UNIT I

Accounting as an information system

Accounting as an information system

The users of financial accounting information and their needs.

Another definition of the American Institute of Certified Public Accountants (AICPA) is: Interpret the result. "

Accounting includes recording, classifying, and summarizing business transactions. This is the process of identifying, measuring, and communicating economic information, including four interrelated phases. They are outlined here:

First, the first phase is intended to record economic events or transactions called journals-recording them in chronological books in chronological order as they occur. This process is known as journaling. Next is the ledger posting phase. This is the process by which all transactions are synthesized for each account and the cumulative balance for each of those accounts can be determined. The ledger posting process is very important because it helps you see the net effect of various transactions over a particular time period. The next step is to prepare a trial balance that includes aggregating all ledger accounts into debit and credit balances. This activity allows you to see if the total debit is equal to the total credit. Finally, there is the stage of preparing financial statements. This phase aims to close the account by measuring the profit and loss account at the end of the accounting period and creating a balance sheet.

Accounting information has different users, who can be inside or outside your organization. Accounting information is economic information because it relates to the financial or economic activity of a corporate organization. Because numerous people use accounting information for therefore many diverse purposes, the aim of monetary statements is that the needs of users who may lead them to form better financial decisions. Is to respond to. Users can be categorized as internal users and external users.

The internal or primary users of accounting information are:

Management-Accounting information is very useful for managing planning, management, and decision-making processes. In addition, management needs accounting information to assess an organization's performance and status and can take the necessary steps to improve performance. What's more, accounting information helps managers make their jobs better.

Employees-Employees use accounting information to study the financial position, sales, and profitability of their business to determine employment stability, future compensation potential, severance pay, and employment opportunities.

Owner – The owner uses accounting information to analyze the feasibility and profitability of an investment. Accounting information allows owners to assess the ability of a business organization to pay dividends. It also guides you in deciding on future course of action.

The external or secondary users of accounting information are:

Creditors – Creditors are interested in accounting information because they can determine the creditworthiness of their business. Credit terms and standards are set based on the financial position of the business, which helps you analyse with accurate information. Creditors include financial suppliers and lenders such as banks. Trade creditors are generally more interested in accounting information in a shorter period of time than lenders.

Investor – We need information because we are interested in the risks and returns inherent in our investment. It is important to assess the feasibility of investing in a company and should be analysed before funding the company.

Customers – Customers are interested in accounting information to assess the financial position of their business. This is because you can maintain a stable business source, especially if you are involved in the long term.

Regulators – Accounting information is needed to ensure that it complies with rules and regulations and protects the interests of stakeholders who depend on such information.

General-purpose financial statements provide much of the knowledge needed by external users of monetary accounting. These financial statements are formal reports that provide information about the company's financial position, cash inflows and outflows, and operating results. Many companies publish these statements in their annual reports, also known as 10-K or 10-Q (quarterly reports). The annual report contains the opinion of the independent auditor on the fairness of the financial statements and information on the company's activities, products and plans. The best place to find these reports for public companies is usually the investor public relations section of your website. Financial statements used by external entities are prepared using generally accepted accounting principles (GAAP). The GAAP language will be discussed in more detail in a later section.

Government / IRS

Government agencies that track and use taxes are interested in a company's financial story. They want to know if a company pays taxes according to current tax law. The language in which tax-related financial statements are produced is called the IRC or the Internal Revenue Service. Tax preparation is outside the scope of this ours.

Qualitative characteristics of Accounting Information

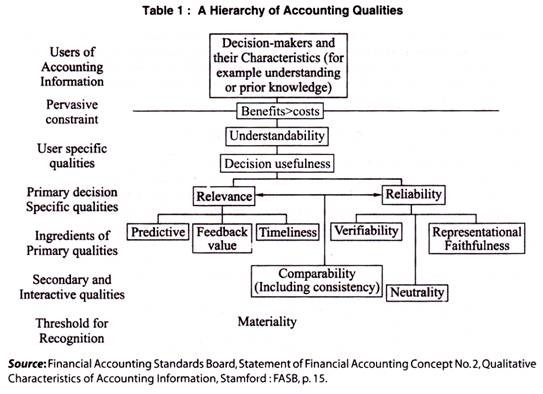

The qualitative characteristics or quality required for information play a major supporting role in the usefulness of decision making in accounting theory, the approach of decision-making models. A qualitative feature is a compliment that makes the information provided in the financial statements useful to the user.

The accounting information reported to facilitate financial decisions must have certain characteristics or normative standards. Table 1 shows the quality of information recognized in FASB (US) Concept No. 2 “Quality Characteristics of Accounting Information”.

Fig 1

The International Accounting Standards Board (1ASB) comprises four key features:

1. Easy to understand

2. Relevance

3. Reliability

4. Comparability.

Other qualities proposed by the IASB are importance, faithful expression, substance to form, neutrality, prudence, completeness, and timeliness.

The qualitative features that have been found to be widely accepted and recognized in the accounting literature are:

1. Relevance:

Relevance is closely and directly associated with the concept of useful information. Relevance means that you need to report all information items that may help users make decisions and forecasts. In general, the more important information in decision making is more relevant.

In particular, it is the ability of information to make a difference that identifies it as relevant to decision making. The Commission, which prepares a statement on the basic accounting theory of the American Accounting Society, describes relevance as "a primary standard and influences actions designed to facilitate information or outcomes that are desired to be generated. Or need to be usefully associated. "

2. Reliability:

Confidence is described as one of the two main qualities (relevance and credibility) that make accounting information useful for decision making. Reliable information is needed to make decisions about a company's profitability and financial position. Reliability varies from item to item.

Some of the information contained in the annual report is more reliable than the others. For example, information about plants and machinery may be less reliable than certain information about current assets due to differences in realization uncertainty. Reliability is the quality that allows users of data to rely on it with confidence as a representative of what the data is trying to represent.

The FASB Concept No. 2 concludes that:

To be useful information, it can only be trusted. There must be no relevance. You need to be aware of the degree of reliability. There are few black or white issues, but it is a high or low reliability issue. Reliability is verified by accounting explanations or measurements. It is possible, expressively faithful and dependent to some extent. Information neutrality also interacts with these two elements of reliability and affects the usefulness of information. "

3. Intelligibility:

Intelligibility is the quality of information that enables users to recognize its importance. You can increase the benefits of information by making it easier to understand and helping more users.

Presenting information that only sophisticated users can understand and others cannot understand creates a bias that contradicts proper disclosure standards. The presentation of information should not only facilitate understanding, but also avoid misinterpretation of financial statements. Therefore, easy-to-understand financial accounting information presents data that is understandable to the user of the information and is expressed in a format and terminology that fits the user's understanding.

4. Comparability:

To make an economic decision, you need to choose from possible course of action. When making a decision, the decision maker makes a comparison between the alternatives. This is facilitated by financial information. Comparability means that they are reported in the same way and in different ways.

FASB (USA) Concept No. 2 defines comparability as follows: Obviously, a valid comparison is only possible if the measurements (quantities or ratios) used are certain to represent the characteristics to be compared.

Comparable financial accounting information shows similarities and differences that result from the fundamental similarities and differences of a company or its transactions, as well as differences in the treatment of financial accounting.

The information, when comparable, helps decision makers determine relative financial strengths and weaknesses, as well as future prospects, between two or more companies, or between periods of one company.

5. Consistency:

Consistency of the method over a period of time is a valuable quality that makes accounting numbers more useful.

If the investor knows which method is being followed and it is guaranteed that it is being followed consistently each year, then what exact rules and practices are used by the investor to report their earnings. It doesn't really matter if you adopt. Inconsistency creates a lack of comparability. The value of business-to-business comparisons is significantly reduced if significant differences in revenue are caused by fluctuations in accounting practices.

6. Neutrality:

Neutrality is also known as "freedom from prejudice" or the quality of objectivity. Neutrality means that the main concern in developing or implementing a standard should be the relevance and credibility of the resulting information, not the impact of the new rules on a particular interest or user. Means neutral choices between accounting options are not biased towards given results. The purpose of (general purpose) financial reporting serves many different information users with different interests, and one given result may not fit the interests and purposes of all users.

Therefore, accounting facts and practices should be fairly determined and reported without the purpose of intentionally biasing users or groups of users. If there is no bias in the choice of reported accounting information, then one set of profits cannot be said to have an advantage over another. In fact, it may support a particular interest, because the information points to it that way.

7. Importance:

The concept of materiality pervades the entire field of accounting and auditing. The concept of materiality means that all financial information needs to or should not be communicated in accounting reports-only important information should be reported. Information that is not important may be omitted and should probably be omitted. Information that may affect your financial decisions should be disclosed in your annual report. Information that meets this requirement is important.

8. Timeliness:

Timeliness means making information available to decision makers before they lose their ability to influence decisions. Timeliness is an auxiliary aspect of relevance. Future action, if information is not available when needed or becomes available long after the reported event and is not worth it, is irrelevant and of little or no use. Timeliness alone cannot make information relevant, but lack of timeliness can rob you of relevant information that you might otherwise have.

Obviously, there is a degree of timeliness, and some reports need to be produced quickly, such as in the case of takeover bids or strikes. In other situations, such as regular reporting of annual performance by operators, long delays in reporting information can have a significant impact on relevance and thus the usefulness of the information. However, to achieve the increased relevance that accompanies the increased timeliness, other desirable properties of the information must be sacrificed, which can result in an overall increase or decrease in usefulness.

For example, it may be desirable to sacrifice accuracy for timeliness. This is because quickly-produced estimates are often more useful than accurate information reported after longer delays.

9. Verifiability:

Verification does not guarantee the suitability of the method used and does not guarantee the accuracy of the resulting measurements. It conveys some assurance that the measurement rules used, whatever they are, have been carefully applied to the measurer's side with personal prejudice.

It is a means to deal with some measurement problems more than other measurement problems.

Verification of accounting information does not guarantee that the information has a high degree of representational fidelity, and a highly verifiable measurement is a decision that is intended to be useful. Not necessarily related. "

10. Conservatism:

There are places of custom such as conservatism. This is a scrutiny of financial accounting and reporting as business and economic activity is surrounded by uncertainty, but it should be applied with caution.

Conservatism in financial reporting should no longer mean a deliberate, consistent and unobtrusive representation of net worth and profits.

Therefore, conservatism dictates the use of non-optimistic estimates when two estimates of the amount to be received or paid in the future can occur in much the same way. However, if the two amounts are not equal, conservatism is not necessarily the most likely amount and does not dictate the use of a more pessimistic amount.

Functions of Accounting

Accounting Definition

According to AW Johnson; "Accounting collects, edits, systematically records, prepares financial reports, analyses and interprets these reports, and uses these reports for management information and guidance. May be defined as. "

A technique for recording, classifying, and summarizing the terms of money, transactions, and events in a critical way, at least in part, of a monetary nature, and as a result. Interpret is called Accounting. American Institute of Certified Public Accountants [AICPA];

A process of identifying, measuring, and communicating economic information that allows users of information to make informed decisions and decisions is known as Accounting." American Accounting Association [AAA]”

In light of the discussion above and the definition of accounting, we can thus give a comprehensive and meaningful definition of accounting.

Accounting is a field with the technology and methods to properly and systematically record, classify, and summarize all types of transactions that are measurable in terms of money or monetary value. This helps to present and explain income, expenses, loss of profits, and assets and liabilities for a particular period of time, and to provide management and investors with the information and statements they need.

So, we can say that Accounting is the art and science of tracking financial events.

Accounting systematically records business transactions from a financial perspective.

The accounting process produces financial reports and examines them to facilitate decision making.

Accounting is an ongoing process for providing information to interested users.

So, we can say. Accounting is defined as an information system that maintains the process of identifying and measuring quantitative financial activity and communicating these financial reports to decision makers or interested users of the organization.

Accounting is just a tool for measuring the financial position of any entity involved in economic activity. Accounting helps management.

It is a system that keeps a record of financial events, analyzes them, and presents a report of financial results and the location of economic agents.

The accounting process provides the governing body with the information it needs to make decisions. This information is needed by stakeholders. Inside and outside the organization.

The information that accounting provides is very important to do that. For this reason, accounting is also known as the "business language."

Accounting as a business language

Language is a medium of communication process that conveys one person to another, one person to another business, and one business to another, and takes several different forms, such as verbal, written, and non-verbal. You may.

It identifies, records, and communicates the financial events of a business organization to those users who are interested

Accounting is as old as money itself. As a child, commercial activities were based on barter systems, so record keeping was not necessary. The Industrial Revolution of the 19th century paved the way for commercial activity, mass production, and the development of credit terms, along with the rapid population growth. Therefore, the record of commerce has become an important function.

- Applicability

Accounting principles are expected to be feasible, predictable and applicable. It should be easy to apply to accounting systems and easy for anyone to implement.

For example, if you see fixed assets on your balance sheet, replacement costs are difficult, and fluctuations and people can cause fluctuations and market prices. It doesn't change from person to person, but it shouldn't.

2. Recording

Accounting has the unique function of recording all financial transactions. It provides provisions for recording transactions in a detailed way that companies can use. Recording is systematic and can be done by anyone familiar with the basics of accounting and the law.

Recording is done by similar grouping entries under a single title so that all financial transactions can be easily categorized.

3. Classification

Accounting provides the ability to categorize all financial transactions into different categories. These categories are grouped in one place according to their similarity. For example, all payments and receipts received will be reflected in your cashbook or memo book.

This helps to classify all similar transactions into one heading, which helps to find them and makes it easier. A book that has completed the process of opening an account is called a ledger.

4. Usefulness

Accounting principles have been found to be useful and provide important information to anyone trying to find them in an easy way. With different categories and headings that categorize different transactions, the finder can easily find a particular transaction.

These entries help determine and identify the nature of the transaction and analyze its impact on the overall balance sheet.

5. Objectivity

Principals are relevant when there are numbers and facts. Factual accounting principles that support numbers make it very relevant. There is no prejudice, as it is guaranteed that personal whims and prejudices are not included in the accounting case.

This is why accounting is said to be objective.

6. Summary

Accounting is known to provide a summary of the relevant complex financial statements. Cash flow, fund flow and balance sheet statements are briefly summarized and presented to investors and the general public.

These statements help investors make investment decisions. The abstract also provides a test of the organization's overall financial position without spending a lot of time.

Income statements, balance sheets, etc. are mirrors of the company, and summaries are considered to be very important statements.

7. Verification

All statements generated by a Certified Treasury Auditor or Bookkeeper can be audited and verified for their validity. All entries in the accounting system are related to a company's financial transactions. Therefore, financial statements give a glimpse of the mirror of the organization.

All of these entries can be validated and verified to test the validity of the statement.

8. Interpretation

Financial statement summaries can be read and interpreted by anyone with knowledge. The interpretation is universal and there is no difference from person to person or from auditor to auditor. It remains constant regardless of who interprets it, which gives it a characteristic of universality.

You can analyze the interpretation to find out if your organization is in good or bad financial position. Business performance can be determined with the help of accounting statements.

9. Reproducibility

Accounting is characterized by reproducibility due to established procedures and formulas. Accounting steps are calculated based on a fixed formula. For example, ratio analysis uses different formulas to determine different aspects of a stock. This is convenient for investors.

The results obtained from these analyzes are repeatable due to the universality of the formula and are not individual dependent or change over time.

The necessity and importance of accounting

When a person starts a business, big or small, his main purpose is to make a profit. He receives money from certain sources such as selling goods and interest on bank deposits. He has to spend money on certain items such as purchasing goods, salaries, and rent. These activities take place in the course of his normal business. He naturally wants to know the progress of his business at the end of his year. There are so many commerce that I can't remember his memory of how the money was made. At the same time, if he writes down his income and expenses, he can quickly get the information he needs. Therefore, in order to get an easy and accurate answer to the next question at any time, you need to clearly and systematically record the details of your commerce.

I. What happened to his investment?

Ii. What will happen to the results of the commercial transaction?

Iii. How much are your income and expenses?

Iv. How much can I receive from a customer whose goods are sold by credit?

v. How much do you pay the supplier to buy credit?

Vi. What are the nature and value of assets that business concerns have?

Vii. What is the nature and value of debt of business concern?

These and some other questions can be answered with the help of accounting. The need to record commerce in a clear and systematic way is the basis for creating bookkeeping.

Accounting, one of the key aspects of an organization, has many well-defined purposes. The purpose may also vary depending on the genre of the business you belong to. Analyse your accounting objectives from a broader perspective and understand how you can achieve them.

1) Records management

The basic role of the accounting department of an organization is to keep a systematic record of all financial transactions. Systematic records management ensures an appropriate level of analysis to reach the financial position of the organization.

It makes systematic record keeping an absolute purpose of accounting. This is a great help for systematic and accurate decision analysis. Proper recording is one of the key factors and must form the backbone of an organization before it can achieve other purposes or other sections of accounting.

2) Analysis and confirmation of financial results

If you are in business, you will want to determine the exact state of your company's financial position at the end of a particular period. Companies typically prefer quarterly closing of operating finance.

The accounting department creates the profit and loss details of the organization based on the income statement generated using the records held during that period. This is a continuous process and will continue regardless of the specified time period.

3) Analysis of financial condition

Accounting also aims to check the financial status of an organization. This includes liabilities, liabilities, assets, and assets. The accounting section should be able to keep up to date with the financial status of the company.

This is ideally achieved through the creation of a balance sheet. This gives you a glimpse of your organization's financial position over a specific period of time. The balance sheet helps you analyse your company's financial position and make future decisions and goals.

4) Decision-making

Decision-making accounting has a broader purpose of supporting the decision-making of business owners and business owners. Systematic accounting is an important factor in making business decisions and setting goals for future growth and realistic goals for planning.

Here are some examples of decisions that accounting can support:

- Product pricing to achieve maximum profit. Accounting can reach operational and other costs associated with manufacturing a product, so you can reach realistic and accurate pricing without ambiguity.

- Make decisions when you're short on money to maximize your profits and improve your status.

- Helps make decisions when an organization needs to obtain additional funding. This is also true for new product launches and diversification into new businesses.

- Accounting can also help you determine poorly performing products and services.

- Decisions regarding credit lending to customers.

- In essence, these decisions can often be made without the help of accounting. However, accounting provides a reasonable basis for these decisions.

5) Liquidity status

A complete understanding of an organization's liquidity status is also an important goal that accounting must fulfil. Lack of proper accounting often leads to financial mismanagement of the organization and can lead to major problems such as lockouts and business closures.

Appropriate accounting should help management and business owners see how much cash and other resources they have at their disposal to pay their financial commitments. Must be. Knowledge of liquidity also helps to calculate the amount of working capital and the capital that can be used to repay debt.

6) Ensuring positioning

One of the main purposes of accounting is to support the positioning of an organization. Accounting provides a large amount of financial statements to help you reach this goal. The financial position of an organization would ideally be of great help in promoting the financial position of the company.

Financial statements that help you check your organization's financial position include:

- The amount of capital raised by the organization to do business.

- Amount of funds from this capital used for business activities

- The organization's complete balance sheet showing cumulative profits or losses.

- Organizational responsibility. This refers to the amount the company should pay to others

- The sum of cash, inventory, machinery, assets, and other assets owned by the organization.

- Accounting aims to manage and maintain all these statements in order to provide a sound picture of the organization.

7) Accountability

One of the most important goals of accounting perfection is to maximize the accountability of the company. It is the accounting department of an organization that provides a solid foundation for assessing the actual performance of an organization over a period of time.

This also helps to promote organizational accountability in the long run and through multiple layers of the organizational hierarchy. Financial statements in the accounting department also help to give shareholders sufficient trust. In poor performance, the same financial statements help shareholders hold the company's directors and promoters accountable. This is also useful if you are planning to fund a new project. A reliable and accountable financial position helps to secure financing through loans or from investors.

8) Legal purpose

Accounting also serves as legal support to support an organization's financial position. Therefore, one of the key objectives that accounting needs to deal with is to meet the legal requirements of the organization.

Accounting is a legal requirement in accordance with laws around the world. In accordance with the law, all companies are required to maintain and maintain financial records of transactions for a specified period of time and share this information with shareholders, promoters and regulators. In addition, proper accounting helps an organization to positively reach the right financial rights, obligations, and liabilities.

9) Fraud detection and prevention

Financial mismanagement and fraud are one of the main reasons that can cause business closures or losses. One of the main purposes of accounting is to record actual transactions to prevent fraud and mismanagement.

If the records are correct and genuine, you can prevent employees of your organization from indulging in fraudulent financial activities. Accounting provides the coveted transparency of company-wide transactions and thus ensures that fraud is reduced to near zero.

Conclusion

In essence, the main purpose of accounting is to manage and maintain good records of each financial transaction in a systematic way and analyze these records to reach the proper financial position of the organization. Once you start achieving this goal, rest on the goals outlined above.

Overview:

Accounting principles are built on some basic concepts. These concepts are so basic that most financial statement authors do not consciously consider them. As mentioned earlier, they are considered trivial. Some accounting researchers and theorists argue that some of the current accounting concepts are wrong and need to be changed.

Nevertheless, in order to understand the accounting that currently exists, it is necessary to understand the basic concepts currently in use. The basic accounting concepts described here may not be the same as those listed by other authors or groups. However, these are widely accepted and practical concepts used by financial statement authors and auditors to review financial statements.

Objects and functions of Accounting

1 – Compliance with statutory requirements

One of the objectives is to ensure compliance with local laws related to taxation, corporate law, and other statutory requirements related to the country of business. This ensures that the business complies with such laws and that relevant provisions are complied with during the course of the business.

2 – Protecting the interests of various stakeholders

It provides relevant stakeholders, including shareholders, future investors, finance personnel, clients and creditors, with relevant and relevant information related to their business operations. They are suitable not only for those who have an existing business relationship, but also for those who are interested in collaborating with future businesses by providing meaningful information about the business. Further financial accounting standards ensure control of corporate accounting policies to protect the interests of investors.

3 – Useful for measuring business profits and losses

It measures the profitability of a business over a specific period of time and discloses the net profit or loss of the entire business. It also shows the assets and liabilities of the business.

4 – Presenting historical records

Unlike other accounting, it focuses on displaying past records rather than forecasting the future. The main reason for creating financial accounting is the confirmation of profits or losses incurred by the business during the period.

5 – Focus on external business transactions

It focuses on the transactions that a business conducts with external parties such as customers and suppliers, and based on these transactions, quantifies the business, the costs incurred, and the resulting profits or losses. An account will be created for you.

Limitations of Accounting

- Accounting information is expressed in terms of money. Non-monetary events or transactions, however important they may be, are completely omitted.

2. Fixed assets are recorded in the accounting records at the original cost, that is, the actual amount spent on them plus, of course, any incidental charges. In this way the effect of inflation (or deflation) is not taken into consideration. The direct result of this practice is that balance sheet does not represent the true financial position of the business.

3. Accounting information is sometime based on estimates; estimates are often inaccurate. For example, it is not possible to predict with any degree of accuracy the actual useful life of an asset for the purpose of depreciation expense.

4. Accounting information cannot be used as only test of managerial performance on the basis of more profits. Profits of a period of one year can readily be manipulated by omitting such cost of advertisement, research and development, depreciation and soon.

5. Accounting information is not neutral or unbiased. Accountants calculate income as excess of revenue over expenses. But they consider only selected revenues and expenses. They do not, for example, include cost of such items as water or air pollution, employee’s injuries etc.

6. Accounting like any other discipline has to follow certain principles which in certain cases are contradictory. For example: current assets (e.g., stock of goods) are valued on the basis of cost or market price whichever is less following the principle of conservatism. Accordingly, the current assets may be valued on cost basis in some year and at market price in other year. In this manner, the rule of consistency is not followed regularly.

Key takeaways:

- Internal users are people within your business organization who use financial information. Examples of internal users are owners, administrators, and employees.

- An external user is someone outside the entity (organization) that uses the accounting information.

- Accounting is a necessary function for decision making, cost planning, and economic performance measurement, regardless of the size of the business.

- Two important types of corporate accounting are management accounting and costing. Management accounting helps management teams make business decisions, while costing helps business owners determine the cost of a product.

- Professional accountants follow a set of standards known as generally accepted accounting principles (GAAP) when preparing financial statements.

- Government agencies that track and use taxes are interested in a company's financial story.

- General-purpose financial statements provide much of the knowledge needed by external users of monetary accounting.

- The qualitative characteristics or quality required for information play a major supporting role in the usefulness of decision making in accounting theory, the approach of decision-making models.

- A qualitative feature is a compliment that makes the information provided in the financial statements useful to the users.

- The qualitative features that have been found to be widely accepted and recognized in the accounting literature.

- However, if the two amounts are not equal, conservatism is not necessarily the most likely amount and does not dictate the use of a more pessimistic amount.

- Verification of accounting information does not guarantee that the information has a high degree of representational fidelity, and a highly verifiable measurement is a decision that is intended to be useful.

- Timeliness means making information available to decision makers before they lose their ability to influence decisions.

- Accounting may be a necessary function for deciding, cost planning, and economic performance measurement, no matter the dimensions of the business.

- Bookkeepers can handle basic accounting needs, but Certified Accountants (CPA) should utilize them for larger or more advanced accounting tasks.

- Two important sorts of corporate accounting are management accounting and costing. Management accounting helps management teams make business decisions, and costing helps business owners determine the value of a product.

- Professional accountants follow a group of commonly accepted accounting principles (GAAP) when preparing financial statements.

- The main purpose of monetary accounting is to accurately prepare the financial accounting of a corporation for a specific period of your time. This is often also referred to as financial statements.

- The three main financial statements are the earnings report, the record, and therefore the income statement.

- Accounting may be a necessary function for deciding, cost planning, and economic performance measurement, no matter the dimensions of the business.

Overview:

Accounting concepts defines the assumption on the basis of which financial statement of a business entity is prepared. Concepts are those basic assumption and condition which form the basis upon which the accountancy has been laid.

Accounting principles

- They should be based on real assumption

- They must be simple, understandable and explanatory

- They must be followed consistently

- They should be able to reflect future predictions

- They should be informational to users

Accounting convention emerges out of accounting practices, commonly known as accounting principle, adopted by various organizations over a period of time. Accounting bodies may change any of the convention to improve the quality of accounting information.

The basic accounting concept is as follows:

- Entity concept:

The concept of an entity assumes that its financial statements and other accounting information belong to a particular company that is different from its owner. Therefore, an analysis of business transactions, including costs and revenues, is expressed in terms of changes in the company's financial position.

Similarly, the assets and liabilities devoted to business activities are the assets and liabilities of the entity. The company's transaction is reported, not the company's owner's transaction. Therefore, this concept allows accountants to distinguish between personal and commercial transactions. This concept applies to sole proprietorships, partnerships, businesses, and small businesses. It may also apply to multiple companies, such as when a segment of a company, such as a department, or an interrelated company is merged.

2. Going Concern Concept:

An entity is considered to be in business unless there is evidence of opposition. Because companies are relatively permanent, financial accounting is designed with the assumption that the business will survive indefinitely in the future.

The Going Concern concept justifies the valuation of assets on a non-clearing basis and requires the use of acquisition costs for many valuations. In addition, fixed and intangible assets are amortized over their useful lives, rather than in shorter periods, in the hope of early liquidation.

This further means that the data transmitted is tentative and that the current statement should disclose adjustments to the statement over the past year revealed by more recent developments.

3. Money measurement concept:

A unit of exchange and measurement is required to uniformly account for a company's transactions. The common denominator chosen in accounting is the currency unit. Money is the lowest common denominator for measuring the exchangeability of goods and services such as labor, natural resources and capital.

The concept of monetary measurement considers accounting to be a process of measuring and communicating financially measurable company activity. Obviously, the financial statements should show the money spent.

The concept of measuring money means two limitations of accounting. First, accounting is limited to the generation of information expressed in monetary units. It does not record and convey other relevant but non-monetary information. Second, the concept of monetary measurement concerns the limitation of the monetary unit itself as a unit of measurement.

There are concerns about purchasing power, which is the main characteristic of currency units, or the amount of goods and services that money can obtain. Traditionally, financial accounting has addressed this issue by stating that the concept assumes that the purchasing power of a currency unit is stable over the long term or that price changes are not significant. Although still accepted in current financial reporting, the concept of stable monetary units is subject to continuous and permanent criticism.

4. Accounting period concept:

Financial accounting provides information about a company's economic activity over a specific period of time that is shorter than the company's lifespan. The periods are usually the same length for ease of comparison.

The period is specified in the financial statements. The period is usually 12 months. Quarterly or semi-annual statements may also be issued. These are considered provisional and differ from the annual report. Statements that cover shorter periods of time, such as months or weeks, may also be created for administrative use.

5. Cost concept:

The concept of cost is that the asset should be recorded at the exchange price, that is, the acquisition cost or the acquisition cost. Acquisition costs are recognized as an appropriate valuation criterion for recognizing the acquisition of all goods and services, costs, expenses and capital.

For accounting purposes, business transactions are usually measured in terms of the particular price or cost at which the transaction occurred. That is, financial accounting measurements are based on exchange prices, where economic resources and obligations are exchanged. Therefore, the quantity of an asset listed during a company's account doesn't indicate what the asset could also be sold for.

The concept of acquisition cost means there's little point in revaluing an asset to reflect its current value, because the company has no plans to sell its asset. Additionally, for practical reasons, accountants like better to report actual costs over market values that are difficult to verify.

6. Dual aspect concept:

This concept is at the guts of the whole accounting process. Accountants record events that affect the wealth of a specific entity. The question is which aspect of this wealth is vital. Accounting entities are artificial creations, so it's essential to understand who their resources belong to or what purpose they serve.

It's also important to understand what sorts of resources you manage, like cash, buildings, and land. Therefore, the accounting record system was developed to point out two main things: (a) the source of wealth and (b) the shape it takes. Suppose Mr. X decides to line up a business and transfers Rs. 100,000 from his personal checking account to a different business account.

He may record this event as follows:

Obviously, the source of wealth must be numerically adequate to the shape of wealth. S (source) must be adequate to F (form) because they're simply different aspects of an equivalent thing, that is, within the sort of equations.

In addition, transactions or events that affect a company's wealth got to record two aspects so as to take care of equality on each side of the accounting equation.

If a corporation acquires an asset, it must be one among the following:

(A) Other assets are abandoned.

(B) There was an obligation to pay it.

(C) Profitable and increased amount of cash the operator has got to pay to the owner.

(D) The owner funded the acquisition of the asset.

This doesn't mean that the transaction affects both the source and sort of wealth.

There are four categories of events that affect accounting equations:

(A) Both the source and sort of wealth are increased by an equivalent amount.

(B) Both the source and sort of wealth are reduced by an equivalent amount.

(C) Some increase without changing the source of wealth, others decrease.

(D) Some sources of wealth increase and a few decreases without changing the shape of wealth retention.

The above example shows category (a) because once you start a transaction for an entity, the source of wealth and therefore the sort of wealth, cash, increases from zero to rupees. 1,00,000. In contrast, X may plan to withdraw Rs. 20,000 cash from business.

In that case, the financial position of the entity would be:

It is essential to know why each side of the equation are reduced. By withdrawing cash, X automatically reduces the availability of personal funds to the business by an equivalent amount. Now suppose Mr. X buys a listing of products for Rs. 30,000 in cash available. His capital supply remains an equivalent, but the composition of his business assets does.

The two aspects of this transaction aren't within the same direction, but are compensatory and are increasing stocks that set a cash reduction. Similarly, sources of wealth are often suffering from transactions. So, if X gives his son Y, it becomes Rs. 20,000 shares of the business by transferring some of his own profits, the consequences are:

However, if X gives YR. He personally receives $ 20,000 in cash, and when Y puts it into the business, each side of the equation are affected. Y capital Rs. 20,000 is balanced by additional Rs. 20,000 in cash, X capital remains rupees. 80,000.

7. The concept of accrual accounting:

According to the Financial Accounting Standards Board (USA):

"Accrual accounting is that the financial impact of transactions and other events and situations that affect a corporation on cash, not only during the amount during which it had been received, but also during the amount during which those transactions, events and situations occur. Accrual accounting is paid to the corporate as more (or perhaps less) cash spent on resources and activities, also because the start and end of the method. It's associated with the method of being returned. We recognize that purchases, production, sales, other operations, and other events that affect a company's performance during a period often do not match the receipt or payment of cash for that period. "

Realization and matching concepts are central to accrual accounting. Accrual accounting measures revenue for a period of time as the difference between the revenues recognized during that period and the costs that match those incomes. In accrual accounting, the period revenue is usually not the same as the period cash receipt from the customer, and the period cost is usually not the same as the period cash payment.

8. Cash Basis Accounting:

In cash-basis accounting, sales are not recorded until the period in which they are received in cash. Similarly, costs are deducted from sales during the period in which the cash payment was made. Therefore, neither realization nor matching concepts apply to cash basis accounting.

In reality, "pure" cash-basis accounting is rare. This is because the pure cash basis approach requires the acquisition of inventory to be treated as a reduction in profit when paying the acquisition cost, not when selling the inventory. Similarly, the cost of acquiring plant and equipment items is treated as a reduction in profit if these long-lived items are paid in cash rather than after they have been used.

Obviously, such a pure cash basis approach would result in a balance sheet and income statement with limited usefulness. Therefore, what is commonly referred to as cash-basis accounting is actually a mixture of cash-basis for some items (especially cost of goods sold and period costs) and accrual-based for others (especially product costs and long-term assets). This mix is sometimes referred to as modified cash-basis accounting to distinguish it from the pure cash-basis method.

Cash-basis accounting is most often seen in small businesses that do not have large inventories because they provide services. Examples include restaurants, hairdressers, hairdressers, and income tax filing companies.

Most of these establishments do not provide credit to their customers, so cash-basis profits may not differ dramatically from accrual income. Nevertheless, cash basis accounting is not permitted by GAAP for any type of entity.

9. Conservatism concept:

This trait can be considered a reactive version of the Minimax management philosophy. That is, it minimizes the potential for maximum loss.

The concept of accounting conservatism suggests that accounting should be cautious and cautious until the opposite evidence emerges, where and when uncertainty and risk exposure are legitimate. Accounting conservatism does not mean intentionally underestimating income and assets. It applies only to situations where there is reasonable doubt. For example, inventories are valued at the lower end of cost or market value.

In its application to the income statement, conservatism encourages recognition of all losses incurred or may occur, but does not recognize profits until they are actually realized. Early depreciation of intangible assets and restrictions on recording asset valuations have also been motivated, at least to some extent, by conservatism. Not recognizing revenue until the sale is made is another sign of conservatism.

10. Matching concept:

The concept of matching in financial accounting is the process of matching (associating) performance or revenue (measured at the selling price of goods and services offered) with labour or expense (measured at the cost of goods and services used) over a specific period of time. Is. Targets for which income has been determined.

This concept emphasizes which item of expense in a particular accounting period is expense. That is, expenses are reported as expenses for the accounting period in which revenue related to those expenses is reported. For example, if the sales of some products are reported as revenue for one year, the costs for those products are reported as expenses for the same year.

The concept of matching only needs to be met after the accountant has completed the concept of realization. First measure the revenue according to the concept of realization, then associate the costs with these revenues. Cost matches revenue, but not the other way around.

Therefore, the reconciliation process requires significant cost allocation in acquisition cost accounting. Past (history) costs are investigated and steps are taken to assign a cost element that is considered to have expired service potential or to match it with the associated revenue.

The remaining component of the cost, which is considered to have continued potential for future services, is carried over to the past balance sheet and is called an asset. Therefore, the balance sheet is just a report of unallocated past costs waiting for the estimated future service potential to expire before it matches the appropriate revenue.

11. Realization or Cognitive concept:

The concept of realization or recognition indicates the amount of revenue that should be recognized from a particular sale. Realization rules help accountants determine if revenues or expenses have been incurred. This allows accountants to measure, record, and report on financial reports.

Realization refers to the inflow of cash or cash charges (accounts receivable, accounts receivable, etc.) resulting from the sale of goods or services. Therefore, if the customer purchases Rs. If you pay 500 worth of goods in cash at a grocery store, the store will realize Rs. 500 from the sale.

If the clothing store sells Rs suits. 3,000, if the buyer agrees to pay within 30 days, the store will realize Rs. From sale to 3,000 (accounts receivable) (conservative concept), provided the buyer has a good credit record and the payment is reasonably secure.

The concept of realization states that the amount perceived as revenue is reasonably certain to be realized, that is, reasonably certain to be paid by the customer. Of course, there is room for difference in judgment as to whether or not it is "reasonably certain."

However, this concept explicitly acknowledges that the perceived revenue amount is lower than the selling price of the goods and services sold. The obvious situation is the discounted sale of goods at a price lower than the normal selling price. In such cases, the revenue will be recorded at a lower price rather than the normal price.

12. Consistency concept:

In this concept, once an organization has decided on one method, it should be used for all subsequent transactions and events of the same nature unless there is a good reason to change it. Frequent changes in accounting methods make it difficult to compare financial statements for one period with financial statements for another period.

Consistent use of accounting methods and procedures over the long term checks income statement and balance sheet distortions, and possible operations on these statements. Consistency is needed to help external users compare the financial statements of a particular company over time and make sound economic decisions.

13. Materiality concept:

The law has a doctrine called de minimis non curat lex. This means that the court does not consider trivial issues. Similarly, accountants do not attempt to record events that are not so important that the task of recording them is not justified by the usefulness of the results.

The concept of materiality means that transactions and events that have a non-significant or non-significant impact must not be recorded and reported in the financial statements. Recording of non-essential events is claimed to be unjustifiable in terms of their low usefulness to subsequent users.

For example, conceptually, a brand-new paper pad is an asset of an entity. Each time someone writes on the pad's page, some of this asset is exhausted and retained earnings are reduced accordingly. Theoretically, it is possible to see how many partially used pads the company owns at the end of the accounting period and display this amount as an asset.

However, the cost of such efforts is clearly unreasonable, and accountants are not willing to do this. The accountant took a simpler action, albeit inaccurate, that the asset was exhausted (expenditure) when the pad was purchased or when the pad was issued to the user from the consumable inventory. Treat as.

Unfortunately, there is no consensus on what it means to be important and the exact line that distinguishes between important and non-important events. Decisions depend on judgment and common sense. The accounting creator is meant to interpret what is important and what is not.

Perhaps the importance of an event or transaction can be determined in terms of financial position, performance, changes in an organization's financial position, and its impact on user evaluations or decisions.

14. Full disclosure concept:

The concept of full disclosure requires companies to provide all relevant information to external users for the purpose of sound economic decisions. This concept means that information that is substantive or of interest to the average investor is not omitted or hidden from a company's financial statements.

Accounting Principles

The basic assumptions and concepts mentioned above have been modified to make accounting information useful to a variety of stakeholders. The principles of these changes are as follows:

Principles are:

1. Cost-benefit

2. Importance

3. Consistency

4. Be cautious

- Cost-benefit principle

This amended principle states that the cost of applying the principle must not exceed the benefits obtained from it. If the cost is greater than the profit, then the principle needs to be changed.

2. Materiality principle

The principle of materiality requires that all relatively relevant information be disclosed in the financial statements. Important non-essential information is omitted or merged with other items.

3. Principle of consistency

The purpose of the principle of consistency is to maintain the comparability of financial statements. The rules, practices, concepts and principles used in accounting should be continuously adhered to and applied annually. Comparing the financial results of a business between different accounting periods is important and meaningful only if you follow consistent practices in reviewing them. For example, asset depreciation can be provided in a variety of ways, but whichever method you choose, you must do it on a regular basis.

4. Principle of prudence (conservatism)

The principle of prudence takes into account all expected losses, but leaves all expected benefits. For example, when valuing a stock in trade, the lower of the market price and cost is taken into account.

Salient features of Accounting Standard

Accounting Standard Concept:

We know that generally accepted accounting principles (GAAP) aim to bring uniformity and comparability to financial statements. In many places, you can see that GAAP allows different alternative accounting treatments for the same item. For example, different stock valuations result in different financial statements.

Such practices can lead the intended user in the wrong direction when making decisions related to his or her field. Given the problems faced by many accounting users, the need to develop common accounting standards has increased.

To this end, the Institute of Chartered Accountants of India (ICAI), which is also a member of the International Accounting Standards Committee (IASC), formed the Accounting Standards Committee (ASB) in 1977. ASB needed accounting. After detailed investigation and discussion, a draft was prepared and submitted to ICAI. After proper review, ICAI finalized them and notified them of their use in the financial statements.

Meaning of accounting standards:

Accounting standards are written statements consisting of rules and guidelines issued by accounting institutions for the preparation of unified and consistent financial statements and other disclosures that affect different users of accounting information. Is.

Accounting standards set the conditions for accounting policies and practices with codes, guidelines, and adjustments that facilitate the interpretation of items contained in financial statements and even their handling in the books.

Nature of accounting standards:

Based on the discussion above, accounting standards can be said to be guides, dictators, service providers, and harmonizers in the field of accounting processes.

(I) Useful as a guide to accountants:

Accounting standards serve accountants as a guide to the accounting process. They provide the basis for the account to be prepared. For example, they provide a way to value inventory.

(II) Act as a dictator:

Accounting standards act as a dictator in the field of accounting. In some areas, like dictators, accountants have no choice but to choose practices other than those listed in accounting standards. For example, the cash flow statement must be prepared in the format specified by accounting standards.

(III) Act as a service provider:

Accounting standards constitute the scope of accounting by defining specific terms, presenting accounting issues, specifying standards, and explaining numerous disclosures and implementation dates. Therefore, accounting standards are descriptive in nature and act as a service provider.

(IV) Functions as a harmonizer.

There is no bias in accounting standards and there is uniformity in accounting methods. They remove the effects of various accounting practices and policies. Accounting standards often develop and provide solutions to specific accounting problems. Therefore, whenever there is a contradiction in the accounting problem, it is clear that the accounting standard acts as a harmonizer and facilitates the accountant's solution.

Purpose of Accounting Standards:

Previously, accounting was used to record business transactions of a financial nature. Currently, its main focus is on providing accounting information during the decision-making process.

Accounting standards are required for the following purposes:

(I) To bring unity to accounting methods:

Accounting standards brings equality to accounting methods by proposing standard treatments for accounting issues. For example, AS-6 (revised edition) describes depreciation accounting methods.

(II) To improve the reliability of financial statements:

Accounting is the language of business. The information provided by accountants is often based solely on the information contained in the financial statements, and many users make various decisions about their field. In this regard, financial statements need to provide a true and fair view of business concerns. Accounting standards bring credibility and credibility to different users.

They also help potential users of the information contained in financial statements with disclosure standards that make it easier for even the layperson to interpret the data. Accounting standards provide a concrete theoretical basis for the accounting process. They provide accounting uniformity, make financial statements for different business units comparable in different years, and again facilitate decision making.

(III) Simplify accounting information:

Accounting standards prevent users from reaching misleading conclusions and make financial data easy for everyone. For example, AS-3 (revised edition) clearly classifies cash flows in terms of "sales activities," "investment activities," and "finance activities."

(IV) Prevent fraud and manipulation:

Accounting standards prevent management from manipulating data. By systematizing accounting methods, fraud and operations can be minimized.

(V) Assist auditors:

Accounting standards set the conditions for accounting policies and practices with codes, guidelines, and adjustments for creating and interpreting the items that appear in financial statements. Therefore, these terms, policies, guidelines, etc. are the basis for auditing the books.

Accounting standard formulation procedure

Let's take a quick look at the procedure setup process that ASB follows:

- First, ASB identifies areas where accounting standards may need to be developed.

- The ASB then forms research groups and panels to discuss and study the topic at hand. Such a panel drafts a standard. Drafts usually include definitions of important terms, the purpose of the criteria, their scope, measurement principles, and representations of the data in the financial statements.

- ASB then carries out the deliberations of the aforementioned draft of the standard. Changes and corrections will be made as needed.

- The draft will then be circulated to all relevant authorities. This typically includes members of the ICAI and relevant authorities such as the Ministry of Internal Affairs and Communications (DCA), SEBI, CBDT, the Standing Conference of State Enterprises (SCPE), and the Board of Audit and Inspection of India.

- The ASB then arranges meetings with these representatives to debate their views and concerns regarding the draft and its provisions.

- The Exposure Draft is then completed and made publicly available for review and comment.

- Review public comments on the Exposure Draft. A final draft is then prepared for ICAI review and review.

- The ICAI Council will then review and consider the final draft of the standard. We may suggest some changes as needed.

- Finally, the accounting standard is issued. For non-corporate standards, ICAI issues the standards. Also, if the relevant subject matter relates to a business entity, the central government will issue the standard.

Salient features of Accounting Standard (AS): 1 (ICAI)

The characteristics of accounting standards:

1. Recognize financial events.

2. Measure financial transactions.

3. Presentation of financial statements in a fair manner.

4. Corporate disclosure requirements to prevent erroneous information from being provided to stakeholders.

5. Improve the reliability of financial statements.

6. Check your company's progress and market position with comparability.

7. Required disclosure requirements and valuation methods for various financial transactions.

Key takeaways:

- Accounting rules are guidelines that help companies determine how to record business transactions that are not yet fully covered by accounting standards.

- They are generally accepted by accounting institutions, but are not legally binding.

- Accounting rules no longer apply if the supervisory body has guidelines that address the same topics as accounting rules.

- There are four widely recognized accounting rules. Conservatism, consistency, full disclosure, and importance.

- Accounting policies are the procedures that a company uses to prepare financial statements. Unlike accounting principles, which are rules, accounting policies are the basis for following those rules.

- Accounting policies may be used to legally manipulate revenue.

- The choice of a company in its accounting policy indicates whether management is willing or conservative in reporting its revenue.

- Accounting policies should still adhere to generally accepted accounting principles (GAAP).

- The Financial Accounting Standards Board (FASB) sets accounting rules for public and personal companies and non-profits within the us.

- The relevant organization, the Governmental Accounting Standards Board (GASB), sets the rules for state and local governments.

- In recent years, the FASB has worked with the International Accounting Standards Board (IASB) to establish compatible standards around the world.

- Accounting standards are a general set of principles, standards, and procedures that define the basis of financial accounting policies and practices.

- Accounting standards apply to the overall financial position of a company, including assets, owners, income, expenses and shareholders' equity.

- Banks, investors and regulators rely on accounting standards to ensure that information about a particular entity is appropriate and accurate.

Introduction

Accounting aims in ascertaining and presenting the results of the business for an accounting period. For ascertaining the periodical business results, the nature of transactions should be analyzed whether they are of capital or revenue nature. The Revenue Expense relates to the operations of the business of an accounting period or to the revenue earned during the period or the items of expenditure, benefits of which do not extend beyond that period. Capital Expenditure, on the other hand, generates enduring benefits and helps in revenue generation over more than one accounting period. Revenue Expenses must be associated with a physical activity of the entity. Therefore, whereas production and sales generate revenue in the earning process, use of goods and services in support of those functions causes expenses to occur. Expenses are recognised in the Profit & Loss Account through matching principal which tells us when and how much of the expenses to be charged against revenue. A part of the expenditure can be capitalised only when these can be traced directly to definable streams of future benefits.

The distinction of transaction into revenue and capital is done for the purpose of placing them in Profit and Loss account or in the Balance Sheet. For example: revenue expenditures are shown in the profit and loss account as their benefits are for one accounting period i.e. in which they are incurred while capital expenditures are placed on the asset side of the balance sheet as they will generate benefits for more than one accounting period and will be transferred to profit and loss account of the year on the basis of utilisation of that benefit in particular accounting year. Hence, both capital and revenue expenditures are ultimately transferred to profit and loss account.

Revenue expenditures are transferred to profit and loss account in the year of spending while capital expenditures are transferred to profit and loss account of the year in which their benefits are utilised. Therefore, we can conclude that it is the time factor, which is the main determinant for transferring the expenditure to profit and loss account. Also, expenses are recognized in profit and loss account through matching concept which tells us when and how much of the expenses to be charged against revenue. However, distinction between capital and revenue creates a considerable difficulty. In many cases borderline between the two is very thin.

CONSIDERATIONS IN ASCERTAINING CAPITAL AND REVENUE EXPENDITURES

The basic considerations in distinction between capital and revenue expenditures are:

(a) Nature of business: For a trader dealing in furniture, purchase of furniture is revenue expenditure but for any other trade, the purchase of furniture should be treated as capital expenditure and shown in the balance sheet as asset. Therefore, the nature of business is a very important criterion in separating expenditure between capital and revenue.

(b) Recurring nature of expenditure: If the frequency of an expense is quite often in an accounting year then it is said to be an expenditure of revenue nature while non-recurring expenditure is infrequent in nature and do not occur often in an accounting year. Monthly salary or rent is the example of revenue expenditure as they are incurred every month while purchase of assets is not the transaction done regularly therefore, classified as capital expenditure unless materiality criteria define it as revenue expenditure.

(c) Purpose of expenses: Expenses for repairs of machine may be incurred in course of normal maintenance of the asset. Such expenses are revenue in nature. On the other hand, expenditure incurred for major repair of the asset so as to increase its productive capacity is capital in nature. However, determination of the cost of maintenance and ordinary repairs which should be expensed, as opposed to a cost which ought to be capitalised, is not always simple.

(d) Effect on revenue generating capacity of business: The expenses which help to generate income/ revenue in the current period are revenue in nature and should be matched against the revenue earned in the current period. On the other hand, if expenditure helps to generate revenue over more than one accounting period, it is generally called capital expenditure.

When expenditure on improvements and repair of a fixed asset is done, it has to be charged to Profit and Loss Account if the expected future benefits from fixed assets do not change, and it will be included in book value of fixed asset, where the expected future benefits from assets increase.

(e) Materiality of the amount involved: Relative proportion of the amount involved is another important consideration in distinction between revenue and capital.

CAPITAL EXPENDITURES AND REVENUE EXPENDITURES

As we have already discussed, capital expenditure contributes to the revenue earning capacity of a business over more than one accounting period whereas revenue expense is incurred to generate revenue for a particular accounting period. The revenue expenses either occur in direct relation with the revenue or in relation with accounting periods, for example cost of goods sold, salaries, rent, etc. Cost of goods sold is directly related to sales revenue whereas rent is related to the particular accounting period. Capital expenditure may represent acquisition of any tangible or intangible fixed assets for enduring future benefits. Therefore, the benefits arising out of capital expenditure last for more than one accounting period whereas those arising out of revenue expenses expire in the same accounting period.

Preface

Accounting is intended to confirm and present the results of the business during the accounting period. To see regular performance, the nature of the transaction needs to be analyzed whether they are the nature of capital or the nature of earnings. Revenue and expense are related to the operation of the business during the accounting period, or the income or expense items earned during that period, and the profits do not extend beyond that period. Capital investment, on the other hand, produces lasting profits and helps generate revenue over multiple accounting periods. Revenue costs must be associated with the physical activity of the entity. Therefore, while production and sales generate revenue in the revenue process, the use of goods and services that support these features is costly. Expenses are recognized in the income statement through a matching principal that informs you when and how much the expense will be charged to your revenue. Part of the expenditure can only be capitalized if the definable flow of future benefits can be traced directly.

The distinction between revenue and equity of a transaction is made for the purpose of placing them in the income statement or balance sheet. Example: Revenue and expenditure appear in the income statement because the profit is for one accounting period. That is, capital expenditures are placed on the asset side of the balance sheet because profits are generated over multiple accounting periods. It is a period and is transferred to the income statement for that year based on the use of that profit in a particular fiscal year. Therefore, both capital expenditures and revenue expenditures are ultimately transferred to the P & L account.

Income and expenditure are transferred to the profit and loss account of the year of expenditure, and capital expenditure is transferred to the profit and loss account of the year in which the profit is used. Therefore, we can conclude that the main determinant for transferring expenses to the income statement is the time factor. Expenses are also recognized in the income statement through a matching concept that indicates when and how much expense is charged against revenue. However, the distinction between capital and income creates considerable difficulty. Often the border between the two is very thin.

Things to consider when checking Capital and Revenue Expenditure

Here are some basic considerations when distinguishing between capital and revenue expenditures:

(A) Nature of business: For furniture traders, the purchase of furniture is a revenue expense, but in other transactions, the purchase of furniture is treated as a capital expense and appears on the balance sheet as an asset. Therefore, the nature of the business is a very important criterion in separating spending between capital and income.

(B) Repetitive nature of spending: If the frequency of spending is very frequent in a fiscal year, it is said to be spending of the nature of income, but non-recurring spending is inherently rare and It does not occur frequently in the fiscal year. Monthly salaries and rents are examples of monthly income and expenditures, but asset purchases are not regular transactions and are classified as capital expenditures unless defined as income and expenditures by materiality criteria.

(C) Purpose of costs: Machine repair costs may be incurred during the normal maintenance process of the asset. Such costs are essentially income. On the other hand, the expenditure incurred to repair assets on a large scale to increase capacity is essentially capital. However, in contrast to the costs that need to be capitalized, determining the costs of maintenance and regular repairs that need to be costly is not always easy.

(D) Impact on the revenue-generating capacity of the business: Revenues / costs that help generate revenues for the period are essentially revenues and must be matched to revenues for the period. On the other hand, when spending helps generate revenue over multiple accounting periods, it is commonly referred to as capital spending.

If expenses are made to improve and repair fixed assets and the expected future profits from fixed assets do not change, the income statement must be charged, and if expected, the book value of fixed assets. Included in. Future profits from the asset will increase.

(E) Importance of the amount involved: The relative proportion of the amount involved is another important consideration in distinguishing between income and equity.

Capital and Revenue Expenditures

Definition and Description of Capital Expenditures:

If the profit of the expenditure spans several trading years, the expenditure is capital expenditure. Capital expenditures may include the following expenditures:

- Expenditures required to acquire fixed assets (tangible or intangible) related to the business for the purpose of profit, not resale of land and buildings, plants and machines, furniture and fixtures, goodwill, patents and copyrights, etc.

- Fixed asset costs include all expenses required before the asset becomes available. For example, the cost of every building you purchase includes the price paid to the seller, legal costs, and broker fees. Similarly, machine costs include purchase prices, freight charges, import taxes, wagons, octroi taxes, construction and installation costs.