UNIT 4

Preparation of Funds Flow and Cash Flow Statements

Funds flow statement

A fund flow statement is a statement in summary form that indicates changes in terms of financial position between two different balance sheet dates showing clearly the different sources from which funds are obtained and uses to which funds are put.

Definition

Roy A. Fouke defines fund flow statement as “a statement of sources and application of funds is a technical device designed to analyse the changes in the financial condition of a business enterprise between two dates.”

Steps for preparing funds flow statement

- Determine the change (increase or decrease) in working capital.

- Determine the adjustments account to be made to net income.

- For each non-current account on the balance sheet, establish the increase or decrease in that account. Analyze the change to decide whether it is a source (increase) or use (decrease) of working capital.

- Be sure the total of all sources including those from operations minus the total of all uses equals the change found in working capital in Step 1.

General rules for preparing funds flow statement

- Increase in a current asset means increase (plus) in working capital.

- Decrease in a current asset means decrease (minus) in working capital.

- Increase in a current liability means decrease (minus) in working capital.

- Decrease in a current liability means increase (plus) in working capital.

- Increase in current asset and increase in current liability does not affect working capital.

- Decrease in current asset and decrease in current liability does not affect working capital.

- Changes in fixed (non-current) assets and fixed (non-current) liabilities affects working capital.

Format of funds flow statement

The fund flow analysis involves the preparation of two statement

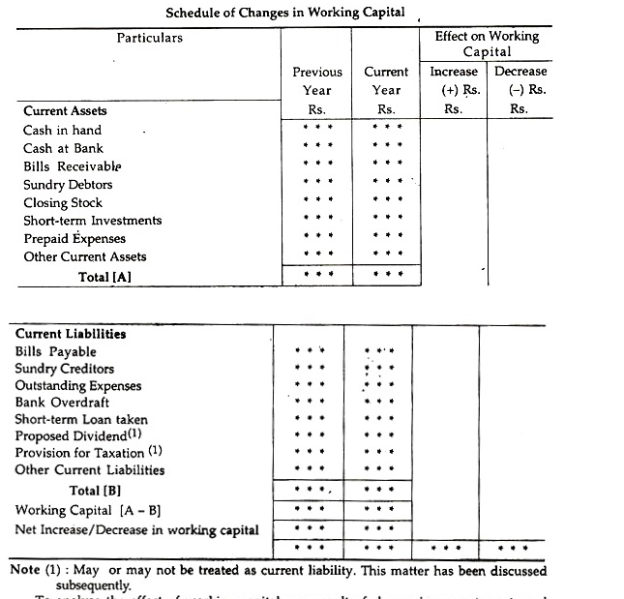

- Statement or Schedule of Changes in Working Capital: The main purpose of a fund flow statement is to explain the net change in working capital.

The Schedule or Statement of changes in working capital is a statement that compares the change in the amount of current assets and current liabilities on two balance sheet dates and highlights its impact on working capital.

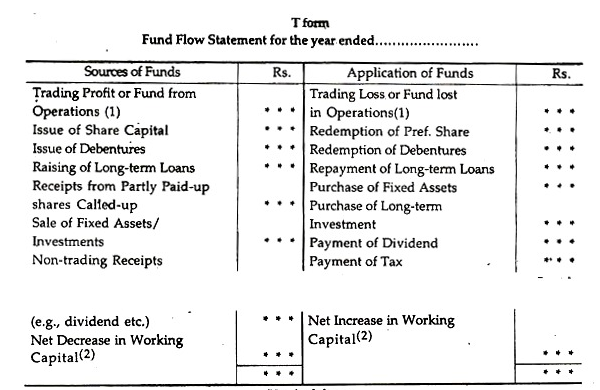

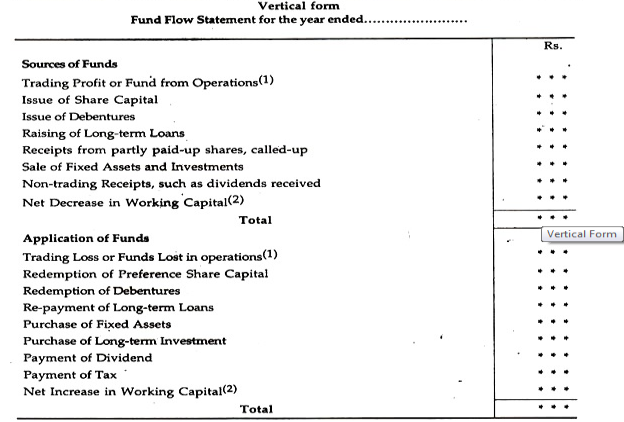

2. Funds flow statement: After preparing the schedule of changes in working capital, the next step is to find out the different sources and applications of funds through preparation of funds flow statement. This statement GIVES emphasis on the changes in the fixed assets and fixed liabilities. The statement may be prepared either in ‘T form’ or in ‘Vertical form’.

Key takeaways –

- A fund flow statement is a statement in summary form that indicates changes in terms of financial position between two different balance sheet dates

Cash flow statements

Definition

A cash flow statement is a financial statement showing the movements of cash and cash equivalents during the period. This financial statement demonstrates the effects of changes in the accounts of balance sheet on cash and cash equivalents.

Cash flow statement is an important part of financial statement. Cash flow statement provides useful information to the investors and creditors. The investors want to know the financial stability and soundness of the business.

Cash includes cash on hand and demand deposits. Cash equivalents means short term highly liquid investments that are readily convertible into cash for meeting short term cash commitments. These cash are not used for investments and other purposes.

Objectives of cash flow statement

- Useful in short-term financial planning.

- Useful inefficient cash management.

- Helpful in formulation of business policies.

- Assists in preparation of cash budget.

- Used for assessment of cash flow from various activities, viz operating, investing and financing activities.

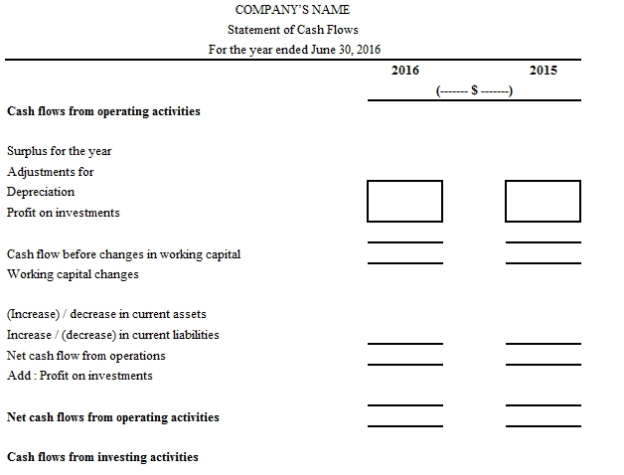

Format

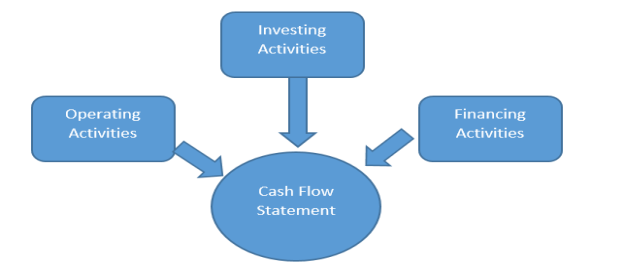

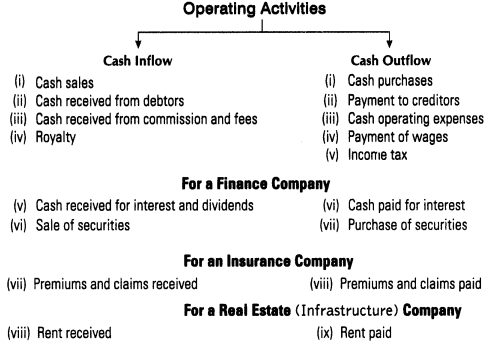

Cash flow from operating activities – the operating activities includes the primary or main activities of an enterprise. Cash flows from operating activities are primarily derived from the main activities of the enterprise. They generally result from the transactions and other events that enter into the determination of net profit or loss.

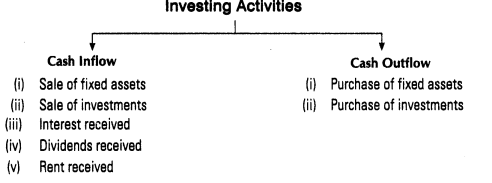

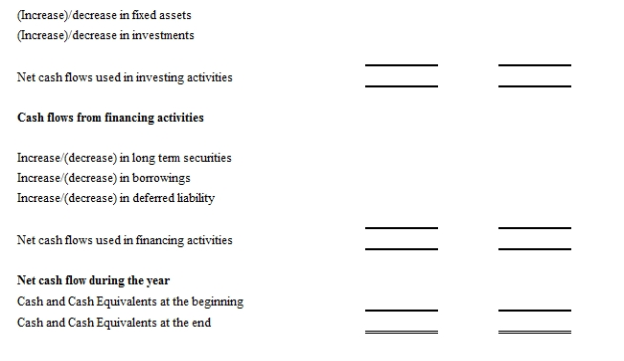

Cash flow from investing activities - Investing activities consist of the acquisition and disposal of long-term assets and other investments which are not included in cash equivalents. The purchase and sale of long-term assets or fixed assets such as machinery, furniture, land and building, etc. are included in investing activities.

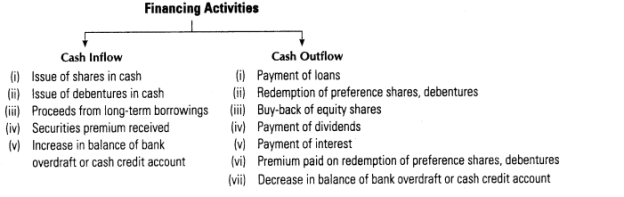

Cash flow from financing activities - Financing activities comprises of owners capital and borrowings or long-term funds or capital of an enterprise, e.g., cash proceeds from issue of equity shares, debentures, raising long-term bank loans, repayment of bank loan, etc.

Key takeaways –

- A cash flow statement is a financial statement showing the movements of cash and cash equivalents during the period.

Sources

- S. P. Gupta : Management Accounting

- B. K. Mehta & K. L. Gupta : Management Accounting

- Manmohan and Goyal : Management Accounting

- Hingorani and Others : Management Accounting

- R. N. Anthony : Management Accounting

- Agarwal and Mehta : Management Accounting