Unit 1

Introduction

The I.C.M.A. London defines Cost Accounting as “the process of accounting for cost from the point at which expenditure is incurred or committed to the establishment of its ultimate relationship with cost centers and cost units”.

In practice, costing, cost accounting and cost accountancy are often used interchangeably. Costing refers to ascertainment of costs, accumulation and measurement of cost of activities, processes, products or services. Cost data are used to prepare the statement of cost or cost sheet. Cost Accounting is a specialized branch of accounting which assists management to control costs and to create an awareness of the importance of cost to wells- being of the business organization. Systematic and useful cost data and reports are required to manage the business to achieve its objectives.

Cost accounting is a formal mechanism of cost control. It is the process of accounting for cost which begins with the recording of expenditure and ends with the preparation of periodical statements and reports for ascertaining and controlling cost. According to Charles T. Horngren “Cost accounting is often a way by that info consists, apportion summed up and understood for three main purposes: (in) elaboration and operational management, (ii) specific decision; and (iii) product Decision. ".

Cost Accounting is very important for a commercial organization. It is also useful for any other organization. It helps management in different fields one of such fields is presentation of information in the most useful manner. Cost Accounting is used to measure, analyze or estimate the costs. Profitability and Performance of individual products, departments and other segments of an organization, for either internal or external or both and to report to the interested parties. Cost Accounting concerns itself with the synthesis and analysis of costs. Its purpose in the modern days is to help management in the twin functions of decision- making and control. Thus, Cost Accounting is not simply cost finding but it is advising management, planning and control of organization and business operations. The Companies Act also provides that certain companies have to maintain cost accounting records and accounts and conduct the audit of cost accounts.

The main objectives of cost accounting are-

- Ascertainment of cost: it consists of two methods-

a) Post costing: It analyses the actual information as recorded in financial books.

b) Continuous costing: It aims at collecting information about cost as and when it takes place.

2. Determination of selling price: It provides information about the cost of production and selling price of product/provided service.

3. Cost control: To exercise cost control it clearly defines objective of cost, measure the actual performance, investigate into the causes of failure to perform according to plan, institute corrective action.

4. Cost reduction: It implies permanent and genuine savings in the cost of manufacturing, administration, distribution and selling by eliminating wasteful and unnecessary wastage.

5. Ascertain the profit of each activity: The profit of any activity is ascertained by matching cost with the revenue of that activity.

A good system of costing is a way to manage spending and help bring the economy. Since it is a production product, it meets the needs of many people as follows.

(A) Benefits to management: The information revealed by costing is primarily for support purposes. Management is decision-making and profit optimization. In addition to this, there are certain benefits. The impact of costing on management is price fixing and profitability, to eliminate unprofitable activities, idle capacity, cost control and inventory control.

(B) Benefits to employees: In cost accounting, wage structure, efficient bonuses,. Sincere employees increase productivity, profitability and reduce costs.

(C) Benefits to creditors: Improving financial management through cost accounting leads to timely Debt repayment by the company in the form of loan repayments and interest payments. Stay to grow in competition and judge the health and cost of current and future borrowers. The report gives a better overview of efficiency benefits and capacity.

(D) Benefits to Government: Costing enables government. Prepare a plan for the economy. To develop policies on national development, taxation, excise tax, exports, prices and caps, Granting subsidies, etc.

(E) Consumer / Public Benefits: Costing helps consumers get better products Quality at a reasonable price.

Difference between financial accounting and management accounting are-

- Meaning- Financial accounting is an accounting system that focuses on the preparation of a financial statement of an organization to provide financial information to the interested parties.

The accounting system which provides relevant information to the managers to make policies, plans and strategies for running the business effectively is known as Management Accounting.

2. Orientation- Financial Accounting is historical in nature whereas Management Accounting is future oriented.

3. Users- Financial Accounting is both concentrated to internal and external users whereas Management Accounting is focused only to internal users.

4. Nature of statements prepared- Financial Accounting is general-purpose financial statements whereas Management Accounting is special purpose financial statements.

5. Rules- In Financial Accounting, rules of GAAP are followed whereas in Management Accounting, no fixed rules are followed for the preparation of reports.

6. Reports- Only financial aspects are prepared in financial accounting whereas in Management Accounting both financial and non-financial aspects are prepared.

7. Time span- Financial statements are prepared for a fixed period, i.e., one year whereas management reports are prepared whenever needed.

8. Objective- The objective of financial statement is to create periodical reports whereas the objective of Management accounting is to assist internal management in planning and decision-making process by providing detailed information on various matters.

9. Publishing and auditing- Financial Accounting are required to be published and audited by statutory auditors whereas management accounting is not meant to be published or audited. It is for internal use only.

10. Format- Financial Accounting is specified whereas Management accounting is not specified.

Differences Between Financial Accounting and Management Accounting

The difference between financial accounting and management accounting are as follows:

- Financial Accounting is a discipline that deals with the preparation of financial statements, and communication of the information to the users. As against, management accounting is all about the provision of information that is useful to the management, to assist the management in the formulation of policies and day to day operations for efficient operation of the business.

- Financial Accounting uses the monetary records of past financial activities, so it is historically oriented. As against, management accounting is future-oriented, as it provides both present and future information in the form of forecasts and budgets which are duly analysed and presented in a detailed manner, so as to act as a base for management decision making.

- Financial Accounting reports only those events which can be described in monetary terms, but non-monetary events which have a positive or negative impact on the company’s success or failure are completely ignored. Conversely, management accounting records and reports both financial and non-financial events, for better decision making. Measures like a number of employees. Labour hours, machine hours and product units are also important for analysis and decision making.

- In financial accounting, the reports prepared are mainly used by external users, but internal users also use them. It reflects how the business enterprise uses resources during a particular period of time. External users use it for decision-making purposes. However, it is the members of management who use the reports generated under management accounting.

- For the purpose of recording, classifying, summarizing and reporting business transactions, in financial accounting. Generally Accepted Accounting Principles (GAAPs) are used. Conversely, in the case of management accounting, there is no such compulsion of using Generally Accepted Accounting Principles (GAAPs).

- Financial Accounting generates information and reports that are public in nature. These are general purpose financial statements that serve the informational needs of multiple users. It keeps a track of the financial performance of the entire firm and not just of an individual segment or department. As against, in management accounting reports are prepared for private use by the company’s management and so they are confidential. These are specific purpose reports and are meant to determine the performance of entities, product lines and departments. Data produced comprise facts, estimates, analysis forecasts, budgets etc.

- Financial Accounting looks at the big picture, as it looks at the business as a whole. As against, management accounting looks at business in segments, commonly known as responsibility centres.

- Maintenance of records and preparation of the periodical financial statements, as per the financial accounting system is compulsory. In contrast, management accounting is optional.

Cost concept:

According to the Association of Certified Management Accountants, costs are "expenditures (actual or hypothetical) incurred or resulting from a particular thing or activity." Similarly, according to Anthony and Wilsch, "cost is a monetary measure of the amount of resources used for several purposes."

Costs have been or may be incurred by the Cost Terminology Committee of the American Accounting Association, "in the realization of the management objectives mentioned above, which may be the manufacture of products or the provision of services. Is defined."

From the above, it can be said that the cost is the sum of all the costs of a product or service. Therefore, the cost of a product means the actual shipment or confirmed change that occurred in its manufacturing and sales activities. In short, it is the number of resources that have been exhausted in exchange for some goods and services.

So-called resources are expressed in money or currency units. What is said above does not make sense until it is used only as an adjective, that is, when it conveys its intended meaning.

Therefore, when we talk about prime cost, works cost, fixed cost, etc., we want to explain the specific implications that are essential when calculating, measuring, or analysing different aspects of cost.

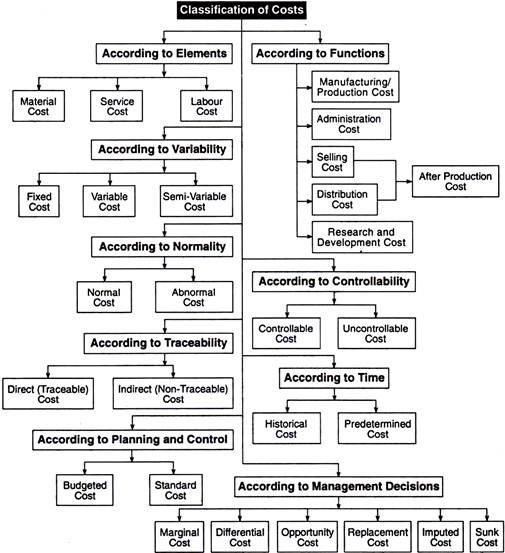

Cost classification:

To refer to costs in a cost centre, proper classification of costs is absolutely necessary. Costs are usually categorized according to their nature: materials, workforce, overhead, and so on. The same cost figures can be categorized in different ways depending on the needs of the company.

(A) According to the function:

The total cost is divided into various segments according to the purpose of the company. Therefore, costs are grouped according to company requirements in order to properly evaluate the functioning of the company. In other words, the total cost includes all costs, from material costs to product packaging costs.

Direct material costs, direct labour costs, paid costs, and all overhead costs are born by the head of manufacturing / manufacturing costs.

At the same time, administrative costs (related to clerical and administrative) and sales and distribution costs (i.e., related to sales) are categorized separately and added to find the total cost of the product. If these functional classifications are not done properly, the true cost of the product cannot be accurately determined.

(B) According to volatility:

These costs per volume can be subdivided as follows:

- Fixed costs;

- Variable costs;

- Semi-variable cost.

In other words, we maintain fixed costs (salary, rent, etc.) up to a certain limit regardless of production volume. It is interesting to note that if more units are products, the fixed cost per unit will be reduced, and if fewer units are produced, the fixed cost per unit will obviously increase.

On the other hand, variable costs fluctuate in proportion to production volume. s of production volume. In other words, changes in production (raw material prices, labour, etc.) do not have a direct impact on cost per unit. On the contrary, semi-variable costs are partially fixed and partially variable (e.g., building repairs).

(C) According to controllability:

Costs can be broadly divided into two categories, depending on the performance of the members of the company.

They are:

(I) Manageable costs. And

(II) Uncontrollable costs.

Manageable costs are costs that may be affected by decisions made by certain members of the management of the company, or costs that are at least partially management-dependent and manageable by management. All direct costs, direct material costs, direct labour costs, and billable costs (a component of prime costs) are manageable at a lower level of control and are carried out accordingly.

Uncontrollable costs are costs that are unaffected by the actions taken by a particular member of management. For example, fixed costs, that is, building rent, salary payments, and so on.

(D) According to normality:

Under this condition, costs are categorized according to the normal needs of a particular level of output for the normal level of activity generated for such output.

They are divided as follows.

(I) Normal cost; and

(II) Unusual cost

Normal cost is the cost that is normally required for normal production at a particular output level and is part of production.

Anomalous costs, on the other hand, are costs that are not normally required to successfully produce a particular level of output, or are not part of the production cost.

(E) According to time:

Costs can also be categorized according to the time factor within them. Therefore, costs are categorized as follows:

(I) Acquisition cost; and

(II) Prescribed costs.

Acquisition costs are costs that are considered after they occur. This is possible, especially if production for a particular unit of output has already taken place. They have only historical value and cannot help manage costs.

On the other hand, the given cost is the estimated cost. Such costs are pre-calculated based on past experience and records. Needless to say, if it is scientifically determined, it will be the standard cost. Comparing these standard costs to actual costs reveals the reasons for the differences and helps management take appropriate steps to make adjustments.

(F) According to traceability:

Costs can be identified by a particular product, process, department, and so on. Costs are categorized as follows:

(I) Direct (traceable) costs; and

(II) Indirect (untraceable) costs.

Direct / traceable costs are the costs that can be directly tracked or assigned to a product. That is, it includes all traceable costs, that is, all costs associated with easily traceable costs of raw materials, labour, and other services used.

Indirect / non-traceable costs are costs that cannot be directly tracked or assigned to a product. That is, it includes all untraceable costs. Shopkeeper salary, general and administrative expenses, that is, things that cannot be properly allocated directly to the product.

(G) According to planning and management:

Costs can also be categorized as follows:

(I) Budget costs; and

(II) Standard cost

Budget cost refers to the estimated manufacturing cost calculated based on the information available prior to the actual production or purchase. In reality, budget costs include standard costs. Both are pre-determined costs and the amounts may match, but for different purposes. It provides a medium that can measure the validity of current results and hold derivation responsibilities.

Standard costs are pre-determined for each element: materials, labour, and overhead costs. The standard costs are:

(I) the cost per unit is determined to produce the estimated total output for the next period.

(A) Material;

(B) Labour; and

(C) Overhead.

(II) Costs should depend on past experience and experimentation, and technical staff specifications.

(III) Expenses must be expressed in rupees.

(H) According to management's decision: Under this, costs may be categorized as follows:

(A) Marginal cost:

Marginal cost is the cost of producing additional units by separating fixed costs (that is, capacity costs) from variable costs (that is, production costs) that help us know profitability. In addition, we know that certain costs (fixed) may not increase at all to increase production, and only some costs related to material costs, labour costs, and variable costs will increase. Therefore, the total cost so increased by the production of one or more units is the cost of the marginal unit, which cost is known as the marginal cost or the incremental cost.

(B) Difference cost:

The differential cost is due to the additional features and is part of the cost of the features that can be identified by the additional features. That is, a cost change as a result of a change in activity level or production method.

(C) Opportunity cost:

This is the expected cost change associated with the adoption of alternative machines, processes, raw materials, specifications, or operations. In other words, it is the largest alternative revenue you could have earned if your existing capacity was changed to another alternative.

(D) Replacement cost:

This is the cost of exchanging an item or group of assets at the current price in a particular region or market region.

(E) Implicit cost:

This is the cost used to indicate the presence of an arbitrary or subjective element of product cost that is more important than usual. This is also known as notional cost. For example, interest on capital, but no interest is paid. This is especially useful when making decisions about alternative capital investment projects.

(F) Sunk cost:

This is a past cost resulting from a decision that cannot be modified at present and is associated with specialized equipment or other facilities that cannot be easily adapted to current or future objectives. Such costs are often seen as forming a small factor in future-impacting decisions.

A cost accountant in a manufacturing organisation plays several important roles.

He establishes a cost accounting department in his concern.

He ascertains the requirement of cost information which may be useful to organisational managers at different levels of the hierarchy.

He develops a manual, which specifies the functions to be performed by the cost accounting department. The manual also contains the format of various forms which would be utilised by the concern for procuring and providing information to the concerned officers. It also specifies the frequency at which the cost information would be supplied to a concerned executive.

Usually, the functions performed by a cost accounting department includes –

Cost ascertainment, requires the classification of costs into direct and indirect. Further it requires classification of indirect costs (known as overheads) into three classes viz., factory overheads; administration overheads and selling and distribution overheads.

Cost accountant suggests the basis which may be used by his subordinates for carrying out the necessary classifications as suggested above.

Cost comparison is the task carried out by cost accountant for controlling the cost of the products manufactured by the concern. Cost accountant of the concern establishes standards for all the elements of cost and thus a standard cost of the finished product. The standard cost so determined may be compared with the actual cost to determine the variances. Cost accountant ascertains the reasons for the occurrence of these variances for taking suitable action.

Cost analysis may also be made by cost Accountant for taking decisions like make or buy and for reviewing the current performance.

Cost accountant also plays a key role in the preparation of cost reports. These reports help the executives of a business concern in reviewing their own performance and in identifying the weak areas, where enough control measures may be taken in future.

In brief, one may say that there is hardly any activity in a manufacturing organisation with which a cost accountant is not directly associated in some form.

Or, one may say that there is hardly any activity in a manufacturing organisation with which a cost accountant is not directly associated in some form or the other.

Some other roles of Cost Accountant are-

- Manufacturing

Cost accountants work closely with production personnel to measure and report manufacturing costs. The efficiency of the production departments in scheduling and transforming materials into finished units is evaluated for improvements.

2. Engineering

Cost accountants and engineers translate specifications for new products into estimated costs; by comparing estimated costs with projected sales prices, they help management decide whether manufacturing a product will be profitable.

3. Systems design

Cost accountants are becoming more involved in designing computer integrated manufacturing (CIM) systems and databases corresponding to cost accounting needs. The idea is for cost accountants, engineers and system designers to develop a flexible production process responding swiftly to market needs

4. Treasury

The treasurer uses budgets and related accounting reports developed by cost accountants to forecast cash and working capital requirements. Detailed cash reports indicate where there are excess funds to invest or where cash deficits exist and need to be financed.

5. Financial accounting

Cost accountants work closely with financial accountants who use cost information in valuing inventory for external reporting and income determination purposes.

6. Marketing

Marketing involves the cost accountant during the product innovation stage, the manufacturing planning stage and the sales process. The marketing department develops sales forecast to facilitate preparing a products manufacturing schedule. Cost estimates, competition, supply, demand, environmental influences and the state of technology determines the sales price that the product will be offered and will command in the market.

7. Personnel

Personnel department administers the wage rate and pay methods used in calculating each employees pay. This department maintains adequate labour records for legal and cost analysis purposes.

At this point, it cannot be over-emphasized that cost accounting is simply an information system designed to produce information to assist the management of an organization in planning and controlling the organisation’s activities. It also assists the management to make informed decisions so as to enable the organization to operate at maximum effectiveness and efficiently.

References:

- Arora M.N.: Cost Accounting - Principles and Practice; Vikas, New Delhi.

- Jain S.P. And Narang K.L.: Cost Accounting; Kalyani New Delhi.

- Anthony Robert, Reece, et al: Principles of Management Accounting; Richard D. Irwin Inc. Illinois.

- Horngren, Charles, Foster and Datar; Cost Accounting - A Managerial Emphasis; Prentice – Hall of India, New Delhi.

- Khan M.Y. And Jain P.K.: Management Accounting; Tata McGraw Hill.

Unit 1

Introduction

The I.C.M.A. London defines Cost Accounting as “the process of accounting for cost from the point at which expenditure is incurred or committed to the establishment of its ultimate relationship with cost centers and cost units”.

In practice, costing, cost accounting and cost accountancy are often used interchangeably. Costing refers to ascertainment of costs, accumulation and measurement of cost of activities, processes, products or services. Cost data are used to prepare the statement of cost or cost sheet. Cost Accounting is a specialized branch of accounting which assists management to control costs and to create an awareness of the importance of cost to wells- being of the business organization. Systematic and useful cost data and reports are required to manage the business to achieve its objectives.

Cost accounting is a formal mechanism of cost control. It is the process of accounting for cost which begins with the recording of expenditure and ends with the preparation of periodical statements and reports for ascertaining and controlling cost. According to Charles T. Horngren “Cost accounting is often a way by that info consists, apportion summed up and understood for three main purposes: (in) elaboration and operational management, (ii) specific decision; and (iii) product Decision. ".

Cost Accounting is very important for a commercial organization. It is also useful for any other organization. It helps management in different fields one of such fields is presentation of information in the most useful manner. Cost Accounting is used to measure, analyze or estimate the costs. Profitability and Performance of individual products, departments and other segments of an organization, for either internal or external or both and to report to the interested parties. Cost Accounting concerns itself with the synthesis and analysis of costs. Its purpose in the modern days is to help management in the twin functions of decision- making and control. Thus, Cost Accounting is not simply cost finding but it is advising management, planning and control of organization and business operations. The Companies Act also provides that certain companies have to maintain cost accounting records and accounts and conduct the audit of cost accounts.

The main objectives of cost accounting are-

- Ascertainment of cost: it consists of two methods-

a) Post costing: It analyses the actual information as recorded in financial books.

b) Continuous costing: It aims at collecting information about cost as and when it takes place.

2. Determination of selling price: It provides information about the cost of production and selling price of product/provided service.

3. Cost control: To exercise cost control it clearly defines objective of cost, measure the actual performance, investigate into the causes of failure to perform according to plan, institute corrective action.

4. Cost reduction: It implies permanent and genuine savings in the cost of manufacturing, administration, distribution and selling by eliminating wasteful and unnecessary wastage.

5. Ascertain the profit of each activity: The profit of any activity is ascertained by matching cost with the revenue of that activity.

A good system of costing is a way to manage spending and help bring the economy. Since it is a production product, it meets the needs of many people as follows.

(A) Benefits to management: The information revealed by costing is primarily for support purposes. Management is decision-making and profit optimization. In addition to this, there are certain benefits. The impact of costing on management is price fixing and profitability, to eliminate unprofitable activities, idle capacity, cost control and inventory control.

(B) Benefits to employees: In cost accounting, wage structure, efficient bonuses,. Sincere employees increase productivity, profitability and reduce costs.

(C) Benefits to creditors: Improving financial management through cost accounting leads to timely Debt repayment by the company in the form of loan repayments and interest payments. Stay to grow in competition and judge the health and cost of current and future borrowers. The report gives a better overview of efficiency benefits and capacity.

(D) Benefits to Government: Costing enables government. Prepare a plan for the economy. To develop policies on national development, taxation, excise tax, exports, prices and caps, Granting subsidies, etc.

(E) Consumer / Public Benefits: Costing helps consumers get better products Quality at a reasonable price.

Difference between financial accounting and management accounting are-

- Meaning- Financial accounting is an accounting system that focuses on the preparation of a financial statement of an organization to provide financial information to the interested parties.

The accounting system which provides relevant information to the managers to make policies, plans and strategies for running the business effectively is known as Management Accounting.

2. Orientation- Financial Accounting is historical in nature whereas Management Accounting is future oriented.

3. Users- Financial Accounting is both concentrated to internal and external users whereas Management Accounting is focused only to internal users.

4. Nature of statements prepared- Financial Accounting is general-purpose financial statements whereas Management Accounting is special purpose financial statements.

5. Rules- In Financial Accounting, rules of GAAP are followed whereas in Management Accounting, no fixed rules are followed for the preparation of reports.

6. Reports- Only financial aspects are prepared in financial accounting whereas in Management Accounting both financial and non-financial aspects are prepared.

7. Time span- Financial statements are prepared for a fixed period, i.e., one year whereas management reports are prepared whenever needed.

8. Objective- The objective of financial statement is to create periodical reports whereas the objective of Management accounting is to assist internal management in planning and decision-making process by providing detailed information on various matters.

9. Publishing and auditing- Financial Accounting are required to be published and audited by statutory auditors whereas management accounting is not meant to be published or audited. It is for internal use only.

10. Format- Financial Accounting is specified whereas Management accounting is not specified.

Differences Between Financial Accounting and Management Accounting

The difference between financial accounting and management accounting are as follows:

- Financial Accounting is a discipline that deals with the preparation of financial statements, and communication of the information to the users. As against, management accounting is all about the provision of information that is useful to the management, to assist the management in the formulation of policies and day to day operations for efficient operation of the business.

- Financial Accounting uses the monetary records of past financial activities, so it is historically oriented. As against, management accounting is future-oriented, as it provides both present and future information in the form of forecasts and budgets which are duly analysed and presented in a detailed manner, so as to act as a base for management decision making.

- Financial Accounting reports only those events which can be described in monetary terms, but non-monetary events which have a positive or negative impact on the company’s success or failure are completely ignored. Conversely, management accounting records and reports both financial and non-financial events, for better decision making. Measures like a number of employees. Labour hours, machine hours and product units are also important for analysis and decision making.

- In financial accounting, the reports prepared are mainly used by external users, but internal users also use them. It reflects how the business enterprise uses resources during a particular period of time. External users use it for decision-making purposes. However, it is the members of management who use the reports generated under management accounting.

- For the purpose of recording, classifying, summarizing and reporting business transactions, in financial accounting. Generally Accepted Accounting Principles (GAAPs) are used. Conversely, in the case of management accounting, there is no such compulsion of using Generally Accepted Accounting Principles (GAAPs).

- Financial Accounting generates information and reports that are public in nature. These are general purpose financial statements that serve the informational needs of multiple users. It keeps a track of the financial performance of the entire firm and not just of an individual segment or department. As against, in management accounting reports are prepared for private use by the company’s management and so they are confidential. These are specific purpose reports and are meant to determine the performance of entities, product lines and departments. Data produced comprise facts, estimates, analysis forecasts, budgets etc.

- Financial Accounting looks at the big picture, as it looks at the business as a whole. As against, management accounting looks at business in segments, commonly known as responsibility centres.

- Maintenance of records and preparation of the periodical financial statements, as per the financial accounting system is compulsory. In contrast, management accounting is optional.

Unit 1

Introduction

The I.C.M.A. London defines Cost Accounting as “the process of accounting for cost from the point at which expenditure is incurred or committed to the establishment of its ultimate relationship with cost centers and cost units”.

In practice, costing, cost accounting and cost accountancy are often used interchangeably. Costing refers to ascertainment of costs, accumulation and measurement of cost of activities, processes, products or services. Cost data are used to prepare the statement of cost or cost sheet. Cost Accounting is a specialized branch of accounting which assists management to control costs and to create an awareness of the importance of cost to wells- being of the business organization. Systematic and useful cost data and reports are required to manage the business to achieve its objectives.

Cost accounting is a formal mechanism of cost control. It is the process of accounting for cost which begins with the recording of expenditure and ends with the preparation of periodical statements and reports for ascertaining and controlling cost. According to Charles T. Horngren “Cost accounting is often a way by that info consists, apportion summed up and understood for three main purposes: (in) elaboration and operational management, (ii) specific decision; and (iii) product Decision. ".

Cost Accounting is very important for a commercial organization. It is also useful for any other organization. It helps management in different fields one of such fields is presentation of information in the most useful manner. Cost Accounting is used to measure, analyze or estimate the costs. Profitability and Performance of individual products, departments and other segments of an organization, for either internal or external or both and to report to the interested parties. Cost Accounting concerns itself with the synthesis and analysis of costs. Its purpose in the modern days is to help management in the twin functions of decision- making and control. Thus, Cost Accounting is not simply cost finding but it is advising management, planning and control of organization and business operations. The Companies Act also provides that certain companies have to maintain cost accounting records and accounts and conduct the audit of cost accounts.

The main objectives of cost accounting are-

- Ascertainment of cost: it consists of two methods-

a) Post costing: It analyses the actual information as recorded in financial books.

b) Continuous costing: It aims at collecting information about cost as and when it takes place.

2. Determination of selling price: It provides information about the cost of production and selling price of product/provided service.

3. Cost control: To exercise cost control it clearly defines objective of cost, measure the actual performance, investigate into the causes of failure to perform according to plan, institute corrective action.

4. Cost reduction: It implies permanent and genuine savings in the cost of manufacturing, administration, distribution and selling by eliminating wasteful and unnecessary wastage.

5. Ascertain the profit of each activity: The profit of any activity is ascertained by matching cost with the revenue of that activity.

A good system of costing is a way to manage spending and help bring the economy. Since it is a production product, it meets the needs of many people as follows.

(A) Benefits to management: The information revealed by costing is primarily for support purposes. Management is decision-making and profit optimization. In addition to this, there are certain benefits. The impact of costing on management is price fixing and profitability, to eliminate unprofitable activities, idle capacity, cost control and inventory control.

(B) Benefits to employees: In cost accounting, wage structure, efficient bonuses,. Sincere employees increase productivity, profitability and reduce costs.

(C) Benefits to creditors: Improving financial management through cost accounting leads to timely Debt repayment by the company in the form of loan repayments and interest payments. Stay to grow in competition and judge the health and cost of current and future borrowers. The report gives a better overview of efficiency benefits and capacity.

(D) Benefits to Government: Costing enables government. Prepare a plan for the economy. To develop policies on national development, taxation, excise tax, exports, prices and caps, Granting subsidies, etc.

(E) Consumer / Public Benefits: Costing helps consumers get better products Quality at a reasonable price.

Difference between financial accounting and management accounting are-

- Meaning- Financial accounting is an accounting system that focuses on the preparation of a financial statement of an organization to provide financial information to the interested parties.

The accounting system which provides relevant information to the managers to make policies, plans and strategies for running the business effectively is known as Management Accounting.

2. Orientation- Financial Accounting is historical in nature whereas Management Accounting is future oriented.

3. Users- Financial Accounting is both concentrated to internal and external users whereas Management Accounting is focused only to internal users.

4. Nature of statements prepared- Financial Accounting is general-purpose financial statements whereas Management Accounting is special purpose financial statements.

5. Rules- In Financial Accounting, rules of GAAP are followed whereas in Management Accounting, no fixed rules are followed for the preparation of reports.

6. Reports- Only financial aspects are prepared in financial accounting whereas in Management Accounting both financial and non-financial aspects are prepared.

7. Time span- Financial statements are prepared for a fixed period, i.e., one year whereas management reports are prepared whenever needed.

8. Objective- The objective of financial statement is to create periodical reports whereas the objective of Management accounting is to assist internal management in planning and decision-making process by providing detailed information on various matters.

9. Publishing and auditing- Financial Accounting are required to be published and audited by statutory auditors whereas management accounting is not meant to be published or audited. It is for internal use only.

10. Format- Financial Accounting is specified whereas Management accounting is not specified.

Differences Between Financial Accounting and Management Accounting

The difference between financial accounting and management accounting are as follows:

- Financial Accounting is a discipline that deals with the preparation of financial statements, and communication of the information to the users. As against, management accounting is all about the provision of information that is useful to the management, to assist the management in the formulation of policies and day to day operations for efficient operation of the business.

- Financial Accounting uses the monetary records of past financial activities, so it is historically oriented. As against, management accounting is future-oriented, as it provides both present and future information in the form of forecasts and budgets which are duly analysed and presented in a detailed manner, so as to act as a base for management decision making.

- Financial Accounting reports only those events which can be described in monetary terms, but non-monetary events which have a positive or negative impact on the company’s success or failure are completely ignored. Conversely, management accounting records and reports both financial and non-financial events, for better decision making. Measures like a number of employees. Labour hours, machine hours and product units are also important for analysis and decision making.

- In financial accounting, the reports prepared are mainly used by external users, but internal users also use them. It reflects how the business enterprise uses resources during a particular period of time. External users use it for decision-making purposes. However, it is the members of management who use the reports generated under management accounting.

- For the purpose of recording, classifying, summarizing and reporting business transactions, in financial accounting. Generally Accepted Accounting Principles (GAAPs) are used. Conversely, in the case of management accounting, there is no such compulsion of using Generally Accepted Accounting Principles (GAAPs).

- Financial Accounting generates information and reports that are public in nature. These are general purpose financial statements that serve the informational needs of multiple users. It keeps a track of the financial performance of the entire firm and not just of an individual segment or department. As against, in management accounting reports are prepared for private use by the company’s management and so they are confidential. These are specific purpose reports and are meant to determine the performance of entities, product lines and departments. Data produced comprise facts, estimates, analysis forecasts, budgets etc.

- Financial Accounting looks at the big picture, as it looks at the business as a whole. As against, management accounting looks at business in segments, commonly known as responsibility centres.

- Maintenance of records and preparation of the periodical financial statements, as per the financial accounting system is compulsory. In contrast, management accounting is optional.

Cost concept:

According to the Association of Certified Management Accountants, costs are "expenditures (actual or hypothetical) incurred or resulting from a particular thing or activity." Similarly, according to Anthony and Wilsch, "cost is a monetary measure of the amount of resources used for several purposes."

Costs have been or may be incurred by the Cost Terminology Committee of the American Accounting Association, "in the realization of the management objectives mentioned above, which may be the manufacture of products or the provision of services. Is defined."

From the above, it can be said that the cost is the sum of all the costs of a product or service. Therefore, the cost of a product means the actual shipment or confirmed change that occurred in its manufacturing and sales activities. In short, it is the number of resources that have been exhausted in exchange for some goods and services.

So-called resources are expressed in money or currency units. What is said above does not make sense until it is used only as an adjective, that is, when it conveys its intended meaning.

Therefore, when we talk about prime cost, works cost, fixed cost, etc., we want to explain the specific implications that are essential when calculating, measuring, or analysing different aspects of cost.

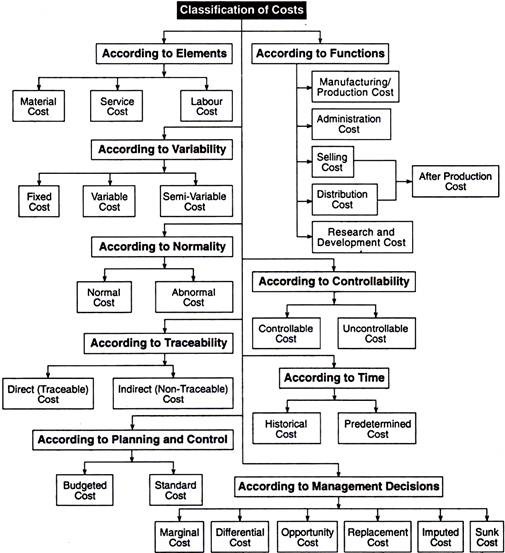

Cost classification:

To refer to costs in a cost centre, proper classification of costs is absolutely necessary. Costs are usually categorized according to their nature: materials, workforce, overhead, and so on. The same cost figures can be categorized in different ways depending on the needs of the company.

(A) According to the function:

The total cost is divided into various segments according to the purpose of the company. Therefore, costs are grouped according to company requirements in order to properly evaluate the functioning of the company. In other words, the total cost includes all costs, from material costs to product packaging costs.

Direct material costs, direct labour costs, paid costs, and all overhead costs are born by the head of manufacturing / manufacturing costs.

At the same time, administrative costs (related to clerical and administrative) and sales and distribution costs (i.e., related to sales) are categorized separately and added to find the total cost of the product. If these functional classifications are not done properly, the true cost of the product cannot be accurately determined.

(B) According to volatility:

These costs per volume can be subdivided as follows:

- Fixed costs;

- Variable costs;

- Semi-variable cost.

In other words, we maintain fixed costs (salary, rent, etc.) up to a certain limit regardless of production volume. It is interesting to note that if more units are products, the fixed cost per unit will be reduced, and if fewer units are produced, the fixed cost per unit will obviously increase.

On the other hand, variable costs fluctuate in proportion to production volume. s of production volume. In other words, changes in production (raw material prices, labour, etc.) do not have a direct impact on cost per unit. On the contrary, semi-variable costs are partially fixed and partially variable (e.g., building repairs).

(C) According to controllability:

Costs can be broadly divided into two categories, depending on the performance of the members of the company.

They are:

(I) Manageable costs. And

(II) Uncontrollable costs.

Manageable costs are costs that may be affected by decisions made by certain members of the management of the company, or costs that are at least partially management-dependent and manageable by management. All direct costs, direct material costs, direct labour costs, and billable costs (a component of prime costs) are manageable at a lower level of control and are carried out accordingly.

Uncontrollable costs are costs that are unaffected by the actions taken by a particular member of management. For example, fixed costs, that is, building rent, salary payments, and so on.

(D) According to normality:

Under this condition, costs are categorized according to the normal needs of a particular level of output for the normal level of activity generated for such output.

They are divided as follows.

(I) Normal cost; and

(II) Unusual cost

Normal cost is the cost that is normally required for normal production at a particular output level and is part of production.

Anomalous costs, on the other hand, are costs that are not normally required to successfully produce a particular level of output, or are not part of the production cost.

(E) According to time:

Costs can also be categorized according to the time factor within them. Therefore, costs are categorized as follows:

(I) Acquisition cost; and

(II) Prescribed costs.

Acquisition costs are costs that are considered after they occur. This is possible, especially if production for a particular unit of output has already taken place. They have only historical value and cannot help manage costs.

On the other hand, the given cost is the estimated cost. Such costs are pre-calculated based on past experience and records. Needless to say, if it is scientifically determined, it will be the standard cost. Comparing these standard costs to actual costs reveals the reasons for the differences and helps management take appropriate steps to make adjustments.

(F) According to traceability:

Costs can be identified by a particular product, process, department, and so on. Costs are categorized as follows:

(I) Direct (traceable) costs; and

(II) Indirect (untraceable) costs.

Direct / traceable costs are the costs that can be directly tracked or assigned to a product. That is, it includes all traceable costs, that is, all costs associated with easily traceable costs of raw materials, labour, and other services used.

Indirect / non-traceable costs are costs that cannot be directly tracked or assigned to a product. That is, it includes all untraceable costs. Shopkeeper salary, general and administrative expenses, that is, things that cannot be properly allocated directly to the product.

(G) According to planning and management:

Costs can also be categorized as follows:

(I) Budget costs; and

(II) Standard cost

Budget cost refers to the estimated manufacturing cost calculated based on the information available prior to the actual production or purchase. In reality, budget costs include standard costs. Both are pre-determined costs and the amounts may match, but for different purposes. It provides a medium that can measure the validity of current results and hold derivation responsibilities.

Standard costs are pre-determined for each element: materials, labour, and overhead costs. The standard costs are:

(I) the cost per unit is determined to produce the estimated total output for the next period.

(A) Material;

(B) Labour; and

(C) Overhead.

(II) Costs should depend on past experience and experimentation, and technical staff specifications.

(III) Expenses must be expressed in rupees.

(H) According to management's decision: Under this, costs may be categorized as follows:

(A) Marginal cost:

Marginal cost is the cost of producing additional units by separating fixed costs (that is, capacity costs) from variable costs (that is, production costs) that help us know profitability. In addition, we know that certain costs (fixed) may not increase at all to increase production, and only some costs related to material costs, labour costs, and variable costs will increase. Therefore, the total cost so increased by the production of one or more units is the cost of the marginal unit, which cost is known as the marginal cost or the incremental cost.

(B) Difference cost:

The differential cost is due to the additional features and is part of the cost of the features that can be identified by the additional features. That is, a cost change as a result of a change in activity level or production method.

(C) Opportunity cost:

This is the expected cost change associated with the adoption of alternative machines, processes, raw materials, specifications, or operations. In other words, it is the largest alternative revenue you could have earned if your existing capacity was changed to another alternative.

(D) Replacement cost:

This is the cost of exchanging an item or group of assets at the current price in a particular region or market region.

(E) Implicit cost:

This is the cost used to indicate the presence of an arbitrary or subjective element of product cost that is more important than usual. This is also known as notional cost. For example, interest on capital, but no interest is paid. This is especially useful when making decisions about alternative capital investment projects.

(F) Sunk cost:

This is a past cost resulting from a decision that cannot be modified at present and is associated with specialized equipment or other facilities that cannot be easily adapted to current or future objectives. Such costs are often seen as forming a small factor in future-impacting decisions.

A cost accountant in a manufacturing organisation plays several important roles.

He establishes a cost accounting department in his concern.

He ascertains the requirement of cost information which may be useful to organisational managers at different levels of the hierarchy.

He develops a manual, which specifies the functions to be performed by the cost accounting department. The manual also contains the format of various forms which would be utilised by the concern for procuring and providing information to the concerned officers. It also specifies the frequency at which the cost information would be supplied to a concerned executive.

Usually, the functions performed by a cost accounting department includes –

Cost ascertainment, requires the classification of costs into direct and indirect. Further it requires classification of indirect costs (known as overheads) into three classes viz., factory overheads; administration overheads and selling and distribution overheads.

Cost accountant suggests the basis which may be used by his subordinates for carrying out the necessary classifications as suggested above.

Cost comparison is the task carried out by cost accountant for controlling the cost of the products manufactured by the concern. Cost accountant of the concern establishes standards for all the elements of cost and thus a standard cost of the finished product. The standard cost so determined may be compared with the actual cost to determine the variances. Cost accountant ascertains the reasons for the occurrence of these variances for taking suitable action.

Cost analysis may also be made by cost Accountant for taking decisions like make or buy and for reviewing the current performance.

Cost accountant also plays a key role in the preparation of cost reports. These reports help the executives of a business concern in reviewing their own performance and in identifying the weak areas, where enough control measures may be taken in future.

In brief, one may say that there is hardly any activity in a manufacturing organisation with which a cost accountant is not directly associated in some form.

Or, one may say that there is hardly any activity in a manufacturing organisation with which a cost accountant is not directly associated in some form or the other.

Some other roles of Cost Accountant are-

- Manufacturing

Cost accountants work closely with production personnel to measure and report manufacturing costs. The efficiency of the production departments in scheduling and transforming materials into finished units is evaluated for improvements.

2. Engineering

Cost accountants and engineers translate specifications for new products into estimated costs; by comparing estimated costs with projected sales prices, they help management decide whether manufacturing a product will be profitable.

3. Systems design

Cost accountants are becoming more involved in designing computer integrated manufacturing (CIM) systems and databases corresponding to cost accounting needs. The idea is for cost accountants, engineers and system designers to develop a flexible production process responding swiftly to market needs

4. Treasury

The treasurer uses budgets and related accounting reports developed by cost accountants to forecast cash and working capital requirements. Detailed cash reports indicate where there are excess funds to invest or where cash deficits exist and need to be financed.

5. Financial accounting

Cost accountants work closely with financial accountants who use cost information in valuing inventory for external reporting and income determination purposes.

6. Marketing

Marketing involves the cost accountant during the product innovation stage, the manufacturing planning stage and the sales process. The marketing department develops sales forecast to facilitate preparing a products manufacturing schedule. Cost estimates, competition, supply, demand, environmental influences and the state of technology determines the sales price that the product will be offered and will command in the market.

7. Personnel

Personnel department administers the wage rate and pay methods used in calculating each employees pay. This department maintains adequate labour records for legal and cost analysis purposes.

At this point, it cannot be over-emphasized that cost accounting is simply an information system designed to produce information to assist the management of an organization in planning and controlling the organisation’s activities. It also assists the management to make informed decisions so as to enable the organization to operate at maximum effectiveness and efficiently.

References:

- Arora M.N.: Cost Accounting - Principles and Practice; Vikas, New Delhi.

- Jain S.P. And Narang K.L.: Cost Accounting; Kalyani New Delhi.

- Anthony Robert, Reece, et al: Principles of Management Accounting; Richard D. Irwin Inc. Illinois.

- Horngren, Charles, Foster and Datar; Cost Accounting - A Managerial Emphasis; Prentice – Hall of India, New Delhi.

- Khan M.Y. And Jain P.K.: Management Accounting; Tata McGraw Hill.