UNIT 2

MONETARY POLICY

Monetary policy consists of the process of drafting, announcing, and implementing the plan of actions taken by the central bank, currency board, or other competent monetary authority of a country that controls the quantity of money in an economy and the channels by which new money is supplied. Monetary policy consists of management of money supply and interest rates, aimed at achieving macroeconomic objectives such as controlling inflation, consumption, growth, and liquidity. These are achieved by actions such as modifying the interest rate, buying or selling government bonds, regulating foreign exchange rates, and changing the amount of money banks are required to maintain as reserves. Some view the role of the International Monetary Fund as this.

Meaning:

Monetary policy is concerned with the changes in the supply of money and credit. It refers to the policy measures undertaken by the central bank to influence the availability, cost and use of money and credit with the help of monetary techniques to achieve specific objectives. Monetary policy aims at influencing economic activity in the economy mainly through two major variables, i.e, (a) money or credit supply and (b) the rate of interest.

Definition:

RBI: Monetary policy refers to the policy of the central bank with regard to the use of monetary instruments under its control to achieve the goals specified in the Act (1934).

A.J. Shapiro: “Monetary policy is the exercise of the central bank’s control over the money supply as an instrument for achieving the objectives of economic policy.”

N.G. Mankiw: “Monetary policy refers to the setting of the money supply in the economy by the central bank.”

G.F. Stanlake: “It is any deliberate action by the monetary authorities which is designed to change the availability (money supply) or the cost of money (rate of interest).”

Monetary policy is how a central bank or other agency governs the supply of money and interest rates in an economy in order to influence output, employment, and prices.

Monetary policy can be broadly classified as either expansionary or contractionary.

Monetary policy tools include open market operations, direct lending to banks, bank reserve requirements, unconventional emergency lending programs, and managing market expectations (subject to the central bank's credibility).

Understanding Monetary Policy

Economists, analysts, investors, and financial experts across the globe eagerly await the monetary policy reports and outcome of the meetings involving monetary policy decision-making. Such developments have a long lasting impact on the overall economy, as well as on specific industry sector or market.

Monetary policy is formulated based on inputs gathered from a variety of sources. For instance, the monetary authority may look at macroeconomic numbers like GDP and inflation, industry/sector-specific growth rates and associated figures, geopolitical developments in the international markets (like oil embargo or trade tariffs), concerns raised by groups representing industries and businesses, survey results from organizations of repute, and inputs from the government and other credible sources.

Monetary authorities are typically given policy mandates, to achieve stable rise in gross domestic product (GDP), maintain low rates of unemployment, and maintain foreign exchange and inflation rates in a predictable range. Monetary policy can be used in combination with or as an alternative to fiscal policy, which uses to taxes, government borrowing, and spending to manage the economy.

The Federal Reserve Bank is in charge of monetary policy in the United States. The Federal Reserve has what is commonly referred to as a "dual mandate": to achieve maximum employment (with around 5 percent unemployment) and stable prices (with 2 to 3 percent inflation). It is the Fed's responsibility to balance economic growth and inflation. In addition, it aims to keep long-term interest rates relatively low. Its core role is to be the lender of last resort, providing banks with liquidity and serve as a bank regulator, in order to prevent the bank failures and panics in the financial services sector.

OBJECTIVES OF MONETARY POLICY

The primary objectives of monetary policies are the management of inflation or unemployment, and maintenance of currency exchange rates.

Inflation

Monetary policies can target inflation levels. A low level of inflation is considered to be healthy for the economy. If inflation is high, a contractionary policy can address this issue.

Unemployment

Monetary policies can influence the level of unemployment in the economy. For example, an expansionary monetary policy generally decreases unemployment because the higher money supply stimulates business activities that lead to the expansion of the job market.

Currency exchange rates

Using its fiscal authority, a central bank can regulate the exchange rates between domestic and foreign currencies. For example, the central bank may increase the money supply by issuing more currency. In such a case, the domestic currency becomes cheaper relative to its foreign counterparts.

Tools of Monetary Policy

Central banks use various tools to implement monetary policies. The widely utilized policy tools include:

Interest rate adjustment

A central bank can influence interest rates by changing the discount rate. The discount rate (base rate) is an interest rate charged by a central bank to banks for short-term loans. For example, if a central bank increases the discount rate, the cost of borrowing for the banks increases. Subsequently, the banks will increase the interest rate they charge their customers. Thus, the cost of borrowing in the economy will increase, and the money supply will decrease.

Change reserve requirements

Central banks usually set up the minimum amount of reserves that must be held by a commercial bank. By changing the required amount, the central bank can influence the money supply in the economy. If monetary authorities increase the required reserve amount, commercial banks find less money available to lend to their clients and thus, money supply decreases.

Commercial banks can’t use the reserves to make loans or fund investments into new businesses. Since it constitutes a lost opportunity for the commercial banks, central banks pay them interest on the reserves. The interest is known as IOR or IORR (interest on reserves or interest on required reserves).

Open market operations

The central bank can either purchase or sell securities issued by the government to affect the money supply. For example, central banks can purchase government bonds. As a result, banks will obtain more money to increase the lending and money supply in the economy.

International monetary system refers to a system that forms rules and standards for facilitating international trade among the nations.

It helps in reallocating the capital and investment from one nation to another.

It is the global network of the govt and financial institutions that determine the exchange rate of various currencies for international trade. It's a governing body that sets rules and regulations by which different nations exchange currencies with one another .

With the growing complexity within the international trade and financial market, the international monetary system is necessary to assign a standard value of the international currencies. The rules and regulations set by the international monetary system to regulate and control the exchange value of the currencies are agreed upon by the respective governments of the nations. Thus, the government’s stand may affect the choice making of the international monetary system. For instance , change in the trade policy of a government may affect the international trade of goods and services.

International monetary system motivates and encourages the nations to participate within the international trade to improve their BOP and minimize the deficit . It's grown over the years as one architectural body with a vision to integrate the global economy. a number of the important achievements of the international monetary system over the years are the establishment of world bank and International fund within the year 1944.

The establishment of IMF and world bank is the results of the agreement among nations to line a body, which promotes and supports the international trade. Now, let’s discuss the evolution of international monetary system. Earlier in 1870 to 1914, trade was carried with the assistance of gold and silver without any institutional support. At that point , monetary system was decentralized and market based and money played a bit part as compared to gold in international trade.

The use of gold declined after world war I as war increased expenditure and inflation. In such a scenario, countries planned to revive the standard of gold but failed because of Great Depression . Thus, in 1944, 730 representatives of 44 nations met at Bretton Woods, New Hampshire, us to make a new international monetary system.

This was called because the Bretton Woods system, which became a turning point within the history of international trade. The aim of new international monetary system is to make a stabilized international currency system and ensure a monetary stability for all the nations.

It was decided that since the us held most of the world’s gold, thus all the nations would determine the values of their currencies in terms of dollar. The central banks of nations got the task of maintaining fixed exchange rates with reference to dollar for each currency.

The Bretton Woods system led to 1971 because the deficit and growing inflation undermined the worth of dollar within the whole world. In 1973, the floating exchange rate system, also known as flexible exchange rate system was developed that was market based.

Meaning

Definition: The foreign exchange Market may be a market where the buyers and sellers are involved within the sale and buy of foreign currencies. In other words, a market where the currencies of different countries are bought and sold is named a foreign exchange market. The structure of the exchange market constitutes central banks, commercial banks, brokers, exporters and importers, immigrants, investors, tourists. These are the main players of the foreign market.

Currencies are always traded in pairs, so the "value" of one of the currencies in that pair is relative to the value of the opposite . This determines how much of country A's currency country B can buy, and the other way around . Establishing this relationship (price) for the worldwide markets is that the main function of the exchange market. This also greatly enhances liquidity altogether other financial markets, which is vital to overall stability. The exchange market is an over-the-counter (OTC) marketplace that determines the rate of exchange for global currencies. It is, by far, the largest financial market within the world and is comprised of a worldwide network of monetary centers that transact 24 hours each day , closing only on the weekends. Currencies are always traded in pairs, therefore the "value" of 1 of the currencies therein pair is relative to the value of the other.

The following are the key points:

• The foreign exchange (also called FX or forex) market is a global marketplace for exchanging national currencies against each other .

• Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the most important and most liquid asset markets within the world.

• Currencies trade against one another as exchange rate pairs. For instance , EUR/USD.

• Forex markets exist as spot (cash) markets also as derivatives markets offering forwards, futures, options, and currency swaps.

• Market participants use forex to hedge against international currency and interest rate risk, to take a position on geopolitical events, and to diversify portfolios, among several other reasons

DETERMINATION OF EXCHANGE RATE

The demand for and provide of exchange , currency within the economy supports to work out the exchange conversion rate. The demand and provide of foreign currency in the economy is determined by prices prevailing within the domestic and foreign marketplace for the respective goods, commodities and services, the worth elasticity of products , and services, and also the movement of capital from one market to the another.

Additionally, to some extent the speculative activities within the foreign exchange market, future expectations of rate of exchange s then on also impact the foreign exchange currency exchange rate.

If the demand and provide of foreign currency is equal within the domestic market, then the speed of exchange would generally be in equilibrium. In the economical terminology, it's described as par-value of exchange.

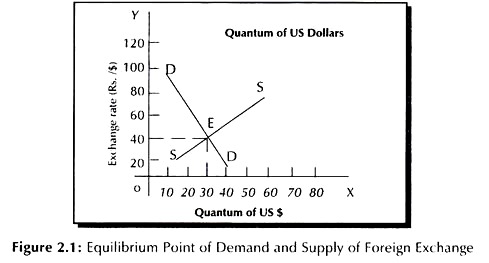

The impact of demand and supply of foreign currency on the exchange rate is shown within the diagram as per Figure 2.1:

In the diagram, dollar’s demand (as DD curve) and supply (SS curve) with reference to Indian Rupees are shown. V-axis indicates Indian Rupees per unit of the US dollar and the X-axis indicates the quantum folks dollar available within the economy at a particular point of your time . The equilibrium point (point E) achieved where DD and SS curves intersect one another . At point E, the value of 1 US dollar is worth Indian Rs. 40.

It also can be concluded that, as the value of dollar increases, the value of the domestic currency, i.e., Indian Rupees decreases. Reversely, the value of local national currency will be higher in compare to foreign currency, when the domestic country’s balance of payments is favourable with respective counter party country.

PURCHASING POWER PARITY THEORY

The purchasing power parity theory was propounded by Professor Gustav Cassel of Sweden. According to this theory, rate of exchange between two countries depends upon the relative purchasing power of their respective currencies. One popular macroeconomic analysis metric to compare economic productivity and standards of living between countries is purchasing power parity (PPP). PPP is an economic theory that compares different countries' currencies through a "basket of goods" approach. According to this concept, two currencies are in equilibrium—known as the currencies being at par—when a basket of goods is priced the same in both countries, taking into account the exchange rates.

Meaning: The theory aims to determine the adjustments needed to be made in the exchange rates of two currencies to make them at par with the purchasing power of each other. In other words, the expenditure on a similar commodity must be same in both currencies when accounted for exchange rate. The purchasing power of each currency is determined in the process.

Description: Purchasing power parity is used worldwide to compare the income levels in different countries. PPP thus makes it easy to understand and interpret the data of each country.

Example: Let's say that a pair of shoes costs Rs 2500 in India. Then it should cost $50 in America when the exchange rate is 50 between the dollar and the rupee.

Suppose in the USA one $ purchases a given collection of commodities. In India, same collection of goods costs 60 rupees. Then rate of exchange will tend to be $ 1 = 60 rupees. Now, suppose the price levels in the two countries remain the same but somehow exchange rate moves to $1=61 rupees.

This means that one US$ can purchase commodities worth more than 46 rupees. It will pay people to convert dollars into rupees at this rate, ($1 = Rs. 61), purchase the given collection of commodities in India for 60 rupees and sell them in U.S.A. For one dollar again, making a profit of 1 rupee per dollar worth of transactions.

This will create a large demand for rupees in the USA while supply thereof will be less because very few people would export commodities from USA to India. The value of the rupee in terms of the dollar will move up until it will reach $1 = 60 rupees. At that point, imports from India will not give abnormal profits. $ 1 = 60 rupees and is called the purchasing power parity between the two countries.

Thus, while the value of the unit of one currency in terms of another currency is determined at any particular time by the market conditions of demand and supply, in the long run the exchange rate is determined by the relative values of the two currencies as indicated by their respective purchasing powers over goods and services.

In other words, the rate of exchange tends to rest at the point which expresses equality between the respective purchasing powers of the two currencies. This point is called the purchasing power parity. Thus, under a system of autonomous paper standards the external value of a currency is said to depend ultimately on the domestic purchasing power of that currency relative to that of another currency. In other words, exchange rates, under such a system, tend to be determined by the relative purchasing power parities of different currencies in different countries.

In the above example, if prices in India get doubled, prices in the USA remaining the same, the value of the rupee will be exactly halved. The new parity will be $ 1 = 120 rupees. This is because now 120 rupees will buy the same collection of commodities in India which 60 rupees did before. We suppose that prices in the USA remain as before. But if prices in both countries get doubled, there will be no change in the parity.

In actual practice, however, the parity will be modified by the cost of transporting goods (including duties etc.) from one country to another.

Gold has historically been used as a medium of exchange primarily because of its scarce availability and desirable properties. Besides its durability, portability, and simple standardization, the high production costs of the yellow metal make it costly for governments to manipulate short-run changes in its stock.

As gold is commodity money, it tends to market price stability within the long run. Thus, the purchase power of an ounce of gold will tend toward equality with its long-run cost of production.

The various versions of gold standards used were:

Gold specie standard:

The actual currency in circulation consists of gold coins with fixed gold content.

Gold bullion standard:

The currency in circulation consists of paper notes but a fixed weight of gold remains the basis of money. Any amount of currency is converted into gold and vice versa by the country’s monitory authority at a hard and fast conversion ratio.

Features of Gold Standard:

The basic features of the gold standard are:

(i) The monetary unit is defined in terms of certain weight and fineness of gold.

(ii) All gold coins are held as standard coins and considered unlimited legal tender.

(iii) All other sorts of money (paper money or token money) are freely convertible into gold or equivalent of gold.

(iv)There's unlimited coinage of gold at no cost.

(v)There's free and unlimited melting of gold.

(vi)Import and export of gold is freely allowed.

(vii) The monetary authority is under permanent obligation to buy and sell gold at the fixed price without limit.

Functions of Gold Standard:

The Gold standard performs two important functions:

1. To regulate the volume of Currency:

Internally, gold standard forms the idea of the currency and acts as a regulator of the volume of currency in the country. This function is called the domestic aspect of the gold standard since it's concerned with stabilising the interior value of the currency. Under gold standard, currency notes are exchangeable on demand for gold of equivalent value.

Thus, note issue is fully backed by gold reserves and the growth of fiduciary note issue (without gold backing) is checked. Moreover, since the quantity of money in the country is limited by the gold reserve held by the financial institution and there must be a cash basis for credit creation, the capacity of the banks to make credit is also limited by the gold reserve. Thus under gold standard, total currency of the country is regulated by its gold reserves.

2. To maintain the stability of Exchange Rate:

Externally, gold standard aims at regulating and stabilising the rate of exchange between the gold standard countries. This function is named the international aspect of the gold standard because it's concerned with stabilising the external value of the currency. Under gold standard, every member country fixes the worth of its currency in terms of certain weight of gold given purity.

Moreover, there's an undertaking given by each country’s monetary authority to get or sell gold in unlimited quantity at the officially fixed price. Under these conditions, a stable relation exists between the money units of various gold standard countries and free movement of gold helps in maintaining the stability of exchange rates.

Thus, under gold standard, a gold reserve is maintained for two purposes:

(a) As backing for note issue; and

(b) to cover a deficit within the balance of payments and thus to maintain the steadiness of exchange rate.

While distinguishing between the 2 aspects or functions of gold standard, Crowther writes- “The cardinal point within the Domestic Gold Standard is clearly the proportion of volume enforced by the law between the gold reserves and the currency. The essence of the International Gold Standard is that the convertibility of the currency into gold- that's the fixed proportion useful between a unit of gold and a unit of currency.”

Automatic Working of Gold Standard:

The most important feature of the gold standard is that it's an automatic standard. It can operate automatically without interference from the monetary authority. In other words, under international gold standard, the equilibrium within the balance of payments of the gold standard countries is automatically achieved through gold movements.

The self-adjusting mechanism of gold standard is often explained by the idea of gold movements. Consistent with this theory, the country with relatively high cost-price structure loses gold, while the country with relatively low cost-price structure gains gold. In other words, the country with deficit balance of payments (i.e., with more than imports over exports) will experience gold outflow and therefore the country with surplus balance of payments (i.e., more than exports over imports) will experience gold inflow.

Suppose two countries A and B are on gold standard. Further suppose that country A experiences a deficit balance of payments, while country B a surplus balance of payments.

The disequilibrium between these two countries are going to be automatically corrected through the mechanism involving the subsequent steps:

1. Gold Movement:

Gold will effuse of country A with adverse balance of payments and can flow in country B with favorable balance of payments.

2. Changes in Money Supply:

Given the gold reserve ratio in both the gold standard countries, the outflow of gold will cause a contraction within the supply of money (i.e., of currency and credit) in country A. On the other hand, the inflow of gold will end in the expansion of money supply in country B.

3. Changes in Prices and Economic Activity:

Contraction in funds will cause a fall within the prices and the profit margins in country A. This will, in turn, reduce investment, income, output and employment therein country. On the opposite hand, expansion of money supply will raise prices and profit margins and consequently investment, income, output and employment in country B.

4. Changes in Imports and Exports:

Fall in prices in country A will encourage foreigners’ demand for its products. Moreover, decrease in incomes in country A will discourage demand for goods from other countries. Thus, exports will increase and imports will decrease in country A. Similarly, rise in prices in country B will lead to an expansion of imports therein country.

5. Equilibrium within the Balance of Payments:

Expansion of exports and contraction of imports will create conditions of favourable balance of payments in country A. On the other hand, Contraction of exports and expansion of imports will cause an adverse balance of payments in country B. As a result, gold will start flowing from country B to country A and this may ultimately remove disequilibrium within the balance of payments in both the countries.

Thus, the movements of gold as a consequence of a disequilibrium in balance of payments will automatically create conditions for the removal of the disequilibrium and ultimately cause an equilibrium within the balance of payments within the gold-standard countries.

Disequilibrium in balance of payments → (leading to) movements of gold (leading to) changes in money supply → (leading to) changes in prices and incomes → (leading to) changes in exports and imports → (leading to) equilibrium within the balance of payments.

Rules of Gold Standard:

For the smooth and automatic working of gold standard, certain conditions are to be fulfilled. These conditions are called ‘the rules of the gold standard game’. Consistent with Crowther. “The gold standard may be a jealous God. It'll work provided it's given exclusive devotion.”

1. Free Movements of Gold:

There should be no restriction on the movement of gold among the gold standard countries. They will freely import and export gold.

2. Elastic Money Supply:

The Government of the gold standard countries must expand currency and credit when gold is coming in and contract currency and credit when gold goes out. This requires that whatever non-gold money (paper money or coins or demand deposits) could also be in circulation, gold reserves in some fixed proportion must be kept. For example, if the gold reserve ratio is 50%, then for a reduction of $ 1 gold reserve, there must be a reduction of $ 2 of credit money.

3. Flexible Price System:

Price-cost system of gold standard countries should be flexible in order that when funds increases (or decreases) as a results of gold inflow (or gold outflow), the costs , wages, interest rates, etc., rise (or fall).

4. Free Movement of Goods:

There should even be free movement of goods and services among the gold standard countries. Under gold standard, differences in prices between countries are expressed through excess of exports or imports of 1 country over the other and therefore the more than exports or imports are adjusted through inflow or outflow of gold. Thus, restrictions on import or export of goods disturb the automatic working of the gold standard.

5. No Speculative Capital Movements:

There shouldn't be large movements of capital between countries. Small short-term capital movements are necessary to fill the gap within the international payments and, thereby, to correct the disequilibrium within the balance of payments.

For example, the monetary authority of a country, with adverse balance of payments, can raise interest rates, and thus, attract capital from other countries and, in turn, correct its adverse balance of payments position. But large panic movements of capital as a results of political, social and economic disturbances are dangerous for the graceful working of the gold standard.

6. No International Indebtedness:

Gold standard countries should make efforts to avoid international indebtedness. When external debt increases, the country should increase exports to pay back the interest and therefore the principal.

7. Proper Distribution of Gold:

An important requirement for the successful working of the gold standard is pie availability of sufficient gold reserves and their proper distribution among the participating countries.

Merits of Gold Standard:

Various advantages of the gold standard are discussed as under:

1. Simplicity:

Gold standard is considered to be a very simple monetary standard. It avoids the complicacies of other standards and may be easily understood by the general public.

2. Public Confidence:

Gold standard promotes public confidence because- (a) gold is universally desired due to its intrinsic value, (b) all types of no-gold money, (paper money, token coins, etc.) are convertible into gold, and (c) total volume of currency within the country is directly related to the volume of gold and there is no danger of over-issue currency.

3. Automatic Working:

Under gold standard, the monetary system functions automatically and requires no interference of the govt . Given the connection between gold and quantity of money, changes in gold reserves automatically cause corresponding changes within the supply of money. Thus, the disequilibrium conditions of adverse or favourable balance of payment on the international level or of inflation or deflation on the domestic level are automatically corrected.

4. Price Stability:

Gold standard ensures internal price stability. Under this monetary system, gold forms the currency base and therefore the prices of gold don't fluctuate much due to the steadiness within the monetary gold stock of the planet and also because the annual production of gold is merely a small fraction of world’s total existing stock of monetary gold. Thus, the price system which is founded on relatively stable gold base will be more or less stable than under the other monetary standard.

5. Exchange Stability:

Gold standard ensures stability in the rate of exchange between countries. Stability of exchange rate is important for the development of international trade and therefore the smooth flow of capital movements among countries. Fluctuations within the exchange rate adversely affect the foreign trade.

Demerits of Gold Standard:

The gold standard suffers from the subsequent defects:

1. Not Always Simple:

Gold standard in all its forms isn't simple. The gold coin standard and, to some extent, gold bullion standard could also be regarded as simple to understand. But, the gold exchange standard which relates the currency unit of a rustic thereto of the opposite is by no means simple to be comprehended by a common man.

2. Lack of Elasticity:

Under the gold standard, the monetary system lacks elasticity. Under this standard, funds depends upon the gold reserves and therefore the gold reserves can't be easily increased. So money supply isn't flexible enough to be changed to fulfill the changing requirements of the country.

3. Costly and Wasteful:

Gold standard may be a costly standard because the medium of exchange consists of pricy metal. It's also a wasteful standard because there's a great wear and tear of the precious metal when gold coins are actually in circulation.

4. Fair-Weather Standard:

The gold standard has been regarded as a fair-weather standard because it works properly in normal or peaceful time, but during the periods of war or economic crisis, it invariably fails. During abnormal periods, those that have gold attempt to hoard it and people who have paper currency cry for its conversion into gold. So as to guard the falling gold reserves, the monetary authority prefers to suspend the gold standard.

5. Sacrifice of Internal Stability:

The gold standard sacrifices domestic price stability so as to make sure international exchange rate stability. In fact, under gold standard, inflation and deflation respectively are the required companions to a favourable and an unfavourable balance of payments.

Give the world’s total monetary gold stock, a private country’s monetary gold stock, and consequently, the cash supply and therefore the internal price level, changes by the inflow or outflow of gold as a results of international trade. Thus the presence of external trade almost guarantees price instability under gold standard mechanism.

6. Not Automatic:

The automatic working of the gold standard requires the mutual cooperation of the participating countries. But, during the world War I, due to the shortage of international cooperation, all types of countries, those receiving gold also as those losing gold, found it necessary to abandon the gold standard to prevent disastrous inflation on the one hand and even more disastrous deflation and unemployment on the other.

7. Deflationary:

According to Mrs. Joan Robinson, gold standard generally suffers from an inherent bias towards deflation. Under this standard, the gold losing country is under the compulsion to contract money supply in proportion to the fall in gold reserves.

But the gold gaining country, on the opposite hand, might not increase its money supply in proportion to the increase in gold reserves. Thus, the gold standard, which necessarily produces deflation within the gold losing country, might not generate inflation in gold receiving country.

8. Economic Dependence:

Under gold standard, the problems of one country are passed on to the opposite countries and it's difficult for a private country to follow independent policy .

9. Unsuitable for Developing Countries:

Gold standard is especially not suitable to the developing economies which have adopted a policy of planned economic development with an objective to secure self-sufficiency.

Breakdown of Gold Standard:

Before war I, gold standard worked efficiently and remained widely accepted. It succeeded in ensuring exchange stability among the countries. But with the starting of the war in 1914, gold standard was abandoned everywhere.

Mainly due to two reasons:

(a) To avoid adverse balance of payments and

(b) To stop gold exports falling into the hands of the enemy.

After the war in 1918, efforts were made to revive gold standard and, by 1925, it had been widely established again. But, the good depression of 1929-33 ultimately led to the breakdown of the gold standard which disappeared completely from the world by 1937. The gold standard failed because the principles of the gold standard game weren't observed.

Following were the most reasons of the decline of the gold standard:

1. Violation of Rules of Gold Standard:

The successful working of the gold standard requires the observance of the basic rules of the gold standard:

(a) There should be free movement of gold between countries;

(b) There should be automatic expansion or contraction of currency and credit with the inflow and outflow of gold;

(c) The governments in several countries should help facilitate the gold movements by keeping their internal price system flexible in their respective economies.

After war I, the governments of gold standard countries didn't want their people to experience the inflationary and deflationary tendencies which would result by following the gold standard.

2. Restrictions on Free Trade:

The successful working of gold standard requires free and uninterrupted trade of goods between the countries. But during interwar period, most of the gold standard countries abandoned the trade policy under the impact of narrow nationalism and adopted restrictive policies regarding imports. This resulted within the reduction in international trade and thus the breakdown of the gold standard.

3. Inelastic Internal Price System:

The gold standard aimed toward exchange stability at the expense of the internal price stability. But during the inter-war period, the monetary authorities sought to maintain both exchange stability also as price stability. This was impossible because exchange stability is usually accompanied by internal price fluctuations.

4. Unbalanced Distribution of Gold:

A necessary condition for the success of gold standard is the availability of adequate gold stocks and their proper distribution among the member countries. But within the interwar period, countries like the U.S.A. And France accumulated an excessive amount of gold, while countries of Eastern Europe and Germany had very low stocks of gold. This shortage of gold reserves led to the abandonment of the gold standard.

5. External Indebtedness:

Smooth working of gold standard requires that gold should be used for trade purposes and not for the movement of capital. But during the inter-war period, excessive international indebtedness led to the decline of gold standard.

There were three main reasons for the excessive movement of capital between countries:

(a) After war I, the victor nations forced Germany to pay war reparation in gold,

(b) There was movement of huge amounts of short-term capital (often called as refugee capital) from one country to a different in search of security,

(c) There was many borrowing by the underdeveloped countries from the advanced countries for investment purpose.

6. Excessive Use of Gold Exchange Standard:

The excessive use of gold exchange standard was also liable for the break-down of gold standard. Many small countries which were on gold exchange standard kept their reserves in London and ny . But, rumors of war and abnormal conditions forced the depositing countries to withdraw their gold reserves. This led to the abandonment of the gold standard.

7. Absence of International Monetary Centre:

Movement of gold involves cost. Before 1914, such movement wasn't heeded because London was working because the international monetary centre and therefore the countries having deposit accounts within the London banks adjusted their adverse balance of payments through book entries.

But during inter-war period, London was fast losing its position as a world financial center. Within the absence of such a center, every country had to stay large stocks of gold with them and large movements of gold had to require place. This wasn't proper and easily manageable. Thus, gold standard failed thanks to the absence of inter-national financial center after war I.

8. Lack of Co-Operation:

Economic co-operation among the participating countries may be a necessary condition for the success of gold standard. But after war I, there was complete absence of such cooperation among the gold standard countries, which led to the downfall of the gold standard.

9. Political Instability:

Political instability among the European countries also was liable for the failure of gold standard. There have been rumors of war, revolutions, political agitations, fear of transfer of funds to other countries. Of these factors threatened the safe working of the gold standard and ultimately led to its abandonment.

10. Great Depression:

The world-wide depression of 1929-33 probably gave the ultimate blow to the gold standard. Falling prices and wide-spread unemployment were the fundamental features of depression which forced the countries to impose high tariffs to limit imports and thus international trade. The good depression was also liable for the flight of capital.

11. Rise of Economic Nationalism:

After the World War I, a wave of economic nationalism swept him European countries. With an objective to secure self-sufficiency, each country followed protectionism and thus imposed restrictions on international trade. This was an immediate interference within the working of the gold standard.

Thus, both endogenous also as exogenous factors were responsible for the breakdown of the gold standard:

(a) Some factors referred to the inner weaknesses of the gold standard;

(b) Others acknowledged the failures of the monetary authorities to assist the smooth working of the system; and

(c) Still others indicated the adverse external circumstances under which the gold standard had to work.

Under the conditions prevailing today, motivated by economic nationalism and dominated by selfish commercial systems, there's little hope of the revival of the gold standard in the near future.

GOLD EXCHANGE STANDARD:

Paper currency is often converted at a fixed rate into the paper currency of the other country, if it's operating a gold specie or gold bullion standard. Such an exchange regime was followed within the post-Bretton Woods era.

Exchange rates from 1876 to 1913 were generally dictated by gold standards. Each country backed up its currency with gold, and currencies were convertible into gold at specified rates. Relative convertibility rates of the currencies per ounce of gold determined the exchange rates between the 2 currencies.

Gold standard was suspended following war I in 1914 and governments financed massive military expenditure by printing money. This led to a sharp rise both within the supply of money and market prices. Hyperinflation in Germany presents a classic example where the price index rapidly shot from 262 in 1919 to 12,61,60,00,00,00,000 (a factor of 481.5 billion) in December 1923.

The US and a few other countries returned to gold standards so on achieve financial stability, but following the good Depression in 1930, gold standards were finally abandoned. Some countries attempted to peg their currencies to the US dollar or British pound within the 1930s but there were frequent revisions.

This followed severe restrictions on international transactions and instability within the foreign exchange market, resulting in a decline in the volume of international trade during this period.

Period of 1898-1917, The Gold Exchange Standard:

In March 1893, the govt of India, during a communication to the Secretary of State, urged him to require “active steps to secure the early establishment of a gold standard and a stable exchange.” This led to the appointment of a committee under Sir Henry Fowler for recommending measures calculated to make effective the declared policy of building a gold standard in India.

The Committee had to answer three main questions:

(a) Should there be a reversion to the standard with free coinage of silver?

(b) Or if it was desirable to adopt a gold standard, should it's protected by a gold currency in actual circulation or by gold in reserve?

(c) Should existing arrangements continue?

The Committee rejected the suggestion for return to the silver standard be¬cause, in their opinion, it meant drilling back to the risks and uncertainties of 1874-1897. Further, it had been likely to hamper international trade and revive the difficulties in meeting the home charges.

They were also against allowing the established order to continue because that might have raised doubts regarding the success of the gold standard in India. The Committee, therefore, came to the conclusion that the govt should proceed with measures for the effective establishment of a gold standard in India. During this connection, the Committee recommended.

(1) That British Sovereign should be made a legal tender and a current coin in India. The Indian mints should be thrown open to the coinage of gold sovereigns and half sovereigns.

(2) That the rate of exchange should be made stable at IS. 4d.: rupee.

(3) That the rupee should remain unlimited tender .

(4) That the govt. Should still give rupees for gold but fresh rupees shouldn't be coined “until the proportion of the gold within the currency was found to exceed the requirements of the general public.”

(5) That the profits on any future silver coinage undertaken by the govt. . Should be credited to a gold fund to be kept “as a special Reserve, entirely aside from the paper currency Reserve and therefore the ordinary treasury balances.”

(6) That the govt. Should be under no legal obligation to offer gold for rupees for this would make her liable to find gold at a moment’s notice in undefined terms.

(7) That the govt. Should make gold available for export if exchange showed a bent to fall below the specie point.

These recommendations were almost entirely accepted by the govt. . And the Act XXII of 1899 made the Sovereign and half-Sovereign tender throughout India at Rs. 15: £. A reserve, called the Gold Reserve, was created to line apart the profits on the coinage of rupees. At the same time, active steps were taken to encourage the use of gold as currency.

Unexpectedly, the results proved unsatisfactory when a large number of gold coins were returned to the govt..Treasuries. There was almost a run on silver which nearly exhausted the currency reserves. Both notes and Sovereigns went at discount. The Govt. Was, thus, forced to resume the coinage of rupees on a substantial scale in 1900. Apparently, it had been concluded that the people didn't want gold coins.

In reality, the scheme failed because both the time and mariner of putting gold coins into circulation were ill chosen. The country was within the grip of a famine about this point and rupees were needed for little payments. Also, the tactic of forcing Sovereign simultaneously from several sides was also not correct.

With the resumption of rupee coinage, the currency system steadily drifted away from the aim of an effective gold standard. In 1900, the experiment of introducing gold coins failed. In 1902, the scheme to determine a gold mint was dropped. Within the same year the arrangement, initiated in 1893, of issuing currency notes against gold received in London was made permanent.

In 1904, the Secretary of State notified his willingness to sell rupees for Sterling at IS. 4d. Without limit. The G old Reserve, constituted out of profits on the coinage of rupees, was remitted to London and invested in Sterling Securities. A rupee-branch of the Gold Reserve was also created to make sure ready supply of rupees in exchange for gold tendered in India at 1S. 4d.so on prevent an increase within the exchange rate.

The name of the Reserve, after the creation of this branch, was changed to Gold Standard Reserve which now consisted of a Rupee portion and Sterling securities, portion.

These steps, although within the nature of experiments to maintain the value of the rupee at 1S. 4d., led to the establishment of a new quite currency system — the Gold Exchange Standard in India. This new system was the results of a series of administrative acts. It had therefore, no basis in law. It had been never adopted as a consistent whole for it had been never consciously designed.

The main characteristics of the system were:

(a) The rupee was unlimited tender but inconvertible into Gold.

(b) Currency notes of the denomination of Rs. 5, 10, 50, 100, 500, 1000 and 10,000 were unlimited tender and convertible into rupees.

(c) Sovereigns and half sovereigns were unlimited legal tender in India at the rate of Rs. 15 per sovereign.

(d) As a matter of administrative practice, the Govt. Was willing to offer sovereigns for rupees at that rate but the practice was sometimes suspended.

(e) As a matter of administrative practice, the Govt. Was willing to sell rupees or rupee currency payable in Calcutta or Bombay in exchange for gold or Sovereigns or Sterling tendered in London at the utmost rate of 1S. 4 1/8d. Per rupee. This was referred to as the sale of council bills.

(f) As a matter of administrative practice, the Govt. Was also willing to sell gold or Sovereigns or Sterling, payable in London, in exchange for rupees tendered in Calcutta or Bombay, at the minimum rate of 1S.3 29/32d. Per rupee. This was called the sale of Sterling Drafts or Reverse Councils.

Mechanism of Gold Exchange Standard:

The system was worked by the sale of council drafts and Reverse Council Drafts. Council Drafts were orders by the Secretary of State to the govt. . Of India to pay rupees. These orders might be sent by sent by post once they were called ‘Council Bills’ or during a telegraphic form once they were called ‘Telegraphic Transfers.’

These orders were sold to British Banks, firms, and importers in exchange for sterling received from them. Internet results of the sale of Council Bills was that the Secretary of State received Sterling and therefore the Govt. Of India released the same amount of rupees. By the sale of those , the speed of exchange can be prevented from rising beyond IS. 41/8d: 1 rupee.

The sale of Council Drafts was one aspect of the Gold Exchange Standard, the opposite being the sale of Reverse Councils Drafts. The Reverse Councils were orders by the govt. . Of India to the Secretary of State to pay Sterling reciprocally for rupees received by them. The results of the sale of Reverse Council Drafts was that the govt. . Of India received rupees while the Secretary of State released, from his funds, Sterling.

Reverse Councils weren't sold below the speed of 1S. 329/32d : 1 rupee. By the sale of council Drafts and Reverse Councils, the rate of exchange was prevented from deviating considerably from a fixed rate of 1S. 4d a rupee. It could only fluctuate between 1S. 329/32d and IS 41/8d to the rupee.

Crisis of 1907-1908:

The mechanism of the Gold Exchange Standard was completed when a partial failure of monsoons in 1907 led to a decline in Indian exports. At an equivalent time, there was an important arrival of imports in response to earlier contracts.

To this was added a significant financial crisis in America which resulted in monetary stringency everywhere the world. This caused the Indian exchange to become very weak although the danger of this happening was considered ‘illusory’ only a touch earlier.

To meet things, the Govt. Started selling Reverse Councils on London at the rate of 1S. 329/32d: 1 rupee. The Secretary of State, firstly, released gold from the paper currency Reserve in London and, Secondly, sold the Sterling Securities within the Gold Standard Reserve to finance the Reverse Councils. These steps, as also the revival in 1908 of India’s export trade, brought the rupee Exchange back to 1S. 4d.

The rupee was established by this mechanism but, in the process, a severe strain was imposed on the gold resources of the country. This might be seen from the very fact that the total gold resources utilized in India and London together during this one year of crisis amounted to just about £ 18 million.

In India, practically the whole stock of gold was exhausted. This was sure to arouse strong public criticism. It had been acknowledged that the sale of Council Bills by the Secretary of State in more than his needs on account of Home charges prevented the export of gold from England that was really needed in India. Criticism was also directed against the situation and use of the Gold Standard Reserve.

It was said that the situation of the reserve in London deprived India of a large accumulation of resources which could are utilised for the economic and social advancement of the country or for the reduction of taxes.

This criticism of the currency system was delivered to a head when the India office purchased a large quantity of silver for coinage purposes in India office from a personal firm and not from the “recognized and constituted agents”; namely, the Bank of England.

The whole proceedings assumed a sinister look. The agitation, which followed, resulted within the appointment of the Royal Commission on Indian currency and finance under the chairmanship of Mr. Austen Chamberlain.

Merits:

The Gold Exchange Standard was an accidental find for India. It had received the approval and praise of J.M.Keynes and therefore the Chamberlain Commission. India, Keynes said, had discovered a wonderful standard which lay within the ‘mainstream of currency evolution.’ The system, it had been claimed, had the merit of economy.

Since gold coins didn't circulate, monetary authorities didn't need to buy gold for coinage purpose. This meant an excellent economy within the use of gold. Further, the same gold reserves, kept in London, served because the basis of the monetary systems both in Great Britain and India thereby reducing the pressure on the gold supply of the world.

Another achievement with which the system was credited was that it gave the country a long period of exchange stability. These advantages seemed illusory after the system, which Keynes once hailed as wonderful, collapsed. It was found to possess many shortcomings.

Defects:

Firstly, the Gold Exchange standard in India had resulted from a series of administrative notifications, not consistently informed by a deliberately adopted ideal. The system was never clearly defined and this had a general unsettling effect. Secondly, the system was faraway from simple and not easily intelligible.

Thirdly, it involved a cumbrous duplication of reserves, namely, the Gold Standard and paper currency and Banking reserves with a dangerous division of responsibility for the control of currency and credit policy. Fourthly, the utilisation of the reserves and balances was never governed by a consistent policy.

They were sometimes treated separately and, at others, involved thereby causing confusion. Fifthly, the system wasn't automatic but wholly dependent on the will of the govt. Sixthly, the system lacked elasticity, particularly contractibility.

The inevitable result was an inflation of currency and an excessive upward movement of prices. Seventhly, under this technique unnecessarily large amounts were trans¬ferred from India to London through the sale of Council Bills. This encouraged the policy of surplus budgets in India thereby curtailing development expenditure. Eighthly, the system involved locating the Gold Standard Reserve in London.

Not only that, the system worked in such a manner on divert the flow of gold from India and saving London the inconvenience and price of finding it for herself. Ninthly, the system did not destroy the hoarding habit of the people. Lastly, there were defects of the system which arose primarily because of the absence of a central bank in India.

The management of the standard was within the hands of the officials who didn't always possess the required training nor were they in touch with the trade and market conditions. Understandably, their management of the quality was often miscalculated.

The Gold Exchange Standard was often commended for its cheapness. But, in sight of the disadvantages mentioned above, there's little doubt that the cheapness of the system was indeed very dearly bought.

The International fund, also called the IMF or just the ‘Fund’, was conceived at a United Nations Conference convened in Bretton Woods, New Hampshire, US in July 1944. The 45 governments represented at the conference sought to make a framework for economic cooperation that might avoid a repetition of the disastrous economic policies that had contributed to the great Depression of the 1930s.

The IMF offers regular dialogue and policy advice to every of its members. Generally, once a year, the Fund conducts in-depth appraisals of each member country’s economic situation. It discusses with the country’s authorities the policies that are most conducive to stable exchange rates and a growing and prosperous economy.

In its overview of its members’ economic policies, the IMF looks mainly at a country’s macro-economic performance. This comprises total spending and its major components like consumer spending and business investment, output, employment, and inflation, also because the country’s balance of payments.

Responsibilities of the International Monetary Fund:

i. Promoting international monetary cooperation

Ii. Facilitating the expansion and balanced growth of international trade

Iii. Promoting exchange stability

Iv. Assisting within the establishment of a multilateral system of payments.

v. Making its resources available, under adequate safeguards to members experiencing balance of payments difficulties

The Fund seeks to market economic stability and prevent crises; to assist resolve crises once they do occur, and to market growth and alleviate poverty. To meet these objectives, it employs three main functions, as discussed here.

Functions of the International Monetary Fund:

(i) Surveillance:

A core responsibility of the IMF is to encourage a dialogue among its member countries about the national and international consequences of their economic and financial policies, to promote external stability.

This process of monitoring and consultation, normally mentioned as ‘surveillance’, has evolved rapidly because the world economy has changed. IMF surveillance has also become increasingly open and transparent in recent years.

The initiatives wont to inform bilateral surveillance and aimed toward promoting global economic stability are as follows:

i. The IMF works to boost its ability to assess the member countries’ vulnerabilities to crisis, identifying and promoting effective responses to risks to economic stability, including risks from payments imbalances, currency misalignment, and financial market disturbances.

Ii. In collaboration with the world Bank, the IMF conducts in-depth assessments of countries’ financial sectors under the Financial Sector Assessment Programme (FSAP). The Fund is further deepening financial and capital market surveillance, particularly in its analysis of emerging market members.

Iii. The IMF has developed and actively promotes standards and codes of good practice in economic policy making. It's also involved in international efforts to combat money laundering and therefore the financing of terrorism.

The importance of effective surveillance was underscored by the financial crises of the late 1990s. In response, the IMF has undertaken many initiatives to strengthen its capacity to detect vulnerabilities and risks at an early stage, to assist member countries strengthen their policy frameworks and institutions, and to enhance transparency and accountability.

(ii) Technical Assistance:

The objective of IMF technical assistance is to contribute to the event of the productive resources of member countries by enhancing the effectiveness of economic policy and financial management. The IMF helps countries strengthen their capacity to style and implement sound economic policies.

The IMF helps its member countries build their human and institutional capacity to style and implement effective macroeconomic and structural policies, put in place reforms that strengthen their financial sectors, and reduce vulnerability to crises.

The IMF generally provides technical assistance freed from charge to any requesting member country within the IMF resource constraints. About three-quarters of the Fund’s technical assistance attend low- and lower-middle income countries, particularly in Sub-Saharan Africa and Asia, and post-conflict countries.

The IMF provides technical assistance in its areas of expertise: namely macroeconomic policy, tax program and revenue administration, expenditure management, monetary policy, the rate of exchange system, financial sector sustainability, and macro- economic and financial statistics.

Since the demand for technical assistance far exceeds supply, the IMF gives priority in providing assistance where it complements and enhances the IMF’s other key sorts of assistance, i.e., surveillance and lending.

(iii) Lending:

Even the best economic policies cannot eradicate instability or avert crises. Within the event that a member country does experience financing difficulties, the IMF can provide financial assistance to support policy programmes which will correct underlying macroeconomic problems, limit disruptions to the domestic and global economies, and help restore confidence, stability, and growth.

IMF financing instruments also can support crisis prevention.

The IMF is accountable to the governments of its member countries. At the apex of its organizational structure is its board of governors, which consists of one governor from each of the IMF’s 185 member countries. All governors meet once a year at the IMF-World Bank Annual Meetings.

The IMF’s resources are provided by its member countries, primarily through payment of quotas, which broadly reflect each country’s economic size. The annual expenses of running the Fund are met mainly by the difference between interest receipts on outstanding loans and interest payments on quota ‘deposits’.

Special drawing right:

The special drawing right (SDR) is a world reserve asset, created by the IMF to supplement the existing official reserves of member countries. SDKs, sometimes referred to as ‘paper gold’, although they need no physical form, are allocated to member countries (as book-keeping entries) as a percentage of their IMF quotas. Its value is based on a basket of international currencies.

The SDR was introduced by the IMF in 1969 as an international reserve asset to support the Bretton Woods fixed exchange rate system. a rustic participating during this system needed official reserves, government or central bank holdings of gold, and widely accepted foreign currencies that would be wont to purchase the domestic currency in world foreign exchange markets, as needed to maintain its exchange rate.

Since the supply of the 2 key reserve assets, i.e., gold and also the US dollar proved inadequate for supporting the expansion of world trade, the international community decided to make a new international reserve asset under the auspices of the IMF.

However, the Bretton Woods System collapsed barely two years later and therefore the major currencies shifted to a floating rate of exchange regime. Moreover, the growth in international capital markets facilitated borrowing by creditworthy governments. These developments lessened the necessity for SDKs.

Presently, the SDR has only limited use as a reserve asset and its main function is to function the unit of account of IMF and a few international organizations. Readers should note that the SDR is neither a currency, nor a claim on the IMF Rather it's a possible claim on the freely usable currencies of IMF members.

The value of the SDR was initially defined as like 0.888671 grams of fine gold which at the time was also like one US dollar. After the collapse of the Bretton Woods System in 1973, the SDR was redefined as a basket of currencies.

Presently, it comprises the Euro, Japanese Yen, British pound , and the US dollar. The basket composition is reviewed every five years to make sure that it reflects the relative importance of currencies within the world’s trading and financial systems.

The weights of currencies within the SDR basket were revised within the most recent review in November 2005, supported value of goods and services and therefore the amount of reserves denominated in respective currencies, which were held by other members of the IMF These changes became effective from 1 January 2006, and therefore the next review is likely to take place in late 2010.

The management of the IMF is rested on two bodies:

(a) Board of Governors and

(b) Board of Executive Directors.

Every member country appoints one Governor for participating within the meetings of Board of Governors and also appoints one Alternate Governor to represent the Governor is respect of its absence. The Board of Governors in authorized to formulate the overall policies of the Fund. To carry on day to day activities of the IMF, the Board of Executive Directors in formed.

At present, there are 22 members within the Board of Executive Directors, six of which are appointed by members maintaining largest quotas, i.e. USA, UK, Germany, France, Japan and Saudi Arabia and the remaining sixteen directors are elected by other nations.The managing director of Board of Directors, the top most official of IMF, in elected by the Board of Directors. He's accountable for organisation and management of the Fund.

Resources of IMF:

The resources of IMF are built up by the subscription of members. Again the subscription quota of every member is decided by its value and its condition of international trade. After determination of quota, every member nation contributes 25 per cent of its quota in international assets and the remaining 75 per cent is contributed in member’s own currency.

The contribution of first 25 per cent was made originally in terms of gold but now it's being made in Special Drawing Rights (SDRs), a world reserve asset created by the IMF in 1969. There's also provision to enlarge the resources of the Fund by resorting to borrowing, by selling gold to the people and also by receiving fee from its borrowing members.

There is provision of revising the quotas of member countries in every five years. The newest general increase in quotas as results of 9th review has enlarged the capital base of the Fund and accordingly the Fund could increase the loan assistance extended to its member countries.

Quota features a great significance to the member nations due to its following implications:

(i) Quota determines the subscription of members to the IMF which determines the quantum of IMF resources;

(ii) It also determines the member country’s access to IMF resources either through drawings or borrowings from the IMF.

(iii) The quota also can determine the voting power of member in IMF management.

(iv) The quota also can determine the share of member country in respect of allocation of SDRs.

Critical Appraisal of IMF:

It would be better to form an appraisal of the activities of IMF within the sort of its achievements and failures.

Achievements:

The functioning of IMF has become successful in certain areas like—expansion of fund, making adequate provision of credit for the developing countries, attaining exchange stability, expansion of world trade, raising international liquidity, removing international monetary system, fixing multilateral trade and payment system, eliminating short-term disequilibrium of balance of payments, checking competitive currency devaluation and fixing machinery for consultation so on provide export guidance to member countries in formulating its fiscal and financial policies.

Failures:

In spite of achieving a point of success by the IMF in certain areas, the Fund suffers as a results of failures in many fronts.

Following are a number of these failures:

(i) The IMF has failed in respect of achieving the essential objectives of international exchange stability. Neither the Fund put any loan exchange fluctuations nor it prevents competitive devaluation of currencies by its members.

(ii) The Fund has followed discriminatory treatment in favour of certain members in its day to day functioning. It favours some Western countries and neglects the real interests of underdeveloped and backward countries.

(iii) The IMF has also failed to establish a stable and sound international monetary system and thereby experiences serious monetary crisis arising out of rapidly fluctuating exchange rates. Thus the Fund has did not bring complete stability in exchange rates.

(iv) The Fund has also failed to persuade the member countries to eliminate exchange controls and other restrictions on foreign trade.

(v) In respect of promoting international liquidity the Fund has found it difficult to satisfy the exchange requirements of the members.

(vi) The IMF has also failed to eliminate the multiple exchange rates with reference to different transactions.

(vii) The IMF has also failed to bring the free convertibility of currency of different countries.

(viii) In respect of problems of future disequilibrium within the balance of payments faced by different countries, the IMF can provide only short term credit facilities.

(ix) The IMF has also failed to tackle the matter of petro dollars. The Fund should have played an efficient role in recycling the surpluses of OPEC countries towards the developmental purposes of developing countries.

(x) The IMF has also failed to remove the varied restrictions of trade imposed by different countries. Accordingly, the foremost of the countries are making extensive use of the trade and exchange controls.

(xi)In IMF affairs, the developing countries are having inadequate representation. Although developing countries of Asia, Africa and Latin America constitute about 90 per cent of the members of IMF but actually these countries are having 38 per cent of the entire voting power in various affairs of Fund.

(xii) As a results of non-revision of quota of IMF, the share of quotas as a percentage of world trade has been declining fast from 16 per cent in 1965 to a mere 4 per cent in 1981.

(xiii) As a results of following faulty and biased method of extending credit on the basis of quotas but not on the idea of need, the underdeveloped and developing countries aren't getting adequate support from the IMF due to their small quotas.

(xiv) The rich member countries are maintaining larger quotas and thereby can influence the policies and decisions of the IMF easily. Therefore, the IMF has been branded as Rich Men’s Club due to their growing dominance

(xv) Finally, it's also been argued that IMF has been interfering or influencing the economic policies of poor and developing countries by putting various restrictions on them.