Unit - 2

Capital Budgeting

Capital Budgeting is one of the appraising techniques of investment decisions. Capital Budgeting is defined as the firm‘s decision to invest its current funds most efficiently in long term activities in anticipation of an expected flow of future benefits over a series of years.

Charles. T. Horngreen defined capital budgeting as ― “Long term planning for making and financing proposed capital out lay”.

According to Keller and Ferrara, ― “Capital Budgeting represents the plans for the appropriation and expenditure for fixed asset during the budget period”.

Robert N. Anthony defined as ― “Capital Budget is essentially a list of what management believes to be worthwhile projects for the acquisition of new capital assets together with the estimated cost of each product.”

The capital budgeting involves the following steps-

Figure: Capital budgeting process

A) Project identification:

The first step towards capital budgeting is to identify a project for investments. Such projects may be addition of a new product line or expanding the existing one, increase the production or reduce the costs of outputs etc.

B) Project Screening and Evaluation:

In this step the manager conduct research about a project for evaluation of viability of project. This has to match the objective of the firm to maximize its market value. The tool of time value of money comes handy in this step. Also, the estimation of the benefits and the costs needs to be done. The total cash inflow and outflow along with the uncertainties and risks associated with the proposal has to be analysed thoroughly and appropriate provisioning has to be done for the same.

C) Project Selection:

There is no such defined method for the selection of a proposal for investments as different businesses have different requirements. That is why, the approval of an investment proposal is done based on the selection criteria and screening process which is defined for every firm keeping in mind the objectives of the investment being undertaken. Once the proposal has been finalized, the different alternatives for raising or acquiring funds have to be explored by the finance team. This is called preparing the capital budget. The average cost of funds has to be reduced. A detailed procedure for periodical reports and tracking the project for the lifetime needs to be streamlined in the initial phase itself. The final approvals are based on profitability, Economic constituents, viability and market conditions.

D) Implementation:

Money is spent and thus proposal is implemented. The different responsibilities like implementing the proposals, completion of the project within the requisite time period and reduction of cost are allotted. The management then takes up the task of monitoring and containing the implementation of the proposals.

E) Performance review:

The final stage of capital budgeting involves comparison of actual results with the standard ones. The unfavourable results are identified and removing the various difficulties of the projects helps for future selection and execution of the proposals.

Key takeaways

- Capital Budgeting is one of the appraising techniques of investment decisions. Capital Budgeting is defined as the firm ‘s decision to invest its current funds most efficiently in long term activities in anticipation of an expected flow of future benefits over a series of years.

Cash flow estimation is necessary to estimate the cash flow in analysing the investment proposal. While analysing the cash flow, it is also necessary to estimate the cash outflow as well as cash inflow. Estimation of the net cash flow in an investment project should cover the following procedures:

Figure: Process of cash flow estimation

Step 1: Determination of Net Investment or Net Cash Outlay or Initial Cash Outlay.

Initial investment or start-up costs are net cash outflows at present cost. It refers to the sum of all cash outflows and cash inflows occurring at zero time periods. Net investment refers to the amount of which will be required for the acquisition of fixed assets. Thus, initial investment of a new fixed assets or project comprises cost, freight, installation charges, custom duty etc. Determination of net investment in replacement case is different than investment of new proposal

Step 2: Determination of annual net cash inflow or cash inflow after tax:

It is second step of capital budgeting which is determined after the determination of net cash outflow of investment proposal. In this step, net cash inflow is determined during the life of the project. It is called net cash inflow or cash flow after tax. It is determined on the basis of accounting for cash flow concept. To determine the net cash inflow, interest amount is not included.

Step 3: Determination of net cash inflow for the final year:

Final year net cash flow may be different due to course of working capital and salvage value of assets. If working capital is invested in initial stage, less in net cash outflow and plus in final year net cash inflow. It is called release of working capital. If working capital is reduced in initial year, plus in net cash outflow and less is final year net cash inflow. Similarly, final year net cash inflow is affected by salvage value of assets. If salvage value of assets is not given, CFAT is effected only by working capital. The tax is adjusted on profit or loss on sales of assets.

Methods of cash flow estimation

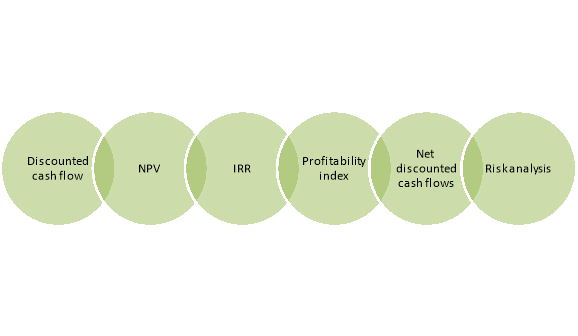

Cash flow estimates are used to determine the economic viability of long-term investments. The cash flows of a project are estimated using discounted and non-discounted cash flow methods.

Figure: Methods of cash flow estimation

- Discounted Cash Flows

Discounted cash flow, or DCF, methods account for the time value of money when determining the viability of projects. This time value is the change in the purchasing power of the dollar over time. The DCF methods also indicate the opportunity cost -- that is, the consequences of forgoing alternative investments to make the chosen investment. The main types of DCF methods are net present value, internal rate of returns and the profitability index.

2. Net Present Value

Net present value, or NPV, is the difference between an investment’s present value of cash inflows and its present value of cash outflows. The cash flow estimates are determined using a market-based discount rate, also known as a hurdle rate, which accounts for the time value of money. NPV expresses the wealth generation impact of an investment in dollar terms. The rule of thumb is to accept capital investments with positive cash flows and reject the ones with negative cash flows. This is because a positive NPV confirms that the investment’s cash flow will sufficiently compensate its costs, the cost of financing and the underlying cash flow risks.

3. Internal Rate of Return

Internal rate of return, or IRR, is the rate at which an investment is expected to generate earnings during its useful life. IRR is actually the discount rate that pushes the NPV to zero. This is more or less the discount rate at which the present value of cash outflows equals the present value of cash inflows. Accept a capital investment if the IRR is greater than the cost of capital, and reject it if the IRR is lower than the cost of capital.

4. Profitability Index

The profitability index, or PI, is the ratio of an investment’s NPV. It shows the ratio of the present value of cash inflows to the present value of cash outflows. This method facilitates the ranking of investments, especially when dealing with mutually exclusive investments or rationed capital resources. Accept a capital investment when the PI is greater than 1, and reject it when the PI is less than 1.

5. Non-discounted Cash Flows

Non-DCF methods do not account for the time value of money; they assume the value of the dollar will remain constant over the economic life of a capital investment. The payback period, or PBP, is the only non-DCF method that uses cash flow estimations. PBP is the duration it takes to recover the initial capital of an investment. Investments with short PBP are preferred over investments with longer PBP. However, this method has major shortcomings, because it does not show the timing of cash flows and the time value of money.

6. Risk Analysis

Risk analysis is the process of evaluating the nature and scope of expected and unexpected setbacks that may derail the achievement of investment goals. A capital budgeting risk is the likelihood of a long-term investment failing to generate the expected cash flows. Such risks arise from imperfections in future cash flow estimates, a situation that exposes your business to possibilities of embracing loss-making capital investments. Always analyse such probable risks and apply the appropriate risk premiums -- that is, the applicable rate of returns you should earn for embracing the extra risks.

Key takeaways

- Cash flow estimation is necessary to estimate the cash flow in analysing the investment proposal. While analysing the cash flow, it is also necessary to estimate the cash outflow as well as cash inflow.

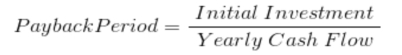

Payback Period Method

It is the most popular and widely recognized traditional methods of evaluating the investment proposals. It can be defined as the number of years to recover the original capital invested in a project. The payback period can be used as accept or reject criterion as well as a method of ranking projects. The payback period is the number of years to recover the investment made in a project. If the payback period calculated for a project is less than the maximum payback period set-up by the company, it can be accepted. As a ranking method it gives the highest rank to a project which has the lowest payback period, and the lowest rank to a project with the highest payback period. Whenever a company faces the problem of choosing among two or more mutually exclusive projects, it can select a project on the basis of payback period, which has shorter period than the other projects. The formula for calculation of payback period method is-

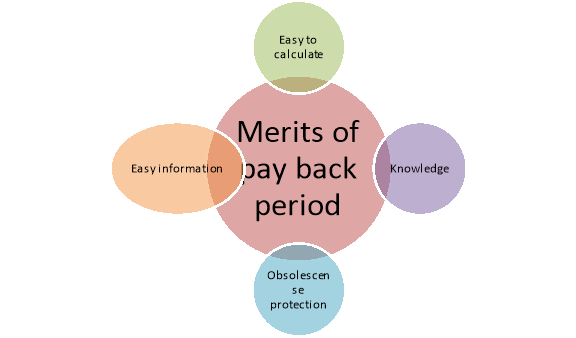

The following are the merits of the payback period method:

Figure: Advantages of pay back method

(i) Easy to calculate: It is one of the easiest methods of evaluating the investment projects. It is simple to understand and easy to compute.

(ii) Knowledge: The knowledge of payback period is useful in decision-making, the shorter the period better the project.

(iii) Protection from loss due to obsolescence: This method is very suitable to such industries where mechanical and technical changes are routine practice and hence, shorter payback period practice avoids such losses.

(iv) Easily availability of information: It can be computed on the basis of accounting information, what is available from the books.

The payback period method has certain demerits:

(i) Failure in taking cash flows after payback period: This method is not taking into account the cash flows received by the company after the payback period.

(ii) Not considering the time value of money: It does not take into account the time value of money.

(iii) Non-considering of interest factor: It does not take into account the interest factor involved in the capital outlay.

(iv) Maximisation of market value not possible: It is not consistent with the objective of maximizing the market value of share.

(v) Failure in taking magnitude and timing of cash inflows: It fails to consider the pattern of cash inflows i.e., the magnitude and timing of cash inflows.

Accounting Rate of Return

This technique uses the accounting information revealed by the financial statements to measure the profitability of an investment proposal. It can be determined by dividing the average income after taxes by the average investment. According to Soloman, Accounting Rate of Return can be calculated as the ratio, of average net income to the initial investment. On the basis of this method, the company can select all those projects whose ARR is higher than the minimum rate established by the company. It can reject the projects with an ARR lower than the expected rate of return. This method also helps the management to rank the proposal on the basis of ARR.

Accounting Rate of Return (ARR) = Original Investment Average Net Income

OR

Accounting Rate of Return (ARR) = Average Investment Average Net Income

The following are the merits of ARR method:

(i) It is very simple to understand and calculate;

(ii) It can be readily computed with the help of the available accounting data;

(iii) It uses the entire stream of earnings to calculate the ARR.

This method has the following demerits:

(i) It is not based on cash flows generated by a project;

(ii) This method does not consider the objective of wealth maximization;

(iii) It ignores the length of the projects useful life;

(iv) If does not take into account the fact that the profile can be re-invested; and

(v) It ignores the time value of money.

Net Present Value (NPV)

The net present value method is a classic method of evaluating the investment proposals. It is one of the methods of discounted cash flow techniques, which recognizes the importance of time value of money. It correctly postulates that cash flows arising at time periods differ in value and are comparable only with their equivalents i.e., present values. It is a method of calculating the present value of cash flows (inflows and outflows) of an investment proposal using the cost of capital as an appropriate discounting rate. The net present value will be arrived at by subtracting the present value of cash outflows from the present value of cash inflows. Steps to compute net present value:

(i) Estimation of future cash inflows

(ii) An appropriate rate of interest should be selected to discount the cash flows. Generally, this will be the ―cost of capital‖ of the company, or required rate of return.

(iii) The present value of inflows and outflows of an investment proposal has to be computed by discounting them with an appropriate cost of capital.

(iv) The net value is the difference between the present value of cash inflows and the present value of cash outflows.

The formula for the net present value can be written as:

NPV= C1 /(1+k)1 + C2 / (1+K)2 +C3 /(1+k)3 +…………. Cn /(1+K)n – I

Where,

C = Annual Cash inflows,

Cn = Cash inflow in the year n

K = Cost of Capital

I = Initial Investment

The following are the merits of the net present value (NPV) methods:

(i) Consideration to total Cash Inflows: The NPV methods considers the total cash inflows of investment opportunities over the entire life-time of the projects unlike the payback period methods.

(ii) Recognition to the Time Value of Money: This method explicitly recognizes the time value of money, which is investable for making meaningful financial decisions.

(iii) Changing Discount Rate: Due to change in the risk pattern of the investor different discount rates can be used.

(iv) Best decision criteria for Mutually Exclusive Projects: This Method is particularly useful for the selection of mutually exclusive projects. It serves as the best decision criteria for mutually exclusive choice proposals.

(v) Maximisation of the Shareholders Wealth: Finally, the NPV method is instrumental in achieving the objective of the maximization of the shareholders’ wealth. This method is logically consistent with the company’s objective of maximizing shareholders’ wealth in terms of maximizing market value of shares, and theoretically correct for the selections of investment proposals.

The following are the demerits of the net present value method:

(i) It is difficult to understand and use.

(ii) The NPV is calculated by using the cost of capital as a discount rate. But the concept of cost of capital itself is difficult to understand and determine.

(iii) It does not give solutions when the comparable projects are involved in different amounts of investment.

(iv) It does not give correct answer to a question when alternative projects of limited funds are available, with unequal lives.

Internal Rate of Return (IRR)

The internal rate of return method is also a modern technique of capital budgeting that takes into account the time value of money. It is also known as ‘time adjusted rate of return’ discounted cash flow’ ‘discounted rate of return,’ ‘yield method,’ and ‘trial and error yield method’.

In the net present value method, the net present value is determined by discounting the future cash flows of a project at a predetermined or specified rate called the cut-off rate. But under the internal rate of return method, the cash flows of a project are discounted at a suitable rate by hit and trial method, which equates the net present value so calculated to the amount of the investment.

Under this method, since the discount rate is determined internally, this method is called as the internal rate of return method. The internal rate of return can be defined as that rate of discount at which the present value of cash-inflows is equal to the present value of cash outflows.

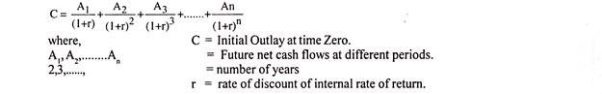

It can be determined with the help of the following mathematical formula:

Internal Rate of Return (IRR)

The internal rate of return method is also a modern technique of capital budgeting that takes into account the time value of money. It is also known as ‘time adjusted rate of return’ discounted cash flow’ ‘discounted rate of return,’ ‘yield method,’ and ‘trial and error yield method’.

In the net present value method, the net present value is determined by discounting the future cash flows of a project at a predetermined or specified rate called the cut-off rate. But under the internal rate of return method, the cash flows of a project are discounted at a suitable rate by hit and trial method, which equates the net present value so calculated to the amount of the investment.

Under this method, since the discount rate is determined internally, this method is called as the internal rate of return method. The internal rate of return can be defined as that rate of discount at which the present value of cash-inflows is equal to the present value of cash outflows.

The following steps are required to practice the internal rate of return method:

(1) Determine the future net cash flows during the entire economic life of the project. The cash inflows are estimated for future profits before depreciation but after taxes.

(2) Determine the rate of discount at which the value of cash inflows is equal to the present value of cash outflows. This may be determined as explained after step (4).

(3) Accept the proposal if the internal rate of return is higher than or equal to the minimum required rate of return, i.e., the cost of capital or cut off rate and reject the proposal if the internal rate of return is lower than the cost of cut-off rate.

(4) In case of alternative proposals select the proposal with the highest rate of return as long as the rates are higher than the cost of capital or cut-off-rate.

Advantages of Internal Rate of Return Method

(i) Like the net present value method, it takes into account the time value of money and can be usefully applied in situations with even as well as un even cash flow at different periods of time.

(ii) It considers the profitability of the project for its entire economic life and hence enables evaluation of true profitability.

(iii) The determination of cost of capital is not a pre-requisite for the use of this method and hence it is better than net present value method where the cost of capital cannot be determined easily.

(iv) It provides for uniform ranking of various proposals due to the percentage rate of return.

(v) This method is also compatible with the objective of maximum profitability and is considered to be a more reliable technique of capital budgeting.

Disadvantages of Internal Rate of Return Method:

(i) It is difficult to understand and is the most difficult method of evaluation of investment proposals.

(ii) This method is based upon the assumption that the earnings are reinvested at the internal rate of return for the remaining life of the project, which is not a justified assumption particularly when the average rate of return earned by the firm is not close to the internal rate of return. In this sense, Net Present Value method seems to be better as it assumes that the earnings are reinvested at the rate of firm’s cost of capital.

(iii) The results of NPV method and IRR method may differ when the projects under evaluation differ in their size, life and timings of cash flows.

Key takeaways

- It is the most popular and widely recognized traditional methods of evaluating the investment proposals. It can be defined as the number of years to recover the original capital invested in a project.

- This technique uses the accounting information revealed by the financial statements to measure the profitability of an investment proposal. It can be determined by dividing the average income after taxes by the average investment.

- The net present value method is a classic method of evaluating the investment proposals. It is one of the methods of discounted cash flow techniques, which recognizes the importance of time value of money.

- The internal rate of return method is also a modern technique of capital budgeting that takes into account the time value of money. It is also known as ‘time adjusted rate of return’ discounted cash flow’ ‘discounted rate of return,’ ‘yield method,’ and ‘trial and error yield method’.

Case study

Need to grasp SME capital budgeting

Conducive policies have to be framed not only to provide funds to small firms but also to help them in the management of cash resources

The lifeline of any business is finance. The allocation and usage of funds — technically known as capital budgeting — is one of the most important strategic decisions of any business. But is this decision different for small firms as compared to large ones? The allocation of capital in small enterprises is often more important than in large firms — given their lack of access to capital markets — as the funds necessary to correct a mistake may not be available. Also, big firms allocate capital to numerous projects, so a mistake in one can be offset by success in others.

While capital investment is a relevant area for small firms, the majority of studies conducted during the past four decades have focused on the capital budgeting decisions of large enterprises and similar evidence does not exist for small organisations. Therefore, little is known about the capital budgeting practices of small businesses. Given the proportion and importance of small companies in economies the world over and their constant motivation for more efficient use of resources to remain competitive, there is a definite need for information on the methods used by small firms to accumulate and allocate their scarce capital.

The Small and Medium Enterprises (SME) sector is the backbone of any growing economy and is recognised as the engine of growth — accounting for about 70 per cent of employment and significantly contributing to the Gross Domestic Product (GDP). The contribution of this sector can be seen from the statistics provided by the Confederation of Indian Industry (CII) which shows that it contributes about 6.11 per cent to the manufacturing GDP and 24.6 per cent to the GDP from services. Further, it has a 45 per cent share in the overall exports from India and provides employment to around 120 million people. It manufactures more than 8,000 diverse products, ranging from low-tech items to technologically-advanced ones. Globally, 99.7 per cent of all enterprises in the world are SMEs and the balance 0.3 per cent are large-scale enterprises.

The SME sector in India accounts for 95 per cent of all industrial units. Since this sector is critically important for any economy, proper financial management is of utmost importance for its survival. It is a known fact that financial problems are often a major cause for the failure of small businesses. The two major problems, undercapitalisation and the difficulty in getting external finance support, are often related to poor fiscal management. Poor and in some cases lack of proper financial record-keeping close the avenues of small firms to avail from traditional lending sources as these businesses cannot demonstrate their financial viability.

Many SMEs in the start-up phase, underestimate the cost of operating a business and thus fail to manage the cash flow and the amount of operating capital required. Several studies have attempted to establish the existence of the association between SME performance and specific financial practices. The evidence suggests that successful financial performance by SMEs have a positive association with effective management of financial matters, such as planning, maintenance of financial records, obtaining external finance, professional finance advice and other factors.

The capital budgeting theory is based on certain assumptions like maximisation of shareholders’ wealth by investing in all positive Net Present Value (NPV) projects and rejecting those with negative NPV; and access to perfect financial markets, allowing it to finance all value-enhancing projects. However, applicability of these assumptions to small firms may be doubtful. The separation principle, that states that investment decisions can be made independent of shareholders’ tastes and preferences, does not hold for closely-held and small businesses. Under the NPV technique, the projects are accepted if the NPV is positive, that is, if the cash outflows are less than the present values of future cash inflows discounted at the firm’s cost of capital. However, since shares of small firms are not readily marketable, market determined discount rates are inappropriate in small businesses. One of the most important differences between capital budgeting for large and small companies is that in the former decisions can be made independently of stockholders’ view but in the latter, it is essential that owners be involved in the decision-making process.

Small firms also face difficulty in raising funds from the capital markets. In fact, shortage of equity and long-term funds continue to halt the growth of SMEs in the country. In addition, research shows that small companies are not able to access bank loans because of their information-opaqueness and lack of strong banking relationships.

Furthermore, for some small enterprises, it is impossible to raise funds through a public issue and for others it may be prohibitively expensive. The above-mentioned cash constraints encourage the small enterprises to maintain sufficient cash balances to be ready for any potentially attractive investment opportunity.

Although the SME sector contributes to the overall economy in a major way, over the past four decades financial research has limited itself to understanding the capital budgeting techniques preferred by large organisations and studied the usage of sophisticated tools like NPV, Internal Rate of Return (IRR), Profitability Index (PI) and easy tools like payback.

In research conducted on 333 small firms in India, it became evident that small businesses in the country employ less sophisticated methods to analyse potential investments than those recommended by the capital budgeting theory. In particular, survey results show these firms use Discounted Cash Flow (DCF) analysis less frequently than “gut feel”, payback period and accounting rate of return.

Although 46 per cent of the respondents have advanced professional degrees, they may not be financially literate and their small management team may not be competent enough to undertake a capital budgeting analysis. Additionally, employing an outside consultant to implement the DCF techniques may prove to be a costly affair for small firms.

Since the capital projects are relatively smaller in size, it may not be economical to sustain the cost of analysing them. This suggests that small firms with small projects may be making sense when they depend on less sophisticated techniques or on the owners’ “gut feel”. Since small firms are concerned with basic survival, they tend to be cash-oriented and therefore may emphasise on payback methods.

Small business owners are also not comfortable in making forecasts beyond the immediate future since they face greater uncertainty in cash flows and capital budgeting.

There exists a gap between education, Government policies and the real business world. The traditional business education mostly focuses on financial management of large firms. However, the major focus has to now shift to financial management of small businesses. In addition, conducive policies have to be framed not only to provide funds to small firms but also to help them in the management of funds.

References:

1. Bhalla V.K – Financial Management – S.Chand.

2. Horne, J.C. Van and Wackowich. Fundamentals of Financial Management. 9thed. New Delhi Prentice Hall of India.

3. Johnson, R.W. Financial Management. Boston Allyn and Bacon.

4. Joy, O.M. Introduction to Financial Management. Homewood: Irwin.

5. Khan and Jain. Financial Management text and problems. 2nd ed. Tata McGraw Hill New Delhi.

6. Pandey, I.M. Financial Management. Vikas Publications.

7. Chandra, P. Financial Management- Theory and Practice. (Tata McGraw Hill).

8. Rustagi, R.P. Fundamentals of Financial Management. Taxmann Publication Pvt. Ltd.

8. Singh, J.K. Financial Management- text and Problems. 2nd Ed. DhanpatRai and Company, Delhi.

9. Singh, Surender and Kaur, Rajeev. Fundamentals of Financial Management. Book Bank International.

10. Brigham and Houston, Fundamentals of Financial Management, 13th Ed., Cengage Learning