Unit – 3

Depreciation, Reserves and provisions

Depreciation:

Depreciation means the reduction in the value of an asset due to its use, leading its wear and tear, or due to obsolescence or due to general market trend. The prescribed rules state that the amount of depreciation of a depreciable asset must be allocated in every accounting period throughout the life of the asset.

Depreciable assets are those assets that are used for the purpose of business which can be depreciated. That is, the value of the asset is considered as a business expense over the useful life of the asset. A company can depreciate most of the tangible assets like Building, Machinery, Vehicles, Furniture and Fixtures, Computers and Equipment and intangible assets like Patents, Copyrights and Computer Software.

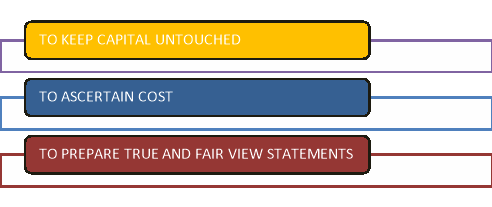

Purposes of Providing Depreciation:

NOTE: The methods of Depreciation are explained later in 3.3 of this Chapter.

Reserves:

Different types of Reserves:

There are broadly three types of Reserves – Capital Reserves, Revenue Reserves ad Statutory Reserves.

Capital Reserve:

A capital reserve is taken out of the capital profit and is not shared as a dividend to the shareholder. This reserve cannot be created out of the profit earned from the core operation.

Few examples of capital reserves are:

1) Cash received by selling current assets

2) Premium earned on the issue of share and debentures

3) Excess on revaluation of assets and liabilities

Revenue Reserve:

Revenue reserve is a portion of profit owned by the company and is kept aside for the use of other multiple purposes. This reserve is recorded in the profit and loss account and can be used the following way:

1) Dividend to shareholder

2) Expand the business

3) Stabilise the dividend rate

In other words, Revenue reserves are portions of profits earned by a company’s normal operations which are then set aside.

Revenue reserves are divided into two types:

1) General Reserve and

2) Specific Reserve

Provisions:

A provision is an amount that is set aside from a company’s profits, usually to cover an expected liability; the specific amount of the same might be unknown at present times.

In other words, a provision should not be understood as a form of savings, instead, it is recognition of an upcoming liability, in advance.

Types of Provisions in Accounting:

The most common type of provision is a provision for bad debt. A provision for bad debt is one that has been calculated to cover the debts during an accounting period that is not ‘expected’ to be paid.

The Other common kinds of provisions in accounting include:

Provision for depreciation, Provision for bad and doubtful debts, Provision for taxation, Provision for discount on debtors, Provision for repairs and renewals, etc.

Accounting Treatment for Depreciation:

Treatment of Depreciation is dealt in another section, before solving practical questions.

Accounting Treatment for Reserves:

The accounting treatment of all types of reserves is similar. For creating a reserve, the following journal entry is passed:

Capital A/c Dr.

To ___________ Reserve A/c

Accounting Treatment for Provisions:

The accounting treatment of all types of provisions is similar. For creating a provision for doubtful debts, the following journal entry is passed:

Profit and Loss A/c Dr.

To Provision for _________ A/c

To conclude, certain expenses/losses which are related to the current accounting period but amount of which is not known with certainty at present, because they are not yet incurred.

Methods:

Depreciation is allowable as expense in Income Tax Act, 1961 on basis of block of assets on Written Down Value (WDV) method. Depreciation on Straight Line Method (SLM) is not allowed.

Companies Act prescribes two methods for calculating depreciation:

- Straight Line Method (SLM) and

- Written Down Value Method (WDV)

Straight Line Method (SLM):

Straight line basis is calculated by dividing the difference between an asset's cost and its expected salvage value by the number of years it is expected to be used.

In other words, to calculate depreciation on straight line basis, company take the purchase price of an asset and then subtract the salvage value, its estimated sell on value when it is no longer expected to be needed. The resulting figure is then divided by the total number of years the asset is expected to be useful, referred to as the useful life.

Symbolically, the formula is –

Depreciation on Straight Line Basis = Purchase Price of Asset - Salvage Value

Estimated Useful Life of Asset

Written Down Value Method (WDV):

Under this method, the depreciation is calculated at a certain fixed percentage each year on the decreasing book value commonly known as WDV of the asset

WDV is calculated as Book value less Depreciation.

It is also known as Reducing Balance or Reducing Instalment Method or Diminishing Balance Method.

Q 1) On April 1, 2010, Bajrang Marbles purchased a machine for Rs. 2,80,000 and spent Rs. 10,000 for its carriage and Rs. 10,000 on its installation. Its working life is estimated at 10 years and scrap value Rs. 20,000.

Prepare Machinery A/c and Depreciation A/c for first 2 years by providing Depreciation on SLM basis.

Solution:

WN 1 - Cost of the asset = Purchase Price + Expenses which were incurred to bring the asset at such place of its use (Transport) + Expenses incurred to bring it into its present condition to use it

Therefore, Cost = 2,80,000 + 10,000 +10,000 = 3,00,000

WN 2 - Depreciation = [Cost – Residual Value (Scrap)] / Life (in years)

Therefore, Depreciation = (3,00,000 – 20000) / 10 = 28,000/-

In the Books of Bajrang Marbles

Machinery A/c

Date | Particulars | JF | Amount | Date | Particulars | JF | Amount |

2010-11 Apr 1 |

To Bank A/c To Bank A/c To Bank A/c |

|

2,80,000 10,000 10,000 | 2010-11 Mar 31

Mar 31 |

By Depreciation

By Balance c/d |

|

28,000

2,72,000 |

|

|

| 3,00,000 |

|

|

| 3,00,000 |

2011-12 Apr 1 |

To Balance b/d |

|

2,72,000 |

2011-12 Mar 31 Mar 31 |

By Depreciation By Balance c/d |  |

28,000 2,44,000 |

|

|

| 2,72,000 |

|

|

| 2,72,000 |

Depreciation A/c

Date | Particulars | JF | Amount | Date | Particulars | JF | Amount |

2010-11 Mar 31 |

To Machinery A/c |

|

28,000 | 2010-11 Mar 31 |

By Profit and Loss A/c

|

|

28,000

|

|

|

| 28,000 |

|

|

| 28,000 |

2011-12 Mar 31 |

To Machinery A/c |

|

28,000 |

2011-12 Mar 31

|

By Profit and Loss A/c |  |

28,000

|

|

|

| 28,000 |

|

|

| 28,000 |

Q 2) P and Sons, Patna made Furniture on 1st Oct, 2015. They spent 72,000 on Materials and 32,000 on Wages. Estimated life of the asset is 10 years and scrap value would be Rs. 24,000. They sold entire furniture for Rs. 80,000 on 1st Oct, 2017. Show Furniture A/c for first 3 years and Depreciation A/c for only 3rd year.

Solution: In the Books of P and Sons

Furniture A/c

Date | Particulars | JF | Amount | Date | Particulars | JF | Amount |

2015-16 Oct 1 |

To Bank A/c (72000 + 32000) |

|

1,04,000 | 2015-16 Mar 31

Mar 31 |

By Depreciation

By Balance c/d |

|

4,000

1,00,000 |

|

|

| 1,04,000 |

|

|

| 1,04,000 |

2016-17 Apr 1 |

To Balance b/d |

|

1,00,000 |

2016-17 Mar 31 Mar 31 |

By Depreciation By Balance c/d |  |

8,000 92,000 |

|

|

| 1,00,000 |

|

|

| 1,00,000 |

2017-18 Apr 1

|

To Balance b/d

|

|  92,000 | 2017-18 Oct 31

Oct 31 Oct 31 |

By Depreciation A/c By Bank A/c To Loss on Sale of Asset A/c |  |

4,000

80,000

8,000 |

|

|

| 92,000 |

|

|

| 92,000 |

Depreciation A/c

Date | Particulars | JF | Amount | Date | Particulars | JF | Amount |

2017-18 Oct 31 |

To Machinery A/c

|

|

4,000 | 2017-18 Mar 31 |

By Profit and Loss A/c

|

|

4,000

|

|

|

| 4,000 |

|

|

| 4,000 |

NOTE FOR STUDENTS: (NOT TO MENTION IN EXAM)

Profit on Sale is debited in Asset A/c; while Loss is credited.

Depreciation though charged at the sale of the asset, it will be transferred to Profit and Loss A/c only at the end of the year.

Q 3) Sangam Trading Company, Darbhanga purchased Vehicle on 1st April 2016 costing 85000 and spent 5000 on its registration. On 30th September 2016 additional vehicle is purchased for 10000.

On 31st March 2018 a Vehicle was sold for 12000; the original cost of which was Rs. 20000 on 1st April 2016.

Prepare Vehicle A/c for the year 2016-17, 2017-18 and 2018-19 assuming that vehicle is depreciated at 10% per annum on diminishing balance method on 31st March every year.

Solution: In the books of Sangam Trading Co.

Vehicle A/c

Date | Particulars | JF | Amount | Date | Particulars | JF | Amount |

2016-17 Apr 1

Sep 1 |

To Bank A/c (85,000+5,000) To Bank A/c |

|

90,000

10,000 | 2016-17 Mar 31

Mar 31 |

By Depreciation A/c (9,000+500) By Balance c/d |

|

9,500

90,500 |

|

|

| 1,00,000 |

|

|

| 1,00,000 |

2017-18 Apr 1 |

To Balance b/d |

|

90,500 |

2017-18 Mar 31

Mar 31

Mar 31

Mar 31

Mar 31 |

By Depreciation A/c (on asset sold) By Bank A/c (asset sold) By Loss on Sale of Vehicle A/c By Depreciation A/c (Assets hold) By Balance c/d |  |

1,800

12,000

4,200

7,250

65,250 |

|

|

| 90,500 |

|

|

| 90,500 |

2018-19 Apr 1

|

To Balance b/d

|

|  65,250 | 2018-19 Mar 31

Mar 31 |

By Depreciation A/c

By Balance c/d |  |

6,525

58,725 |

|

|

| 65,250 |

|

|

| 65,250 |

W.N. 1)

Particulars | Asset 1 | Asset 2 | Asset 3 | Total |

2016-17 1. Cost Date of Purchase 2. Depreciation |

20,000 1.4.16 2,000 (20,000 x 10/100) |

70,000 1.4.16 7,000 (70,000 x 10/100) |

10,000 30.9.16 500 (10,000 x 10/100 x 6/12) |

9,500 |

2017-18 3. Op. Balance - WDV on 1.4.17 (1 – 2) 4. Depreciation |

18,000

1,800 |

63,000

6,300 |

9,500

950 |

9,050 |

2018-19 5. Op. Balance - WDV on 1.4.18 (3 – 4) (-) Sold for LOSS ON SALE 6. Depreciation |

16,200

12,000 4,200 NIL (asset sold) |

56,700

5,670 |

8,550

855 |

6,525 |

Books recommended :

1. M. C. Shukla and T. S. Grewal —Advanced Account

2. S. M. Shukla —Advanced Accounts.

3. R. L. Gupta —Advanced Accounts.

4. Man Mohan Prasad — Advanced Accounts.

5. S. K. Singh & R. U. Singh —Specialised Accounts