UNIT II

Computation of Income under Various Heads

Introduction:

Section 14 of income tax lays out that there can be various modes of income for a person. These modes are classified into 5 broad heads for the purpose of calculating and determining gross income and tax rates, and then applied.

The 5 main heads of income are-

- Income from salary

- Income from home property

- Capital gains

- Profit and profit from business and profession

Income from other sources

Income from other sources

- Income from salary

Section 15 of the law establishes the conditions under which income falls under the head of the “salary".’

- Compensation, whether paid or not, is paid by the employer to the former employee (assessor) during the previous year's employment period.

- Salary paid to the employee by the employer or former employer in the previous year, even though it was not due to him.

- Salaries paid to employees by the employer or former employer in the previous year that was not charged under Income Tax in other previous years.

An important element of this head is that it mandates the relationship between the employer and the employee. If there is no relationship between the employer and the employee, then the income is not accessible under the head of the salary.

Section 17 of the Act refers to the term “salary."-

- Wages;

- Any pension or pension;

- Any gratuity;

- Fees, benefits or benefits in lieu of compensation or wages, or nevertheless;

- Any advance on salary;

- Any payment received by the worker with respect to any time of leave not benefited by him;

- In accordance with Rule 6 of Part A of the fourth schedule may be assessed to a certain extent on pay, the annual savings to the balance of employees participating in the perceived Provident Fund.

- To some extent it is billable to be assessed under Rule 2 of the Fourth Schedule Part A Rule 11 sub-rule 4 of the employees participating in the perceived Provident Fund.、

- Contributions made by the central government or other employer in the previous year to the employee's account under the pension plan listed in Section 80CCD

Allowances

The employer pays the allowance to his employee to meet his personal expenses. Allowances can be taxed in full or partially. Some tax allowances include rent allowances and special allowances under Sections 10(14)(i)and(ii).The allowances that are fully taxed are:

- Dearness Allowance

- Overtime allowance

- Flat-rate medical allowance

- Tiffin allowance

- Servant allowance

- Non-internship allowance

- Hill allowance

- Warden and Warden allowance

- Request for refund of overpayment

Perquisites

In addition to their salary, employees are often given some other benefits that may not even be in the form of cash. For example, you can rent free accommodation or a car, which is given to the employee by the employer.

Reimbursement of invoices is not a perk. Perquisites are given only during the continuation of employment. The taxable conditions are

- Rent free accommodation

- Interest-free loans

- Movable property

- Education expenses

- Premiums paid on behalf of employees

The exempted benefits include:

- Medical benefits

- Leaving a travel concession

- Health insurance premiums

- Car, laptop etc. For personal use.

- Staff benefits system

Get a profit instead of a salary

Section 17(3) gives a comprehensive sense of profit instead of salary, Payments or unpaid payments that should be paid to employees by the employer. There are two essential features for the payment to be valid under Section 17 (3- )

- There must be compensation received by the assessor from his employer or former employer;

- It is received or in connection with the termination of his employment or adjustment of conditions.

Payments from unrecognized provident or retirement funds are taxable as "benefits instead of salaries” if the balance is an employer contribution or interest on employer contributions.

Exceptions to Article 17 (3) (exemptions under Article 10)

- Death cum retirement gratuity;

- Rent allowance;

- Commuting value of pensions;

- Reduced revenue received by employees;

- Payments received from statutory or authorized reserves;

- Payment from the approved old age fund;

- Payment from the recognized Provident Fund.

Calculation of income tax on salaries

Let me give you an example. –

Individuals, for example, let Mr. A receive the following payments –

Basic salary-rupees 2, 50,000 per year;

Dearness Allowance-Rs. 10,000 per year;

Entertainment Allowance-Rs. 3,000 per year;

Professional tax-Rs. 1,500 per year;

After that, how much money will be taxable from his salary?

When examining the total salary = basic salary + attendance allowance + entertainment allowance, etc., 2, 50,000 + 10,000 + 3,000 =2, 63,000

Under Section 16 (iii) =2, 63,000-1500=Rs per deduction. 2, 61,500

The rate of income tax on income Rs. 2, 61,500 is 5% and equals Rs. This amount of 13,075 is taxable.

2. Income from home property

The assessor is the owner separately from the property that is used for business or profession, and the proceeds that are taxed under the Income Tax Act are divided into the range of income from residential property (section 22).)

Income from home property includes lease and accredited ownership.

Income from the property of the house is taxable after taking into account the deductions under Section 24 of the law. In the case of repair or maintenance of the property, thirty percent of the net annual value is deducted. This deduction is not allowed on self-occupied property.

For the purpose of calculating income from the property of the house, the property of the house is divided into three categories. House property :

- It was put out during the previous year.

- Let's go out partly, partly vacant.

- It is a servant when it is cut.

Deemed ownership-

Section 27 provides that a particular person is not the legal owner of the property, but under certain conditions is still considered to be the owner.

- Condition 1-handover of property to a child or partner, without consideration.

- Condition 2-the holder of the concessional property is considered the owner of the entire estate.

- Condition 3-a member of a cooperative or company or person's Association

- Condition 4-a person who owns a property on lease for 12 years or more in accordance with Section 269UA(f).

Property co-owners-Section 26

If there is more than one owner and the share of the co-owner is determined, the income arising from such property is calculated as income from one property, and the co-owner they are entitled to relief under Article 23.

Unrealized rent (rent not paid by the tenant for any reason)

Unrealized rent is not included in the calculation of the net annual value. If the rent is received in subsequent years, the amount is added to the income from the property of the house for that particular year.

Loss set-off and carryover

Under Section 70 of the Income Tax Act, if a person suffers losses from home property, he can set them off from the income of other home property.

Article 71 of the Act provides for a provision to offset losses from home property from the head of other income, but does not provide for casual income (income that may not occur again).)

Unadjusted losses can be carried forward for a maximum period of 8 years starting from the year following the year in which the loss occurred. In subsequent years, the set-off is allowed only from the head “income from the property of the House".

The amount of loss that can be set off on the property of the house from the other income head is limited to Rs 2lakh if either the house is self-occupied or the property is sold.

Calculation of income from home property

Step 1-subtract the city tax paid annually from the total annual value that will be the net annual value.

Step 2-deduct the amount under Section 24 (a) and Section 24 (b) where the deduction is provided.

For example –

An individual, let’s say Mr. X owns three properties and gives it to rent. What would be the total annual value of all properties? Please see the property details below.-

Details | Property 1 | Property 2 | Property 3

|

Municipal rent | 7,50,000 | 7,50,000 | 2,00,000 |

Fair rental | 2,00,000 | 2,00,000 | 7,50,000 |

Standard rent | – | 80,000 | 9,00,000 |

Amount in Step | 8,00,000 | 50,000 | 8,50,000 |

Not implemented rent | 1,00,000 | NIL | 50,000 |

|

|

|

|

|

|

|

|

Ans: Step 1: high value of reasonable expected rent, municipal rent or fair rent.

Particular | Property 1 | Property 2 | Property 3 |

Municipal Rent | 7,50,000 | 7,50,000 | 2,00,000 |

Fair Rent | 2,00,000 | 2,00,000 | 7,50,000 |

Standard Rent | - | 80,000 | 9,00,000 |

Amount at Step 1 | 7,50,000 | 80,000 | 7,50,000 |

Step 2: deduct unrealized rent (e.g. 8, 00,000-1,00,000)

Particulars | Property 1 | Property 2 | Property 3 |

Amount at step 2 | 7,00,000 | 50,000 | 8,00,000 |

Step 3: the higher value calculated from Step 1 and Step 2 will be the total annual income.

Particulars | Property 1 | Property 2 | Property 3 |

Amount at step 1 | 7,50,000 | 80,000 | 7,50,000 |

Amount at step 2 | 7,00,000 | 50,000 | 8,00,000 |

Amount at step 3 | 7,50,000 | 80,000 | 8,00,000 |

3. Income from capital gains

Profits or profits arising from the exchange of capital assets held as investments are charged under the head capital gains. The gain can be for short-term and long-term gains. Capital gains appear when capital assets are transferred. This means whether the moved asset is certainly not a capital asset. The profit or profit that appeared in the previous year, when the transfer was made, is considered the income of the previous year and, if applicable, is imposed on it under the head capital gain and indexation.

To fall into the range of income from capital gains, you need –

- Capital assets

- This is forwarded by the assessor

- The transfer took place in the final year

- Profit or loss is arising from it

Capital assets include all types of property owned by the assessor, whether tangible or intangible, movable or motionless, and may be used for business and professional purposes.

Capital assets do not include assets such as stocks in trade, used personal goods, agricultural land.

Capital gains are two types

- Short-term capital assets-assets held by the assessor for up to 36 months immediately prior to the transfer date.

ITO v. Narayana K Shah 2000 74 ITD 419 Mums.

In this case, the court ruled that if the assessor held certain shares of the company that were granted ownership of the flat, these shares could not be treated as "shares" as set forth in Paragraph 2 (42A), and if sold after holding for less than 36 months, the resulting profits should be treated as short-term capital gains.

2. Long-term capital assets-assets held by the assessor for more than 36 months. Long-term capital gains are generally taxed at lower rates.

Long-term capital assets may not require a period of 36 months, and assets held for 12 months or more are valid for long-term capital assets. These conditions are –

- Listed or preferred shares;

- Securities listed on recognized stock exchanges, such as bonds, stock exchanges;

- UTI units;

- Mutual fund units;

- Zero coupon bond;

- Unlisted or preferential shares;

- A unit of a stock-oriented fund.

The tax on long-term capital assets is 20 percent.

Exemptions under Section 54:

These refers to exemptions on the transfer of long-term capital assets only if the assessor is an individual or a Hindu Undivided Family. Capital gains arise from the transfer of residential property in which the evaluator has purchased the property of another house within a year or two prior to the date of the transfer or transfer.

The amount of exemptions available is either less on capital gains and new home costs.

Calculation of capital gains

Long-term capital gains-The problem-Mr. Shah has a total gross income of Rs. It has invested 4, 00,000 and Rs. It is a tax saving product of 1, 50,000 yen. After applying all deductions, the total taxable income will be Rs. 2, 00,000. And the tax limit on exemption by income tax slab is Rs.2, 50,000. With the sale of gold, he has a long-term capital gain of Rs. 5, 00,000.

Solution-total taxable income=2, 00,000, less than 2, 50,000;

Long-term capital gain@20%=4,50,000 (difference between tax-free limit and actual taxable income)=10,000

This mass mount can save you from tax.

The tax rate is the same for short-term capital gains.

4. Income from profits and profits from business and profession

Business and occupation are defined under Section 2 (13) and Section 2 (36), respectively.

Business: This includes trade, commerce or manufacturing, or adventure or concern in the nature of trade, commerce, or manufacturing.

Occupation: "Occupation" includes occupation.

Article 28 of the Income Tax Act covers "interests and interests of businesses or occupations “and has the following income imposed under the heading “interests and interests of businesses or occupations":” :

- Interests and interests of any business or profession;

- Any compensation or other payment by the person specified in Article 28 (II), by the Indian company or any person in charge of all operations other than the Indian company, or any compensation or other payment received shall be made at the end of his management.;

- Trade from Express services performed for its members, determined by experts or equivalent associations.;

- Benefits of sales of import qualification licenses, incentives by cash compensation support, disadvantages of Duty;

- Any benefits regarding the replacement of Duty qualified passbook scheme;

- Any benefits on the exchange of Duty Free replenishment certificate;

- Estimates of any profits or perks, whether coming out of business or professional activities and turning into money;

- Interest, payment, compensation, commission or compensation received by company partners from such companies;

- Any amount received under the key man insurance policy, including bonuses;

- Income from speculative transactions;

- If the exhaustive expenditure of such capital assets is allowed as a deduction under Section 35AD, the sum received in real money or in kind by which capital assets are destroyed, destroyed, disposed of or transferred.

The deduction under the head of" profits and profits from business or profession" was mentioned under Sections 30 to 37.

- Section 30. Deductions must be allowed in the case of leases, fees, taxes, amendments, and insurance for premises used for business or professional purposes.

- Section 31. Deductions must be allowed for repairs and insurance of equipment, plants or furniture used for business or professional purposes and must be paid for current repairs.

- Section 32. Deterioration of buildings, hardware, plants or furniture, being a tangible asset, know-how, license, copyright, trademark, patent, establishment or some other business or business right of a comparative nature, being an intangible asset that is wholly or somewhat owned by the assessor for business or professional purposes.

- Section 32AC. Deductions for investments in new factories or hardware, or for investments in new factories or hardware, which are organizations occupied in the business Assembly or production of goods or objects since 31st March 2013.

- Section 33AB. An assessor undertaking a tea or coffee or rubber development and assembly business in India should be kept on a Tea Board or Coffee Board or Rubber Board or in a record confirmed by the central government and audited by an accountant, six months from the end of the previous year or before the deadline for filing a return of income.

- Section 33. An amount or amount deposited in the State Bank of India by an assessor who is continuing a business consisting of exploration, or extraction or generation of oil or natural gas or both in India and agrees to an arrangement with the central government for such business and whose account must be audited by an accountant.

- Section 33AC. Taking over the business of a vessel by a government organization or a public company, the deduction must be allowed not to exceed 50% of the profit derived from the business of the operation of the vessel.

- Section 35. In the event of any expenditure on scientific research related to the project, the deduction shall be granted, but the applicant must agree to the prescribed authority for cooperation in the R & D facility and meet the conditions for supporting the maintenance of accounting and auditing.

- Section 35ABB. Spending on obtaining licenses for media transmission services at any time of the previous year before or after the start of the business, since the instalment for obtaining licenses is actually made.

- Section 35AC. If the assessor is a public sector company or local authority, or an alliance or establishment approved by the National Commission to implement a qualified venture or plan, the assessor will not be able to determine the status of the project.

- Section 35AD. In the event that capital expenditures are incurred in whole or exclusively for the purpose of a particular business, a deduction shall be allowed.

- Section 35CCA. Expenditure by means of instalment to accession and establishment to implement rural development programs.

- Section 35CCC. Any expenditure incurred on agricultural expansion projects notified by the council shall be allowed to be deducted to a sum equal to half double the expenditure.

- Section 35CCD. If an organization causes expenditure on a capacity building program advised by the board, that sum must be allowed for a deduction of the sum equivalent to half of the expenditure.

- Section 35D.Write-off of certain preliminary costs.

- Section 35E.Deductions of expenditure on exploration for, or extraction or production of certain minerals, the deduction shall be allowed to one-tenth of the amount of such expenditure

- Section 36. Other deductions include-

- Under Section 36 (1) (I), the amount paid in respect of insurance against the risk of harm or disappearance of shares or stores utilized for business or professional purposes shall not be refunded.

- Under Section 36(1)(ib), the amount of premiums paid by non-cash payment methods by the assessor as an employer towards the health of the employee.

- The amount paid to an employee as a bonus or commission for the services rendered by him under Section 36 (1) (II);

- The amount of interest paid in respect of capital borrowed for business or professional purposes under Section 36(1)(iii).

- The proportional amount of the discount on the zero coupon bond with respect to the life of such bonds, calculated in the manner prescribed under Section 36(1)(iiia).

- Under Section 36(1)(iv)an employer's contribution to a certified Provident Fund is an approved superannuation fund.

- The employer's contribution to the Pension Scheme notified under Section 36 (1) (iva).

- Contributions to GRATUITY funds approved under Section 36(1)(v).

- Employee contributions towards staff welfare schemes under Section 36(1)(va).

- Under Section 36(1)(vi), there is no provision for animals that are used for business or professional purposes and have died or have been found to be worthless all the time.

- Under Section 36(1)(vii), The amount of nonperforming loans associated with the assessor's business or occupation must be written down in the assessor's account book.

- Provisions for bad and bad debt related to rural branches of commercial banks under Section 36 (1) (viia).

- Transfer to a special reserve under Section 36(1)(viii).

- Section 36(1) (ix) under family planning spending.

- Contributions to the exchange risk management fund under Section 36(1)(x).

- Revenue expenditure incurred by an entity established under any central, state or local law under Section 36 (1) (xii).

- Contributions to the Credit Guarantee Trust Fund under Section 36(1)(xiv).

- Section 36 (1) (xvi) under commodity transaction tax.

18. Section 37 (2B). Gifts, leaflets, regions, handouts or such published by political parties, and expenditures acquired by commercial assessors are not deductible.

Computation of income under the heads of “Profits & Gains of Business or Profession”

The amount of net profit is Rs. 4, 00,000m/s D Ltd. And other information provided:

Prepayment income tax=Rs debited to the profit and loss account. 30000

Party brochure printing=Rs. 5000

Return=the amount of money not deposited until the date of submission of Rs. 50,000

What is M / s D Ltd's taxable income?

Particulars | Amount |

Net Profit | 4,00,000 |

Amount of advance income tax | 30000 |

Expenses incurred for political parties | 5000 |

An amount that has not to deposit | 50000 |

Net taxable income | 4,85,000 |

5. Income from other sources

All types of income not covered by the above head are covered under this head and are paid. Income from other sources is provided for in Section 56 of the act. Some of these are:

- Dividends in Section 2 (22));

- Win from lotteries, horse racing, crossword puzzles, and other games;

- Contributions received by the employer as evaluator from his work towards staff welfare schemes;

- Interest on corporate bonds, government bonds/bonds;

- If the assessor leaves to the contract apparatus, plants or furniture belonging to him and further buildings, then the payment from this can be assessed as a salary from other sources, if it is not taxable under the head of “interests and interests of business or profession”;

- Total received under the key man insurance policy, including compensation;

- Salary from hardware, factory or furniture belonging to the assessor.

Gift that cannot be charged:

- Gifts received from relatives

- Gifts received during marriage

- Gifts are given by local authorities

- Gifts received in the form of inheritance

- Gifts received from any funds, institutions, hospitals, etc.

Deductions applicable on income from other sources – section 56 and 57

S.No. | Sections | Nature of Income | Deductions Allowed |

1 | 57(i) | Dividend or interest on securities | Any reasonable amount paid by method for commission or compensation to a banker or some other individual for the purpose of realizing dividend (other than dividends referred to in section 115-O) or interest on securities |

2 | 57(ia) | Employees contribution to PF. Superannuation fund, ESI fund or any other fund set up for the welfare of such employees | If employees’ contribution is credited to their account in the relevant fund on or before the due date |

3 | 57(ii) | Rental income letting of plant, machinery, furniture or building | Lease, rates, charges, repairs, insurance, and devaluation, and so on. |

4 | 57(iia) | Family pension | 1/3rd of family pension subject to a maximum of Rs. 15,000. |

5 | 57(iii) | Any other income | Any other expenditure (not being capital expenditure) expended completely and solely for earning such income |

6 | 57(iv) | Interest on compensation or enhanced compensation | 50% of such interest (subject to certain conditions) |

7 | 58(4) | Income from the activity of owning and maintaining race horses | All expenditure relating to such activity. |

Calculation of income from other sources

Calculation of income from other sources can be done in two ways;

- If the income is one-time income or casual income, a 30% tax is imposed on the total income.

- If the income is from other methods, then the tax must be applied according to the tax slab.

For example- A person gets a family pension=Rs. 30,000(the exemption for this is 33.33% or 1500); 33.33% of Rs. 30,000 = rupees. 9,999, this amount is less than 1500. Thus, the taxable income is 30,000-9,999=20,001. Rs. 20,001 and is taxable as income from other sources.

Conclusion

These five heads of income we have discussed method to different categories of people to calculate their income according to their applicability as taxpayers, so they will be easier to plan their capital in the right direction.

Key takeaways:

- According to Section 14 of the Income Tax Act 1961, there can be several modes of income for individuals.

- The calculation of income tax is an important part, which must be calculated according to the income of a person.

- For hassle-free calculations, income must be properly classified so that there is zero confusion about the same thing.

- The five main heads of income by Section 14 above for the calculation of income tax in India are:

Income from salary

Income from home property

Income from business or profession profits and profits

Capital gains income

Income from other sources

Introduction

Income from salary is income or compensation received by an individual for the services he provides or the contracts he undertakes. This provision essentially assimilates the compensation received by a person for the services provided by him under the employment contract.

This amount of compensation is considered income under the income tax code only if there is an employer-employee relationship between the person making the payment and the person receiving the payment.

Employer-employee relationship–if there is an employer-employee relationship between the payer and the recipient, the payment received by a person is treated as income under the income tax law. In order to qualify income as income from salary, their relationship must be a master-servant relationship. The master is the one who directs the Employee what should be done and how it should be done, and the servant is the one who is responsible for performing the work in the manner told by the employer.

Meaning of Salary

Salaries for the purpose of calculating income from salaries include:

- Wages;

- Pension;

- Pension;

- Gratuity;

- Previous salary;

- Fees, fees, perquisites, profits on behalf of or in addition to salaries or wages;

- Annual accretion to the balance of certified Provident Fund;

- Leave the encasement.;

- Transfer balance in certified Provident Fund;

- Contributions by the central government.

- Or other employers to employee pension A/C Sec .It are listed in 80CCD.

What is CTC?

CTC is one of the generic names when people talk about salaries. CTC stands for Cost to Company. That's the company amount of spending on hiring and supporting employees.

CTC provides employees with salaries, as well as meal coupons, office space rent, provident fund, medical insurance, rent allowance (HRA) and other elements that can cost the company.

It can be noted that unlike the actual income from the salary a person receives, the CTC also includes variables that exceed the actual salary a person is receiving.

Calculation of Income from salary

Calculation of Income from salary

Particulars

|  |

Basic Salary | — |

Add: | — |

1. Fees, Commission and Bonus | — |

2. Allowances | — |

3. Perquisites | — |

4. Retirement Benefits | — |

5. Fees, Commission and Bonus | — |

Gross Salary | — |

Less: Deductions from Salary | — |

1. Entertainment Allowance u/s 16 | — |

2. Professional Tax u/s 16 | — |

Net Salary | — |

|

|

|

|

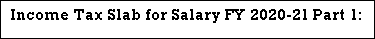

Income Tax Slabs | Tax Rates |

Within the tax bracket of ₹5,00,001 to ₹10,00,000 | ₹12,500 + 20% of total income exceeding ₹5,00,000 |

Above ₹10,00,000 | ₹1,12,500 + 30% of total income exceeding ₹10,00,000 |

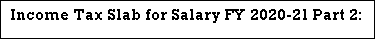

Income Tax Slabs | Tax Rates |

Up to ₹3,00,000 | Nil |

Within the tax bracket of ₹3,00,000 to ₹5,00,000 | 5% |

Within the tax bracket of ₹5,00,001 to ₹10,00,000 | ₹10,000 + 20% of total income exceeding ₹5,00,000 |

Above ₹10,00,000 | ₹1,10,000 + 30% of total income exceeding ₹10,00,000 |

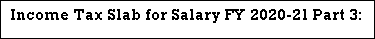

Income Tax Slabs | Tax Rates |

Up to ₹5,00,000 | Nil |

Within the tax bracket of ₹5,00,000 to ₹10,00,000 | 20% |

Above ₹10,00,000 | ₹1,00,000 + 30% of total income exceeding ₹10,00,000 |

Allowances

- Fully Taxable allowances:

- Dearness’s allowance: the allowance is paid to employees to cope with inflation.

- Entertainment allowance: this is an allowance that is provided to employees to repay the costs incurred in hospitality.

- Overtime allowance: overtime allowance is an allowance paid to employees for working beyond their normal working hours.

- City compensation allowance: this allowance is paid to employees who move to the city.

- Project allowances: when employers provide allowances to employees to meet project costs.

- Tiffin / meal allowance: meals allowance may be provided to employees.

- Cash allowances: employers may also offer cash allowances in some cases, such as for marriage or holiday purposes

Partial tax allowance:

- Rent allowance: it is an allowance that the employer pays his employees for accommodation.

- Entertainment allowance

- Special allowances such as travel allowances, uniforms and study allowances.

- Special allowances to meet personal expenses, such as children's educational allowance, children's hostel allowance, etc.

Tax-free allowance:

- Allowances paid to the government. Foreign civil servants: when Indian government employees are paid allowances when they are serving abroad.

- Salary allowances: salary allowances paid to HC and SC judges are not taxed.

- Allowances paid by UNO: allowances received by UNO employees are completely exempt from taxes.

- Compensation allowance paid to the judge: if the judge receives compensation allowance, it is also not taxable.

It can be noted that a person can save taxes on income from salary by getting a tax-saving allowance.

Perquisites

Perquisites are payments that are received by an employee from an employer that exceeds the salary.

Taxable conditions for all employees:

- Rent free accommodation

- Club fee payment

- Movable property

- Concessions on accommodation rent

- Interest-free loans

- Education expenses

- Premiums paid on behalf of employees

Perquisites those are taxable only to certain employees:

- Free gas, electricity etc. For domestic purposes

- Concessional transport facilities

- Concessional education expenses

- Payments made to gardeners, sweepers and attendants.

Perquisites exempt from taxes:

- Medical benefits

- Health insurance premiums

- Leaving a travel concession

- Staff benefits system

- Car, laptop etc. For personal use.

FORM 16

FORM 16

FORM 26AS

Key takeaways:

- Before calculating your taxable income in salary, it is essential to collect all the details necessary to file an income tax return.

- You will then need to calculate your total taxable income, followed by the calculation of the final tax refundable or payable.

- To calculate the final tax, you must use the applicable tax rate before deducting any taxes already paid through advance tax or TCS/TDS from the tax amount

Gratuity - gratuity is the “retirement benefit amount." The gratuity Act, the 1972 Act, envisages providing retirement benefits to workers who are rendering long and unblemished services to employers. A gratuity is a reward for a long and meritorious service. Previously, it was not mandatory for employers to reward their employees when they leave or resign. But in 1972 the government passed the GRATUITY Payment Act, which required all employers with 10 or more employees to pay for gratuities.

Application of the gratuity act of 1972: the Act provides for payment of gratuities to workers employed in all factories, mines, oil fields, plantations, ports, railways, shops & establishments or educational institutions employing more than 10 people on any given day of 12 months.

Stores or facilities to which this law applies must continue to be governed by the law, even if the number of employees falls below 10 at a later stage.

Here an employee is defined as an employee hired in the company payroll.

Gratuity eligibility criteria

Gratuity must be paid to the "employee” at the end of his employment after he renders continuous service for more than five years.

- About his retirement.

- About his retirement or resignation.

- About his death or disablement by accident or illness.

Note: however, if the service is terminated due to death or invalidity, the terms of continuous service for five years are not required.

To whom will the gratuity is to be paid?

Gratuity is usually paid to the employee himself, but in case of the death of the employee, it had to be paid to his candidate, and the nomination was made to his heir. If the nominee is a minor, the share of the minor must be deposited with the controlling authority, which must invest the same for the benefit of the minor until he/she achieves a majority.

Maximum payment under the gratuity method, 1972:-

Gratuity paid to government employees will be completely exempt. For non-government employees covered under the gratuity Act payments, in 1972, the maximum limit of the exemption is Rs20lakhs, and for other employees, the maximum limit of the exemption is Rs10Lakhs [Section 4(3)][of course, employers can pay more. The employee also has the right to earn more if it is obtained under an award or contract with the employer, as revealed in Section 4 (5)].

Nomination facility: - Yes, by filling out the Form "F" at the time of the new joinee format, each employee must nominate one or more members of his family, as defined in the act of receiving a tip in the event of the death of the employee.

Tip confiscation: - tip of an employee, whose service has been terminated by wilful omission or negligence, causing damage or loss or destruction to property belonging to the employer, the tip shall be confiscated to the extent of the damage or loss caused. The right to forfeit is limited to the degree of damage.

Gratuity paid to employees shall be completely confiscated:

1. If the services of such an employee are terminated due to his noisy or disorderly conduct or other violent acts, or

2. If the services of such an employee are terminated for acts that constitute a crime involving moral turpitude, provided that such offenses are committed by him in the course of his employment.

Applicability to contract employees:-Yes, the only criterion is to provide the service at once for at least 5 years.

Calculation of gratuity

A) With respect to employees covered under the payment of gratuity Act 1972:

- According to the law, the amount of gratuity is the wage of 15 days multiplied by the number of years you put in. Here, wage refers to the attendance allowance in addition to the basic salary. At retirement or retirement, take the monthly salary (basic + attendance allowance) that you last pulled out. Divide this by 26. This will give you a daily salary. Multiply this amount by 15 days, plus the number of years of service you put in.

- If you have put 10 years and seven months into the organization, Your Service term will be 11 years. However, if the term of your service is 10 years and five months, for the purposes of this calculation your term will be only 10 years.

Let's give an example. Suppose your average monthly salary is Rs26, 000. Your daily salary will be Rs1, 000. Multiply this by 15, then by 10. The gratuity you are entitled to after 10 years of service will be Rs1.5lakh.

Formula: - the gratuity must be calculated according to the following formula:

Gratuity=last drawn salary x15/26X no. Years of Service

Your last drawn salary will make up your basic +DA. For the calculation of gratuity, your service period will be rounded to the nearest full year.

B) With respect to employees not covered under the payment of gratuity Act 1972:

For non-government employees who are not covered under this law, the method of calculating gratuity is different. First, the average salary is calculated: for this, the average of the salary for the last ten months is taken (this is the Basic plus, as a percentage of the turnover achieved by the employee, divide this average salary by 30 (we ignore the fraction). Now, multiply this amount by 15, and then multiply by the number of years of Service. If you divide your daily salary by 30 instead of 26, those that are not subject to the gratuity law will be disadvantaged.

Formula: - the gratuity must be calculated according to the following formula

Gratuity=last drawn salary x ½ no x Years of Service

Your last drawn salary constitutes your basic + DA + Commission on sales on a sales basis. For the calculation of gratuity, your service period will not be rounded to the nearest full year. While calculating the completed year, any part of the year is ignored. For example, if an employee has a total service of 20 years, 10 months and 25 days, then only 20 years are taken into account in the calculation.

Tax treatment of gratuity: - For purposes of gratuity exemption under 10 (10), employees are divided into three categories:

1. Any death-cum-retirement gratuity received by the central and state governments. Employees, Defence employees and employees of local authorities must be exempt.

2. All gratuities received by a person eligible for payment under the gratuity act of 1972 are subject to the following restrictions:-

- For all completed years of the service or part thereof, the gratuity shall be paid at a rate of fifteen days ' wages based on the wage rate that the employee last drew.

- The amount of gratuity calculated above should not exceed Rs. 20,00,000 / -(the limit was increased to Rs. 20 lakh with effects from 29.03.2018, the previous limit was Rs. 10 million)

3. For other employees, the gratuity received are waived and the following waivers apply

- The exemption shall be limited to a half-monthly salary (based on the average of the past 10 months) for each length of service or Rs. One of the 10Lakhs is less.

- The gratuity also states that if any one or more previously received in the previous year and any exemption allowed for the same, the exemptions granted during that year are already allowed 10 laxatives.

By letter of the board F. No.194/6/73-it (A-1s) date 19.06.73 exemption on gratuity is acceptable even in the case of termination of employment by resignation. The taxable portion of gratuity is subject to relief u/s89(1).

Payment of gratuity to the widow or other statutory heir of an employee who has died in active duty shall be subject to income tax under the provisions of notice 573 21.08.90 above.

Rs ceiling. 20 / 10lakh apply to the tally of gratuity received from one or more employers in the same or different years.

What is taxable under the head: - If the gratuity is received by employees at retirement are taxable under the head "salary" and gratuity received by legal heirs is taxable under the head “income from other sources".

Key takeaways:

- Income from salary is income or compensation received by an individual for the services he provides or the contracts he undertakes.

- Such provision essentially assimilates the compensation received by a person for the services provided by him under the employment contract.

- Annuities are taxable under the head salary of your income tax return.

- Annuities are paid regularly and generally monthly. However, you can also choose to receive a pension as a lump sum (also called a commuter pension) rather than a regular payment.

Books:

- Income Tax Law & Accounts For B.Com Vth Semester of Calicut University (English, Paperback, Dr. H.C. Mehrotra, Dr. S.P. Goyal)