UNIT 1

MONEY

DEFINITION OF MONEY

Money is an economic unit that functions as a generally recognized medium of exchange for transactional purposes in an economy. Money provides the service of reducing transaction cost, namely the double coincidence of requirements. Money originates in the kind of a commodity, having a physical property to be adopted by market participants as a medium of exchange. Money can be: market-determined, officially issued legal tender or fiat moneys, money substitutes and fiduciary media, and electronic crypto currencies.

Meaning:-

Money is also anything chosen as the medium of exchange. As per some economist money is anything that performs the function of cash . It's something which is widely accepted in payment for goods and services and in settlement of debts. During a modern society for commodities are expressed and valued in terms of money. During a wider sense, the term money includes all medium of exchange – Gold, Silver, Copper, Paper, Cheques, Commercial Bills of exchange, etc.

UNDERSTANDING MONEY

Money is usually stated as currency. Economically, each government has its own money system. Crypto currencies also are being developed for financing and international exchange across the world.

Money is a liquid asset utilized in the settlement of transactions. It functions based on the overall acceptance of its value within a governmental economy and internationally through foreign exchange. The present value of monetary currency isn't necessarily derived from the materials wont to produce the note or coin. Instead, value springs from the willingness to comply with a displayed value and believe it to be used in future transactions. This is often money's primary function: a generally recognized medium of exchange that people and global economies shall hold as and are willing to simply accept as payment for current or future transactions.

Economic money systems began to be developed for the function of exchange. The utilization of money as currency provides a centralized medium for purchasing and selling in a market. This was first established to exchange bartering. Monetary currency helps to supply a system for overcoming the double coincidence of requirements . The double coincidence of requirements is a ubiquitous problem during a barter economy, where so as to trade, each party must have something that the opposite party wants. When all parties use and willingly accept an agreed-upon monetary currency, they'll avoid this problem.

In order to be most useful as money, a currency should be: 1) fungible, 2) durable, 3) portable, 4) recognizable, and 5) stable. These properties make sure that the advantage of reducing or eliminating the transaction cost of the double coincidence of requirements isn't outweighed by other sorts of transaction costs related to that specific good.

Fungible

Units of the good should be of relatively uniform quality so that they're interchangeable with each other . If different units of the good have different qualities, then their value to be used in future transactions might not be reliable or consistent. Trying to use a non-fungible good as money results in transaction costs of individually evaluating each unit of the great before an exchange can happen .

Durable

The physical character of the good should be durable enough to retain its usefulness in future exchanges and be reused multiple times. A perishable good or a good that degrades quickly with use in exchanges won't be as useful for future transactions. Trying to use a non-durable good as money conflicts with money's essentially future-oriented use-value.

Portable

It should be divisible into small quantities in order that people appreciate its original use value highly enough that a worthwhile quantity of the good can be conveniently carried or transported. An indivisible good, immovable good, or good of low original use-value can create issues. Trying to use a non-portable good as money could produce transaction costs of either physically transporting large quantities of the low value good or defining practical, transferable ownership of an indivisible or immobile object.

Recognizable

The authenticity and quantity of the good should be readily ascertainable to the users in order that they will easily comply with the terms of an exchange. Trying to use a non-recognizable good as money produces transaction costs of agreement on the authenticity and quantity of the products by all parties to an exchange.

Stable

The value that people place on a good in terms of the opposite goods that they're willing to trade should be relatively constant or increasing over time. a good whose value varies widely up and down over time or consistently loses value over time is less suitable. Trying to use a non-stable good as money produces transaction costs of repeatedly revaluing the good in each successive transaction and therefore the risk that the exchange value of the good might drop below its other direct use-value or not be useful in the least , during which case it'll not circulate as money.

Money may be a generally accepted, recognized, and centralized medium of exchange in an economy that's used to facilitate transactional trade for goods and services.

The use of cash eliminates issues from the double coincidence of requirements which will occur in bartering.

Economically, each government has its own money system, defined and monitored by a central authority.

Crypto currencies represent a new type of money, with international exchange opportunities.

FUNCTIONS OF MONEY

As stated above, money primarily functions as a medium of exchange. However, it also has developed secondary functions that derive from its use as a medium of exchange. These other functions include: 1) a unit of account, 2) a store of value, and 3) a standard of deferred payment.

Unit of Account

Due to its use as a medium of exchange for both buying and selling and its use to assign prices to all kinds of other goods and services, money can be used to keep track of the money gained or lost across multiple transactions and to compare money values of various combinations of different quantities of different goods and services mathematically. This makes things such as accounting for profit and loss of a business, balancing a budget, or valuing the total assets of a company all possible.

Store of Value

Because money's usefulness as a medium of exchange in transactions is inherently future-oriented, it provides a means to store value obtained through current production or trade for use in the future, in the form of other goods and services. In particular trading their non-fungible, non-durable, non-portable, non-recognizable, or non-stable goods or services for money here and now, people can store the value of those goods to trade for goods at other times and places. This facilitates saving for the future and engaging in transactions over long distances possible.

Standard of Deferred Payment

To the extent that money is accepted as a general medium of exchange and serves as a useful store of value, it can be used to transfer value for exchange use at different times between people through the tools of credit and debt. One person can loan a quantity of money to another for a period of time to use and repay another agreed-upon quantity of money at a future date. The stored value represented by the loaned money is transferred from the lender to the borrower in exchange for an agreed quantity of stored value in the future. The borrower can then use and enjoy the value of other goods and services that they can now purchase in exchange for payment at a later date. The lender in effect is able to loan the current use of real goods and services, which he does not himself originally possess, to the borrower. The sellers of the goods are able to receive payment for their goods now instead of loaning the goods directly to the borrower in hope of future return or repayment.

Functions of Money:-

Money performs various functions. Mainly the functions of money can be classified into three groups’ namely Primary functions Secondary function Contingent functions

Primary function: Primary functions are basic or fundamental function of money. Infact, they are the original functions of money which ensure smooth working of the economy. Following are the primary functions:

Medium of exchange: Money acts as an effective medium of exchange. It facilitates exchange of goods and services. Everything is bought and sold with help of money. By performing as the medium of exchange, money removes the difficulties of barter system.

Measure of value: Money serves as a common measure of value. The value of all goods and services are measured in terms of money. In other words, pieces of all goods and services are expressed in terms money.The pricing system unable a compare the value of different goods and services and each the right choice.

Secondary function: Secondary functions are those functions which are derived from primary function.

Standard of deferred payment: Money acts as an effective standard of deferred payments. Deferred payments refer to payment to be made in future. Deferred payments have become the day to day activity in modern society. Money facilitates all kinds of credit transactions. Both, borrowings as well as lending are done in terms of money. All kinds of Hire purchase transactions are carried out in terms of money. As money enjoys the attributes of stability, Durability and General acceptability, it acts as a better standard of deferred payments.

Store of value: Money serves as a store of value. Savings were discouraged under the barter system due to lack of store of value. With inventions of money, it is possible to save. At present all savings are done in terms of money. Bank deposits represent the savings of the people. Moreover, money can be easily converted into any other Marketable assets like Land, Machinery, Plant, etc. Thus it facilitates capital accumulation. Money being the most liquid assets, it acts as a better store of value than any other assets.

Transfer of value: Money acts as a means of transferring purchasing power. Money facilitates transfer of value from one person to another person & one place to another place. As money enjoys general acceptability, a person can dispose of his property in Delhi and purchase new property at Mumbai. Instrument like cheques and bank drafts enable such transfer easy and quick.

Contingent function: In additions to the above functions, money has to performs certain special function known as contingent functions –

Basis of credit: The modern business system is entirely linked to the credit system of the country. The credit system, on the other hand, derives its strength from money. In the absence of money, the credit instruments like cheque, bill of exchange, etc. are of no use. It is the quantity of money supply which determines the supply of credit in the country.

Measurement & Distribution of national income: The national income is the result of efforts contributed by various factors of production. Money is helpful in measuring the contribution made by each factor of production and thus facilitates the distribution of national income between factors.

Equalization of marginal utility: Every consumer is interested in spending his limited income in such a manner as to achieve maximum satisfaction (utility) for this purpose of achieving maximum satisfaction; he has to equalize marginal utilities from different goods. Money helps the consumer in equalizing marginal utilities.

Liquidity: Money being the most liquid asset, it can be converted into any other assets quickly. An entrepreneur has to keep capital in liquid form for various purposes, such as transaction, Precautionary and speculative motives. Money provides such liquidity.

Estimation of Macro Economic variables: Macro economic variables like Gross National Product, total savings, total investment etc. can be easily estimated in monetary terms. It also facilitates government tax collection, budgeting etc.

CLASSIFICATION OF MONEY

There are several sorts of money.

Market-Determined Money

Money originates as a feature of the spontaneous order of markets through the practice of barter (or direct exchange), where people trade one good or service directly for another good or service. So as for a trade to occur in barter, the parties to the exchange must want the good or service that their counterparties need to offer. This is often referred to as the double coincidence of requirements , and it sharply limits the scope of transactions which will occur during a barter economy.

However certain goods during a barter economy will be generally desired by more people in trade for whatever they need to offer in barter. These tend to be goods that have the most effective combination of the five properties of cash listed above. Over time these special sorts of goods can come to be desired in trade partly for his or her wide acceptance, as a way to overcome the problem posed by the double coincidence of requirements in future transactions with others. Eventually, people can come to desire an honest mostly or solely for its use-value in reducing transaction costs in future exchanges.

Such a good can then be called money because it's generally recognized by participants within the economy as a valuable good for its use as a medium to indirectly exchange other goods and services between multiple parties. The physical commodity will still have another use-value, but the primary use of any source of value has within the market is for its use as money. Historically, precious metals like gold and silver were adopted as these types of market-determined moneys.

Legal Tender and fiat money

Sometimes market-determined money is officially recognized as legal money by a government. Under some circumstances, goods that don't necessarily meet the five properties of optimal market-determined money outlined above are often used to fulfill the functions of cash in an economy. Typically this involves a legal mandate to use a particular good as money (known as a tender law) or some quite prohibition on the utilization of money (such because the use of cigarettes as a medium of exchange among prison inmates). Tender laws specify a particular good as legal money, which courts will recognize as a final means of payment in contracts and therefore the legal means of settling tax bills. By default, the tender will typically be used as a medium of exchange by market participants within the political jurisdiction of the authority that declares it to be money.

The term fiat money or fiat currency is usually associated with a classification of money that has been authorized to be used by a country's government.

Legal tender laws don't always adopt market-determined money as legal tender. a new medium of exchange that doesn't serve any original non-money use as an economic good are often imposed to replace market-determined money by legal declaration. This sort of tender also can be called paper money . Fiat money becomes a medium of exchange through legal imposition on the market, instead of through the method of adoption by the marketplace for easing transactions. Fiat money often doesn't meet the overall characteristics of cash and therefore the market-determined money that it replaces. Because the fiat money tends to be less suitable to be used as money, market participants could also be reluctant to adopt it as money. Prohibitions (or even confiscation) of market-based money are sometimes enacted as a part of tender laws that impose fiat money on an economy.

Fiat moneys can cause increased economic transaction costs, market distortions, and unintended consequences to the extent that they are doing not meet the characteristics that make a specific good suitable to function money. For instance , in nowadays, most countries' legal tender moneys consistently lose value over time, sometimes rapidly, leading to the social costs related to inflation.

Governmental currencies fall into the category of fiat money. Internationally, the International monetary fund and world bank function global watchdogs for the exchange of currencies between countries. Governments establish their own money system which is monitored primarily by the financial institution and Treasury authorities. A governmental currency will have an intranational value and a world value. Established governmental currencies trade 24 hours every day seven days a week on the foreign exchange market, which is that the largest financial trading market worldwide. Governments can establish formal and informal trade relations to peg currency values to at least one another for reduced volatility. Governmental currencies can also be free-floating.

Money Substitutes and Fiduciary Media

Physical units of currency (cash) can circulate from hand handy within the course of economic transactions or by being reassigned from person to person for accounting purposes while being persisted deposit at a bank or similar institution. Within the second case, tokens or paper notes that substitute for and represent the deposited money are passed from person to person in daily transactions and settled later by financial institutions. Paper notes and checks are samples of these sorts of money substitutes. The utilization of money substitutes can increase the portability and sturdiness of money, also as reducing other risks. Money substitutes enhance the function of cash by allowing people to simultaneously enjoy the utilization of their money in day-to-day transactions while also keeping the cash secure from theft or physical damage.

Normally, however, banks issue a bigger (often much larger) quantity of money substitutes than the amount of physical currency entrusted to them by depositors. By simultaneously issuing money substitutes like the same units of physical money to both the depositors and borrowers to whom the bank makes loans, during a process referred to as fractional reserve banking, banks can dramatically expand the availability of money available for transactions beyond the available supply of physical money. The new money substitutes that don't correspond to new units of physical money are called fiduciary media of exchange since they exist solely as entries within the accounting and financial system of the banks. Though widely accepted today, the

Use of fiduciary media has been controversial. Some economists believe that the (over)issuance of a fiduciary is accountable for business cycles and economic recessions, while others welcome it as a means to allow the expansion of money supply to suit the requirements of the economy.

In the U.S. The Federal Reserve System and the Department of the Treasury monetary several kinds of funds for the aim of regulating and mitigating monetary issues.

Crypto currencies

Crypto currencies are peer-based money, like bitcoin. This sort of cash is electronically supported electronic accounting entries which will be used as a medium of exchange. Crypto currencies share many characteristics of both market-determined money and paper money .

Crypto currencies are a kind of money which will be wont to facilitate international transactions.

Crypto currencies first originated as accounting units assigned to users as compensation in return for helping to process and verify transactions during a crypto currency block chain. They need also evolved to become a replacement sort of coin offering that helps to function financing for new technological business initiatives and corporations . Crypto currencies are becoming more widely used and adopted as a medium of exchange for daily transactions. However, crypto currencies do pose many risks. As such, they're being researched and controlled by authorities on an ongoing basis.

The device of index numbers comes to our aid in measuring changes in the value of money or price level. An index is a statement within the type of a table which represents a change in the general price level. Index numbers have great importance in lately . When it's desired to find bent what extent prices have risen or fallen, an index number is ready . In every advanced country, index numbers are being regularly prepared officially by the governments and also non-officially by other bodies interested in economic changes.

Preparation of Index Numbers:

The following steps are necessary for the preparation of index numbers:

(a) Selection of the base Year:

The first thing necessary is to pick a base year. It's the year with which we wish to compare this prices, so as to ascertain what proportion the costs have risen or fallen. The base year must be a normal year. It shouldn't be a year of famine, or war, or a year of outstanding prosperity.

(b) Selection of Commodities:

The next step is to pick the commodities to be included within the index number. The commodities will depend on the aim that the index number is ready . Suppose we want to understand how a particular class of people has been suffering from a change in the general price index. Therein case, we should always include only those commodities which enter into the consumption of that class.

(c) Collection of Prices:

After commodities are selected, their prices need to be ascertained. Retail prices are the simplest for the purpose, because it's at the retail prices that a commodity is actually consumed. But retail prices differ almost from shop to shop, and there's no proper record of them. Hence we've to take the wholesale prices of which there are a correct record.

(d) Finding Percentage Change:

The next step is to represent this prices because the percentages of the bottom year prices. The bottom year price is equated to 100, then the present year’s price is represented accordingly. This may be clear from the index given on subsequent page.

(e) Averaging.

Finally, we take the typical of both the base year and therefore the current year figures so as to seek out out the general change. In May 1985, the worth index was 355 which means that the price on the average were more than three-and a-half times as much or 255 per cent more than what they were in 1970-71.

Uses of Index Numbers:

Index numbers is used for a number of purposes:

(i) Index numbers are used not merely to live changes within the price index or changes within the value of cash . They can be accustomed measure quantitative change. Thus, we will prepare an index number of wages, imports, exports, industrial production, unemployment, profits, area under cultivation, enrolment during a college, etc.

(ii) Such quantitative changes as are measured by index numbers can indicate social and economic trends and help in framing policies with respect to them. As an example , an index number of cost of living can guide us within the adjustment of wages to changing prices.

(iii) we will also compare, with the assistance of index numbers, economic conditions of a category of people at two different periods.

(iv) Index numbers can be used as basis for, and equitable discharge of, contracts relating to borrowing and lending. We all know when prices rise, creditors lose. It's going to perhaps be considered more just to ensure that the creditor gets back the same purchasing power. Hence, when prices rise, the debtor may be asked to pay a correspondingly higher sum to discharge a debt.

Limitations:

It may, however, be noticed that index numbers aren't a faultless guide.

They suffer from variety of limitations, a number of which are given below:

(i) Approximations:

Index numbers are at best only approximations. They can't be taken as infallible guides. Their data are open to question and that they lead to different interpretations.

(ii) International Comparisons Difficult:

Use of index numbers for inter¬national comparisons presents several difficulties. The result's that such comparisons are difficult, if not impossible, on account of the various bases, different sets of commodities or differences in their quality, etc.

(iii) Comparisons between Different Times Difficult:

It is not easy to institute comparisons between different periods of time. Over long periods, some popular commodities are replaced by others. Entirely new commodities come to figure in consumption, or a commodity could also be vastly different from what’ it wont to be. Consider a contemporary railway engine and one among the first ones. Ford cat 1985 may be a different commodity from the 1950 Ford.

(iv) Measure Sectional Price Levels Only:

Index numbers measure only changes in the sectional price-levels. An index , therefore, prepared for a particular purpose, might not be useful for an additional . An index that helps us to review the economic conditions of mill-hands or railway coolies are going to be useless for a study of the conditions of college lecturers.

An entirely different set of commodities will have to be selected. Different people use various things and hold different assets. Therefore, different classes of people are affected differently by a given change within the price-level. Hence, the same index numbers cannot throw light on the effects of a price change on all sections of society.

(v) Weighting Changes Result:

One set of weights may yield quite different result from another, and weighting is all arbitrary.

Index number

Index number isn't an absolute measure, it measures the percentage change during a variable over time. It does so by comparing the worth of a variable at the present to its value at a base year. Index gives a quantitative foundation to qualitative statements like prices are falling or rising. Lastly, index numbers show changes in average. In effect, it means if the average change is 5% then some goods won't change exactly at 5%.

Why Use Index Numbers?

The most important use of index is that the determination of the value of money using price index number. It effectively displays the change in price levels and depicts inflation or deflation. As already mentioned index numbers are wont to calculate the standard of living in various areas. Price level numbers are extensively used by business communities as a tool to plan policies.

To calculate the change in production of various sectors, index numbers of production are used. This, in turn, helps the govt to require necessary measures to increase production and growth. Export and import policies are formulated by pertaining to the index of imports and exports. Lastly, the govt plans its fiscal and monetary policies to increase growth, employment, productivity etc. with the aid of index numbers. By and enormous , an index is an important statistical tool.

The Negative Side

Index numbers deal with averages and are a rough estimate of the change in a variable. Consequently, they simply indicate temporal changes for the variable which aren't completely true or accurate. Also with changing times, consumptions patterns undergo a drastic change. As a result, comparison of previous index numbers to recent ones doesn’t seem viable.

Calculation of retail price index number isn't possible hence we calculate wholesale price index number although the former one displays the important scenario. Lastly, for every variable, we have to calculate different index numbers, which widens our calculations.

Simple Index Numbers

Before moving forward with construction of an index number, we shall discuss the 2 broad classifications of those numbers.

Simple index numbers grant equal importance to all or any items regardless of what share it's . In other words, it considers each item to be equal with reference to the given variable. Consequently, it's an easy average and is a smaller amount accurate in comparison to the other class of index numbers.

Simple Price Index:

To construct a simple price index, compute the price relatives and average them. Add the worth relatives and divide them by the number of things . Table 64.1 illustrates the construction of a simple index of wholesale prices.

TABLE 64.1

Commodity | Prices in 1970(P0) | Base 1970=100 | Prices in 1980(P1) = P1/P0xl00 | Price Relatives (R) |

A Rs | . 20 per kg | 100 | Rs. 25 | 125 |

В | 5 per kg | 100 | 10 | 200 |

С | 15 per metre | 100 | 30 | 200 |

D | 25 per kg | 100 | 30 | 120 |

E | 200 per quantal | 100 | 450 | 225 |

N = 5 |

| 500 |

| ∑R = 870 |

Using arithmetic mean, price index in 1980 = ∑R/N = 870/5 = 174

The preceding table shows that 1970 is the base period and 1980 is the year that the price index has been constructed on the idea of price relatives. The index of wholesale prices in 1980 comes to 174. This means that the price level rose by 74 per cent in 1980 over 1970.

Weighted Price Index:

Taking the example of Table 64.2 already given, we assign high weights to commodities of greater importance to consumers and low weights to commodities of lesser importance.

TABLE 64.2

Commodity | Weight (W) | Prices in 1970 Rs | Base 1970 = 100 | Prices in 1980 Rs | Price Relatives (R) | W x R |

A | 6 | 20 | 100 | 25 | 125 | 750 |

В | 4 | 5 | 100 | 10 | 200 | 800 |

С | 2 | 15 | 100 | 30 | 200 | 400 |

D | 4 | 25 | 100 | 30 | 120 | 480 |

E | 10 | 200 | 100 | 450 | 225 | 2250 |

| ∑24 |

|

|

|

| ∑WR = 4680 |

Using arithmetic mean, the weighted price level in 1980 = 4680/24 = 195.

The weighted price level is more accurate than the simple price level . In the example given above, the weighted price level shows a rise of 91 per cent within the price level in 1980 over 1970 as against the rise of 74 per cent according to the simple price index.

(a) Simple index number and

(b) Weighted index number.

Simple index number again are often constructed either by – (i) Simple aggregate method, or by (ii) simple average of price relative’s method. Similarly, weighted index number can be constructed either by (i) weighted aggregative method, or by (ii) weighted average of price relative’s method. The choice of method depends upon the supply of data, degree of accuracy required and therefore the purpose of the study.

Construction of price index Numbers (Formula and Examples):

Constructions of price level numbers through various methods are often understood with the help of the subsequent examples:

1. Simple Aggregative Method:

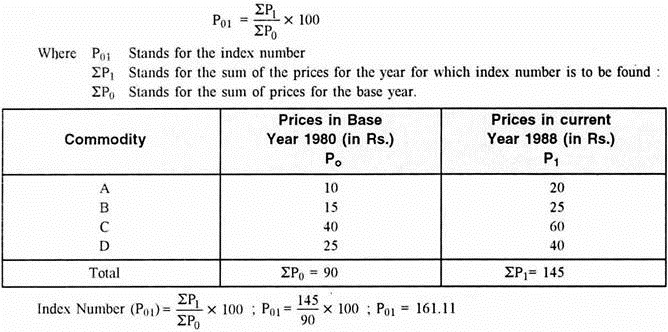

In this method, the index number is equal to the sum of prices for the year that index number is to be found divided by the sum of actual prices for the base year.

The formula for finding the index number through this method is as follows:

2. Simple Average of Price Relatives Method:

In this method, the index is equal to the sum of price relatives divided by the number of things and is calculated by using the subsequent formula:

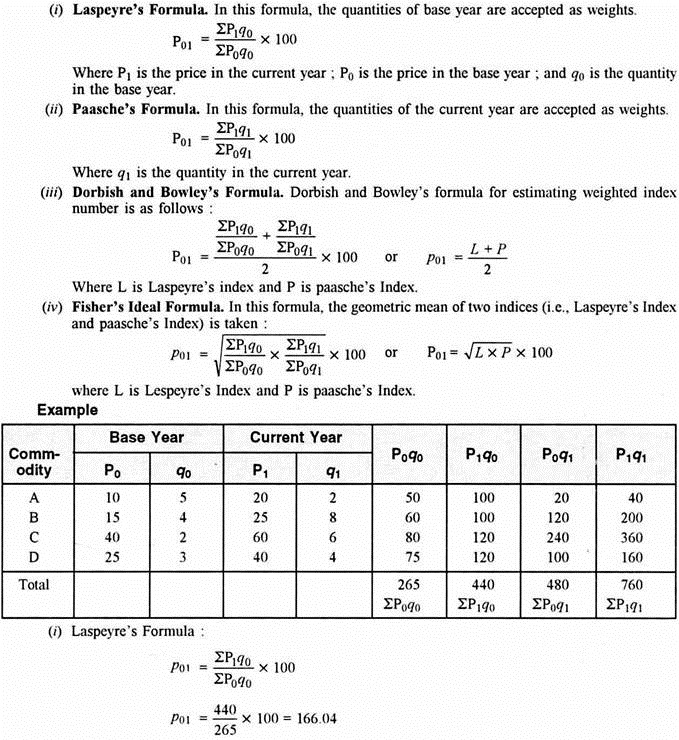

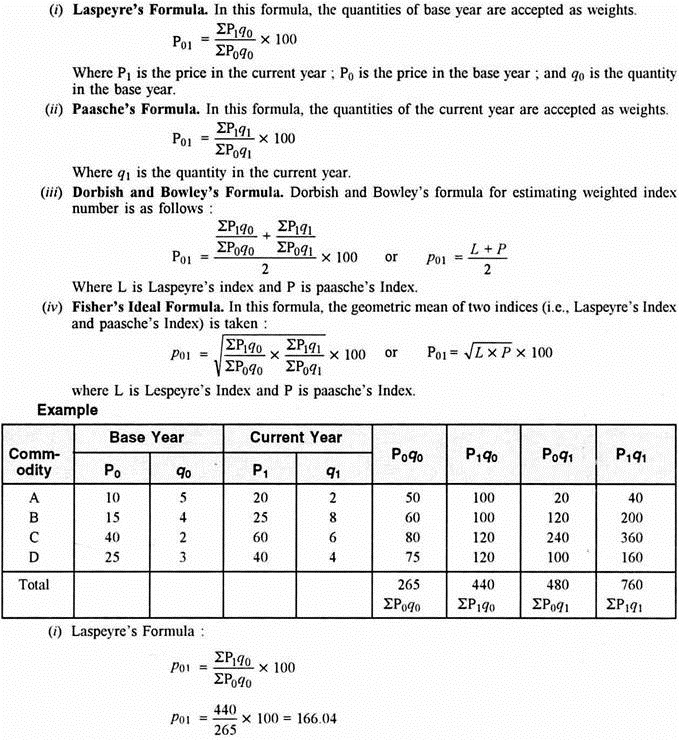

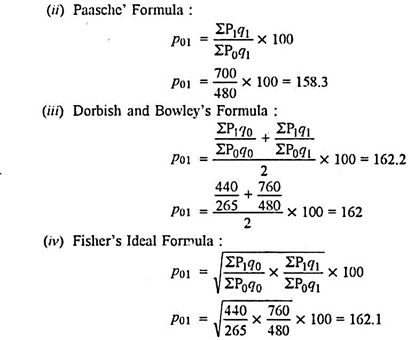

3. Weighted Aggregative Method:

In this method, different weights are assigned to the things consistent with their relative importance. Weights used are the number weights. Many formulae are developed to estimate index numbers on the basis of quantity weights.

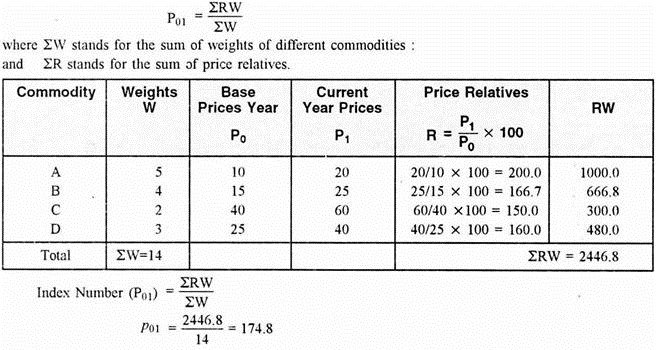

4. Weighted Average of Relatives Method:

In this method also different weights are used for the items according to their relative importance.

The price index number is found out with the help of the following formula:.

Difficulties in Measuring Changes in Value of Money:

Measurement of changes within the value of money through price index number isn't an easy and reliable technique. There are a number of theoretical also as practical difficulties within the construction of price index numbers. Moreover, the index number technique itself has many limitations.

Weighted Index Numbers

Unlike simple index numbers, weighted index numbers, because the name suggests, weigh items consistent with their importance with reference to the concerned variable. For example, when calculating the price index number if the worth of a unit of rice is twice the price of a unit sugar then the rice will be weighed in as ‘2’ whereas sugar will be weighed in as ‘1’.

Hence it's a comparatively average measure. In essence, it's more realistic in comparison to simple index number because it accurately reflects the change over time.

The average level of all prices in a country is termed the price level. There are thousands of waves in a sea, each wave having a distinct height.

Nevertheless, we will calculate the typical level of the sea and call it the sea- level. Similarly, we will calculate the price level, although there are thousands of prices, all moving in alternative ways.

When the price level rises money can purchase less goods and services. So we are saying that its purchasing power has fallen. Conversely, when the worth level falls, money can buy more and that we can say its purchasing power has gone up. Thus, the worth of cash changes inversely with the price level. In our country, the worth level increased by about 400% during war n (1939-1945). The worth of the rupee fell by the same percentage.

Why does the price Level Change?

Changes in the price index are caused by two factors:

(a) Changes in the supply of money, and

(b) Changes within the supply of goods and services.

When the quantity of money in circulation during a country is increased (e.g., by printing new notes) extra money is available to the people for making purchases, the demand for goods and services goes up and the price level tends to rise.

Conversely, if the supply of money decreases people can buy less and therefore the price level tends to go down Again, if there's a rise in the supply of goods and services, the worth level tends to fall and, within the converse case, it tends to rise.

Thus, if the supply of money increases by 25% and therefore the supply of goods and services also increase by an equivalent 25%, there'll ordinarily be no effect on the worth level. There are other factors which influence the price level (e.g., the amount of times money changes hands or the speed of circulation) but the primary two factors are the most important of all.

In India, during war II, there was a large increase within the volume of notes printed by the govt . There was, at an equivalent time, a decrease within the supply of goods (due to reduction of imports, etc.). Consequently, the worth level increased many times.

It is possible to analyse the causes of price changes during a different way. Modern writers believe that price level changes are caused by changes within the level of income, i.e., the average amount of money earned by that people when more income is earned, the demand for the products and services goes up and price rise. When income falls, less goods and services are demanded and price fall. [Changes within the level of income depend on two factors, the quantity of savings and therefore the volume of investment within the country.]

FISHER’S QUANTITY THEORY OF MONEY: THE CASH TRANSACTIONS APPROACH:

The quantity theory of money states that the quantity of money is the main determinant of the price level or the value of money. Any change within the quantity of money produces an exactly proportionate change within the price level.

In the words of Irving Fisher, “Other things remaining unchanged, because the quantity of money in circulation increases, the worth level also increases in direct proportion and therefore the value of money decreases and the other way around .”

If the number of cash is doubled, the price level also will double and the value of cash will be one half. On the opposite hand, if the number of cash is reduced by one half, the price level also will be reduced by one half and therefore the value of money will be twice.

Fisher has explained his theory in terms of his equation of exchange:

PT = MV + M’V’

Where P = price level, or 1/P = the value of money;

M = the total quantity of legal tender money;

V = the speed of circulation of M;

M’ = the total quantity of credit money;

V = the speed of circulation of M’;

T = the total amount of goods and services exchanged for money or transactions performed by money.

This equation equates the demand for money (PT) to supply of money (MV=M’V’). The entire volume of transactions multiplied by the worth level (PT) represents the demand for money. Consistent with Fisher, PT is ∑PQ. In other words, price index (P) multiplied by quantity bought (Q) by the community (∑) gives the entire demand for money.

This equals the entire supply of cash within the community consisting of the quantity of actual money M and its velocity of circulation V plus the entire quantity of credit money M’ and its velocity of circulation V. Thus the entire value of purchases (PT) during a year is measured by MV+M’V. Thus the equation of exchange is PT=MV+M’V’. So as to seek out out the effect of the quantity of money on the price level or the value of money, we write the equation as

P = MV+M’V

T

Fisher points out that the price level (P) varies directly as the quantity of money (M+M’), provided the volume of trade (T) and velocity of circulation (V, V’) remain unchanged. The truth of this proposition is evident from the fact that if M and M’ are doubled, while V, V’ and T remain constant, P is also doubled, but the value of money (MP) is reduced to half.

Fisher’s quantity theory of cash is explained with the help of Figure 1 (A) and (B). Panel A of the figure shows the effect of changes within the quantity of money on the worth level. To start with, when the number of cash is M1, the worth level is P1.

When the quantity of cash is doubled to M2, the price level is additionally doubled to P2. Further, when the quantity of cash is increased four-fold to M4, the price level also increases by four times to P4. This relationship is expressed by the curve P=f (M) from the origin at 45°.

Assumptions of the Theory:

Fisher’s theory is based on the subsequent assumptions:

1. P is a passive factor in the equation of exchanger which is affected by the other factors.

2. The proportion of M’ to M remains constant.

3. V and V are assumed to be constant and are independent of changes in M and M’.

4. T also remains constant and is independent of other factors like M, M’, V and V’.

5. It's assumed that the demand for money is proportional to the value of transactions.

6. The supply of money is assumed as an exogenously determined constant.

7. The idea is applicable within the end of the day .

8. It's based on the assumption of the existence of full employment in the economy.

Criticisms of the Theory:

The Fisherian quantity theory has been subjected to severe criticisms by economists:

1. Truism:

According to Keynes, “The quantity theory of money may be a truism.” Fisher’s equation of exchange may be a simple truism because it states that the entire quantity of cash (MV+M’V’) paid for goods and services must equal their value (PT). But it can't be accepted today that a particular percentage change within the quantity of money results in an equivalent percentage change within the price level.

2. Other Things not equal:

The direct and proportionate relation between quantity of money and price level in Fisher’s equation is predicated on the idea that “other things remain unchanged”. But in real life, V, V’ and T aren't constant. Moreover, they're not independent of M, M’ and P. Rather, all elements in Fisher’s equation are interrelated and interdependent. As an example , a change in M may cause a change in V.

Consequently, the price level may change more in proportion to a change within the quantity of cash . Similarly, a change in P may cause a change in M. Rise within the price level may necessitate the issue of more money. Moreover, the quantity of transactions T is also suffering from changes in P.

When prices rise or fall, the volume of business transactions also rises or falls. Further, the assumptions that the proportion M’ to M is constant, has not been borne out by facts. Not only this, M and M’ aren't independent of T. a rise within the volume of business transactions requires a rise in the supply of money (M and M’).

3. Constants Relate to Different Time:

Prof. Halm criticizes Fisher for multiplying M and V because M relates to a point of time and V to a period of your time . the former is a static concept and the latter a dynamic. It is, therefore, technically inconsistent to multiply two non-comparable factors.

4. Fails to live Value of Money:

Fisher’s equation doesn't measure the purchasing power of cash but only cash transactions, that is, the quantity of business transactions of all types or what Fisher calls the volume of trade in the community during a year. But the purchasing power of cash (or value of money) relates to transactions for the purchase of goods and services for consumption. Thus the number theory fails to live the value of money.

5. Weak Theory:

According to Crowther, the quantity theory is weak in many respects.

First, it cannot explain ‘why’ there are fluctuations within the price level in the short run.

Second, it gives undue importance to the price level as if changes in prices were the foremost critical and important phenomenon of the economic system.

Third, it places a misleading emphasis on the number of money as the principal cause of changes in the price level during the business cycle . Prices might not rise despite increase within the quantity of money during depression; and that they may not decline with reduction in the quantity of money during boom.

Further, low prices during depression aren't caused by shortage of quantity of cash , and high prices during prosperity aren't caused by abundance of quantity of money. Thus, “the quantity theory is at the best an imperfect guide to the causes of the business cycle in the short period,” according to Crowther.

6. Neglects Interest Rate:

One of the main weaknesses of Fisher’s quantity theory of money is that it neglects the role of the speed of interest together of the causative factors between money and costs . Fisher’s equation of exchange is said to an equilibrium situation during which rate of interest is independent of the quantity of money.

7. Unrealistic Assumptions:

Keynes in his General Theory severely criticised the Fisherian quantity theory of cash for its unrealistic assumptions.

First, the quantity theory of money is unrealistic because it analyses the relation between M and P within the end of the day . Thus it neglects the short run factors which influence this relationship.

Second, Fisher’s equation holds good under the idea of full employment. But Keynes regards full employment as a special situation. The overall situation is one among the underemployment equilibrium.

Third, Keynes doesn't believe that the relationship between the number of cash and the price level is direct and proportional. Rather, it's an indirect one via the speed of interest and the level of output.

According to Keynes, “So long as there's unemployment, output and employment will change in the s.ame proportion as the quantity of money, and when there's full employment prices will change within the same proportion because the quantity of money.”

Thus Keynes integrated the idea of output with value theory and monetary theory and criticised Fisher for dividing economics “into two compartments with no doors and windows between the theory of value and theory of money and prices.”

8. V not Constant:

Further, Keynes acknowledged that when there's underemployment equilibrium, the speed of circulation of money V is very unstable and would change with changes in the stock of money or money income. Thus it was unrealistic for Fisher to assume V to be constant and independent of M.

THE CAMBRIDGE EQUATIONS: THE CASH BALANCES APPROACH:

As an alternate to Fisher’s quantity theory of money, Cambridge economists Marshall, Pigou, Robertson and Keynes formulated the cash balances approach. Like value theory, they regarded the determination of value of money in terms of supply and demand.

Robertson wrote during this connection: “Money is only one among the various economic things. Its value, therefore, is primarily determined by precisely the same two factors as determine the value of the other thing, namely, the conditions of demand for it, and the quantity of it available.”

The supply of money is exogenously determined at a point of time by the banking system. Therefore, the concept of velocity of circulation is altogether discarded within the cash balances approach because it ‘obscures the motives and decisions of people behind it’.

On the other hand, the concept of demand for money plays the main role in determining the value of money. The demand for money is that the demand to hold cash balances for transactions and precautionary motives.

Thus the cash balances approach considers the demand for money not as a medium of exchange but as a store useful . Robertson expressed this distinction as money “on the wings” and money “sitting”. It's “money sitting” that reflects the demand for money within the Cambridge equations.

The Cambridge equations show that given the supply of money at a point of time, the value of money is decided by the demand for cash balances. When the demand for money increases, people will reduce their expenditures on goods and services so as to have larger cash holdings. Reduced demand for goods and services will bring down the price level and raise the value of money. On the contrary, fall within the demand for money will raise the worth level and lower the value of money.

The Cambridge cash balances equations of Marshall, Pigou, Robertson and Keynes are discussed as under:

MARSHALL’S EQUATION:

Marshall didn't put his theory in equation form and it was for his followers to explain it algebraically. Friedman has explained Marshall’s views thus: “As a primary approximation, we may suppose that the amount one wants to carry bears some reference to one’s income, since that determines the quantity of purchases and sales in which one is engaged. We then add up the cash balances held by all holders of money within the community and express the entire as a fraction of their total income.”

Thus we will write:

M = kPY

Where M stands for the exogenously determined supply of money, k is that the fraction of the real money income (PY) which people wish to hold in cash and demand deposits, P is the price level, and Y is that the aggregate real income of the community. Thus the price level P = M/kY or the value of money (the reciprocal of price level) is

1/P = kY/M

PIGOU’S EQUATION:

Pigou was the primary Cambridge economist to express the cash balances approach in the form of an equation:

P = kR/M

Where P is that the purchasing power of cash or the value of money (the reciprocal of the price level), k is that the proportion of total real resources or income (R) which people wish to hold in the form of titles to legal tender, R is that the total resources (expressed in terms of wheat), or real income, and M refers to the number of actual units of tender money.

The demand for money, consistent with Pigou, consists not only of legal money or cash but also bank notes and bank balances. So as to incorporate bank notes and bank balances within the demand for money, Pigou modifies his equation as

P = kR/M {c + h(1-c)}

Where c is the proportion of total real income actually held by people in legal tender including token coins, (1-c) is that the proportion kept in bank notes and bank balances, and h is that the proportion of actual tender that bankers keep against the notes and balances held by their customers.

Pigou points out that when k and R in the equation P=kR/M and k, R, c and h are taken as constants then the two equations give the demand curve for legal tender as a rectangular hyperbola. This implies that the demand curve for money features a uniform unitary elasticity.

ROBERTSON’S EQUATION:

To determine the value of money or its reciprocal the price level, Robertson formulated an equation almost like that of Pigou. The sole difference between the two being that rather than Pigou’s total real resources R, Robertson gave the volume of total transactions T. The Robertsonian equation is M = PkT or

P = M/kT

Where P is that the price level, M is that the total quantity of money, k is that the proportion of the entire amount of goods and services (T) which individuals wish to carry in the form of cash balances, and T is the total volume of products and services purchased during a year by the community.

If we take P as the value of money instead of the price level as in Pigou’s equation, then Robertson’s equation exactly resembles Pigou’s P = kT/M.

KEYNES’S EQUATION:

Keynes in his A Tract on Monetary Reform (1923) gave his Real Balances Quantity Equation as an improvement over the opposite Cambridge equations. Consistent with him, people always want to have some purchasing power to finance their day to day transactions.

The amount of purchasing power (or demand for money) depends partly on their tastes and habits, and partly on their wealth. Given the tastes, habits, and wealth of the people, their desire to carry money is given. This demand for money is measured by consumption units. A consumption unit is expressed as a basket of standard articles of consumption or other objects of expenditure.

If k is that the number of consumption units within the form of cash, n is that the total currency in circulation, and p is that the price for consumption unit, then the equation is

n= pk

If k is constant, a proportionate increase in n (quantity of money) will cause a proportionate increase in p (price level).

This equation are often expanded by taking into account bank deposits. Let k’ be the number of consumption units in the form of bank deposits, and r the cash reserve ratio of banks, then the expanded equation is

n=p (k + rk’)

Again, if k, k’ and r are constant, p will change in exact proportion to the change in n.

Keynes regards his equation superior to other cash balances equations. The opposite equations fail to point how the worth level (p) can be regulated. Since the cash balances (k) held by the people are outside the control of the monetary authority, p are often regulated by controlling n and r. It's also possible to manage bank deposits k’ by appropriate changes within the bank rate. So p will be controlled by making appropriate changes in n, r and k’ so on offset changes in k.

INFLATION

Inflation is a quantitative measure of the speed at which the average price level of a basket of selected goods and services in an economy increases over a period of time. It's the constant rise within the general level of prices where a unit of currency buys but it did in prior periods. Often expressed as a percentage, inflation indicates a decrease within the purchasing power of a nation’s currency.

Inflation – its concepts and causes of inflation.

According to A.C. Pigou (Cambridge University), inflation comes in existence “when money income is expanding more than in proportion to income activity”. An increase in general price level takes place when people have more money income to spend against less goods and services.

G. Crowther (British economists)brings out the meaning precisely when he says, “inflation is a state in which the value of money is falling i.e. prices rising”.

Inflation, according to Harry G. Johnson (Canadian economist), “is a sustained rise in prices”.

Paul Samuelson (American economist) defines inflation as “a rise in the general level of prices”.

According to Milton Friedman (American economists), ‘inflation is taxation without representation’.

Causes of Inflation

Demand- Pull Inflation

Increase in Money Supply: When the monetary authorities increase the money supply in excess of the supply of goods and services it results in additional demand and consequent increase in price level. As Milton Friedman put it “inflation is always and everywhere a monetary phenomenon”.

Deficit Finance: As increase in money supply also takes place when the government resorts to deficit financing to incur the public expenditure. Deficit financing undertaken for unproductive investment or expenditure becomes purely inflationary. Even when it is used on productive activities, prices would still increase during the gestation period.

Credit Creation: Commercial banks increase the quantity of money in circulation when they advance loans through credit creation. Credit creation is similar to that of deficit financing in its effects.

Exports: Exports reduce the goods available in domestic market. Export earnings enhance the purchasing power of the exporters and others linked with export. An increase in exports would aggravate the situation by reducing the supply of goods and at the same time pushing up the demand because of additional income.

Repayment of Public Debt: Public debt is a common feature of modern governments. When such debts are repaid, people will have more income at their disposal. Additional disposable income tends to raise the demand for goods and services.

Black Money: Social and economic evils like corruption, tax evasion, smuggling and other illegal activities give rise to unaccounted (for tax payment) or black money. People with black money indulge in extravanza, affecting demand and thus the price level.

Increase in Population: The size of the population is one of the important determinants of demand In many developing countries population is large in size and still increasing. India provides an example where demand outstrips supply due to the large and increasing population.

Cost- Push Inflation

Inflation need not necessarily be due to an increase in demand but increase in cost. Increase in the prices of inputs including labour, increase in profit margin by the business firms and monopsony in factor market may push up prices as they influence the supply price.

The important cost push factors are:

Increase in wages: When prices increase due to increase in wages it is called wage-push inflation. Wages are influenced by many factors besides the demand and supply forces. Trade unions play an important role in deciding the wage rate. Strong and powerful trade unions succeed in securing higher wages for their members. Higher wages granted in the organised sector influencing the wage rate in the unorganised sector too, resulting in an increase in cost everywhere.

Increase in Material cost: Prices of materials used in producing goods constitute a significant part of the cost. Prices of the materials may increase either due to an increase in demand for these materials or independently owing to national and international developments. Increase in crude oil price till recently is an example in this context. When the prices of basis inputs like energy, cement, steel, etc. increase, the effect is felt throughout the economy. An increase in the prices of materials especially the basic inputs alters the cost structure of all goods and services. Higher the cost of production leads to upward revision of final prices.

Increase in Profit Margin: Firms operating under oligopoly or enjoying monopoly power (petroleum firms in public sector) may have ‘administered prices’ with higher profit margins. Such administered prices though imposed by few firms, have their impact on other firms too. The desire to have higher profit margins by all those who have the power to do so becomes the cause for inflationary trend.

Other factors: Cost of production may increase when input prices go up due to scarcity – natural or artificial. Natural calamities like draught or floods adversely affect supplies of raw materials thus making them dearer. Firms operating with excess capacity either because of monopolistic competitive market or any other reasons, produce at a higher cost.

REMEDIES TO CONTROL INFLATION

Inflation must be controlled at an appropriate level. Uncontrolled inflation may turn into hyperinflation. Since inflation occurs due to disequilibrium in aggregate demand and aggregate supply, it would be controlled by correcting the forces which causes such disequilibrium. Control of inflation requires a combination of monetary, fiscal and other measures.

Monetary Measures

An increase in money supply without the corresponding increase in supply of goods and services creates excess demand causing inflation. Monetary and services creates excess demand causing inflation Monetary authorities through monetary instruments could increase the cost of credit and reduce the money supply. At the same time monetary measures may encourage the production and supply of essential commodities by supplying the requires amount of credit at concessional terms. For this purpose the central bank of the country applies quantitative and qualitative methods.

The Quantitative Methods Are:

Bank Rate: Inflation compels the Central Bank of the economy to increase the Bank Rate. Bank rate is the rate at which the central bank lends money to the member banks. An increase in bank rate makes borrowing costlier thus discourages borrowing, leading to a check on increase in supply. Similarly lowering bank rate makes borrowing cheaper, increases money supply along with decrease in cost. Cost push inflation may require to bring down the cost of borrowing. A change in bank rate brings changes in other interest rates in market in the same direction.

Open Market Operation (OMO): Under this method a central bank sells or purchases government securities in the market. Any body can participate in this purchase or sale, hence it is called open market operation. The central bank reduces quantity of money in circulation through the sale of securities and increases the quantity of money by purchasing them. During inflation it is expected to sell the securities, bringing down the money in circulation, hence the aggregate demand in the economy for goods and services.

Variable Reserve Ratio (VRR): Variable reserve ratio has two components: (i) Cash reserve ratio (CRR) and Statutory Liquidity Ratio (SLR). An increase in these ratios, reduces the ability to create credit. A reduction in CRR and SLR increases the reserves with banks and consequently their ability to expand credit. During inflation these ratios are usually increased. In recent decades many central banks have introduced some additional quantitive measures. They are in the form of repo rate and liquidity adjustment facility (LAF). They influence the cost of borrowing (higher cost during inflation) affecting total money in circulation.

The above mentioned quantitative methods may not be very effective in controlling inflation. Increase in prices which bring more profits and prevailing optimism will not deter business firms from borrowing at a higher costs.

An uniform monetary policy- dear or cheap- throughout the economy does not bring the required result. The central banks, therefore, apply the selective credit control measures too. These measures comprise margin requirements, consumer credit controls, directives, rationing of credit and any other method whereby a selective approach can be adopted in supplying credit. Selective credit controls discriminate in favour of essential activities and discourage demand for credit for non-essential uses. In developing countries selective credit controls are more popular as they help the monetary authorities to have a ‘controlled – expansion’ of credit. Quantitative measures in these countries are less effective due to the underdevelopment of the money market. Monetary measures by themselves are not enough to control inflation. They become more helpless if inflation is due to cost- push.

In extreme cases the central bank/ government, may resort to demonetisation of currency. This measure is usually applied to higher denomination currency. It helps to bring out black money and check excess demand. Hypher inflation may even compel the government to issue new currency and replace the existing one in a given ratio, for example 100: 1. India demonetised its higher value currencies on 8 November 2016, to flush out black money and check the price level.

Fiscal Measures

Inflation cannot be controlled by monetary measures alone. They should be supported by fiscal measures. Broadly speaking, the government manipulates the budget to reduce the private as well as the public expenditure to check demand for goods and services and encourage production of essential commodities through incentives to private sector in addition to its own expenditure on production and distribution of goods ad services.

The fiscal measures are (i) taxation (ii) public borrowing (iii) compulsory saving and (iv) public expenditure.

Direct and Indirect taxes are leived to reduce the disposable income of the people. While imposing the tax, care should be taken to avoid the adverse effects of taxation on savings, investment and production. Essential commodities should not be taxed, lest inflation be aggravated.

Public borrowing can be undertaken to reduce the disposable income of the people. It is to reduce the quantity of money with the public. It is a costly instrument since the government has to pay interest on public loans. Repayment of public loans during inflation should be avoided. This would prevent additional money supply and consequent additional demand.

Compulsory saving or any other forced saving scheme and deferred payment (a part of the payment is credited to the employees provident fund accounts, thus blocking its current use) are some other instruments to reduce excess demand.

Public expenditure is the major source of injecting money into the economy. Modern welfare states spend huge amounts of money through public projects and welfare schemes. Public expenditure should be reduced during inflation. Though it is difficultto cut down public expenditure the government should attempt to avoid all unproductive expenditure.

Direct (Administrative) Measures

Some of the direct measures are:

Price control or ceiling on price specially of essential commodities.

Public distribution system (PDS) to supply or distribute essential consumer goods. Rationing and fair price shops are the channels through which the pubic distribution system is operated.

Imports of essential consumer commodities may be required to maintain the supply.

Control or freezing of wages, profits, dividends and bonus may also be introduced. Such controls aim at limiting the income of the people and thereby reducing the demand for goods and services. These measures being drastic are likely to create social and political tension.

Increase in supply: If inflation is due to shortage of goods and services, controlling demand through monetary and fiscal measures is not of much use. Here the solution lies in increasing the supply of goods and services by improving the working of supply chains. The long-run solution lies in increasing production by creating a positive and conducive environment. This may involve improving infrastructure, providing incentives and effective implementation of various measures which enable more production.

Indexation: Inflation affects all sections of people. Among the different sections, wage/ salary earners and other fixed income group suffer the most. To compensate against inflation, a method of indexation of their income can be introduced. Indexation, according to Samuelson and Nordhaus, “is a mechanism of wages, prices and contracts that are partially or wholly compensated for changes in the general price level”. Under this system, payment received by the above mentioned groups can be increased to the extent of rate of inflation, so that their real income remains the same. In India the practice of periodical increase in dearness allowance is one of the methods of compensation against inflation.

Control of inflation is a must and should be attempted before it crosses a moderate limit. Attempts to control inflation by any particular types of measures are bound to fail. A judicious combination of all methods is a must to achieve success. A dear monetary policy must be supported by a surplus budgetary (or reduced deficit) policy along with necessary direct measures.

Success of the measures to control inflation depends on effective implementation which requires efficient and honest administration.

Built-In Inflation

Built-in inflation is that the third cause that links to adaptive expectations. Because the price of goods and services rises, labor expects and demands more costs/wages to maintain their cost of living. Their increased wages end in higher cost of goods and services, and this wage-price spiral continues as one factor induces the other and vice-versa.

Theoretically, monetarism establishes the relation between inflation and money supply of an economy. For instance , following the Spanish conquest of the Aztec and Inca empires, massive amounts of gold and particularly silver flowed into the Spanish and other European economies. Since the cash supply had rapidly increased, prices spiked and the value of cash fell, contributing to economic collapse.

DEFLATION

Deflation may be a general decline in prices for goods and services, typically related to a contraction within the supply of money and credit in the economy. During deflation, the purchasing power of currency rises over time.

Deflation is that the general decline of the price level of goods and services.

Deflation is usually related to a contraction within the supply of money and credit, but prices also can fall due to increased productivity and technological improvements.

Whether the economy, price level, and money supply are deflating or inflating changes the appeal of various investment options.

Understanding Deflation

Deflation causes the nominal costs of capital, labor, goods, and services to fall, though their relative prices could also be unchanged. Deflation has been a popular concern among economists for many years. On its face, deflation benefits consumers because they will purchase more goods and services with the same nominal income over time.

However, not everyone wins from lower prices and economists are often concerned about the consequences of falling prices on various sectors of the economy, especially in financial matters. In particular, deflation can harm borrowers, who are often sure to pay their debts in money that's worth more than the money they borrowed, also as any financial market participants who invest or speculate on the prospect of inflation .

Causes of Deflation

By definition, monetary deflation can only be caused by a decrease within the supply of money or financial instruments redeemable in money. In times , the money supply is most influenced by central banks, like the federal reserve. When the supply of money and credit falls, without a corresponding decrease in economic output, then the prices of all goods tend to fall. Periods of deflation most ordinarily occur after long periods of artificial monetary expansion. The first 1930s was the last time significant deflation was experienced within the us . The main contributor to this deflationary period was the fall within the money supply following catastrophic bank failures. Other nations, like Japan within the 1990s, have experienced deflation in modern times.

World-renowned economist Friedman argued that under optimal policy, during which the central bank seeks a rate of deflation equal to the real rate of interest on government bonds, the nominal rate should be zero, and therefore the price index should fall steadily at the real rate of interest. His theory birthed the Friedman rule, a monetary policy rule.

However, declining prices are often caused by a number of other factors: a decline in aggregate demand (a decrease within the total demand for goods and services) and increased productivity. A decline in aggregate demand typically leads to subsequent lower prices. Causes of this shift include reduced government spending, stock market failure, consumer desire to increase savings, and tightening monetary policies (higher interest rates).

Falling prices also can happen naturally when the output of the economy grows faster than the availability of circulating money and credit. This occurs especially when technology advances the productivity of an economy, and is usually concentrated in goods and industries which benefit from technological improvements. Companies operate more efficiently as technology advances. These operational improvements cause lower production costs and cost savings transferred to consumers within the sort of lower prices. This is often distinct from but similar to general price deflation, which may be a general decrease within the price level and increase within the purchasing power of money.

Price deflation through increased productivity is different in specific industries. For instance , consider how increased productivity affects the technology sector. Within the last few decades, improvements in technology have resulted in significant reductions within the average cost per gigabyte of knowledge . In 1980, the average cost of one gigabyte of data was $437,500; by 2010, the average cost was three cents. This reduction caused the prices of manufactured products that use this technology to also fall significantly.

METHODS TO MANAGE INFLATION AND DEFLATION

Control of Inflation:

It is, therefore, clear that inflation can't be allowed to go unchecked and the various monetary and fiscal measures need to be adopted to combat it.

Since it's caused by an excess of effective demand, measures to regulate it imply a reduction within the total effective demand.

Amongst the monetary measures we include higher bank rate, open-market operations, higher reserve requirements, consumer credit control, higher margin requirements, compulsory saving etc.

Fiscal measures with reference to inflation include government spending, taxes, public borrowing, saving, debt management etc. Besides monetary and fiscal measures, there are important non-monetary anti-inflation measures which include output adjustment, suitable wage policy, price control, rationing, etc. These measures are, however, supplementary to main monetary and fiscal measures.

Control of Deflation:

Deflation adversely affects the level of production, business activity and employment and, therefore, it's equally essential to regulate it. During deflation the bank rate is lowered and securities are purchased through the open market operations and the volume of money and credit is expanded in every possible way. This policy is known as cheap-money policy. The idea is that with a rise within the quantum of money and credit, there'll be increase in investment, production and employment. But these monetary measures alone may prove inadequate.

Mere expansion of cash and credit may fail to revive economic activity, for the entrepreneurs may not be willing to expand investment (as anticipated) for want of necessary optimism. So, these monetary measures to combat deflation have to be combined with the fiscal measures like increased expenditure through deficit financing, tax concession and public works programmes, thereby providing jobs to unemployed people and generating the necessary effective demand needed for recovery.

These monetary and fiscal measures will prove simpler if combined with other measures, like the price support programmes, (i.e., to prevent the prices from falling below a certain level), lowering of wages and other costs to cause adjustment between the price-cost structure. The best remedy to fight deflation is to possess a ready programme of public works to be resorted to, as and when unemployment appears.

Some of the main ways to regulate deflation are as follow: 1. Monetary Policy 2. Fiscal Policy!

Deflation are often controlled by adopting monetary and fiscal measures in only the opposite manner to regulate inflation.

However, we discuss these measures in short .

1. Monetary Policy:

To control deflation, the central bank can increase the reserves of commercial banks through a cheap money policy. They will do so by buying securities and reducing the rate of interest . As a result, their ability to increase credit facilities to borrowers increases. But the experience of the good Depression tells us that during a serious depression when there is pessimism among businessmen, the success of such a policy is practically nil.

In such a situation, banks are helpless in bringing a few revival. Since business activity is nearly at a standstill, businessmen don't have any inclination to borrow to build up inventories even when the speed of interest is very low. Rather, they need to reduce their inventories by repaying loans already drawn from the banks.

Moreover, the question of borrowing for long-term capital needs doesn't arise during deflation when the business activity is already at a really low level. An equivalent is the case with consumers who faced with unemployment and reduced incomes don't wish to purchase any durable goods through bank loans.

Thus all that the banks can do is to form credit available but they can't force businessmen and consumers to simply accept it. Within the 1930s, very low interest rates and therefore the piling from unused reserves with the banks didn't have any significant impact on the depressed economies of the world. Thus the success of monetary policy in controlling deflation is severely limited.

2. Fiscal Policy:

Fiscal policy through increase in public expenditure and reduction in taxes tends to raise national income, employment, output, and prices. a rise publicly expenditure during deflation increases the aggregate demand for goods and services and results in a large increase in income via the multiplier process, while a discount in taxes has the effect of raising income thereby increasing consumption and investment expenditures of the people.

The government should increase its expenditure through deficit budgeting and reduction in taxes. The general public expenditure includes expenditure on such structure as roads, canals, dams, parks, schools, hospitals and other buildings, etc. and on such relief measures as unemployment insurance, pensions, etc.

Expenditure on public works creates demand for the products of private construction industries and helps in reviving them while expenditure on relief measures stimulates the demand for consumer goods industries. Reduction in such taxes as corporate profits tax, tax , and excise taxes tends to leave more income for spending and investment.

Borrowing by the govt to finance budget deficits utilises idle money lying with banks and financial institutions for investment purposes. But the effectiveness of public expenditure primarily depends upon the public works programme, its importance within the economic system, the volume and nature of public works and their planning and timing.