiality of an arbitrator and the format of the disclosure by such person who has been approached to be appointed as arbitrator respectively.

- Section 12 (5) provides that a person having relationships as specified in the Seventh Schedule shall be ineligible to be appointed as an arbitrator; For example: The arbitrator is an employee, consultant, advisor or has any other past or present business relationship with a party to the dispute; or the arbitrator is a manager, director or part of the management, or has a similar controlling influence over the parties to the dispute.

- But that parties may, subsequent to disputes having arisen between them, waive the applicability of this sub-section by an express agreement in writing.

- Thus section 12 does not prescribe any disqualification, it only provides the duty of the person to disclose such relation and it is on the option of the party to appoint him as arbitrator. If the parties instead of disclosure agree to appoint him as arbitrator, such appointment cannot be questioned.

H. Expansion of the powers of arbitral tribunal for granting interim measures etc., Section 17

- The arbitral tribunal shall have power to grant all kinds of interim measures which the Court is empowered to grant under section 9 of the Act.

- Such interim measures can be granted by the arbitral tribunal during the arbitral proceedings or at any time after making the arbitral award, but before it is enforced under section 36 of the Act.

- Further Section 17(2) of the section provides that any order issued by the arbitral tribunal for grant of interim measures shall be deemed to be an order of the Court for all purposes and shall be enforceable under the Code of Civil Procedure, 1908 in the same manner as if it were an order of the Court.

- Now there is a conflict and ambiguity between the starting point of section 17 and ending point of section 17.

I. Recognition of counter claims and set off, Section 23 (2A)

- Prior to this amendment the position regarding filing or counter claim or set–off was not clear but this amendment made this position clear.

- Inserted section 23 (2A) recognizes the counter claim and defense of set–off on the part of the respondent.

- It provides that the respondent, in support of his case, may also submit a counter claim or plead a set- off, which shall be adjudicated upon by the arbitral tribunal, if such counterclaim or set- off falls within the scope of the arbitration agreement.

J. Day- to- day oral hearings and prohibition on adjournments

- Newly added proviso to section 24 provides that the arbitral tribunal shall as far as possible, hold oral hearings for the presentation of evidence or for oral argument on day-to-day basis .

- It further provides that the arbitral tribunal shall not grant any adjournments unless sufficient cause is made out, and may impose costs including exemplary costs on the party seeking adjournment without any sufficient cause.

K. Time Limit for arbitral award, Section 29 A

- Section 29 A has been inserted in the act which provides for time limit for arbitral award.

- Arbitral tribunal shall pass the award within 12 months from the date on which the arbitration tribunal enters upon the reference.

- However the tribunal may extend the period by a maximum of 6 months with the consent of the parties to the arbitration agreement.

- But if still the award is not made then the court has the prerogative of extending the period beyond 18 months. The court will exercise this power on the application given by any of the parties and after being satisfied by the reasons mentioned in the application it may grant extension

- Such application shall be decided by the court within 60 days.

- If the court finds that the extension is because of the delay on the part of the arbitrator, the court may order reduction in the fee of the arbitrator by an amount not exceeding 5% for each months delay.

- The court has also been empowered to impose actual and exemplary costs on the party at default.

- Further an incentive has been offered by the amendment that in case the tribunal passes the award within 6 months instead of allowed 12 months, the arbitral tribunal shall be entitled to receive additional fees as determined by the parties

- It further provides that if the arbitral tribunal is reconstituted or all the members of the tribunal are substituted under this section, the arbitral tribunal thus reconstituted shall be deemed to be in continuation of the previously appointed arbitral tribunal.

- CRITICISM : Thus on analysising this section it appears that thought the legislators have made a beautiful attempt to make arbitration proceeding as expeditious as possible but by inserting the provisions for further extension by court for unlimited time, has made its attempt futile. It may be said that it has closed all the doors to prevent delay in arbitral proceedings but has left one window open.

L. Introduction of Fast Track Procedure, Section 29 B

- The fast track procedure is an attempt in the direction of making the arbitration as expeditious as possible.

- The parties to an arbitration agreement may either before or at the time of appointment of the arbitral tribunal, agree in writing to have their dispute resolved by the fast track procedure and in this process they may agree on an arbitral tribunal consisting of a sole arbitrator which shall be chosen by them

- Under the fast track procedure, the arbitral tribunal shall follow the following procedure: The arbitral tribunal shall decide the dispute on the basis of written pleadings , documents and submissions filed by the parties without any oral hearing ;

- The arbitral tribunal shall have power to call for any further information or clarification from the parties in addition to the pleadings and documents filed by them ;

- An oral hearing may be held only, if, all the parties make a request or if the arbitral tribunal considers it necessary to have oral hearing for clarifying certain issues;

- The arbitral tribunal may dispense with any technical formalities, if an oral hearing is held, and adopt such procedure as deemed appropriate for expeditious disposal of the case.

- It provides that the arbitral tribunal shall pass the award within 6 months from the date on which the arbitration tribunal enters upon the reference. But the conditions as prescribed under Sec 29 A (3) to Section 29 A (9) are also applicable to it.

M. Defined Public Policy, Section 34

Before Amendment

- What exactly the public policy means was not clear.

- Explanation of the section only provided that it would be considered as opposed to public policy of India if the making of the award was induced or affected by fraud or corruption or was in violation of section 75 or section 81.

- In the lack of elaborate provision ,there was major scope for judiciary for interpretation.

- In Renusagar Power Co v. General Electric co, (1994) Supp (1) SCC 644, the Apex Court determined the term public policy as anything contrary to- 1. Fundamental policy of Indian Law 2. The interest of India 3. Justice or morality

- In ONGC v. Saw Pipes Ltd (2003)5SCC705 The Apex Court added one more ground to the meaning of public policy. It held that the award can be set aside if it is patently illegal .

- Patently illegal means the illegality must go to the root of the matter.

After Amendment

- Arbitration and Conciliation (Amendment) Act, 2015 incorporated the ratio of these two decisions in the act itself.

- Now explanation which explains what are in conflict of public policy of India also includes these two: 1. It is in contravention with the fundamental policy of Indian Law, and 2.It is in conflict with the most basic notions of morality or justice.

- Further a new explanation has been added which provides that for the avoidance of doubt, the test whether there is a contravention with the fundamental policy of Indian law shall not entail a review on the merits of the dispute.

- The decision of the ONGC s case has been incorporated in sub section 2A of the section 34.

- It provides that an arbitral award arising out of arbitrations other than international commercial arbitrations, may also be set aside by the Court, if the Court finds that the awards is vitiated by patent illegality appearing on the face of the award.

- A proviso has been added to it which provides that an award shall not be set aside merely on the ground of an erroneous application of the law or by re- appreciation of evidence.

N. Enforcement of Arbitral Award, Section 36

Before Amendment

- Where the time for making an application to set aside the arbitral award under section 34 has expired, or such application having been made, it has been refused, the award shall be enforced under the Code of Civil Procedure, 1908 (5 of 1908) in the same manner as if it were a decree of the court.

- Thus the award could not be enforced if the application for setting aside the award has been moved to the court.

After Amendment

- Mere filing of application for setting aside an arbitral award would not render ipso facto that award unenforceable until and unless the court grants an order of stay on the operation of the said award on a separate application made for that purpose.

- Thus the if the application for setting aside the award has been moved to the court and the court does not give stay, the award may be enforced in the meanwhile and if the court wishes to grant stay , it will have to mention the reasons for granting such stay.

O. Amendment in the grounds of Appeal, Section 37

In section 37 which talks about appealable orders, the following additional ground has been added for appeal:

- Refusing to refer the parties to arbitration under section 8. The other two grounds are the same as contained in the act i.e.

- Granting or refusing to grant any measure under sec tion.9;

- Setting aside or refusing to set aside an arbitral award under section 34.

- The party initiating conciliation shall send to the other party a written invitation to conciliate under this Part, briefly identifying the subject of the dispute.

- Conciliation proceedings shall commence when the other party accepts in writing the invitation to conciliate.

- If the other party rejects the invitation, there will be no conciliation proceedings.

- If the party initiating conciliation does not receive a reply within thirty days from the date on which he sends the invitation, or within such other period of time as specified in the invitation, he may elect to treat this as a rejection of the invitation to conciliate and if he so elects, he shall inform in writing the other party accordingly.

- There shall be one conciliator unless the parties agree that there shall be two or three conciliators.

- Where there is more than one conciliator, they ought, as a general rule, to act jointly.

APPOINTMENT OF CONCILIATORS.

(1) Subject to sub-section (2),

- In conciliation proceedings with one conciliator, the parties may agree on the name of a sole conciliator;

- In conciliation proceedings with two conciliators, each party may appoint one conciliator;

- In conciliation proceedings with three conciliators, each party may appoint one conciliator and the parties may agree on the name of the third conciliator who shall act as the presiding conciliator.

(2) Parties may enlist the assistance of a suitable institution or person in connection with the appointment of conciliators, and in particular,

- a party may request such an institution or person to recommend the names of suitable individuals to act as conciliator; or

- The parties may agree that the appointment of one or more conciliators be made directly by such an institution or person: Provided that in recommending or appointing individuals to act as conciliator, the institution or person shall have regard to such considerations as are likely to secure the appointment of an independent and impartial conciliator and, with respect to a sole or third conciliator, shall take into account the advisability of appointing a conciliator of a nationality other than the nationalities of the parties.

SUBMISSION OF STATEMENTS TO CONCILIATOR.

- The conciliator, upon his appointment, may request each party to submit to him a brief written statement describing the general nature of the dispute and the points at issue. Each party shall send a copy of such statement to the other party.

- The conciliator may request each party to submit to him a further written statement of his position and the facts and grounds in support thereof, supplemented by any documents and other evidence that such party deems appropriate. The party shall send a copy of such statement, documents and other evidence to the other party.

- At any stage of the conciliation proceedings, the conciliator may request a party to submit to him such additional information as he deems appropriate.

- Explanation: In this section and all the following sections of this Part, the term “conciliator” applies to a sole conciliator, two or three conciliators as the case may be.

ROLE OF CONCILIATOR.

- The conciliator shall assist the parties in an independent and impartial manner in their attempt to reach an amicable settlement of their dispute.

- The conciliator shall be guided by principles of objectivity, fairness and justice, giving consideration to, among other things, the rights and obligations of the parties, the usages of the trade concerned and the circumstances surrounding the dispute, including any previous business practices between the parties.

- The conciliator may conduct the conciliation proceedings in such a manner as he considers appropriate, taking into account the circumstances of the case, the wishes the parties may express, including any request by a party that the conciliator hear oral statements, and the need for a speedy settlement of the dispute.

- The conciliator may, at any stage of the conciliation proceedings, make proposals for a settlement of the dispute. Such proposals need not be in writing and need not be accompanied by a statement of the reasons therefor.

COMMUNICATION BETWEEN CONCILIATOR AND PARTIES.

- The conciliator may invite the parties to meet him or may communicate with them orally or in writing. He may meet or communicate with the parties together or with each of them separately.

- Unless the parties have agreed upon the place where meetings with the conciliator are to be held, such place shall be determined by the conciliator, after consultation with the parties, having regard to the circumstances of the conciliation proceedings.

DISCLOSURE OF INFORMATION

- When the conciliator receives factual information concerning the dispute from a party, he shall disclose the substance of that information to the other party in order that the other party may have the opportunity to present any explanation which he considers appropriate: Provided that when a party gives any information to the conciliator subject to a specific condition that it be kept confidential, the conciliator shall not disclose that information to the other party.

CO-OPERATION OF PARTIES WITH CONCILIATOR.

The parties shall in good faith co-operate with the conciliator and, in particular, shall endeavour to comply with requests by the conciliator to submit written materials, provide evidence and attend meetings.

SUGGESTIONS BY PARTIES FOR SETTLEMENT OF DISPUTE.

Each party may, on his own initiative or at the invitation of the conciliator, submit to the conciliator suggestions for the settlement of the dispute.

SETTLEMENT AGREEMENT

- When it appears to the conciliator that there exist elements of a settlement which may be acceptable to the parties, he shall formulate the terms of a possible settlement and submit them to the parties for their observations. After receiving the observations of the parties, the conciliator may reformulate the terms of a possible settlement in the light of such observations.

- If the parties reach agreement on a settlement of the dispute, they may draw up and sign a written settlement agreement. If requested by the parties, the conciliator may draw up, or assist the parties in drawing up, the settlement agreement.

- When the parties sign the settlement agreement, it shall be final and binding on the parties and persons claiming under them respectively.

- The conciliator shall authenticate the settlement agreement and furnish a copy thereof to each of the parties.

STATUS AND EFFECT OF SETTLEMENT AGREEMENT

- The settlement agreement shall have the same status and effect as if it is an arbitral award on agreed terms on the substance of the dispute rendered by an arbitral tribunal under section 30.

CONFIDENTIALITY

- Notwithstanding anything contained in any other law for the time being in force, the conciliator and the parties shall keep confidential all matters relating to the conciliation proceedings. Confidentiality shall extend also to the settlement agreement, except where its disclosure is necessary for purposes of implementation and enforcement.

TERMINATION OF CONCILIATION PROCEEDINGS

- The conciliation proceedings shall be terminated

- By the signing of the settlement agreement by the parties on the date of the agreement; or

- By a written declaration of the conciliator, after consultation with the parties, to the effect that further efforts at conciliation are no longer justified, on the date of the declaration; or

- By a written declaration of the parties addressed to the conciliator to the effect that the conciliation proceedings are terminated, on the date of the declaration; or

- By a written declaration of a party to the other party and the conciliator, if appointed, to the effect that the conciliation proceedings are terminated, on the date of the declaration.

RESORT TO ARBITRAL OR JUDICIAL PROCEEDINGS

- The parties shall not initiate, during the conciliation proceedings, any arbitral or judicial proceedings in respect of a dispute that is the subject-matter of the conciliation proceedings except that a party may initiate arbitral or judicial proceedings where, in his opinion, such proceedings are necessary for preserving his rights.