Unit - 1

Financial Management

Financial Management is managerial activity which is concerned with the planning and controlling of the firm’s financial resources. Financial management also refers to the effective planning, organising, and controlling of monetary resources. Financial management primarily includes decisions and considerations regarding the size of investments, sources and range of use for capital, and the extent of profit earned from the same. It generally involves applying different management techniques to an enterprise’s financial resources to maximise profits.

Definitions:

Howard and Uptron define Financial Management “as an application of general managerial principles to the area of financial decision-making”.

Weston and Brighem define Financial Management “as an area of financial decision making, harmonizing individual motives and enterprise goal”.

Nature of financial management

The nature of financial management includes the following –

Figure: Functions of financial management

- Estimates capital requirements

Financial management helps in anticipation of funds by estimating working capital and fixed capital requirements for carrying business activities.

2. Decides capital structure

Proper balance between debt and equity should be attained, which minimizes the cost of capital. Financial management decides proper portion of different securities (common equity, preferred equity and debt).

3. Select source of fun

Source of fund is one crucial decision in every organisation. Every organisation should properly analyse various source of funds (shares, bonds, debentures etc.) and must select appropriate funds which involves minimal risk.

4. Selects investment pattern

Before investing the amount, the investment proposal should be analysed and properly evaluates its risk and returns.

5. Raises shareholders value

It aims to increase the amount of return to its shareholders by decreasing its cost of operations and increase in profits.

Finance manager should focus on raising the funds from different sources and invest them in profitable avenues.

6. Management of cash

Finance manager observes all cash movements (inflow and outflow) and ensures they should face any deficiency or surplus of cash.

7. Apply financial controls −

Implying financial controls helps in keeping the company actual cost of operation within limits and earning the expected profits. There different approaches involved like developing certain standards for business in advance, comparing the actual cost or performances with pre-established standards and taking all require remedial measures.

Scope of financial management

Financial management is applicable in different areas of management that facilitates effective management of fund in the organisation. The scope of financial management is discussed below-

Figure: Scope of financial management

- Investment decision –

Investment decision is also known as capital budgeting. Investment decisions are related to investment in fixed assets. It may be long term and short term.

Figure: Types of investment decision

- Long-term investment decisions allow committing funds towards resources like fixed assets. Long-term investment decisions determine the performance of a business and its ability to achieve financial goals over time.

- Short-term investment decisions or working capital financing decisions mean committing funds towards resources like current assets. It occupies funds for a shorter period, including investments in inventory, liquid cash, etc. Short-term investment decisions directly affect the liquidity and performance of an organisation.

2. Financing decision –

Financing decision involves the possible sources of raising finances. The financial manager estimates the requirement of funds and accordingly determines the sources of raising the required funds. They are of 2 different types –

Figure: Financial decisions

- Financial planning decisions attempt to estimate the sources and possible application of accumulated funds. A proper financial planning decision is crucial to ensure the availability of funds whenever required.

- Capital structure decisions involve identifying various sources of funds. It involves decisions regarding the combination of owned capital and borrowed capital. It facilitates the selection of the best external sources for short or long-term financial requirements.

3. Dividend decision –

It involves decisions taken with regards to net profit distribution profits. It involves decisions regarding-

- Dividend for the shareholders.

- Retained profits (usually depends on a particular company’s expansion and diversification plans).

Figure: Dividend decision

Objectives of Financial management

There are mainly two objectives of financial management-

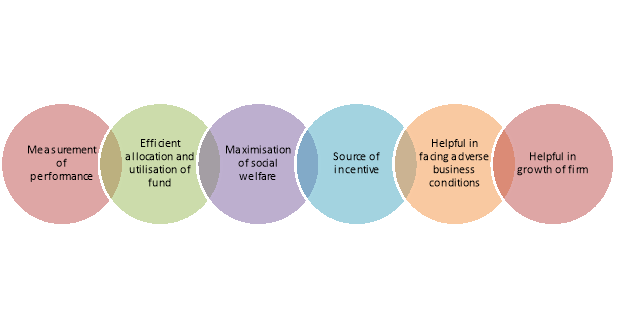

Figure: Objectives of financial management

(1) Profit Maximization:

According to this approach, all activities which increase profits should be undertaken and which decrease profits should be avoided. Profit maximization implies that the financial decision making should be guided by only one test, which is, select those assets, projects and decisions which are profitable and reject those which are not.

The following arguments are advanced in favour of this approach:

(i) Measurement of Performance

Profit is a test of economic efficiency of a business. It is a yardstick by which the economic performance of a business can be judged.

(ii) Efficient Allocation and Utilisation of Resources

Profit maximization leads to efficient allocation and utilisation of scarce resources of the business because sources tend to be directed to uses from less profitable projects to more profitable projects.

(iii) Maximisation of Social Welfare

Profitability is essential for fulfilling the goal of social welfare also. Maximization of profits leads to the maximization of social welfare.

(iv) Source of Incentive

Profit acts as a motivator or incentive which induces a business organisation to work more efficiently. If profit motive is withdrawn the pace of development will be reduced.

(v) Helpful in Facing Adverse Business Conditions

Economic and business conditions go on changing from time to time. There may be adverse business conditions like recession, severe competition etc. Under adverse circumstances a business will be able to survive only if it has some past earnings to rely upon. Hence, a business should maximize its profits when the circumstances are favourable.

(vi) Helpful in the Growth of the Firm

Profits are the major source of finance for the growth of a firm.

However, the profit maximization approach has been criticised on several grounds:

Figure: Disadvantages of profit maximisation

(i) Ambiguous:

One practical difficulty with this approach is that the term profit is vague and ambiguous. Different people take different meanings of term profit. For example, profit may be short-term or long-term, it may be before tax or after tax, and it may be total profit or rate of profit. Similarly, it may be returned on total capital employed or total assets or shareholders’ funds and so on.

(ii) Ignores the Time Value of Money:

This approach ignores the time value of money, i.e., it does not make a distinction between profits earned over the different years. It ignores the fact that the value of one rupee at present is greater than the value of the same rupees received after one year. Similarly, the value of profit earned in the first year will be more in comparison to the equivalent profits earned in later years.

(iii) Ignores Risk Factor:

This approach ignores the risk associated with the earnings. If the two firms have the same total expected earnings, but if earnings of one firm fluctuate considerably as compared to the other, it will be more risky.

Investors in general, have a preference for a lower income with less risk in comparison to high income with greater risk. But this approach does not pay any attention to the risk factor.

(iv) Ignores Future Profits:

The business is not solely run with the objective of maximising immediate profits. Some firms place more importance on growth of sales. They are willing to accept lower profits to achieve stability provided by a large volume of sales.

(v) Ignores Social Obligations of Business:

This approach ignores the social obligations of business to various social groups like workers, consumers, society, Government etc. A firm cannot exist for long when interests of social groups are ignored because these groups contribute to its smooth run.

(vi) Neglects the Effects of Dividend Policy on Market Price of the Shares:

Under this approach the firm may not think of paying dividends because retaining profit in the business may satisfy the goal of maximising the earning per share.

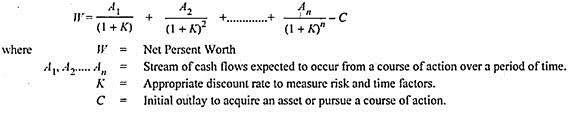

(2) Wealth Maximization:

This approach is now universally accepted as an appropriate criterion for making financial decisions as it removes all the limitations of profit maximization approach. It is also known as net present value (NPV) maximization approach. According to this approach the worth of an asset is measured in terms of benefits received from its use less the cost of its acquisition. Benefits are measured in terms of cash flows received from its use rather than accounting profit which was the basis of measurement of benefits in profit maximization approach. Measuring benefits in terms of cash flow avoids the ambiguity in respect of the meaning of the term profit. Another important feature of this approach is that it also incorporates the time value of money. While measuring the value of future cash flows an allowance is made for time and risk factors by discounting or reducing the cash flows by a certain percentage. This percentage is known as discount rate. The difference between the present value of future cash inflows generated by an asset and its cost is known as net present value (NPV). A financial action (or an asset or a project) which has a positive NPV creates wealth for shareholders and, therefore, is undertaken. On the other hand, a financial action resulting in negative NPV should be rejected since it would reduce shareholder’s wealth. If one out of various projects is to be chosen, the one with the highest NPV is adopted. Hence, the shareholder’s wealth will be maximized if this criterion is followed in making financial decisions.

The NPV can be calculated with the help of the following formula:

It has the following advantages in its favour:

(1) It uses cash flows instead of accounting profits which avoids the ambiguity regarding the exact meaning of the term profit.

(2) It gives due importance to the time value of money by reducing the future cash flows by an appropriate discount or interest rate. If higher risk and longer time period are involved, higher rate of discount or interest will be used to find out the present value of future cash benefits. The discount or interest rate will be lower for the projects which involve low risk.

(3) It gives due importance to payment of regular dividends – In this approach financial decisions are taken in such a way that the shareholders receive the highest combination of dividends and increase in the market price of the shares.

(4) It gives due importance to risk factor and analyses risk and uncertainty so that the best course of action can be selected out of different alternatives.

(5) It gives due importance to social responsibilities of the business.

(6) It takes into consideration long-run survival and growth of the firm.

Key takeaways

- Financial Management is managerial activity which is concerned with the planning and controlling of the firm’s financial resources. Financial management also refers to the effective planning, organising, and controlling of monetary resources.

The differences between profit maximisation and wealth maximisation are highlighted below-

Sr. No. | Profit maximisation | Wealth maximisation |

| It is short term objective. | It is long term objective. |

2. Time value of money | It takes into account time value of money. | It does not take into account time value of money. |

3. Risk | It does not consider risk factor. | It considers the risk factor. |

4. Objective | It focuses on large of amount of profit. | Its objective is to achieve highest market value of common stock. |

5. Usage | It helps in achieving a larger value of a company’s worth, which may reflect in the increased market share of the company. | It helps in achieving efficiency in the company’s day-to-day operations to make the business profitable. |

Time value of money is defined as “the value derived from the use of money over time as a result of investment and reinvestment”. Time value of money means that “worth of a rupee received today is different from the worth of rupee to be received in future”. The preference for money now, as compared to future money is known as time preference of money. “Time value of money means that the value of a sum of money received today is more than its value received after some time”, conversely the sum of money received in future is less valuable than it is to-day. The whole set of financial decisions (whether financing decision or investment decision) hinges on the fact that the value of one rupee today is not equal to the value of one rupee at the end of one year or at the end of second year. In other words, we cannot assume that the value of rupee remains the same. This is known as ‘Time Value of Money’.

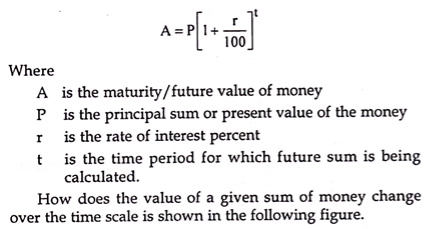

The whole process can be explained as follows:

Suppose the rate of interest is 10 percent per annum.

If we receive a sum of Rs. 500 now, it will earn an interest of Rs. 50 in one year and will become equal to Rs. 550 after 1 year. The same sum will earn an interest of Rs. 55 in the second year and will become equal to Rs. 605 after two years. How this money grows at different points of time can be calculated by the following compound interest formula?

In the above figure, different values are given at different time periods. These are all values of the same Rs. 500 at different points of time, assuming the rate of interest to be 10 per cent per annum. The amount of Rs. 500 becomes Rs. 550 after one year, 605 after two years and 805.26 after 5 years. In terms of valuation all sums have equal value.

All these values have been calculated by the above-mentioned compound interest formula. This, well known compound interest formula, can be modified a little to make our working more convenient. Instead of using ‘r’ as rate per cent, we use the symbol ‘i’ to indicate rate per rupee.

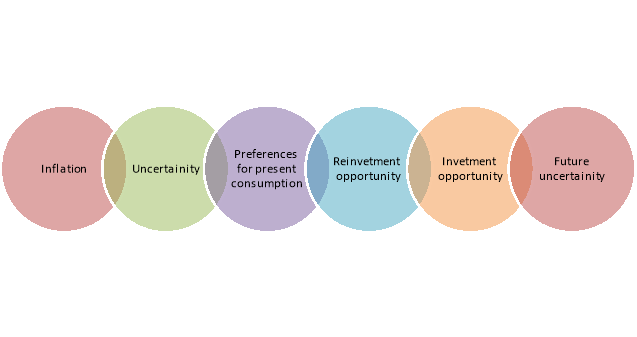

Importance of time value of money

The importance of time value of money is discussed below-

Figure: Importance of time value of money

(i) Inflation

Because of inflationary conditions, the rupee today has a higher purchasing power than rupee in future. As a result, those who have to receive the money prefer to receive the same as early as possible, while those who have to pay the money try to delay the payment.

(ii) Uncertainty

Since the future is characterised by uncertainty, individuals/business concerns prefer to have current income rather than having the same payment at a later date. They have an apprehension that the party making the payment may default due to insolvency or other reasons.

(iii) Preference for Present Consumption

Both due to uncertainty and inflationary conditions, individuals prefer the consumption to future consumption. They do not wish to save for the future by curtailing current consumption.

(iv) Opportunities for reinvestment

Money can be employed to generate real returns. Individual’s business concerns reinvest the money at a certain rate so as to have some yield on it.

(v) Preference for Consumption:

Most people have preference for present consumption over future consumption of goods and services either because of the urgency of their present wants or because of the risk of not being in a position to enjoy future consumption that may be caused by illness or death, or because of inflation.

(vi) Investment Opportunities:

Most individuals prefer present cash to future cash because of the available investment opportunities to which they can put present cash to earn additional cash.

(vii) Future Uncertainties:

One of the reasons for preference of current money is that there is a certainty about it whereas the future money has an uncertainty. There may be chances that the other party (the creditor) may become insolvent.

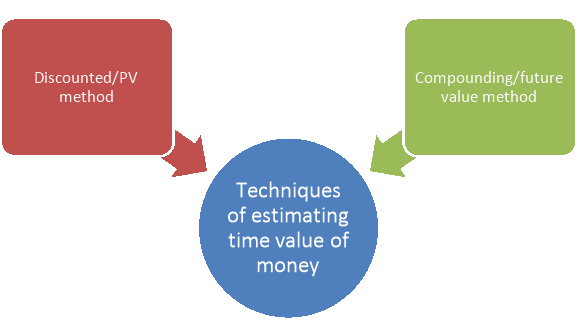

There are two techniques of estimating time value of money

The techniques of estimating time value of money are discussed below-

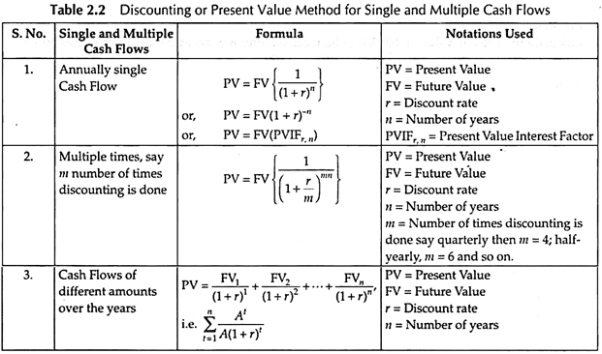

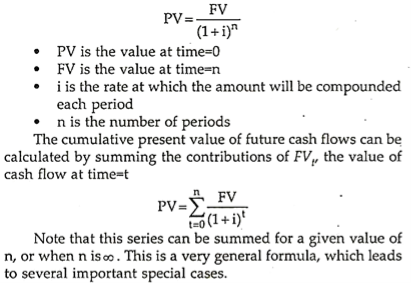

1. Discounting or Present Value Method:

The current value of an expected amount of money to be received at a future date is known as Present Value. If we expect a certain sum of money after some years at a specific interest rate, then by discounting the Future Value we can calculate the amount to be invested today, i.e., the current or Present Value.

Hence, Discounting Technique is the method that converts Future Value into Present Value. The amount calculated by Discounting Technique is the Present Value and the rate of interest is the discount rate.

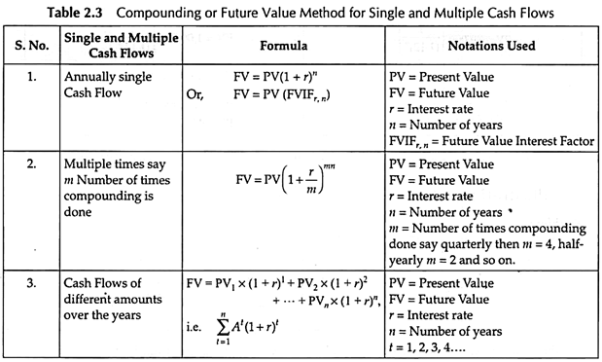

2. Compounding or Future Value Method:

Compounding is just the opposite of discounting. The process of converting Present Value into Future Value is known as compounding. Future Value of a sum of money is the expected value of that sum of money invested after n number of years at a specific compound rate of interest.

Time Value of Money – Formula for Calculating Present and Future Value of Money

A. Present Value:

i. Present Value of a Future Sum:

The present value formula is the core formula for the time value of money; each of the other formulae is derived from this formula.

For example- the annuity formula is the sum of a series of present value calculations.

The Present Value (PV) formula has four variables, each of which can be solved for

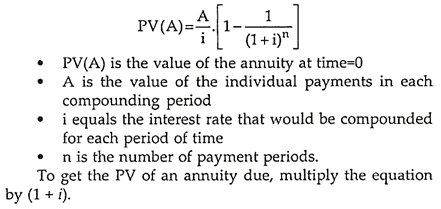

Ii. Present Value of an Annuity for n Payment Periods:

In this case the cash flow values remain the same throughout the n periods. The present value of an annuity formula has four variables, each of which can be solved for –

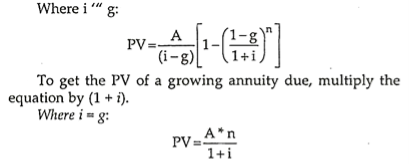

Iii. Present Value of a Growing Annuity:

In this case each cash flow grows by a factor of (1+g). Similar to the formula for an annuity, the present value of a growing annuity (PVGA) uses the same variables with the addition of g as the rate of growth of the annuity (A is the annuity payment in the first period). This is a calculation that is rarely provided for on financial calculators.

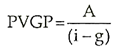

Iv. Present Value of a Growing Perpetuity:

When the perpetual annuity payment grows at a fixed rate (g) the value is theoretically determined just as to the following formula. In practice, there are few securities with precise characteristics, and the application of this valuation approach is subject to various qualifications and modifications.

Most importantly, it is rare to find a growing perpetual annuity with fixed rates of growth and true perpetual cash flow generation. Despite these qualifications, the general approach may be used in valuations of real estate, equities, and other assets.

This is the well-known Gordon Growth model used for stock valuation.

Present Value of Perpetuity:

B. Future Value:

i. Future Value of a Present Sum:

The Future Value (FV) formula is similar and uses the same variables.

FV = PV. (1 + i)n

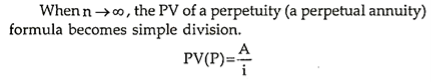

Ii. Future Value of an Annuity:

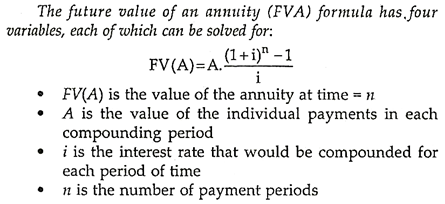

Iii. Future Value of a Growing Annuity:

Key takeaways

- Time value of money is defined as “the value derived from the use of money over time as a result of investment and reinvestment”. Time value of money means that “worth of a rupee received today is different from the worth of rupee to be received in future”.

Risk is the variability in the expected return from a project. In other words, it is the degree of deviation from expected return. Risk is associated with the possibility that realized returns will be less than the returns that were expected. So, when realizations correspond to expectations exactly, there would be no risk.

i. Elements of Risk:

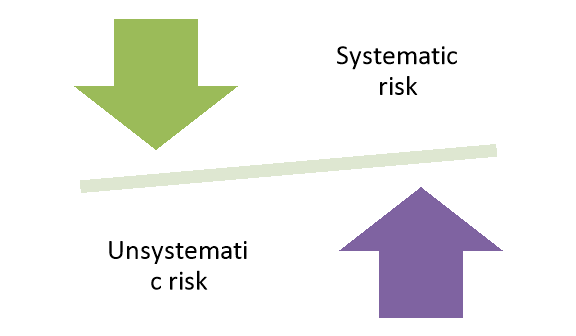

Various components cause the variability in expected returns, which are known as elements of risk. There are broadly two groups of elements classified as systematic risk and unsystematic risk.

Figure: Types of risk

a) Systematic Risk:

Business organizations are part of society that is dynamic. Various changes occur in a society like economic, political and social systems that have influence on the performance of companies and thereby on their expected returns. These changes affect all organizations to varying degrees. Hence the impact of these changes is system-wide and the portion of total variability in returns caused by such across the board factors is referred to as systematic risk. These risks are further subdivided into interest rate risk, market risk, and purchasing power risk.

b) Unsystematic Risk:

The returns of a company may vary due to certain factors that affect only that company. Examples of such factors are raw material scarcity, labour strike, management inefficiency, etc. When the variability in returns occurs due to such firm-specific factors it is known as unsystematic risk. This risk is unique or peculiar to a specific organization and affects it in addition to the systematic risk. These risks are subdivided into business risk and financial risk.

Ii. Measurement of Risk:

Quantification of risk is known as measurement of risk.

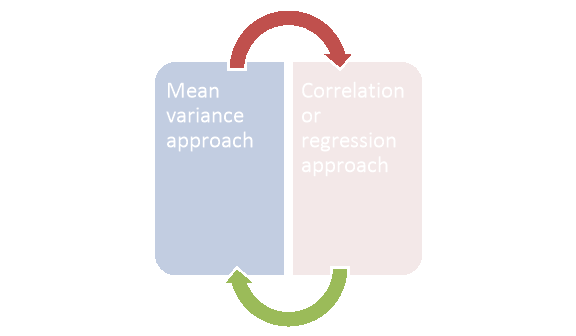

Two approaches are followed in measurement of risk:

Figure: Risk measurement approach

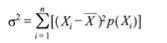

(i) Mean-variance approach, and

Mean-variance approach is used to measure the total risk, i.e., sum of systematic and unsystematic risks. Under this approach the variance and standard deviation measure the extent of variability of possible returns from the expected return and is calculated as:

Where, Xi = Possible return,

P = Probability of return, and

n = Number of possible returns.

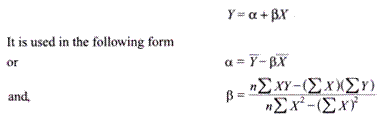

(ii) Correlation or regression approach

Correlation or regression method is used to measure the systematic risk. Systematic risk is expressed by β and is calculated by the following formula:

Where, rim = Correlation coefficient between the returns of stock i and the return of the market index,

σm = Standard deviation of returns of the market index, and

σi = Standard deviation of returns of stock i.

Using regression method, we may measure the systematic risk.

The form of the regression equation is as follows:

Where, n = Number of items,

Y = Mean value of the company’s return,

X = Mean value of return of the market index,

α = Estimated return of the security when the market is stationary, and

β = Change in the return of the individual security in response to unit change in the return of the market index.

Concept of Return:

Return can be defined as the actual income from a project as well as appreciation in the value of capital. Thus, there are two components in return—the basic component or the periodic cash flows from the investment, either in the form of interest or dividends; and the change in the price of the asset, commonly called as the capital gain or loss. The term yield is often used in connection to return, which refers to the income component in relation to some price for the asset. The total return of an asset for the holding period relates to all the cash flows received by an investor during any designated time period to the amount of money invested in the asset. It is measured as:

Total Return = Cash payments received + Price change in assets over the period /Purchase price of the asset. In connection with return we use two terms—realized return and expected or predicted return. Realized return is the return that was earned by the firm, so it is historic. Expected or predicted return is the return the firm anticipates to earn from an asset over some future period.

Case study

- Somnath Ltd. Is engaged in the business of export of garments. In the past, the performance of the company had been upto the expectations. In line with the latest technology, the company decided to upgrade its machinery. For this, the Finance Manager, Dalmia estimated the amount of funds required and the timings. This will help the company in linking the investment and the financing decisions on a continuous basis. Dalmia therefore, began with the preparation of a sales forecast for the next four years. Fie also collected the relevant data about the profit estimates in the coming years. By doing this, he wanted to be sure about the availability of funds from the internal sources of the business. For the remaining funds he is trying to find out alternative sources from outside.

2. Ramnath Ltd. Is dealing in import of organic food items in bulk. The company sells the items in smaller quantities in attractive packages. Performance of the company has been up to the expectations in the past. Keeping up with the latest packaging technology, the company decided to upgrade its machinery. For this, the Finance Manager of the company, Mr. Vikrant Dhull, estimated the amount of funds required and the timings. This will help the company in linking the investment and the financing decisions on a continuous basis. Therefore, Mr. Vikrant Dhull began with the preparation of a sales forecast for the next four years. He also collected the relevant data about the profit estimates in the coming years. By doing this, he wanted to be sure about the availability of funds from the internal sources. For the remaining funds he is trying to find out alternative sources.

References:

- Horne, J.C Van and Wackowich. Fundamentals Of Financial Management.9th Edition New Delhi Prentice Hall of India.

- Levy H and M. Sarnat, Principles of Financial Management. Engelwood Ciiffs, Prentice Hall.

- Johnson, RW Financial Management Boston Allyn and Bacon.

- Joy, O.M. Introduction to Financial Management Homewood: Irwin.

- Khan And Jain. Financial Management Text Problems. 2nd Edition, Tata Mc Graw Hill New Delhi.