Unit 2

Computation of income under different heads

Salaries

Salary is chargeable to tax either on ‘due’ basis or on ‘receipt’ basis, whichever is earlier. Hence, taxable salary includes:

- Advance salary (on ‘receipt’ basis)

Salary paid in advance is taxable under the head ‘Salaries’ in the year of receipt.

- Outstanding salary (on ‘due’ basis)

Salary falling due is taxable under the head ‘Salaries’ in the year in which it falls due.

- Arrear salary

Any increment in salary with retrospective effect which have not been taxed in the past, such arrears will be taxed in the year in which it is allowed. Arrear salary are taxable on receipt basis

In case Salary is received after deduction of following items... These are added back to get fully Salary:

(i) Own Contribution to Provident Fund.

(ii) Tax Deducted at Source (TDS)

(iii) Repayment of Loan etc.

(iv) LIC Premium, if deducted from salary.

(v) Group Insurance Scheme.

(vi) Rent of House provided by employer.

Salary U/s 17(1):

1.Wages. Fully Taxable.

2.Annuity or Pension. Fully Taxable

3.Gratuity. It has been treated separately.

4. (a) Any Fees -- Fully Taxable

(b) Commission -- Fully Taxable

(c) Bonus -- Fully Taxable

(d) Perquisites -- (Perks) These are treated separately u/s 17(2)

(e) Profit in lieu of Salary -- These are treated separately u/s17(3)

5.Salary in lieu of Leave / Leave Encashment. Fully Taxable.

6.Advance Salary. Fully Taxable

7.Arrears of Salary. Fully Taxable.

8.Refund of Provident Fund (PF)

(a) If SPF -- Fully exempted

(b) If RPF -- Fully exempted if service is more than 5 years.

(c) If URPF -- Taxable portion is added in salary income. Taxable portion is equal to employer’s contribution + interest on this part. Interest on own contribution to URPF is taxable under the head “Income from Other Sources.”

Allowances:

A. Fully Exempted Allowances:

Foreign Allowance given by Govt. To its employees posted abroad. HRA given to Judges of High Court & Supreme Court.

B. Fully Taxable Allowances:

(i) Dearness Allowance / Additional D.A. / High Cost of Living Allowance -- Fully Taxable.

(ii) City Compensation Allowances (CCA).

(iii) Capital Compensatory Allowance

(iv) Lunch Allowance

(v) Tiffin Allowance

(vi) Marriage / Family Allowance

(vii) Overtime Allowance

(viii) Fixed Medical Allowance.

(ix) Electricity and Water Allowance

(x) Entertainment Allowance. It is fully added in employee’s Salary.

In case of Government employees, a deduction is allowed u/s 16(ii) at the rate of least of following:

(a) Statutory Limit Rs. 5,000 p.a.

(b) 1/5th (20%) of Basic Salary; or

(c) Actual Entertainment Allowance received.

Partly Taxable Allowances:

1. House Rent Allowance (HRA)

(a) Fully Exempted, if received by the Judges of High Court and Supreme Court.

(b) Fully Taxable, if received by an employee who is living in his own house or in a house for which no rent is paid.

(c) Exempted up to least of following for those employees who are living in rented houses:

(i) Actual HRA received by the employee.

(ii) Rent paid - 10% of Salary; or

(iii) 40% of Salary in ordinary town; 50% of Salary in Mumbai, Kolkata, Chennai or Delhi.

Ø Taxable HRA = HRA Received - Least of Above.

Ø Salary = Pay + D.A. Which enters into Pay for Service or Retirement Benefits + Commission on Turnover Achieved by Him.

Following Allowances are Exempted up to actual expenditure incurred for employment. Excess, if any, shall be taxable...

2. Uniform Allowance

3. Conveyance Allowance

4. Traveling Allowance

Following Allowance are Exempted up to amount so notified.

5. Special Compensatory Allowance

6. Border Area Allowance

7. Tribal Area Allowance -- Exempted up to Rs. 200 p.m. If received in the States of M.P., Tamil Nadu, U.P., Karnataka, Tripura, Assam, West Bengal, Bihar, or Orissa.

8. Children’s Education Allowance -- Exempted up to Rs.100 p.m. Per child for education in India of own two children only.

9. Hostel Expenditure Allowance -- Exempted up to Rs. 300 p.m. Per child for Hostel expenditure on own two children only.

Perquisites:

A. Exempted Perquisites:

1. Leave Travel Concession subject to conditions & actual spent only for travels.

2. Computer/ Laptop provided for o official / personal use.

3. Initial Fees paid for corporate membership of a club.

4. Refreshment provided by the Employer during working hours in office premises.

5. Payment of annual premium on Personal Accident Policy.

6. Subscription to periodicals and journal required for discharge of work.

7. Provision of Medical Facilities.

8. Gift not exceeding Rs. 5,000 p.a.

9. Use of Health Club, Sports facility.

10. Free telephones whether fixed or mobile phones.

11. Interest Free / concessional loan of an amount not exceeding Rs.20,000 (limit not application in the case of medical treatment)

12. Contribution to recognised Provident Fund / approved super annulation fund, pension or deferred annuity scheme & staff group insurance scheme.

13. Free meal provided during working hours or through paid non-transferable vouchers not exceeding Rs. 50 per meal or free meal provided during working hours in a remote area.

The value of any benefit provided free or at a concessional rate (including goods sold at concessional rate) by a company to the Employees by way of allotment of shares etc., under the Employees stock option plan as per Central Government Guidelines.

B. Taxable Perquisites:

1. Rent Free Accommodation

2. Provision of Motor Car or any other Conveyance for personal use of Employee.

3. Provision of Free or Concessional Education Facilities.

4. Reimbursement of Medical Expenditure.

5. Expenditure on Foreign Travel and stay during medical expenditure.

6. Supply of Gas, Electricity & Water.

7. Sale of an Asset to the Employee at concessional price including sale of Share in the Employer Company.

C. Perks Exempted for Employees but Taxable for Employer under Fringe Benefit Tax.

Value of the following benefits is not taxable in the hands of an employee. The employer has to pay tax on deemed income calculated as percentage of expenditure incurred.

- Any free or concessional ticket provided by the employer for private journeys of his employee or their family members

- Any contribution by the employer to an approved superannuation fund for employees;

- It includes-

- Expenditure incurred on entertainment;

- Expenditure incurred on provision of hospitality of every kind by the employer to any person.

- Expenditure incurred on conference like conveyance, tour & travel (including foreign travel), on hotel, or boarding and lodging in connection with any conference shall be deemed to be expenditure incurred for the purposes of conference.

- Expenditure incurred on sales promotions including publicity;

- Expenditure incurred on employee’s welfare;

- Expenditure incurred on conveyance

- Expenditure incurred on Hotel, Boarding & Lodging facilities;

- Expenditure incurred on Repair, Maintenance of Motor Cars and the amount of Depreciation there on.

- Expenditure incurred on use of telephone and Mobile Phones.

- Expenditure incurred on maintenance of any accommodation in the nature of Guest House other than used for Training purpose.

- Expenditure incurred on Festival Celebrations.

- Expenditure incurred on use of Health Club and similar facilities.

- Expenditure incurred on gifts;

Fringe Benefit Tax (FBT) is not applicable in case of following type of employers.

- An Individual or a sole Proprietor

- A Hindu Undivided Family

- Government

- A Political Party

- A person whose income is exempt u/s 10(23c)

- A Charitable Institution registered u/s 12AA.

- RBI

- SEBI

Profits in Lieu of Salary:

Receipts which are included under the head ‘Salary’ but Exempted u/s 10.

1. Leave Travel Concession (LTC) - Exempt up to rules.

2. Any Foreign Allowance or perks - If given by Govt. To its employees posted abroad are fully exempted.

3. Gratuity: A Govt. Employee or semi-Govt. Employee where Govt. Rules are applicable -- Fully Exempted.

A. For employees covered under Payment of Gratuity Act. --

Exempt up to least of following:

(a) Notified limit = Rs. 10,00,000

(b) 15 days Average Salary for every one completed year of

service (period exceeding 6 months =1 year)

1/2 month’s salary = (Average monthly salary or wages x 15/26

(c) Actual amount received.

B. Other Employees -- Exempted up to least of following provided service is more than 5 years or employee has not left service of his own:

(a) Notified limit = Rs. 10,00,000

(b) 1/2 month’s average salary for every one year of completed service (months to be ignored.)

(c) Actual amount received

Average Salary = Salary for 10 months preceding the month of retirement divided by 10.

4. Commutation of Pension:

In case commuted value of pension is received --

(a) If Govt. Employee -- is Fully Exempted.

(b) If other employee who receive gratuity also -Lump sum amount is exempted up to commuted value of 1/3rd of Pension.

If other employee who does not get gratuity -- Lump sum amount is exempted up to commuted value of 1/2 of pension.

5. Leave Encashment u/s 10(10AA)

(a) If received at the time of retirement by a Govt. Employee---Fully Exempted

(b) If received during service---Fully taxable for all employees

(c) If received by a private sector employee at the time of retirement exempted up to:

(i) Notified limit Rs. 3,00,000

(ii) Average salary x 10 months

(iii) Actual amount received.

(iv) Average Salary x No. Of months leave due.

6. Any Tax on perks paid by employer. It is fully Exempted.

7. Any payment received out of SPF Any payment received out of SPF is Fully Exempted.

8. Any payment received out of RPF Any payment received out of RPF is Fully Exempted, if service exceeds 5 years.

9. Any payment received out of an approved superannuation fund. is Fully Exempted

Deduction Out of Gross Salary [ Sec. 16]

1. Entertainment Allowance [ U/s 16(ii)]

Deduction u/s 16(ii) admission to govt. Employee shall be an amount equal to least of following:

- Statutory Limit of Rs.5,000 p.a.

- 1/5th of Basic Salary

- Actual amount of entertainment allowance received during the previous year.

2. Tax on Employment u/s 16(iii

In case any amount of professional tax is paid by the employee or by his employer on his behalf it is fully allowed as deduction.

Deduction U/S 80C Out of Gross Total Income (GTI)

The following are the main provisions of the newly inserted Section 80C.:

- Under Section 80C, deduction would be available from Gross Total Income.

- Deduction under section 80C is available only to individual or HUF.

- Deduction is available on the basis of specified qualifying investments / contributions / deposits / payments made by the taxpayer during the previous year.

- The maximum amount deduction under section 80C, 80CCC, and 80CCD cannot exceed Rs.1 lakh.

Deduction u/s 80C shall be allowed only to the following assessee:

- An Individual

- A Hindu Undivided Family (HUF)

![Computation of 'Salary' Income [Section 15-17]](https://glossaread-contain.s3.ap-south-1.amazonaws.com/epub/1650499382_6994324.jpeg)

Income from house property (Section 22)

The annual value of property consisting of any buildings or lands appurtenant thereto of which the assessee is the owner, other than such portions of such property as he may occupy for the purposes of any business or profession carried on by him the profits of which are chargeable to income-tax, shall be chargeable to income-tax under the head ―income from house property.

Annual value how determined (section 23)

(1) For the purposes of section 22, the annual value of any property shall be deemed to be—

(a) the sum for which the property might reasonably be expected to let from year to year; or

(b) where the property or any part of the property is let and the actual rent received or receivable by the owner in respect thereof is in excess of the sum referred to in clause (a), the amount so received or receivable; or

(c) where the property or any part of the property is let and was vacant during the whole or any part of the previous year and owing to such vacancy the actual rent received or receivable by the owner in respect thereof is less than the sum referred to in clause (a), the amount so received or receivable:

Provided that the taxes levied by any local authority in respect of the property shall be deducted (irrespective of the previous year in which the liability to pay such taxes was incurred by the owner according to the method of accounting regularly employed by him) in determining the annual value of the property of that previous year in which such taxes are actually paid by him.

(2) Where the property consists of a house or part of a house which—

(a) is in the occupation of the owner for the purposes of his own residence; or

(b) cannot actually be occupied by the owner by reason of the fact that owing to his employment, business or profession carried on at any other place, he has to reside at that other place in a building not belonging to him, the annual value of such house or part of the house shall be taken to be nil.

(3) The provisions of sub-section (2) shall not apply if—

(a) the house or part of the house is actually let during the whole or any part of the previous year; or

(b) any other benefit therefrom is derived by the owner.

(4) Where the property referred to in sub-section (2) consists of more than one house—

(a) the provisions of that sub-section shall apply only in respect of one of such houses, which the assessee may, at his option, specify in this behalf;

(b) the annual value of the house or houses, other than the house in respect of which the assessee has exercised an option under clause (a), shall be determined under sub-section (1) as if such house or houses had been let.

Deductions from income from house property (Section 24)

Income chargeable under the head ―Income from house property‖ shall be computed after making the following deductions, namely: —

(a) a sum equal to thirty per cent. Of the annual value;

(b) where the property has been acquired, constructed, repaired, renewed or reconstructed with borrowed capital, the amount of any interest payable on such capital:

Provided that in respect of property referred to in sub-section (2) of section 23, the amount of deduction shall not exceed thirty thousand rupees:

Amounts not deductible from income from house property (Section 25)

Interest chargeable under this Act which is payable outside India (not being interest on a loan issued for public subscription before the 1st day of April, 1938), on which tax has not been paid or deducted under Chapter XVII-B and in respect of which there is no person in India who may be treated as an agent under section 163 shall not be deducted in computing the income chargeable under the head ―Income from house property.

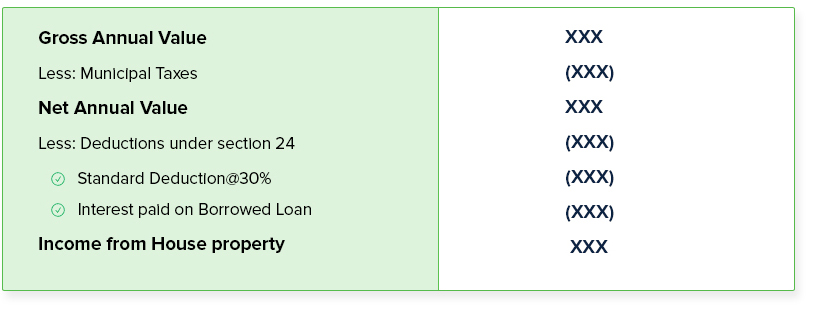

How to calculate Income from House Property for income tax purposes?

The income tax categorises your income under two categories for the purpose of taxability of house property income. These are:

Self-Occupied House Property | This is the type of property that is self-owned and used for own residential purposes. This may be occupied by the owner’s family or relative or self. A property that is unoccupied is considered as a self-occupied property for the purpose of income tax. Before the Financial Year 2019-20 if taxpayer owns more than one house property, only one is considered as self-occupied property and rest are assumed to be let out. From 2019-20 onwards two properties are considered as self-occupied properties. |

Let Out House Property | Any house property that is rented for complete or part of the year is considered as a let-out property for income tax purposes. |

Note: Inherited Property Any property inherited from parents, grandparents, etc, can be either considered as self-occupied or let out house property based on the usage as discussed above. | |

Steps to compute “Income from House Property”

The calculation of income from house property involves various steps. These steps are common to both the categories of house property Self-Occupied and Let Out. These are:

Calculation of Income from House property

Calculation/Assessment of “Income from House Property” in both cases – Self-occupied and Let Out

Type of House Property | Self-Occupied Property | Let Out Property |

Gross Annual Value

Income from House property | Nil | XXX |

Important Note: From the F.Y. 2017-18, set of loss of income from house property from other sources of income is restricted to Rs. 2,00,000. | ||

How to calculate the Gross Annual Value of House Property?

Assessment of Gross Annual Value of Self-Occupied House Property:

The annual value will be nil if the individual self-occupies the only property he or she owns. However, if the person has multiple properties with the purpose of self-occupation, only one property is considered as self-occupied and its annual value can be specified as nil. The assessment of the annual value of the remaining properties will be done according to the expected rent if the property was let out.

Assessment of Gross Annual Value of Let-Out House Property:

Step 1: Find out the Reasonable Expected Rent of the Property (A)

Reasonable Expected Rent is the amount for which the property can be reasonably be expected to be let out from year to year. It is higher of the Municipal Valuation or Fair Rent of the property, but cannot exceed the standard rent determined as per the Rent Control Act. Reasonable Expected Rent = Higher of Municipal Valuation or Fair Rent, subject to maximum Standard Rent

Step 2: Find out the Actual Rent Received or Receivable (B)

Step 3: Higher of (A) or (B), is the Gross Annual Value.

Key Takeaways

- The annual value of property consisting of any buildings or lands appurtenant thereto of which the assessee is the owner, other than such portions of such property as he may occupy for the purposes of any business or profession carried on by him the profits of which are chargeable to income-tax, shall be chargeable to income-tax under the head ―income from house property.

References:

1. Ahuja, Giri & Gupta, Ravi: Systematic Approach to Incomes Tax

2. Agrawal, B.K.: Income Tax law and practice

3. Agrawal, B.K.: Ayakar Vidhan Avam lekhe

4. Chandra, Mahesh & Shukla, D.C.: Income Tax Law and practices

5. Chandra, Girish: Income Tax