UNIT V

Contract Costing

Definition of Contract Costing

Contract costing, unlike short-term jobs, is a special system of job costing that applies to long-term contracts. Contract costing applies primarily to civil engineering and engineering projects, shipbuilding, road and rail contracts, bridge construction, and more. Contract costing may be a sort of specific order costing. This applies to contracts that take a considerable amount of time to complete and fall into different accounting periods. However, periods longer than one year are not an essential feature of long-term contracts. Some contracts with a term shorter than one year should be accounted for as long-term contracts if they are significant enough for the activity of that term.CIMA defines contract costs and contract costs as follows:

The total price related to one contract specified as a price unit."Features of contract costing:

Contracts to which contract costing applies have the following features:

(A) The contract is based on the special requirements of the customer.

(B) The contract period is relatively long.

(C) Contract work is done on-site, unlike manufacturing under the roof.

(D) Contract work mainly consists of construction activities.

Accounting procedure for contract costing:

If there are many contracts, an identification number and name are given to each contract for accounting and management reasons. A separate contract account is maintained for every contract.

All costs associated with the contract will be charged to each contract account. In the contract cost structure, the majority of spending is of a direct nature in the form of materials, wages, plant and store use, direct costs, etc., and only a small portion is charged as allocated overheads.

Accounting Treatment of Costs:

1. Material:

(A) All materials purchased for the contract or sent to the site will be charged for the contract.

(B) If the material is returned to the store, or is on an unused site, or if the material is transferred to another contract site, it will be credited to the contract account.

(C) If the material is not needed immediately, the material will be stored and its costs will be debited to the stock account.

2. Labor:

All labor employed or worked in the field is treated as direct labor and all costs associated with them are charged to the contract account. Salaries and incentives for management and supervisory staff of a particular contract are also charged for that particular contract.

3. Plants:

(A) If the plant is hired, the employment fee will be charged to the contract account.

(B) If the plant was specially purchased for a contract or the plant was sent to the site, the value of the plant is debited to the contract account. The value of the returned or remaining on-site plant will be credited to the contract account. The balance between the debited amount and the credited amount in the contract represents the value of the plant used in the field.

(C) The depreciation amount provided by the plant may be debited to the contract account instead of displaying the value of the plant issued to the site and remaining on the site.

4. Subcontract fee:

Part of the contract work may be provided on a subcontract basis and payments made in the subcontract work may be debited to the contract account.

5. Overhead:

General overhead and head office expenses are fairly distributed to different contracts, and some overhead is charged to the contract account.

6. Difficulty of cost control:

Contracts are generally large and contract work is done on-site. This causes some problems with material use, labor utilization, labor supervision, plant and work damage, material and tool theft, and more. This site-based work makes it difficult to control the cost of contracts.

7. Surveyor Certificate and Deposit:

In contract work, surveyors, architects, and civil engineers visit the site on a regular basis to inspect the completed work. He issues a certificate stating the completion stage of the work and the value of the work completed by the certificate issuance date. Payment will be released to the contractor by the contractor based on the certificate.

Payments are typically released only up to a certain percentage, for example 80% of certified work. The balance of certified work is retained by the contractor until the entire contract is successfully completed.

The amount of money so reserved is called a "reservation". The contractor does so to protect itself from the risks that may arise from the contractor. Generally, the percentage of retained earnings is up to 20% of the amount of certified work.

8. Work in progress:

The amount of work in process includes the value of certified and uncertified work in process as it appears in your contract account.

9. Cost of running contract:

Due to the long-term nature of the contract, it was necessary to determine the profit attributable to each accounting period. For long-term contracts, it is believed that the results can be evaluated with reasonable certainty before they are signed, and imputed profits should be carefully calculated and included in the current account.

The profits taken up should be based on the principles of standard costing. For completed contracts, all profits arising from the contract can be transferred to the income statement.

However, in the case of an incomplete contract, preparations are made to deal with unforeseen circumstances and unexpected losses, so depending on the scope of work completed in the contract, only part of the profit is reflected in the income statement Will be done. There are no strict rules for calculating profits reflected in the income statement.

However, in general, the following principles are followed:

(1) If an incomplete contract causes a loss, the entire loss will be debited to the income statement.

(2) Profit should only be considered for certified jobs. Uncertified work should be evaluated at cost.

(3) Contract completion is less than 25% of the contract price – no profit should be recorded on the income statement and the entire amount is retained as a reserve for contingencies.

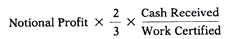

(4) Contract completion up to 25% or more, less than 50% of the contract price – in this case, one-third of the profit, a decrease in the ratio of cash received to the certified work will be reflected in the profit and loss account. The balance remains as a reserve in case of contingency.

(5) Contract completions up to 50% or more and less than 90% – in this case, two-thirds of the profit is reduced by the percentage of cash received for the work authorized to be brought into the income statement, leaving the rest Keep up the amount of reserve.

The formula is given below:

Key takeaways:

- Contract costing, unlike short-term jobs, is a special system of job costing that applies to long-term contracts.

A separate contract account is maintained for every contract.

- The amount of work in process includes the value of certified and uncertified work in process as it appears in your contract account

Profit of unfinished contracts:

Contracts that start and end during the same fiscal year do not cause accounting problems. However, for contracts that take more than a year to complete, the question arises whether the profits of the contract are calculated only at the completion of the contract or at the end of each fiscal year for partially completed work. If you calculate the profit only when the contract is completed, the profit in the year when the contract is completed will be high, but as in the years of other contract work, the profit will be zero.

This will not only distort profit patterns, but will also result in higher tax obligations as you may have to pay higher tax rates of income tax. Therefore, if the contract period exceeds one year, it is necessary to consider the profits and losses gained from each year's business. This helps avoid distortions in the business's year-to-year profit trends.

There are two aspects to profit calculation.

(1) Calculation of expected profit or estimated profit, and

(2) Calculation of the portion of such profit that is transferred to the income statement.

The portion of the expected or estimated profit transferred to the income statement depends on the stage of completion of the contract. Prudent demands that the sum of the expected profits should not be transferred to the income statement, some of which should be withheld as reserves for unforeseen future costs or contingencies. There are no strict rules in this regard. However, in this context, you can follow the following general rules:

1. First rule:

If the certified work is less than 1/4 of the contract price, the profit will not be transferred to the income statement. It is based on the principle that profits should not be taken into account unless the contract is reasonably advanced.

2. Second rule:

If the certified job is more than 1/4 of the contract price and less than 1/2, one-third of the profit is usually remitted to the income statement. The balance will be treated as a reserve. Therefore, the profit transferred to the income statement is calculated by the following formula –

3. Third rule:

If the certified work is more than 1/2 (i.e., 50%) of the contract price and less than 9/10 (i.e., 90%), the profit transferred to the income statement is calculated by:

4. Fourth rule:

If the contract is nearly complete, the estimated profit should be calculated for the entire contract. The percentage of estimated profit transferred to the income statement is calculated using one of the following formulas:

5. Fifth Rule – Loss of Incomplete Contracts:

If you incur losses on an incomplete contract, you must transfer them all to your income statement whatever the stage of contract completion.

5. Cost plus contract method:

The cost-plus contract method is when the contract price is not settled between the contractors, but the contractor has a certain percentage of the total cost incurred by the contractor over the total cost of the work done. I agree to pay the profits of. Such contracts are made during wartime, economic fluctuations, or when contracts are urgently signed and it is difficult to estimate the contract price.

Application of cost-plus contract method:

However, this type of contract is usually signed during the war or during economic fluctuations.

However, it turns out to be useful in the following situations:

(I) When production work must be completed urgently.

(Ii) When it is difficult to estimate labor costs, material costs, and other costs.

(Iii) When plants and machinery must be imported from abroad.

(Iv) When the work to be carried out is essential and it is difficult for the contractor to estimate the cost.

(V) When materials, labor, machinery and specialists are provided by the contractor and the contractor only works on the contract.

Benefits of cost-plus contract method:

(A) Benefits for contractors:

(I) there is no loss.

(Ii) Certainty of profits when labor and material prices rise.

(Iii) The contract can be fulfilled at uncertain times.

(IV) No bid price approval will be obtained.

(V) When the performance of the contract is urgent.

(VI) Availability of professional, raw material and worker services.

(B) Benefits for contractors:

(I) Rapid completion of work.

(Ii) High quality work.

(Iii) Work can be done easily in an emergency.

Disadvantages of cost-plus contract method:

(I) this method usually increases the contract price.

(Ii) Costs are increasing excessively because the contractor is not worried about the increase in costs.

(Iii) Uneconomical use and labor of raw materials by contractors.

(Iv Limited income to the contractor.

(V) It is monotonous for contractors.

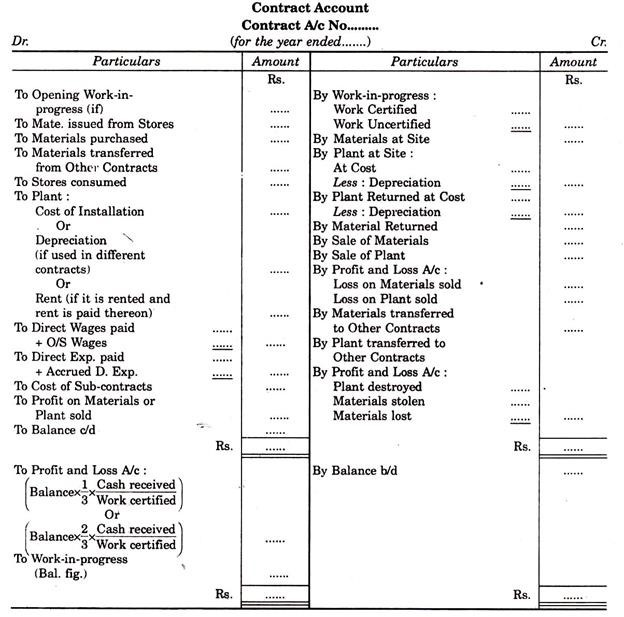

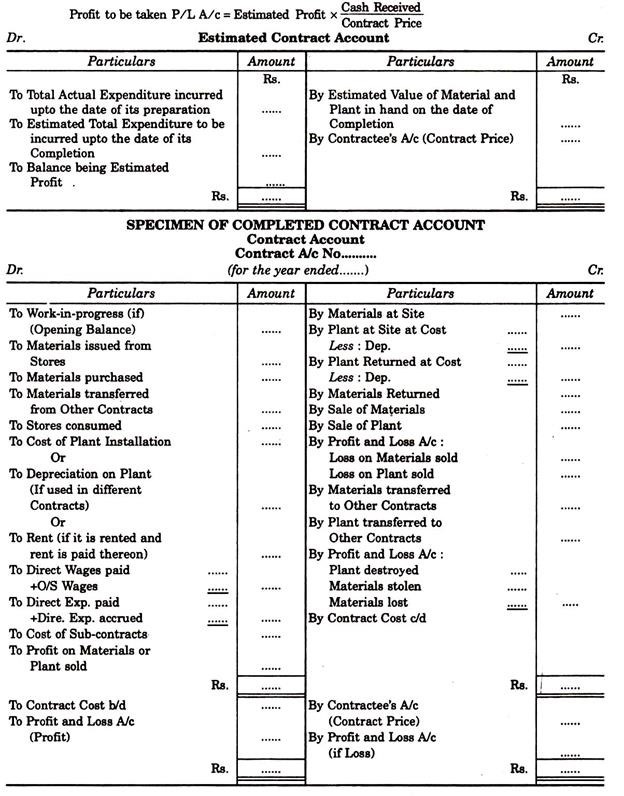

Preparation of Contract Account

Note: (1) If the total of debit side of Contract Account exceeds the total of the credit side of Contract Account, the resultant will be loss, which will be transferred to P/L A/c and not to Work-in- progress A/c.

(2) If contract is near to completion, then profit will be calculated by adopting the following formula –

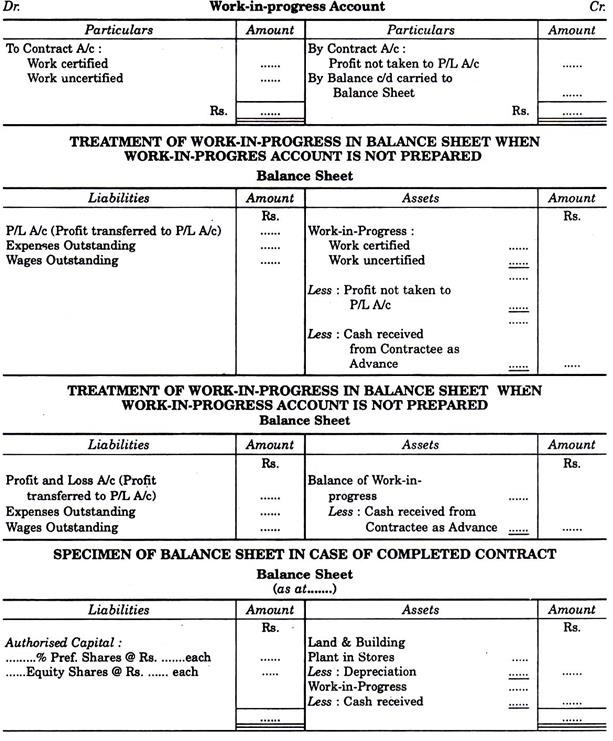

Work in process account:

If the contract is not completed by the end of the fiscal year, the incomplete work is recorded in the work in process account. The work-in-process account is created by debiting this account, the account for authenticated and unauthenticated work, and crediting the reserve profit, that is, part of the profit that was not transferred to the profit and loss account. The difference between a debit and a credit is work in process, but all cash received for such an incomplete contract is shown as a deduction while it is shown on the balance sheet.

Key takeaways:

- Contracts that start and end during the same fiscal year do not cause accounting problems.

- The portion of the expected or estimated profit transferred to the income statement depends on the stage of completion of the contract.

- Two aspects to profit calculation.

- Preparation of Contract Account.

- Work in process account.

Reconciliation Statement.

Overview of Cost Accounting

In the initial, the road was thought of as a value accounting technique of goods or services backed by historical knowledge. Thanks to the character of the market has recognized that crucial prices don't seem to be as vital as dominant prices. Therefore, the prices compared to clerking, clerking was seen additional as a price management technique. Due to the areas of technological development altogether, value | the worth reduction} is presently put together inside the worth space Accounting. Therefore, it's the road of registration, classification and outline of the prices of Identify the worth of any product or service, plan, manage and cut back those prices and see from information to management to come to a decision.

Line meanings and definitions

“Cost accounting are often a way by that info consists, apportion summed up and understood for three main purposes: (in) elaboration and operational management, (ii) specific decision; and (iii) product Decision. "Charles T. Horngren

“Cost accounting is the strategy of the road from the aim that the unit of expenses incurs of committed to manufacturing your final relationship with value units. Inside the broadest sense, it includes the production of mathematical knowledge, the dear device management strategies and, moreover, the identification of

The profitableness of the activities assigned or planned is written as results of the appliance of accounting and equity accounting Principles, strategies and techniques for crucial prices and to investigate savings and / or surpluses as compared to previous expertise or standards. "- Institute of prices and Management contain the presentation of the info that has therefore been derived for the aim of decision-making in social control positions. –Wheldon

Cost accounting therefore provides management with info for elections of every kind. This is why the functions have invariably been indistinguishable from management accounting or alleged accounting internal accounting. Wilmot has adopted the road kind as "scan, record, Standardization, Prediction, Comparison, News and suggestions “and the role of a price account itself from "a scholar, news agent and Rophet"

What is costing?

Costing, called the form of management accounting that companies use to classify, summarize, and analyze different costs, helps management make better decisions for cost control and cost savings.The main function of costing is said to be to adjust, record, and identify investment allocations that are appropriate for the investment in determining the cost of goods and services. It also helps present relevant data to administrators involved in searching for services, contracts, or shipping costs.

It also contains information related to production, distribution and sales costs.

What is financial accounting?

Financial accounting is the accounting department involved in summarizing, recording, and reporting financial transactions that arise from business concerns over a period of time. Financial accounting is used to create various financial statements that companies can use to show financial performance to different users of financial information such as creditors, investors, customers, and suppliers.

Preparation of adjustment statement or memorandum adjustment account:

You need to create an adjustment statement or memorandum adjustment account to adjust the profits shown in the two sets of books. You can use the results shown by any set of books as a base and make the necessary adjustments to reach the results shown by any set of books. Reconciliation Statements and Memorandums The techniques for creating reconciliation accounts are described below.

Preparing the adjustment statement involves the following steps:

(1) It can be used based on the profit of each set of books (cost or finance). This is actually the starting point for determining profits, as shown in the other series of books, after making appropriate adjustments considering the causes of the differences.

(2) It is necessary to investigate the effect of a particular cause of difference on the benefits presented by other series of books.

(3) If the profits shown by another set of books increase due to the cause, the increase must be added to the profits of the previous set used as the base.

(4) If it causes a decrease in the displayed profit of other books, it is necessary to deduct the decrease from the profit based on the previous books.

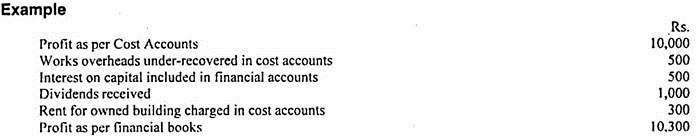

There is a difference in Rs. 300 between the profits shown on the financial books and the profits shown on the cost books. Adjustment statements can be made to adjust the profits presented by the two sets of books on the following criteria:

1. It may be based on costing profit. In other words, if you take into account the causes of the above differences and adjust this profit figure appropriately, you will be able to find the profit shown in your financial books.

2. Overhead costs are charged more in the financial account than in the cost account. This means that the profits shown in financial accounting are less than the profits shown in costing in Rs. 500 (amount of under recovery). The amount of Rs because it is based on the profit from cost accounting. You must deduct 500 from this base profit to reach the profit shown in financial accounting.

3. Inclusion of interest on capital as an expense reduced profits as shown in the financial books. In other words, the profits shown on the cost books are greater than the profits shown on Rupee's financial books. 500 (amount of interest). Therefore, that amount must be deducted from the base profit.

4. Dividends received are credited to the financial books. This means that the profits shown on the financial books are greater than the profits shown on the Rs cost books. 1,000. Therefore, that amount should be added to the profit as shown in the cost book.

5. The rent of the building you own is listed free of charge in your financial books. However, that amount is charged on the cost statement. This means that the profits shown on the financial books are this amount higher than the profits shown on the cost books. Therefore, you need to add the amount to your profit, as shown in the cost book.

Adjustment statements can now be conveniently displayed in the following formats:

In the example above, the cost account shows a loss of Rs. For 10,000, you should enter the amount of loss in the "Minus" column instead of profit. Next, the adjustment statement should be written in the same pattern, assuming that there is a profit instead of a loss.

Creating a memorandum adjustment account:

Memorandum reconciliation accounts can be created on the same line as the reconciliation statement. Difference says “Dr. Means “-" and "Cr." means "+".

Taking the above example, the memo adjustment account would look like this:

Importance of Reconciliation Statement:

If separate books are maintained for costing and financial transactions, there is usually a difference between the profits shown in costing and the profits shown in financial accounting. However, by chance, it is possible that the overall benefits of the two books are the same. Nevertheless, in all cases, the results presented by both sets of books should be adjusted to identify the cause of the difference (if any) and establish the accuracy of both sets of books.

For business concerns, costing and financial accounting can be maintained on the basis of non-integrated or integrated accounting systems. In a non-integrated accounting system, costing and financial accounting are managed separately. Costing is maintained by costing personnel in accordance with costing principles and reviews the total cost per unit of products and jobs at various stages of production or execution.

Financial accounting is maintained by a financial accountant in accordance with the principles of financial accounting and records the day-to-day transactions of a business with the aim of finding the net impact on the profitability and financial position of the business.

Therefore, the objectives, objectives, principles, and methods of maintaining costing and financial accounting are not the same. Therefore, the profits shown in costing may not match the profits shown in financial accounting. The inconsistent information provided by these two sets of accounts may not help you make the right policy decisions.

Therefore, the costing system must be able to coordinate with financial accounting. Costing is unreliable unless such an analysis is coordinated with financial accounting, as costing relies primarily on estimates and constitutes a detailed analysis of financial expenditures.

Meaning of reconciliation:

Adjustments can be represented as a process of aggregating performance or profits, as shown in Costing and Financial Accounting. The arithmetic accuracy of profits was revealed by two different books. Efforts have also been made to determine this. "

Therefore, costing and financial accounting adjustment involves the process of identifying and accounting for the items that led to the difference in performance, as shown in Costing and Financial Accounting. Adjustments are made in the form of analytics presented in the form of statements (called adjustment statements) or memo accounts (called memorandum adjustment accounts).

Need for reconciliation:

The need to collate cost and financial accounts arises for the following reasons:

(I) Adjustments help ensure the accuracy and reliability of the various accounting books maintained by business concerns.

(II) Analytical disclosure of reasons for fluctuations in profits or losses facilitates internal control.

(III) We support cooperation and coordination between cost accounting firms and accounting firms.

(IV) Helps develop appropriate policies regarding overhead absorption, depreciation and stock valuation.

Causes of discrepancies between costing and results shown in financial accounts:

In a non-integrated accounting system, if you manage costing and financial accounting separately, the documents used to see the amount of expenses charged for some items are the same (for example, the cost of the materials used). The labor costs paid must be confirmed with the help of material invoices and wages, respectively), but for one or more of the following reasons –

1. Overhead under / over absorption:

Financial accounting constitutes actual expenditures for factory, office, administration, sales and distribution overheads, while costing provides estimated charges for these items based on historical records or pre-determined absorption rates. Configure. As a result, overhead costs are generally under / over absorbed in costing.

2. Receipt / income items displayed only in financial accounts:

The following receipt and income items are shown or included in financial accounting but are excluded from costing –

(A) Interest and discounts received.

(B) Rent received.

(C) Dividends received.

(D) Commission received.

(E) The transfer fee received.

(F) Take advantage of the sale of fixed assets and investments.

3. Expense / loss items displayed only in the financial account:

The following cost and loss items are billed to the financial account but do not appear in the cost account –

(A) Interest allowed on the loan.

(B) Interest on capital.

(C) Cash discounts are allowed.

(D) Interest paid on corporate bonds.

(E) Expenses and losses associated with the issuance of shares and bonds.

(F) Loss on transaction of fixed assets and investments.

(G) Profit appropriation items, that is, income tax paid or provision for income tax, transfer to reserve

+

(H) Reserve costs are amortized.

(I) Goodwill has been amortized.

(J) Donations and charity payments.

4. Unusual profit / loss items included only in financial accounts:

There are various items of extraordinary profit and loss that are included in financial accounting but excluded from costing.

These items are:

(A) Cost of extraordinary loss of material.

(B) The cost of unusual idle time for workers.

(C) The cost of extraordinary savings in materials.

(D) Exceptional non-performing loans.

(E) Fines and fines paid for violating government rules and regulations.

5. Expense items included only in costing:

The following expense items are only recorded in the cost account and are not considered in the financial account –

(A) Estimated rent of owned facilities.

(B) Depreciation of assets that do not have book values in their financial accounts.

6. Differences in billing standards for asset depreciation:

Costing and depreciation of fixed assets in the financial account may be calculated differently, which can lead to different results. In financial accounting, depreciation is typically based on the depreciation (devaluation) method or the original cost method. However, costing may follow machine time rates or unit of measure depreciation methods.

7. Differences in stock valuation criteria:

Raw material inventories in financial accounting are valued at cost or market price, whichever is lower, while costing is valued using one of the methods, FIFO, LIFO, or AVERAGE pricing. Amounts in progress for costing purposes may be valued based on prime or factory costs, but financial accounting considers some of the administrative and administrative costs.

In financial accounting, finished product inventory is valued based on cost or market price, whichever is lower, while in costing, it is valued based on actual cost.

Costing and adjustment of financial results:

If there is a difference between the work results disclosed in costing and the work results disclosed in financial accounting, you need to perform the following steps to determine the reason for the difference.

1. You need to check the degree of difference between the actual overhead recorded in financial accounting and the cost recorded in costing.

2. You need to schedule all costs and losses that are included in your trading and profit and loss accounts but not in your cost accounts.

3. You need to schedule all revenues and profits that are credited to the P & L account but excluded from the cost account.

4. You need to schedule all items that are included in costing but excluded from financial accounting.

5. You need to review the criteria by which raw material, work in process, and finished product inventories were valued for balance sheet purposes and compare them to the value shown in costing to see their differences.

6. Finally, you need to see all the items that are included in the cost and finance accounts but have different values.

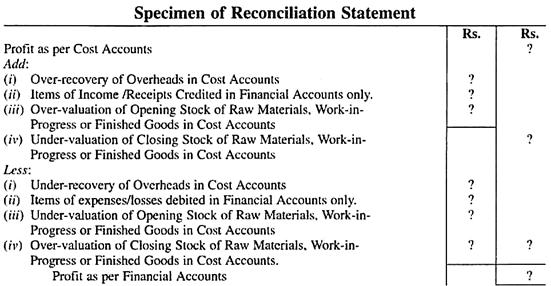

If you find a discrepancy, you should create an adjustment statement starting with the profit disclosed in costing.

Next, you need to add the following items to your profit according to costing:

(I) Overhead costs (factories, offices, management, sales and distribution) are either over-absorbed or over-recovered in cost accounting or under-absorbed in financial accounting.

(II) Receipt items that appear in the financial books but not in costing.

(III) Overvaluation of starting inventory (of raw materials, work in process, or finished products) in costing.

(IV) Undervaluation of end-of-term inventory (of raw materials, work in process, or finished products) in costing.

(V) An item of unusual efficiency (abnormal savings) that appears in the financial books but not in costing.

The following items should be deducted from your profit according to costing.

(I) Underabsorption of overhead costs in the cost account or overabsorption in the financial account,

(Ii) The item of expense that appears in the financial account, not the cost account.

(Iii) Undervaluation of starting inventory (of raw materials, work in process, or finished products) in costing,

(Iv) Overvaluation of closing inventory in cost accounts.

After making the above adjustments, the costing profit will match the financial accounting profit.

Key takeaways

- Overview of Cost Accounting.

- Costing, called the form of management accounting that companies use to classify, summarize, and analyze different costs.

- Financial accounting is the accounting department involved in summarizing, recording, and reporting financial transactions.

- Preparation of adjustment statement or memorandum adjustment account.

- Importance of Reconciliation Statement

- Adjustments can be represented as a process of aggregating performance or profits, as shown in Costing and Financial Accounting.

- Specimen of Reconciliation Statement.

Meaning and definition:

A cost audit is a crucial review conducted to verify the accuracy of costing and make sure that costing principles and plans are adhered to efficiently. It's worth noting that India is that the only country that has introduced statutory cost audits to manage about 45 key industries within the country. Cost auditing is defined by the Chartered Institute of Management Accountants (CIMA) as "verification of costing and confirmation of compliance with costing plans".

This definition means that:

(I) A costing plan must be created the aim of costing must be kept in mind to ascertain if the plan itself and therefore the numbers collected cause the achievement of goals or objective sets. .. For instance , if your goal is to realize maximum efficiency, data planning and analysis is different than if your sole goal is price fixing.

(Ii) it's necessary to think about whether the prescribed methods and other relevant decisions are implemented to verify costs. The treatment and determination of anomalous losses of profits, or the direct or indirect treatment of certain costs, are good examples.

(Iii) it's necessary to ensure the accuracy of the numbers.

The concept of cost auditing is elaborated by the ICWA as "Auditing the efficiency of paying details while work is ongoing and not post-inspection." Auditing is "honest compliance" and price auditing is primarily a precautionary measure, a barometer of performance, also as a guide to management policy and deciding .

Cost audits are often called efficiency audits. It's proven by the modification in Section 209. "

A management audit may be a process of "auditing the standard of a manager by evaluating the manager as a private management audits are intended to gauged how managers perform various management functions (planning, coordination, motivation, etc.).

Benefits of cost auditing:

The main advantage of cost auditing is that it ensures that management has reliable data for price-fixing, decision-making, control, and other purposes. The existence of such an audit system is additionally very helpful in maintaining internal checks. It's also very useful for accounting audits. However, it's important to know that financial and price audits have different purposes.

The former aims to stop fraud and errors, and by presenting the earnings report and record , it's possible to understand things (profit obtained during the year and economic condition at the top of the year) during a true and fair manner. Is aimed toward .

It's not about functional analysis, it's about spending and revenue as an entire . Cost audits are involved within the proper analysis and estimation of data in order that management can quickly obtain the knowledge they have , establishing cost accuracy for every product, job, activity, and so on. Aside from data reliability, cost auditing has certain incidental benefits. Rather, it must be said that cost audits help integrate and realize the advantages expected from costing systems. Following a press release by Minister of Justice HR Go Curry, judicial and company issues highlight the social benefits of cost auditing.

The reasonableness of the worth charged is to properly determine the prices and margins charged by producers and their retailers. Guaranteed only by. Another purpose underlying this step is cheap to take care and efficient for the industries subject to such rules and to scale back costs the maximum amount as possible. Informing about the value . Therefore, counting on this method protects the interests of consumers and may be a clear step towards eliminating social injustice.

Advantages of Cost Audit

(I) Thoroughly check all waste (in-store materials, workers, etc.), promptly identify and report.

(II) Production inefficiencies (or efficiencies) are identified and converted into financial terms.

(III) Exceptional management is possible by establishing individual responsibilities.

(IV) The budget control and standard costing system is greatly facilitated by cost audits by qualified costing personnel.

(V) Records are up to date and information is available for a variety of purposes.

(Vi) Cost audits can uncover many errors and frauds that may not otherwise be revealed. This is because cost auditors take a closer look at spending and compare it to criteria to see the exact reason for the discrepancy.

Importance of Cost Audit

The following are some of the purposes for which cost audits are conducted.

- To establish the accuracy of costing data. This is done by verifying the arithmetic accuracy of the costing entries in the books.

- To ensure that costing principles are governed by management goals and are strictly adhered to when creating costing.

- To ensure that costing is correct and detect errors, fraud, and fraud in existing systems.

- To check the overall work of the value department of a corporation and make suggestions for improvement.

- To help management make the right decisions about certain key issues

- To determine the actual production cost when the goods are ready.

- Its effective internal cost audit system is in operation to reduce the amount of detailed checks by external auditors.

- To ensure that each spending item associated with the relevant component of the manufactured or produced product has been properly generated.

Key takeaways:

- A cost audit is a crucial review conducted to verify the accuracy of costing and make sure that costing principles and plans are adhered to efficiently.

- The main advantage of cost auditing is that it ensures that management has reliable data for price-fixing, decision-making, control, and other purposes.

- Purposes for which cost audits are conducted