Unit - 1

Introduction

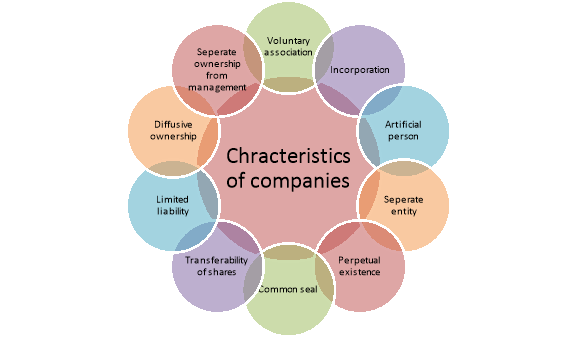

Company is an association of person registered under the companies act 1956 or 2013. Some of the most important characteristics of a company are as follows:

Figure: Characteristics of company

1. Voluntary Association:

A company is a voluntary association of two or more persons. A single person cannot constitute a company. At least two persons must join hands to form a private company. While a minimum of seven persons are required to form a public company. The maximum membership of a private company is restricted to fifty, whereas, no upper limit has been laid down for public companies.

2. Incorporation:

A company comes into existence the day it is incorporated/registered. In other words, a company cannot come into being unless it is incorporated and recognised by law. This feature distinguishes a company from partnership which is also a voluntary association of persons but in whose case registration is optional.

3. Artificial Person:

In the eyes of law there are two types of persons viz:

(a) Natural persons i.e., human beings and

(b) Artificial persons such as companies, firms, institutions etc.

Legally, a company has got a personality of its own. Like human beings it can buy, own or sell its property. It can sue others for the enforcement of its rights and likewise be sued by others.

4. Separate Entity:

The law recognizes the independent status of the company. A company has got an identity of its own which is quite different from its members. This implies that a company cannot be held liable for the actions of its members and vice versa. The distinct entity of a company from its members was upheld in the famous Salomon Vs. Salomon & Co case.

5. Perpetual Existence:

A company enjoys a continuous existence. Retirement, death, insolvency and insanity of its members do not affect the continuity of the company. The shares of the company may change millions of hands, but the life of the company remains unaffected. In an accident all the members of a company died but the company continued its operations.

6. Common Seal:

A company being an artificial person cannot sign for itself. A seal with the name of the company embossed on it acts as a substitute for the company’s signatures. The company gives its assent to any contract or document by the common seal. A document which does not bear the common seal of the company is not binding on it.

7. Transferability of Shares:

The capital of the company is contributed by its members. It is divided into shares of predetermined value. The members of a public company are free to transfer their shares to anyone else without any restriction. The private companies, however, do impose some restrictions on the transfer of shares by their members.

8. Limited Liability:

The liability of the members of a company is invariably limited to the extent of the face value of shares held by them. This means that if the assets of a company fall short of its liabilities, the members cannot be asked to contribute anything more than the unpaid amount on the shares held by them. Unlike the partnership firms, the private property of the members cannot be utilized to satisfy the claims of company’s creditors.

9. Diffused Ownership:

The ownership of a company is scattered over a large number of persons. According to the provisions of the Companies Act, a private company can have a maximum of fifty members. While, no upper limit is put on the maximum number of members in public companies.

10. Separation of Ownership from Management:

Though shareholders of a company are its owners, yet every shareholder, unlike a partner, does not have a right to take an active part in the day-to-day management of the company. A company is managed by the elected representatives of its members. The elected representatives are individually known as directors and collectively as ‘Board of Directors’.

Key Takeaways

- Company is an Association of Person Registered Under the Companies Act 1956 Or 2013.

A corporate veil is a legal concept that separates the acts done by the companies and organizations from the actions of the shareholders. It protects the shareholders from being liable for the actions done by the company. This is not an absolute right the court depending on the facts of the case can take the decision whether the shareholder is liable or not.

The doctrine of lifting the corporate veil means ignoring the corporate nature of the body of individuals incorporated as a company. A company is a juristic person, but in reality, it is a group of people who are the beneficial owners of the property of the corporate body. Being an artificial person, it (company) cannot act on its own, it can act only by natural persons. The doctrine of lifting the veil can be understood as the identification of the company with its members. It allows a company to perform juristic acts in its own name, as well as to sue and to be sued. Members and Directors enjoy protection against personal liability. Although this fundamental rule has considerable influence in Company Law across the globe, including India, it cannot be absolute and must allow some exceptions, where the court may disregard the legal personality of the company. Such exceptions as there are represent haphazard refusals by the legislature or the courts to apply logic where it is to flagrantly oppose to justice, convenience or the interest of the revenue. The veil of incorporation never means that the internal affairs of the company are completely concealed from view.

Statutory Provisions in support of Lifting the Corporate Veil

- Reduction of number of members below the statutory minimum: If at any time the minimum number of members of a company falls below two, in case of Private company or below seven, in case of Public company; then the company can carry on the business for a period of six months while the number is so reduced, every person who is a member of the company during the time that it still continues to carry on the business, knowing the fact that the minimum number of members is reduced and the grace period of six months is also finished, then as the case may be, the company and its members will be held liable and can sue an amount which they made during those six months or else the company may be severally sued, therefore.

- Failure to refund application fee: The directors of the company shall be jointly and severally liable to repay the money (application money) with an interest of six per cent per annum from the date of expiry of one hundred and thirtieth day if they fail to repay the application money without interest within one hundred and twenty days when the company fails to allot shares.

3. Misdescription of company’s name: An officer of an organization (company) who signs any bill of trade, hundi, promissory note, check wherein the name of the organization isn’t referenced in the recommended way, such official can be held personally liable to the holder of the bill of trade, hundi, etc. except if it is properly paid by the company.

4. Fraudulent trading: Under section 339 of the Companies Act, 2013, If in the course of the winding-up of a company, it appears that any business of the company has been carried on with intent to defraud creditors of the company or any other persons or for any fraudulent purpose, the Tribunal, on the application of the Official Liquidator, or the Company Liquidator or any creditor or contributory of the company, may, if it thinks it proper so to do, declare that any person, who is or has been a director, manager, or officer of the company or any persons who were knowingly parties to the carrying on of the business in the manner aforesaid shall be personally responsible, without any limitation of liability, for all or any of the debts or other liabilities of the company as the Tribunal may direct. Every person who had the knowledge of such fraud will be punishable with imprisonment for a term which may extend to two years or with a fine which can extend up to fifty thousand or with both.

5. For investigating company’s ownership: Under section 216 of the Companies Act, 2013, the Central Government may appoint Inspectors to investigate and report on the membership of the company for the purpose of determining the true individuals who are financially interested in the company and who control its policy. Thus, the Central Government may ignore the Corporate veil.

Key Takeaways

- The doctrine of lifting the corporate veil means ignoring the corporate nature of the body of individuals incorporated as a company. A company is a juristic person, but in reality, it is a group of people who are the beneficial owners of the property of the corporate body. Being an artificial person, it (company) cannot act on its own, it can act only by natural persons.

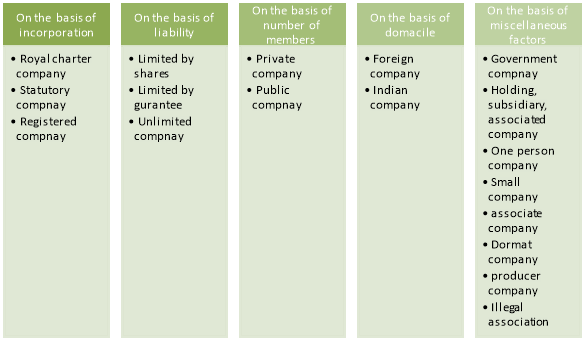

The Indian economy has a variety of companies existing in its market such as public companies, private companies, investment companies, limited liability companies etc. These numerous entities in the market may look different from each other on the surface, but based upon certain identifiable common characteristics. The companies may be classified based upon the mode of their incorporation and incorporation process which is defined under Section 7 of the Companies Act, 2013.

Figure: Classification of company

(I) Classification of Companies on the basis of incorporation

a) Royal Charter Company

It may be better understood as the company born out of the authorization of the sovereign or the crown. This was the mode of incorporation which was followed earlier to the Registration under the Companies Act. A charter is granted by the crown to the people requesting to form a cooperative or a company. To name a few, The Bank of England (1694), The East India Company (1600) were formed by the means of charters passed by the then Crown of England. The authorization given by the sovereign gives legal existence to these companies by means of the body of the charter. This mode of incorporation is no more recognised in any Companies Act to incorporate new Companies.

b) Statutory Company

As the name suggests, these are the companies that are formed by the means of a special statute passed by the Parliament or the State Legislature. The examples of statutory companies in India are the Reserve bank of India, the Life Insurance Corporation of India Act, etc. The Statutory origins of these companies provide power to such companies to be bound by their own statute, i.e., whenever there is any dispute between statute under which these companies were formed and the Companies Act 2013, the statute being special legislation persists over the general law of Companies Act. The parliaments both State and Centre are empowered to make such legislation for incorporation under the power endowed to them by the Constitution of India.

c) Registered Company

As defined under Section 2(20) of the Companies Act, 2013, registered companies are the companies which get registered under the statute of the Companies Act. Companies are also provided with a certificate of incorporation by the Registrar of the Company.

(II) Classification of Companies on the basis of liability of members

The liability upon the members is also used to classify the companies, it describes the limit to which member will be liable if such liability were to befall upon the company. On the basis of liability of the members, the companies may be classified into:

a) Companies limited by shares:

These types of companies are mentioned in Section 2(22) of the Companies Act, 2013. The liability of the members of such a company is based upon the number of shares kept unpaid. This liability against the shares kept may be brought to the authority. Once the payment towards the security is made by the shareholder or member then no liability beyond that is placed upon such member. The liability may be enforced during the company’s existence and even during its winding-up process.

b) Companies limited by guarantee

These types of companies are mentioned in Section 2(21) of the Companies Act, 2013. In a Company where the liability is limited by guarantee, it means the member of the Company has agreed on the Memorandum of Association to repay the same amount during winding up of such Company. In such companies, the liability of the members is limited to the undertaking given by them. Trust research associations, etc. are examples of company’s liability limited by guarantee.

c) Unlimited Liability Company

These companies as defined under Section 2(92) of the Companies Act, 2013 do not have a cap on the amount of liability that may add on their members in case the company has to repay any debt. For any amount that the company owes these members, the unlimited liability company shall be liable to the extent of their interest in the company. These companies do not draw any popularity when it comes to Indian Market.

(III) Classification of Company on the basis of the number of members

a) Private Company

The private companies as defined under Section 3(1)(b) of the Companies Act, 2013 are very restrictive in nature wherein it may in its Articles of Association restrict the right to transfer shares. The number of members in such a company might be a maximum of 50. The shares and debentures of such companies are not available for the public at large. The number of members in a company to be called a private company is two, wherein it is clearly set that two members jointly holding a single share shall be considered as one member and not two members. The easy identification of Private companies is the ‘Pvt. Ltd.’ attached to its name.

b) Public Company

As defined under Section 2(71) of the Companies Act, 2013, Public Companies are the ones which are not a private company. As mandated under Section 3(1)(a) of the Companies Act, 2013, there should be at least 7 members to form a public company. It is the intrinsic nature of the public company that there is the right to transfer shares and debentures of the public company to the public at large.

(IV) Classification of Companies on the basis of domicile

a) Foreign Company

A Company which is situated outside India, but has a registered place in India may be physical or electronic address or perhaps company has ownership itself or through the agents, representatives or managers of the company is known as a foreign company under Section 2 (42) of the Companies Act, 2013. The aforementioned definition included in the new Companies Act has widened the scope of the definition of foreign companies extending the same to the entities having their electronic presence in India. The list of foreign companies listed in India has names of the corporate giants such as Whirlpool of India Ltd., Timex Group India Ltd., Ambuja Cements Ltd., etc.

b) Indian Company

Indian Company has been defined under Section 2(20) of the Companies Act, 2013 as any company registered under the Companies Act, 2013, or any other previous law is known as an Indian Company. An Indian company may prove its locus standi with the help of its office address and the legislation provides a guideline to be followed while using such powers by an Indian company.

(V) Classification of companies on the basis of Miscellaneous factors

a) Government Company

As defined under Section 2(45) of the Companies Act, 2013, any company in which a minimum of 51 per cent of the paid-up share capital is held by the Central/State Government, and/or held fractionally by the Central Government and partly by one or more State Governments is known as a Government Company. The major drawback of having a government company is the lack of autonomy.

b) Holding, Subsidiary Companies and Associated Companies

Under Section 2(46) of the Companies Act, 2013, a company is known as the holding company of another company if it has administrative control over another company. Such control may be regarding the affairs of the company. Under Section 2(87) of the Companies Act, 2013, a company is known as a subsidiary company of another company when control is exercised by the other company over the subsidiary company.

c) One person company

Under Section 2(62) of the Companies Act, a company in which one person is the whole and sole owner of the share capital of the company is known as a One Man Company. In order to meet the statutory requirement of a minimum number of members, some namesake company shareholders hold one or two shares each. The namesake shareholder members are usually nominated by the principal shareholder. The principal shareholder enjoys all the profits of the business with the protective shield of limited liability. Such companies have been given legal sanctity.

d) Small company

According to Section 2(85) of CA, 2013, Small Company means the company which satisfies the following conditions: –

- It has paid up share capital of not more than 50 lakhs or such higher amount as may be prescribed which shall not be more than 10 crores; and

- It has annual turnover of not more than 2 crores or such higher amount as may be prescribed which shall not be more than 100 crores.

e) Associate company

These Companies as defined under Section 2(6) of the Companies Act, 2013 are the one in which the other company has significant influence but these Companies are not the subsidiaries of such influencing companies known as the Associate Company. The Joint Venture Companies are such associate companies.

f) Dormant company

Where a company is formed under Section 455 of the Company Act, 2013 for a future endeavour or to hold an asset which may be a physical or intellectual property and has no significant accounting transaction, such a company or inactive company can make an application to the Registrar in the prescribed manner for obtaining the status of the dormant company.

g) Producer Company

The concept of Producer Company in India was introduced to allow cooperatives to function as a corporate entity under the Ministry of Corporate Affairs. In this article, we look at the procedure for registering a Producer Company in India, under the Companies Act, 2013. The Companies Act defines Producer as any person engaged in any activity connected with or relatable to any primary produce (Produce: “things that have been produced or grown, especially by farming”). A Producer Company is thus a body corporate having an object that is one or all of the following:

- Production

- Harvesting,

- Procurement

- Grading

- Pooling

- Handling

- Marketing

- Selling

- The export of primary produce of the Members or import of goods or services for their benefit.

Illegal Association

Companies Act, 2013, lists certain associations to be illegal, when that association/ partnership hides from Companies Act 2013, by non-registration, and carries on profit gaining business. This is known as Illegal Association. Section 464 of the Companies Act, 2013, states that any association or partnership formed exceeding fifty members for a profit gaining business, without registering it as a company under Companies Act, 2013, is said to be known as Illegal Association.

Fine:

Section 464(3) of the Companies Act 2013, provides that, any association formed in contravention to Section 464(1), which prohibits the formation of illegal association. It also imposes a fine on persons of illegal association and also all liabilities incurred on such type of business.

Exemption:

There are certain kinds of associations, which are exempted to consider illegal association. They are-

1. Hindu Undivided Family carrying on any business: A Hindu Undivided Family is a family that consists of all persons lineally descended from a common ancestor, and also the wives and daughters of the male descendants. It consists of the Karta, who is typically the eldest person or head of the family, while other family members are coparceners. As they are considered as a unit or holds the capacity of the individual business, it isn’t necessary for the Hindu Undivided family to register themselves as an association.

2. Partnership or Association Governed by any Special Acts: Any partnership or Association, which is governed by special acts is always within the purview of the Special Act and it isn’t necessary for that association to register themselves, under the Companies Act, 2013.

Key Takeaways

- The Indian economy has a variety of companies existing in its market such as public companies, private companies, investment companies, limited liability companies etc. These numerous entities in the market may look different from each other on the surface, but based upon certain identifiable common characteristics.

Since a company is an artificial person, it has to be formed according to legal provisions. In India, these legal provisions have been provided in the Companies Act, 2013. Formation of a company involves various stages which are as follows:

Figure: Stages of company formation

1. Promotion Stage:

The term ‘promotion’ refers to the sum total of activities by which a business enterprise is brought into existence. At the promotion stage of a company, the promoters conceive the idea of promoting a company and the type of activities that it intends to undertake.

These activities are as follows:

i. Identification of business opportunity and the type of business to be undertaken.

Ii. Undertaking feasibility study to determine technical, economic and legal viability of the project to be undertaken by the company.

Iii. Deciding the name of the company to be formed and getting this name approved from the Registrar of Companies.

Iv. Obtaining consent of the persons who will be signatories to documents to be submitted to the Registrar of Companies for getting the company registered. (In the case of a private company, 2 signatories, and in the case of a public company, 7 signatories are required.)

v. Obtaining consent of the persons who will act as first directors (2 required in the case of a private company and 3 in the case of a public company).

Vi. Selecting professionals who will prepare various relevant documents required for registration of the company like Memorandum of Association, Articles of Association, etc., and the professionals who will work as first auditors of the company.

Vii. Getting relevant documents prepared.

2. Incorporation Stage:

Incorporation or registration stage involves putting an application for registering the company before the concerned Registrar of Companies and getting it registered. In India, there is an office of the Registrar of Companies in each major State of the country. The concerned Registrar is one who is located in the State where the registered office of the company is to be located.

Incorporation stage involves the following activities:

i. Filing registration application with the Registrar of Companies along with relevant documents (Memorandum of Association, Articles of Association or declaration of accepting Table A which is a model set of Articles of Association, written consent of proposed Directors, certificate of approval of the company’s name, agreement entered with the proposed Managing Director, statutory declaration that all legal requirements for registration have been completed and documentary evidence of payment of registration fees).

Ii. Scrutiny of the application and documents by the Registrar of Companies.

Iii. Registering the company by the Registrar if all requirements are fulfilled and entering the name of the company in the relevant register.

Iv. Issue of Certificate of Incorporation by the Registrar of Companies.

On issue of the Certificate of Incorporation, the company comes into existence as an artificial person.

3. Capital Subscription Stage:

After a company is registered, it proceeds to get money through allotment of share capital to members. Initially, shares are allotted to persons who are signatories to documents and have agreed to subscribe to the prescribed number of shares. After this, a private company may start its business while a public company is required to get the Certificate of Commencement of Business from the concerned Registrar of Companies.

The procedure for subsequent allotment of shares varies for a private company and a public company. In a private company, subsequent shares are allotted through personal contacts. In a public company, shares may be allotted through public issue of shares.

The usual procedure for this is as follows:

i. Filing of prospectus with Securities and Exchange Board of India (SEBI).

Ii. Getting approval from SEBI.

Iii. Appointing managers, underwriters and registrar to the issue.

Iv. Appointing bankers for receiving applications for shares along with money and brokers for promoting the issue.

v. Inviting the general public (including institutions) for share subscription.

Vi. On receiving the minimum prescribed subscription, allotting the shares in consultation with the concerned stock exchange where the shares are to be listed for trading.

4. Commencement of Business Stage:

For commencing the business, a public company has to obtain the Certificate of Commencement of Business from the concerned Registrar of Companies. For this purpose, the company is required to submit the following documents:

i. A declaration that the shares to be subscribed on cash basis have been allotted.

Ii. A declaration that all the Directors have paid in cash for the shares subscribed by them.

Iii. A declaration, signed either by a Director or Secretary of the company, that the above requirements have been complied with.

The Registrar of Companies scrutinises the above documents and issues the Certificate of Commencement of Business if all requirements are as per the provisions of the Companies Act.

Key Takeaway

- Since a company is an artificial person, it has to be formed according to legal provisions. In India, these legal provisions have been provided in the companies act, 2013.

References:

- Gowar, LCB, Principles of Modern Company Law, Stevens & sons, Londan.

- Hanningan, Brenda, Company Law, Oxford University Press, U.K

- MC Kuchhal Corporate Laws, Shri Mahaveer Book Depot. (Publishers)

- J.P. Sharma, An Easy Approach to Corporate Laws, Anne Books Pvt. Ltd., New Delhi

- Ramaiya, A Guide to Companies Act, LexisNexis, Wadhwa and Buttersworth

- Kannal, S. AND V.S. Sworirajan, Company Law Procedure, Taxman Allied Services(P) Ltd., New Delhi

- Singh, Harpal. Indian Company Law, Galgotia Publishing, New Delhi

- Companies Act and Corporate Laws, Bharat Law House Pvt. Ltd, New Delhi