UNIT 3

BANKING

MEANING OF BANK:

The term bank has originated from the term ‘Banchi’. In olden days, the traders of Italy who performed the job of exchanging money were known as Banchi or Bancheri because the table which they used for making payment was called a Banchi.

According to some people, the term bank is derived from the Greek word ‘Banque.’

A bank deals in money in the same way as a businessman deals in goods. Banks are business enterprises which deal in money, financial instruments and provide financial services for a price called interest, discount, commission etc.

Following are cited some prominent definitions of bank:

(1) “Banking is the business of accepting for the purpose of lending or investment, of deposits of money from the public repayable on demand or otherwise and withdraw-able by cheque, draft, and order or otherwise.” Indian Banking Regulation Act, 1949

(2) “A bank is an organisation whose principal operations are concerned with the accumulation of the temporarily idle money of the general public for the purpose of advancing to others for expenditure.”-R.P. Kent

TYPES OF BANKS:

Following are important types of Banks:

(i) Commercial Banks

(ii) Central Bank:

Central Banks is the apex institution which supervises and controls the entire banking system. Each country has one central bank. The Reserve Bank of India (RBI) is the central bank of our country.

Some important functions of the central banks are:

1. Enjoying exclusive monopoly of issuing currency notes

2. Acting as the Government’s bank

3. Acting as controller of credit, in the economy

4. Acting as custodian of the foreign currency reserves of the country, etc.

(iii) Industrial Banks:

Industrial banks provide long term and medium term finance to industrial units; for purposes of modernization, expansion etc. These also provide technical and managerial guidance to industrial units. Industrial Development Bank of India (IDBI), Industrial Credit and Investment Corporation of India (ICICI) etc. are examples of industrial banks.

(iv) Land Mortgage Banks (or Agricultural Banks):

These banks provide long-term finance to farmers, against the mortgage of agricultural land etc. for purchasing tractors, installation of modem agricultural facilities, buying cattle, seeds, fertilizers etc

(v) Merchant Banks:

These banks specialize in providing financial services to companies, like issue management, underwriting, consultancy services etc. SBI Capital Market is a leading example of a merchant bank, in India.

(vi) Exchange Banks:

These banks provide financing for foreign trade; and deal in foreign exchange.

(vii) Co-Operative Banks:

These banks are registered under the Co-operative Societies Act, and function on principles of co-operation. They accept deposits from members and grant loans to them at low rates of interest.

(viii) Foreign Banks:

Most of foreign banks in India are subsidiaries of foreign banks. They are owned and managed by foreign promoters. Some foreign banks in India are – Citibank, Bank of America, Standard Chartered Bank, American Express, and Hong-Kong Bank.

(ix)Savings Banks:

The main objective of a savings banks is an encourage thrift among people; so that they can save for future. In India, there are hardly any independent savings banks. Mostly these are operated as a part of the post office called Postal Savings banks.

(x) Indigenous Banks:

These are money lenders who accept deposits and grant loans. They are popular in villages and small towns. They provide banking facilities to those who cannot approach banks for any reasons whatsoever. Prior to the development of banking system in our country; indigenous bankers played a very important role in the lives of businessmen and common people.

TYPES OF BANKING:

Banks can be classified into different groups either on the basis of their structure or on the basis of their function. Structurally banking can be divided into Branch banking and Unit Banking. Functionally, banking can be divided into Deposit Banking, Investment Banking and Mixed Banking.

Branch Banking:

This refers to a system under which two or more banks are opened under a single ownership. Examples are State Bank of India, Punjab National Bank, Indian Bank etc. which have several branches spread all-over India.

Unit Banking:

This refers to that system of banking in which banking operations are carried on through a single organisation, without any branches. This system used to be popular in America.

One great advantage of branch banking is that the same bank can cater to several parts of a large country (through its branches situated in those parts) which a unit bank would find difficult to do. As against this, a unit bank has the advantage that its efforts are concentrated in one area so that it can serve that area well.

Group Banking:

This is a system under which two or more banks, separately incorporated, are connected by being controlled by a single holding company as trust.

Chain Banking:

This is similar to Group Banking. Here two or more banks are controlled by a single group through the ownership of shares or otherwise.

Deposit Banking:

In this category, the banks act as custodian or trustees of the depositors.

Investment Banking:

This refers to banks whose main function is to provide finance for investment to industrial concerns. They provide this by purchasing shares and debentures of newly floated companies.

Mixed Banking:

Most banks in India play both roles. Deposit Banking and Investment Banking. Such type of banking is called mixed banking.

Commercial Banks, investment policy of Commercial Banks.

Meaning:

A commercial bank is an institution that operates for profit. It accepts deposits from the general public and extends loans to the households, the firms and the Government. The essential characteristics of commercial banking include

(1) Acceptance of deposits from the public.

(2) For the purpose of lending or investment.

(3) Withdrawal by means of an instrument whether a cheque, draft, order, etc.

Definition:

According to Cairns Cross, “A bank is an institution which deals in money and credit.”

According to Sayers, “Banks are institutions whose debts are usually referred to as ‘bank deposits’ and commonly accepted in final settlement of other people debts.”

FUNCTIONS OF COMMERCIAL BANKS

Modern commercial banks perform a variety of functions and help the industrialists, businessmen and traders. They keep the wheels of commerce, trade and industry always revolving. Modern commercial banks perform mainly two types of functions i.e. primary or banking functions and secondary or subsidiary functions.

Functions of commercial bank

Functions of commercial bank

Primary Function Secondary Functions

(Banking Function) (Non Banking Function)

Accepting Deposits Granting Advance Agency Functions General Utility Functions

(A) Primary Functions:

The primary functions of a bank are also known as banking functions. They are the main functions of a bank. They are as follows –

(I) Accepting Deposits: Accepting Deposits from the public is the most important function of a modern commercial bank offering various types of deposit accounts; banks mobilize the savings of the community. People who have surplus money deposit it with a bank for safety. The commercial banks protect the deposits and give interest on such deposits. There are four types of accounts:

(a) Saving Deposits Accounts: It is a deposit account which is operated by individuals for the purpose of saving a part of their income. Its main objective is to promote savings. It encourages saving habits among the salary earners and others. There is no restriction on the number and amount of deposits. But withdrawals are subject to certain restrictions. Banks pay a certain percentage of interest on this deposit. At present it is 4 % p.a. The money can be withdrawn either by cheque or withdrawal slip.

(b) Fixed Deposits Accounts: Fixed deposits are kept in a bank for fixed period varying from 30 days to several years. A certain sum of money is deposited for a fixed period. A higher rate of interest is paid. The rate may vary from bank to bank Withdrawals are not allowed before the maturity of period. In case of emergency, if the depositor wants to withdraw money before the maturity date, he will have to lose some interest. The depositor is given a fixed deposit receipt which he has to produce at the time of maturity. The deposit can be renewed for further period. Fixed deposit account is also known as time deposit.

(c) Current Deposits Accounts: These accounts are also known as demand deposits because the amount can be withdrawn on demand. This type of account is opened by businessmen who have a number of regular transactions with the bank, both deposits and withdrawals. There, is no restriction on the number and amount of deposits. There are also no restrictions on the withdrawals. Bank does not pay any rate of interest on such accounts. The bank provides overdraft facility to current account holder. Banks charge incidental commissions on such accounts. It facilitates the industrial progress.

(d) Recurring Deposits Account: Under this account, regular income earners deposit a certain amount of money at regular intervals for a certain period of time. For example, an individual can deposit, say Rs 500 every month for a certain period say, 2 years. Its main objective is to develop regular savings habits among the public. The period of deposit is minimum 6 months and maximum 10 years. The rate of interest is higher. At the end of the maturity period, the account holder can get substantial amount, which can be utilized for the purchase of consumer durables or some other investment such as land, machinery, etc.

(II) Granting Advances (Loans):

The second important function of a commercial bank is to extend loans and advances. The money which is received by banks by way of deposits is utilized for granting loans and advances to worthy borrowers. The profit earning capacity of a bank mainly depends upon the performance of the function. This function is also important in the context of economic development in general and development of trade, industry and commerce.

(a) Overdraft Facility: An overdraft facility is granted by the bank only to those persons who have their current accounts in the bank. To meet the temporary needs of the customer, the bank may permit the customer to overdraw the amount from the bank in excess of his balance. The bank may grant such advance on the personal security. The interest is charged only on the actual amount used. The overdraft is granted only occasionally and for short periods. A certain amount is sanctioned as overdrafts which can be withdrawn within a certain period of time say three months or so. It is sanctioned to traders, partnership firms and joint stock companies. The overdraft facility can be renewed from time to time.

(b) Cash Credit: It is a short-term credit given by the bank to any businessman to meet regular working capital needs. The bank opens a separate account in respect of cash credit. The borrower is allowed to draw from that account upto a certain ‘limit against a bond signed by securities or any other eligible securities. Interest is charged only on the actual amount withdrawn by the customer. It can be availed by current account holders as well as other businessmen. Most industrial concerns and business houses borrow money in this form.

(c) Loans: When a banker makes a lump-sum advance to the customers, it is called 'loan'. Interest is charged on the entire amount sanctioned irrespective of whether the complete amount is used or not by the customer. Loans are of various types i.e. Term loans, participation loans, personal loans, call loans, collateral loans etc.

a) Call Loans or Money at call: are loans repayable at short notice. They are called call loans, as they can be called back at any time. These loans are given to for a period of 7 to 15 days for investment in stock market. The rate of interest is the lowest.

b) Short term Loans: are provided by commercial bank for a period not more than two years. The rate of interest is higher. They are given to businessmen to satisfy their working capital requirement.

c) Medium term Loans: The loans are sanctioned for a period of two to five years period. The rate of interest charged for this type of loan is more than the short term loans. Such loans are useful to industries to introduce innovations or for introduction of new method of production.

d) Long term Loans: Loans which are sanctioned for five years are known as long term loans. The rate of interest charged is higher than other loans. Such loans help businessmen to introduce permanent changes in the methods of production.

(a) Discounting Bills of exchange: Another important function that the modern banks perform is the discounting of bills of exchange. Advances are made by discounting the bills of exchange. These advances are given for short periods only. When the holder of the bill is not in a position to wait till the maturity of the bill and requires the cash urgently, he sells the bill of exchange to the bank. The bank purchases the instrument at a discount. This type of business is very common in advanced countries.

(B) Secondary Functions:

Secondary functions are also known as non-banking functions or subsidiary functions or subsidiary functions. They are classified into two main categories

(a) Agency functions (b) General utility Functions

(A) Agency Functions: Bank also act as agents for their customers and in that capacity perform certain functions, which are known as agency functions. For these services, the bank charges certain commission from the customers. Some of the agency functions are as follows:

1) Collection: The commercial banks collect cheque, bills, draft interest, dividends on behalf of their customers and credit them into their accounts. This service is provided on the standing instructions from customers.

2) Payments: Banks also pay bills, insurance premium interest, loan installments, electricity bills, telephone bills, etc. on behalf of their customers as per their direction.

3) Purchase and Sale of Securities: Banks purchase or sell shares, bonds and securities of private companies on behalf of their clients.

4) Acts as Trustee: Banks acts as the trustee and the executor of the wills of their customers after their death.

5) E-Banking (Electronic Banking): A customer can operate his bank account through internet. Money can be transferred from one place to another for their customers. E-banking helps businessmen, traders, merchants in transacting business.

6) Dematerialization Account (De-mat Account): Some banks provide De-mat facility. De-mat account is useful to investors who deal in shares. The transactions related to buying and selling of shares are recorded in a separate De-mat account. Periodically statements regarding shares transactions are given to each investor.

B) General Utility Functions:

1) Safe Deposit Vault (Lockers): This facility is available to the general public to enable them to keep their valuables and securities like ornaments, jewels, documents, deeds, etc. There is a separate section in banks where lockers are provided in various sizes on payment of fixed rates.

2) Remittance of Funds: Banks remit money from one place to another or even from one country to another. Remittance of fund is done by telegraphic transfer, mail transfer, demand draft, etc.

3) Letter of credit: Commercial banks also issue letters of credit, to enable the traders to buy goods from foreign countries on credit. Through this letter of credit, the bank in one country authorizes another bank in foreign country to honour the draft or cheque of the person named in the document. The payment is limited to the amount shown in the letter and the amount is chargeable to the bank which issues the letter.

4) Referee: As a referee a bank authenticates the credit worthiness of its customers. This enables the customers to run their business smoothly and also obtain goods and services on credit.

5) Underwriter: Banks provide underwriting facility to the joint stock companies especially new business enterprises and also to the government in order to help them in raising funds. It guarantees the purchase of certain portion of shares if not sold in the market. Later they are free to sell these shares in the market whenever they want to do so. This is all done by the banks on a small commission from the company.

6) Dealings in Foreign Exchange: By keeping separate foreign exchange department, commercial banks offer services for converting one currency into another.

7) ATM facility (Automated Teller machine): Now-a-day banks also provide ATM facility to their customers. AS a result they can withdraw money at any time of the day, at their convenience, whenever they need it.

8) Collects statistics: The modern banks also collect statistics about money, banking, trade, commerce and publish them in form of pamphlets and hand outs. This helps their customers in acquiring knowledge about the latest economic situation.

9) Travellers’ Cheques: Banks help customers by issuing internal or international travellers’ cheques. When people travel within the country or between countries traveller’s cheques are used as most convenient method of carrying funds.

CREDIT CREATION (CREDIT CREATION BY BANKS)

The banks are monetary institutions capable of expanding or contracting money through credit. In the words of Sayers, "Banks are not merely purveyors of money but also, in an important sense, manufacturers of money".

A bank can create money and multiply it too. It can convert a deposit of Rs. 1000 into Rs. 10,000 and Rs. 10,000 into 1, 00,000. No wonder, it looks like a magic. The process by which banks can multiply their deposits is called credit creation.

Though every bank can create credit on its own, multiple credit creation is possible when the entire banking system is involved in the process of credit creation.

Assumptions: The process of credit creation can be explained under the following assumptions:

(i) The bank should be prepared to lend on the basis of reserves. The required reserves are kept on the basis cash reserve ratio (CRR) fixed by the central bank. Let us suppose the cash reserve ratio is 10 percent. The remaining 90 percent would go into the process of credit creation.

(ii) The public should be willing to deposit their money in banks rather than hoarding.

(iii) There should be sufficient demand for bank loans.

(iv) People should accept the cheques in settlements of debts in place of cash.

(v) There are several banks operating in the economy.

Primary Deposits and Derivative Deposits:

It is important to learn the concepts of primary deposit and derivative deposit to understand the process of credit creation. Primary deposits are the original deposits held by people with the bank in the form of savings accounts, current accounts, fixed deposits etc. Suppose if Mr. P deposits Rs. 100 in his savings account, it becomes a primary deposit.

A banker knows by his experience that all the depositors do not withdraw all their deposits at the same time and diverts the major part of deposits into credit creation after keeping a part (say 10 percent) for meeting the requirements of cash reserve ratio.

Every one creates a deposit. Suppose a bank grants a loan of Rs. 90 to a borrower, he is supposed to maintain an account in which the loan is credited. Thus the loan ultimately becomes a deposit. As this deposit is derived from primary deposit, it is called derivative deposit or secondary deposit. Thus every loan creates a deposit.

Let us suppose bank X receives a primary deposit of Rs. 100 from a deposit holder. Bank X keeps cash reserves of 10 percent (i.e. Rs. 10) and lend the remaining amount Rs. 90 as a loan to Mr. A. Now the balance sheet of bank X appears as follows:

Balance Sheet of Bank X

Liabilities | Amount Rs. | Assets | Amount Rs. |

Deposits | 100 | Cash reserve | 10 |

|

| Loan to B | 90 |

| 100 |

| 100 |

Under double entry system, the amount Rs. 100 appears on both the sides. The deposit Rs. 100 is a liability to bank X since it is obliged to return the same to the deposit.

At the same time the cash reserves and loan are treated as assets of the bank and therefore they appear on the asset side.

Let us suppose Mr. A uses the loan Rs. 90 to pay off his creditor Mr. B by means of a cheque. Mr. B in turn deposits the cheque in his bank Y. As a result Rs. 90 becomes deposit for bank Y.

Bank Y will keep 10 percent of the deposit as cash reserves and the remaining amount is granted as a loan to Mr. C. Now the balance sheet of bank Y will appear as follows.

Balance Sheet of Bank Y

Liabilities | Amount Rs. | Assets | Amount Rs. |

Deposits | 90 | Cash reserve | 09 |

|

| Loan to C | 81 |

| 90 |

| 90 |

Mr. C who receives a loan of Rs. 90 will issue a cheque of Rs.90 to his creditor Mr. D. Who in turn will deposit the cheque in his bank Z. Bank Z will follow the same procedure and expansion of credit will take place to extent of Rs. 72.90 by bank Z.

Now the balance sheet of bank Z will appear as follows:

Balance Sheet of Bank Z

Liabilities | Amount Rs. | Assets | Amount Rs. |

Deposits | 81 | Cash reserve | 8.10 |

|

| Loan to C | 72.90 |

| 81 |

| 81 |

The system of credit expansion continues in several banks till the original deposit Rs. 100 gets exhausted. Thus the original deposit Rs.100 becomes additional deposits of Rs. 90,81,72.90,65.61 etc. If all these additional deposits are added, it will lend to a total of Rs.1000. The final position appears as follows:

The process of Multi Credit Expansion:

Banks | Primary Deposits (Rs.) | Cash Reserve (Rs.) | Loans (Rs.) |

X | 100 | 10 | 90 |

Y | 90 | 9 | 81 |

Z | 81 | 8.10 | 72.90 |

Total | 271 | 27.10 | 243.90 |

Meaning:

The Central Bank is the most important banking institution in the banking structure of every country. It is the ‘apex’ (highest) banking institution and is rightly treated as the ‘Lender of the money market’. It guides and regular the activities of all the banks in the country. The Central Bank acts as an agent, banker and adviser to the government in economic and financial matters. Their main objective is to regulate currency and credit system and to ensure economic stability and growth in the country. Today almost all the countries of the world have their own Central Banks.

The Reserve Bank of India, which is the Central Bank of our country, was established on 1st April, 1935 under the RBI Act, 1934.

Definition:

According to Prof. R. P. Kent, Central Bank is “An institution charged with the responsibility of managing the expansion and contraction of the volume of money in the interest of the general public welfare”.

Functions of Central Bank:

The functions are divided into two parts:

A) Monetary Function B) Non-Monetary Function

A) Monetary Function:

1) Monopoly of notes issue: The main function of the Central Bank is the issue of notes. Central Bank has been authorized to print and issue currency notes. No bank other than the Central Bank enjoys the right of note issue. As the Central Bank is the only authority of note issue, its notes enjoys a distinctive prestige. There is uniformity in the issue of notes and over-issue can avoid. Moreover, it creates confidence among people.

In India, the Reserve Bank of India acts as the Central Bank which enjoys the monopoly of note issue. It has been authorized to print and issue all currency notes except one rupee notes and coins. The RBI adopts what is known as minimum reserve system to print notes. As per 1957 Reserve Bank of India (amendment) Act, the RBI keeps a minimum reserve of Rs. 200crores in gold and foreign securities. Out of this, Rs. 115 crores must be in gold and Rs. 85 crores in foreign securities. The notes issued in excess of Rs. 200 crores are backed by the government rupee securities.

2) Banker to the Government: It acts as the banker, advisor and agent of the government.

1) As a banker to the government: As a banker of the government it carries out all banking requirements of the government. It accepts deposits and makes payments of all government workers. It transfers funds from one place to another or from one use to another use for the government. It collects taxes on behalf of the government and advances loans to the government. It manages public debts, interest on loans, repayments of loan from International organizations etc. Central Bank advises the government on monetary problems and implemented the monetary policy of the nation. In India the Reserve Bank of India performs all these functions. Since, its operation is spread all over India. The RBI has appointed the State Bank of India as its sole agent for transaction government business.

2) As an advisor to the Government: The central bank has complete knowledge about the functioning of the economy and can therefore advice the government on various economic and monetary matters. It advices the government on various financial matters such as framing the budget, controlling inflation, foreign exchange policy, managing fiscal deficit, Monetary policy, etc.

3) Bankers Bank: The Central Bank is the apex body of the banking system. It supervises co-ordinates and controls the operations and activities of the commercial banks. It is the legal tradition that all commercial banks should keep a certain proportion of the demand and time deposits with the Central Bank of the country. This proportion is called cash reserve ratio (CRR).

The Reserve Bank of India also rediscount bill and provides financial assistance to commercial banks. The RBI grants loans to the scheduled banks for a period 90days against eligible bills. The RBI has been empowered to control the activities of all commercial banks under Reserve Bank of India Act 1934 and Banking Regulation Act, 1949.

4) Custodian of Nation’s Foreign Exchange / Determination of Exchange rate:

All foreign exchange reserve of the country is kept by the Central Bank of the country. It enables the Central Bank to exercise control over the foreign exchange. All foreign exchange transaction is done through the Central Bank. The Reserve Bank of India maintains the stability of the rate of exchange, section 40 of the RBI with this function.

It is obligatory for the RBI to buy and sell currencies of the members of the IMF. The Foreign Exchange Regulation Act (FERA) passed in 1947 to give wide powered to RBI to exercise control over foreign exchange. Over the years the act has been amended many times and currently, it is known as Foreign Exchange & Management Act (FEMA).

5) Lender of the last resort: The Central Bank helps the commercial banks when they face a financial crisis. When all the sources are closed, commercial banks can rely (depend) upon the Central Bank as the last resort (option) for securing financial assistance. That is why the Central Bank is called the Lender of the last resort. Sometimes cash reserve of the commercial banks gets exhausted. During such situations, Commercial banks can approach the Central Bank to come to their rescue. The Reserve Bank of India provides the necessary funds and relieves from their burden.

6) Clearing house facility: Central Bank provides clearing facility for the smooth functioning of commercial bank. It is a fact that there are large numbers of commercial banks opening in the economy. Each bank will have claims and counter claims over other. This is not possible for all commercial bank to meet personally to settle their claims. Central Bank solves this problem smoothly by debiting and crediting each bank concerned.

B) Non-Monetary Function:

1) Control & supervisory function: The Central Bank of India also takes the responsibility of supervising the activities for all commercial banks. It issues licenses to banking companies. It can take direct action against the erring commercial banks. It can suspend the activities of such commercial banks or may refuse to renew the license. In India the RBI controls, supervises the functions of all commercial banks.

The Reserve Bank of India Act, 1934 & Banking Regulation Act, 1949 have given RBI the power of supervision and control over commercial and co-operative bank.

2) Promotional & Development function:

a) To promote banking habits: The Central Bank has been playing a more responsible role towards the economic development of our country. Its functions are not confirmed to control of money market alone. In India, RBI exercises its power over commercial banks and puts them under pressure to open branches in the rural sector. This has contributed a lot towards rural banking and to cultivate banking habits among the poor people.

b) Agricultural finance: As a significant step towards rural credit, the RBI created various agencies and institutions for weaker sections under the various schemes for rural development. The arrival of NABARD in India has created a history in the field of rural finance.

c) Industrial finance: Central Bank takes several steps to meet the long term requirements of the industrial finance. The financial institutions like IFCA, SFCA, ICICI, LIC, IDBI, IRCI, SIOBI, etc. play a vital role in boosting the growth in industrial sector in India.

d) Export-Import finance: RBI played a responsible role in the establishment of the Export-Import Bank (EXIM Bank) to provide finance towards export and import activities. The EXIM Bank was establishing in January, 1982 to provide refinance to the commercial banks and financial institutions against their export-import financing activities.

e) Encouraging small savings: To provide opportunities of investment and better returns for small savers, the RBI played an active role in the establishment of UNIT TRUST OF INDIA in 1963.

Methods of Credit control by Central Bank:

Credit control also means that monetary management or Instrument of monetary policy. Central Bank controls the credit by using two methods –

a) Quantitative Method

b) Qualitative Method.

A) Quantitative Method: It refers to the steps aimed at controlling credit by checking the quantity of money in circulation.

1) Bank rate policy: Bank rate is the rate at which Central Bank rediscount bill of commercial Banks and provides financial assistance to commercial bank.

During inflation Central Bank follows the Dear money policy. It increases the bank rate & thereby makes borrowing costly. This will discourage the commercial bank from the obtaining funds from the Central Bank. When Bank rate increases, the rate of interest prevailing in the money market will also increase. The borrowers will have to pay high rate of interest and their tendency to demand credit will decline. It leads to contraction of supply of credit money and reduces investment. Such reduction in business activities results in contraction of factor rewards which in turn in brings the effective demand down. As demand declines price will fall and inflation is controlled.

During deflation the bank will follow, Cheap money policy and the bank rate will be reduced. As a result the rate of interest collected by the Commercial Banks will also fall. This encourages the business community to demand more loans and it leads to expansion of credit. This would put deflation under check.

2) Open market policy: It refers to buying and selling of securities and other eligible papers by central bank in the open Market.

Central Bank can create contraction and expansion of credit selling and buying securities. It can control the credit money by selling securities and eligible papers in the open market. When it sells securities money flows to Central Bank. It reduces the volume of deposit received by the commercial banks and contracts credit. It expands credit by buying securities from the market. It results in large volume of circulation of money among commercial banks.

Open market policy technique is superior to Bank rate policy. First of all bank need not depend upon commercial banks for the success of open market operation. By knowing their reserve position. Central Bank of India can directly influence the commercial banks. Secondly, Open market operations successful when government borrows money from public debt has been expanding, Government can successfully sell its securities to the public.

3) Varying cash reserve ratio: This is another weapon used by the Central Bank to control credit. Cash reserve is the ratio upon which all commercial bank. It is a legal tradition which every commercial bank has to follow. The reserves left with commercial banks after meeting minimum reserve is known as excess reserves. Thus has a direct impact on the capacity of banks to create credit. When the Central Bank raises the cash reserve ratio, the ability of the commercial banks to create credit. When the cash reserve ratio is brought down, the ability of commercial banks to create credit widens.

B) Qualitative Method:

It refers to the step aimed at controlling credit by checking the allocation of credit. Such steps check the purpose for which credit money is used. They encourage credit money for socially desirable purposes and restrict the same towards undesirable and non productive areas.

1) Issuing directives: a) Purposes on which advances can be granted. b) Margin requirements against securities. c) Maximum limit regarding advances granted to any borrower. d) Terms and conditions including the rate of interest for granting loans.

2) Margin requirements: A bank requires security such as gold, shares, property against loan sanction. No bank gives loan equal to the market value of the property, if a person produces security worth Rs. 30,000, he may be got a loan of Rs. 25,000. Thus, difference between the value of security and the actual amount loan is taken as margin. It may direct the commercial bank to keep higher margin towards loan against stock of food grains, equity shares, etc.

3) Regulation of consumer credit: Commercial bank often advance loan to consumer for durable luxury goods like Television, Refrigerator, etc. Central Bank can regulate consumer loans by minimum down payment and increase the period of repayment i.e. installment may be reduce.

4) Rationing of credit: Central bank can also regulate the volume of credit by imposing ceiling on different type of loans provided by the commercial banks, It check the flow of money into undesirable uses.

5) Moral situation: It refers to the general appeal or request made by the central bank persuading the commercial bank to co-operative in controlling credit, Central bank may request the commercial bank to seek further accommodation or not to speculative activities.

6) Direct action: The Central bank also applying to hard measure to control the erring commercial bank. Such as commercial bank refusal of renewal suspending of license, refusing financial assistance to commercial bank etc.

Functions:

The Reserve Bank of India is performing various functions related to monetary management, banking operations, foreign exchange, developmental works and research on problems of economy.

The following are some of the major functions normally performed by the Reserve Bank of India:

1. Note Issue:

Being the Central Bank of the country, the RBI is entrusted with the sole authority to issue currency notes after keeping certain minimum reserve consisting of gold reserve worth Rs. 115 crore and foreign exchange worth Rs. 85 crore. This provision was later amended and simplified.

2. Banker to the Government:

The RBI is working as banker of the government and therefore all funds of both Central and State Governments are kept with it. It acts as an agent of the government and manages its public debt

3. Banker’s Bank:

The RBI is also working as the banker of other banks working in the country. It regulates the whole banking system of the country, keep certain percentage of their deposits as minimum reserve, works as the lender of the last resort to its scheduled banks and operates clearing houses for all other banks.

4. Credit Control:

The RBI is entrusted with the sole authority to control credit created by the commercial banks by applying both quantitative and qualitative credit control measures like variation in bank rate, open market operation, selective credit controls etc.

5. Custodian of Foreign Exchange Reserves:

The RBI is entrusted with sole authority to determine the exchange rate between rupee and other foreign currencies and also to maintain the reserve of foreign exchange earned by the Government. The RBI also maintains its relation with International Monetary Fund (IMF).

6. Developmental Functions:

The RBI is also working as a development agency by developing various sister organisations like Agricultural Refinance Development Corporation. Industrial Development Bank of India etc. for rendering agricultural credit and industrial credit in the country.

On July 12, 1986, NABARD was established and has taken over the entire responsibility of ARDC. Half of the share capital of NABARD (Rs. 100 crore) has been provided by the Reserve Bank of India. Thus, the Reserve Bank is performing a useful function for controlling and managing the entire banking, monetary and financial system of the country.

Regulatory and Promotional Roles of Reserve Bank of India:

The Reserve Bank of India (RBI) has been playing an important role in the economy of the country both in its regulatory and promotional aspects. Since the inception of planning in 1951, the developmental activities are gaining momentum in the country. Accordingly, more and more responsibilities have been entrusted with the RBI both in the regulatory and promotional area. Now-a-days, the RBI has been performing a wide range of regulatory and promotional functions in the country.

The following are some of the regulatory and promotional functions performed by the RBI:

1. Regulating the Volume of Currency:

The RBI is performing the regulatory role in issuing and controlling the entire volume of currency in the country through its Issue Department. While regulating the volume of currency the RBI is giving priority on the demand for currency and the stability of the economy equally.

2. Regulating Credit:

The RBI is also performing the role to control the credit money created by the commercial banks through its qualitative and quantitative methods of credit control and thereby maintains a balance in the money supply of the country.

3. Control over Commercial Banks:

Another regulatory role performed by the RBI is to have control over the functioning of the commercial banks. It also enforces certain prudential norms and rational banking principles to be followed by the commercial banks.

4. Determining the Monetary and Credit Policy:

The RBI has been formulating the monetary and credit policy of the country every year and thereby it controls the Statutory Liquidity Ratio (SLR), Cash Reserve Ratio (CRR), bank rate, interest rate, credit to priority sectors etc.

5. Mobilizing Savings:

The RBI is playing a vital promotional role to mobilize savings through its member commercial banks and other financial institutions. RBI is also guiding the commercial banks to extend their banking network in the unbanked rural and semi-urban areas and also to develop banking habits among the people. All these have led to the attainment of greater degree of monetization of the economy and has been able to reduce the activities of indigenous bankers and private moneylenders.

6. Institutional Credit to Agriculture:

The RBI has been trying to increase the flow of institutional credit to agriculture from the very beginning. Keeping this objective in mind, the RBI set up ARDC in 1963 for meeting the long term credit requirement of rural areas. Later on in July 1982, the RBI set up NABARD and merged ARDC with it to look after its agricultural credit functions.

7. Specialized Financial Institutions:

The RBI has also been playing an important promotional role for setting specialized financial institutions for meeting the long term credit needs of large and small scale industries and other sectors. Accordingly, the RBI has promoted the development of various financial institutions like, WCI, 1DBI, ICICI, SIDBI, SFCs, Exim Bank etc. which are making a significant contribution to industry and trade of the country.

8. Security to Depositors:

In order to remove the major hindrance to the deposit mobilization arising out of frequent bank failures, the RBI took major initiative to set up the Deposit Insurance Corporation of India in 1962. The most important objective of this corporation is to provide security to the depositors against such failures.

9. Advisory Functions:

The RBI is also providing advisory functions to both the Central and State Governments on both financial matters and also on general economic problems.

10. Policy Support:

The RBI is also providing active policy support to the government through its investigation research on serious economic problems and issues of the country and thereby helps the Government to formulate its economic policies in a most rational manner. Thus, it is observed that the RBI has been playing a dynamic role in the economic development process of the country through its regulatory and promotional framework.

INTRODUCTION TO AGRICULTURAL CREDIT:

In agricultural business credit plays a prominent part particularly in developing countries. Once agricultural credit was supposed to be like a Hangsman’s rope but at that time agricultural business was on traditional level without scientific management.

Now, the conditions have very much changed with the development of technology and knowledge spread about the use of new inputs and their management credit gives control over the capital needs of the farmer.

Generally, in farming the fixed capital investment is huge which has come from father to son through inheritance but the problem arises for the running costs. For high income an optimum combination of land, labour, capital and organization is important but if any of these is limited it will tell on the farming efficiency particularly when the capital is short.

Agricultural Credit could be defined as “transfer of funds from the have’s to have-not’s, either directly or indirectly.”

The direct transfer comes in the case of private lending agencies like money lender from the village or otherwise, relatives, friends, big land holders. The indirect transfer of funds is from the institutional agencies such as nationalized commercial banks, cooperative agricultural credit societies, land development banks, regional rural banks, National Agricultural Bank for Agricultural and Rural Development (NABARD).

In the institutional agencies like banks the surplus income is saved for getting the interest which the bank lends to those who borrow to invest for profitable business. In the modern system of farming the role of institutional agricultural credit has become highly important which has been facilitated by the socialization of commercial banks who were very shy in investing in agricultural sector since 1970’s.

Now, the question that arises is how should the farmer use agricultural credit so that the business of farming becomes awarding and meets the twin objectives of farm management in profit maximization and family welfare.

In the modern business world the farmer must take decisions for the use of agricultural credit that is, the decision:

(a) When to borrow,

(b) How much to borrow,

(c) What to borrow for,

(d) Length of loan and repayment schedule,

(e) What to use for security.

According to agricultural finance experts there are five C’s and three R.s.

The three R’s are—return from the proposed investment, repaying capacity, and risk bearing ability. The five C’s are—character, capacity, capital collateral, conditions and common sense. If the farm operator adheres to the C’s and R’s and the concepts behind these he would be successful in using the agricultural credit and keep himself out of debts and with prosperity around him.

Length of Agricultural Credit Loan:

The time period of return ability is:

1. Short Term Loan or Crop Loan:

It varies from six months to a year. The money is borrowed to support crop production.

2. Medium Term Loan:

The duration is from two years to five years. This is used for adding assets like buying work stock, poultry farming, buying implements, dairy or cattle fanning. The loan is paid out in annual installment.

3. Long Term Loan:

This is invested in bringing permanent improvement on the farm like improvement of land, fencing of the farm, land reclamation—these all increase the income generating capacity on the farm. The loan is paid out up to twenty five years period.

This loan is termed as ‘land improvement or development loan’. This requires collaterization i.e., Generally, the length of loan should correspond to the length of time it takes to recover the borrowed capital investment with some margin of safety.

The repayment schedule should fit in the flow of income from the invested loan. Long term loan should be amortized (payment made cither in annual and bi¬annual installments. Moreover, the principle gets tapered as the payment is paid and the interest is charged on the current principal).

The surplus accumulated should be kept aside and invested where its opportunity cost is high. Risk must be considered along with profit. If there is unfavorable price or weather condition repayment of loan may be distributed.

Under such conditions the loan should be adjusted to the fluctuating income and weather conditions. One way is to adjust payments by preponement or another way is to adjust interest and principal payment to fluctuating farm income or the length of the loan be increased.

Security for Getting Loan:

In case of short term or crop loan no security is required except honesty, managerial ability and promptness in repayment. But in case of medium and long term loans security in terms of the hypothecation of the asset purchased with the bank is a requirement and in case of land development bank loan hypothecation of land is a must.

The Basis of Agricultural Credit:

It is not that easy to borrow from the banks as the bank- men are interested in the safe utilization of loans in safeguard of their own interest (loss of fund) and the interest of the client (who should reap good return from the investment of bank loan—supervised credit).

The bank men look for:

(a) Farmer’s own capital position;

(b) his management ability (they ask for farmer’s three years business performance) and his (c) honesty.

The 3 R’s & five C’s are kept in mind.

Basis for Agricultural Credit:

In the case of collateral agricultural credit the farmer need to increase their security base quickly. In case of non-collateral agricultural credit the requirement that the bank manager demand are: managerial ability of the borrower, his honesty, promptness in repayment of loans and his net worth.

Sound Financial Planning for Agricultural Credit:

The sound financial planning is the sine quo none of the loan. The farmer should prepare the plan and budget it for calculating the profitability from the investment. In order to have the profitability timely and adequacy of loan is a must because delay in operation costs in terms of low output.

In case, there is an outstanding loan (short term) it should be included in budgeting. The opportunity cost principle and risk considerations are the fundamental guides in the use of borrowed and own capital.

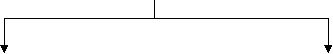

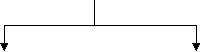

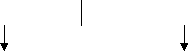

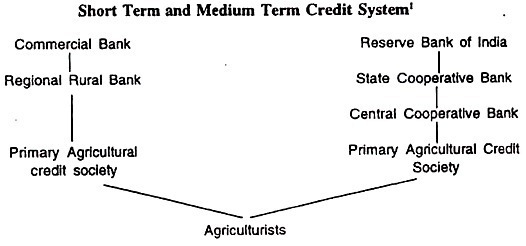

Commercial banks give loans to agriculturists either directly or through Primary Agricultural Credit Society. Or the Regional Rural Banks which give the loan directly to agriculturists or to them through the primary agricultural credit society—the loan which it gets from the commercial banks. The Reserve bank of India either gives loan to regional rural banks which goes to agriculturists through the primary agricultural credit societies or directly to agriculturist from their source.

OR

The Reserve Bank of India passes credit to State Cooperative Bank which passes to Central Cooperative Banks and CCB passes it to Primary Agricultural Credit Societies which ultimately gives loan to agriculturists.

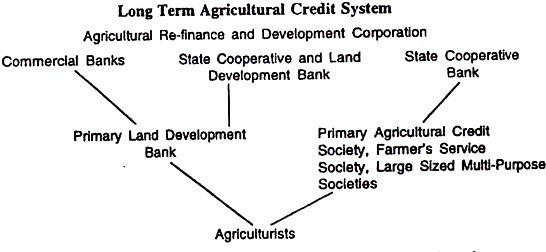

The Agricultural Refinance and Development Corporation gives loan to com¬mercial banks which gives loan to agriculturists. The Agricultural Refinance and Development Corporation passes the loan to State Cooperative and Land Development Bank which then passes the loan to Primary Land Development Bank which ultimately passes it to Agriculturists.

The Agricultural Refinance and Development Corporation gives loan to State Cooperative Banks which passes it on to Primary Agricultural Credit Societies or Farmer Service Societies or Large Sized Multi-purpose Society and finally it reaches the Agriculturists.

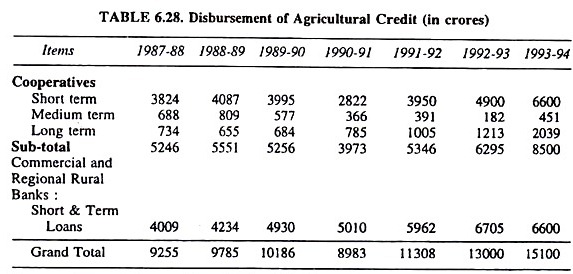

Agricultural credit is disbursed through multi-agency network consisting of Commercial Banks, Regional Rural Banks and Cooperatives. The total quantum of agricultural credit from various institutional sources has increased from Rs. 7,005 crores in 1985-86 to Rs. 13,000 crores in 1992-93. The target for agricultural credit disbursement for 1994-95 was Rs. 16,700 crores.

The agency wise disbursement of loans (credit) is given in the following table:

The shares of these agencies are as, cooperatives short term loans 57.5%, commercial banks 37.5%. Regional rural banks 5%. In medium-term and long-term (investments) credit cooperatives account 30% commercial banks 65%, and regional rural banks 5%. The statistics of these lending agencies are: The primary agricultural credit societies 88,000 and primary units for long-term agricultural credit are 2,258. They reached credit to remote corners of the country.

Though there has been reasonably good achievement in cooperative and com¬mercial bank lending which has gone up from 3 per cent and less than 3%, respectively from 1952-54 (as reported in All India Rural Credit Survey) to the level as mentioned, there are many problems faced by these institutions.

There are problems of over dues in cooperatives and RRB’s. The government has initiated certain measures to revitalize the cooperatives on the recommendations of Agricultural Credit Review Committee. These measures include amendments of State Cooperative Laws, holding elections of cooperative bodies and revitalizing primary agricultural credit societies through business development planning.

The government is also contemplating the introduction of comprehensive scheme of revitalizing the cooperative agricultural credit structure. NABARD has also initiated the process of drawing up Development Action Plans (DAP’s) for cooperative agricultural credit institutions structure in order to make it viable and self-sustaining. In October, 1994, the RBI deregulated the interest rate structure for cooperative lending (subject to a minimum of 12%) and for raising deposits.

NABARD: National Bank for Agriculture and Rural Development

As the name suggests NABARD may be a development bank focusing totally on the agricultural sector of the country. It is, in fact, India‘s apex development bank. It's one among the foremost important institutions within the country. NABARD is liable for the event of the tiny industries, cottage industries, and the other such village or rural projects.

Established on 12th July 1982, it had an initial capital of 100 crores. The bank is under the supervision of a Board of Directors which the govt of India will appoint. The headquarters of NABARD is in Mumbai but it's many branches and regional divisions.

NABARD is instrumental within the development and efficiency of the present rural system . Over half the credit within the rural region comes from Co-operative banks and Regional Rural Banks. NABARD is liable for regulating and supervising the functioning of such banks. Over the years NABARD has been pushing for development within the credit schemes for rural populations to satisfy their new credit requirements.

Other than meeting credit requirements of the agricultural sector NABARD is additionally instrumental in social innovations and projects. It partners with various organizations for several innovative projects like SHG-Bank linking, innovative schemes for water and conservation . Over the last three decades, the institution has gained goodwill and trust within the farmers and rural communities.

Functions of NABARD

Let us take a glance at a number of the most functions of this organisation. It basically performs three sorts of roles, i.e. credit functions, development functions, and supervisory functions.

• Frames the policy for rural credit within the country for all financing institutions

• National Bank for Agriculture and Rural Development will itself provide finance and refinancing facilities to the banks and rural regional banks

• Identification of credit potential and preparation of the credit plans for all districts

• It also helps all regional banks and institutes under its governance with the preparation of their own credit plans and policies

• Helps Regional Rural Banks establish an agreement with State Governments and other Co-op Banks and institutions

• It also will monitor the implementation of such plans and track their progress

• Helps banks improve their MIS system, modernize their technology, develop human resources etc

• As per theBanking Regulation Act 1949, NABARD has got to conduct the inspection of Regional Rural Banks and other Co-op banks

• It communicates and consults the RBI in matters like issuing of licenses for brand spanking new banks, the opening of branches of Rural Banks etc.

• From time to time it'll also inspect the investment portfolios of Regional Rural Banks and other State Co-op Banks

CO-OPERATIVE BANKS

A depository financial institution may be a member-owned financial cooperative, democratically controlled by its members, and operated for the aim of promoting thrift, arranging credit at competitive rates, and providing numerous other financial services to its members.

The Co-operative Credit Institutions in India are often classified as under a three-tier structure.

(i) Primary Credit Societies at rock bottom

(ii) Central Co-operative Bank at the center

(iii) State Co-operative Bank at the highest

The primary societies are functioning within the various towns and villages, the Central Banks at the district headquarters and therefore the State Co-operative Banks at the state capitals forming the apex of the system.

The Federal Reserve Bank of India assists the co-operative structure by providing concessional finance through NABARD within the sort of General Lines of Credit for lending to agricultural & allied activities. Thus, the entire system is integrated with the Banking structure of the country.

Let us have a discussion about these institutions one by one.

(i) the first Agricultural Credit Societies:

A primary society is an association of borrowers and non-borrowers residing during a particular locality and taking interest within the business affairs of 1 another. As membership is practically hospitable all inhabitants of a neighborhood , people of various status are brought together into the common organization.

(ii) Central Co-operative Banks:

A Central Co-operative Bank may be a federation of primary societies during a specified area. Where membership of a Central Co-operative Bank is restricted to primary societies only, it's referred to as a 'banking union'. Nowadays, individuals also are admitted as members of just about all Central Co-operative Banks.

(iii) State Co-operative Banks:

At the highest of the co-operative banking, there are State Co¬operative Banks, organized with the thing of attracting deposits from the rich urban classes. These Banks also are more suitably equipped to function channel between the co-operative movement and therefore the joint stock banks.

REGIONAL RURAL BANKS IN INDIA:

Rural finance may be a matter of credit concern during a developing economy

Like India where 70 percent of the entire population depends upon agriculture for its livelihood. 40 percent of the GDP in India is contributed by the agricultural sector.

The economic development of our country are often achieved only through uplift of the folks consisting of farmers, agricultural labourers, artisans etc.

Finance being the lifeblood of each commercial venture, the availability of adequate funds at reasonable terms may be a must to make sure speedy economic development of a village.

From the First- Five Year Plan (1951-56) to the Tenth Five-Year Plan (2002-2007), the agricultural development has been given due importance.

Marginal farmers, rural artisans and agricultural labourers are bereft of the crucial input of timely and adequate credit from the institutional sources. The govt has been taking elaborate and extensive initiatives (both policy and administrative) to reinforce the outreach of formal channel to rural masses.

Financial institutions especially in rural areas play a really significant role within the economic also as rural development. It's a special role to play in removing the poverty. The general development of the economy depends to an outsized extent on the banking sector, as financial institutions act as suppliers of capital for production of products and services v\/hich successively raises income and standard of living of the people. In India, the banking sector has received from time to time definite orientations, and this sector has come to occupy a prominent position among the infrastructural factors of economic development. Before nationalization of banks their role and activities attracted tons of criticism. The failure of the banking sector in performing its expected role during a planned economy led to their nationalization first in 1969 and again in 1980.

The informal sector for rural finance is age-old. It consists primarily of rural money lenders, traders, merchants etc.

It proved to be avaricious and ruinous for rural India.

As a deterrent to the indigenous moneylenders, a 3 tier cooperative banking structure was found out by a cooperative movement, which established the efficacy of cooperation.

Growing sporadically, the cooperative societies alone are now the bastions of rural finance during a number of states in India. The formal sector was found out only within the planning era and banks were nationalized to increase support to the agricultural financial institutions like cooperatives.

Indeed, this formal sector is predicated on a multi-agency approach consisting of public sector banks, cooperatives and Regional Rural Banks.

Consistent with the All India Rural Credit Survey Report, 1954, the sources of the credit within the country are often divided into nine categories, viz. Government cooperatives, relatives, landlords, agriculturists, money lenders, professional money lenders, traders and commission agents, commercial banks et al. .The problem of inequality and inequity became serious day by day despite the favored slogan 'Garibi Hatao' and good intention of the govt to raise the lot of masses, the agricultural poor remained neglected and kept striving hard for his or her subsistence.

Therefore, the necessity was felt for establishing financial institutions, specialized to cater to the requirements of the agricultural 35 poor so as to refill the regional and functional gap within the financial credit available to rural areas. Among various institutional agencies engaged in rural finance, Regional Rural Banks play a big role in financing the target group within the rural sector. They're specially designed financial institutions working under the guidance of the

NABARD and therefore the parent commercial banks, spread in rural areas with an in depth network of branches serving a specific district or region.

Functions of RRBs the most function of the RRBs is to supply credit and banking facility to the agricultural people. It also provides some non- banking facility to the agricultural people.

It also provides some non-banking facility to the agricultural population like constructing and maintaining goo down on their own, supplying agricultural inputs and acquiring agricultural and other equipments for leasing it out, providing assistance within the marketing of agricultural and other products.

The varied functions of the RRBs could also be listed

a) to supply short-term and medium-term credit for agriculture and other purposes to rural producers and long-term loans to agriculturists as agent of the exploitation bank.

b) To mobilize local savings.

c) To implement programmes of the supervised credit, tailored to satisfy the requirements of individual farmers.

d) to supply ancillary banking services to local people.

e) to line up and maintain godowns.

f) To undertake supply of inputs for agricultural and other products through marketing organization.

g) Generally help within the overall development of the villages in its areas.