UNIT II

Computation of Income under Various Heads

Introduction:

Section 14 of income tax lays out that there can be various modes of income for a person. These modes are classified into 5 broad heads for the purpose of calculating and determining gross income and tax rates, and then applied.

The 5 main heads of income are-

- Income from salary

- Income from home property

- Capital gains

- Profit and profit from business and profession

Income from other sources

Income from other sources

- Income from salary

Section 15 of the law establishes the conditions under which income falls under the head of the “salary".’

- Compensation, whether paid or not, is paid by the employer to the former employee (assessor) during the previous year's employment period.

- Salary paid to the employee by the employer or former employer in the previous year, even though it was not due to him.

- Salaries paid to employees by the employer or former employer in the previous year that was not charged under Income Tax in other previous years.

An important element of this head is that it mandates the relationship between the employer and the employee. If there is no relationship between the employer and the employee, then the income is not accessible under the head of the salary.

Section 17 of the Act refers to the term “salary."-

- Wages;

- Any pension or pension;

- Any gratuity;

- Fees, benefits or benefits in lieu of compensation or wages, or nevertheless;

- Any advance on salary;

- Any payment received by the worker with respect to any time of leave not benefited by him;

- In accordance with Rule 6 of Part A of the fourth schedule may be assessed to a certain extent on pay, the annual savings to the balance of employees participating in the perceived Provident Fund.;

- To some extent it is billable to be assessed under Rule 2 of the Fourth Schedule PartA Rule 11 sub-rule 4 of the employees participating in the perceived Provident Fund.、

- Contributions made by the central government or other employer in the previous year to the employee's account under the pension plan listed in Section 80CCD

Allowances

The employer pays the allowance to his employee to meet his personal expenses. Allowances can be taxed in full or partially. Some tax allowances include rent allowances and special allowances under Sections 10(14)(i)and(ii).The allowances that are fully taxed are:

- Dearness Allowance

- Overtime allowance

- Flat-rate medical allowance

- Tiffin allowance

- Servant allowance

- Non-internship allowance

- Hill allowance

- Warden and Warden allowance

- Request for refund of overpayment

Perquisites

In addition to their salary, employees are often given some other benefits that may not even be in the form of cash. For example, you can rent free accommodation or a car, which is given to the employee by the employer.

Reimbursement of invoices is not a perk. Perquisites are given only during the continuation of employment. The taxable conditions are

- Rent free accommodation

- Interest-free loans

- Movable property

- Education expenses

- Premiums paid on behalf of employees

The exempted benefits include:

- Medical benefits

- Leaving a travel concession

- Health insurance premiums

- Car, laptop etc. For personal use.

- Staff benefits system

Get a profit instead of a salary

Section 17(3) gives a comprehensive sense of profit instead of salary, payments or unpaid payments that should be paid to employees by the employer. There are two essential features for the payment to be valid under Section 17 (3- )

- There must be compensation received by the assessor from his employer or former employer;

- It is received or in connection with the termination of his employment or adjustment of conditions.

Payments from unrecognized provident or retirement funds are taxable as "benefits instead of salaries if the balance is an employer contribution or interest on employer contributions”.

Exceptions to Article 17 (3) (exemptions under Article 10)

- Death cum retirement gratuity;

- Rent allowance;

- Commuting value of pensions;

- Reduced revenue received by employees;

- Payments received from statutory or authorized reserves;

- Payment from the approved old age fund;

- Payment from the recognized Provident Fund.

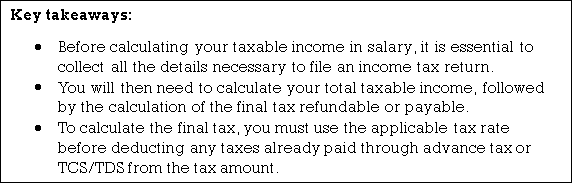

Calculation of income tax on salaries

Let me give you an example. –

Individuals, for example, let Mr. A receive the following payments –

Basic salary-rupees. 2, 50,000 per year;

Dearness Allowance-Rs. 10,000 per year;

Entertainment Allowance-Rs. 3,000 per year;

Professional tax-Rs. 1,500 per year;

After that, how much money will be taxable from his salary?

When examining the total salary = basic salary + attendance allowance + entertainment allowance, etc., 2, 50,000 + 10,000 + 3,000 =2, 63,000

Under Section 16 (iii) =2, 63,000-1500=Rs per deduction. 2, 61,500

The rate of income tax on income Rs. 2, 61,500 is 5% and equals Rs. This amount of 13,075 is taxable.

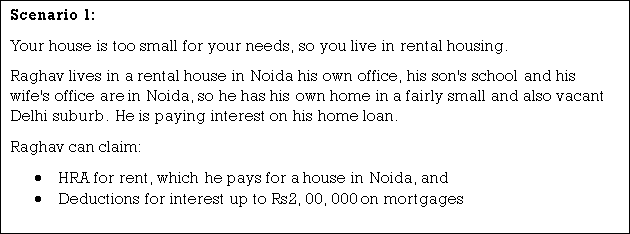

2. Income from home property

The assessor is the owner separately from the property that is used for business or profession, and the proceeds that are taxed under the Income Tax Act are divided into the range of income from residential property (section 22).)

Income from home property includes lease and accredited ownership.

Income from the property of the house is taxable after taking into account the deductions under Section 24 of the law. In the case of repair or maintenance of the property, thirty percent of the net annual value is deducted. This deduction is not allowed on self-occupied property.

For the purpose of calculating income from the property of the house, the property of the house is divided into three categories. House property:

- It was put out during the previous year.

- Let's go out partly, partly vacant.

- It is a servant when it is cut.

Deemed ownership-

Section 27 provides that a particular person is not the legal owner of the property, but under certain conditions is still considered to be the owner.

- Condition 1-handover of property to a child or partner, without consideration.

- Condition 2-the holder of the concessional property is considered the owner of the entire estate.

- Condition 3-a member of a cooperative or company or person's Association

- Condition 4-a person who owns a property on lease for 12 years or more in accordance with Section 269UA(f).

Property co-owners-Section 26

If there is more than one owner and the share of the co-owner is determined, the income arising from such property is calculated as income from one property, and the co-owner they are entitled to relief under Article 23.

Unrealized rent (rent not paid by the tenant for any reason)

Unrealized rent is not included in the calculation of the net annual value. If the rent is received in subsequent years, the amount is added to the income from the property of the house for that particular year.

Loss set-off and carryover

Under Section 70 of the Income Tax Act, if a person suffers losses from home property, he can set them off from the income of other home property.

Article 71 of the Act provides for a provision to offset losses from home property from the head of other income, but does not provide for casual income (income that may not occur again).)

Unadjusted losses can be carried forward for a maximum period of 8 years starting from the year following the year in which the loss occurred. In subsequent years, the set-off is allowed only from the head “income from the property of the House".

The amount of loss that can be set off on the property of the house from the other income head is limited to Rs 2lakh if either the house is self-occupied or the property is sold.

Calculation of income from home property

Step 1-subtract the city tax paid annually from the total annual value that will be the net annual value.

Step 2-deduct the amount under Section 24 (a) and Section 24 (b) where the deduction is provided.

For example –

An individual, let’s say Mr. X owns three properties and gives it to rent. What would be the total annual value of all properties? Please see the property details below.-

Details | Property 1 | Property 2 | Property 3

|

Municipal rent | 7,50,000 | 7,50,000 | 2,00,000 |

Fair rental | 2,00,000 | 2,00,000 | 7,50,000 |

Standard rent | – | 80,000 | 9,00,000 |

Amount in Step | 8,00,000 | 50,000 | 8,50,000 |

Not implemented rent | 1,00,000 | NIL | 50,000 |

|

|

|

|

|

|

|

|

Ans: Step 1: high value of reasonable expected rent, municipal rent or fair rent.

Particular | Property 1 | Property 2 | Property 3 |

Municipal Rent | 7,50,000 | 7,50,000 | 2,00,000 |

Fair Rent | 2,00,000 | 2,00,000 | 7,50,000 |

Standard Rent | - | 80,000 | 9,00,000 |

Amount at Step 1 | 7,50,000 | 80,000 | 7,50,000 |

Step 2: deduct unrealized rent (e.g. 8, 00,000-1,00,000)

Particulars | Property 1 | Property 2 | Property 3 |

Amount at step 2 | 7,00,000 | 50,000 | 8,00,000 |

Step 3: the higher value calculated from Step 1 and Step 2 will be the total annual income.

Particulars | Property 1 | Property 2 | Property 3 |

Amount at step 1 | 7,50,000 | 80,000 | 7,50,000 |

Amount at step 2 | 7,00,000 | 50,000 | 8,00,000 |

Amount at step 3 | 7,50,000 | 80,000 | 8,00,000 |

3. Income from capital gains

Profits or profits arising from the exchange of capital assets held as investments are charged under the head capital gains. The gain can be for short-term and long-term gains. Capital gains appear when capital assets are transferred. This means whether the moved asset is certainly not a capital asset. The profit or profit that appeared in the previous year, when the transfer was made, is considered the income of the previous year and, if applicable, is imposed on it under the head capital gain and indexation.

To fall into the range of income from capital gains, you need –

- Capital assets

- This is forwarded by the assessor

- The transfer took place in the final year

- Profit or loss is arising from it

Capital assets include all types of property owned by the assessor, whether tangible or intangible, movable or motionless, and may be used for business and professional purposes.

Capital assets do not include assets such as stocks in trade, used personal goods, agricultural land.

Capital gains are two types

- Short-term capital assets-assets held by the assessor for up to 36 months immediately prior to the transfer date.

ITO v. Narayana K Shah 2000 74 ITD 419 Mums.

In this case, the court ruled that if the assessor held certain shares of the company that were granted ownership of the flat, these shares could not be treated as "shares" as set forth in Paragraph 2 (42A), and if sold after holding for less than 36 months, the resulting profits should be treated as short-term capital gains.

2. Long-term capital assets-assets held by the assessor for more than 36 months. Long-term capital gains are generally taxed at lower rates.

Long-term capital assets may not require a period of 36 months, and assets held for 12 months or more are valid for long-term capital assets. These conditions are –

- Listed or preferred shares;

- Securities listed on recognized stock exchanges, such as bonds, stock exchanges;

- UTI units;

- Mutual fund units;

- Zero coupon bond;

- Unlisted or preferential shares;

- A unit of a stock-oriented fund.

The tax on long-term capital assets is 20 percent.

Exemptions under Section 54:

These are exemptions on the transfer of long-term capital assets only if the assessor is an individual or a Hindu Undivided Family. Capital gains arise from the transfer of residential property in which the evaluator has purchased the property of another house within a year or two prior to the date of the transfer or transfer.

The amount of exemptions available is either less on capital gains and new home costs.

Calculation of capital gains

Long-term capital gains-The problem-Mr. Shah has a total gross income of Rs. It has invested 4, 00,000 and Rs. It is a tax saving product of 1, 50,000 yen. After applying all deductions, the total taxable income will be Rs. 2, 00,000. And the tax limit on exemption by income tax slab is Rs.2, 50,000. With the sale of gold, he has a long-term capital gain of Rs. 5, 00,000.

Solution-total taxable income=2, 00,000, less than 2, 50,000;

Long-term capital gain@20%=4,50,000 (difference between tax-free limit and actual taxable income)=10,000

This mass mount can save you from tax.

The tax rate is the same for short-term capital gains.

4. Income from profits and profits from business and profession

Business and occupation are defined under Section 2 (13) and Section 2 (36), respectively.

Business: This includes trade, commerce or manufacturing, or adventure or concern in the nature of trade, commerce, or manufacturing.

Occupation: "Occupation" includes occupation.

Article 28 of the Income Tax Act covers "interests and interests of businesses or occupations “and has the following income imposed under the heading “interests and interests of businesses or occupations":

- Interests and interests of any business or profession;

- Any compensation or other payment by the person specified in Article 28 (II), by the Indian company or any person in charge of all operations other than the Indian company, or any compensation or other payment received shall be made at the end of his management.;

- Trade from Express services performed for its members, determined by experts or equivalent associations.;

- Benefits of sales of import qualification licenses, incentives by cash compensation support, disadvantages of Duty;

- Any benefits regarding the replacement of Duty qualified passbook scheme;

- Any benefits on the exchange of Duty Free replenishment certificate;

- Estimates of any profits or perks, whether coming out of business or professional activities and turning into money;

- Interest, payment, compensation, commission or compensation received by company partners from such companies;

- Any amount received under the key man insurance policy, including bonuses;

- Income from speculative transactions;

- If the exhaustive expenditure of such capital assets is allowed as a deduction under Section 35AD, the sum received in real money or in kind by which capital assets are destroyed, destroyed, disposed of or transferred.

The deduction under the head of" profits and profits from business or profession" was mentioned under Sections 30 to 37.

- Section 30. Deductions must be allowed in the case of leases, fees, taxes, amendments, and insurance for premises used for business or professional purposes.

- Section 31. Deductions must be allowed for repairs and insurance of equipment, plants or furniture used for business or professional purposes and must be paid for current repairs.

- Section 32. Deterioration of buildings, hardware, plants or furniture, being a tangible asset, know-how, license, copyright, trademark, patent, establishment or some other business or business right of a comparative nature, being an intangible asset that is wholly or somewhat owned by the assessor for business or professional purposes.

- Section 32AC. Deductions for investments in new factories or hardware, or for investments in new factories or hardware, which are organizations occupied in the business Assembly or production of goods or objects since 31st March 2013.

- Section 33AB. An assessor undertaking a tea or coffee or rubber development and assembly business in India should be kept on a Tea Board or Coffee Board or Rubber Board or in a record confirmed by the central government and audited by an accountant, six months from the end of the previous year or before the deadline for filing a return of income.

- Section 33. An amount or amount deposited in the State Bank of India by an assessor who is continuing a business consisting of exploration, or extraction or generation of oil or natural gas or both in India and agrees to an arrangement with the central government for such business and whose account must be audited by an accountant.

- Section 33AC. Taking over the business of a vessel by a government organization or a public company, the deduction must be allowed not to exceed 50% of the profit derived from the business of the operation of the vessel.

- Section 35. In the event of any expenditure on scientific research related to the project, the deduction shall be granted, but the applicant must agree to the prescribed authority for cooperation in the R & D facility and meet the conditions for supporting the maintenance of accounting and auditing.

- Section 35ABB. Spending on obtaining licenses for media transmission services at any time of the previous year before or after the start of the business, since the instalment for obtaining licenses is actually made.

- Section 35AC. If the assessor is a public sector company or local authority, or an alliance or establishment approved by the National Commission to implement a qualified venture or plan, the assessor will not be able to determine the status of the project.

- Section 35AD. In the event that capital expenditures are incurred in whole or exclusively for the purpose of a particular business, a deduction shall be allowed.

- Section 35CCA. Expenditure by means of instalment to accession and establishment to implement rural development programs.

- Section 35CCC. Any expenditure incurred on agricultural expansion projects notified by the council shall be allowed to be deducted to a sum equal to half double the expenditure.

- Section 35CCD. If an organization causes expenditure on a capacity building program advised by the board, that sum must be allowed for a deduction of the sum equivalent to half of the expenditure.

- Section 35D.Write-off of certain preliminary costs.

- Section 35E.Deductions of expenditure on exploration for,or extraction or production of certain minerals, the deduction shall be allowed to one-tenth of the amount of such expenditure

- Section 36. Other deductions include-

- Under Section 36 (1) (I), the amount paid in respect of insurance against the risk of harm or disappearance of shares or stores utilized for business or professional purposes shall not be refunded.

- Under Section 36(1)(ib), the amount of premiums paid by non-cash payment methods by the assessor as an employer towards the health of the employee.

- The amount paid to an employee as a bonus or commission for the services rendered by him under Section 36 (1) (II);

- The amount of interest paid in respect of capital borrowed for business or professional purposes under Section 36(1)(iii).

- The proportional amount of the discount on the zero coupon bond with respect to the life of such bonds, calculated in the manner prescribed under Section 36(1)(iiia).

- Under Section 36(1)(iv)an employer's contribution to a certified Provident Fund is an approved superannuation fund.

- The employer's contribution to the Pension Scheme notified under Section 36 (1) (iva).

- Contributions to GRATUITY funds approved under Section 36(1)(v).

- Employee contributions towards staff welfare schemes under Section 36(1)(va).

- Under Section 36(1)(vi), there is no provision for animals that are used for business or professional purposes and have died or have been found to be worthless all the time.

- Under Section 36(1)(vii), The amount of nonperforming loans associated with the assessor's business or occupation must be written down in the assessor's account book.

- Provisions for bad and bad debt related to rural branches of commercial banks under Section 36 (1) (viia).

- Transfer to a special reserve under Section 36(1)(viii).

- Section 36(1) (ix) under family planning spending.

- Contributions to the exchange risk management fund under Section 36(1)(x).

- Revenue expenditure incurred by an entity established under any central, state or local law under Section 36 (1) (xii).

- Contributions to the Credit Guarantee Trust Fund under Section 36(1)(xiv).

- Section 36 (1) (xvi) under commodity transaction tax.

18. Section 37 (2B). Gifts, leaflets, regions, handouts or such published by political parties, and expenditures acquired by commercial assessors are not deductible.

Computation of income under the heads of “Profits & Gains of Business or Profession”

The amount of net profit is Rs. 4, 00,000m/s D Ltd. And other information provided:

Prepayment income tax=Rs debited to the profit and loss account. 30000

Party brochure printing=Rs. 5000

Return=the amount of money not deposited until the date of submission of Rs. 50,000

What is M / s D Ltd's taxable income?

Particulars | Amount |

Net Profit | 4,00,000 |

Amount of advance income tax | 30000 |

Expenses incurred for political parties | 5000 |

An amount that has not to deposit | 50000 |

Net taxable income | 4,85,000 |

5. Income from other sources

All types of income not covered by the above head are covered under this head and are paid. Income from other sources is provided for in Section 56 of the act. Some of these are:

- Dividends in Section 2 (22));

- Win from lotteries, horse racing, crossword puzzles, and other games;

- Contributions received by the employer as evaluator from his work towards staff welfare schemes;

- Interest on corporate bonds, government bonds/bonds;

- If the assessor leaves to the contract apparatus, plants or furniture belonging to him and further buildings, then the payment from this can be assessed as a salary from other sources, if it is not taxable under the head of “interests and interests of business or profession”;

- Total received under the key man insurance policy, including compensation;

- Salary from hardware, factory or furniture belonging to the assessor.

Gift that cannot be charged:

- Gifts received from relatives

- Gifts received during marriage

- Gifts are given by local authorities

- Gifts received in the form of inheritance

- Gifts received from any funds, institutions, hospitals, etc.

Deductions applicable on income from other sources – section 56 and 57

S.No. | Sections | Nature of Income | Deductions Allowed |

1 | 57(i) | Dividend or interest on securities | Any reasonable amount paid by method for commission or compensation to a banker or some other individual for the purpose of realizing dividend (other than dividends referred to in section 115-O) or interest on securities |

2 | 57(ia) | Employees contribution to PF. Superannuation fund, ESI fund or any other fund set up for the welfare of such employees | If employees’ contribution is credited to their account in the relevant fund on or before the due date |

3 | 57(ii) | Rental income letting of plant, machinery, furniture or building | Lease, rates, charges, repairs, insurance, and devaluation, and so on. |

4 | 57(iia) | Family pension | 1/3rd of family pension subject to a maximum of Rs. 15,000. |

5 | 57(iii) | Any other income | Any other expenditure (not being capital expenditure) expended completely and solely for earning such income |

6 | 57(iv) | Interest on compensation or enhanced compensation | 50% of such interest (subject to certain conditions) |

7 | 58(4) | Income from the activity of owning and maintaining race horses | All expenditure relating to such activity. |

Calculation of income from other sources

Calculation of income from other sources can be done in two ways;

- If the income is one-time income or casual income, a 30% tax is imposed on the total income.

- If the income is from other methods, then the tax must be applied according to the tax slab.

For example- A person gets a family pension=Rs. 30,000(the exemption for this is 33.33% or 1500); 33.33% of Rs. 30,000 = rupees. 9,999, this amount is less than 1500. Thus, the taxable income is 30,000-9,999=20,001. Rs. 20,001 and is taxable as income from other sources.

Conclusion

These five heads of income we have discussed method to different categories of people to calculate their income according to their applicability as taxpayers, so they will be easier to plan their capital in the right direction.

Introduction

Income from salary is income or compensation received by an individual for the services he provides or the contracts he undertakes. This provision essentially assimilates the compensation received by a person for the services provided by him under the employment contract.

This amount of compensation is considered income under the income tax code only if there is an employer-employee relationship between the person making the payment and the person receiving the payment.

Employer-employee relationship–if there is an employer-employee relationship between the payer and the recipient, the payment received by a person is treated as income under the income tax law. In order to qualify income as income from salary, their relationship must be a master-servant relationship. The master is the one who directs the Employee what should be done and how it should be done, and the servant is the one who is responsible for performing the work in the manner told by the employer.

Meaning of Salary

Salaries for the purpose of calculating income from salaries include:

- Wages;

- Pension;

- Pension;

- Gratuity;

- Previous salary;

- Fees, fees, perquisites, profits on behalf of or in addition to salaries or wages;

- Annual accretion to the balance of certified Provident Fund;

- Leave the encasement.;

- Transfer balance in certified Provident Fund;

- Contributions by the central government.

- Or other employers to employee pension A/C Sec .It are listed in 80CCD.

What is CTC?

CTC is one of the generic names when people talk about salaries. CTC stands for Cost to Company. That's the company amount of spending on hiring and supporting employees.

CTC provides employees with salaries, as well as meal coupons, office space rent, provident fund, medical insurance, rent allowance (HRA) and other elements that can cost the company.

It can be noted that unlike the actual income from the salary a person receives, the CTC also includes variables that exceed the actual salary a person is receiving.

Calculation of Income from salary

Calculation of Income from salary

Particulars

|

|

Basic Salary | — |

Add: | — |

1. Fees, Commission and Bonus | — |

2. Allowances | — |

3. Perquisites | — |

4. Retirement Benefits | — |

5. Fees, Commission and Bonus | — |

Gross Salary | — |

Less: Deductions from Salary | — |

1. Entertainment Allowance u/s 16 | — |

2. Professional Tax u/s 16 | — |

Net Salary | — |

|

|

|

|

Income Tax Slabs | Tax Rates |

Within the tax bracket of ₹5,00,001 to ₹10,00,000 | ₹12,500 + 20% of total income exceeding ₹5,00,000 |

Above ₹10,00,000 | ₹1,12,500 + 30% of total income exceeding ₹10,00,000 |

Income Tax Slabs | Tax Rates |

Up to ₹3,00,000 | Nil |

Within the tax bracket of ₹3,00,000 to ₹5,00,000 | 5% |

Within the tax bracket of ₹5,00,001 to ₹10,00,000 | ₹10,000 + 20% of total income exceeding ₹5,00,000 |

Above ₹10,00,000 | ₹1,10,000 + 30% of total income exceeding ₹10,00,000 |

Income Tax Slabs | Tax Rates |

Up to ₹5,00,000 | Nil |

Within the tax bracket of ₹5,00,000 to ₹10,00,000 | 20% |

Above ₹10,00,000 | ₹1,00,000 + 30% of total income exceeding ₹10,00,000 |

Allowances

- Fully Taxable allowances:

- Dearness’s allowance: the allowance is paid to employees to cope with inflation.

- Entertainment allowance: This is an allowance that is provided to employees to repay the costs incurred in hospitality.

- Overtime allowance: Overtime allowance is an allowance paid to employees for working beyond their normal working hours.

- City compensation allowance: This allowance is paid to employees who move to the city.

- Project allowances: When employers provide allowances to employees to meet project costs.

- Tiffin / meal allowance: meals allowance may be provided to employees.

- Cash allowances: employers may also offer cash allowances in some cases, such as for marriage or holiday purposes

Partial tax allowance:

- Rent allowance: it is an allowance that the employer pays his employees for accommodation.

- Entertainment allowance

- Special allowances such as travel allowances, uniforms and study allowances.

- Special allowances to meet personal expenses, such as children's educational allowance, children's hostel allowance, etc.

Tax-free allowance:

- Allowances paid to the government. Foreign civil servants: When Indian government employees are paid allowances when they are serving abroad.

- Salary allowances: Salary allowances paid to HC and SC judges are not taxed.

- Allowances paid by UNO: Allowances received by UNO employees are completely exempt from taxes.

- Compensation allowance paid to the judge: If the judge receives compensation allowance, it is also not taxable.

It can be noted that a person can save taxes on income from salary by getting a tax-saving allowance.

Perquisites

Perquisites are payments that are received by an employee from an employer that exceeds the salary.

Taxable conditions for all employees:

- Rent free accommodation

- Club fee payment

- Movable property

- Concessions on accommodation rent

- Interest-free loans

- Education expenses

- Premiums paid on behalf of employees

Perquisites those are taxable only to certain employees:

- Free gas, electricity etc. For domestic purposes

- Concessional transport facilities

- Concessional education expenses

- Payments made to gardeners, sweepers and attendants.

Perquisites exempt from taxes:

- Medical benefits

- Health insurance premiums

- Leaving a travel concession

- Staff benefits system

- Car, laptop etc. For personal use.

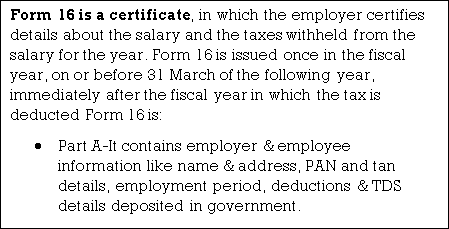

FORM 16

FORM 16

FORM 26AS

FORM 26AS

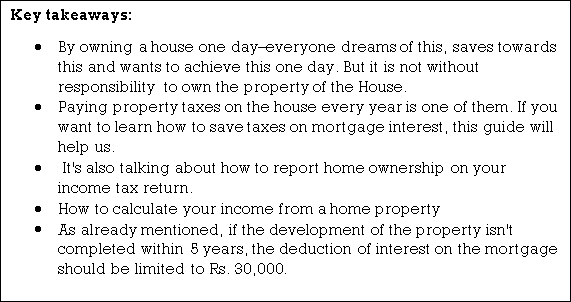

Income tax on home property: on owning a home one day–everyone dreams of this, saves towards this and wants to achieve this one day. But it is not without responsibility to own the property of the House. Paying property taxes on the house every year is one of them. If you want to learn how to save taxes on mortgage interest, this guide is for you. It's also talking about how to report home ownership with your income tax return1. Basic knowledge of housing property tax

A home property could be land attached to a building such as Your Home, Office, shop, building or parking lot. The income tax law does not distinguish between commercial and residential real estate. All types of property are taxed under the head of “income from home property “on an income tax return. The owner for income tax purposes is a person who is its legal owner and can exercise the rights of the owner in his own right, and not on behalf of someone else.

If you use property for business or professional purposes, or to perform freelance work, it is taxed under the head of “income from business or profession". The cost of its repair and maintenance is allowed as business expenditure.

- Self-employed residential property

Self-occupied house properties are used for their own residential purposes. It can be occupied by the taxpayer's family–parents and/or spouses and children. Vacant house property is considered as self-occupied for income tax purposes.

Until 2019-20, if the taxpayer owns more than one self-occupied property, only one will be considered self-occupied property, and the rest will be put out. The choice of property to choose as self-occupied is up to the taxpayer.

From 2019-20, the number of self-employed workers will increase to 2 per cent. Now the homeowner can claim his 2 properties as self-occupied and remaining homes to be put out for income tax purposes.

b. Let the property in the House

A home property that is rented for the whole or part of the year is considered to let the home property for income tax purposes

C. Inherited properties

Inherited property, that is, property bequeathed again from parents, grandparents, etc., can be self-occupied property or released based on its usage as described above.

2. Way to calculate income from home property

Here's how you calculate your income from a home property:

- Determine the entire annual value of the property (GAV): the entire annual value of the self-occupied home is zero. For a let-out property, it is the rent collected for a rent home.

- Reduce property tax: property tax, when paid, is allowed as a deduction from the Gav of property.

- Determine internet annual value (NAV): net annual value=total annual value-property tax

- Reduce the NAV 30%towards the quality deduction: 30% of the NAV is allowed as a deduction from the NAV under Section 24 of the tax Act. Other costs, like painting and repairs, can't be billed as tax breaks above the 30% cap under this section.

- Reduce mortgage interest: deductions under Section 24 also are available for interest paid during the year of a useful mortgage.

- Determine the income from the house property: the resulting value is your income from the house property. This is often taxed at a rate of slab applicable to you.

- Loss from home property: when owning a self-occupied home, since there's no gav, claiming a mortgage interest deduction will end in a loss from the house property. During this case, the adjustment to the profit of others won't be.

Note: when a property is put out, its total annual value is that the rental value of the property. The rental value should be no but an inexpensive rent for the property determined by the municipality.

3. Mortgage decrease

- Tax credit on mortgage interest: Section 24 a home-owner can claim a deduction of up to Rs2lakh on mortgage interest if the owner or his family is present on the property of the House. An equivalent treatment applies when the home is vacant. If you owe the property, the interest on the whole mortgage is allowed as a deduction.

However, the deduction for interest is restricted to Rs. 30,000 rupees rather than 2 lakh if both of the subsequent conditions are met:

a. The loan are going to be taken after 1april1999 or

b. Purchase or construction isn't completed within 5 years from the top of the year when the loan was availed

When is the deduction limited to Rs30, 000?

As already mentioned, if the development of the property isn't completed within 5 years, the deduction of interest on the mortgage should be limited to Rs. 30,000. The 5-year period is calculated from the top of the financial year during which the loan was taken. So if the loan was taken on 30th April 2015, construction on the property would need to be completed by 31st March 2021. (The period before the 2016-17 fiscal year was 3 years, but the budget increased to five years in 2016).

Note: the interest deduction can only be charged from the financial year when the development of the property is completed.

How do I claim a decrease for a loan taken before the development of the property is completed?

Mortgage interest deductions can't be claimed when the home is under construction. It is often argued only after the top of construction. The amount from borrowing money to the completion of the development of the home is called the amount before construction.

The interest paid during this era is often claimed as a decrease in equal instalments ranging from the year the development of the property is completed. During this example, better understand the pre-construction interest.

B. Tax credit on principal repayment

Deductions to say principal repayment are available for up to Rs. 1, 50,000 Section 80C.Check your lender and appearance at the principal repayment amount or the instalment details of your loan within the general limit.

Conditions to say this deduction-

Mortgage

You must not sell the property within five years from the time it had been owned. In doing so, add the deduction to your income again within the year you sell.

Stamp duty and registration fees stamp tax and registration fees and other expenses directly associated with the transfer are allowed as deductions under Section 80C and a maximum deduction of Rs1.5 lakh please charge these expenses within the same year you create those payments.

C. Tax credits for first-time homeowners: Section 80EE

Section 80EE recently added to the Income Tax Act provides homeowners, with a tax benefit of up to Rs 50,000, only the property of the house on loan sanctions date.

D. Tax credits for first-time homeowners: section 80eea

The new section 80EEA is added to extend the tax benefits of mortgage interest deductions taken for affordable housing between 1April2019 and 31March2020 under the amount of what an individual taxpayer does not have the right to be 80EE.

Click here to read more. These benefits are not available for properties under construction.

Do you own multiple homes?

If you own multiple homes, you will need to submit an ITR-2 form.

See the ITR-2 form guide here.

4. Mortgage deduction claims

- The amount of deductions you can claim depends on the share of ownership you have on the property.

- The mortgage should also be in your name. Co-borrowers can also claim these deductions.

- The mortgage deduction can only be charged from the financial year when construction is completed.

- Submit a mortgage rate certificate to the employer as a source of adjusted tax credits. This document contains your ownership share, borrower details and EMI payment interest and principal split information.

- Otherwise, you may need to calculate the tax yourself and request a refund upon tax return. It is also possible that if you have taxes to pay, you may need to deposit the membership fee on your own.

- If you are a self-employed or freelancer, you don't even need to submit these documents to your IT department anywhere. You need them to calculate your pre-tax liabilities quarterly. You need to keep them safe to answer any queries that might arise from your IT department or your own records.

5. Tax advantages of mortgages for co-owners

In addition, co-owners who are co-borrowers of self-occupied home property can claim deductions for mortgage interest up to Rs2lakh each. And principal repayment deductions, including deductions for stamp duty and registration fees under Section 80C within the Rs overall limit.1.5 lakh for each of the co-owners. These deductions can be charged at the same ratio as the ownership share of the property.

In addition, the loan is communal, unless the owner of the property–you cannot pay taxes. There have been situations where the property is owned by the parent and the parent and child together take a loan that is paid off only by the child. In such cases, a child who is not a co-owner lacks tax incentives for a mortgage.

Therefore, to claim tax breaks on property:

1. You must be the co-partner of the property

2. You must be a co-borrower on the loan

Each co-owner may claim a deduction of up to Rs 80lakh towards repayment of principal under Section 1.5 C. This is within the overall limit of Rs 1.5 lakh in Section 80C.Therefore, you can take advantage of the large tax benefits against the interest paid on the mortgage when the property is co-owned and your interest outgo exceeds Rs2lakh per year.

It is important to note that once the construction of the property is completed, tax benefits of both mortgage interest and principal repayment deductions can be claimed under Section 80C.

6. HRA and Deduction on Home Loan

7. Case study

Aditya earns rental income from his house in Vizag. Look at the GAV and NAV calculations, such as for due dates, if you cannot pay taxes.

8. Here's an example of the big budget changes and impacts of 2017

Until the 2016-17 fiscal years, losses under the main family property can be set off against other heads of income without any restrictions. However, in the 2017-18 financial years, it is limited to 2 million units. This amendment would not actually affect taxpayers with self-occupied house property. The move will affect taxpayers who are letting out/renting their property. There is no bar on the amount of interest on the mortgage, which can be claimed as a deduction under Section 24 for property in rental housing, but the losses that may arise for such interest payments can be set off only in the range of Rs2lakhs.

Here are some examples to help you understand the impact of the amendment:

Particulars | AY 2017-18 | AY 2018-19 |

Salary income | 10,00,000 | 10,00,000 |

Income from other sources (Interest income) | 4,00,000 | 4,00,000 |

Income from house property (*) | (4,40,000) | (2,00,000) |

Gross Total Income | 9,60,000 | 12,00,000 |

Deductions | 2,00,000 | 2,00,000 |

Taxable income | 7,60,000 | 10,00,000 |

Tax on the above | 77,000 | 1,12,500 |

Additional tax outgo excluding cess in AY 2018-19 on account of the amendment |

| 35,500 |

Workings for Income from House Property

Particulars | AY 2017-18 | AY 2018-19 |

Property A |

|

|

Annual Value | Nil | Nil |

(-) Interest on housing loan restricted to | 2,00,000 | 2,00,000 |

Loss from House Property(A) | (2,00,000) | (2,00,000) |

Property B |

|

|

Net income from House Property after all deductions (B) | 60,000 | 60,000 |

Property C |

|

|

Annual Value | 5,00,000 | 5,00,000 |

Less : Standard Deduction | 1,50,000 | 1,50,000 |

Less : Interest on loan | 6,50,000 | 6,50,000 |

Loss from House Property (C) | (3,00,000) | (3,00,000) |

Total income from house property (A+B+C) | (4,40,000) | Restricted to (2, 00,000). Balance loss of Rs 2.4 lakh can be carried forward for the next 8 AYs |

![100% Off] Start Making Passive Income Online: The Complete Bundle [Updated] Udemy Coupon - Real Discount](https://glossaread-contain.s3.ap-south-1.amazonaws.com/epub/1643010914_0631711.jpeg)

What is Business and Profession?

Income from a business or occupation can only be taxed if the business or occupation is carried by the taxpayer at any time during the previous year. Let's first understand what business is.:

Business, in simple words, means a profession carried by a person with a view to profit. Business does not include profits from the profession or affiliated companies. In this business、 –

- Trade,

- Commerce,

- Manufacturing,

Think of things as rendering services and other businesses

For example: owning a store, running a hotel, transportation, travel agency, share broking, etc. a profession may be defined as a profession, or a job that requires thought, skill and special knowledge. Thus the profession refers to those activities whose livelihood is obtained by persons through their intellectual or manual skills such as:

- Legal

- Medical

- Engineer

- Certified Public Accountant

- Architecture, etc.

Income arising from the above activities is taxed under the heading “income from business and profession".

Managing accounts

In the case of business

- A business that meets one of the following criteria must maintain accounting books in accordance with the income tax law:

- Income over 1, 20,000 Indian rupees or,

- Total sales, sales or receipts have exceeded INR10, 00, 000 in any of the previous years

In addition, this condition is relaxed when individuals and HUF are bound by the obligation to maintain the books:

- Income INR2. 5 lakh or higher,

- Total sales, sales or gross receipts are greater than INR 25 Lakh in any of the last 3 years.

In the case of occupation

Taxpayers who carry out any of the above occupations are required to maintain an accounting book in accordance with rule 6F of the income tax rules. These specialists are required to maintain accounting books if the gross receipts exceed 1.5 INR3Lakhs in any of the previous years.

Income imposed under business and profession

The income earned by the taxpayer with the intention of earning a profit is covered under the head of the business and profession. There are 3 types that are defined for businesses and occupations under the Income Tax Act:

- Non-speculative business/profession: includes profit/loss from all normal business carried by taxpayers. Any salary, remuneration, fees, etc. received by the partner from the Partnership Company are also considered to be the business and professional income of the partner. But the same is exempt from taxes in the hands of partners.

- Speculative business: as the name implies, it is a profit/loss by doing a speculative transaction i.e. without taking the actual delivery of the goods, i.e. profit from a speculative business (for example. Stock transactions) are paid under this head and they should be maintained and displayed separately while e-filing income tax returns

- Specific business: includes profit/loss from business as defined in Article 35 of the Income Tax Act. These businesses include affordable housing planning, Water Manufacturing Units, etc.

However, the following are income that is not charged as income from business or occupation:

- Profits from activities other than the above mentioned businesses will appear as casual income and will appear under income from other sources

- Income from salaries, remuneration, bonuses, etc., received by the directors of the company, is treated as salary income, and not as business and professional income.

Allowable expenses from business and occupational income

All expenses incurred in full and exclusively with respect to business and profession shall be allowed for income from such business and profession. Here's some of the spending:

- Building rent and insurance.

- Payment for legal and professional services.

- Salaries, bonuses, commissions, etc. to employees.

- Salary, interest and compensation for partners who work under certain conditions.

- Cost of travel and transmission.

- Admission fee and annual membership fee

- Payment of know-how, patents, copyrights, trademarks and licenses.

- Depreciation of fixed assets.

- Expenditure on scientific research for business purposes.

- Preliminary expenses in the case of the company.

- Communication costs

- Discounts are allowed to customers.

- Advertising costs for the promotion of business products.

- Financial expenses (eg. Interest on the loan).

- Bank fees/bank fees.

- Entertainment/business promotion costs.

- Staff benefits costs.

- Cost of printing and stationery.

- Cost of shipping cost.

- All other expenses related to business/occupation.

All these costs are allowed on the basis of actual payments and on the basis of accrual on the last day of the account. For example: an employee will receive a salary for the month of May 2020 in April 2020. However, since the salary is related to the 2019-20 financial year (ending on 31st March 2020), it is not necessary to charge for income from business/professional income for the 2019-20 financial year.

Costs allowed only on a payment basis

Certain illustrations to help explain it are given below:

- Any taxes, duties, cess or fees by whatever name is called.

- Expenses directed at contributions to the provident fund, the employee's state insurance premium, the chip fund, or other funds for the welfare of the employee.

- Leave a bonus, commission or encashment to be paid to employees.

- Interest on loans from public financial institutions, state financial corporations or planned banks.

Calculation of taxable income from business and profession

Taxable income from business and occupation is profit after deducting costs associated with business activities. Taxpayers can find profits from the books maintained during the year. Income obtained from business and occupation is taxable at the slab rate that applies to taxpayers. Slab charges applicable in 2019-20 / 2020-21 are as follows:

Total Income | Tax Rate |

Up to INR 2,50,000 | NIL |

INR 2,50,000 to 5,00,000 | 5% |

INR 5,00,000 to INR 10,00,000 | 20% |

Above INR 10,00,000 | 30% |

An additional 4% Health and Educational Cess will be applicable to the tax amount calculated.

Set of losses from business and profession and carryover

- Non-speculative business losses can be set off against any income other than salary in the current year. Taxpayers can carry forward the remaining losses for 8 years and set off against business income in future years.

- Speculative business losses can be offset against speculative business income only. The taxpayer can carry forward the remaining loss for 4 years and offset it only for future speculative business income.

- Specify the business loss can be set against any income other than salary in the current year. Taxpayers can carry forward the remaining losses for 9 years and set off against business income in future years.

TDs / advance tax on income from business and occupation

The taxpayer is required to pay taxes on the income obtained from business or professional activities. Direct tax on income can be paid in 2 ways:

- TDS (withholding tax): TDS to pay while you earn the concept is deducted on payments made to taxpayers for goods and services sold. Hence business owners need to keep in mind the TDS that are deducted by their customers. You can claim deductible TDs while submitting an ITR for a business or occupation. And if there is any loss from B&P it will become your refund, and if you get any profit from B&P it will reduce your tax liability.

- Advance tax: if the tax liability is expected to exceed Rs. 10,000, the taxpayer must calculate and pay the advance tax. This is to avoid interest under sections 234B and 234C:

Due date of installment | Advance Tax payable by Individual and Corporate Taxpayers |

On or before 15th June | 15% of the tax liability |

On or before 15th September | 45% of the tax liability |

On or before 15th December | 75% of the tax liability |

On or before 15th March | 100% of the tax liability |

Taxes for freelancers

Freelancers are people who are self-employed. They have the freedom to choose their own projects and assignments. They do not earn salary income. The nature of their income is more professional income. Therefore, it is covered under the head" income from business and occupation "under the Income Tax Act.

The sum of all receipts received from different projects will be income. And all costs associated with freelancers will be deducted. Below are the taxable incomes of freelancers:

Net taxable income=gross receipts–freelance expenses

What is speculative business income filing your tax return?

First of all, to understand speculative business income, you need to understand what speculative trading is.

When a contract for the purchase and sale of goods (including stocks and shares) is regularly or eventually settled without the actual delivery or transfer of the goods, it is called a speculative transaction, and if it is to receive income from such transactions, it will be income from speculative transactions.

One example of a speculative business is a stock brokerage, where a broker earns money by buying and selling goods without taking delivery of the same. Income from ordinary business and speculative business is calculated and maintained separately.

Estimated taxation scheme

Estimated taxation schemes have been introduced to give relief to small taxpayers from the tedious work from keeping a book of accounts and getting audited accounts. Estimated taxation schemes can be selected by Indian individuals, Huf, and partnership companies.

Experts with total income up to INR50Lakhs can opt for an estimated taxation scheme in which they can provide 50% of the total income as taxable income and pay taxes according to the slab rate applied to such income. When taxpayers opt for this scheme, they cannot claim any of the occupational-related costs as deductions.

Applicability of tax audit

Tax Audit is applicable to Companies with total sales of INR 1Cr or higher. It is responsible for the tax audit during the fiscal year. Taxpayers are required to electronically submit Form 3CD for the tax audit report. In addition, Finance Minister Nirmala Sitharaman announced that the due date for the tax audit for the current fiscal year has been extended to October31, 2020, from September30, 2020

In the case of a profession, the taxpayer is responsible for conducting a tax audit if the total receipt under this income head exceeds INR50Lakhs during any fiscal year. If the taxpayer did not audit the accounting books, he is responsible for paying fines of up to 0.5 lakh of 1.5% of the total income or lower.

ITR forms and document checklist

The ITR3 form is for individuals or HUF with income from a business or profession, from a Partnership Company/LLP. Simply put, ITR3 should be submitted when income is obtained under the head" profit or profit of a business or profession". It is also submitted if a tax audit is applied. However, experts can choose an estimated taxation scheme and declare 50% of total income as income by submitting ITR 4AY from 2017-18.

GST applicability and return application

If the turnover from the business exceeds Rs, then the GST (goods and services tax) is also applied 40 lakh in a particular fiscal year. For the profession, if your receipt exceeds Rs, then GST will apply. 20 LAX one must take the registration of the GST and file the return of the GST as well. The types of GST registration are:

- Mandatory registration,

- Optional registration,

- Complex scheme registration.

Basis of income charges under business and profession under Section 28

The income imposed under" profit and profit of a business or profession" is as follows:

- Profits and profits from any business/profession carried by the assessor at any time during the previous year

- Any compensation/other payment received by or by,—any person, by any name,to cover the whole or significant whole of the affairs of the Indian company.

- Profit from the acquisition of trade from the Association of certain services performed by its members

- Value of any perk/profit from business or profession, whether it is converted into money

- Interest, fees, salaries, rewards, or bonuses received by or from company partners

- All sums received under the key man insurance policy, including the sum given as a bonus

- Income from any speculative transactions

- Any sum, whether received/Accounts Receivable, Cash/for type:

- To not perform any acts related to any business, or

- To not share know-how, patents, copyrights, trademarks, licenses, franchises or other business/commercial rights

- Profit incurred by transfer of Duty-Free replenishment certificate

- Any profits made by the transfer of Duty qualified passbook scheme

- Profits made from the sale of licenses made under the import (control) instruction, 1955, import and Export (Control) Act, 1947 (18 of 1947))

- Tax-free income under business and occupation

Well, let us look at tax-free income under the head "interests and interests of business and profession:

Rent of home property: it is taxable under the head "income from home property". Even, if the property constitutes a share transaction of the recipient of the lease, or he has a business to let the property into the lease.

This is taxable under the head "income from other sources": equity dividends considered. However, dividends received from the Indian company cannot be taxed in the hands of shareholders. Even, if we consider it a regular business activity.

From business or occupation--additional amortization

It can be claimed in new plant & machine acquired after 31st march2005 by assessors

- The year before it starts manufacturing or production.

- Additional depreciation rate: 20% of the actual cost.

Non-absorption amortization Section 32 (2)

- If the profit for the year is not enough to fully or partially absorb depreciation,

- Depreciation, which is not absorbed, can be deducted from the head of other income. If it still remains

- It can be carried over to a year of subsequent assessment to be regulated against which it is not absorbed.

Gains or gains arising from the transfer of capital assets held as investments, gains or gains arising from the transfer of capital assets held as investments, gains can be for short-term and long-term benefits. Capital gains occur only when capital assets are transferred. That is, if the transferred asset is not a capital asset, it will not be covered under the head capital gain. Any profit or profit generated in the previous year from which the transfer was made shall be considered income of the previous year and shall be subject to income tax, if the concepts of head capital gains and indexation apply.

Capital assets: it is any property held by the assessor of income tax except Jewellery, drawings, paintings

Items held for a person's business or profession (inventory, ready goods, raw materials) are taxed under the head of the interests and interests of the business or profession

Agricultural land means land on which agricultural income is obtained. Land that is outside the city, not the municipality, 8 kilometres, and whose population is less than 10,000, is eligible to be agricultural land

There are two types of capital assets: short-term capital assets and long-term capital assets.

Short-term capital assets: this is an asset held for no more than 36 months immediately before the transfer date. This period of 36 months is replaced by 12 months in the case of certain assets such as shares held in the company or preferred shares, other security listed on the recognized stock exchange of India, certain stocks mutual funds and units of zero coupon bonds.

Long-term capital asset: this is an asset that is held for 36 or 12 months or more in some cases. A transfer is defined as the sale of an asset, the waiver of rights to the asset, the compulsory acquisition by law, or the maturity of the asset. Many transactions are not considered transfers, such as transferring capital assets under a will. If a unit of a stock or stock diversification mutual fund held for more than a year, it is subject to long-term capital gains. In the case of real estate, if it is held for more than two years, it is eligible for long-term capital gains. Earlier in the financial Act 2017, Real Estate was considered as a long-term capital asset only if it was held for more than three years.

Capital gains: any profit or profit arising from the transfer of capital assets made in the previous year shall be levied on income tax under the head capital gains. Examples of assets are flat or apartment, land, stocks, mutual funds and gold among many others. Types of gains:

Short-term capital gains: capital gains resulting from the transfer of short-term capital assets.

Long-term capital gains: capital gains resulting from the transfer of long-term capital assets.

Tax on Short-Term and Long-Term Capital Gains

Tax Type | Condition | Tax applicable |

Long-term capital gains tax | Except on sale of equity shares/ units of equity oriented fund | 20% |

Long-term capital gains tax | On sale of Equity shares/ units of equity oriented fund | 10% over and above Rs 1 lakh |

Short-term capital gains tax | When securities transaction tax is not applicable | The short-term capital gain is added to your income tax return and the taxpayer is taxed according to his income tax slab. |

Short-term capital gains tax | When securities transaction tax is applicable | 15%. |

Tax on Equity and Debt Mutual Funds

Gains made on the sale of debt funds and equity funds are treated differently. Any fund that invests heavily in equities (more than 65% of their total portfolio) is called an equity fund.

Funds | Effective 11 July 2014 | On or before 10 July 2014 | ||

Short-Term Gains | Long-Term Gains | Short-Term Gains | Long-Term Gains | |

Debt Funds | At tax slab rates of the individual | At 20% with indexation | At tax slab rates of the individual | 10% without indexation or 20% with indexation whichever is lower |

Equity Funds | 15% | Nil | 15% | Nil |

Capital gains:

- The assessor must own capital assets

- The assessor must have transferred capital assets in the previous year.

- There must have been a profit or profit as a result of such a transfer

Capital gains calculation

In accordance with Section 10 (38) of the Income Tax Act 1961, the Securities and Exchange tax (STT) is deducted and paid for the long-term capital gains of stocks or securities or mutual funds.

Indexation concepts

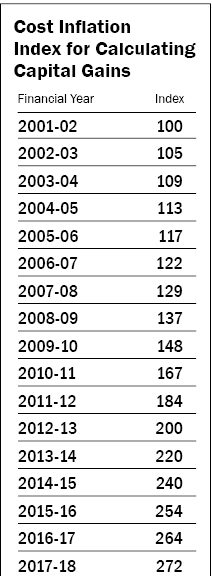

The value of today's rupee is not the same as it will be the value of tomorrow due to inflation. The same applies to equitable payment of capital if there is a tax effect, the inflation rate of the purchase is included. For example, if you bought a flat in May 2002 for 20lakh for RS and sold it in May 2017 for 60lakh for Rs; You Do not pay taxes on Rs 40lakh gay allow the concept of indexing so that the tax authorities can reduce the taxes paid on profits, lowering the overall profit, indicating higher purchase costs. How to use it? Using the inflation index, it is necessary to increase the purchase price of the asset to reflect the true price after the inflation-adjusted for the year of sale.

Indexed acquisition cost= (the cost inflation index (CII) of the year in which the asset was transferred or sold) divided by the CII of the year in which the asset was acquired or purchased). So, in the above example, the year in which assets are transferred or sold is 2016-17, and the 2011 cost inflation index (CII) =264. The year in which the asset was acquired or purchased is 2001-2002, with the cost inflation index (CII) =2001-02. Thus, the cost inflation index (CII) =264/100=2.64

Then multiply the CII by the purchase price to reach the indexed acquisition cost, which is the actual or true cost at the time of tax calculation or calculation. Indexed acquisition cost=Rs20,00,000x2.64=Rs52,80,000 therefore long-term capital gain=full value of sale-indexed acquisition cost=Rs60,00,000-Rs52,80,000 = Rs7,20,000

Tax liabilities linked to fixed assets and not linked

For long-term capital gains, tax liability is lower than the amount arrived by two:

20% tax liability has arrived by the indexing act

10% tax liability arrived without using indexing method

In the above example, using indexing, the tax liability would be (20/100) x7, 20,000=Rs1, 44,000. Without indexing: capital gain=selling price of the asset-acquisition cost=60, 00,000-20, 00,000=Rs40, 00, 000. The capital gains tax on this is 10 per cent= (10/100) x40, 00,000=Rs4, 00, 000. This is an advantage to use indexation as it benefits in tax savings.

- Guide to the acquisition of funds profit statement from the cam data read the Clear Tax.

Rather than entering details manually, simply view your investment performance, capital gains and losses for the present and last fiscal year across cams service funds.

2. Guide to the acquisition of funds profit statement from KARVY Data read the Clear Tax.

Rather than entering details manually, simply check your investment performance, capital gains and losses for the current and last financial year across the KARVY Service Fund.

3. Guide to get funds profit statement from ZERODHA data read, Clear Tax

Instead of entering details manually, you can upload a realized gain statement, which is the integration of investment performance, capital gains and income for the current and last financial year of the entire ZERODHA Service Fund

4. Capital gains exemptions

Example: Manya bought a house in May 2004 for 50lakh,and the full value of the consideration received in the 2016-17 fiscal year is Rs1. 8crore. Since this property has been held for more than 3 years, this will be a long-term capital asset. The cost is adjusted for inflation and the indexed cost of the acquisition is taken. Using the indexed cost of the acquisition formula, the adjusted cost of the house is Rs1.17crore. The net capital gain is Rs63, 00, 000. Long-term capital gains are taxed at 20%. For a net capital gain of Rs63, 00,000, the total tax amount is Rs12, 97,800. This is a significant amount of money paid in taxes. This would benefit from the exemption provided by the Income Tax Act on capital gains when profits from a sale are reinvested in buying another asset.

Section 54: exemption on the sale of home property within the purchase of other home property

Budget 2019 announcement!

- Exemption of capital gains under Section 54: however, capital gains on the sale of residential property shall not exceed Rs2crores, until the assessor has two House properties against the previous offer of one house property on the same terms.

- Exemptions under Section 54 are available when capital gains from the sale of residential property are reinvested in the purchase or construction of another residential property (prior to the 2019 budget, capital gains exemptions were limited to 1 residential property only).Exemptions for two-home properties are allowed once in a taxpayer's lifetime unless capital gains exceed Rs. Crowless 2-piece set taxpayers need to invest capital gains amounts rather than the entire sale proceeds. If the purchase price of the new property is higher than the amount of capital gains, the exemption shall be limited to the sum of capital gains at the time of sale.

- Conditions for this benefit to be useful

- The new property are often purchased either 1 year before the sale or

- Years after the sale of the property.

- Profit can also be invested in the construction of the property, but the construction must be completed within three years from the date of sale.

- The 2014-15 budgets reveal that only 1 House can be bought or built from capital gains to claim this exemption.

- Please note that if this new property is sold within 3 years of the completion of its purchase/construction, you can regain this exemption.

Section 54F: exemption from capital gains in the sale of assets other than residential real estate

If there is a capital gain from the sale of long-term assets other than residential real estate, an exemption under Section 54F is available. Buying a new residential property claiming this exemption should be considered for the entire sale and invest capital gains as well as buying a new property either one year before the deal or 2 years after the deal of the property. You can also use the profits to invest in the construction of the property. However, the development must be completed within 3 years from the date of sale. The Budget 2014-15 reveals that only 1 House can be bought or built from sale to claim this exemption. If this new property is sold within 3 years of purchase, this exemption can be recouped. If the entire proceeds of the sale are invested in a new home, the entire capital gain will be exempt from taxes if the above conditions are met. However, if you invest a portion of the proceeds from the sale, the capital gain exemption will be a percentage of the amount invested in the sale price=capital gain x new house expenses/net consideration.

Section 54EC: exemptions on the sale of home property on reinvestment in certain bonds

Exemptions are available under Section 54EC if the capital gains from the sale of the first property are reinvested in a particular bond.

- If you are not keen to reinvest your profits from the sale of your first property to another, invest in bonds up to Rs 50 lakh issued by the National Highway Administration of India (NHAI) or Rural Electrification Corporation (REC).

- The invested money can be redeemed after 3 years, but not before 3 years from the date of sale. From fiscal 2018 to fiscal 2019, the 3-year period has been extended to 5 years.;

- Homeowners have six months ' time to invest profits in these bonds. However, to be able to claim this exemption, you must invest by the tax filing deadline.

When can I invest in a Capital Gains Account Scheme?

Finding a suitable seller, placing the necessary funds and getting documents in place for a new property is a time-consuming process. Fortunately, the Income Tax department agrees with these restrictions. If the capital gains are not invested until the filing date of return (usually 31July) for the fiscal year in which the property is sold, the profit is not required to pay taxes, the Capital Gains Account Scheme, 1988 this deposit can be claimed as an exemption from the capital gains. However, if the funds are not invested, the deposit shall be treated as a short-term capital gain for the years after the specified period has passed.

5. Tax savings on the sale of farmland

In some cases, capital gains from the sale of agricultural land may be exempt from income tax entirely or not taxed under the head of capital gains.

- Agricultural land in rural areas of India is not considered a capital asset, so the profit from the sale is not taxed. For more information about what defines agricultural land in rural areas, see above.

- Do you have farmland as trading stock? In such cases, if you are buying and selling land regularly or in the course of your business, the profit from its sale is subject to taxation under the head business and profession.

- Capital gains on compensation received for compulsory acquisition of urban agricultural land are tax-free under Section 10 (37) of the Income Tax Act.

If farmland is not sold out, you can also claim an exemption from the bottom 54B.

Section 54B: exemption from capital gains from the transfer of land used for agricultural purposes

The amount exempted is an investment in a new asset or capital gain. It is necessary to reinvest in new agricultural land within 2 years from the date of transfer. New farmland purchased to claim capital gains exemption should not be sold within 3 years from the date of purchase. In accordance with the Capital Gains Account Scheme of 1988, the exemption of the public sector bank or IDBI Bank may be charged for the amount deposited if the farmland cannot be purchased by the date of filing the income tax return. If the amount deposited by the capital gains account method is not used for the purchase of farmland, it is treated as the capital gain for the year after the expiration of the 2-year period from the date of sale of the land. If you want to know more about the potential of good capital gains and investment choices, invest in Clear Tax investments. Our carefully selected plans will help you build the best portfolio for your financial goals and risk profile.

Income that cannot be taxed under the head of other income and should not be excluded from gross income must be taxed as residual income under the head of "income from other sources".

All types of income not covered by the above head are covered under this head and are paid. Income from other sources is provided for in Section 56 of the act. Some of these are:

- Dividends in Section 2 (22));

- Win from lotteries, horse racing, crossword puzzles, and other games;

- Contributions received by the employer as evaluator from his work towards staff welfare schemes;

- Interest on corporate bonds, government bonds/bonds;

- If the assessor leaves to the contract apparatus, plants or furniture belonging to him and further buildings, then the payment from this can be assessed as a salary from other sources, if it is not taxable under the head of “interests and interests of business or profession”;

- Total received under the key man insurance policy, including compensation;

- Salary from hardware, factory or furniture belonging to the assessor.

Gift that cannot be charged:

- Gifts received from relatives

- Gifts received during marriage

- Gifts are given by local authorities

- Gifts received in the form of inheritance

- Gifts received from any funds, institutions, hospitals, etc.

Basis of Charge [Sec. 56]: |

S.No | The nature of income that's taxed as residential income |

Dividends | |

2. | Income through winnings from races including lotteries, crossword puzzles, racing , card games, gambling and bets of any form or nature |

3. | The amount received by the employer from the worker as a contribution to the PF/ESI/retirement fund, etc. If an equivalent isn't deposited within the relevant fund, it's not taxable under the top "profit and take advantage of business or profession". |

4. | Interest on securities doesn't comes under this head |

5. | If the income and income from machinery, factories or furniture belonging to the taxpayer can't be taxed under the top, then you'll hire a “business or occupation profit". |

6. | Letting such is inseparable and such income isn't taxable under the top combined income from letting of buildings and plants, machinery and furniture “business". |

7. | If the top isn't taxed under the “benefits and benefits of business or profession “or the head “salary", the sum of all received under the key man insurance contract (including bonuses) is calculated |

8. | Any amount or property received by a private or HUF from a person (except from a relative or member of HUF, or in certain circumstances, see Note 1) shall be deemed to be "the property of another person.” a) if the sum is received inconsiderately beyond Rs. 50,000 during the previous year, the complete amount shall be taxed; b) if the estate is received inconsiderately and therefore the stamp tax value exceeds Rs. 50,000, the stamp tax value of such property shall be taxed; C) if the property is received for consideration that's less than the stamp tax value of the property, the difference are going to be taxed: (i)the amount of Rs. 50,000 (ii)The amount adequate to 10% of the consideration. e) If the movable property is received for consideration in more than Rs but the sum of the fair market price of the property; 50,000, the difference between the mixture fair market price and consideration are going to be charged to taxes. |

9. | If the shares of a closely held company are received from the corporate or other closely held company inconsiderately or thanks to insufficient consideration, taxes could also be levied if there's a complete fair market price of such shares reduced by consideration paid. Note: if the taxable amount doesn't exceed Rs, nothing is going to be taxed. 50,000. |

10. | If the general public company receives consideration for the issuance of shares that exceed the fair market price of such shares, the entire amount of consideration reduced by the fair market price of such shares are going to be deducted from the fair market price of such shares. Note: this provision doesn't apply within the following cases: a) Consideration of the amount of shares issued or risk capital business from risk capital companies or risk capital funds. b) When the corporate receives consideration for the issuance of shares from a category or an individual of a category notified by the govt.

|

10A

| Compensation received by an individual in reference to the termination of his employment or changes within the conditions related to it. |

11. | Interest received in reward or enhanced reward |

12. | The amount received beforehand or otherwise within the process of negotiations for the transfer of capital assets must be taxed under this head. a) Such amounts are going to be confiscated. b) negotiations don't end in the transfer of such capital assets; |

Deduction [Section 57]]:The following expenditures are allowed as deductions from taxable income under the top of “other sources income:

S.N. | Section | Nature of income | Deductible |

| 57(i) | Dividends or interest on securities | A reasonable amount paid to a bank or other person through a commission or reward to understand dividends or interest on securities |

2. | 57(ia)

| Contribution of employees to the set-up of provident fund, old-age pension , ESI fund or other funds for the welfare of such employees | If the employee's contribution is credited to the account of the relevant Fund on or before the maturity |

3. | 57(ii)

| You can get income for a plant, machine, furniture or building

| Rent, fees, taxes, repairs, insurance and depreciation etc. |

4. | 57(iia) | Family pension

| 1/3 of the topic of family pension to a maximum of Rs. 15,000. |

5. | 57(iii)

| Other income | Other expenditures (not capital expenditures) are spent entirely and exclusively to get such income |

6. | 57(iv)

| Interest on compensation or enhanced compensation | 50% of such interest (depending on specific conditions) |

7. | 58 (4)

| Income from racehorse ownership and maintenance activities. | All expenditures associated with such activities. Non-deductible expenses[Article 58] |

Expenses not deductible [Section 58]:

S.No | Section | Nature of income |

58(1)(a)(i) | Personal expenses | |