UNIT 5

Transfer Pricing

Definition

Transfer pricing can be defined as the value which is attached to the goods or services transferred between related parties. In other words, transfer pricing is the price which is paid for goods or services transferred from one unit of an organization to its other units situated in different countries

Transfer price is defined as ‘The price at which goods or services are transferred from one process or department to another or from one member of a group to another. The extent to which costs and profits are covered by the price is a matter of policy. A transfer price may, for example, be based upon marginal cost, full cost, market price or negotiation.’ – CIMA Official Terminology.

Transfer pricing guidelines for multinational companies are regulated by Organization for Economic Co-operation and Development (OECD). The guidelines are accepted by all tax authorities as its states the rules and regulations on transfer pricing to ensure accuracy and fairness.

They specify the controlled transaction price made between internally related companies must follow arms length principle. This principle states that a company must charge a similar price for a controlled transaction as an uncontrolled transaction made by a third party. In other words, the transaction amount must be a fair market price.

Transfer pricing methods

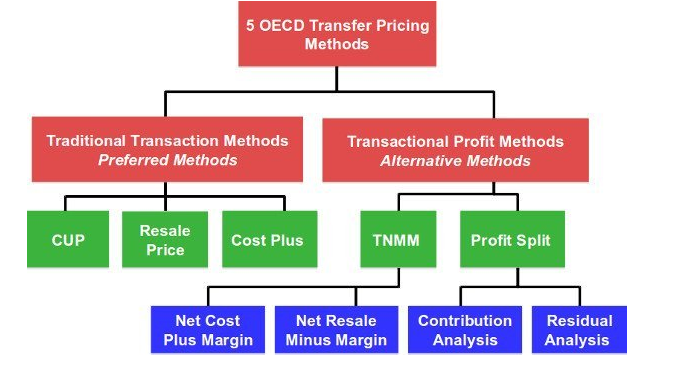

The five transfer pricing methods are divided in “traditional transaction methods” and “transactional profit methods.”

Traditional Transaction Methods

Traditional transaction methods deals with measuring the terms and conditions of actual transactions between independent enterprises and compares the actual transaction with those of a controlled transaction to take corrective actions.

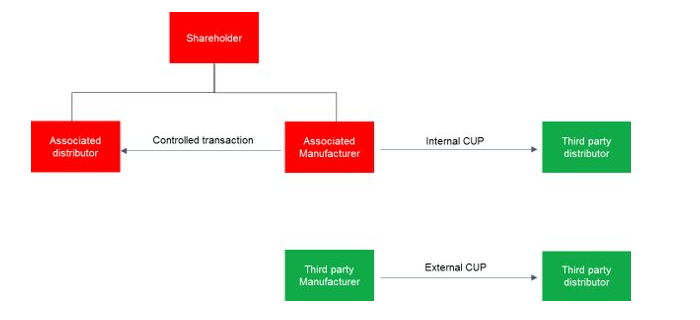

- CUP method - The CUP Method involves comparing the terms and conditions of a controlled transaction to those of a third party transaction. There are two kinds of third party transactions.

- Internal cup - A transaction between the taxpayer and an independent enterprise.

- External cup - A transaction between two independent enterprises.

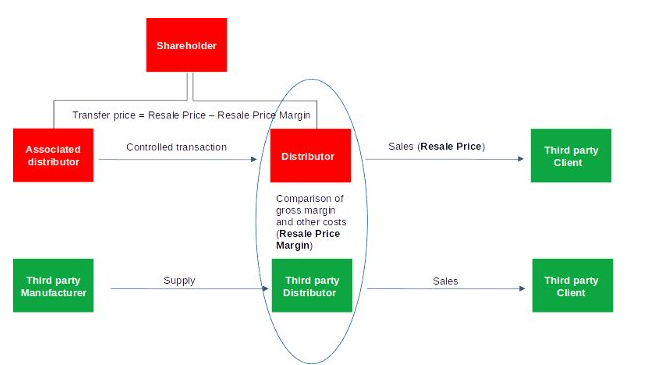

2. Resale price method – it is also known as resale minus method. In this method resale prices refers to the prices at which the associated enterprise sells its product to the third party. The gross margin is calculated by comparing the gross margins in a comparable uncontrolled transaction is then reduced from this resale price. Then the cost like custom duties, etc associated with the purchase of the product is deducted.

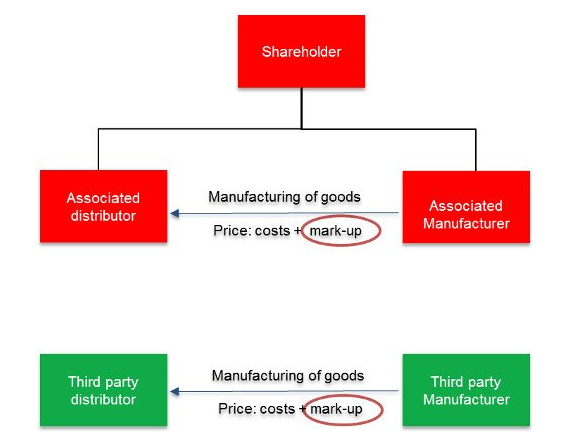

3. The cost plus method – under the cost plus method the gross profits are compared to the cost of sales. It involves the following steps; firstly, evaluate the costs incurred by the supplier in a controlled transaction for products transferred to an associated purchaser. Secondly, to make an appropriate profit in light of the functions performed, an appropriate mark-up has to be added to this cost. The price can be considered at arm’s length after adding markup to these costs. The application of this method requires the identification of a mark-up on costs applied for comparable transactions between independent enterprises.

Transactional profit methods

Transactional profits methods do not measure the terms and conditions of actual transaction. Under this method net operating profits are realized from controlled transactions and profit level are compared with the profit level realized by independent enterprises that are engaged in comparable transactions. The transactional profit methods are less precise and more applied than the traditional transactional methods.

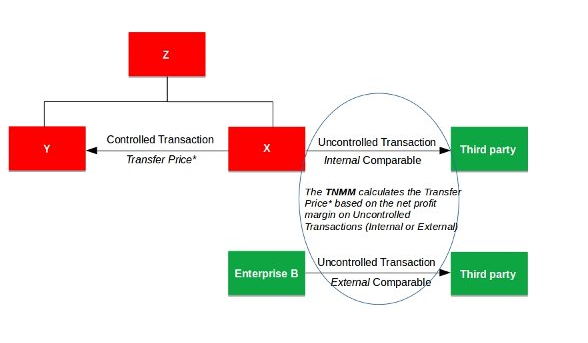

- The transactional net margin method – this method determines the net profit of a controlled transaction of an associated enterprise. The net profit determined is compared to the net profit realized by comparable uncontrolled transactions of independent enterprises. It is also called as comparable profit methods. This method is most commonly used and applicable as it requires financial data.

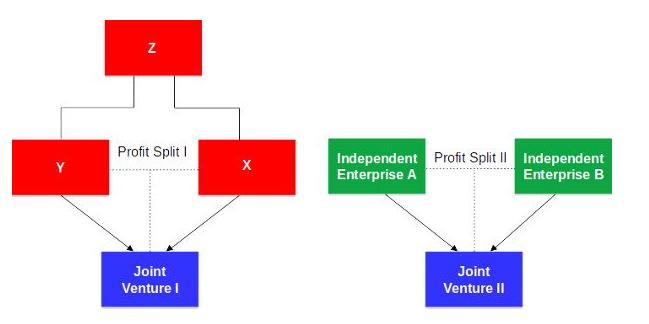

2. Profit split method – the profit split method examines the terms and conditions of interrelated controlled transactions by determining the division of profits those independent enterprises would have realized from engaging in those transactions. It looks the profit in holistic way rather than on a transactional basis. It leads to more accurate assessment of the company’s financial performance.

Key takeaways - transfer pricing is the practice of setting the price of goods and services for transactions between affiliated organizations

Sources

- S. P. Gupta : Management Accounting

- B. K. Mehta & K. L. Gupta : Management Accounting

- Manmohan and Goyal : Management Accounting

- Hingorani and Others : Management Accounting

- R. N. Anthony : Management Accounting

- Agarwal and Mehta : Management Accounting