Unit - 2

Documents

The memorandum of association of a company is an important corporate document in India. A Memorandum of Association (MoA) represents the charter of the company. It is a legal document prepared during the formation and registration process of a company to define its relationship with shareholders and it specifies the objectives for which the company has been formed.

As per Section 2(56) of the Companies Act,2013 “memorandum” means the memorandum of association of a company as originally framed or as altered from time to time in pursuance of any previous company law or of this Act.

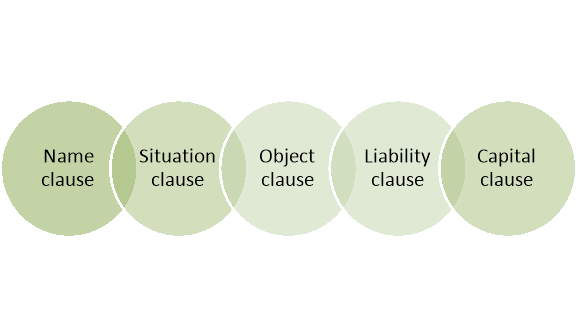

Clauses of Memorandum of Association:

Section 4 of the Companies Act, 2013 deals with MOA. The Memorandum of a company shall contain the following:

1. Name Clause:

The name of the company with the last word “Limited” in the case of a public limited company, or the last words “Private Limited” in the case of a private limited company.

2. Situation Clause:

The State in which the registered office of the company is to be situated.

3. Object Clause:

The objects for which the company is proposed to be incorporated and any matter considered necessary in furtherance thereof.

4. Liability Clause:

The liability of members of the company, whether limited or unlimited, and also state:

(i) in the case of a company limited by shares– liability of its members is limited to the amount unpaid, if any, on the shares held by them; and

(ii) in the case of a company limited by guarantee-the amount up to which each member undertakes to contribute—

(A) to the assets of the company in the event of its being wound-up while he is a member or within one year after he ceases to be a member, for payment of the debts and liabilities of the company or of such debts and liabilities as may have been contracted before he ceases to be a member, as the case may be; and

(B) to the costs, charges and expenses of winding-up and for adjustment of the rights of the contributories among themselves;

5. Capital Clause:

(i) the amount of share capital with which the company is to be registered and the division thereof into shares of a fixed amount and the number of shares which the subscribers to the memorandum agree to subscribe which shall not be less than one share; and

(ii) the number of shares each subscriber to the memorandum intends to take, indicated opposite his name;

In the case of One Person Company, the name of the person who, in the event of death of the subscriber, shall become the member of the company.

Alterations of MOA

Alteration in the Memorandum of Association can be carried out only by a special resolution at the Shareholders meeting. The following are the provisions related to alteration in Name Clause, Objects Clause, Liability Clause, Capital Clause and Subscription Clause.

I. Alteration of Name Clause in Memorandum of Association

A company may by passing a special resolution alter is name with the approval of the Central Government. If the alteration involves change of the name to private limited or public limited, permission of Central Government is not required.

In case a company has been registered with a name which resembles a name of an existing company, the Central Government may ask it to change its name. In such case ordinary resolution is sufficient. The intimation of name change should be given to the Registrar who will issue a fresh certificate of incorporation. Alteration of Situation clause

1. In case registered office has to be shifted within the same city, town or village, a notice has to give to the Registrar within thirty days of the change.

2. In case registered office has to be shifted from one town to another town or one village to another village, a special resolution has to be passed.

3. A company can change its registered office from one State to another State for the following reasons:

- To carry on business more efficiently and economically;

- To achieve the important purpose of the company by sophisticated means;

- To expand its operations in the current location;

- To control any of the existing objects;

- To sell whole or part of the business undertaking;

- To amalgamate with other business or person.

II. Alteration of Objects Clause in Memorandum of Association

A company can alter is objects clause by passing a special resolution. Alteration of objects clause can be done for the following reasons:

1. For the purpose of carrying on its business more economically and efficiently.

2. For the purpose of obtaining the main business of the company by new and improved means

3. For the purpose of enlarging or changing the local area of its operations.

4. For the purpose of carrying on some business, which may be conveniently or advantageously combined with the existing business.

5. For the purpose of abandoning any of the objects specified in the memorandum.

6. For the purpose of selling the whole or any part of the undertaking.

7. For the purpose of amalgamating with any other company.

III. Alteration of Liability Clause in Memorandum of Association

The liability clause can be altered only when a public company is converted to a private company.

IV. Alteration of Capital Clause in Memorandum of Association

A company can alter its capital clause by passing an ordinary resolution in a general meeting. Alteration of capital may relate to:

- Sub division of shares

- Consolidation of shares

- Conversion of shares into stock and cancellation of unsubscribed capital.

Within thirty days of passing a resolution, the altered Articles and Memorandum have to be submitted to the Registrar.

V. Alteration of subscription clause in Memorandum of Association

The company can alter is subscription clause to make the liability of the directors appointed subsequent to the alteration as unlimited.

Key Takeaways

- The Memorandum of Association of a company is an important corporate document in India. A Memorandum of Association (moa) represents the charter of the company.

Articles of Association is a written document of company that contain the by-laws that regulate the operations and functioning of the company like the appointment of directors and handling of financial records to name a few. As per Section 2 (5) of the Companies Act, 2013, Articles of Association have been defined as “the Articles of Association (AOA) of a company originally framed or altered or applied in pursuance of any previous company law or this Act.” Sec 5 of the Companies Act, 2103 states that the Articles of association:

- Must include the regulations for the management of the company

- Include matters that have been prescribed under the rules

- They do not prevent a company from including additional matter in the AOA or from doing any alterations as may be considered necessary for the functioning of the company affairs.

Contents of the Articles of Association

The AOA contains the rules and by-laws for the following;

- Share capital: Rights of various shareholders, share certificates, payment of a commission, etc.

- Lien of shares

- Calls on shares

- The process for the transfer of shares

- Transmission of shares

- Forfeiture of shares

- Surrender of shares

- Process for conversion of shares to stocks

- Share warrants

- Alteration of capital: Increase, decrease, or rearrangement of capital

- General meetings and proceedings

- Voting rights of members

- The appointment, remuneration, qualifications, powers of directors, etc.

- Proceedings of the boards of directors meetings

- Dividends and reserves

- Accounts and Audits

- Borrowing Powers of the company

- Provisions relating to the winding up of the company

Forms of Articles of Association (AOA)

The forms for Articles of Association (AOA) in tables F, G, H, I and J for different types of companies have been mentioned under Schedule I of the Companies Act, 2013. AOA must be in the respective form.

- Table F- AOA of a company limited by shares

- Table G- AOA of a company limited by guarantee and having a share capital

- Table H- AOA of a company limited by guarantee and not having a share capital

- Table I- AOA of an unlimited company and having a share capital

- Table J- AOA of an unlimited company and not having a share capital

Alteration of Articles

Sec. 31 of the Companies Act, 1956, provides that a company may by passing a special resolution alter regulations contained in its Articles any time subject to

a) the provisions of the Companies Act and

b) Conditions contained in the Memorandum of Association [Section 31(1)].

A copy of every special resolution altering the Articles shall be filed in Form no 23, with the Registrar within 30 days its passing and attached to every copy of the Articles issued thereafter. The fundamental right of a company to alter its articles is subject to the following limitations:

a) The alteration must not exceed the powers given by the Memorandum of Association of the company or conflict with the provisions thereof.

b) It must not be inconsistent with any provisions of Companies Act or any other statute.

c) It must not be illegal or against public policies

d) The alteration must be bona fide for the benefit of the company as a whole.

e) It should not be a fraud on minority, or inflict a hardship on minority without any corresponding benefits to the company as a whole.

f) The alternation must not be inconsistent with an order of the court. Any subsequent alteration thereof which of inconsistent with such an order can be made by the company only with the leave of the court.

g) The alteration cannot have retrospective effect. It can operate only from the date of amendment.

h) If a public company is converted into a private company, then the approval of the Central Government is necessary. Printed copies of altered articles should be filed with the Registrar within one month of the date of Central Government’s approval. [Section 31 (2A)].

i) An alteration that has the effect of increasing the liability of a member to contribute to the company is not binding on a present member unless he has agreed thereto in writing.

j) A reserve liability once created cannot be undone but may be cancelled on a reduction of capital.

k) An assumption by the Board of Directors of a company of any power to expel a member by amending its Articles is illegal or void.

Procedures for Alteration of Articles of Association

For effecting alteration to the articles of association, the following procedures is required to be followed-

1. Take the necessary decision by convening a Board Meeting to change all or any of the existing Articles of Association and fix up the day, time, place and agenda for a general meeting for passing special resolution to effect the change.

2. See that any such change in the Articles of the company conforms to the provisions of the companies Act, 1956 and the conditions contained in the Memorandum of Association of the company.

3. See that any such change does not increase the liability of any member who has become so before the alteration to contribute to the share capital of or otherwise to pay money to, the company.

4. See that any such change does not have the effect of converting a public company into a private company. If such is the case, then make an application to the Central Government for such alteration.

5. See that any such change does not provide for expulsion of a member by the company.

6. Issue notices for the General Meeting proposing the Special resolution and explaining inter alia, in the explanatory Statement the implication and reasons of the changes being proposed.

7. If the shares of the company are enlisted with any recognised Stock Exchange, then forward copies of all notices sent to the shareholders with respect to change in the Articles of Association to the Stock Exchange.

8. Hold the General Meeting and pass the special resolution.

9. File with the stock exchange with which your company is enlisted six copies of such amendments as soon as the company adopts it in General Meeting. Out of the six copies, one copy must be a certified true copy.

10. Forward promptly to the Stock Exchange with which your company is enlisted three copies of the notice and a copy of the proceedings of the General Meeting.

11. File the Special resolution with the concerned Registrar of companies with explanatory statement in Form No.23 within thirty days of its passing after payment of the requisite filing fee in cash as per Schedule X. If the Articles of Association have been completely or substantially changed, file a new printed copy of the Articles after paying the requisite fee in cash prescribed under Schedule X to the Companies Act, 1956. Payments upto Rs.50/-

12. Effect the changes in all copies of the articles of association.

13. Any alteration so made be as valid as if originally contained in the Articles of Association and be subject to alteration by Special Resolution as above.

14. If the articles are altered pursuant to an order of the Company law Board made under section 397 or 398 then see that such alterations are not inconsistent with the said and if it is so then obtain first leave of the Company Law Board to make such alteration.

Key Takeaways

- Articles of association is a written document of company that contain the by-laws that regulate the operations and functioning of the company like the appointment of directors and handling of financial records to name a few.

The Companies Act, 2013 defines a prospectus under section 2(70). Prospectus can be defined as “any document which is described or issued as a prospectus”. This also includes any notice, circular, advertisement or any other document acting as an invitation to offers from the public. Such an invitation to offer should be for the purchase of any securities of a corporate body. For any document to considered as a prospectus, it should satisfy two conditions-

- The document should invite the subscription to public share or debentures, or it should invite deposits.

- Such an invitation should be made to the public.

- The invitation should be made by the company or on the behalf company.

- The invitation should relate to shares, debentures or such other instruments.

Types of the prospectus as follows-

- Red Herring Prospectus

- Shelf Prospectus

- Abridged prospectus

- Deemed Prospectus

Shelf Prospectus

Shelf prospectus can be defined as a prospectus that has been issued by any public financial institution, company or bank for one or more issues of securities or class of securities as mentioned in the prospectus. When a shelf prospectus is issued then the issuer does not need to issue a separate prospectus for each offering he can offer or sell securities without issuing any further prospectus. The provisions related to shelf prospectus has been discussed under section 31 of the Companies Act, 2013. The regulations are to be provided by the Securities and Exchange Board of India for any class or classes of companies that may file a shelf prospectus at the stage of the first offer of securities to the registrar. The prospectus shall prescribe the validity period of the prospectus and it should be not be exceeding one year. This period commences from the opening date of the first offer of the securities. For any second or further offer, no separate prospectus is required. While filing for a shelf prospectus, a company is required to file an information memorandum along with it.

Red herring prospectus

Red herring prospectus is the prospectus which lacks the complete particulars about the quantum of the price of the securities. A company may issue a red herring prospectus prior to the issue of prospectus when it is proposing to make an offer of securities. This type of prospectus needs to be filed with the registrar at least three days prior to the opening of the subscription list or the offer. The obligations carried by a red herring prospectus are same as a prospectus. If there is any variation between a red herring prospectus and a prospectus then it should be highlighted in the prospectus as variations. When the offer of securities closes then the prospectus has to state the total capital raised either raised by the way of debt or share capital. It also has to state the closing price of the securities. Any other details which have not been included in the prospectus need to be registered with the registrar and SEBI. The applicant or subscriber has right under Section 60 B (7) to withdraw the application on any intimation of variation within 7 days of such intimation and the withdrawal should be communicated in writing.

Key Takeaways

- The companies act, 2013 defines a prospectus under section 2(70). Prospectus can be defined as “any document which is described or issued as a prospectus”.

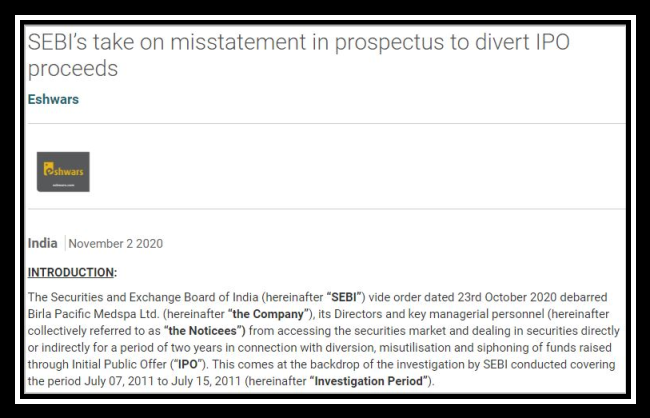

Misstatement in a prospectus occurs when an untrue or misleading statement is included and issued in the prospectus. Any deletion and inclusion of any matter which misleads the public is also a misstatement under Section 34 of this Act. For instance, and statement which gives the incorrect location of the company’s office is misstatement in the prospectus or any statement offering shares misleads the public is a misstatement in a prospectus. Misleading representation includes –

- Any untrue statement

- Statements implicating wrong impression

- Mis-leading statements

- Not disclosing true facts

- Omission of data

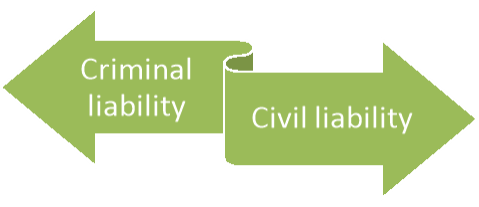

Liability for misstatement within the prospectus

The one who gives the consent and signs the prospectus is to blame for any misstatement in a prospectus. The Managers, CS and also the Directors of the corporation are answerable for the same. However, mere signing won’t result in liability for misstatement if the person who signed the prospectus is neither a Manager nor draws salary from that company. There are two types of liability for misstatement in prospectus-

Figure: Types of liability for misstatement in prospectus

Criminal liability for misstatement in prospectus

When any statement within the prospectus includes misleading or untrue information is distributed then everyone who authorized the issue of the prospectus is liable under section 447 of the Companies Act.

Who may be sued in criminal liability for any misstatement in the prospectus?

The people who can be sued are –

- The company that issues the prospectus.

- Every Director of the company.

- Every person whose name appeared in the prospectus as a proposed Director of the company.

- Every Promoter of the prospectus.

- Every person who authorized the issue of the prospectus.

- Any expert such as an engineer, a chartered accountant, a company secretary, a cost accountant, etc.)

Civil liability for misstatement

Section 62 of the Companies Act deals with civil liability and makes the actual person responsible to pay every single individual who has contributed for any share or debentures and could have grieved any damages by believing the prospectus where false and misleading information has been published. Every person and the company is liable who-

- Is a director when the prospectus was issued

- Named as the director or authorized himself or has agreed to become a director

- The promoter of the corporation

- Has authorized the issue of the prospectus

Remedies for misstatements in prospectus

Remedies for civil liability

There are two remedies available against company:

1. Revocation of the Contract– The person who purchased the securities can cancel the contract. The money will be refunded to him, which he paid to the company.

2. Damages for Fraud– After revocation, the shareholders can claim damages from the company by filing a case in the court.

Remedies against the Directors, promoters and the authorized persons who issued the prospectus:

1. Damages for misstatement– Compensation will be given to the shareholders for the loss by the directors, promoters and the authorized persons.

2. Damages for non-disclosure- Fine of Rs. 50000 ad recovering the damages must be given by the people who mislead the purchasers from the one that is chargeable for the damages.

Remedies for criminal liability

1. Imprisonment up to 2 years or Rs. 50000 fine must beard by the people that mislead.

2. Person who knowingly issued a misstatement is punishable for imprisonment up to 5 years or with a fine Rs. 100000 or both.

Key Takeaways

- Misstatement in a prospectus occurs when an untrue or misleading statement is included and issued in the prospectus. Any deletion and inclusion of any matter which misleads the public is also a misstatement under section 34 of this act.

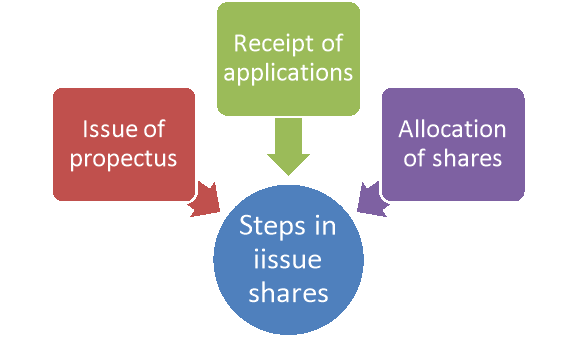

The issue of shares is the procedure in which enterprises allocate new shares to the shareholders. Shareholders can be either corporates or individuals. The enterprise follows the rules stipulated by Companies Act 2013 while circulating the shares. The Issue of Prospectus, Receiving Applications, Allocation of Shares are 3 key fundamental steps of the process of issuing the shares. The significant steps in the process of issue of shares are given below:

Figure: Steps in issue of shares

- Issue of Prospectus: The enterprise initially issues the prospectus to the public generally. The prospectus is an appeal to the public that a new enterprise has come into the presence and it would require funds for operating the trading concern. It comprises of complete data regarding the enterprise and the way in which the money is to be collected from the prospective investors.

- Receipt of Applications: When the prospectus is circulated to the public, prospective investors contemplating to sign up and subscribe the share capital of the enterprise would make an application along with the application money and deposit it with a scheduled bank as mentioned in the prospectus.

- Allocation of shares: Once the minimum subscription has been done, the shares can be allocated. Normally, there is always oversubscription of shares, so the allocation is done on pro-rata ground. Letters of Allotment are sent out to those people who have been allocated their part of shares. This results in an authentic contract between the enterprise and the claimant, who will now be a part-owner of the enterprise.

Allotment of shares

The term 'Allotment' has nowhere been defined; in the Companies Act. It may be said that allotment is an appropriation by the Board of directors of a certain number of shares to a specified person in response to his application. In other words, allotment means the appropriation out of the previously un-appropriated capital of a company, of a certain number of shares to a person.

Notice of Allotment

An allotment is the acceptance of an offer to take shares by an applicant, and like any other acceptance, it must 5e communicated. There can be no binding contract unless the acceptance of the offer is properly communicated. Thus, notice of allotment must be given to the allottee. If the letter of allotment is properly posted i.e., it is correctly addressed and stamped, a contract will arise even if the letter of allotment is delayed or lost in the course of transit. In this letter of allotment, besides other details of the number of shares applied for, the number of shares allotted etc., the allottee is asked to pay the money due on allotment to the company's bankers within a specified time unless there is partial allotment and the allotment money is appropriated out of the excess application money.

Rules regarding Allotment of Shares

The rules regarding allotment of shares can be discussed under the two broad headings - (a)general rules and (b) the legal rules.

a) General Rules

The general rules relating to valid acceptance of an offer must be followed. The general rules regarding allotment of shares are as follows:

i) The allotment must be made by proper authority:

It is the duty of the Board of' directors to allot the shares. However, the Board may delegate this authority to some other person or persons as per the provisions of the articles of association. Allotment of Shares made by an improper authority will make it void.

Ii) The allotment should be made within a reasonable time:

The offer to purchase shares of the company must be accepted within a reasonable time otherwise the applicants may refuse to take shares because after a reasonable time the offer lapses. What is the 'reasonable time' is a question of fact in each case.

Iii) It must be communicated:

The allotment of shares should be communicated to the applicants. Posting of a properly addressed and stamped letter of allotment will be taken as a valid communication.

Iv) It must be absolute and unconditional

The allotment of shares must conform to the terms and conditions of the application. If the allotment is not according to the terms and conditions, the applicant may refuse to accept the shares even though allotment has been made to him. If the conditions are not fulfilled, the applicant, must reject the shares promptly. His silence or acceptance will debar him from this right.

Forfeiture of shares

Forfeiture of shares is referred to as the situation when the allotted shares are cancelled by the issuing company due to non-payment of the subscription amount as requested by the issuing company from the shareholder. In the event of forfeiture of shares, the shareholder loses the rights and interests of being a shareholder and ceases to be a member of the organisation. Some shareholders might fail to pay instalments, viz., allocation of money or call money. In such a scenario:

- Their share will be forfeited, which means that the shareholder’s share will be cancelled.

- All the entries associated with the forfeited stocks, apart from those associated with premium, already mentioned in the accounting records must have conversed.

- The share capital account is debited with the amount called-up.

The following rules are applicable relating to the forfeiture of shares:

i) The power to forfeit shares must be given in the articles of the company.

Ii) Shares can be forfeited only for non-payment of calls. A forfeiture on any other ground is invalid.

Iii) The company must serve a proper notice on the defaulting member asking him to pay the amount within a fixed period, failing which the shares shall be forfeited. The shareholder must be given at least fourteen days’ notice to pay the amount. The notice must indicate the exact amount to be paid. If there is a slight defect in the notice, the forfeiture will become invalid. Allotment or shares.

Iv) The Board of directors must pass a resolution for the forfeiture of shares. v) The power for forfeiture must be exercised in good faith and for the benefit of the company.

Effects of Forfeiture

a) The shareholder ceases to be a member of the company in respect of such shares. He loses all his rights. The money paid on such shares is forfeited. On forfeiture, his name is removed from the register of members.

b) The shareholder cannot be sued by the company for unpaid calls. The articles of the company may, however, make him liable for the unpaid calls. Any action must be taken within three years from the date of forfeiture.

c) The former shareholder can be placed on the 'B' list of contributories, if the company is wound up within twelve months of the date of forfeiture.

d) After forfeiture, the shares become the property of the company and the company can dispose them of in any manner it likes. Generally, the forfeited shares are reissued.

Calls on shares

A call may be defined as a demand by the company on the shareholders to pay whole or part of the balance remaining unpaid on each share, made at any time during the ' life-time of the company.

Essentials of a Valid Call

According to Section 36(2) of the Act, the unpaid money on a share is a debt due from member. Therefore, once a call has been made, the shareholder is under an obligation to pay the amount called. But the liability to pay this debt or call will not arise until a valid call has been made. The essentials of a valid call are as follows:

i) He calls must be made under a resolution of the Board of directors, me resolution must be passed in a properly convened meeting of the directors,

Ii) The resolution must specify the amount of call, and the time and place of payment of calls.

Iii) Call should be made on a uniform basis, on all shares, falling under the same class i.e., no differentiation should be made between shareholders of the same class.

Iv) The power to make call is in the nature of trust and therefore, the directors must exercise this power in good faith and for the benefit of the company. The directors should not make calls for their own benefit, if it is for their own benefit, it shall be an invalid call.

v) The call must be made according to the provisions of the articles of association, some of the rules are:

a) The maximum amount per call shall not be more than 25 per cent of the nominal value of shares.

b) There must be at least one month's interval between two calls.

c) At least fourteen days' notice must be given to each member.

d) The directors have the discretion to revoke or postpone a call. If a call is made in contravention to the rules mentioned above, it is termed as an invalid call and the shareholders are not bound to pay it.

Issue of sweat capital

‘Sweat equity shares’ are such equity shares, which are issued by a Company to its directors or employees at a discount or for consideration, other than cash, for providing their know-how or making available rights in the nature of intellectual property rights or value additions, by whatever name called. Sweat equity shares is one of the modes of making share-based payments to employees of the company. The issue of sweat equity shares allows the company to retain the employees by rewarding them for their services. Sweat equity shares rewards the beneficiaries by giving them incentives in lieu of their contribution towards the development of the company.

There are certain conditions that need to be fulfilled by the company before issuing sweat equity shares.

- A special resolution is passed for authorizing the issue of sweat equity share.

- The Listed companies have to follow the provisions of SEBI for the issue of Sweat equity shares while the unlisted company can issue as per Section 54 of the Companies Act, 2013.

- These shares can be issued by the company after the expiry of one year from the date of commencement of business.

The company can issue sweat equity shares up to:

Fifteen percent of the existing paid-up capital.

Rs 5 Crore (Subject to 25 percent of the paid-up capital of the company).

The Sweat Equity shares must be issued with a lock-in period of three years.

The facts need to be mentioned, such as the shares are locked in along with the expiry of the lock-in period in the share certificate.

The shares must be issued at a fair price.

The amount of sweat equity shares should be treated as managerial remuneration in case it fulfils the following conditions:

If it is issued to the Director or manager.

If they are issued for non-cash consideration.

The details regarding the issue and allotment of sweat equity shares must be mentioned in the Board report with the following details-

Class of Directors.

Class of Shares.

Number id issued shares.

The formula used for valuation.

Percentage of Sweat equity shares of the total post-issue paid-up capital.

Consideration received or benefits to the company.

If the shares are issued for non-cash consideration, it should be treated in the books of account of the company:

When it takes the form of a depreciable asset, it must be noted in the Balance sheet.

While in other cases, it is treated as expense according to the accounting standard.

Key Takeaway

- The issue of shares is the procedure in which enterprises allocate new shares to the shareholders. Shareholders can be either corporates or individuals. The enterprise follows the rules stipulated by companies act 2013 while circulating the shares.

Section 2(37) of the Companies Act, 2013 defines employees stock option as the option given to the directors, employees or officers of the company or of its holding or subsidiary company, the right to purchase or benefit or subscribe for the shares of the company at a predetermined price on a future date. The Employee Stock Option Plan (ESOP) is an employee benefit plan. It is issued by the company for its employees to encourage employee ownership in the company. The shares of the companies are given to the employees at discounted rates. Any company can issue ESOP. All companies other than listed companies should issue it in accordance with the provisions of the Companies Act, 2013 and Companies (Share Capital and Debentures) Rules, 2014. In the case of listed companies, they should issue in accordance with Securities and Exchange Board of India Employee Stock Option Scheme Guidelines.

Rule 12(1) of Companies (Share Capital and Debentures) Rules, 2014 states that ESOP can be issued to the following employees-

- A permanent employee of the company who is working in India or outside India.

- A Director of the company, including a whole-time or part-time director but not an independent director.

- A permanent employee or director of a subsidiary company in India or outside India, or holding company, or an associate company.

A company cannot issue ESOP to the following employees-

An employee who is belonging to the promoter group or is a promoter of the company.

A director who either himself or through anybody corporate or through his relative holds more than ten per cent of the outstanding equity shares of the company, whether directly or indirectly.

A bonus issue, also known as a scrip issue or a capitalization issue, is an offer of free additional shares to existing shareholders. A company may decide to distribute further shares as an alternative to increasing the dividend pay-out. Regulatory framework for issuance of bonus shares:

- In Case of Unlisted Company:

a) Section 63 of Companies Act, 2013 and

b) Rule 14 of Companies (Share Capital and Debentures) Rules, 2014.

2. In Case of Listed Company: SEBI (ICDR) Regulations, 2009

Sources for issuance of bonus share:

Section 63 provides that a company may issue fully paid-up bonus shares to its members, out of-

1. Its free reserves;

2. The securities premium account; or

3. Capital redemption reserve account.

CONDITIONS FOR ISSUE OF BONUS SHARE:

The following conditions must be satisfied before issuing bonus shares:

1. Issue of Bonus Shares is authorized by its articles;

2. Bonus Shares are being issued on the recommendation of the Board and been authorized in the general meeting of the company;

3. The Company has not defaulted in payment of interest or principal in respect of fixed deposits or debt securities issued by it;

4. The company has not defaulted in respect of the payment of statutory dues of the employees, such as, contribution to provident fund, gratuity and bonus;

5. The partly paid-up shares, if any outstanding on the date of allotment, are made fully paid-up;

6. It complies with such conditions as may be prescribed.

Key Takeaways

- Section 2(37) of the companies act, 2013 defines employees stock option as the option given to the directors, employees or officers of the company or of its holding or subsidiary company, the right to purchase or benefit or subscribe for the shares of the company at a predetermined price on a future date.

Transfer of Shares

– Transfer of shares is a voluntary act that takes place by way of contract between transferor and transferee.

– Transfer deed is executed in transfer of shares.

– Transfer of shares refers to the transfer of title to shares, voluntarily, by one party to another.

– Adequate consideration is involved under this contract.

– Liabilities of transferor cease on the completion of transfer.

– Stamp duty is involved under transfer and payable on the market value of shares.

Main Provisions Relating to Transmission of Shares

- Person eligible to apply for transmission: The survivors in case of joint holding can get the shares transmitted in their names by production of the death certificate of the deceased holder of shares. In other words, in case of joint holding, the survivor or survivors shall only be entitled for registration and the legal heir of the deceased member shall have no right or claims.

- Share transfer deed not required for Transmission: Execution of transfer deed not required in case of transmission of shares. Intimation/application of Transmission accompanied with relevant documents would be enough for valid transmission request.

- Documents required for Transmission of Shares: In case of transmission of shares by operation of law, it is not necessary to execute and submit transfer deed. A simple application to the company by a legal representative along with the following documents:

a. Certified copy of death certificate;

b. Succession certificate; (Required only in case “Will” is not available).

c. Probate;

d. Specimen signature of the successor.

- Liability on shares shall continue: In case of transmission of shares, shares continue to be subject to the original liabilities, and if there was any lien on the shares for any sums due, the lien would subsist, notwithstanding the devaluation of the shares.

- Payment of consideration or stamp duty not required: Since the transmission is by operation of law, payment of consideration or payment of stamp duty would not be required on instrument of transmission.

- Time limit for issue of share certificate on transmission: Every company, unless prohibited by any provision of law or order of any Court, Tribunal or other authority, shall, within one month deliver the certificates of all shares transmitted after the application for the registration of the transmission of any such shares received. As per section 56 (4) of companies act 2013, every company shall, unless prohibited by any provision of law or any order of Court, Tribunal or other authority, deliver the certificates of all securities transmitted within a period of one month from the date of intimation of transmission under sub-section (2) in case of transmission of securities.

- Time Limit for Refusal of registration of Transmission: Provisions related to Refusal of registration and appeal against refusal is given in Section 58 of the Companies Act, 2013.Power of refusal to register transmission of shares is to be exercised by the company within thirty (30) days from the date on which the intimation of transmission is delivered to the company.

- Time Limit for appeal against refusal to register Transmission by Public Company: As per section 58(4), the person who gave intimation of the transmission by operation of law may, within a period of sixty (60) days of such refusal or where no intimation has been received from the company, within ninety (90) days of the delivery of the intimation of transmission, appeal to the Tribunal against such refusal.

Transmission of Shares

– Transmission of shares means the transfer of title to shares by the operation of law.

– It is initiated by legal heir or receiver.

– No transfer deed is involved in transmission of shares.

– No adequate consideration is involved under this contract.

– Original liability of shares continues to exist.

– No stamp duty is payable.

Procedures to be followed for Transmission of Shares:

1. The survivor in case of joint holding or legal heir, as the case may be, for transmission of shares by operation of law in his/her favour shall file a simple application with the Company with relevant documents such as death certificate, succession certificate, probate, etc., depending upon various circumstances as may be considered for transmission of shares by the Company.

2. The company records the particulars of the death certificate and a reference number of recording entry is given to the shareholder so as to enable him/her to quote such number in all future correspondence with the company.

3. The company review and verify the documents submitted with transmission request. If all the documents are in order, company shall approve the transmission request and register the shares in the name of the survivor or legal heir as the case may be.

4. The company shall within thirty (30) days, from the date on which the intimation of transmission is delivered to the company, communicate refusal to the concerned person in case documents submitted with transmission request are not in order.

5. Dividend declared before the death of the shareholder will be payable to legal representative but dividend declared after the death of a member can be paid to him only after registration of his name and till that period it has to be kept in abeyance.

Key Takeaways

- Transfer of shares is a voluntary act that takes place by way of contract between transferor and transferee.

- Transmission of shares means the transfer of title to shares by the operation of law.

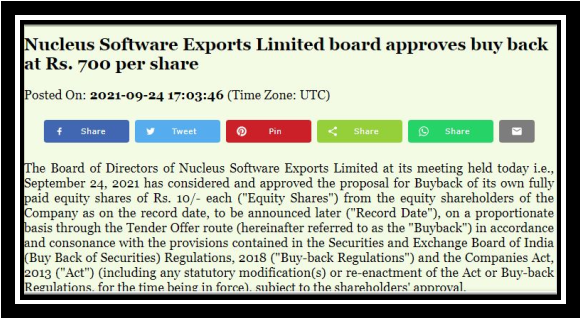

Buy back of shares means buying its own shares in the market. Section 68 of the Companies Act, 2013 empowers a company to purchase its own shares or other securities in certain cases. Sections 68 to 70 of the Companies Act, 2013 and Rule 17 of the Companies (Share Capital and Debentures) Rules, 2014 deal with buy-back of shares. A company may purchase its shares out of:

- Its free reserves;

- The securities premium account; or

- The proceeds of the issue of any shares or other specified securities.

However, no buy-back of any kind of shares can be made out of the proceeds of an earlier issue of the same kind of shares.

Provisions for Buy-Back of Shares

- Authorization for Buy-Back:

Articles of Association (AOA) of the company should authorize Buy-Back, if no provision in AOA, then first alter the AOA.

2. Approval:

The Buy-back can be made with the approval of the Board of directors at a board meeting and/or by a special resolution (SR) passed by shareholders in general meeting, depending on the quantum of buy back: Approval of Board of Directors- up to10% of the total paid-up equity capital and free reserves of the company. Approval of Shareholders- up to25% of the aggregate of paid-up capital and free reserves of the company.

3. Notice of General Meeting:

The notice of the meeting at which the special resolution is proposed to be passed shall be accompanied by an explanatory statement in which the particulars required to be mentioned as per section 68(3) [a to e] and Rule 17(1) [a to n] of Companies (Share Capital and Debentures) Rules, 2014 should be disclosed.

4. Methods of Buy-Back:

The Buy-back of shares of private & unlisted public companies may be:

from the existing shareholders on a proportionate basis;

by purchasing the securities issued to employees of the company pursuant to a scheme of stock option or sweat equity.

5. Letter of Offer (Form SH-8):

Before the buy-back of shares, the company shall file with the Registrar of Companies a Letter of Offer in e-form SH-8 and the Letter of Offer shall be dispatched to the shareholders immediately after filing the same with the Registrar of Companies but not later than 20 days from its filing with the Registrar of Companies ensuring the matters as prescribed in the Sub-rule 10 of Rule 17 of The Companies (Share Capital and Debentures) Rules, 2014.

6. Declaration of Solvency (Form SH-9): The company shall file with the Registrar of Companies, along with the letter of offer, a declaration of solvency in e-Form SH-9.

7. Offer Period: The offer for buy back shall remain open for a minimum period of 15 days but not more than 30 days from the date of dispatch of letter of offer. (Period may be less than 15 days, if all the members agree.)

8. Debt-equity Ratio: The ratio of the aggregate of secured and unsecured debts owed by the company after buy-back shall not be more than twice the paid-up capital and its free reserves.

9. Fully Paid-up Shares: Shares to be bought back must be fully paid up.

10. Time limits: Buy-back shall be completed within a period of 1 (one) year from the date of passing of SR or Board Resolution, as the case may be. No offer of buy-back shall be made within a period of one year from the date of the closure of the preceding offer of buy-back, if any.

11. Acceptance of Offer: In case the number of shares offered by the shareholders is more than the total number of shares to be bought back by the company, the acceptance per shareholder shall be on proportionate basis out of the total shares offered for being bought back.

12. Verification: The company shall complete the verifications of the offers received within fifteen days from the date of closure of the offer and the shares lodged shall be deemed to be accepted unless a communication of rejection is made within twenty-one days from the date of closure of the offer.

13. Separate Bank Account: After the closure of the buy-back offer, the company shall immediately open a separate bank account and deposit therein, such sum, as would make up the entire sum due and payable as consideration for the shares tendered for buy-back.

14. Payment: Within 7 days from the date of verification of the offers:

- Make payment of consideration in cash to those shareholders whose shares have been accepted.

- Return the share certificates to those shareholders whose shares are not accepted at all or the balance of shares, if partly accepted.

15. Extinguishment of Shares: The company shall Extinguish and physically destroy the shares bought back within 7 days of the last date of completion of buy back.

16. Prohibition on further issue of shares: The company shall not make a further issue of the same kind of shares including allotment of new shares under Clause (a) of Sub-section (1) of Section 62 within a period of six months except by way of a bonus issue or in the discharge of subsisting obligations such as conversion of warrants, stock option schemes, sweat equity or conversion of preference shares or debentures into equity shares.

17. Register of Buy-Back (Form SH-10): The Company shall maintain a register of shares which has been bought back in Form SH-10.

18. Return of Buy-Back (Form SH-11): The Return of Buy back with the Registrar in Form SH-11 on completion of buy back along with the certificate in Form SH-15 certifying that the buy-back of shares has been made in compliance with the provisions of the Act and rules within 30 days of such completion.

19. Capital Redemption Reserve Account: If the buy-back of shares is made out of free reserves or securities premium account a sum equal to the nominal value of the shares so purchased shall be transferred to the capital redemption reserve account and details of such transfer shall be disclosed in the balance sheet and the amount of the said reserve may be applied by the company, in paying up unissued shares of the company to be issued to members of the company as fully paid bonus shares.

20. Punishment: If a company makes any default in complying with the provisions of Section 68, then the punishment shall be as follows:

Company Fine not less than Rupees One Lakh but which may extend to Rupees Three Lakh.

Every officer Imprisonment for a term which may extend to three years or with fine which shall not be less than Rupees One Lakh, but which may extend to Rupees Three Lakh, or with both.

Key Takeaways

- Buy back of shares means buying its own shares in the market. Section 68 of the companies act, 2013 empowers a company to purchase its own shares or other securities in certain cases.

References:

- Gowar, LCB, Principles of Modern Company Law, Stevens & sons, Londan.

- Hanningan, Brenda, Company Law, Oxford University Press, U.K

- MC Kuchhal Corporate Laws, Shri Mahaveer Book Depot. (Publishers)

- J.P. Sharma, An Easy Approach to Corporate Laws, Anne Books Pvt. Ltd., New Delhi

- Ramaiya, A Guide to Companies Act, LexisNexis, Wadhwa and Buttersworth

- Kannal, S. AND V.S. Sworirajan, Company Law Procedure, Taxman Allied Services(P) Ltd., New Delhi

- Singh, Harpal. Indian Company Law, Galgotia Publishing, New Delhi

- Companies Act and Corporate Laws, Bharat Law House Pvt. Ltd, New Delhi