UNIT III

Income from House Property

Income tax on home property: on owning a home one day–everyone dreams of this, saves towards this and wants to achieve this one day. But it is not without responsibility to own the property of the House. Paying property taxes on the house every year is one of them. If you want to learn how to save taxes on mortgage interest, this guide is for you. It's also talking about how to report home ownership with your income tax return1. Basic knowledge of housing property tax

A home property could be land attached to a building such as Your Home, Office, shop, building or parking lot. The income tax law does not distinguish between commercial and residential real estate. All types of property are taxed under the head of “income from home property “on an income tax return. The owner for income tax purposes is a person who is its legal owner and can exercise the rights of the owner in his own right, and not on behalf of someone else.

If you use property for business or professional purposes, or to perform freelance work, it is taxed under the head of “income from business or profession". The cost of its repair and maintenance is allowed as business expenditure.

- Self-employed residential property

Self-occupied house properties are used for their own residential purposes. It can be occupied by the taxpayer's family–parents and/or spouses and children. Vacant house property is considered as self-occupied for income tax purposes.

Until 2019-20, if the taxpayer owns more than one self-occupied property, only one will be considered self-occupied property, and the rest will be put out. The choice of property to choose as self-occupied is up to the taxpayer.

From 2019-20, the number of self-employed workers will increase to 2 per cent. Now the homeowner can claim his 2 properties as self-occupied and remaining homes to be put out for income tax purposes.

b. Let the property in the House

A home property that is rented for the whole or part of the year is considered to let the home property for income tax purposes

C. Inherited properties

Inherited property, that is, property bequeathed again from parents, grandparents, etc., can be self-occupied property or released based on its usage as described above.

2. Way to calculate income from home property

Here's how you calculate your income from a home property:

- Determine the entire annual value of the property (GAV): the entire annual value of the self-occupied home is zero. For a let-out property, it is the rent collected for a rent home.

- Reduce property tax: property tax, when paid, is allowed as a deduction from the Gav of property.

- Determine internet annual value (NAV): net annual value=total annual value-property tax

- Reduce the NAV 30%towards the quality deduction: 30% of the NAV is allowed as a deduction from the NAV under Section 24 of the tax Act. Other costs, like painting and repairs, can't be billed as tax breaks above the 30% cap under this section.

- Reduce mortgage interest: deductions under Section 24 also are available for interest paid during the year of a useful mortgage.

- Determine the income from the house property: the resulting value is your income from the house property. This is often taxed at a rate of slab applicable to you.

- Loss from home property: when owning a self-occupied home, since there's no gav, claiming a mortgage interest deduction will end in a loss from the house property. During this case, the adjustment to the profit of others won't be.

Note: when a property is put out, its total annual value is that the rental value of the property. The rental value should be no but an inexpensive rent for the property determined by the municipality.

3. Mortgage decrease

- Tax credit on mortgage interest: Section 24 a home-owner can claim a deduction of up to Rs2lakh on mortgage interest if the owner or his family is present on the property of the House. An equivalent treatment applies when the home is vacant. If you owe the property, the interest on the whole mortgage is allowed as a deduction.

However, the deduction for interest is restricted to Rs. 30,000 rupees rather than 2 lakh if both of the subsequent conditions are met:

a. The loan are going to be taken after 1april1999 or

b. Purchase or construction isn't completed within 5 years from the top of the year when the loan was availed

When is the deduction limited to Rs30, 000?

As already mentioned, if the development of the property isn't completed within 5 years, the deduction of interest on the mortgage should be limited to Rs. 30,000. The 5-year period is calculated from the top of the financial year during which the loan was taken. So if the loan was taken on 30th April 2015, construction on the property would need to be completed by 31st March 2021. (The period before the 2016-17 fiscal year was 3 years, but the budget increased to five years in 2016).

Note: the interest deduction can only be charged from the financial year when the development of the property is completed.

How do I claim a decrease for a loan taken before the development of the property is completed?

Mortgage interest deductions can't be claimed when the home is under construction. It is often argued only after the top of construction. The amount from borrowing money to the completion of the development of the home is called the amount before construction.

The interest paid during this era is often claimed as a decrease in equal instalments ranging from the year the development of the property is completed. During this example, better understand the pre-construction interest.

B. Tax credit on principal repayment

Deductions to say principal repayment are available for up to Rs. 1, 50,000 Section 80C.Check your lender and appearance at the principal repayment amount or the instalment details of your loan within the general limit.

Conditions to say this deduction-

Mortgage

You must not sell the property within five years from the time it had been owned. In doing so, add the deduction to your income again within the year you sell.

Stamp duty and registration fees stamp tax and registration fees and other expenses directly associated with the transfer are allowed as deductions under Section 80C and a maximum deduction of Rs1.5 lakh please charge these expenses within the same year you create those payments.

C. Tax credits for first-time homeowners: Section 80EE

Section 80EE recently added to the Income Tax Act provides homeowners, with a tax benefit of up to Rs 50,000, only the property of the house on loan sanctions date.

D. Tax credits for first-time homeowners: section 80eea

The new section 80EEA is added to extend the tax benefits of mortgage interest deductions taken for affordable housing between 1April2019 and 31March2020 under the amount of what an individual taxpayer does not have the right to be 80EE.

Click here to read more. These benefits are not available for properties under construction.

Do you own multiple homes?

If you own multiple homes, you will need to submit an ITR-2 form.

4. Mortgage deduction claims

- The amount of deductions you can claim depends on the share of ownership you have on the property.

- The mortgage should also be in your name. Co-borrowers can also claim these deductions.

- The mortgage deduction can only be charged from the financial year when construction is completed.

- Submit a mortgage rate certificate to the employer as a source of adjusted tax credits. This document contains your ownership share, borrower details and EMI payment interest and principal split information.

- Otherwise, you may need to calculate the tax yourself and request a refund upon tax return. It is also possible that if you have taxes to pay, you may need to deposit the membership fee on your own.

- If you are a self-employed or freelancer, you don't even need to submit these documents to your IT department anywhere. You need them to calculate your pre-tax liabilities quarterly. You need to keep them safe to answer any queries that might arise from your IT department or your own records.

5. Tax advantages of mortgages for co-owners

In addition, co-owners who are co-borrowers of self-occupied home property can claim deductions for mortgage interest up to Rs2lakh each. And principal repayment deductions, including deductions for stamp duty and registration fees under Section 80C within the Rs overall limit.1.5 lakh for each of the co-owners. These deductions can be charged at the same ratio as the ownership share of the property.

In addition, the loan is communal, unless the owner of the property–you can not pay taxes. There have been situations where the property is owned by the parent and the parent and child together take a loan that is paid off only by the child. In such cases, a child who is not a co-owner lacks tax incentives for a mortgage.

Therefore, to claim tax breaks on property:

1. You must be the co-partner of the property

2. You must be a co-borrower on the loan

Each co-owner may claim a deduction of up to Rs 80lakh towards repayment of principal under Section 1.5 C. This is within the overall limit of Rs 1.5 lakh in Section 80C.Therefore, you can take advantage of the large tax benefits against the interest paid on the mortgage when the property is co-owned and your interest outgo exceeds Rs2lakh per year.

It is important to note that once the construction of the property is completed, tax benefits of both mortgage interest and principal repayment deductions can be claimed under Section 80C.

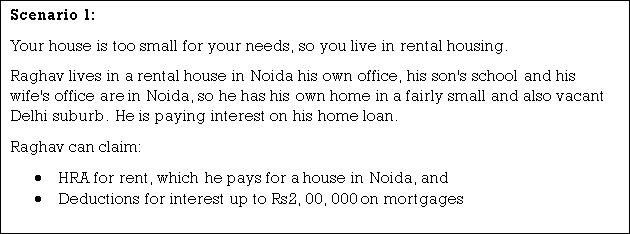

6. HRA and Deduction on Home Loan

7. Case study

Aditya earns rental income from his house in Vizag. Look at the GAV and NAV calculations, such as for due dates, if you cannot pay taxes.

8. Here's an example of the big budget changes and impacts of 2017

Until the 2016-17 fiscal years, losses under the main family property can be set off against other heads of income without any restrictions. However, in the 2017-18 financial years, it is limited to 2 million units. This amendment would not actually affect taxpayers with self-occupied house property. The move will affect taxpayers who are letting out/renting their property. There is no bar on the amount of interest on the mortgage, which can be claimed as a deduction under Section 24 for property in rental housing, but the losses that may arise for such interest payments can be set off only in the range of Rs2lakhs.

Here are some examples to help you understand the impact of the amendment:

Particulars | AY 2017-18 | AY 2018-19 |

Salary income | 10,00,000 | 10,00,000 |

Income from other sources (Interest income) | 4,00,000 | 4,00,000 |

Income from house property (*) | (4,40,000) | (2,00,000) |

Gross Total Income | 9,60,000 | 12,00,000 |

Deductions | 2,00,000 | 2,00,000 |

Taxable income | 7,60,000 | 10,00,000 |

Tax on the above | 77,000 | 1,12,500 |

Additional tax outgo excluding cess in AY 2018-19 on account of the amendment |

| 35,500 |

Workings for Income from House Property

Particulars | AY 2017-18 | AY 2018-19 |

Property A |

|

|

Annual Value | Nil | Nil |

(-) Interest on housing loan restricted to | 2,00,000 | 2,00,000 |

Loss from House Property(A) | (2,00,000) | (2,00,000) |

Property B |

|

|

Net income from House Property after all deductions (B) | 60,000 | 60,000 |

Property C |

|

|

Annual Value | 5,00,000 | 5,00,000 |

Less : Standard Deduction | 1,50,000 | 1,50,000 |

Less : Interest on loan | 6,50,000 | 6,50,000 |

Loss from House Property (C) | (3,00,000) | (3,00,000) |

Total income from house property (A+B+C) | (4,40,000) | Restricted to (2, 00,000). Balance loss of Rs 2.4 lakh can be carried forward for the next 8 AYs |

Key takeaways:

- By owning a house one day–everyone dreams of this, saves towards this and wants to achieve this one day. But it is not without responsibility to own the property of the House.

- Paying property taxes on the house every year is one of them. If you want to learn how to save taxes on mortgage interest, this guide will help us.

- It's also talking about how to report home ownership on your income tax return.

- How to calculate your income from a home property

- As already mentioned, if the development of the property isn't completed within 5 years, the deduction of interest on the mortgage should be limited to Rs. 30,000.

Gains or gains arising from the transfer of capital assets held as investments, gains or gains arising from the transfer of capital assets held as investments, gains can be for short-term and long-term benefits. Capital gains occur only when capital assets are transferred. That is, if the transferred asset is not a capital asset, it will not be covered under the head capital gain. Any profit or profit generated in the previous year from which the transfer was made shall be considered income of the previous year and shall be subject to income tax, if the concepts of head capital gains and indexation apply.

Capital assets: it is any property held by the assessor of income tax except Jewellery, drawings, paintings

Items held for a person's business or profession (inventory, ready goods, raw materials) are taxed under the head of the interests and interests of the business or profession

Agricultural land means land on which agricultural income is obtained. Land that is outside the city, not the municipality, 8 kilometres, and whose population is less than 10,000, is eligible to be agricultural land

There are two types of capital assets: short-term capital assets and long-term capital assets.

Short-term capital assets: this is an asset held for no more than 36 months immediately before the transfer date. This period of 36 months is replaced by 12 months in the case of certain assets such as shares held in the company or preferred shares, other security listed on the recognized stock exchange of India, certain stocks mutual funds and units of zero coupon bonds.

Long-term capital asset: this is an asset that is held for 36 or 12 months or more in some cases. A transfer is defined as the sale of an asset, the waiver of rights to the asset, the compulsory acquisition by law, or the maturity of the asset. Many transactions are not considered transfers, such as transferring capital assets under a will. If a unit of a stock or stock diversification mutual fund held for more than a year, it is subject to long-term capital gains. In the case of real estate, if it is held for more than two years, it is eligible for long-term capital gains. Earlier in the financial Act 2017, Real Estate was considered as a long-term capital asset only if it was held for more than three years.

Capital gains: any profit or profit arising from the transfer of capital assets made in the previous year shall be levied on income tax under the head capital gains. Examples of assets are flat or apartment, land, stocks, mutual funds and gold among many others. Types of gains:

Short-term capital gains: capital gains resulting from the transfer of short-term capital assets.

Long-term capital gains: capital gains resulting from the transfer of long-term capital assets.

Tax on Short-Term and Long-Term Capital Gains

Tax Type | Condition | Tax applicable |

Long-term capital gains tax | Except on sale of equity shares/ units of equity oriented fund | 20% |

Long-term capital gains tax | On sale of Equity shares/ units of equity oriented fund | 10% over and above Rs 1 lakh |

Short-term capital gains tax | When securities transaction tax is not applicable | The short-term capital gain is added to your income tax return and the taxpayer is taxed according to his income tax slab. |

Short-term capital gains tax | When securities transaction tax is applicable | 15%. |

Tax on Equity and Debt Mutual Funds

Gains made on the sale of debt funds and equity funds are treated differently. Any fund that invests heavily in equities (more than 65% of their total portfolio) is called an equity fund.

Funds | Effective 11 July 2014 | On or before 10 July 2014 | ||

Short-Term Gains | Long-Term Gains | Short-Term Gains | Long-Term Gains | |

Debt Funds | At tax slab rates of the individual | At 20% with indexation | At tax slab rates of the individual | 10% without indexation or 20% with indexation whichever is lower |

Equity Funds | 15% | Nil | 15% | Nil |

Capital gains:

- The assessor must own capital assets

- The assessor must have transferred capital assets in the previous year.

- There must have been a profit or profit as a result of such a transfer

Capital gains calculation

In accordance with Section 10 (38) of the Income Tax Act 1961, the Securities and Exchange tax (STT) is deducted and paid for the long-term capital gains of stocks or securities or mutual funds.

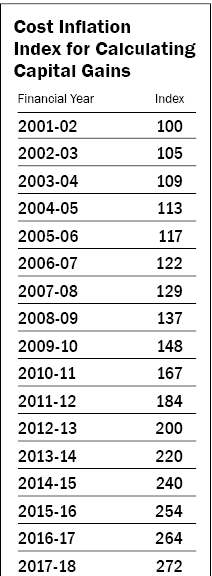

Indexation concepts

The value of today's rupee is not the same as it will be the value of tomorrow due to inflation. The same applies to equitable payment of capital if there is a tax effect, the inflation rate of the purchase is included. For example, if you bought a flat in May 2002 for 20lakh for RS and sold it in May 2017 for 60lakh for Rs; You Do not pay taxes on Rs 40lakh gay allow the concept of indexing so that the tax authorities can reduce the taxes paid on profits, lowering the overall profit, indicating higher purchase costs. How to use it? Using the inflation index, it is necessary to increase the purchase price of the asset to reflect the true price after the inflation-adjusted for the year of sale.

Indexed acquisition cost= (the cost inflation index (CII) of the year in which the asset was transferred or sold) divided by the CII of the year in which the asset was acquired or purchased). So, in the above example, the year in which assets are transferred or sold is 2016-17, and the 2011 cost inflation index (CII) =264. The year in which the asset was acquired or purchased is 2001-2002, with the cost inflation index (CII) =2001-02. Thus, the cost inflation index (CII) =264/100=2.64

Then multiply the CII by the purchase price to reach the indexed acquisition cost, which is the actual or true cost at the time of tax calculation or calculation. Indexed acquisition cost=Rs20,00,000x2.64=Rs52,80,000 therefore long-term capital gain=full value of sale-indexed acquisition cost=Rs60,00,000-Rs52,80,000 = Rs7,20,000

Tax liabilities linked to fixed assets and not linked

For long-term capital gains, tax liability is lower than the amount arrived by two:

- 20% tax liability has arrived by the indexing act

- 10% tax liability arrived without using indexing method

In the above example, using indexing, the tax liability would be (20/100) x7, 20,000=Rs1, 44,000. Without indexing: capital gain=selling price of the asset-acquisition cost=60, 00,000-20, 00,000=Rs40, 00, 000. The capital gains tax on this is 10 per cent= (10/100) x40, 00,000=Rs4, 00, 000. This is an advantage to use indexation as it benefits in tax savings.

- Guide to the acquisition of funds profit statement from the cam data read the Clear Tax.

Rather than entering details manually, simply view your investment performance, capital gains and losses for the present and last fiscal year across cams service funds.

2. Guide to the acquisition of funds profit statement from KARVY Data read the Clear Tax.

Rather than entering details manually, simply check your investment performance, capital gains and losses for the current and last financial year across the KARVY Service Fund.

3. Guide to get funds profit statement from ZERODHA data read, Clear Tax

Instead of entering details manually, you can upload a realized gain statement, which is the integration of investment performance, capital gains and income for the current and last financial year of the entire ZERODHA Service Fund

4. Capital gains exemptions

Example: Manya bought a house in May 2004 for 50lakh,and the full value of the consideration received in the 2016-17 fiscal year is Rs1. 8crore. Since this property has been held for more than 3 years, this will be a long-term capital asset. The cost is adjusted for inflation and the indexed cost of the acquisition is taken. Using the indexed cost of the acquisition formula, the adjusted cost of the house is Rs1.17crore. The net capital gain is Rs63, 00, 000. Long-term capital gains are taxed at 20%. For a net capital gain of Rs63, 00,000, the total tax amount is Rs12, 97,800. This is a significant amount of money paid in taxes. This would benefit from the exemption provided by the Income Tax Act on capital gains when profits from a sale are reinvested in buying another asset.

Section 54: exemption on the sale of home property within the purchase of other home property

- Exemption of capital gains under Section 54: however, capital gains on the sale of residential property shall not exceed Rs2crores, until the assessor has two House properties against the previous offer of one house property on the same terms.

- Exemptions under Section 54 are available when capital gains from the sale of residential property are reinvested in the purchase or construction of another residential property (prior to the 2019 budget, capital gains exemptions were limited to 1 residential property only).Exemptions for two-home properties are allowed once in a taxpayer's lifetime unless capital gains exceed Rs. Crowless 2-piece set taxpayers need to invest capital gains amounts rather than the entire sale proceeds. If the purchase price of the new property is higher than the amount of capital gains, the exemption shall be limited to the sum of capital gains at the time of sale.

Conditions for this benefit to be useful

- The new property are often purchased either 1 year before the sale or

- Years after the sale of the property.

- Profit can also be invested in the construction of the property, but the construction must be completed within three years from the date of sale.

- The 2014-15 budgets reveal that only 1 House can be bought or built from capital gains to claim this exemption.

- Please note that if this new property is sold within 3 years of the completion of its purchase/construction, you can regain this exemption.

Section 54F: exemption from capital gains in the sale of assets other than residential real estate

If there is a capital gain from the sale of long-term assets other than residential real estate, an exemption under Section 54F is available. Buying a new residential property claiming this exemption should be considered for the entire sale and invest capital gains as well as buying a new property either one year before the deal or 2 years after the deal of the property. You can also use the profits to invest in the construction of the property. However, the development must be completed within 3 years from the date of sale. The Budget 2014-15 reveals that only 1 House can be bought or built from sale to claim this exemption. If this new property is sold within 3 years of purchase, this exemption can be recouped. If the entire proceeds of the sale are invested in a new home, the entire capital gain will be exempt from taxes if the above conditions are met. However, if you invest a portion of the proceeds from the sale, the capital gain exemption will be a percentage of the amount invested in the sale price=capital gain x new house expenses/net consideration.

Section 54EC: exemptions on the sale of home property on reinvestment in certain bonds

Exemptions are available under Section 54EC if the capital gains from the sale of the first property are reinvested in a particular bond.

- If you are not keen to reinvest your profits from the sale of your first property to another, invest in bonds up to Rs 50 lakh issued by the National Highway Administration of India (NHAI) or Rural Electrification Corporation (REC).

- The invested money can be redeemed after 3 years, but not before 3 years from the date of sale. From fiscal 2018 to fiscal 2019, the 3-year period has been extended to 5 years.;

- Homeowners have six months ' time to invest profits in these bonds. However, to be able to claim this exemption, you must invest by the tax filing deadline.

When can I invest in a Capital Gains Account Scheme?

Finding a suitable seller, placing the necessary funds and getting documents in place for a new property is a time-consuming process. Fortunately, the Income Tax department agrees with these restrictions. If the capital gains are not invested until the filing date of return (usually 31July) for the fiscal year in which the property is sold, the profit is not required to pay taxes, the Capital Gains Account Scheme, 1988 this deposit can be claimed as an exemption from the capital gains. However, if the funds are not invested, the deposit shall be treated as a short-term capital gain for the years after the specified period has passed.

5. Tax savings on the sale of farmland

In some cases, capital gains from the sale of agricultural land may be exempt from income tax entirely or not taxed under the head of capital gains.

- Agricultural land in rural areas of India is not considered a capital asset, so the profit from the sale is not taxed. For more information about what defines agricultural land in rural areas, see above.

- Do you have farmland as trading stock? In such cases, if you are buying and selling land regularly or in the course of your business, the profit from its sale is subject to taxation under the head business and profession.

- Capital gains on compensation received for compulsory acquisition of urban agricultural land are tax-free under Section 10 (37) of the Income Tax Act.

If farmland is not sold out, you can also claim an exemption from the bottom 54B.

Section 54B: exemption from capital gains from the transfer of land used for agricultural purposes

The amount exempted is an investment in a new asset or capital gain. It is necessary to reinvest in new agricultural land within 2 years from the date of transfer. New farmland purchased to claim capital gains exemption should not be sold within 3 years from the date of purchase. In accordance with the Capital Gains Account Scheme of 1988, the exemption of the public sector bank or IDBI Bank may be charged for the amount deposited if the farmland cannot be purchased by the date of filing the income tax return. If the amount deposited by the capital gains account method is not used for the purchase of farmland, it is treated as the capital gain for the year after the expiration of the 2-year period from the date of sale of the land. If you want to know more about the potential of good capital gains and investment choices, invest in Clear Tax investments. Our carefully selected plans will help you build the best portfolio for your financial goals and risk profile.

Key takeaways:

- Capital gains are indicated as the net profit that an investor makes after selling a capital asset that exceeds the purchase price.

- The entire value obtained by selling capital assets is considered taxable income.

- If an asset is sold within 36 months of its acquisition, the profit gained from it is known as a short-term capital gain.

- The profits earned by selling assets held for more than 36 months are known as long-term capital gains.

- The calculation of capital gains depends on the type of asset and the duration of its holding.

- Some terms that an individual should know before calculating profits against capital investment tax exemptions can be found in the following section on profits earned against assets.