UNIT 5

Federal finances and public enterprise

Federal system is defined as the government functions are divided into two authorities’ i.e the central government and the state government. Federal finance refers to the distribution of income between the state and central government for the efficient use to the welfare of the society.

Definition

Prof. K. C. Wheare states:

“by the federal principle I mean the method of dividing power so that the general and regional governments are each, within a sphere, Co- ordinate and independent.

Federation is characterized by the following points

- Division of power and functions,

- Supremacy of the constitutions,

- Constitutional independence of the constituent units, and

- Federal predominance.

Principles of federal finance

- Principle of independence

The government should be free to raise revenue and spend them. The government should have autonomy in fixing taxes, collecting taxes, borrowing money and spending the income for welfare of society. Each state and central government should be financially independent to do their normal activities.

Prof. Adaekar Says, “full freedom of financial operations must be extended to both federal as well as state government’s in-order that they may not suffer from a feeling of Cramp in the discharge of their normal activities and in the achievements of their legitimate aspirations for the promotion of social and economic advancement.”

2. Principle of equity and uniformity

Principle of uniformity states that there should be no discrimination between citizens of different states. The allocation of resources should be fair to the individuals and business firms in different places. Every regional vary in the level of economic development. The contribution of revenue to each state should be based on its ability or economic condition.

For federal finance each state should pay equal tax payments. But this practice is not possible as equality of contribution imposes heavy burden on backward states. This principle of uniformity emphasis on the uniformity of pattern of expenditure in all the states

3. Principle of adequacy of resources

Principle of adequacy states that distribution of resources to each layer of government (central and state government) should be sufficient to carry out the activities efficiently and effectively. The allocations of resources are decided based on the current and future needs. Resources should be elastic and flexible to the changing conditions of the economy such as natural calamities.

As John Athan Says “if a federal system with real independence in the states is to continue, the state must have financial resources under their own control reasonably adequate to meet their responsibilities.”

4. Principle of fiscal access

This principle states that there should be no bar on central and state government to develop new source of revenue to meet the growing financial requirements. In other words resources should grow with the growth in responsibilities. Division of resources should be flexible from state to state based on the economic conditions which differ time to time.

5. Principle of integration and coordination

This principle states that, in order to have a prosperous federal system, there should be a perfect coordination among different layers of the financial system (central and state government) of the country. This helps in promoting overall economic development of the country.

6. Principle of efficiency

This principle states that the different layers financial system should be organized and efficiently administered. This helps in no scope of fraud and double taxation. It also results in minimizing administrative cost.

As point out by prof. Seligman, the nature of tax and character of administration determine the effectiveness of different taxes. This will ensure optimum utilization of revenue potential and help to prevent corruption and evasion in revenue mobilization and realization.

7. Principle of accountability

This principle states that different layers of government are accountable to its own legislature for its taxing and spending decisions. The Central government is accountable to the Parliament and the State to the Assembly. Utmost transparency should be maintained by the central and state government.

The enterprises owned and managed by central, state and local government are called public enterprise. The public enterprise includes manufacturing, trading and service organization. Public enterprise also includes some private organization which is owned and controlled by government.

Objectives of public enterprise

- Economic development

Public enterprise focuses on the economic growth in a planned manner. Private entrepreneurs will not invest where there is low profit. Public enterprises invest in all industries whether they are profitable or not. It helps in rapid industrialization of the country.

2. Development of backward areas

Public sector aims at developing backward areas to reduce regional imbalances. Private sectors focus more on profitability and not on balanced economic and regional development. Government considers the development of different areas while setting up new units.

3. Employment generation

Unemployment is the biggest problem in India. Government invests in industries to increase employment and provide a standard living. To save jobs, government nationalized sick private sector.

4. To provide necessities

Government provides necessities like electricity, coal, gas, water at cheaper rate to the people. Private sector cannot be relied on providing such services. Thus public utilities are provided by public enterprises.

5. To run monopoly sectors

Some industries like defense, nuclear energy, etc are developed by public sector. Such industries are not left for private enterprises. Government has monopoly to run these sectors.

6. Economic surplus

Public enterprise generate surplus for reinvestment. The enterprises use public savings for industrial development and earn money

7. Labour welfare

The public enterprises ensure welfare and social security of employees. They provide developed townships, schools, college and hospitals for their worker.

8. To provide healthy competition to the private sector

Private sector provides goods and services at a competitive price. On the other hand public sector aims at providing goods and services at a reasonable price. Thus public enterprises provide healthy competition to private sector which sells goods at same rates.

9. Helps in implementing government plans

The public enterprises help in implementing various plans and policies of government to achieve various targets for output, employment and distribution.

10. Self reliance

Public enterprises aim at promoting self-reliance in strategic sectors of the national economy. For this purpose, public enterprises have been set up in transportation, communication, energy, petro-chemicals, and other key and basic industries.

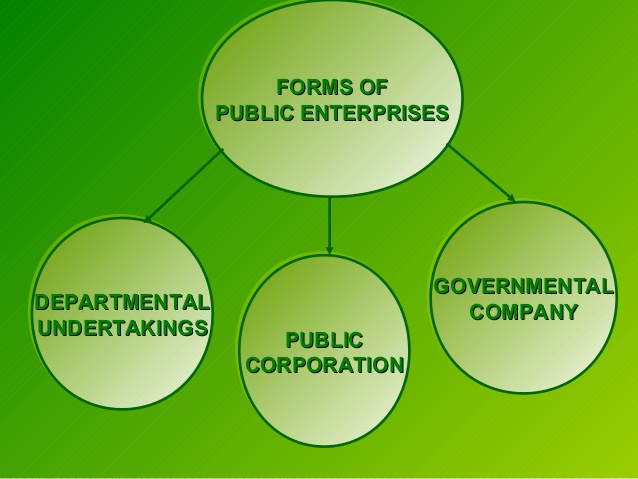

Types of public enterprise

The three forms of public enterprise are

- Departmental organization

- A departmental organization is a public enterprise which runs as a department of government and under the direction of ministry governed.

- All policy matters and other important decisions are taken by the controlling ministry.

- If the public are not satisfied with the service of departmental organization, then the issue can be raised in parliament.

- This includes

- The Indian Post and Telegraph Department

- All India Radio

- The Doordarshan

- The Indian Railways

- Defence

- Atomic Energy etc.

Characteristics

- It is established by the government and its overall control rests with the minister.

- It is a part of the government and is managed like any other government department.

- It is financed through government funds.

- It is subject to budgetary, accounting and audit control.

- Its policy is laid down by the government and it is accountable to the legislature.

Merits

- Secrecy: the departmental undertakings directly report to their respective ministry. The secrecy is maintained by the departmental organization in certain areas like defense industry

- Instrument of social policy: The objective of departmental organization is to maintain social and economic objectives.

- Contribution to government revenue: the surplus of any departmental undertakings leads to increase in government undertakings

- Little scope of misuse of fund: the departmental undertakings are controlled and audited under the ministry concerned. Thus there are less chances of misuse of fund.

- Direct criticism id parliament: if the public is dissatisfied by the working of departmental undertaking, then the matter can be raised in parliament.

Demerits

- The influence of bureaucracy: the departmental undertakings are controlled by government which results in bureaucracy. The organization have to take permission from legislative for any expenditure, promotion, decisions, etc. because of this important decision get delayed.

- Excessive parliament control: Day to day working of departmental organization gets hampered due to excessive parliament control. In case of any issue, parliament repeatedly questions the working of departmental undertaking.

- Lack of flexibility: Flexibility is necessary for the success of the business. But departmental organization lacks flexibility because its policies cannot be changed.

- No separate funds for expansion: The incomes of the enterprise are merged with the general revenues of the govt. And are not generally used for the expansion of the business.

- No long term policies: departmental undertakings finds difficult to follow long term policy as the officers are transferred frequently.

2. Public corporation

- A public or statutory corporation is created by a special Act of the parliament or state legislative assembly which defines its powers, functions, privileges and prescribes the pattern of management.

- Example - State Bank of India, Life Insurance, Corporation of India, Industrial Finance Corporation of India, etc

Features

- It is incorporated under a special act of parliament.

- It is an autonomous body and is free from government control for its internal management.

- It is managed by board of directors which included trained and experience in business management

- The capital is wholly provided by the government

- The employees are recruited as per the board

Merits

- Expert management: the enterprise is run under the guidance of expert and experienced professionals. It has advantage of both departmental and private undertakings.

- Internal autonomy: Governments do not have any interference in day to day activities of these organizations. All the decisions can be taken without any hindrances.

- Responsible to parliament: These organizations are accountable to parliament. Their activities are watched by the press and public.

- Flexibility: The organizations are flexible as per the changing requirement of the society. This result in good performance and operational result.

- Promotion of national interest: under the provision of Acts, government is authorized to give policy directions to the statutory corporations’ results in promoting national interest.

Demerits

- Government interference: it is true that statutory corporation is independent in taking decision. But in reality, government has excessive interference.

- Rigidity: It is a rigid form of organization as any change in its constitution and powers will require amendment of the special act.

- Ignoring commercial approach: The statutory corporations usually face little

Competition and lack motivation for good performance.

3. Government companies

- Under the Companies Act, 1956, Government Company has been defined as “any company in which not less than 51% of paid-up share capital is held by the Central Government or by any State Government or Governments or partly by the Central Government and partly by one or more State Governments”.

- Examples – Hindustan machine tools limited, steel authority of india limited, Hindustan shipyard limited

Features

- It is registered under companies act 1956

- It has a separate legal entity

- The annual reports of the government companies are required to be presented in parliament

- The capital is wholly or partially provided by the government.

- It is managed by the board of directors appointed by the government

- It audit practice are similar to private enterprise and its auditors are Chartered accountant appointed by the government.

Merits

- Simple procedure of establishment: The government companies can be easily formed as there is no bill passed by the parliament or state legislative. It can be formed simply by following the procedure of Companies Act.

- Efficient working on business lines: The government company is fully independent in financial and administrative matters. The directors of board are expert professionals and they run on business principles

- Healthy competition: The companies offer healthy competition to private sector. Thus goods and services are available at reasonable price without compromising the quality.

Demerits

- Lack of initiative: the government companies have fear of public accountability. As a result, lack of initiative in taking right decision at right time.

- Lack of business experience: the management of such companies are in the hand of administrative service officers who do not have experience in managing the business professionally.

- Change in policies and management: the policies of such companies keep changing as the government changes. This leads to unhealthy situation for the business.

- Marginal cost basis

Marginal cost is the cost of producing an additional unit of product. Under this policy, welfare of the community gets maximized, if the consumer is willing to pay an extra unit of product. If this policy is taken into consideration by public enterprise, then resources will automatically be allocated to the production of different goods which result in maximization of welfare of the community. The drawback of this policy is difficulty in calculating marginal cost in public utilities such as electricity, transport, etc.

2. Pricing on the basis of average cost

‘Average cost pricing principle’ refers to fixing the price of a commodity on the basis of the average cost of population of the commodity. It ensures the cost of production is reflected on the price of the commodity. The calculation takes into consideration total cost of production and normal profit. The price of the commodity is higher than the principle of no profit and no loss principle. Under this policy, the consumer pays the entire cost of the product that he is consuming.

3. Break even principle

It is also refers as no profit no loss principle. Under this principle public enterprise maintains price in such a way that there is no profit or loss. The price just covers the cost of production. In this case the public enterprise will not incur any loss. Thus no subsidizing the public enterprise out of the government treasury or by taxing the people. This principle will prevent public enterprise from over expansion and under expansion.

4. Profit making principle of pricing

Profit making principle of pricing includes public enterprise maintains price of the products and services is such a way they earn surplus after absorbing all the cost elements, including the profit. The principle is used by developing countries like India, public enterprise generate more surplus so that they are further invested in developing projects.

Profitability of public enterprise

The performance of private sector is measured by the net profit or loss. Their main aim is to maximize the profit. This measure fails in case of public sector companies.

The public sector invests in projects where profitability is low and gestation period is long. For instance investment in infrastructure, where there is no early return, profit is less in the beginning may be negative. Investment is important for expansion of industrial activities in the future. Investments made by the public sector in the steel industry, fertilizers, power projects, mining, etc., come under this category.

Involvement of private sector has an adverse effect on the industrial activity as they push up the prices. While public sector keeps the prices low though its cuts into the profits. Public sector is capital intensive and material intensive. Taking these into consideration, public sector should not be judge what they earn but by the total additions they make to the flow of goods and services in the economy.

Accountability of public enterprise

Accountability implies that the public enterprises should be accountable to some public authority be it a department of the government or parliament of the country. The ownership and management of public enterprise arises the need for public accountability. Also public accountability is necessary so that enterprise will work according to the planned programme of economic development and fulfill their social obligations. Too much public accountability result in excessive interference by the government and complete control of decision making hampers the growth and efficient working of public enterprise.

For efficient functioning of the public enterprise there should be clear division of functions between the Government which is the owner of the public enterprises and the Board of Management which is responsible for the efficient running of these enterprises.

The evaluation of public sector is very difficult. It is measured on account of social cost benefits rather than profitability alone.

The performance of the public sector can be made on the following grounds:

- Public enterprise contributes one fourth of the total income of the economy. Public sector annual growth rate was 6% where as private sector contributes 2.8 per cent.

- While comparing the efficiency of public sector against the performance of private sector, private sector are 2.5 times profitable than public enterprise. Public sector invests on heavy industries where the early return is less. The efficiency of public sector can be evaluated in terms of industrial structure, modernization, higher labour productivity on a countrywide scale etc.

- Public sector plays an important role in capital formation. During the first and second plans the share of public sector was 41% and 49% during the third year plan. It reduced to 42 per cent in the fourth Plan and 40 per cent in the fifth Plan. It rose to 47% and 48% in sixth and seventh plan

- The workers employed in public sector contribute 7% of the total labour force. While private sector contributes 3%. Public sector also provides better wages and other facility. They spent huge amount for the development of townships around industries.

- Goods which were imported about three decades ago are now been manufactured in the country by the public sector enterprises. This has saved valuable foreign exchange

- The public sector evaluated by the flow of goods is service in the economy. The total turnover of public sector showed a growth of 3.26% in 2017. The overall net profit increased to 11.7 per cent.

Sources

1. Public finance in theory Baltic - Musgrave

2. Public Finance Department and Developing countries - Dr. S.K. SINGH