Unit 1

Inland Branch Accounting

Introduction

A branch may be defined as section of an enterprise, geographically separated from the rest of the business, controlled by head office, and generally carrying on the same activities as of the enterprise. As a business grow, it may open up branches in different towns and cities in order to market its product/services over a large territory and thus increase its profit.

For example, Bata shoe Co. Ltd has branches in various cities all over the country. The same example holds good for a commercial bank also.

As per the provision of Companies Act, branch office in relation to a company means-

a) Any establishment described as a branch by the company; or

b) Any establishment carrying on either the same or substantially the same activity as that carried on by the head office of the company; or

c) Any establishment engaged in any production, processing or manufacture.

It should be mentioned that a branch is not a separate legal entity it is simply a segment of a business. From an accounting standpoint, a branch is a clearly identifiable profit centre. In order to exercise greater control over the branches it is necessary to ascertain profit or loss made by such branches separately. Apart from this, specialised accounting techni9have to be adopted for controlling various branches activities and for their smooth running both at the branch level and at the head office level. The system of accounting varies between different enterprises in accordance with their type of activities, methods of operation and the preference of their managements.

- Ascertain the profitability of each branch separately for particular accounting period.

- Ascertain the financial position of each branch separately at the end of that accounting period.

- Assess the progress and performance of each branch

- Incorporate the profit or loss made by the branch and its assets and liabilities in the firm's final accounts

- Ascertain the requirements of cash and stock for each branch,

- Ascertain whether the branch should expend or closed

From accounting point of view, the branches can be divided into the following main cases:

1) HOME BRANCHES: -

a) Dependent Branches (Where the head office maintains all the accounts)

b) Independent Branches (Where the branch keeps its own accounts)

2) FOREIGN BRANCHES: -

They almost invariably trade independently and record their transaction in foreign currency.

Dependent Branches

When the policies and administration of a branch are totally controlled by the head office, who also maintains its accounts, the branch is called as dependent branch.

Independent Branches

Independent Branches are those which make purchases from outside, get goods from Head Office, supply goods to Head Office and fix the selling price by itself Thus an independent Branch enjoys a good amount of freedom like an American Son.

The accounting arrangement of a branch depends upon its size, the type of activities, the methods of operation and the degree of control to be exercised by the head office. There are three main system of accounting for branches transaction, viz.

- Debtors System

- Stock and Debtors System

- Final Account system

This system of accounting is suitable for the small- size branches. Under this, a Branch Account is opened for each branch in the head office ledger. All the transaction relating to that branch is recorded in this account. The branch account is prepared in such a way that it discloses the profit or loss of the branch.

Head office may send goods to branch either at "cost price" or "selling price".

Cost price method: - under this method at the beginning of the year the branch Account is debited with the opening balances of asset such as stock, petty cash, furniture, prepaid expenses, etc. lying with the branch. Similarly, it is credited with the opening balance of liabilities of the branch such as, creditors, outs salary, rent, etc.

The branch is then debited with the amount of goods sent to the branch and other amounts remitted to meet various expenses such as, salaries, rent, rates, taxes, etc. Likewise, the branch account is credited with the return of goods by the branch and receipts from branches. At the year end, Branch Account is debited with the closing values of liabilities and credited with the closing values of assets. The difference between the two sides represents profit or loss for the branch for a particular period.

Debtors Method

Journal entries

1) For goods sent to branch

Branch A/c _______Dr.

To Goods Sent to Branch A/c

(Being goods sent to branch)

2) For goods returned by the branch

Goods Sent to Branch A/c _______Dr.

To Branch A/c

(Being goods returned by the branch)

3) For amount sent to branch for expenses

Branch A/c _______ Dr.

To Bank A/c

(Being cheque sent to branch for expenses)

4) For amount received from branch

Bank A/c _______ Dr.

To Branch A/c

(Being cash or cheque received from branch)

5) For closing goods sent to branch account

Goods Sent to Branch A/c Dr.

To Purchase A/c

(Being balance transferred to Trading Account)

6) For closing balances of assets at the branch

Branch Assets A/c ________ Dr. (Individually)

To Branch A/c

(Being closing balances of assets brought into account)

7) For closing balances of Liabilities at the branch

Branch A/c ________Dr.

To Branch Liabilities A/c (Individually)

(Being closing balances of liabilities brought into account)

8) For transferring Profit or Loss to General Profit and Loss Account

i) If Profit

Branch A/c _______ Dr.

To General Profit and Loss, A/c

(Being branch profit transferred to General P & L A/c)

Ii) If Loss

General Profit and Loss A/c ________ Dr.

To Branch A/c

(Being branch loss transferred to General P & L A/c)

The closing balances of branch assets and liabilities are shown in the Balance Sheet

Of the head office. At the beginning of the next year, the entire numbers 6 and 7 are

Reversed so as to show opening balances in the Branch Account.

Stock and Debtors’ Method

Under this method accounts relating to branch are maintained in a more comprehensive and detailed manner as compared to Debtor’s method. This method keeps a better control stock. Under this method separate accounts are prepared for various accounting function

This accounting procedure under this method depends upon the policy of head office with regard to pricing of goods send to branch. Head office may adopt one of the following methods for invoicing goods to branch.

- At cost price to head office.

- At selling price of the branch.

- At cost price plus fixed margin of profit. In this case branch may sell goods at higher or lower than the invoice price.

When goods have been invoiced to branch at cost price.

In this case following accounts are prepared.

a) Branch Stock Account

b) Goods sent to Branch Account

c) Branch Debtors Account

d) Branch Expenses Account

e) Branch Profit & Loss Account

f) Branch Cash Account

I) When goods are sent to the branch (at invoice price)

Branch Stock A/c _____ Dr.

To Goods Sent to Branch A/c

2) When goods are returned by the branch to the H.O. (at invoice price)

Goods Sent to Branch A/c _______ Dr.

To Branch Stock A/c

3) When sales are made by the branch

i) For Cash Sales

Cash A/c _______ Dr.

To Branch Stock A/c

Ii) For Credit Sales

Branch Debtors A/c _______ Dr.

To Branch Stock A/c

4) When Cash is Received from Debtors

Cash A/c ______ Dr.

To Branch Debtors A/c

5) For Sales Returns

Branch Stock A/c ________ Dr.

To Branch Debtors A/c

6) For discount allowed, bad debts, etc.

Branch Expenses A/c ________ Dr.

To Branch Debtors A/c

7) For Shortage of Stock

Branch Adjustment A/c ________ Dr.(with amount of loading)

Branch P & L A/c ________ Dr. (with cost of shortage)

To Branch Stock A/c

For surplus at branch, the reverse entry will be passed.

8) For Branch Expenses paid in Cash

Branch Expenses A/c ______ Dr.

To Cash A/c

9) For Closing Branch Expenses Account

Branch P&L A/c ______ Dr.

To Branch Expenses A/c

10) For Adjustment of Loading on the Opening Stock

Stock Reserve A/c ______ Dr.

To Branch Adjustment A/c

11) For Adjustment of Loading on the Closing Stock

Branch Adjustment A/c ______ Dr.

To Stock Reserve A/c

12) For Adjustment Loading Goods sent to Branch

Goods Sent to Branch A/c ________ Dr.

To Branch Adjustment A/c

13) For Transfer of Gross Profit

Branch Adjustment A/c _______ Dr.

To Branch P & L A/c

Examples

Q.1 (AT COST)

Suri is having his Head office at Mumbai and Branch Office at Nasik. Prepare the branch Account in the books of the Head Office from the following transaction with the branch:

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

Opening Balance at Branch: |

| Amounts remitted to the Branch for: |

|

- Petty Cash | 1,000 | - Petty Cash Expenses | 4,000 |

- Stock | 39,500 | - Salary | 12,000 |

- Debtors | 21,000 | - Rent and Taxes | 3,500 |

Goods Supplied to Branch during the year | 3,10,000 | Closing balances ay Branch: |

|

Amounts remitted by the branch |

| - Petty | 950 |

- Cash Sales | 1,13,200 | - Debtors | 53,000 |

- Realisation from Debtors | 2,30,300 | - Stock | 26,500 |

SOLUTION: -

IN THE BOOKS OF H.O.

Dr. NASIK BRANCH ACCOUNT. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d |

| By Bank (Remittance): |

|

Branch petty cash | 1,000 | - Petty Cash Expenses | 4,000 |

Branch Stock | 39,500 | - Salary | 12,000 |

Branch Debtors | 21,000 | - Rent and Taxes | 3,500 |

To Goods sent to Branch | 3,10,000 | Closing balance at Branch |

|

To cash remitted for: |

| - Petty Cash | 950 |

Petty Cash Expenses | 4,000 | - Debtors | 53,000 |

Salary | 12,000 | - Stock | 26,500 |

Rent | 3,500 |

|

|

To General P&L (Bal Fig) | 32,950 |

|

|

TOTAL | 4,23,950 | TOTAL | 4,23,950 |

Q.2 (INVOICE PRICE)

D of Delhi have a branch at Madras. Goods are sent by the Head Office at Invoice Price which is at the Profit of 25% on Cost Price. All the Expenses of the branch are paid by the Head Office. From the following particulars, prepare Branch Account in Head Office Books

BALANCES | OPENING | CLOSING |

Stock at invoice | 11,000 | 13,000 |

Debtors | 1,700 | 2,000 |

Petty Cash | 100 | 25 |

TOTAL | 12,800 | 15,025 |

Goods sent to branch at invoice price Rs. 20,000.

Expenses made by head office: -Rent Rs.600, Wages Rs.200, Salaries Rs.900

Remittance made to Head Office: - Cash Sales Rs. 2,650, Cash collected from debtors Rs. 21,000

Goods Returned by Branch at Invoice Price Rs.400

SOLUTION: -

IN THE BOOKS OF HEAD OFFICE

Dr. MADRAS BRANCH A/c. Cr.

PARTICULARS | AMOUNT | AMOUNT | PARTICULARS | AMOUNT | AMOUNT |

To Balance b/d |

|

| By Stock Reserve A/c b/d(Load on OP. Stock 11,000 X 25/125) |

| 2,200 |

Stock (IP) |

| 11,000 | By Bank |

|

|

Debtors |

| 1,700 | Cash Sales | 2,650 |

|

Petty Cash |

| 100 | Cash collected from Debtors | 21,000 | 23,650 |

To Goods sent to Branch (IP) |

| 20,000 | By Goods sent to branch (Returns at IP) |

| 400 |

To Bank (Expenses): |

|

| By Goods sent to branch (19,600 X 25/125; net Loading) |

| 3,920 |

Rent | 600 |

| By Balance c/d |

|

|

Wages | 200 |

| Stock (IP) | 13,000 |

|

Salaries | 900 | 1,700 | Debtors | 2,000 |

|

To Stock Reserve A/c c/d(Load on Cl. Stock 13,000 X 25/125) |

| 2,600 | Petty Cash | 25 | 15,025 |

To Net Profit tfd to general P&L (Bal Fig) |

| 8,095 |

|

|

|

TOTAL |

| 45,195 | TOTAL |

| 45,195 |

Note: Goods are sent by Head Office at @ 25% on Cost Price.

So, Cost + Profit = Invoice Price

100 + 25 = 125

Profit charged by Head Office is 1/5 or 20% of Invoice Price.

Q.3 (INVOICE PRICE)

One M.P. Head Office has a branch at Berhampur to which goods are invoiced at cost plus 20%. From the following particulars prepare the Branch Account in the Head Office Books:

PARTICULARS | AMOUNT |

Goods sent to Branch at invoice Price | 2,11,872 |

Total Sales | 2,06,400 |

Cash Sales | 1,10,400 |

Cash received from Branch Debtors | 88,000 |

Branch Debtors at commencement | 24,000 |

Branch Stock at commencement at Invoice price | 7,680 |

Branch Stock at Close of the period at Invoice Price | 13,440 |

SOLUTION: -

IN THE BOOKS OF M.P. HEAD OFFICE

Dr. BERHAMPUR BRANCH ACCOUNT. Cr.

PARTICULARS | AMOUNT | AMOUNT | PARTICULARS | AMOUNT | AMOUNT |

To Balance b/d |

|

| By Stock Reserve A/c b/d (Load on OP. Stock) |

| 1,280 |

Stock (IP) |

| 7,680 | By Bank |

|

|

Debtors |

| 24,000 | Cash Sales | 1,10,400 |

|

To Goods sent to Branch (IP) |

| 2,11,872 | Cash collected from Debtors | 88,000 | 1,98,400 |

To Stock Reserve A/c c/d (Load on Cl. Stock) |

| 2,240 | By Goods sent to branch (2,11,872 X 20/120; net Loading) |

| 35,312 |

To Net Profit tad to general P&L (Bal Fig) |

| 34,640 | By Balance c/d |

|

|

|

|

| Stock (IP) | 13,440 |

|

|

|

| Debtors | 32,000 | 45,440 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

| 2,80,432 | TOTAL |

| 2,80,432 |

Working Note:

Dr. BERHAMPUR BRANCH DEBTORS ACCOUNT. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 24,000 | By Cash | 88,000 |

To Credit Sales | 96,000 | By balance c/d (balancing figure) | 32,000 |

TOTAL | 1,20,000 | TOTAL | 1,20,000 |

(2)

Total Sales =2,06,400

Less: - Cash Sales =1,10,400

Credit Sales =96,000

(3)

Goods are sent by Head Office at @ 20% on Cost Price.

So, Cost + Profit = Invoice Price

100 + 20 = 120

Profit charged by Head Office is 1/6 of Invoice Price.

Q.4 (AT COST)

The Canada commercial company invoiced goods to its Jaipur Branch at cost. The head office paid all the branch expenses from its bank except petty cash expenses which were Paid by the branch. From the following details relating to the branch, prepare

(1): Branch Stock A/c

(2) Branch Debtors A/c

(3) Branch Expenses A/c

(4) Branch P&L A/c

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

Stock (Opening) | 21,000 | Discount to Customer | 4,200 |

Debtors (Opening) | 37,800 | Bad Debts | 1,800 |

Petty Cash (Opening) | 600 | Goods returned by customers to branch | 1,500 |

Goods sent to H.O. | 78,000 | Salaries | 18,600 |

Goods returned to H.O. | 3,000 | Rent | 3,600 |

Cash Sales | 52,500 | Debtors (Closing) | 29,400 |

Advertisement | 2,400 | Petty Cash (Closing) | 300 |

Cash received from debtors | 85,500 | Credit Sales | 85,200 |

Stock (Closing) | 19,500 |

|

|

Allowances to Customer | 600 |

|

|

|

|

|

|

SOLUTION: -

Dr. BRANCH STOCK A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 21,000 | By Branch Cash | 52,500 |

To Goods sent to send Branch | 78,000 | By Goods sent to Branch | 3,000 |

To Branch Debtors | 1,500 | By Branch Debtors | 85,200 |

To Branch P&L (Transfer) | 59,700 | By Balance c/d | 19,500 |

TOTAL | 1,60,200 | TOTAL | 1,60,200 |

Dr. BRANCH DEBTORS A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 37,800 | By Branch Cash | 85,500 |

To Branch Stock (Credit Sales) | 85,200 | By Branch expenses Bad Debts 1,800 Allowances 600 Discount 4,200

| 6,600 |

|

| By Branch Stock (Returns) | 1,500 |

|

| By Balance c/d | 29,400 |

TOTAL | 1,23,000 | TOTAL | 1,23,000 |

Dr. BRANCH EXPENSES A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Debtors | 6,600 | By Branch P&L | 31,500 |

To Bank Advertisement 2,400 Salaries 18,600 Rent 3,600 | 24,600 |

|

|

To Petty Expenses (600-300) | 300 |

|

|

|

|

|

|

TOTAL | 31,500 | TOTAL | 31,500 |

Dr. BRANCH PROFIT & LOSS A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Expenses | 31,500 | By Branch Stock | 59,700 |

To General P&L (Bal Fig) | 28,200 |

|

|

TOTAL | 59,700 | TOTAL | 59,700 |

Q.5 (AT COST)

The following are the details of ‘Indore Branch’ for the year 2018

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

Opening stock | 6,000 | Salaries | 2,000 |

Opening Petty Cash | 500 | Rent | 1,500 |

Opening Debtors | 8,000 | Closing Stock | 8,000 |

Goods sent to Branch | 24,000 | Cash sent to Branch | 2,200 |

Goods returned by Branch | 800 | Discount Allowed | 100 |

Remittance from Branch | 33,500 | Bad Debts | 150 |

Returns from Debtors | 2,000 | Commission Paid | 750 |

Collection from Debtors | 34,000 | Closing Petty Cash | 450 |

Cash Sales | 1,500 | Closing Debtors | 9,000 |

Prepare: (1) Branch Stock A/c (2) Branch Debtors A/c (3) Branch Expenses A/c

(4) Branch P&L A/c (5) Branch Cash (6) Goods sent to Branch A/c

SOLUTION: -

Dr. BRANCH STOCK A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 6,000 | By Branch Cash (Cash Sales) | 1,500 |

To Goods sent to send Branch | 24,000 | By Goods sent to Branch | 800 |

To Branch Debtors (Return Inwards) | 2,000 | By Branch Debtors (Credit Sales) | 37,250 |

To Branch P&L (Transfer) | 15,550 | By Balance c/d | 8,000 |

TOTAL | 47,550 | TOTAL | 47,550 |

Dr. BRANCH DEBTORS A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 8,000 | By Branch Cash (Received from Debtors) | 34,000 |

To Branch Stock (Credit Sales) (Bal Fig) | 37,250 | Branch expenses Bad Debts 150 Discount 100 | 250 |

|

| By Branch Stock (Returns) | 2,000 |

|

| By Balance c/d | 9,000 |

TOTAL | 45,250 | TOTAL | 45,250 |

Dr. BRANCH CASH A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance (Petty Cash) | 500 | By Branch Expenses Salaries 2,000 Rent 1,500 Commission 750 | 4,250 |

To Bank (Remittance) | 2,200 | By Bank (Remittance from Branch) | 33,500 |

To Branch stock (Cash Sales) | 1,500 | By Balance (Petty Cash) | 450 |

To Branch Debtors (Received) | 34,000 |

|

|

|

|

|

|

TOTAL | 38,200 | TOTAL | 38,200 |

Dr. BRANCH EXPENSES A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Debtors | 6,600 | By Branch P&L | 31,500 |

To Bank Advertisement 2,400 Salaries 18,600 Rent 3,600

| 24,600 |

|

|

To Petty Expenses (600-300) | 300 |

|

|

|

|

|

|

TOTAL | 31,500 | TOTAL | 31,500 |

Dr. BRANCH EXPENSES A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Debtors | 250 | By Branch P&L (Balance Transferred) | 4,500 |

To Branch Cash | 4,250 |

|

|

|

|

|

|

|

|

|

|

TOTAL | 4,500 | TOTAL | 4,500 |

Dr. GOODS SENT TO BRANCH A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Stock | 800 | By Branch Stock | 24,000 |

To Purchase | 23,200 |

|

|

|

|

|

|

|

|

|

|

TOTAL | 24,000 | TOTAL | 24,000 |

Dr. BRANCH PROFIT & LOSS A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Expenses | 4,500 | By Branch Stock (Gross Profit) | 15,550 |

To General P&L (Bal Fig) | 11,050 |

|

|

TOTAL | 15,550 | TOTAL | 15,550 |

Q.6 Mumbai Textile Mills Ltd. Has branch at Agra. Goods are invoiced to branch at cost plus 50%. Branch remits all cash received to the head office and all expenses are met by head office. From the following particulars, prepare the necessary accounts under the Stock and Debtors system to Show the Profit Earned at the Branch:

PARTICULARS | AMOUNT |

Stock on the 1st April,2013 (Invoice Price) | 93,000 |

Debtors on 1st April,2013 | 68,000 |

Goods Invoiced to Branch (Cost) | 3,40,000 |

Sales at Branch: |

|

Cash | 2,50,100 |

Credit | 3,10,000 |

Cash Collected from Debtors | 3,04,000 |

Goods Returned by Debtors | 12,000 |

Goods Returned by Branch to head office | 1,500 |

Shortage of Stock | 4,500 |

Discount Allowed to Customer | 2,000 |

Expenses at Branch | 54,000 |

SOLUTION: -

Dr. BRANCH STOCK A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 93,000 | By Branch Cash (Cash Sales) | 2,50,100 |

To Goods sent to send Branch (3,40,000 X 150%) | 5,10,000 | By Branch Debtors (Credit Sales) | 3,10,000 |

To Branch Debtors | 12,000 | By Goods sent to Branch | 1,500 |

|

| By Branch Adjustment (Shortage) | 4,500 |

|

| By Balance c/d | 48,900 |

TOTAL | 6,15,000 | TOTAL | 6,15,000 |

Dr. BRANCH ADJUSTMENT A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Stock (Shortage) | 4,500 | By Stock Reserve (Loading on Opening Stock) | 31,000 |

To Goods Sent to Branch | 500 | By Goods Sent to Branch | 1,70,000 |

To Gross Profit c/d | 1,79,700 |

|

|

To Stock Reserve (Loading on Closing Stock) | 16,300 |

|

|

TOTAL | 2,01,000 | TOTAL | 2,01,000 |

Dr. BRANCH PROFIT & LOSS A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Expenses | 54,000 | By Branch Stock (Gross Profit) | 1,79,700 |

To Discount | 2,000 |

|

|

To General P&L (Bal Fig) | 1,23,700 |

|

|

TOTAL | 1,79,700 | TOTAL | 1,79,700 |

Dr. GOODS SENT TO BRANCH A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Stock | 1,500 | By Branch Stock | 5,10,000 |

To Branch Adjustment | 1,70,000 | By Branch Adjustment | 500 |

To Trading A/c (Bal Fig) | 3,39,000 |

|

|

|

|

|

|

TOTAL | 5,10,500 | TOTAL | 5,10,500 |

Dr. BRANCH DEBTORS A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 68,000 | By Branch Cash (Received from Debtors) | 3,04,000 |

|

| By Branch expenses (Discount) | 2,000 |

To Branch Stock (Credit Sales) | 3,10,000 | By Branch Stock (Returns) | 12,000 |

|

| By Balance c/d | 60,000 |

TOTAL | 3,78,000 | TOTAL | 3,78,000 |

Dr. BRANCH CASH A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Sales | 2,50,100 | By Head Office Cash | 5,54,100 |

To Debtors | 3,04,000 | (Sent to HO) |

|

TOTAL | 5,54,100 | TOTAL | 5,54,100 |

Q.7. A Ltd. Has a branch in Calcutta. Goods are invoiced at cost plus 25%. | |

Opening Balance | 2002 |

Stock | 3,200 |

Debtors | 1,300 |

Goods sent to Branch (Invoice price) | 75,000 |

Sales at Calcutta |

|

Cash Sales | 32,000 |

Credit Sales | 38,000 |

Cash collected from Debtors | 33,400 |

Discount allowed | 400 |

Bad Debts written off | 250 |

Cash sent to Branch for expenses | 5,500 |

Stock at end | 7,900 |

SOLUTION: -

BRANCH STOCK A/C | |||

To Balance b/d | 3,200 | To Cash Sales | 32,000 |

To Goods Sent to Branch A/c |

| By Branch Debtors | 38,000 |

| 75,000 | By Branch Adjustment A/c | 300 |

|

| By Balance c/d | 7,900 |

| 78,200 |

| 78,200 |

GOODS SENT TO BRANCH A/C | |||

To br. Adjustment A/c (loading) | 15,000 | By Br. Stock A/c | 75,000 |

To Trading A/c (Transfer) | 60,000 |

|

|

| 75,000 |

| 75,000 |

BRANCH STOCK RESERVE A/C

To Br. Adjustment A/c | 640 | By Balance b/d | 640 | |||

To balance c/d | 1,580 | By Branch Adj. A/c | 1,580 | |||

| 2,220 |

| 2,220 | |||

BRANCH DEBTORS A/C | ||||||

To Balance b/d | 1,300 | By Cash | 33,400 | |||

To Branch Stock (Cr. Sales) | 38,000 | By Branch Exp. A/c |

| |||

|

| Discount | 400 |

| ||

|

| Bad Debts | 250 | 650 | ||

|

| By Bal. c/d | 5,250 | |||

| 39,300 |

| 39,300 | |||

BRANCH ADJUSTMENT A/C | ||||||

To Branch Stock Reserve |

|

| ||||

(Closing stock) A/c | 1,580 | By Stock Reserve (opening stock) | 640 | |||

To br. Stock A/c (shortage) | 300 |

|

| |||

To Br. Exp. A/c | 7,150 | By Goods sent to br. A/c | 15,000 | |||

To P & L A/c | 6,610 |

|

| |||

| 15,640 |

| 15,640 | |||

BRANCH EXPENSES A/C | ||||||

To Cash | 6,500 | By Branch Adjustment A/c | 7,150 | |||

To branch Dr. s A/c |

|

|

| |||

| Discount | 400 |

|

|

| |

| Bad Debts | 250 | 650 |

|

| |

| 7,150 |

| 7,150 | |||

Under Wholesale Branch Accounting system, the goods are invoiced at the wholesale price to a retail branch. Opening stock and closing stock of branch will be shown at the wholesale price and unrealized profits in closing stock will be debited as stock reserve to profit and loss account of head office. Similarly, the stock reserve of opening stock will be credited to profit and loss account of head office.

There are many producers, now-a-days, who have their own retail shop (Branch). It deals in both retail and wholesale transactions. The profit rates earned by Branches differ between the retail sale and wholesale. Here, it is necessary to account the additional profit made by a Branch through retail trading over the wholesale trading. Wholesale price is always less than retail price.

For instance, the cost of a product is Rs 100, the wholesale price is Rs 140 and the retail price is Rs 160. If the Branch sells the product, the profit will be Rs 60; but the real profit earned by the Branch is Rs 20 (Rs 160 – 140), which is the contribution of Branch. The profit of Rs 40 (Rs 140 – Rs 100) would have been made by the Head Office by selling on wholesale basis to others.

Under this situation, to find out the real profit earned by a Branch, the Head Office charges the Branch with wholesale price. This facilitates the Head Office to know the retail profit earned by a Branch. In other words, the difference between the wholesale price and selling price is the pure profit on retailing.

The Head Office sends the goods to Branch at wholesale price and in case all the goods have been sold, there is no problem. If not, the unsold goods lying with the Branch will be at invoice price and in such case adjustment for the unrealized profit of the Head Office Trading Account must be made through Branch Stock Reserve Account in order to find out true profit of the concern as a whole.

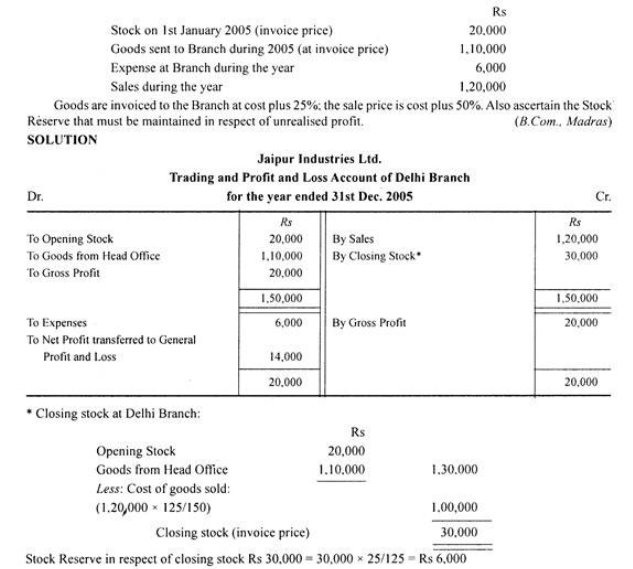

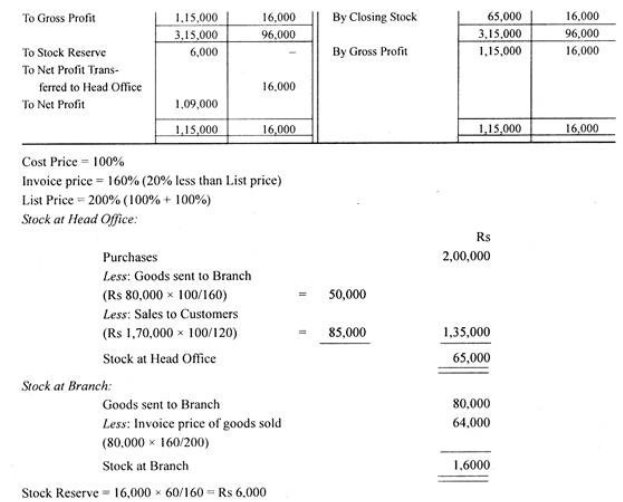

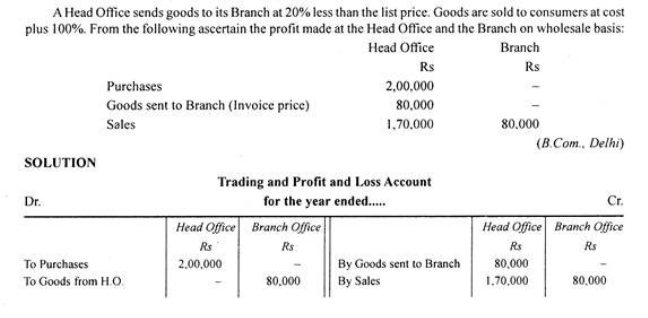

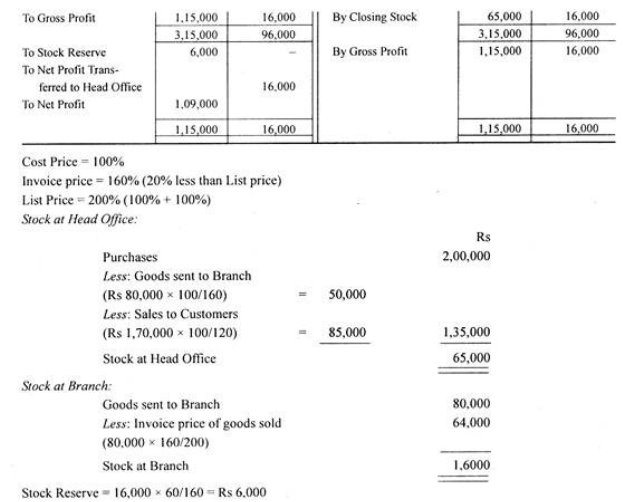

Illustration 1:

Ascertain the profit that you consider as having been earned by the Delhi Branch of Jaipur Industries Ltd. From the following:

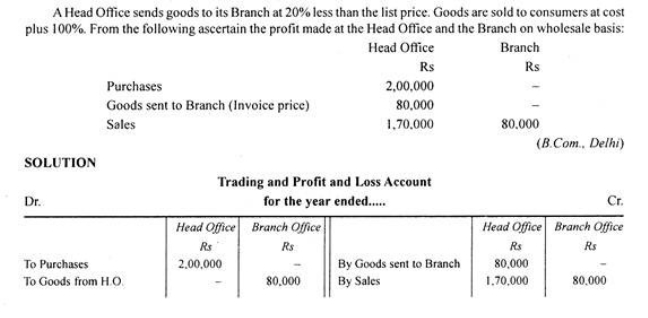

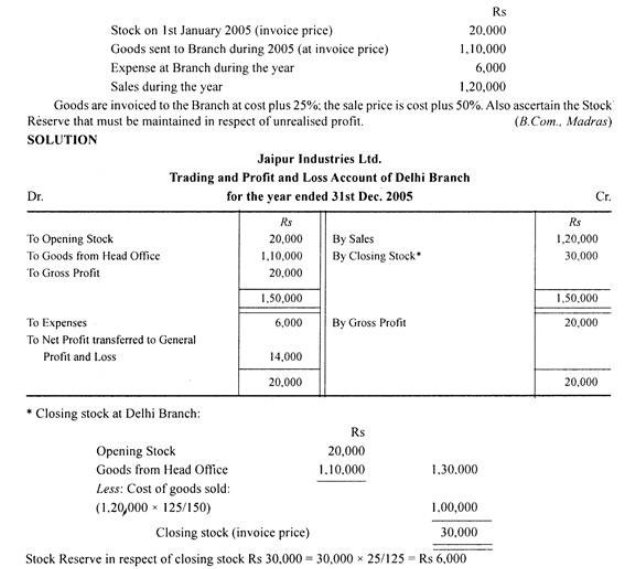

Illustration 2:

Steps to maintain an independent branch account

The independent branch, like the headquarters, keeps all records individually and independently in the double-entry bookkeeping system. Dependents have little power, rely on headquarters for supplies and expenses, and are like a minor son.

An independent branch is a branch that purchases from outside, receives goods from the head office, supplies the goods to the head office, and fixes the selling price on its own. Therefore, an independent branch enjoys considerable freedom like an American son.

Features of independent branches:

1. The Independent Branch holds a complete set of books. Such branches receive goods from headquarters and external parties. I have my own bank account. Therefore, the branch maintains an accounting frill system.

2. Create your own trial balance, transaction and income statement and balance sheet. A copy of these statements is sent to headquarters for inclusion in the headquarters books.

3. The books contain accounts called "head office accounts" or "head office checking accounts". This account will be credited with everything received from headquarters and debited with everything sent to headquarters. That is, all transactions related to headquarters are recorded in this account. Therefore, the checking account at the head office is the account of the sole proprietor (that is, the capital account).

Despite their independence, branches cannot function without resources, and resources are provided by headquarters, especially in the early stages. Therefore, the investment by the headquarters from the perspective of the headquarters account is essentially a personal account.

Similarly, the head office opens a "branch checking" account on the books. It is also the executive account between the branch and the headquarters, which includes all transactions between the branch and the headquarters.

The feature is that the head office current balance of the branch books and the branch current balance of the head office books are mutually maintained.

The balance of these accounts on any date is equal to the difference between the assets and liabilities of the branch on that day. The branch recurring balance of the head office book and the head office recurring balance of the branch book show the same but opposite balances on a particular date.

4. There may be inter-branch transactions. That is, goods are transferred from one branch to another at the same headquarters. We'll talk about such entries later.

5. When the head office receives the account and statement, the head office checks the balance. The balance is displayed in the head office accounts in the branch books and in the branch accounts in the head office books. The difference will be adjusted. This is treated individually.

Accounting Entries, in the books of Branch, for Normal Transactions | |||

1. | Purchases made at Branch | Purchase Account To Cash/Creditors Account | Dr. |

2. | Sales effected at Branch | Cash/Debtors Account To Sales Account | Dr. |

3. | Payments of expenses at Branch | Expenses Account To Cash Account | Dr. |

4. | Any income received by the branch | Cash/Bank/Account To Concerned Income Account | Dr. |

Accounting Entries for Transactions between Branch and Head Office

|

| Branch Book |

| Head Office Book |

|

1. | Goods supplied to Branch by Head office | Goods Supplied by Head Office A/c To Head Office A/c | Dr. | Branch Account To Goods Supplied to Branch Account | Dr. |

2. | Cash received from Head Office | Cash Account To Head Office A/c | Dr. | Branch Account To Bank Account | Dr. |

3. | Goods returned to Head Office by Branch | Head Office A/c To Goods Supplied by Head Office A/c | Dr. | Good Supplied to Branch A/c To Branch Account | Dr. |

4. | Cash sent to Head Office by Branch | Head Office A/c To Cash Account | Dr. | Bank Account To Branch Account | Dr. |

5. | When asset purchased by Branch and the Asset Account is kept by Head Office | Head Office A/c To Cash Account | Dr. | Branch Asset Account To Branch Account | Dr. |

6. | Depreciation for the above | Depreciation A/c To Head Office A/c | Dr. | Branch Account To Branch Asset A/c | Dr. |

7. | Head Office expenses chargeable to Branch | Expense Account To Head Office A/c

| Dr. | Branch Account To Profit & Loss A/c | Dr. |

|

|

|

|

|

|

Accounting journals for regular transactions

Inter-branch transactions:

If the head office has multiple branches, transactions may take place between them, and such transactions are called inter-branch transactions. A branch does not need to have an account at another branch. Inter-branch transactions are treated as transactions with the head office.

The entries are:

In the books of Sending Branch | Head Office A/c To Goods Supplied Account | Dr. |

In the books of Receiving Branch | Goods Received Account To Head Office Account | Dr. |

In the books of Head Office | Receiving Branch Account To Sending Branch Account | Dr. |

Example

A Head Office has three Branches in three places-A, B and C. They are independent Branches. But they are under the control of Head Office. They buy and sell goods at cost price from one another, under intimation to the Head Office. The following table shows the transactions amongst the Branches:

Buying Branches | Buying Branches | ||

| A | B | C |

| Rs | Rs | Rs |

A | - | 10,000 | 9,000 |

B | 8,000 | - | 16,000 |

C | 12,000 | 13,000 | - |

Show the journal entries in the books of Branches as well as in the books of Head Office to record the above transactions.

Solution:

| A Branch Journal |

| Dr. | Cr. |

For Buying

| Goods Received from Head Office A/c To Head Office Current Account (Being goods received from B Branch Rs 10,000 and from C Branch Rs 9,000)

| Dr. | 19,000 |

19,000 |

For Selling | Head Office Current Account to Goods Supplied to Head Office A/c (Being goods supplied to B Branch Rs 8,000 and to C Branch Rs 12,000)

| Dr. | 20,000 |

20,000 |

| B Branch Journal |

| Dr. | Cr. |

For Buying

| Goods Received from Head Office A/c To Head Office Current Account (Being goods received from A Branch Rs 8,000 and from C Branch Rs 16,000)

| Dr. | 24,000 |

24,000 |

For Selling | Head Office Current Account to Goods Supplied to Head Office A/c (Being goods supplied to A Branch Rs 10,000 and to C Branch Rs 13,000)

| Dr. | 23,000 |

23,000 |

| C Branch Journal |

| Dr. | Cr. |

For Buying

| Goods Received from Head Office A/c To Head Office Current Account (Being goods received from A Branch Rs 12,000 and from C Branch Rs 13,000)

| Dr. | 25,000 |

25,000 |

For Selling | Head Office Current Account to Goods Supplied to Head Office A/c (Being goods supplied to A Branch Rs 9,000 and to C Branch Rs 16,000)

| Dr. | 25,000 |

25,000 |

Head Office Journal | |||||

|

B Branch Current Account C Branch Current Account To A Branch Current Account (Being goods supplied by A Branch to B Branch Rs 8.000 and C Branch Rs 12,000)

|

Dr. |

| Rs 8,000 12,000

| Rs

20,000

|

| A Branch Current Account C Branch Current Account To B Branch Current Account (Being goods supplied by B Branch to A Branch Rs 10,000 and C Branch Rs 13,000)

| Dr. |

| 10,000 13,000

|

23,000

|

| A Branch Current Account B Branch Current Account To C Branch Current Account (Being goods supplied by C Branch to A Branch Rs 9,000 and B Branch Rs 16,000)

| Dr. |

| 9,000 16,000

|

25,000

|

Items in transit:

Generally, the balance of the branch's checking in the head office's books is the same as the balance of the head's checking in the branch's books. The balances of these current accounts must be the same, but on the opposite side of both books.

The difference occurs in the following situations:

1. If the branch sends goods or cash to the head office, the branch will enter it in the head office account. However, the same is recorded in the headquarters books only upon receipt of goods or cash. For example, goods or cash sent by a branch just before the end of a fiscal year may not reach headquarters in the same fiscal year.

Therefore, the branch accounts are not credited in the head office books, but the head office accounts are debited in the branch books at the same time. Therefore, there is a difference between the two books.

2. Similarly, the head office may send cash or goods to the branch office. When you submit them, the branch checking account will be debited to the headquarters books. If the item is not received by the branch book, the corresponding entry will not be passed to the branch book.

In this way, goods or cash sent from the head office to the branch office or from the branch office to the head office and not received by the recipient are called in transit.

1. If the goods or cash sent by the branch is in transit, the following entry will be passed.

Goods or cash sent from the branch are in transit

The above entries will remain on the books for a short period of time or until the cash or goods in transit arrive. If the recipient receives the goods or cash in transit, the shipping account will be closed because you need to cancel the entry.

(a) Goods-in-transit | Goods-in-transit Account To Head Office Account | Dr. |

(b) Cash-in-transit | Cash-in-transit Account To Head Office Account | Dr. |

2. When goods or cash sent by Head Office are in transit, the following entries are to be passed.

(a) Goods-in-transit | Goods-in-transit Account To Branch Account | Dr. |

(b) Cash-in-transit | Cash-in-transit Account To Branch Account | Dr. |

Incorporation of branch trial balances into head office books:

If a branch is dependent, it is relatively easy to incorporate the branch results because the accounting for such a branch is done at the headquarters itself. Profit is transferred from the branch account under the debtor system or the branch adjustment account under the stock debtor system to the general profit and loss account. An independent branch with its own accounting system creates a trial balance and sends a copy to the headquarters.

After receiving the trial balance from the branch, the head office passes a built-in entry to prepare the balance sheet combined with the branch's transactions and income statement. With the help of the branch trial balance, the head office records in a book about the branch. This process is known as the integration of branch trial balances.

There are two ways:

(A) Incorporation of all items into the trial balance:

The item is divided into two parts.

(A) Items related to trading and income statement

(B) Items related to the balance sheet.

After passing the above six journals, Headquarters creates branch transactions and P & L accounts.

Closing entries if head office wants

Items related to the balance sheet

After passing all eight of these entries, the total debit of the branch accounts equals the total of the crediting branch accounts, so the branch accounts in the head office books are automatically balanced. That is, if branch assets and liabilities are included, the branch accounts in the head office books created and incorporated after adjustment do not leave a balance.

If the assets and liabilities of the branch are not included, the branch accounts in the head office books created by the above method will leave a closing balance equal to the net assets (assets minus liabilities) as of the closing date.

(B) Incorporation of branch net income / loss, liabilities and assets:

Instead of transferring all items, the branch can create transactions and profit and loss accounts and transfer only net income or net loss to headquarters with or without assets and liabilities.

If assets and liabilities are transferred, the headquarters will not leave a balance. However, if assets and liabilities are not transferred, the head office account will have a balance equal to net worth. However, at the time the consolidated balance sheet was created, this account was replaced by branch assets and liabilities.

Example:

The Chennai company has two branches in Mysore and Bangalore. Headquarters and branches will close their books on December 31st.

The next adjustment is not yet enabled, so you need to enter the next adjustment entry.

(A) A remittance of 4.500 rupees sent to the head office by Mysore on December 30 received by the head office on January 5th.

(B) A product worth 2,000 rupees shipped from the Bangalore branch on December 27 and received by the Mysore branch on December 30 based on instructions from the head office.

(C) The depreciation of the assets of the Mysore branch is Rs 1,100 and the account for such assets is maintained by the head office.

(D) A product worth Rs 9,000 shipped from the head office to the Mysore branch on December 30 was received by that branch on January 7.

Display the entry in the head office book.

Solution:

In the books of the Head Office Journal Entries | |||||

|

Cash-in-transit Account To Mysore Branch Account (Being remittance by Head Office still in transit)

|

Dr. |

| Rs 4,500

| Rs

4,500

|

| Mysore Branch Account To Bangalore Branch Account (Being goods sent by Bangalore Branch to Mysore Branch under instruction from Head Office)

| Dr. |

| 2,000 |

2,000 |

| Mysore Branch Account To Mysore Branch Asset Account (Being depreciation of fixed assets when such assets being maintained at Head Office books)

| Dr. |

| 1,100 |

1,100 |

| Goods-in-transit Account To Mysore Branch Account (Being goods sent to Mysore Branch still in Transit) | Dr. |

| 9,000 |

9,000 |

Example

Mangalore's headquarters had branches in Putter and Udupi. Assuming the book was closed on March 31, 2006, enter an entry in the book at headquarters to correct or adjust the following:

(1) Expenses, Rupees 4,800, will be charged for work done by the head office on behalf of the Udupi branch.

(2) Puttur Branch paid Rs. Salary for visiting headquarters staff is 3,600. The branch credited the amount to the payroll account.

(3) Depreciation at an annual rate of 10% Rs will be charged to Puttur furniture. 10,000, that account is at headquarters.

(4) Products that cost Rs. Headquarters purchased 2,400 from D'Souza Brothers, paid by Puttur Branch.

(5) Remittance of rupees. The 3,750 created at headquarters from the Udupi branch on March 28, 2006 was received at headquarters on April 1, 2006. (B. Com, Mangalore)

Solution:

In the books of the Mangalore Head Office Journal Entries | |||||

SL.No | Particulars |

| L.F | Debit Rs. | Credit Rs. |

1. | Udupi Branch A/C To Bank Ave (For expenses incurred by the HO. On behalf of Udupi Branch)

| Dr. |

| 4,800 |

4,800 |

2. | Salary A/c To Puttur Branch A/c (For salary paid by the Puttur Branch to a Head Office official) The Branch will pass the rectifying entry debiting the HO, and crediting salary

| Dr. |

| 3,600 |

3,600 |

3. | Puttur Branch A/c To Puttur Branch Furniture A/c (For depreciation of branch furniture when Furniture A/c is In the Head Office books) | Dr. |

| 1,000 |

1,000 |

4. | Purchases A/c To Puttur Branch A/c (For purchases made by H.O. And payment for the Same by Puttur Branch)

| Dr. |

| 2,400

|

2,400

|

5. | No entry in the H.O. Books OR Cash in Transit A/c To Udupi Branch A/c (For cash remitted by the Udupi branch but not received By the financial closing)

| Dr. |

| 3,750

|

3,750

|

Example

Eve Ltd in Calcutta and Delhi branches. You need to prepare your trading and P & L accounts and your consolidated balance sheet. After incorporating the assets and liabilities, create a journal to include the Delhi branch account in the headquarters and the branch account in the headquarters books.

| H.O. Dr. | Branch Dr. | H.O. Cr. | Branch Cr. |

Manufacturing expenses Salaries Wages Cash-in-hand Purchase Capital Goods received from H.O Rent General Expenses Sales Goods sent to Branch Purchases Returns Opening Stock Discount earned Machinery H.O. Machinery Branch Furniture-H.O. Furniture-Branch Debtors Creditors HO Account Branch Account | Rs. 30,000 30,000 1,00,000 10,000 1,50,000

8,000 20,000

50,000

1,50,000 50,000 7,000 3,000 40,000

54,000 | Rs. 10,000 10,000 40,000 2,000 80,000

15,000 4,000 5,000

30,000

15,000 | Rs.

2,00,000

4,50,000 15,000 5,000

2,000

30,000 | Rs.

1,50,000

1,000

1,000

5,000 54,000

|

| 7,02,000 | 2,11,000 | 7,02,000 | 2,11,000 |

Closing stock at Head Office was Rs 40.000 and at Branch Rs 30,000. Depreciation is to be provided on Machinery @ 20 per cent and Furniture @ 15 per ceni. Rent outstanding is Rs 500 (for Branch).

| Head Office books Journal |

| Dr. | Cr. |

2005 Dec. 31 |

|

| Rs. | Rs. |

| Delhi Branch Account To Delhi Branch Machinery Account To Delhi Branch Furniture Account (Being depreciation on Branch assets charged to Branch) | Dr. | 10,450 |

10,000 450

|

| Delhi Branch Trading Account To Delhi Branch Account (Being incorporation of the following items:) Stock Rs 30,000 Net Purchases 79,000 Wages 40,000 Manufacturing Wages 10,000 Goods from H.O 15,000

| Dr. | 1,74,000 |

1,74,000 |

| Delhi Branch Account To Delhi Branch Trading Account (Being incorporation of Branch Sales and Closing Stock) | Dr. | 1,80,000 |

1,80,000 |

| Delhi Branch Trading Account To Delhi Branch Profit & Loss Account (Being the transfer of Gross Profit)

| Dr. | 6,000 |

6,000 |

| Delhi Branch Profit & Loss Account To Delhi Branch Account (Being incorporation of the following items) Rent Rs 4,000+ 500 4,500 Salaries 10,000 General Expenses 5,000 Depreciation 10,450 | Dr. | 29,950 |

29,950 |

| Delhi Branch Account To Delhi Branch Profit & Loss A/c (Being incorporation of discount earned) | Dr. | 1,000 |

1,000 |

| General Profit and Loss Account To Branch Profit & Loss Account (Being the loss transferred to Profit and Loss Account of the Head Office)

| Dr. | 22,950 |

22,950 |

| Branch Debtors Account Branch Cash Account Branch Stock Account "To Delhi Branch Account (Being the transfer of various assets at Branch to Head Office books) | Dr. Dr. Dr. | 15,000 2,000 30,000 |

47,000 |

| Delhi Branch Account To Branch Creditors Account To Branch Expenses Outstanding Account (Being the transfer of liabilities at Branch to Head Office books) | Dr. | 5,500 |

5,000 500 |

Dr. | Delhi Branch Account | Cr. | ||

To Balance bid To Branch Assets-Depreciation To Delhi Trading Account Sales and Stock To Delhi Profit and Loss, A/c Discount To Sundry Liabilities A/c

| Rs. 54,000 10,450

1,80,000

1,000 5,000 |

|

By Delhi Trading Account-Opening Stock, purchases etc. By Delhi Profit and Loss Account- Expenses By Sundry Assets

| Rs.

1,74,000

29,950 47,000 |

| 2,50,950 |

|

| 2,50,950 |

Trading and Profit and Loss Account of Eve Ltd.

For the year ended 31st Dec. 2005

Dr. |

|

|

| Cr. | |||||

| Head Office | Delhi Branch |

|

| Head Office | Delhi Branch | |||

To Opening Stock To Purchases: Less Returns To Goods from H.O. To Wages To Manufacturing Wages To Gross Profit

| Rs. 50,000 1,45,000

-

1,00,000 30,000

1,80,000 | Rs. 30,000 79,000

15,000

40,000 10,000

6,000 |

|

By Goods sent to Branch By Sales By Closing Stock

| Rs. 15,000

4,50,000 40,000

| Rs. -

1,50,000 30,000

| |||

| 5,05,000 | 1,80,000 |

|

| 5,05,000 | 1,80,000 | |||

To Rent + O/ To Salaries To General Expenses To Depreciation: Machinery Furniture To Net Profit | 8,000 30,000 20,000

30,000 1,050 92,950

| 4,500 10,000 5,000

10,000 450 - |

| By Gross Profit By Discount By Net Loss | 1,80,000 2.000

| 6,000 1,000 22,950

| |||

| 1,82,000 | 29,950 |

|

| 1,82,000 | 29,950 | |||

Balance Sheet of Eve Limited as on 31st December 2005

Liabilities | Rs. |

| Assets | Rs. |

Share Capital Profit & Loss: Head Office 92,950 Less: Loss of Branch 22,950

Sundry Creditors: Head Office 30,000 Branch 5,000

Rent Outstanding

| 2,00,000

70,000

35,000

500 |

| Fixed Assets: Machinery: H.O. 1,50,000 Machinery Branch 50,000

2,00,000 Less: Depreciation 40,000

Furniture H.O. 7,000 Branch 3,000

10,000 Less: Depreciation 1,500

Stock: Head Office 40,000 Branch 30,000

Debtors: H.O 40,000 Branch 15,000

Cash: Head Office 10,000 Branch 2,000

|

1,60,000

8,500

70,000

55,000

12,000 |

| 3,05,500 |

|

| 3,05,500 |

Example

Stok on 1.1.2005 | 2250 |

|

Purchases | 66,450 | 1,12,500 |

Goods from Head Office | 34,000 |

|

Goods returned to Head Office |

| 2,250 |

Wages and Salaries | 5,500 |

|

Trade Expenses | 5,250 |

|

Head Office account |

| 10,250 |

| 1,13,600 | 1,13,600 |

The stock on hand on 31.12.2005 was Rs 5,200. Close the books of the Branch and prepare a Trading and

Profit and Loss Account in the books of the Branch. Also prepare the Head Office Account.

Solution:

In the books of Agra Branch Trading and Profit and Loss Account for the year ended 31st December 2005

Dr. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Stock A/c 1-1-2005 | 2,250 | By Goods Returned to H. O | 2,250 |

To Goods received from Head Office | 34,000 | By Sales | 1,12,500 |

To Purchases | 66,450 | By Stock 31-12-2005 | 5,200 |

To Gross Profit c/d | 17,250 |

|

|

TOTAL | 1,19,950 | TOTAL | 1,19,950 |

To Wages and Salaries | 5,500 | By Gross Profit bid | 17,250 |

To Trade Expenses | 5,250 |

|

|

To Head Office A/c-Net Profit | 6,500 |

|

|

TOTAL | 17,250 | TOTAL | 17,250 |

Only the net profit is transferred to Head Office Account by debiting Profit and Loss Account and crediting

Head Office Account, i.e.,

| Profit and Loss Account Dr. To National Industries Ltd (Being transfer of profit to Head Office)

|

| Rs

6,500

| Rs

6,500

|

In such case, Head Office and Balance Sheet appear as follows:

Dr. The National Industries Ltd. Account Cr.

PARTICULARS To Balance c/d

| AMOUNT 16,750

| PARTICULARS By Balance b/d By Profit and Loss, A/c | AMOUNT 16,250 6,500 |

| 16,750 |

| 16,750 |

Balance Sheet as on 31st December 2005

Liabilities | Rs. |

| Assets | Rs. |

Liabilities Sundry Creditors | 8,600 16,750

|

| Cash on Hand Sundry Debtors Stock Furniture and Fixtures

| 6,250 12,000 5,200 1,900

|

| 25,350 |

|

| 25,350 |

Alternatively, when branch assets and liabilities are transferred, Head Office Account shows no balance.

In such case, the entries in the branch books are as follows:

| Head Office books Journal |

| Dr. | Cr. |

|

|

| Rs. | Rs. |

| The National Industries Lid. A/c To Opening Stock Ale To Goods received from Head Office A/c To Purchase A/C To Wages and Salaries A/c To Trade Expenses A/c (Being transfer of revenue items to Head Office) | Dr. | 1,13,450

|

2,250 34,000 66,450 5,500 5,250

|

| Returns to Head Office A/c Sales A/c Closing Stock, A/c To National Industries Ltd. A/c (Being transfer of revenue items to Head Office) | Dr. Dr. Dr. | 2,250 1,12,500 5,200

|

1,19,950

|

| To National Industries Ltd. A/c To Cash on Hand A/c To Sundry Debtors A/c To Closing Stock A/c To Furniture and Fixtures, A/c (Being transfer of assets to Head Office)

| Dr. | 25,350 |

6,250 12,000 5,200 1,900 |

| Sundry Creditors A/c To National Industries Ltd. A/c (Being transfer of Creditors to Head Office)

| Dr. | 8,600 |

8,600 |

Dr. The National Industries Ltd. Account Cr.

PARTICULARS To Sundries A/c-Revenue Items Debit Balances To Sundries Ale-Assets

| AMOUNT 1,13,450

25,350

| PARTICULARS By Balance b/d By Sundries A/c Revenue Items Credit Balance By Sundries A/c-Liabilities

| AMOUNT 10,250 1,19,250

8,600 |

| 1,38,800 |

| 1,38,800 |

| The National Industries Ltd. Account |

| Dr. | Cr. |

|

Profit and Loss Ac To National Industries Ltd. A/c (Being transfer of net profit to Head Office) |

Dr.

| Rs. 6,500

| Rs.

6,500

|

| The National Industries Ltd. Ac To Cash in Hand To Sundry Debtors A/c To Stock A/c To Furniture and Fixtures, A/c (Being transfer of assets to Head Office)

| Dr. | 25,350

| 6,250 12,000 5,200 1,900

|

| Sundry Creditors A/c To National Industries Ltd. Ale (Being transfer of Branch Creditors to Head Office)

| Dr. | 8,600

|

8,600

|

Dr. The National Industries Ltd. Account Cr.

PARTICULARS To Cash A/c To Sundry Debtors A/c To Stock A/c To Furniture and Fixtures, A/c

| AMOUNT 6,250 12,000 5,200 1,900

| PARTICULARS By Balance b/d By Profit and Loss, A/c By Sundry Creditors A/c

| AMOUNT 10,250 6,500 8,600

|

| 25,350 |

| 25,350 |

Departmental Accounting refers to maintaining accounts for one or more branches or departments of the company. Revenues and expenses of the department are recorded and reported separately. The departmental accounts are then consolidated into accounts of the head office to prepare financial statements of the company.

The departmental stores are the example of large-scale retail selling just under a single roof. Different departments involve in different goods to be sold out. To calculate the net result of the whole organization, full-fledged trading, and profit, and loss account are to prepare. But to evaluate individual department, it will be creditworthy to prepare individual trading and profit and loss account.

For example, a textile mill which is having head office and factory. Separate accounts are maintained for production facilities and then the final results are sent to the head office which then incorporates by the head office in their accounts. Maintenance of separate accounts for each branch of a bank or financial institution also falls under the category of departmental accounting. The bank then prepares its financial statement after consolidating accounts of all branches.

A departmental accounting system is an accounting information system that records the activities and financial information about the department. Departmental Accounting is a vital one for large prosperous business organizations. It controls wastage & misusing, compensates the employee in terms of profit and commission, compares performance and progress of year to year or department to department or similar type of firm to firm.

Meaning & Concept of Departmental Accounting

Meaning of Departmental Accounting:

Where a big business with diverse trading activities conducts under the same roof the same usually divide into several departments and each department deals with a particular kind of goods or service. For example, a textile merchant may trade in cotton, woollen and jute fabrics. The overall performance for this type of business depends, however, on departmental efficiency.

As a result, it is desirable to maintain accounts in such a manner that the result of each department can be known—together with the result as a whole. The system of accounting follows for this; the purpose knows as Departmental Accounts. This system of accounting helps the proprietors to:

- Compare the results among the different departments together with the previous results thereof,

- Formulate policy to extend or to develop the enterprise in the proper line; and

- Reward the departmental managers based on departmental results.

The Concept of Departmental Accounting:

Departmentalization enables big firms to determine the areas needing special attention to the achievement of overall objectives. The units or departments needing more funds and more attention than others and the one(s) contributing more toward goal attainment could be identified with good departmentalization. The purpose is basically to find out the performance and capability of the units or departments to make adjustments for the achievement of the firm’s objectives.

Each unit, department or subsidiary gives the free use of some of the assets of the firm and some responsibilities which can be profit-making, revenue generation or cost control. As expenses incur by the firm on behalf of all its departments, indirect expenses are to apportion to the departments, if each department is to present a financial statement or if the statement is to prepare by the company on a departmental basis.

Departmental accounting is about the preparation of final accounts taking into consideration divisional performance before the overall performance. With that system of accounting, companies that departmentalize can easily conclude as they are very well’ performing units, averagely or moderately performing units. Departmental accounting aims at separating the several activities of a business to compare results and to assist the proprietors/owners in formulating policies

The most significant advantages of departmental accounts are:

- Individual results of each department can know which helps to compare the performances among all the departments, i.e., the trading results can compare.

- Departmental accounts help to understand or locate the success, failure, rates of profit, etc.

- It helps the management to make a proper plan of action, policies to increase profit after analyzing the results of the operation of various departments.

- Departmental accounting helps us to understand which department should be expanded further or which one should close down as per the results of the operation.

- It also helps to encourage a healthy competitive spirit among the various departments which, ultimately, helps to increase profits of the firm as a whole.

- For additions or alterations of various departments, departmental accounts help a lot as it supplies the necessary information.

- As detailed information about the firm is available from departmental accounting the users of accounting information, particularly, the auditors and investors widely benefit.

- Since departmental accounting presents separate departmental results, the Performance, of a successful department encourages the management, employees and increases the motivation of the staff as a whole.

- The percentage of gross profit on sales and stock turnover ratio of each department helps to make a comparative study among all departments.

A branch may be defined as section of an enterprise, geographically separated from the rest of the business, controlled by head office, and generally carrying on the same activities as of the enterprise. As a business grow, it may open up branches in different towns and cities in order to market its product/services over a large territory and thus increase its profit.

Followings are the main differences between branch and department:

(a) Branches are separated from the main organization. Departments are attached to the main organization under a single roof.

(b) Branches are geographically classified (like different branch offices in different cities of the country). Departments are technically classified such as the production department, finance department, personnel department, etc.

(c) Branches are the outcome of tough competition and the expansion of the business. Departments are the result of fast human life.

(d) The chief executive who is to keep a constant watch over the departments supervises closely and controls effectively. Control is practically un-practicable in the case of a far-off branch since it is not possible for the Head Office to keep a constant watch.

(e) Branches are geographically separated. Departments are not separated rather existed under the same roof.

(f) A department is a technical area of an office which is under the same premises while the branch is an extension of the office with more or less the same features.

(g) Branches are of different types like dependent, independent and foreign. There is no such classification in the department because all are common under the same roof.

(h) The allocation of branch common expenses does not arise. The allocation of departmental common expenses is a tough job.

(i) Departmental trading with their Head Office is conducted under the same roof although each department deals with a separate line of activity. Branch trading is conducted in different parts of the country under the Head Office dealing with usually the same line of activity.

(j) To find out the net result of the organization, the reconciliation of different branch account is the main job. In departmental accounting, no reconciliation is necessary because there is a central account division.

Basis of Allocation of Common Expenditure among different Departments-

Expenses should be allocated among different departments on a rational basis while preparing departmental accounts.

Individual Identifiable Expenses: Expenses incurred specially for a particular department are charged directly thereto, e.g., insurance charges of stock held by the department.

Common Expenses: Common expenses, the benefit of which is shared by all the departments and which are capable of precise allocation are distributed among the departments concerned on some equitable basis considered suitable in the circumstances of the case.

Allocation of Expenses

Sr No | Expenses | Basis of Allocation |

1. | Rent, rates and taxes, repairs and maintenance, insurance of building | Floor area occupied by each department (if given) otherwise on time basis |

2. | Lighting and Heating expenses (e.g., energy expenses) | Consumption of energy by each department |

3. | Selling expenses, e.g., discount, bad Debts, selling commission, freight outward, travelling sales manager’s Salary and other costs | Sales of each department |

4. | Carriage inward/ Discount received | Purchases of each department |

5. | Wages/Salaries | Time devoted to each department |

6. | Depreciation, insurance, repairs and Maintenance of capital assets | Value of assets of each department Otherwise on time basis |

7. | Administrative and other expenses, e.g., salaries of managers, directors, Common advertisement expenses, | Time basis or equally among all Departments |

8. | Labour welfare expenses | Number of employees in each department |

9. | PF/ESI contributions | Wages and salaries of each department |

Note: There are certain expenses and income, most being of financial nature, which cannot be apportioned on a suitable basis; therefore, they are recognised in the combined Profit and Loss Account, for example, interest on loan, profit/loss on sale of investment, etc.

Appropriateness of some of the apportionment methods – key points:

- It can be a very subjective process.

- The best way to apportion costs base on the greatest benefit- i.e., the department who gets the greatest benefit from the cost must take the greatest amount of the cost.

- This makes the apportionment process very time consuming and expensive.

- The more appropriate basis may be for depreciation to base on the book value of assets in each department.

- Insurance of the assets based on the book value of the assets.

An interdepartmental transaction occurs when one department provides a good or service to or for another department for a fee, on a cost recovery basis or for free. An interdepartmental balance is the amount due to or due from a department at month or year-end arising from one or more interdepartmental transactions. The receiving department (debtor) is the department that requests the goods and or services and as a result incurs the expenditure. The supplying department (creditor) is the department that supplies the goods and or services to the receiving department or to another party on behalf of the receiving department.

Inter-departmental transactions are used to track arm’s length business transactions between two or more university departmental accounts. These transactions are used to record what would normally be revenue and expense transactions between two departmental indexes. However, to ensure that “inter-company” revenues and expenses are properly eliminated during the annual financial statement presentation, it is necessary for all inter-departmental transactions to be recorded as inter-departmental credits (for the departmental index receiving the benefit or revenue of the transaction) and inter-departmental charges (for the departmental index incurring the cost of the transaction). Tracking “true” business income and expenses between departments in this method will ensure that such inter-company transactions are eliminated for financial statement presentation purposes as required by Generally Accepted Accounting Principles (GAAP).

Unrealised profit included in unsold stock at the end of accounting period is eliminated by creating an appropriate stock reserve by debiting the combined Profit and Loss Account. The amount of stock reserve will be calculated as:

Transfer price of unsold stock × Profit included in transfer price

Transfer price

Journal Entry

At the end of the accounting year, the following journal entry will be passed for elimination of unrealised profit (creation of stock reserve):

Profit and Loss Account Dr.

To Stock Reserve

(Being a provision made for unrealised profit included in closing stock)

In the beginning of the next accounting year, the aforesaid journal entry will be reversed as under:

Stock Reserve Dr.

To Profit and Loss Account

(Being provision for unrealised profit reversed.)

Disclosure in Balance Sheet

The unsold closing stock acquired from another department will appear on the assets side of the balance sheet as under:

(An extract of the assets side of the balance sheet)

Current assets xxx

Stock xxx

Less: Stock reserve xxx

Xxx

Trading and Profit and Loss and Balance sheet, together, are called as final accounts. Item appearing in the trial balance appears only once in final accounts, either on the debit or credit. Any adjustment entry requires two postings, debit and credit for the same amount. Important point is students should do the posting (debit and credit) in the concerned accounts, simultaneously. Care is to be exercised that the amount is the same for the total debit and credit.

The following is the summary of important adjustments, which are, normally made at the end of accounting period:

Sr No | Adjustment | Effect 1 | Effect 2 |

1 | Closing Stock- Raw Materials | Less from RC- Mfg A/c | BS- Asset Side |

| Closing Stock- Work in Progress | Mfg A/c- Cr Side | BS- Asset Side |

| Closing Stock- Finished Goods | Trading A/c- Cr Side | BS- Asset Side |

2 | Outstanding Expenses or Payable | Add to Expense | BS- Liability Side |

3 | Prepaid Expense | Less from Expenses | BS- Asset Side |

4 | Outstanding Income or Receivable | Add to Income | BS- Asset Side |

5 | Income received in Advance | Less from Income | BS- Liability Side |

6 | Depreciation on Assets used in Mfg | Less from Asset in BS | Mfg A/c Dr Side |

| Depreciation on Office Assets | Less from Asset in BS | P/L A/c Dr Side |

7 | Interest on Capital | P & L A/c Dr Side | Add to Capital in BS |

8 | Interest on Drawings | P & L A/c Cr Side | Less from Capital in BS |

9 | Bad or Doubtful Debts | P & L Dr Side (Formula) | Less From Debtors |

10 | Provision/Reserve for Doubtful Debts (RDD) | P & L Dr Side (Formula) | Less From Debtors |

11 | Provision for Discount on Debtors | Add to Discount (P & L Dr Side) | Less From Debtors |

12 | Provision for Discount on Creditors | Add to Discount (P & L Cr Side) | Less From Creditors |

13 | Unrecorded Sales | Add to Debtors | Add to Sales |

14 | Unrecorded Purchases | Add to Creditors | Add to Purchases |

15 | Uninsured Goods lost by Fire/theft | P & L Dr Side | Trading A/c Cr Side |

16 | Insured Goods lost by Fire/theft | P & L Dr Side- Actual Loss Amount

BS Asset Side - Insurance Claim Receivable | Trading A/c Cr Side- Amount of Goods Lost |

17 | Goods Distributed as Free Samples | P & L Dr Side | Trading A/c Cr Side |

18 | Goods taken for Personal use by proprietor | Add to Drawings | Trading A/c Cr Side |

19 | Bills Receivable Dishonoured | Less from Bills Receivable | Add to Debtors |

20 | Bills Payable Dishonoured | Less from Bills Payable | Add to Creditors |

21 | Interest on Loan Payable | Add to Loan Liability Side | P & L Dr Side |

22 | Interest on Investment Receivable | Add to Investment Asset Side | P & L Cr Side |

Closing Entries

‘Closing Entries’ are essential to ascertain the correct operating results. Accounts relating to expenses and incomes are to be closed to find out the operating profit. So, balances in the expenses and income accounts have to be transferred to Manufacturing, Trading and Profit and Loss Accounts. Process of closing expenses and income accounts is done through closing entries.

B) Statement Form Method

An accounting method refers to the rules a company follows in reporting revenues and expenses. The two primary methods of accounting are accrual accounting (generally used by companies) and cash accounting (generally used by individuals).

Cash accounting reports revenues and expenses as they are received and paid through cash inflows and outflows; accrual accounting reports them as they are earned and incurred through sales and purchases on credit and by using accounts receivable & accounts payable.

Generally accepted accounting principles (GAAP) requires accrual accounting.

All businesses need to keep accounting records. Public companies are required to do so. Accounting allows a business to monitor every aspect of its finances, from revenues to costs to taxes and more. Without accurate accounting, a business would not know where it stood financially, most likely resulting in its demise.

Accounting is also needed to pay accurate taxes to the Internal Revenue Service (IRS). If the IRS ever conducts an audit on a company, it looks at a company's accounting records and methods. Furthermore, the IRS requires taxpayers to choose an accounting method that accurately reflects their income and to be consistent in their choice of accounting method from year to year.

This is because switching between methods would potentially allow a company to manipulate revenue to minimize their tax burdens. As such, IRS approval is required to change methods. Companies may use a hybrid of the two methods, which is allowable under IRS rules if specified requirements are met.

Types of Accounting Methods

Cash Accounting

Cash accounting is an accounting method that is relatively simple and is commonly used by small businesses. In cash accounting, transactions are only recorded when cash is spent or received.

In cash accounting, a sale is recorded when the payment is received and an expense is recorded only when a bill is paid. The cash accounting method is, of course, the method most people use in managing their personal finances and it is appropriate for businesses up to a certain size.

If a business generates more than $25 million in average annual gross receipts for the preceding three years, however, it must use the accrual method, according to Internal Revenue Service rules.

Accrual Accounting

Accrual accounting is based on the matching principle, which is intended to match the timing of revenue and expense recognition. By matching revenues with expenses, the accrual method gives a more accurate picture of a company's true financial condition.

Under the accrual method, transactions are recorded when they are incurred rather than awaiting payment. This means a purchase order is recorded as revenue even though the funds are not received immediately. The same goes for expenses in that they are recorded even though no payment has been made.

References:

- Accounting Notes of Delhi University/Mumbai University.

- Accountingnotes.com

- Accounting Article Library.

- Https://www.yourarticlelibrary.com/accounting/branch-accounts/maintaining-accounts-of-an-independent-branch/51650#:~:text=Independent%20Branches%20are%20those%20which,freedom%20like%20an%20American%20Son.

- Https://edurev.in/question/735175/What-is-meant-by-indepandent-branch-in-Branch-Ac-i

- Https://commerceiets.com/different-types-of-branches/

Unit 1

Inland Branch Accounting

Introduction

A branch may be defined as section of an enterprise, geographically separated from the rest of the business, controlled by head office, and generally carrying on the same activities as of the enterprise. As a business grow, it may open up branches in different towns and cities in order to market its product/services over a large territory and thus increase its profit.

For example, Bata shoe Co. Ltd has branches in various cities all over the country. The same example holds good for a commercial bank also.

As per the provision of Companies Act, branch office in relation to a company means-

a) Any establishment described as a branch by the company; or

b) Any establishment carrying on either the same or substantially the same activity as that carried on by the head office of the company; or

c) Any establishment engaged in any production, processing or manufacture.

It should be mentioned that a branch is not a separate legal entity it is simply a segment of a business. From an accounting standpoint, a branch is a clearly identifiable profit centre. In order to exercise greater control over the branches it is necessary to ascertain profit or loss made by such branches separately. Apart from this, specialised accounting techni9have to be adopted for controlling various branches activities and for their smooth running both at the branch level and at the head office level. The system of accounting varies between different enterprises in accordance with their type of activities, methods of operation and the preference of their managements.

- Ascertain the profitability of each branch separately for particular accounting period.

- Ascertain the financial position of each branch separately at the end of that accounting period.

- Assess the progress and performance of each branch

- Incorporate the profit or loss made by the branch and its assets and liabilities in the firm's final accounts

- Ascertain the requirements of cash and stock for each branch,

- Ascertain whether the branch should expend or closed

From accounting point of view, the branches can be divided into the following main cases:

1) HOME BRANCHES: -

a) Dependent Branches (Where the head office maintains all the accounts)

b) Independent Branches (Where the branch keeps its own accounts)

2) FOREIGN BRANCHES: -

They almost invariably trade independently and record their transaction in foreign currency.

Dependent Branches

When the policies and administration of a branch are totally controlled by the head office, who also maintains its accounts, the branch is called as dependent branch.

Independent Branches

Independent Branches are those which make purchases from outside, get goods from Head Office, supply goods to Head Office and fix the selling price by itself Thus an independent Branch enjoys a good amount of freedom like an American Son.

The accounting arrangement of a branch depends upon its size, the type of activities, the methods of operation and the degree of control to be exercised by the head office. There are three main system of accounting for branches transaction, viz.

- Debtors System

- Stock and Debtors System

- Final Account system

This system of accounting is suitable for the small- size branches. Under this, a Branch Account is opened for each branch in the head office ledger. All the transaction relating to that branch is recorded in this account. The branch account is prepared in such a way that it discloses the profit or loss of the branch.

Head office may send goods to branch either at "cost price" or "selling price".

Cost price method: - under this method at the beginning of the year the branch Account is debited with the opening balances of asset such as stock, petty cash, furniture, prepaid expenses, etc. lying with the branch. Similarly, it is credited with the opening balance of liabilities of the branch such as, creditors, outs salary, rent, etc.

The branch is then debited with the amount of goods sent to the branch and other amounts remitted to meet various expenses such as, salaries, rent, rates, taxes, etc. Likewise, the branch account is credited with the return of goods by the branch and receipts from branches. At the year end, Branch Account is debited with the closing values of liabilities and credited with the closing values of assets. The difference between the two sides represents profit or loss for the branch for a particular period.

Debtors Method

Journal entries

1) For goods sent to branch

Branch A/c _______Dr.

To Goods Sent to Branch A/c

(Being goods sent to branch)

2) For goods returned by the branch

Goods Sent to Branch A/c _______Dr.

To Branch A/c

(Being goods returned by the branch)