UNIT I

Income Tax Act 1961

Introduction to Income Tax Act

Taxes are mandatory financial claims by the government on wages, products, administration, exercises or exchanges. Taxes are the basic mode of income for the government, which is used for the welfare of the general population of the state through government strategies, arrangements, and practices. There are references to taxes in ancient writings such as Manusmurti and kautiriyaalta shastra. It was first started in 1860 to beat the financial crisis of 1857 in India. Thus, it is the Income Tax Act 1961, which is currently implemented in India.

Constitutional Provisions of Taxes in India

The basis of all laws in India is rooted in the Constitution. Under Article 265 of the Constitution, taxes must be collected or collected, except for the powers of law. Under the Constitution there are various provisions that distribute power.

India Constitution Seventh Schedule list I Entry 82 grants power to Parliament to impose taxes on income other than agricultural income. Thus, the income tax is under the Union List, and therefore the central government is responsible for the collection of income tax.

The central government has the authority to collect taxes on income, apart from the agricultural income tax that is levied by the state government. Entry 46 of the list II of the Seventh Schedule of the Indian Constitution lays out that the state government has the authority to collect taxes on agricultural income.

Schedule 7

Listing 1

- Entry 82: taxes on income aside from agricultural income.

- Entry 83: customs duties, including export duties.

- Entry 84: duty of excise duty on tobacco and other goods manufactured or produced in India excluding alcoholic beverages, opium and narcotics for human consumption, but including the preparation of medicines and toilets containing alcoholic beverages, opium or narcotic.

- Entry 85-corporation tax

- Entry 92A: tax on the buying or selling of goods aside from newspapers during which such sell or buy is established within the process of interstate trade or commerce.

- Entry 92B-a tax on consignment of goods in which such consignment is carried out during interstate trade or commerce.

- Entry 92c-taxes on services

- Entry 97-List II, List III, and other issues not included in the taxes not listed in List II or List III.

Listing 2

- Entry 46-tax on agricultural income.

- Entry 51-excise duty on all alcoholic beverages, opium and narcotics.

- Entry 52-tax on the entry of goods into the local area for consumption, use or sale there (usually referred to as Octroi or entry tax).

- Entry 54-taxes on the sale or purchase of goods other than newspapers, except for interstate sales or purchase taxes.

- Entry 55-tax on advertising, excluding advertising in newspapers.

- Entry 56- tax on goods and passengers carried by road transport or inland waterways.

- Entry 59-taxes on professionals, transactions, calls, and employment.

The need for income tax in India

Income tax is a tax on the income of an individual or legal entity. Income tax is the main source of income for the government to perform its functions. The work of government is not only limited to Defence, Law, Order, etc. But it must also carry out activities like welfare and development under areas such as health, education and Rural Development. The government will also have to pay for its own administration. All of these activities require huge finances, which are raised by the collection of taxes.

Purpose of taxation

- Money spent on the development of roads, schools, hospitals, market regulation and legal systems, etc. It is raised by the income generated by the collection of taxes’ Redistribution of resources by richer sections to poorer sections of society.

- Certain products are taxed to eliminate externalities, such as a tobacco tax to discourage smoking

- Subdivision of taxes: direct and indirect taxes.

- Income tax may be a tax imposed on individuals. Real estate and wealth taxes were also direct taxes, but these are now abolished

- Indirect taxes imposed in India are customs duties, central excise taxes, service taxes, sales taxes, and VAT.

For now, the GST has been implemented and all other indirect taxes have been abolished.

Definition

Although income tax as a concept existed in India for many years, James Wilson, the first financial member of India, introduced the first modern Income Tax Act in 1860. "It was just for the advantage of his subjects that he collected taxes from them, because the sun draws moisture from the world and returns thousand times," Kalidas wrote in his epic Raghuvansh.

The Income Tax Act is a comprehensive statute that focuses on the various rules and regulations governing taxation in a country. It provides to collect, manage, collect and collect income tax for the Indian government. It was enacted in 1961.

The tax law contains a complete of 23 chapters and 298 sections, consistent with the official website of the Indian tax Bureau[1]. These different sections correspond to the surface of taxation. The different heads you have to pay income tax include、:

- Salary

- Income from home property

- Capital gay

- Profits and profits from business or profession

- Income from other sources

Every year, the government of India presents its fiscal budget during the month of March. The budget brings various amendments to the Income Tax Act. This change also applies to the tax version. For example, the minister of Finance announced that the personal tax rate of the Rs minimum tax bracket. From 2.5 lakh to 5 lakh will be reduced from 10% to 5% in fiscal 2017. Similarly, taxes on long-term capital gains (LTCG) were reintroduced in the fiscal 2018 budget. As a result, all profits will be greater than Rs. Lakh from equity and equity investment trusts held for more than 1 year is currently subject to LTCG tax at 10%.

The latest budget presented by the current Finance Minister Nirmala Sitharaman included the introduction of a new voluntary taxation system with a reduced rate of income tax. These new rates will be available as an option from the 2020-21 financial years.

Such an amendment will be part of the Income Tax Act from April 1, following the approval of the Indian President.

Key takeaways:

- Income tax is a type of tax that the government imposes on income generated by companies or individuals within its jurisdiction.

- Income tax is used to fund public services, pay government obligations and provide goods to citizens.

- Personal income tax is a type of income tax that is imposed on an individual's Wages, Salaries, and other types of income.

- Business income tax applies to companies, partnerships, small businesses, and people who are self-employed.

Income concept

While the Income Tax Act does not define the term income, Section 2 (24) of the Act describes the various receipts contained under the income range.

- Profits and profits.

- Dividends

- Voluntary donations received by charitable trusts

- The value of any perks or benefit in place of salary.

- Any capital gains.

- Any winnings from the lottery,

- Crossword puzzles and more

- Charging unit

Section 4 of the Income Tax Act, 1961, is the charging section of the law. Therefore, in this section:

- The rate is prescribed under financial law for all valuation years. Income tax for the previous year should be charged according to the rate given.

- Taxable income is for the previous year, not the valuation year

- Total income, calculated in accordance with the provisions of the law, can be levied

- TDs or advance tax will be charged wherever applicable

Head of income

Income falls under 5 major heads under Section 14 of the act

- Income from salary

- Income from home property

- Capital gains income

- Profit and profit from business and profession

- Other sources of income

Agricultural income

Agricultural income is rent or income in cash or in kind derived from the land, which is used for agricultural purposes and the land must be located in India. Income from agriculture should be produced by the cultivator or the beneficiary of the spot rent of its agricultural products, which is suitable for incorporating it into the market.

The income should be obtained from the sale by the cultivator or the rental recipient of its products produced or received by him and cannot carry out any process other than the process of adapting it to the market.

Income that is incurred or deemed to be incurred in India

Income of non-residents or foreign companies is subject to taxation only to the extent that it has occurred in India. However, under Section 9 of the Income Tax Act, other provisions set out criteria as to why certain incomes are considered to occur in India, even though they may actually arise from India. Business connection–the term business connection is not defined in the act, but various judgments and circulars focus on the meaning of it.

In accordance with the Income Tax Notice No. 23: Examples of non-residents with business connections in India are shown-

- India branch

- The agent appointed for the sale of goods for non-residents.

- Form a subsidiary of a non-resident parent company in India

- Established a factory in India to process raw materials and final products are then exported.

- Financial relationship between resident and non-resident companies Residential areas

- The tax code and classification of taxable income earners are the following

Residential status

Three categories of person under taxable law:

- Resident not usually resident

- Non-resident

- Tenants

Resident Person:

There are various tests to determine the residence status of a person:

Test 1-if a person has resided in India for 182 days, not necessarily at once, in the previous year, he is said to be a resident of India.

Test 2-if the person has lived in India for more than 365 days of the previous 4 years and 60 days of the previous year, he is said to be a resident.

Residents who are not ordinary residents –

Individuals are not ordinary residents

Test 1-he has not resided in India for 9 out of 10 prior to that year

Test 2-if the individual has not lived more than 7 days in India in the previous year

Test 3-Hindu not home but the manager meets the above conditions

The company's residential area is the area where it is located.

In accordance with Section 6 (3) of the Income Tax Act, the company is said to be a resident of India if any of the following conditions are met-

- If the company is an Indian company, or

- If the place of effective management is in India for that year.

The place of effective meaning is the place where all important managerial and commercial decisions for the implementation of business are made.

Key takeaways:

- While the Income Tax Act does not define the term income, Section 2 (24) of the Act describes the various receipts contained under the income range.

- Income falls under 5 major heads under Section 14 of the act

- Agricultural income is rent or income in cash or in kind derived from the land.

- Income of non-residents or foreign companies is subject to taxation only to the extent

Meaning and importance of residence status

The taxability of an Indian individual depends on his residency status in India for any particular financial year. The term residency status is coined under India's income tax law and should not be confused with the citizenship of an individual in India. The individual may be a citizen of India but may end up being a non-resident for a certain year. Similarly, a foreigner may end up being a resident of India for income tax purposes in a particular year.

It should also be noted that the status of residence of different types of people-individuals, companies, companies, etc. - is determined differently. In this article, we talked about how you can determine the residence status of an individual taxpayer for a particular fiscal year

How to determine the state of housing?

For the purposes of income tax in India, the income tax law of India classifies the person subject to taxation as follows:

a. Resident

b. A resident who is not a regular resident (RNOR)

c. Non-resident (NR)

The taxability varies for each of the above categories of taxpayers. Before entering the taxable object, let's first understand how the taxpayer becomes a resident, RNOR or NR.

- Resident

Taxpayers can qualify as residents of India if they meet any of the following 2 conditions:

- Annual stay in India more than 182 days or

- Staying in India for the last 4 years is no less than 365 days and no more than 60 days for the relevant fiscal year

If an individual who is a citizen of India or a person of Indian origin leaves India for employment during FY, he is eligible as a resident of India only if he has stayed in India for more than 182 days. Such individuals are allowed to stay in India for a long time of not less than 60 days and less than 182 days. However, from the 2020-21 financial years, for individuals whose gross income (excluding foreign sources) exceeds Rs15lakh, the period will be reduced to more than 120 days.

In another important amendment from the 2020-21 fiscal years, individuals who are citizens of India who are not responsible for taxation in other countries are considered to be residents of India. The conditions of the status of residence considered apply only if the gross income (except for foreign sources) exceeds Rs 15lakh and nil tax liability in another country or region for reasons of his address or residence or other criteria of a similar nature.

2. Resident not usually resident

If an individual qualifies as a resident, the next step is to determine whether he/she is a regular resident (ROR) or RNOR. He will be ROR if he meets both of the following conditions:

1. At least 2 out of 10 years ago, I was a resident of India、

2. Have stayed in India for at least 730 days in the last 7 years

Therefore, if any individual does not meet any of the above conditions, he becomes an RNOR.

From 2020-21, if a citizen or person from India leaves India for employment outside of India, they will be a regular resident if they stay in India for a total of 182 days or more. But this condition applies only if his total income (except for foreign sources) exceeds Rs15lakh.

In addition, Indian citizens who are considered to be resident in India (FY 2020-21) will reside in India and will usually reside in India.

Note: income from foreign sources means income generated or generated outside India (excluding income derived from businesses controlled in India or professions established in India).

Non-resident

Any individual who does not meet any of the conditions set forth in (a) or (b) above will be in the NR for that year.

3. Taxable

Resident: a resident is taxed in India on income earned in India and income earned outside India, i.e. his global income. NR and RNOR: tax liability in India is limited to the income they earn in India. They do not have to pay any taxes in India on their foreign income.

It should also be noted that in the case of double taxation of income, where the same income is taxed in India as well as abroad, you can rely on the Double Taxation Avoidance Agreement (DTAA).

Key takeaways:

- The taxability of an Indian individual depends on his residency status in India for any particular financial year.

- Determination of the residence status of an individual taxpayer for a particular fiscal year.

- A resident is taxed in India on income earned in India and income earned outside India, i.e. his global income.

- If an individual qualifies as a resident.

In general, two types of receipts occur in the course of business. The receipt of capital is the result of the routine activities of the company during the financial year, including sales, commissions, interest on investments, in contrast to non-such as income from the sale of long-term assets, capital brought by the owner, the amount received as a loan, or income from bondholders, etc.

Definition of capital receipt

Capital receipt is the income received by the company, which is non-recurring in nature. They are part of financing and investment activities, not sales activities. Capital receipt reduces assets or increases liabilities. Receipts can be generated from the following sources:

- Issuance of shares

- Problems with debt products such as corporate bonds.

- Bank grants loan.

- Government grants.

- Insurance claims.

- Additional capital introduced by the owner.

Specimen of Capital Receipt

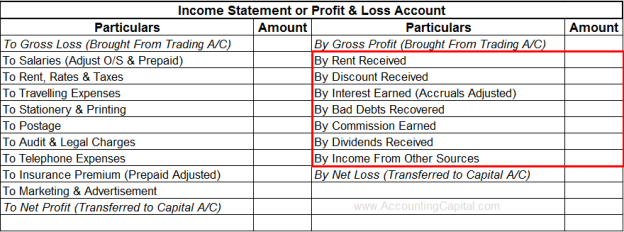

Definition of Revenue receipts

Revenue receipts are receipts that occur through core business activities. These receipts are part of the normal business operation, which is why they occur again and again, but their effect is short-term, so the income received from the day-to-day activities of the current accounting business includes all operations that bring cash to the business, such as:

- Proceeds from the sale of inventory

- Provision of services

- Discounts you receive from creditors or suppliers

- Sales of scrap materials.

- Interest received

- Receipts in the form of dividends

- Rent received

Specimen of Revenue Receipt

The main differences between capital receipt and revenue receipt

The following describes in detail the difference between capital receipt and revenue receipt:

- Receipts generated from investment and financial activities are capital receipts, while receipts from operating activities are revenue receipts.

- Capital receipts are non-recurring and irregular, so they do not occur often. However, the receipt of earnings occurs many times.

- The benefits of receiving capital can be enjoyed in more than one year, while the benefits of receiving income can be enjoyed only in the current year.

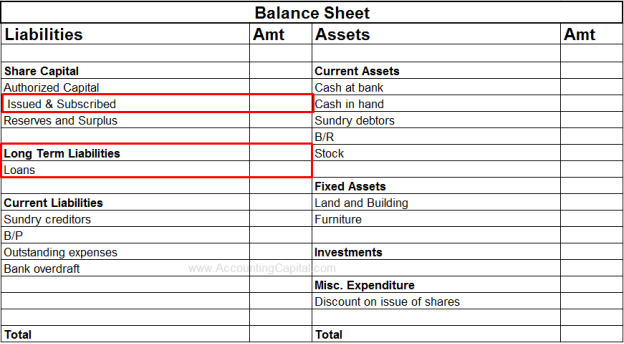

- Capital receipts are always on the debit side of the balance sheet, while revenue receipts are on the credit side of the profit and loss account as profit for the fiscal year.

- Capital receipt is received in exchange for a source of income. Unlike the income received, which is an alternative to income.

- Capital receipt decreases the value of an asset or increases the value of a liability, while revenue receipt does not increase or decrease the value of an asset or liability.

Similarities

- Both receipts are part of business activities.

- Both are essential to the survival and growth of the company.

- Business income source.

Conclusion

In general, capital receipts and revenue receipts play an important role in the growth of the business, as the business may not be able to survive.

Content: Capital Receipt Vs Revenue Receipt

- Comparison Chart

- Definition

- Key Differences

- Similarities

- Conclusion

BASIS FOR COMPARISON | CAPITAL RECEIPT | REVENUE RECEIPT |

Meaning | Capital receipt means that it is the income generated from the investment and financial activities of the business. | Revenue receipts are income generated from the operating activities of a business. |

Nature | Non-regular | Repetition of nature |

Term | Long Term | Short Term |

Shown in | The balance table is shown in the Balance Sheet | The balance table is shown in the income statement

|

Received in exchange of | Income received in exchange | Source of income |

Value of asset or liability | The value of an asset or liability decreases or increases the value of the asset. | Increase or decrease the value of an asset or liability. |

Key takeaways:

- Two types of receipts occur in the course of business

- Capital receipt is the income received by the company, which is non-recurring in nature.

- Revenue receipts are receipts that occur through core business activities.

- Capital receipts are non-recurring and irregular, so they do not occur often. However, the receipt of earnings occurs many times.

List of Exempted Incomes (Tax-Free) Under Section-10

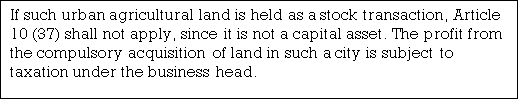

1. Agricultural income [section 10 (1))]

According to Section 10(1), agricultural income earned by Indian taxpayers is exempt from tax. Agricultural income is provided for in Article 2, Paragraph 1 of the Income Tax Act. According to Section 2 (1A), agricultural income generally means:

- Any rent or income derived from land located in India and used for agricultural purposes.

- Any income derived from such land by agricultural operations, including the processing of agricultural products, as it fits for the market or sale of such agricultural products.

- Any income attributable to the farmer subject to the satisfaction of certain conditions specified in this regard in Section 2 (1A). Income obtained from seedlings or seedlings grown in the nursery shall be considered agricultural income.

2. Hindu non-divided families (H.U.F.)

Any sum received by the joint parcener from [Section 10 (2)]

In accordance with Section 10(2), any amount received from the income of the family's property or, in the case of concessional property, any amount received from the income of the family's property by any member of such HUF is exempt from taxation.

Example: HUF won". The previous year there were 90,000 during 2016-17 and it is not taxable. Mr. A, a co-parcener, “is earning personal income." 40,000p.m besides his individual income, Mr. ' receives.50, 000 from his HUF.

Mr. A will pay tax on his personal income, but the amount he receives from HUF will be paid by the joint parcener's hand, regardless of whether the HUF is paying tax on that income.

.

3. Share of income from the company [Section 10(2A)]

In accordance with Section 10 (2A), the share of profits received by the partner from the enterprise is exempt from taxes in the hands of the partner. In addition, the share of profits that an LLP partner receives from an LLP is exempt from taxes in the hands of that partner. This exemption is limited to profit sharing only and does not apply to interest on capital and compensation received by partners from the Company/LLP.

4. Interest paid to non residents [Section 10(4)(I)]

In accordance with Section 10(4)(i), for non residents, income from interest on certain notified securities or bonds (including income from a premium on redemption of such bonds) is exempt from taxation.

In the case of an individual in accordance with Section 10 (4) (II), the interest of the money standing on his credit in a non-resident (external) account of an Indian Bank in accordance with the Foreign Exchange Management Act of 1999.

The exemption under Section 10(4) (II) is only available if the individual is a person residing outside India as defined in Section 2 (q) of the act, or is authorized by the Reserve Bank of India to maintain the aforementioned account.

5. Interest on non residents on non residents (external) accounts [section 10(4) (II)]

Income from interest on money standing on his credit in a non-resident (external) account of any bank in India shall be exempt from taxes in the case of an individual who is a person residing outside India or who is authorized by the RBI to maintain the aforementioned account. Persons residing outside India shall have the same meaning as defined under the Foreign Exchange Regulation Act, 1973, FEMA, 1999. This exemption shall not be available to income due to interest paid or deposited after 1-4-2005.

6. Interest paid to a person of Indian origin and non-resident [Section 10 (4B)]

If an individual, a citizen of India or a person of Indian origin and a non-resident, income from interest on savings certificates issued by the central government shall be fully exempted so that the government may designate in its place by notice of the Official Gazette. Exemptions under this section should not be allowed for bonds or securities issued after 1-6-2002.

This exemption allows an individual to transfer foreign currency or other foreign currency remitted from a country other than India in accordance with the provisions of the Foreign Exchange Act, 1973, FEMA, 1999 and the rules made there.

To this end, a person must be considered to be of Indian origin if he or any of his parents or grandparents were born in India or undivided India.

7. Leave travel concessions or assistance (LTC/LTA) to Indian civil employees [Section 10 (5)]

An employee is entitled to an exemption under Section 10(5) with respect to the value of travel concessions or assistance received by or for him by his employer or a former employer for himself and his family in connection with his procedures—

On vacation to any place in India.

After retiring from service or after the end of his service to any place in India.

Exemptions shall be granted in accordance with the following conditions:

If the trip is carried out by air—the maximum exemption should be an amount that does not exceed the air economic fare of the domestic airline by the shortest route to the destination;

- If the origin and destination of the journey are connected by rail, and the journey is carried out by means of non—air transport-the maximum exemption shall not exceed the air-conditioned first-class railway price by the shortest route to the destination.

- In the presence of a recognized public transport system, in transportation by the shortest route to the destination, in some cases, the 1st or Deluxe Class is used.

- In the absence of a public transport system, the amount equivalent to the air-conditioned first-class rail fare for the distance of the journey by the shortest route, as if done by rail.

The exemption, however, in no case exceeds the particular expenditure incurred on the performance of the journey.

How many times can I request an exemption?

The assessor can claim an exemption with respect to any two journeys in the 4-year block. To this end, the first block in Year 4 was 1986-89, the second block was 1990-93, the third block was 1994-97, the fourth block was 1998-2001, the fifth block was 2002-05, the sixth block was 2006-09, the seventh block was 2010-2013, the eighth block was 2014-2017, and the ninth block was 2018-2021.

If the assessor does not take advantage of the LTC exemption in a particular block, whether for both journeys or for one trip, he can immediately carry over to the end of the four calendar year block, that is, the maximum one trip can carry over and only for the first trip in the next calendar year unless the period is extended in another way. Such journeys made during the extended period will not be considered to determine the duty-free of the two journeys for subsequent blocks.

- Exemptions only available with respect to two children

- Exemptions regarding LTC are not available to two or more surviving children of individuals after 1.10.1998.

- Exception: the above law does not apply in case to children who are born before 1.10.1998 and in the case of multiple births after one child.

Important notes:

If LTC is wrapped without making a trip, then the full amount of the amount received by the employee is taxable.

- Families for this purpose include、:

- Spouses and children of employees;

- Parents, brothers and sisters of employees who are completely or largely dependent on him.

- Exemptions can be useful for trips carried out during the service's tenure on vacation or even after retirement/dismissal from the service.

- Exemptions are only allowed with respect to fares. Expenses incurred during transportation, boarding and accommodation or travel from Porter, residence to train station/airport/bus stand and back are not exempt.

- Exemption is possible for the shortest route. If a trip from the place of origin to a different location is made in a circular or other manner, the exemption from the trip is limited to the shortest route allowed from the place of origin to the farthest point.

8. Compensation or salary received by a private who isn't a citizen of India [Section 10(6)]

The following income is exempt when received by individuals who are not citizens of India:

- Reward [U / s10 (6) (ii)].

Remuneration received by ambassadors or other officials of foreign embassies, High Commission or legation of India.

- Compensation by a foreign consul in India.

- Compensation received by trade commissioners or other official representatives of foreign India, if the corresponding official of the Indian government of the country is given a similar concession.

- Compensation received by a member of the staff of the personnel listed above (a), (b) and (c).

If the person stated in (A)to (d)is the subject of the country represented and is not engaged in business, occupation or employment in India (otherwise than as a member of such staff), the country represented will give similar concessions to the member of the staff of the corresponding staff of the government of India.

II. Compensation received by him as an employee of a foreign company [U/S10 (6) (VI)]

For the services rendered by him during his stay in India (for example, a technician deputed by a foreign company to work in India), the following conditions are met:—

i) Foreign companies are not engaged in trade or business in India;

Ii) His stay in India does not exceed a period of 90 days in total for such a previous year.

Iii) Such compensation is not liable to be deducted from the income of the employer, which is imposed under the law.

III. Employment on foreign ships [U/s10(6) (viii)].

Income received by such individuals as non-residents, or imposed under the"salary"received by such individuals, as compensation for services rendered in connection with employment on foreign ships, where the total stay in India does not exceed the total of 90 days of the previous year.

IV. Compensation received by employees of foreign governments. During his stay in India, he will receive training in India [U / s10 (6) (xi)].

Such compensation shall be fully exempted if he is trained in any of the following concerns:

- Government-owned institutions

- A company wholly owned by the central or state government. Or partially owned by the state government, partly by the central

- Of the company referred to in the above point (B)

- Legal entities established by or under central, state or local law

- All societies registered under the social Registration Act; 186Q and are fully funded by the central or state government.

9. Taxes reimbursed by the government or India's main motive over the income of foreign companies [sections 10 (6A), (6B), (6BB) and (6C)]

(6A) :

i) If a foreign company provides technical services to the Indian government or state government or Indian company, and for such services the foreign company does not pay royalties or fees.

Ii) Such fees or royalties are paid by Indian concern to pursue contracts concluded prior to 1-6-2002; such contracts are approved by the Indian government, which is in accordance with the Indian government's industrial policy.

Iii) Since royalties or fees paid to foreign companies occur in India, such income is responsible for being taxed in India, and the payer of Indian Income in accordance with the contract pays the tax obligations of foreign companies.

Iv) Taxes paid by the Indian government or state government or Indian companies will be exempted, that is, they will not raise the income and profits of foreign companies.

For example: Foreign companies provide technical services to Indian companies, and according to the contract, foreign companies are supposed to be paid Rs fees.

1, 00,000 Rs taxes. 30,000 of such fees are paid by an Indian company. Taxes paid by Indian companies are exempt, so they do not raise the income and profit of foreign companies and the income of such foreign companies will be Rs only.

1, 00,000.

(6B) :

- The tax liability of a non-resident (not a company) or foreign company is waived if it is paid by Indian concern or Indian government or state government, and therefore is not subject to foreign tax liability.

(6BB):

- Taxes paid on income received by foreign governments or foreign companies leasing aircraft.

- 31-3-1996 and later 1-4-2007, under an agreement concluded before and approved by the central government on behalf of this, such income may be received by a foreign government or foreign company by considering obtaining an aircraft or aircraft engine by lease (excluding payments for providing spares or services for the operation of leased aircraft). The income is paid by such an Indian company on the basis of the terms of this contract. However, taxes paid in such a way shall be fully exempted.

- This benefit must be available only to that foreign company, which is a non-resident.

(6℃):

- Any income derived by a foreign company (so notified by the central government. Royalty or royalty for technical services under contract to provide services within and outside India in projects related to security in India.

10. Allowances and allowances paid by the government to employees working outside India [Section 10 (7)]

Allowances or allowances paid or authorized by the government to Indian citizens outside India to provide services outside India are exempt. The following conditions should be met before profits are processed or incurred in India:

- Income must be paid under the head " salary";

- The payer must be the government of India;

- The recipient must be a citizen of India—whether resident or non-resident;

- The service should be provided outside India.

The Indian Citizen's salary in the above cases will be deemed to be incurred or incurred in India, but all allowances or benefits paid by the government to the Indian citizen above for rendering services outside India will be exempted under Section 10(7).

11. Foreign employees working in India under the cooperative Technical Assistance Program [Section 10 (8)]

Persons working in India under the cooperation technical assistance program in accordance with the agreement concluded by the central and foreign governments, the following income of such individuals is not included:

- Compensation received by him directly or indirectly from a foreign government for such duties performed in India.

- With respect to any other income of such individual that occurs or occurs outside of India and is not deemed to occur or occur in India, that individual shall not be liable for any loss or damage incurred in that foreign country.

12. Consultant income [section 10 (8A)]

Remuneration or fees received by the consultant from an international organization funded under a technical assistance grant agreement between such organization and a foreign government, and any other income incurred or incurred outside India (not considered to be incurred or incurred in India) and subject to income tax or Social Security tax in a foreign country, shall be waived in full. How to use it? Consultants of the same service must be approved by competent authorities.

What is a consultant? :

(a) Individuals who are not citizens of India, or

(b) Individuals who are citizens but are not normally resident in India.

All the persons who are non-residents and provide technical services in India are in the connection with a technical assistance program or project.

Conditions established for duty free u/S10 (8A)

- Technical assistance programs and projects in India will be drawn for technical services where fees and rewards are paid.

- The sum is paid directly or indirectly from the funds made available to international organizations in accordance with the agreement between such organizations and foreign governments.

- The technical assistance provided is in accordance with such a contract.

- The agreement on the appointment of a consultant must be approved by the prescribed authorities.

- Any other income generated or generated outside India is subject to income or Social Security taxes in other states.

13. Consultant employee income [section 10 (8B)]

For individuals who are assigned duties in India under a technical assistance program—

- Compensation received by him directly or indirectly from a consultant called U / S10 (8A) above

- Any other income generated or generated outside India (not considered to be generated or generated in India) and subject to income tax or Social Security tax in a foreign country shall be fully exempt

- Such individuals are not citizens of India; or

- If you are a citizen, but not a resident, and

- The contract for services is approved by the competent authorities.

Conditions established for duty free u/S10 (8B)

- The individual must be an employee of the consultant described in Section 8A above.

2. His service contract is approved by the prescribed authority.

3. Compensation will be received in connection with the technical assistance program described in Section 8A.

4. Any other income generated or generated outside India is subject to income or Social Security taxes in other states.

The powers specified in Article 8A and Article 8B is as follows:

Additional Secretary of the Ministry of Finance and economic affairs of the government of India at the same time with members CBDT

14. Income of any member of the family of individuals working in India under the cooperative Technical Assistance Program[Section 10 (9)]

In accordance with Section 10 (9), as described in Section 10 (8) / (8A) / (8B), the income of any member of the family of an individual accompanying to India shall not occur or occur outside India and shall not be deemed to occur or occur in India, and shall not be deemed to have been paid by such member to the government of that foreign country or country of origin. You will be exempt from taxes if you have to pay Social Security taxes.

15. Gratuity: 10 (10))]

A tip is a payment that is paid to the employee by the employer in gratitude for the past service provided by the employee. Your contact number will not be notified of your booking confirmation.

(a) The employee himself at the time of retirement, or

(b)The statutory heir in the event of the death of the employee;

Gratuity received by employees at retirement is taxed under the head "salary" whereas chips received by the statutory heir of a deceased employee must be taxed under the head "income from other sources". However, in both cases described above, according to Section 10 (10), the chip is exempted to certain restrictions. So, if an employee receives a tip, then the salary includes only that part of the chip that is not exempt under Section 10 (10).

- Death-cum-retirement payments received by civil servants [Section 10(10)(I))]

Section 10(10) (i) grant exemptions to chips received by government employees (i.e., central or state or local authorities).

B. Gratuity received by non-government employees that are covered by the CHIP Payment Act, 1972[Section 10(10)(II)]

Minimum of the following 3 limits:

(1) The chip actually received, or

(2) if the salary of 15 days per completion year, or part of it exceeds the salary of 7 days per season, or

(3) ₹. 10, 00,000

Salary meaning:

(I) basic salary + Dearness Allowance

(II) Last drawn salary. Average salary for the previous 3 months for a piece-rate employee

(III) no. 26 of the day of the month taken as

C. Other employees

Minimum of the following 3 limits:

(1) actual received chip

(2) Average half-month salary for each length of Service.

(3) ₹. 10,00,000

Salary meaning:

(i) Basic salary plus D.A., if the terms of employment degrees are a fixed percentage of sales, so provide a commission.

(ii) Average salary for the last 10 months before the month in which the event occurred.

(iii) Only the year of completion of the service should be taken.

16. Commuted value of pensions received [Section 10 (10A)]

- Gavette employees, municipal employees and employees of legal entities : Complete exemption

- Other employees:

- If the chip is not received commuting value of half of the pension he is usually entitled to receive.

- Commuting value of 1/3 of the pension he is usually entitled to receive if he also receives a chip.

The pension received by the employee is taxable under the head of the "salary". However, the family pension received by the statutory heirs after the death of the employee is discussed in detail under the head" income from other sources "as there is no relationship between the manager and the worker in this case.

17. Amount received as a retirement payment [section 10 (10AA)]

- Gavette employee’s i.e. central and state governments. Employees: Complete exemption

2. Other employees: Minimum of four limits below:

- Leave the encashment actually received; or

- Average salary for 10 months; or

- Cash equivalent of non-useful leave calculated on the basis of up to 30 days of leave for each year of actual service rendered; or

- .3,00,000

Salary meaning:

- Basic salary plus D.A. To the extent the terms of employment provide so plus fees, if a fixed percentage of turnover.

- The average salary for the last 10 months quickly advances the retirement date.

18. Reduced revenue compensation received by workers [Article 10(10B)]

Compensation received by workers under the labor-management disputes act of 1947:

- Other acts or rules, or orders or notices issued there.

- Any standing order; or

- Any award, service contract or other way,

The Company shall be exempted to the following limits:

- Actual amount received;

- An average payment of 15 days for all completed years of service or part of it over 6 months;

- The amount specified by the central government, i.e.①. 5,00,000.

Compensation received beyond the above limits is taxable and, accordingly, will form part of the total salary. However, the assessor shall be eligible for relief under Section 89 as read in rule 21A.

19. Bhopal gas leak disaster (handling of Claims) Act 1985[Section 10 (10BB)]

The amount received under the provisions of the scheme enclosed in such an act or there must be completely exempted, but if a payment is received for the loss or damage to which the deduction is earlier claimed, it must be taxed.

19. Compensation in the event of a disaster [Article 10 (10BC) ]

Any amount received from the central or state or local authorities by an individual or his legal heir as compensation for a disaster is exempt from tax. However, the amount received or the amount received cannot be deducted to the extent that such individual or his legal heir is permitted to deduct under the law on loss or damage caused by such disaster. Disaster herein means a natural disaster or man-made cause or accident / negligence that results in substantial loss of human life or damage to property or the environment, resulting in such damages.

20. "Retirement compensation “from public sector companies and other companies [Section 10(10C)]

Under the golden handshake scheme, any compensation received or received by the following employees for any retirement will be waived under Section 10 (10C) :):

- Public sector companies; or

- Other companies; or

- Authority established under central, state or local law; or

- Local government, or

- Cooperative; or

- A university that is established or incorporated by or under central, state or local law and is a university under Section 3, 1956 of the University and college grant Board Act.

- Within the meaning of Section 3 (g) of the law of the Indian Institute of technology and technical Association 1961;or

- Administrative bodies, such as the central government, may be designated in place of this by the notice of the Official Gazette;

- State government;

- Central government;

- An institution of importance to be notified, throughout India or in any state or province.

Exemptions must be available in accordance with the following conditions:

- Compensation is received only upon any retirement or termination of his services, according to any scheme or scheme of any retirement, or in the case of a public sector company, in accordance with the scheme of any separation. Exemption shall be granted even if compensation is received in instalments.

2. Further, the schemes of such companies or authorities or societies or universities or institutions as set forth in paragraphs(vii)and(viii)above are structured in accordance with such guidelines (including, among other things, economic viability criteria)so that, in some cases, payment of such amounts can be governed. In the case of public sector companies, if there is a voluntary separation mechanism, the prescribed guidelines must be followed.

Quantum of immunity:

The exemption amount is the amount of compensation actually received Or₹.

5, 00,000, Less on either.

21. Taxes on non-monetary perquisites paid by employers [Section 10(10cc)]

On non-monetary benefits provided to the employee the income tax actually paid by the employer himself must be exempted by the hands of the employee..

22. All amounts received under the life insurance contract [Section 10 (10d)]

All sums received under life insurance, including the sum allocated by the bonus of such a policy, are completely exempt from tax. However, the following sums are not exempt under this section:

- The sum of all received from the policy under Section 80DD (3) or section 80dda (3); or

- Sum of all received under the key man insurance policy; or

- All sums received, under the insurance contract issued on or after 1. 4. 2003 but on or before 31.3.2012 in that the premium paid for either a year during the terms of the policy of which exceeds 20% of the actual capital total guaranteed. However, such amounts received at the time of the death of a person must be exempted.

- The amount received under the insurance contract issued after 1.4.2012 is not less than 10% of the actual capital total, for which any premium for the year is assumed during the insurance contract period.

Any sum received under an insurance policy issued on or after 1.4. 2013 for insurance on the life of any person, who is

- Persons with disabilities or with severe disabilities as set forth in Article 80U.

- In that the premium to be paid for any of the years during the terms of the policy of suffering from illness or illness specified in the rules made under Section 80DDB exceeds 15% of the actual capital total envisaged.

23. Payments from statutory reserves [Section 10(11)] statutory reserves

Statutory Provident Fund

Donations from business owners

| The employer's contribution to such a fund is not treated as an employee's income |

Amount received at the time of cancellation

| The lump sum received from such funds is exempt from the hands of the employee at the end of the service. |

Interest

| Interest deposited in such funds is exempt from the employee's hands. |

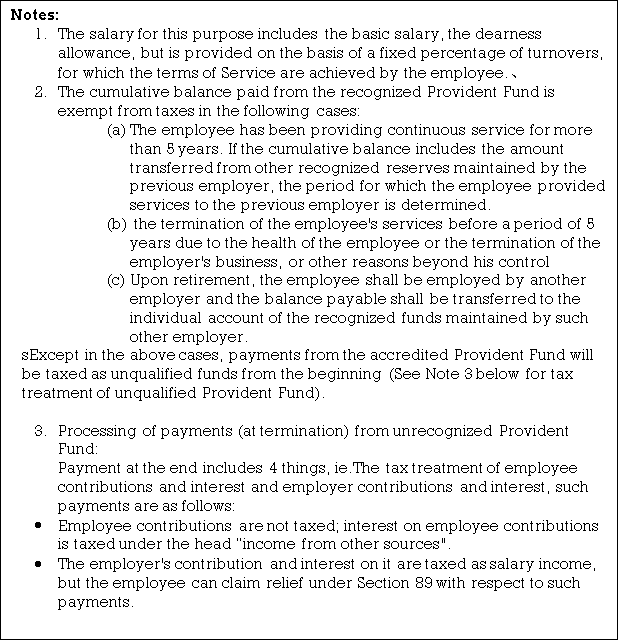

24. Payments from certified provident fund [Section 10(12)]

The cumulative balance paid to employees participating in the recognized Provident Fund is exempted to the extent provided for in Rule 8 of Part A of the Fourth Schedule:

Certified Provident Fund

Donations from business owners | The employer's contribution to such a fund is not treated as an employee's income up to 12% of the salary (see Note 1). |

Interest | Interest deposited in such funds up to 9.5% once a year is exempt within the hands of the worker, and interest over 9.5% is taxed within the hands of the worker. |

Amount received at the time of cancellation | If certain conditions are met, the lump sum amount received from such funds at the end of the service is exempt from the employee's hands. (See Note 2)) |

Unqualified Provident Fund

Donations from business owners | The contribution of the employer to such a fund is not treated as an employee's income. |

Interest | Interest deposited in such funds is exempt in the hands of employees |

Amount received at the time of cancellation Donations from business owners

| (See Note 3)

Employers do not contribute to such funds |

Interest | Interest rates and fair funds are exempt. |

Amount received at the time of cancellation | The lump sum received from the fund at the end of the service is exempt from taxes |

25. Payments from the old-age pension fund [Section 10 (13))]

Like the provident fund, the retirement fund is also a retirement benefit plan for employees. These are funds established under trusts by businesses, usually for the purpose of providing pensions, etc. For employees of the business, for the widow, children or dependents of the employee in case of retirement after a certain age, or becoming incapacitated prior to such retirement, or in case of early demise of the employee. The trust invests funds donated to the fund in a prescribed form and form. Income obtained from these investments shall be exempt if such funds are approved superannuation funds.

Tax treatment: the tax treatment for contributions and payments to the fund is as follows:

- Employee contributions: deductions are available under Section 80C from gross income.

- Employer contributions: Contributions by employers to an approved retirement pension fund are waived up to 1, 50,000 yen per year per employee. If the contribution exceeds 1, 50,000 yen, the balance is taxable in the hands of the employee.

Interest on the accumulated balance: it is exempt from taxes.

Payments from the fund: payments from the approved old age Fund shall be exempt if it is made:

- About the death of the beneficiary; or

- Retirement after the specified age or on behalf of pensions that have become incapacitated before such retirement, or for employees commuting, or

- By reimbursement of contributions for the death of the beneficiary, or

- To the extent that such payments do not exceed the contributions made before the start of this law and their interest, by making a refund of contributions to the employee in connection with the services for which the fund was established, or by having become incapacitated after the specified age or before such retirement.

- By way of transfer to the account of the employee under the pension plan described in Section 80CCD and notified by the central government.

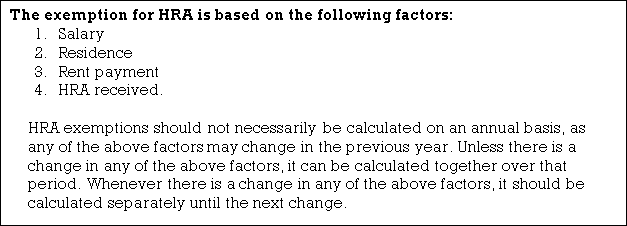

26. Rent allowance-HRA [Section 10(13A) read in Rule 2A]

Quantum of immunity: a minimum of three limits below:

Mumbai/Kolkata/Delhi/Chennai | Other cities |

Actually received allowance | Actually received allowance |

Paid rent in excess of 10% of salary | Paid rent in excess of 10% of salary |

50% of salary% | 40% of salary% |

27. Allowance to be paid for conference expenses [Section 10 (14)]

The following allowances granted to employees in accordance with Section 10 (14) read in rule 2BB are exempt from taxation of certain restrictions:

Allowances | Exemption Limit |

Child education allowance | Up to Rs. Up to 100 children per month up to 2 children are exempt |

Hostel spending allowance | Up to Rs. Up to 300 children per month up to 2 children will be exempt. |

A traffic allowance granted to an employee to meet spending on commuting between his or her place of residence and his or her place of work | Up to Rs. 1,600 yen (rupees) per month. If you are blind or disabled, you will be exempted from 3,200 yen per month

|

It is necessary for an employee working in any transport business to fulfil his personal expenditure during his duties made in the process of carrying out such transport from one place to another. | The amount of exemption shall be lower than the following: a) 70% of such allowances; or B) Rs. 10,000 per month |

Transport Allowance granted to meet expenses for transport in the performance of duties of the office. | Exempt from the scope of expenditure incurred for public purposes |

Travel allowance to meet the cost of travel by tour or transfer

Daily allowance to meet the usual daily fee incurred by the employee for his absence from the usual place of work | Exempt from the scope of expenditure incurred for public purposes

Exempt from the scope of expenditure incurred for public purposes

|

Helper-auxiliary allowance | Exempt from the scope of expenditure incurred for public purposes |

Research allowance granted to encourage academic research and other professional pursuits | Exempt from the scope of expenditure incurred for public purposes |

Uniform allowance | Exempt from the scope of expenditure incurred for public purposes |

Special compensation (hilly areas) (depending on certain conditions and location) | The amount exempt from tax varies from Rs. To 300 rupees. 7,000 per month

|

Allowance in border areas, remote areas or blocked areas or difficult areas (subject to specific requirements and places) | The amount exempt from tax varies from Rs. To 200 rupees. 1,300 per month |

Tribal area allocation in (A)(MP) Madhya Pradesh (B) (TN) Tamil Nadu (C) (UP) Uttar Pradesh (d)(K) Karnataka (e) Tripura (F) Assam (G) West Bengal (H) Bihar (I) Orissa | Up to Rs. 200 per month |

Compensation Field Area Allowance. Having received this exemption, the employee cannot claim an exemption with respect to the border area allowance (depending on the specific conditions and location)

|

Up to Rs. 2,600 per month |

Compensation modification Area Allowance. Having received this exemption, the employee cannot claim an exemption with respect to the border area allowance (depending on the specific conditions and location)

| Up to Rs. 1,000 per month |

Counter insurgency allowances granted to members of the armed forces operating in areas far from their permanent location. Having received this exemption, the employee cannot claim an exemption with respect to the border area allowance (depending on the specific conditions and location)

| Up to Rs. 3,900 per month |

Underground allowance for employees working in an unnatural and unnatural climate in underground mines | Up to Rs. 800 per month |

High altitude allowance granted to troops operating in high altitude areas (depending on specific conditions and location) | A) Up to Rs. 1,060 per month (for altitudes of 9,000-15,000 feet) B) up to Rs. 1,600 per month (above 15,000 feet above sea level) |

Highly active field Area Allowance granted to members of the armed forces (depending on specific conditions and location) | Up to Rs. 4,200 per month |

Mandatory allowance on the island granted to members of the Armed Forces of the Andaman and Nicobar and Lakshadweep groups on the island (depending on the specific conditions and location)

| Up to Rs. 3,250 per month |

28. Interest income [section 10 (15))]

Interest income, which is exempt under Section 10 (15), can be described with the help of the following table-

Section | Income | Exemption to |

10(15)(i)

| Interest, premiums on reimbursement, or other payments such as informed securities, bonds, certificates, deposits. (Subject to the terms and limitations notified

| All ratings |

10(15)(iib)

| Interest, premiums on reimbursement, or other payments such as informed securities, bonds, certificates, deposits. (Subject to the terms and limitations notified)

| All ratings

|

10(15)(iic)

| Interest, premiums on reimbursement, or other payments such as informed securities, bonds, certificates, deposits. (Subject to the terms and limitations notified)

| All ratings |

10 (15) (iid)

| Interest on capital investment bonds notified prior to 1-6-2002

| Personal / HUF |

10 (15) (iii)

| Interest on notice relief bonds

| Personal / HUF |

10 (15) (iiia)

| Interest on notification bonds purchased on foreign exchange (notified prior to 1-6-2002) (subject to certain conditions)

| Individuals-NRI/NRI nominees or survivors / individuals given Bonds by NRI |

10(15)(iiib)

| Interest on securities | Department of Central Bank of Ceylon |

10 (15) (iiia) | Interest on deposits made in banks scheduled with approval of RBI. | Bank Co., Ltd. Overseas |

10(15)(iiib) | Interest expense to Nordic Investment Bank | Nordic Investment Bank |

10(15)(iiic) | 10 (15) (IIIC) 25-11-1993 date framework agreement for financial legal entities between the central government and its banks to pay to the European Investment Bank on the loan granted by it for the pursuit of the agreement.

| European Investment Bank

|

10(15)(iv)(a) | Any money lent to it before 1-6-2001 or debt owed by it before 1-6-2001 received from a government or local authority from a source other than India.

| All assessors who are lending money, etc., from sources outside India |

10(15)(iv)(b) | Interest received from the Indian industrial business on the money lent to it under the loan agreement concluded before 1-6-2001 | Approved foreign financial institutions |

10(15)(iv)(c) | Interest at the approved rate received from Indian industrial operations on borrowed money or debts incurred before 1-6-2001 in foreign countries with respect to purchases of raw materials, components or capital plants and machinery outside India, subject to certain restrictions and conditions

| All assessors in favour of those who lent such money or incurred such debts |

10(15)(iv)(d)

10(15)(iv)(e) | Interest received at an approved rate from a particular financial institution in India on money loaned from sources outside India prior to 1-6-2001 Under the approved loan agreement 1-6-2001, the amount of money lent for a specified purpose from a source outside India prior to an approved loan agreement from other Indian financial institutions or banks.

| All assessors who lent such money

All assessors who lent such money

|

10(15)(iv)(f) | Interest received at an approved rate from an Indian industrial business of money lent in foreign currency from sources outside India under a loan agreement approved before 1-6-2001.

| All assessors who lent such money |

10(15)(iv)(fa) | Interest paid by the bank on foreign currency deposits when the acceptance of such deposits by the bank is approved by the RBI | Non residents or individuals/HUF who are not usually resident in India

|

10(15)( iv)(g) | Formed with the main purpose of providing long-term housing finance, to interest received at an approved rate from an Indian public company that is deductible under Section 36 (1) (viii) and money lent in foreign currency from sources outside India under loan agreements approved before 1-6-2003

| All assessors who lent such money |

10(15)( iv)(h) | Interest received from public sector companies with respect to the notified bond or bond and subject to certain conditions

| All ratings

|

10(15)( iv)(i) | Of the money to be paid for retirement, interest received from the government on the deposit of the notified scheme | Individuals-employees of central government / state government/public sector companies |

10(15)(v) | Interest on securities held at the Reserve Bank SGL a / c No. Deposits made after SL/DH-048 and 31-3-1994 for the benefit of victims of Bhopal gas leak disaster are held in such accounts with RBI or notified public sector banks. | Welfare Commissioner, Bhopal Gas victim, Bhopal |

10(15)(vi) | Interest on gold deposit bonds issued under the gold deposit scheme, 1999 or certificates of deposit issued under the financial capital Scheme, 2015

| All ratings |

10(15)(vii) | 10 (15) (vii) interest on a notice bond issued by a local authority/state pooled financial entity | All ratings |

10(15)(viii) | Interest on deposits made after 1-4-2005 will be charged to the offshore banking unit as described in Section 2(U) of the Special Economic Zone Act 2005.

|

Non residents or who is not residing. |

29. Scholarship system [Article 10 (16))]

The full amount of scholarship granted to satisfy education costs are going to be waived.

The "education fee" includes tuition fees also as all other costs related to receiving an education. The scholarship may are given by the govt .Exemptions are made no matter the particular expenditure incurred by the recipient to satisfy education costs.

30. M.P./M.L.A.I or M.L.C. The allowance [Section 10 (17)]

The following allowances are exempt from taxes within the hands of members of Congress and members of the state legislature—

- Daily allowance received by a member of Congress or a member of the state legislature or a member of any committee thereof.

Any constituency allowance received by members of the state legislature

31. Awards enacted by the government [Section 10 (17A)]

Any payment received in pursuit of the subsequent (whether paid in cash or in kind) is going to be exempt from taxes:

- An award enacted for the general public good by the central government or government or the other agency authorized by the central government on this behalf.

- Compensation by the central or government for any purpose which will be approved by the central government rather than this for the general public interest.

32. Pensions received by certain winners of gallery awards [section 10 (18)]

The amount received by a private as a pension is exempted within the following cases:

Such individuals are within the service of the central or government , and

He/she has been awarded 'Param Vir Chakra 'or 'Mahavir Chakra' or 'Vir Chakra' or other informed brave awards like that.

In addition, any amount received as a family pension by any member of the family of the above-mentioned individuals shall be exempted fully.

33. Family pensions received by relations of the soldiers, including the Para Army [Section 10 (19)]

By effect from the first of the month 2005, the family pension shall be received by the widow or the kid or the appointed heir, in some cases, of members of the Union Army (including paramilitary forces), in such circumstances, and in accordance with the prescribed conditions, within the event of the death of such a member, shall be fully exempted.

34. Income of local governments [Article 10 (20))]

The following income of the agency is exempt from taxes:

Income that heads under "income from home property", "capital gains" or "income from other sources"

Any trade or business carried by or arising from the availability of products or services (not water or electricity) within its own jurisdiction;

Income from water or electricity supply businesses within or outside of a jurisdiction

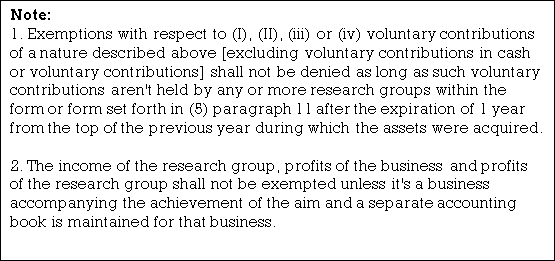

35. Income of the tutorial Research Society [Section 10 (21))]

The income of the study group approved under Article 35(1) (II) / (III) are going to be exempt from tax if the subsequent conditions as set forth in Article 10 (21) are met:

- Income should be applied or accumulated completely and exclusively for the thing to which it had been established.

- Funds shouldn't be invested or deposited for any period during the previous year than one or more of the forms/modes laid out in Section 11(5). However, this condition doesn't apply within the following ways:-

- Assets held by the study group that form a part of the corpus of the association's fund as of Day 1, 1973;

- Corporate bonds of the corporate acquired by the study group before May Day , 1983

- Deposits to shares that form a part of the fund's corpus as described in sub-clause(I)through bonus shares assigned to the study group

- Voluntary contributions received and maintained within the sort of jewellery, furniture or other articles, should be noted, because the board may specify, by the notice of the Official Gazette.

36. Media revenue [Section 10 (22B))])]

If there is an income of a news agency established in India solely for the collection and distribution of news and is notified for this, such income or cumulative income shall be fully exempt unless it is used solely for the collection and distribution of news and distributed in any way among its members.

Approval under this section shall be revoked if the news organization has not applied, accumulated or distributed income in accordance with the prescribed conditions, and the notification under this section shall be cancelled.

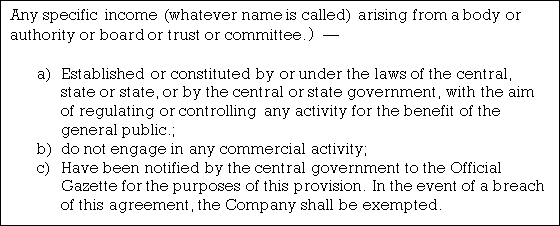

37. Income of some specialized institutions [Section 10 (23A)]

Income of a professional institution / Association (excluding income from the property of the House, income from interest or dividends on certain services or investments) is tax-free if the following conditions are met:

A professional institution is established in India for the purpose of control, supervision, regulation or encouragement of the profession of law, medicine, accounting, engineering or building or other notified profession.

The institution puts in its revenue or accumulates it for application and applies only to the object to which it is established. This institution is approved by the central government by a general or special order.

38. Exemption from income received by the regiment fund [Section 23aa]

It is used on behalf of the regiment fund or non-public fund established by the Indian Army for the welfare of past and current members of such armed forces or their dependents.

39. Income of a fund set up for the welfare of an employee or his dependents [Section 10(23aaa)]

The income of such a fund, approved by the commissioner of income tax, shall be fully exempt if its income applies fully and exclusively for the object on which it is established.

The CBDT has informed the fund of the following purposes for which it is expected to assist its members or their dependents—

- The amount of cash given to members of the fund—

- About retirement, or

- In the event of the illness of the member himself or the illness of the child of the spouse or dependents.

- Members depend onto meet the cost of education of the child.

- The amount of cash to be given to the member's dependents in the event of the member's death

40. Pension fund income set by LIC or other insurance company [Section 10 (23aab)]

The income (not for profit purposes) of an institution composed as a public charitable trust or society established for the development of industry in Khadi and the village is subject to tax if the following conditions are met::

Income is attributed to the business of production, sales or marketing of products of khadi or village industries. The institution is approved by Khadi and the village industry committee

41. State level Khadi and Village Industry Committee income [section 10(23bb)]

Income by state or local law for the development of Khadi or village industries in the province, or from an institution established in the province (known or otherwise known as the Khadi and Village Industries Board), shall be exempt from tax.

42. Income of certain authorities set up to manage religious and charitable organizations [Section 10 (23bba)]

The income of a body or authority established or appointed by or under central, state or local law, which provides for the management of any of the following bodies:

- Public, religious or charitable trusts

- Endowments(including mathematics, Gurudwaras, temples, Wakfs, etc.)); Or

- Societies for religious or charitable purposes registered under the social Act 1860 must be exempt from tax.

43. Income of the European Economic Community [section 10(23BBB)]

European Economic Co-notices derived in India by the way of interest, dividends or capital gains from investments made from its funds under schemes such as the central government may be completely exempted.

44. SAARC fund revenue for Regional Projects [Section 10(23bbc)]

Income of the fund established as a SAARC fund for regional projects established by the Colombo Declaration issued on the 21st. In 1991, it must be completely exempted by the head of state or government of the member states of the association for regional cooperation in South Asia.

45. Insurance Regulatory and Development Authority any income[section 10(23bbe)]

Income of the Insurance Regulatory Development Bureau, established under the Insurance Regulatory Development Bureau Act of 1999, shall be fully exempted

46.Prasar Bharti income [section 10(23BBH)] [inserted by the financial Act 2012, w.e.f.2013-14]

Revenues of PrasarBharti(Broadcasting Corporation of India)established under Section 3(1)of the Prasar Bharti(Broadcasting Corporation of India)Act shall be waived in 1990.

47. Income received by a person on behalf of the following Funds [section 10 (23C)]

Income received on behalf of the Prime Minister's National Relief Fund, the prime minister's fund (folk arts promotion) or the Prime Minister's Student Aid Fund is exempt from tax under Articles 10(23C) (i), (ii) and (iii), respectively.

Any revenue received by any individual on behalf of :

- The Prime Minister's national bailout fund, or

- Prime Minister's fund (folk performing arts promotion), or

- Aid to the Prime Minister's student fund, or

- National Public Kyowa Foundation

- Any educational institution that is

- It is a non-profit revenue organization and is fully or substantially funded by the government;

- Non-profit revenue Organization (notified) whose aggregate annual receipts do not exceed the prescribed limit; or

- Non-profit revenue agencies other than those set forth in (a) and (b) above but approved by the prescribed authority.

- A hospital or other facility for the reception and treatment of persons suffering from illness or mental defects, or for the reception and treatment and charitable purposes only for those in convalescence or in need of medical attention.:

- Is fully or substantially funded by the government ;or

- The total annual income does not exceed the prescribed limit (notified).

- Except as set forth in A) and (b) above, it is approved by the prescribed authority.

- Other funds established for charitable purposes that may be notified by the central government.

- A trust or institution fully set up for religious purposes or purposes that the central government may inform.

The above exemptions apply on behalf of the funds or institutions listed in the points of(iv)and(v)above or the fans listed in the points of(iv)and(v)above.

If the annual receipt of such an institution exceeds 1 crore from the previous year, the application must be submitted no later than the 30th day of the subsequent fiscal year.

The income of certain institutions mentioned above under Section 10 (23C) must be exempt from income tax. In some cases, you may have to obtain approval from a given authority in a given manner in order to qualify for an exemption.

48. Income of Mutual Fund [Section 10(23D)]

Income of the following mutual funds (subject to the provisions of sections 115R to 115T) is exempt from taxes:

- Mutual funds registered under the Securities and Exchange Commission of India law or regulation was made on the basis of it.

- Public sector banks or mutual funds set up by public financial institutions, or mutual funds approved by the RBI (in accordance with the terms notified by the central government).

49. Exemption from income of Securitized trusts [Section 10 (23DA) j [w.e.f.A.Y.2014-15]

From the activities of securitization the income of the Securitization Trust must be exempt.

50. Investor protection fund income [section 10(23EA)]

Proceeds from donations received from the certified Securities Exchange and its members of the notified Investor Protection Fund established by the accredited Securities Exchange of India will be transferred to the authorized Securities Exchange of India.、

However, the amount that stands on the fund's credit and is not charged to income tax in the previous year is shared either in whole or in part with the recognized stock exchange.

51. Exemption of Investor Protection Fund income of depository institutions [Section 10(23ED)][w.e.f.A.Y.2014-15]

Income from contributions received from the depositor will be exempt from taxes if it is from the notification Investor Protection Fund established by the depositor in accordance with the rules made under the SEBI law and the Depositor law

However, if an amount that stands on the trust of the fund and has not been charged income tax in the previous year is shared with the depositary in whole or in part, the total amount that is shared shall be considered income from the previous year for which that amount is shared, and therefore be charged income tax.

52. Exemption for certain income venture capital companies or venture capital funds from certain business or industry information screen when moving the Link 10(23FB).)]

Under this amendment, exemptions will only be available with respect to the income of venture capital companies or venture capital funds from investments in venture capital businesses engaged in a particular business or industry.

New definitions of “venture capital company”, “Venture Capital Fund"and"ventures capital business" [section 1 description 10(23FB)][W.e.f A.Y.20 13-14]

The word (21-5-2012 )venture capital companies according to SEBI regulations in 1996(venture capital funds regulations) under the registered or SEBI regulations under the Category 1 Alternative Investment Fund sub-category of venture capital Fund registered as a company(a)described in section the conditions that must be met.

Venture capital funds trusts registered prior to 21-5-2012 under the venture capital fund rules or Category 1 Alternative Investment Trusts under the Alternative Investment Fund rules must meet the conditions set out in Section (B). You must be a member of the group.

53. Income of registered trade unions [Article 10 (24)]

The following income of the registered trade union is exempt from tax:

- Income from house property.

- Income from other sources.

Trade unions must be registered and formed primarily for the purpose of regulating relations between workers and employers or between workers and workers. This benefit shall also be available to registered trade union associations.

54. Income from reserves and old-age Funds [section 10 (25)]

The reserve account Act 1925 applies to interest on securities held by or that are property of the reserve account and capital gains of the fund resulting from the sale, exchange or transfer of such securities.

All income received by the trustee on behalf of the recognized Provident Fund.

Income received by the trustee on behalf of the approved adulthood fund

55. Employee state insurance fund income [section 10(25A)]

The income of such funds is totally exempt.

56. Schedule tribal members ' income [sections 10 (26) and 10 (26A)]

Certain sorts of income of members of the tribe who are planned to measure within the tribal region are exempt from taxes. The tribes to whom this exemption is meant to use are located within the region designated as part A or Part B of the table added to Article 25, article 366, paragraph 20 of the Constitution, or within the Ladakh region of Arunachal Pradesh, Manipur, Tripura, Mizoram, Nagaland, or Jammu and Kashmir.

The exempt income is that the income that happens or occurs to him:

- From any source of the above regional, state, or union territory, or

- By the way of dividends.

This means that if a member of the Schedule Tribe sets up a business during a location aside from the above, the take advantage of such business is going to be taxed.

57.Sikkimese individual income [section 10 (26aan)] (with a retroactive effect from 1-4-1990)

The following income generated or incurred by Sikkim individuals is exempt from income tax—

- Income from any source in Sikkim; or

- Income from dividends or interest on securities.

This exemption isn't available to Sikkim women who have married non-Sikkim individuals since 1-4-2008.

58. Regulate the marketing of Agricultural Products[section 10[26aab]

For the aim of regulating the sale of agricultural products, for the nonce , the income of the Agricultural Market Commission or board of directors, which consists under the law, shall be exempted.

59. Income of a legal entity established to market the interests of a Scheduled Caste, Scheduled Tribe or backward class [section 10(26B)]

The income of such legal entities or entities, institutions or entities is fully financed by the govt. And people that are found out to market the interests of the above communities must be completely exempt.

60. Income of legal entities established to guard the interests of minorities [Section 10(26bb)]

Income of legal entities established by the central or government to market the interests of members of such minority communities is tax-free under Section 10 (26bb).

61. Income of legal entities established for former military [section 10(26bbb)]

From the assessment of 2004-05, the income of legal entities established by the central, state or local law for the welfare and economic uplift of former military personnel (who are citizens of India) are going to be exempt from taxes under Section 10 (26BBB).