Unit -3

Revenue ,Capital Expenditure and Audit of a company Accounts

Capital Expenditure – Definition:

Capital expenditure means expenditure carrying probable future benefits.

Eric Kohler has defined capital expenditure as "an expenditure intended to benefit future periods; an addition to fixed assets.

Examples –

1) Acquisition of a fixed asset is the most common type of capital expenditure.

All expenses incurred on the assets till they are capable of yielding income are capital expenses.

When a new fixed asset is acquired, its cost includes -

a) Purchase price, import duties, taxes and any direct cost of bringing the asset to its working condition for its intended use.

b) Financing costs e.g. Interest on loans taken especially for purchase of assets.

2) Expenditure that improves the standard of performance of an existing asset is treated as capital expenditure.

a) Extends the useful life of the asset.

b) Expands the capacity of the asset.

c) Increases productivity.

3) Cost of an addition or extension to an existing asset which is of a capital nature and which becomes an integral (inseparable) part of the existing asset.

4) Investments i.e. shares, securities, debentures, immovable properties etc.

Revenue Expenditure – Definition:

Revenue expenditure means an expenditure from which no future benefit is expected.

Eric Kohler has defined revenue expenditure as "an expenditure charged against operation, a term used to contrast with capital expenditure." Revenue expenditure, as opposed to capital expenditure, has no future benefits. The items of expenditure having immediate or short term benefits ( less than 1 year) are treated as revenue expenditure.

Examples –

1) Costs relating to the business activities during the accounting year are treated as revenue expenditure.

a) Cost of production.

b) Cost of administration.

c) Cost of selling and distribution.

d) Cost of finance.

2) Costs relating to the income earned during the accounting year are treated as revenue expenditure e.g. Interest paid on loans taken for investing in shares.

3) Costs whose benefits do not extend beyond the accounting year are treated as revenue expenditure e.g. Purchase of tools having useful life of 6 months.

4) Expenditure on repairs which maintains the standard of performance of an existing fixed asset (i.e. maintains the assets in working condition)

There are broadly three types of Reserves – Capital Reserves, Revenue Reserves ad Statutory Reserves.

Capital Reserve:

A capital reserve is taken out of the capital profit and is not shared as a dividend to the shareholder. This reserve cannot be created out of the profit earned from the core operation.

Few examples of capital reserves are:

1) Cash received by selling current assets

2) Premium earned on the issue of share and debentures

3) Excess on revaluation of assets and liabilities

Revenue Reserve:

Revenue reserve is a portion of profit owned by the company and is kept aside for the use of other multiple purposes. This reserve is recorded in the profit and loss account and can be used the following way:

1) Dividend to shareholder

2) Expand the business

3) Stabilise the dividend rate

In other words, Revenue reserves are portions of profits earned by a company’s normal operations which are then set aside.

Revenue reserves are divided into two types:

1) General Reserve and

2) Specific Reserve

Statutory Reserve:

Statutory Reserve is the amount of money, securities or assets that need to be set aside as a legal requirement by financial institutions to cover its claims or obligations which are due in the near future. This is a mandatory reserve.

It is a legal reserve that is required to be maintained in accordance with the standards that are set by the regulating body for the sector which may vary from country to country.

The primary aim for maintaining a statutory reserve is for the organization to meet its obligations promised to its customers even if it is running into losses.

Before understanding the methods, let us understand the meaning of Depreciation.

Depreciation means the reduction in the value of an asset due to its use, leading its wear and tear, or due to obsolescence or due to general market trend. The prescribed rules state that the amount of depreciation of a depreciable asset must be allocated in every accounting period throughout the life of the asset.

Depreciable assets are those assets that are used for the purpose of business which can be depreciated. That is, the value of the asset is considered as a business expense over the useful life of the asset. A company can depreciate most of the tangible assets like Building, Machinery, Vehicles, Furniture and Fixtures, Computers and Equipment and intangible assets like Patents, Copyrights and Computer Software.

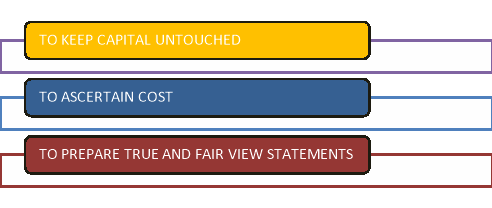

Purposes of Providing Depreciation:

Types:

Depreciation is allowable as expense in Income Tax Act, 1961 on basis of block of assets on Written Down Value (WDV) method. Depreciation on Straight Line Method (SLM) is not allowed.

Companies Act prescribes two methods for calculating depreciation:

- Straight Line Method (SLM) and

- Written Down Value Method (WDV)

Straight Line Method (SLM):

Straight line basis is calculated by dividing the difference between an asset's cost and its expected salvage value by the number of years it is expected to be used.

In other words, to calculate depreciation on straight line basis, company take the purchase price of an asset and then subtract the salvage value, its estimated sell on value when it is no longer expected to be needed. The resulting figure is then divided by the total number of years the asset is expected to be useful, referred to as the useful life.

Symbolically, the formula is –

Depreciation on Straight Line Basis = Purchase Price of Asset - Salvage Value

Estimated Useful Life of Asset

Advantages and Disadvantages of Straight Line Basis:

- Straight line basis is popular because it is easy to calculate. (ADVANTAGE)

- Accountants like the straight line method because it is easy to use, renders fewer errors over the life of the asset, and expenses the same amount every accounting period. (ADVANTAGE)

- One of the most obvious drawbacks of using this method is that the useful life calculation is based on guesswork. (DISADVANTAGE)

For example, there is always a risk that technological advancements could potentially render the asset obsolete earlier than expected.

Written Down Value Method (WDV):

Under this method, the depreciation is calculated at a certain fixed percentage each year on the decreasing book value commonly known as WDV of the asset

WDV is calculated as Book value less Depreciation.

It is also known as Reducing Balance or Reducing Instalment Method or Diminishing Balance Method.

Advantages and Disadvantages of Written Down Value Method:

- Under this method higher depreciation is charged in early years it takes into account that asset is more efficient in early years and therefore it is more realistic way of depreciation. (ADVANTAGE)

- The amount of annual depreciation reduces with the reducing balance of the asset. (ADVANTAGE)

- This method takes care of the obsolescence problem related to the assets as the major part of depreciation is charged in the earlier years. Due to this feature replacement of the assets before the end of its estimated useful life becomes easy and feasible. (ADVANTAGE)

- The value of asset will never be zero in books of account under this even if asset is of no use to company. (DISADVANTAGE)

- This method is not suitable for an asset having a very short life. The calculation of the rate of the depreciation becomes very difficult and creates problems in this case. (DISADVANTAGE)

Verification of assets implies an enquiry; with a view to obtain and examine the evidences regarding an asset. The evidences proves the following:

- That the asset exists.

- That the asset exists in the name of the business entity.

- That the assets are classified and presented as per the requirements of the existing laws.

The process of Verification satisfies the Auditor about the valuationof the assets and liabilities by inspecting the documentary evidences available, which in return helps the Auditor to frame his opinion on the financial statements.

Verification involves confirmation that the assets are held in the name of business entity only for the purpose of business. Verification is a guard against improper use of assets and it exhibits true and fair view of the state of affairs of the business organisation.

Verification also involves proper valuation of assets. Valuation means critically examining and determining the fair value of various assets appearing in the Balance Sheet.

General Principles of Verification of Assets:

- Ascertain that the assets were purchased under appropriate authority.

- Ascertain that the assets were purchased for the purpose of business only.

- Ascertain that no unauthorised charge has been created against any asset.

- Ascertain that the assets have been disclosed in the Balance Sheet as per the relevant statutory requirements and Accounting Standards.

- Ascertain that the assets were existing as on the date of the Balance Sheet.

Distinction between Vouching and Verification:

‘Vouching’ means to check the Vouchers.‘Verification’ means to verify the Assets and Liabilities of the business.

Vouching involves checking the accuracy of the transactions recorded in the books of accounts whereas Verification means a process validating the position of Assets and Liabilities in the Balance Sheet.

By Vouching, items of Profit and Loss A/c are examined while Verification process examines the items of Balance Sheet.

Vouching is a year-round process. On the other hand, Verification can be conducted at the end of the year.

The basic purpose of Vouching are –

- To check the documentary evidence in support of the transactions.

- To verify the totalling and casting of the ledgers.

The basic purpose of Verification are –

- To verify the reliability of the financial statements.

- To verify that the assets are accurately recorded and disclosures are made therein.

- Appointment of First Auditors:

The first Auditor of a company other than a government company shall be appointed by the board of directors within 30 days from the date of registration of the company.

In case they fails to appoint the members of the company within 90 days appoint the Auditor at an extra ordinary General Meeting and search appointed Auditor shall hold office till the conclusion of the first Annual General Meeting.

- Appointment of First Auditors of a Government Company:

The first Auditor of a government company shall be appointed by the Comptroller and Auditor General of India within 60 days from the date of registration of the company. *In case the CAG does not appoint, the Board of Directors shall appoint the Auditor within next 30 days.

In case they fails to appoint, the members of the company, within 60 days, appoint the Auditor at an extra ordinary General Meeting. In any case mentioned above, the appointed Auditor shall hold office till the conclusion of the first Annual General Meeting.

- Appointment of Subsequent Auditors:

Section 139 subsection 1 of the Companies Act 2013 provides that every company shall appoint and individual or a firm as an Auditor at the first Annual General Meeting you shall hold office from the conclusion of that Meeting till the conclusion of its sixth Annual General Meeting and thereafter the conclusion of every vi meeting. The company shall inform the Auditor concerned of his appointment and also file a notice of appointment to the Registrar within 15 days of the appointment.

- Appointment of Subsequent Auditors of a Government Company

In case of a Government Company, the CAG of India shall appoint an Auditor within 180 days from the commencement of a Financial Year.

Remuneration

As per section 142 of the act the remuneration of the Auditor of a company shall be fixed in its General Meeting however board may fix remuneration of the first Auditor appointed by it

It has also been clarified that the remuneration to the Auditor shall also include any facility or facilities provided to him.

- Duty of Auditor to Enquire on Certain Matters: It is the duty of Auditor to enquire on the following matters:

Whether loans and advances made by the company have been properly secured and whether the terms on which they have been made our prejudicial to the interests of the company or its members

Whether transactions of the company which are represented nearly by book entries are prejudicial to the interests of the company

Whether loans and advances made by the company have been shown as deposits

Whether personal expenses have been charged to revenue account

- Duty to Sign the Auditor Report: The person appointed as an Auditor of the company shall sign the Auditor's report or 35 any other document of the company in accordance with the provisions of sub section 2 of section 141

- Duty to Comply with Auditing Standards: Every Auditor shall comply with the auditing standards as per section 143 sub section 9 of the Companies Act 2013

- Duty to Report on Frauds: If an Auditor of the company in the course of the performance of his duties as Auditor, has reason to believe that an offence involving fraud is being or has been committed against the company by officers for employees of the company, we shall immediately report the matter to the central government within such time and in such manner prescribed in rules 13 of the Companies (Audit and Auditors) Rules, 2014

- Duty to State the Reason for Qualification or Negative Report: Whether any of the matters required to be included in the audit report is answered in the negative or without qualification the report cell state the reasons there for

Audit report is written opinion on an entity's financial statements by an Auditor.

The Auditor's report should contain at an expression of opinion on the financial statements taken as a whole.

Basic elements of the Auditor's report:

1) Title: the Auditor's report shall have a title that clearly indicates that it is the report of an independent Auditor.

2) Introductory Paragraph: the introductory paragraph in the Auditor's report shall

- Identify the entity whose financial statement certain audited

- Identify the title of each statement that comprises the financial statements

- Specify the date or period Covered by each financial statement comprising the financial statements

3) Management's Responsibility for the Financial Statements:The section of the Auditor's report describes the responsibilities of those in the organisation that are responsible for the preparation of the financial statements.

4) Signature of the Auditor: The Auditor's report shall be signed.

5) Date of the Auditor’s Report: The Auditor's report shall be dated no earlier than the date on which the Auditor has obtained sufficient appropriate audit evidence.

6) Place of Signature: The Auditor's report shell name specific location which is ordinarily the city where the audit report is signed.

Books Recommended :

1 N. L. Nadda —Ankekshan

2 Spicer and Pagler — Practical Auditing

3 De Paula — The Principles of Auditing

4 T. R. Sharma — Auditing

5 R. R. Gupta —Text Book of Auditing

6 B. N. Tandon —Auditing