UNIT 4

Public debt

Public debt is the total amount borrowed by the government of a country to meet its operational and development expenditure. It is also referred as total liability of the government which the public income fails to meet. The different form of borrowing includes market loans, special bearer bonds, treasury bills and special loans and securities issued by the Reserve Bank. It also includes external debt. In the Indian context, public debt includes the total liabilities of the Union government that have to be paid from the Consolidated Fund of India.

The state borrows to meet the following expenditures

- To meet budget deficit

- To meet the expenses of war and other extraordinary situations

- To finance development activity

Types of public debt

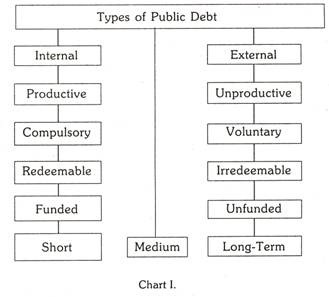

Public debt is classified into various categories:-

- Internal and external debt

- Short term and long term loans

- Funded and unfunded debt

- Voluntary and compulsory loans

- Redeemable and irredeemable loans

- Productive and unproductive debt

Internal and external debt

Money owed to the citizens and institutions are called internal debt. Government loans floated within the country are referred as internal debt. Such debt is borrowed by individuals and institutions within the country. Internal debt has no direct money burden as the government collects from interest payment on debt and imposition of taxation which is transfer of resources from one to another group. Sum borrowed from internal debt are spent on development activities.

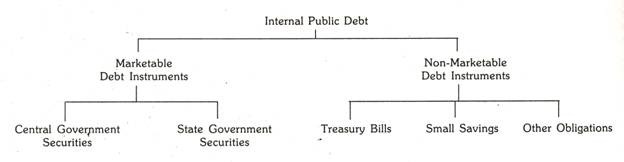

Internal debts are classified as follows

- Marketable debt instruments – these are securities held for longer than one year. This includes central government securities and state government securities.

- Dated loans issued by the government to reserve bank of India in exchange of treasury bills outstanding.

- Treasury bills are issued for short term by the government. Tenure of such issue are 90 to 180 days

- Small savings are Post Office Savings Bank Deposits, Cumulative Time Deposits, Post Office Recurring Deposits, National Defence Certificates, 15-year Annuity Certificates, National Savings Certificates, National Savings Annuity Scheme, National Development Banks, National Savings Account, Indira Vikas Patra, Kisan Vikas Patra.

Money owned to foreigners is called external debt. Government loan floated outside the country market ie. Foreign capital market is referred as external debt. Such debts are borrowed from foreign nationals, foreign governments, and international financial institutions. External debt has direct money burden as the government has to pay interest as well as principal amount for a given period of time to the external creditors.

Short term and long term loans

According to their duration, loans are classified as short term, medium term and long term. Short term loan mature within 3 to 9 months. Short term loans are treasury bills which mature with 90 days. Interest rate for short term debt is very less.

Long term loans mature after a long period exceeding five years or more. Government comes to the public for long term loans. Long term loans bear high rate of interest. Long term debt are raised for development purpose

Medium term loans mature with 1 to 5 years. It falls between short term and long term loans bearing intermediate interest rate. Such loans are raised during war, relief work, etc.

Funded and unfunded debt

Funded debts are long term debt which is repayable after the duration of at least a year. For repayment of such debt government maintains a separate fund called funded debt. The securities of funded debt are marketable on the stock exchange.

On the other hand unfunded debt are for short duration and repayable within a year. To meet the current needs unfunded debt are raised. Repayment of such debt is made by public revenue; no separate fund is maintained by the government. Its also referred as floating debt.

Voluntary and compulsory loans

Loans borrowed by the government using coercive methods are referred as compulsory loans. In case of emergency such as war, natural calamities, etc government force the people to lend money. Tax payers have to pay tax, in case of default then they are punishable.

Loan given by the nationals on their own will and ability are called voluntary loans. Government Issue securities to the public. Based on their wish they purchase securities subscribed by the government from institution like commercial banks. Public debt is voluntary in nature.

Redeemable and irredeemable debt

Based on the maturity, public debt is classified into redeemable and irredeemable debt. Redeemable debt referred to loans which the government promises to pay off at some future date. After the maturity, government pays the interest and principal to the lenders. It is also called terminable loans. This is mostly preferred by the creditors.

Under irredeemable debt, government does not make any promise to pay the principal amount. No maturity date is fixed. The government only agrees to pay interest regularly. Such debts are issued for long duration and the society are burden with the consequence of perpetual debt.

Productive and unproductive debt

Based on purpose of loan, public debt is classified into productive and unproductive debt. Productive debt are referred as loan rose by the government which are invested in productive assets such as railways, irrigation, multipurpose projects etc., it is also called reproductive debt. This leads to increasing the income of the government to pay the interest as well as principal amount. This helps in increasing the productive capacity of the economy. Productive debt is self liquidating in nature

Unproductive debts are also called as deadweight debt. It refers to loan borrowed by government for unproductive purpose such as relief work, financing war, etc. unproductive loans do not add to the productive capacity of the economy. Unproductive debt adds burden to the community as to repay the loan government will impose additional taxation.

Repayment of debt from time to time is necessary to raise the confidence of lender and to save the government from bankruptcy.

The various methods of public debt redemption are as follows:-

- Refunding

Refunding states that to repay the matured loans, government issue new bonds and securities. The owners of the old debt have the option of subscribing new debt or opt for cash. Here, the burden of repayment is postpone to future date ie. Short term loans are replaced by long term securities.

2. Conversion

Conversion is not repayment. It is converting the old high interest debt to new low interest debt. This can take place at or before the time of maturity. This method helps in reducing the interest payment burden of the government and the government will cut down the taxes and provide relieves to the tax payers.

3. Sinking fund

Sinking fund is one of the best methods of redemption of public debt. The government every year accumulates the part of public revenue for repayment of debt at the time of maturity. There are 2 ways to accumulate the fund –

- Deposit a certain amount every year from the public income

- Raise new loan and use that amount in sinking fund

4. Capital levy

A direct tax upon the capital of the tax payers is called capital levy. This process helps the government to repay its debt by collecting additional tax from rich people who have huge properties. This also reduces inequalities in income and wealth.

5. Terminal annuity

Under this method, on the basis of terminal annuity government pays off its debt. It is the method of repayment of debt in installment. The government reduces the burden of debt annually and at the time of maturity entire amount is paid. Here the government does not have to pay lump sum amount at the time of maturity.

6. Surplus balance of payment

To repay the external debt, government needs to increase foreign exchange reserves. Thus it is necessary to create trade surplus by increasing export and reducing import.

7. Additional taxation

The government imposes additional taxation to repay the old debt (principal and interest). This is easier method of redemption of debt. By imposing new taxes both direct and indirect in long term loans, the burden goes to future generation.

8. Compulsory reduction in the rate of interest

When the government suffers financial crisis and huge deficit in its budget, they can pass an ordinance to reduce the rate of interest payable on its debt. This does not happen in normal condition. Under extraordinary situation, government is forced to adopt this method.

Sources

1. Public finance in theory Baltic - Musgrave

2. Public Finance Department and Developing countries - Dr. S.K. SINGH