UNIT-V

Variation in agricultural prices

Theory of price: Study of how prices of goods are determined in the commodity market and how prices of factors of Production are determined in the factors market.

Inverse relationship between quantity demanded of a commodity and its own Price (law of demand): Remaining other things constant, Downward slope of demand curve indicates that more is purchased response to fall in price. This can be explained in terms of the following factors:

Price elasticity of demand: Measurement of percentage change in quantity demand in relation to a given percentage change in own price of commodity.

Degrees of price elasticity of demand –

Price elasticity of supply: Measurement of change in quantity supplied of a commodity due to change in its price.

Law of variable proportion: when more and more of variable factor is combined with fixed factor, a stage will definitely come when marginal product of variable factors starts diminishing.

Factors affecting elasticity of supply:

Minimum Support Price (MSP) is a market intervention initiated by the Government of India to secure agricultural producers against any sharp fall in farm prices. The minimum support prices are started by the Government of India at the beginning of the sowing season for certain crops on the basis of the recommendations of the Commission for Agricultural Costs and Prices (CACP). MSP is price fixed by Government of India to protect the farmers - against imprudent fall in price during heavy production years. The minimum support prices are guarantee price for farmer’s produce by the Government. The major objectives are to support the farmers from anguish sales and to acquire food grains for public distribution.

Determination of MSP

Introduction of the High Yielding Varieties (HYV) seeds programmed in the 1960s demanded a higher supply of fertilizer and irrigation water to the farmers, the government tried to ensure that they were accessible and affordable. Subsidy on fertilizers is provided by the Central government and subsidy on water is provided by the State governments.

Types of Agricultural Subsidy in India

Fertilizer Subsidy: Expansion of cheap chemical or non-chemical fertilizers among the farmers. It amounts to the difference between price received from farmers and price paid to manufacturer of fertilizer (domestic or foreign), rest of the burden is bear by the central government. This subsidy ensures:

(I) To provide cheap inputs to farmers,

(ii) Reasonable returns to manufacturer,

(iii) Stability in fertilizer prices, and

(iv)Fertilizers provided to farmers in adequate quantity at the requirement.

Power Subsidy: The electricity subsidies imply that the government charges lower rates for the electricity supplied to the farmers than actual rates. Power is mainly used by the farmers for irritation purpose. It is the Distinguish between the cost of generating and distributing electricity to farmers and price received from farmers. The State Electricity Boards (SEBs) either generate the power themselves or buy it from other producers such as NTPC and NHPC. Power subsidy “acts as an incentive to farmers to invest in pumping sets, tube wells, bore wells etc.

Irrigations subsidy: under this, government provides irrigation facilities at the cheaper rates than the markets rates. It is the Distinguish between maintenance and operating cost of irrigation infrastructure in the state and irrigation charges recovered from farmers. This may work through provisions of public goods such as canals, tube wells, dams etc. Constructed by government and govt. charges low prices or no prices at all for their use by the farmers. It may also be through availability of cheap private irrigation equipment such as pumping sets.

Seed Subsidy: High yielding variety seeds can be provided by the government at lower prices, and at the future payment options. The research and development activities needed for production of productive seeds are also undertaken by the government, the expenditure on these is a sort of subsidy granted to the farmers.

Export Subsidy: This subsidy is given to the farmers to face the international barriers and completion. When farmers or exporters sells agricultural products in foreign market, they earn money for themself, as well as foreign exchange for the country. Therefore, agricultural exports are generally encouraged as long as these don’t harm the domestic economy. Subsides provided to uplift exports are referred as export subsidies.

Credit Subsidy: It is the distinction between interest charged from farmers, and actual cost of providing credit, plus other costs such as write-offs bad loans. Availability of credit is a major problem for poor and marginal farmers. They don’t have sufficient cash to buy agricultural equipment’s and cannot approach the credit market because they don’t have the collateral needed for loans. To carry out production activities they approach the local landlords or money lenders. Taking merits of the helplessness of the poor farmers the lenders charge very high interest rate. Even many times, the farmers with collateral cannot avail loans because banking institutions are mainly urban based and many a times, they don’t indulge in agricultural credit operations, which is considered to be risky. To resolve these problems the government provided following provisions:

(1) More banking operations and transaction in rural areas-which will advance agricultural loans, and

(2) The rate of interest can be maintained low through subsidization schemes, and

(3) The collateral requirements can be relaxed for the poor.

Agriculture Infrastructure subsidy: Private efforts in many areas don’t prove to be sufficient to improve agricultural production. Information about market, good roads, power, information about market and transportation to the ports etc. are vital for sales promotion and production. These facilities are in the realm of public goods, the costs of which are huge and whose benefits accrue to all the cultivators in an area. No individual farmer will come forward to provide these facilities because of their bulkiness and intrinsic problems related to revenue collections (no one can be excluded from its benefit on the ground of non-payment). Therefore, the government takes the responsibility of providing agriculture infrastructural facilities and given the condition of Indian farmers a lower price can be charged from the poorer farmers.

Income of Indian farmers is widely instable due to various factor, as farmers cultivates crop with Traditional outlook, they mostly involve in subsistence farming and are dependent on outdated and ancient methods of farming. Some reasons result in income instability of farmer’s are:

Indian farmers are suffering from various instabilities like yield instability, price Instability, tenurial Instability etc.

# 1. Yield Instability:In-spite of technology, Indian farmers are still dependent on natural factors and hence are highly unsure. Modern livestock husbandry is less dependent on weather as compared to crop farming but a tough winter or a dry summer can still have a marked influence on livestock production.

Move over, the chance of livestock epidemics is always there. Fluctuations in crop yield take place over which the farmer has no management and which he’s unable to foresee. The extent of yield fluctuation is, however, likely to be greater in some areas as compared to others. For example, tropical regions are more vulnerable to yield instability than the temperate areas.

Moreover, the yield of some crops like cotton is variable than that of others crops like wheat. These variation within the relative degree of instability apart, the essential fact is that the individual farmer is unable to predict accurately the output that he can obtain from a specific input combination.

This happens owing to the biological nature of agricultural industry which makes the yield much more smitten by natural factors as compared to the products of non-farming industries. Yield instability is additionally termed as technical Instability, because it refers to the variability within production coefficient of a given technique.

# 2. Price Instability:In further to yield or technical instability, Instability also exists with relevance to the prices of agricultural products. Price is more or less an uncontrolled or exogenous variable so far as the individual farmer is bothered.

The farmer operates in an exceedingly market structure which approximates to perfect competition and, therefore, the worth he receives for a product of a given quality is altogether unaffected by any setup or courses of action that he or other farmer might adopt. He’s a price taker and not a price maker.

The outside factors which influence prices are:

(a) The behavior of different farmers taken together;

(b) weather-induced random fluctuations in output;

(c) changes in national income and prosperity; and

(d) discontinuous production cycles of the cobweb kind.

Product cost faced by the non-farm industries are also subject to fluctuations, but the degree of price Instability in these industries is much lesser in agriculture.

The main reason for this is that not solely are the non-farm industries much less affected by weather influenced price fluctuations but also that the monopolistic market structure in which they operate allows them to exercise greater control over prices of their products. Price fluctuations are likely to be reduced further in case of industry because it is easier to manage the supply of its products to changes in demand when compared with agriculture.

# 3. Tenurial Instability:Another type of instability that is quite conspicuous in agriculture is the tenurial Instability. We know that land is generally rent out to tenants. The tenant, as farmer, doesn’t know for how long he will be able to retain the land in his Parmer may thus hesitate to make long lasting improvements in land.

# 4. instability with regard to Input Prices/Quality:Yet another degree of instability is that which exists in regard to the price and quality of inputs. This type of instability is particularly essential in the case of capital inputs which are generally costly and subject to frequent qualitative improvements. The farmers generally react to this kind of input price Instability by postponing the purchase of such inputs.

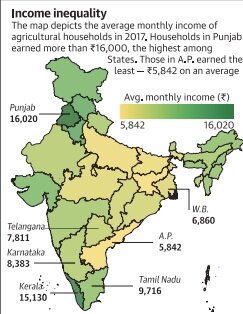

- The data given in the survey illustrate that inter-state income inequality among agricultural household range from Rs 16,020 (In Punjab: highest) to Rs 5,842 (In Andhra Pradesh: lowest).

- Adding more to the grim picture of agricultural distress, the surplus remains after consumption expenditure is just Rs 95 in Andhra Pradesh and Rs 4,314 In Punjab.

- The lowest among the farmer groups in terms of landholding earns the least.

- India primarily consists of small and marginal farmers (Farmers whose land holdings are less than two hectares (Ha) of land. About 85% landholdings in India are below w hectares)

- So, this makes small farmers take longer to rise their income in comparison to large farmers.

- Unfortunately, India’s agrarian reforms did not ensure egalitarianism in the agricultural community.

- The Green Revolution in the 1960s focused on increasing productivity and yield. But since then, landholdings have become essentially fragmented.

Union Budget 2020 India: Agriculture and allied sector is one among the numerous contributors to India’s economy with a share of fourteen.9% one within the total Gross price adscititious (GVA) in 2017-18 at constant costs. It additionally employs forty-three.9% a pair of the country’s total work force. Importance of this sector to each the economy and therefore the country’s rural population, the Central Government has varied priorities for the event of this sector. Some essential ones embody doubling of farmers financial gain by 2022-23, up the terms of trade for farmers by specializing in target based mostly exports, promoting exactitude agriculture through use of innovative technologies, revitalizing specialize in husbandry, increasing water-use potency and farm and fisheries thereby shifting cultivators from farm to non-farm activities.

To achieve these objectives varied initiatives and schemes are undertaken by the govt.. For increasing the farmer’s financial gain, the govt. raised the MSP for choose crops; it's additionally providing Rs half-dozen,000 annually to farmers underneath the Pradhan Mantri Kizan Samman Nidhi (PMKSN); for linking the farmers on to the market the govt. is functioning on the National Agricultural Market (e-NAM), one national market permitting interstate commerce of agricultural turn out.

For up the on-farm water use potency, the Pradhan Mantri Krishi Sinkhole Yojana (PMKSY) has been launched. For making certain continuous offer and mitigating worth volatility in Tomato, Onion and Potato the govt. is implementing the Tomato, Onion and Potato (TOP) theme underneath Operation Greens geared toward promoting market linkages, farm gate Agri infrastructure, Agri-logistics, process facilities etc. to spice up exports, monetary help and subsidies to exporters is being provided through the Agricultural and Processed Food merchandise Export Development Authority (APEDA).

Last year a separate Department of husbandry, farm and Fisheries was fashioned to administer special impetus for harnessing the large potential of this Agri-allied sector. alternative initiatives just like the Fazal Bema Yajna, Agri selling infrastructure theme, Model Agri turn out selling Act etc. also are being undertaken for the development of this sector.

Last year the govt. considerably magnified the budget outlay of the Agri and Allied sector by concerning seventy-eight to Rs one.30 100000 large integer. To supplement these initiatives and to require forward the Agri sector development agenda, some further measures that the govt. will take into account are as follows.

* For providing farmers adequate access to finance, innovative loaning schemes linking loan compensation to the crop harvest amount instead of a hard and fast term could also be introduced. additional delineating formal pointers to allow restructuring of farmer loans with lenders supported the crop harvested, market costs and obligatory farm insurance might also be thought of.

* Last year’s budget proclaimed forming another ten,000 Farmer Producer Organizations (FPOs) within the next five years. to form these FPOs property it's prompt that innovative finance schemes with versatile collateral assessment demand could also be thought of for FPOs. additional to push use of innovative technologies in Agri production, incentives could also be provided to FPOs for adopting good technologies like good water sprinklers, sensors based mostly pesterer management, humidness & soil nutrient sensors etc. this may facilitate individual farmer members to access latest technologies at comparatively lower value.