UNIT V

Control

Concept

Therefore, management can be defined as a management function to ensure that activities within an organization are performed according to plan. Control also ensures the efficient and effective use of organizational resources to achieve goals. Therefore, it is a goal-oriented function.

Control and management control are often considered the same. They both are different from each other. Control is one of the management functions, but management control can be defined as the process that an administrator follows to perform a control function.

Management control refers to setting established standards, comparing actual performance with these standards, and taking corrective actions to ensure that the organization's goals are achieved, if necessary.

Definition of control:

Business management means measuring achievement against standards and correcting deviations to ensure that goals are achieved according to the plan. Koontz and Koontz

Control functions are performed at all levels, top, middle, and supervision levels, at all types of organizations, whether commercial or non-commercial. Therefore, it is a popular feature. Management should not be considered the last function of management.

The control function compares the actual performance with a given standard, finds deviations, and attempts to take corrective action. Ultimately, this process also helps in developing future plans. Therefore, control functions help bring the management cycle back to plan.

Importance of control:

The importance of administrative functions in an organization is as follows:

1. Achievement of organizational goals:

Control helps you compare actual performance to certain criteria, find deviations, and take corrective action to ensure that your activities perform as planned. Therefore, it helps to achieve the goals of the organization.

2. Judgment of standard accuracy:

An efficient control system helps determine standard accuracy. In addition, it helps us review and revise our standards as our organization and environment change.

3. Use resources efficiently:

Management checks the work of employees at all stages of operation. Therefore, you can effectively and efficiently use all resources in your organization while minimizing waste and corruption.

4. Improving employee motivation:

Employees know the criteria by which their performance is judged. A systematic assessment of performance and the resulting rewards in the form of increments, bonuses, promotions, etc. motivate employees to do their best.

5. Ensuring order and discipline:

By managing it, you can closely check the activities of employees. Therefore, it helps reduce fraudulent behaviour of employees and creates order and discipline in the organization.

6. Promote ongoing coordination:

Management helps provide a common direction for all activities and individual efforts of different departments to achieve organizational goals.

Control Process

Its main purpose is to ensure that the activities of the organization are proceeding as planned. The control process that every manager needs to implement consists of several steps. Each of these is equally important and plays a major role in effective management.

The management control process ensures that all activities in the business are driving that goal. This process basically helps managers assess the performance of their organization. By making good use of it, you can decide whether to change the plan or continue.

Process:

The control process consists of the following basic elements and procedures:

1. Establish goals and standards

The task of modifying goals and criteria is done during planning, but it also plays a major role in control. This is because the main purpose of management is to direct business behaviour towards that goal. If members of an organization have a clear understanding of their goals, they will do their utmost to achieve them.

It is very important for managers to communicate their organization's goals, standards and objectives as clearly as possible. There should be no ambiguity among employees in this regard. When everyone works towards a common goal, it helps the organization to thrive.

The goals that administrators need to set and work on are either tangible / concrete or intangible / abstract. A tangible goal is a goal that can be easily quantified numerically. For example, achieving sales equivalent to rupees. Within a year, 100 chores is a concrete goal.

Intangible goals, on the other hand, are goals that cannot be quantified numerically. For example, company may be aiming to win a prestigious award for corporate social responsibility activities.

2. Measure actual performance against goals and criteria

Once the manager knows what his goals are, he then needs to measure and compare the actual performance. This step basically helps you know if your plan is working as intended.

After implementing the plans, the administrator should constantly monitor and evaluate them. If things aren't working properly, they should always be ready to take corrective action. To do this, you need to keep comparing actual performance to your ultimate goal.

This step of process control not only helps managers perform corrective actions, but also helps managers anticipate future problems. In this way, they can take immediate action and save their business from loss.

To compare the actual performance, the manager should measure it first. You can do this by measuring the results financially, seeking customer feedback, or appointing a financial expert. This is often difficult when managers want to measure intangible criteria such as labor relations and market reputation.

3. Take corrective action

If there is a discrepancy between actual performance and goals, managers should take immediate corrective action. Timely corrective actions can not only reduce losses, but also prevent them from happening again in the future.

In some cases, the corporate organization develops default corrective actions in the form of policies. However, for complex issues, this can be difficult to do.

In such cases, the administrator must first quantify the defect and prepare a series of actions to fix it. At times, special measures may need to be taken for unpredictable problems.

4. Follow-up of corrective actions

Taking corrective action is not enough. Administrators also need to draw them to logical conclusions. Even this step requires a thorough evaluation and comparison.

Administrators should stick to the issue until it is resolved. If they refer to it to their subordinates, they must stay around and see him complete the task. They may guide him personally so that he can later solve such problems himself.

Control Limitations:

1. Difficulty in setting quantitative criteria:

If performance criteria cannot be defined quantitatively and it is very difficult to set quantitative criteria such as human behaviour, efficiency level, job satisfaction, employee morale, the control system determines its effectiveness. Lose In such cases, the decision is at the discretion of the manager.

2. No control of external factors:

Enterprises have no control over external factors such as government policy, technology changes, epidemic changes, and competitor policy changes.

3. Employee resistance:

Employees often resist controls, resulting in less effective controls. Employees feel that control reduces or reduces their freedom. Employees can resist and oppose the use of the camera and take a closer look at the camera.

4. Expensive cases:

Management is a costly process and requires a lot of time and effort as you need to pay close attention to observing employee performance. Organizations have to spend a lot of money to install expensive control systems. Administrators need to compare the benefits of controlling the system with the costs associated with installing the system. The profit must be greater than the associated cost. If you don't, just controlling it will work, otherwise it will be inefficient.

Principles of Effective Control

The following are the principles of control.

1. Purpose:

Controls must actively contribute to the achievement of Group goals by quickly and accurately detecting deviations from the plan to enable corrective action.

2. Interdependence between planning and management:

The principle of interdependence is that the more plans are clearer, complete, and integrated, and the controls are designed to reflect such plans, the more effectively the controls meet the needs of managers. He says he will respond.

3. Management responsibility:

According to this principle, the main responsibility for exercising control lies with the manager responsible for executing the particular plan involved.

4. Control principles that adhere to organizational patterns:

Controls should be designed to reflect the nature and structure of the plan. If the organization is clear and the responsibilities for the work done are clearly defined, management will be more effective and it will be easier to isolate the person responsible for the deviation.

5. Control efficiency:

Control techniques and approaches effectively detect deviations from the plan and enable corrective action with minimal unsolicited consequences.

6. Future-oriented control:

It emphasizes that controls should be positive. Effective management should be aimed at preventing current and future deviations from the plan.

7. Control personality:

Management should be designed to meet the individual requirements of administrators within the organization. Some control techniques and information are available to different types of businesses and administrators in the same format, but as a general rule, controls should be tailored to meet specific requirements.

8. Strategic point control:

Effective and efficient management requires attention to strategic factors in assessing performance.

9. Exceptional principle:

You should adopt the exception principle of notifying standard exceptions. You should be aware of the various properties of exceptions, as "small" exceptions in a particular area can be more important than "large" exceptions elsewhere.

10. Review Principle:

The control system should be reviewed on a regular basis. Review exercises can cover some or all of the points highlighted in the above principles. Moreover, flexibility and economic nature or control should not be lost while reviewing the control.

Ratio Analysis (ROI)

What is ratio analysis?

Ratio analysis refers to the analysis of financial information that is contained in a company's financial statement. These are primarily used by external analysts to determine various aspects of the business, such as profitability, liquidity and solvency.

Ratio analysis

Analysts obtain data to assess a company's financial performance based on current and historical financial statements. They use the data to determine if a company's financial position is on the rise or down and compare it to other competitors.

Use of ratio analysis

1. Comparison

One use of ratio analysis is to compare a company's financial performance to similar companies in the industry to understand its position in the market. By obtaining financial ratios such as price-earnings ratios from known competitors and comparing them to company ratios, management can identify market gaps and explore competitive advantages, strengths and weaknesses. I can do it. Management can then use that information to make decisions aimed at improving the company's position in the market.

2. Trend line

Companies can also use ratios to see if they are prone to financial performance. Established companies collect data from financial statements over a number of reporting periods. The trends obtained can be used to predict the direction of future financial performance. It can also be used to identify financial disruptions that are expected to be impossible to predict using a single reporting period ratio.

3. Operational efficiency

Company owners can also use financial ratio analysis to determine the degree of efficiency in managing assets and liabilities. Inefficient use of assets such as automobiles, land and buildings bring unnecessary costs to be eliminated. The financial ratio also helps determine if the financial resources are overused or underused.

Classification

This relationship can be represented as a percentage or quotient. The ratio is simple to calculate and easy to understand. Those interested in analysing financial statements can be grouped under three heads,

i) Owner or investor

Ii) Creditors and

Iii) Financial executives

All these three groups are interested in the financial situation and performance of the company, but each of them is the main objective to try to get from these statements.

Investors primarily want a basis for estimating income capacity. Creditors are primarily concerned with liquidity and the ability to pay interest and redeem the loan within the specified period. Management is interested in the evolution of analytical tools that measure cost, efficiency, liquidity and profitability to make intelligent decisions.

Classification of ratios:

Financial ratios can be divided into the following five groups:

- Structure

- Fluidity

- Profitability

- Sales

- Other.

1. Structure Group: the ratio of structure groups is as follows:

A. Liabilities funded by total capitalization:

The term "total" capitalization refers to the term of the loan, consisting of debt, capital stock and reserves and surpluses. The ratio of funding debt to total capitalization is calculated by dividing funding debt by total capitalization. It can also be expressed as a percentage of the provident debt to the total capitalization.

B. Long term loans

Total capital (share capital +reserve and surplus + long-term borrowings) II) debt to capital:

It is necessary to pay close attention to the calculation and interpretation of this ratio. The definition of debt takes two first. One includes current liabilities and the other includes current liabilities. Therefore, the ratio is calculated by the following two methods:

Long-term loans term credits + total liabilities on capital=current liabilities and reserves share capital + reserves and surplus (or)

Long-term debt on shares = long-term debt / equity capital + reserve and surplus

C. Net fixed assets to funded liabilities:

This ratio acts as a complementary measure to determine the security for the lender. A 2: 1 ratio means that for all rupees of long-term debt, there is a book value of two rupees of net fixed assets:

Fixed assets net assets Reserve debt

D. Reserve (long-term) debt on net working capital:

This ratio is calculated by dividing long-term debt by the amount of net working capital. It helps to find out the creditor's contribution to the company's current assets.

Long-term loans net working capital

2. Liquidity group:

It includes current ratio and acid test ratio

i) Current Ratio:

It is measured by dividing current assets by current liabilities. This ratio indicates the extent to which the receivables of short-term creditors are covered by assets that may be converted into cash in the period corresponding to the maturity of the receivables, so short-term credit to general current assets/current liabilities and reserves+ Inventory

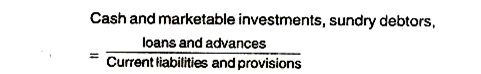

Ii) Acid test ratio:

It is also termed as fast ratio. It is determined by dividing the "quick assets", that is, cash, marketable investments and sundries debtors by current liabilities. This ratio is the most bitter of financial strength than the current ratio, as it does not give consideration to stocks that can move very low.

Liquidity group

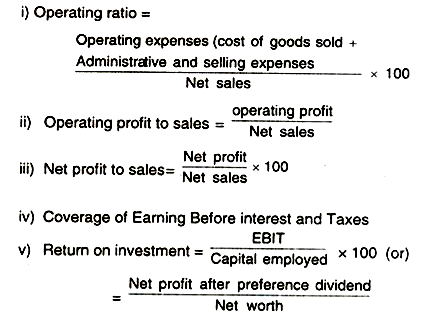

3. Profitability group:

It has five ratios and that they are calculated as follows:

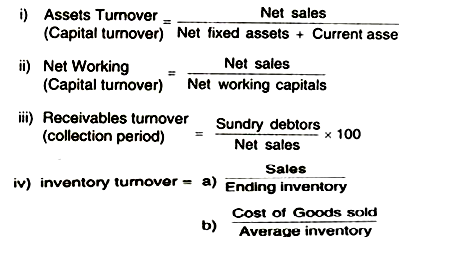

4. Sales group:

It has four ratios, and that they are calculated as follows:

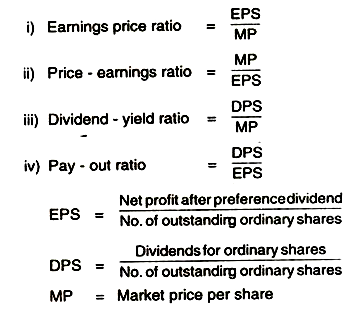

5. Another group:

It contains four ratios, and they are:

Criteria for comparison:

For proper use of proportions, it is essential to fix the criteria for comparison. As long as the ratio itself is not very meaningful, it is also suitable as compared to. The choice of the right criteria for comparison is the most important factor in the ratio analysis. The four most common criteria used in ratio analysis are absolute, historical, horizontal and budgetary.

Absolute standards are those that are generally perceived as desirable, regardless of the company, Time, stage of the business cycle or the purpose of the analyst. Past standards include comparing the company's own past performance as a present or future standard.

On a horizontal basis, one enterprise is compared with another or with the average of other enterprises of the same nature. Budget standards arrive after preparing the budget for the period ratio developed from the actual performance, and to find out the degree of achievement of the expected goals of the enterprise, the planning of the budget is carried out.

Benefits of ratio analysis:

Ratio analysis is widely used as a powerful tool for financial table analysis. It is a numerical or quantitative relationship between the two figures of the financial statements to confirm the strengths and weaknesses of the company, as well as its current financial situation and past performance. It assists various stakeholders to make an assessment of certain aspects of the company's performance. The main advantages of ratio analysis are:

1. Forecasting and planning:

The trend of costs, turnover, profit and other facts can be known by calculating the ratio of the relevant accounting figures for the past few years. With the help of ratios, this trend analysis may help to predict and plan future business activities.

2. Budgeting:

A budget is an estimate of future activities based on past experience. Accounting ratios help to estimate budget figures. For example, the sales budget can be prepared with the help of an analysis of past sales.

3. Measurement of operating efficiency:

The ratio analysis shows the degree of efficiency in the management and use of that asset. Different activity ratios show operational efficiency. In fact, the solvency of the enterprise depends on the sales income generated by utilizing its assets.

4. Communication:

The ratio is an effective means of communication and is important in informing the owner or other party of the position and progress made by the business concern.

5. Performance and cost control:

Ratios may also be used for controlling the performance of different departments or departments of a project as well as controlling costs. Management always concerns the overall profitability of the company. They want to know if the company has the capacity to meet its short-term and long-term obligations to Creditors, ensure a reasonable return to the owner and ensure the optimal use of the company's assets. This is possible if all the proportions are taken into account together.

6. Enterprise-to-enterprise comparison:

Comparing the performance of multiple companies reveals efficient and inefficient companies, and inefficient companies adopt appropriate measures to improve efficiency the best way of enterprise-to-enterprise comparison is to compare the relevant ratio of the organization to the average ratio of the industry.

7. Displaying liquidity positions:

Ratio analysis helps to assess the liquidity position i.e., the short-term debt that pays the company's ability. The liquidity ratio shows the ability to pay and support credit analysis by banks, creditors, and other suppliers of short-term loans.

8. Displaying long-term solvency positions:

Ratio analysis is also used to assess the long-term debt solvency of the enterprise. . This is measured by the ratio of leverage/capital structure to profitability, which indicates profitability and operational efficiency. Ratio analysis shows the strength and weakness of the enterprise in this regard.

9. Indicators of overall profitability

Management always concerns the overall profitability of the company. They want to know if the company has the capacity to meet its short-term and long-term obligations to Creditors, ensure a reasonable return to the owner and ensure the optimal use of the company's assets. This is possible if all the proportions are taken into account together.

10. Signals of corporate illness:

Companies are sick when they are unable to continuously generate profits and are suffering from a serious liquidity crisis. Proper ratio analysis can give industry disease signals in advance so that timely measures can be taken to prevent the occurrence of such diseases.

11. Assistance in decision making:

Ratio analysis helps to make decisions such as whether to supply the enterprise with goods on credit, whether bank loans will be available.

12. Simplify financial statements:

Ratio analysis makes it easy to understand the relationships between various items and helps to understand the financial statements.

These constraints / Limitations:

1. Restrictions on financial statements:

The ratio is calculated from the information recorded in the financial statements. However, the financial statements suffer from many limitations and, therefore, can affect the quality of the ratio analysis.

2. Historical information: financial statements provide historical information. They do not reflect the current situation. Therefore, it is not useful to predict the future.

3. Different accounting policies:

Different accounting policies regarding the valuation of inventories, charges depreciation, etc prevents you from comparing accounting data and accounting ratios for both companies.

4. Lack of criteria for comparison:

No fixed standard can be set for the ideal ratio. For example, it is said that the current ratio is ideal if current assets are twice the current liabilities. But this conclusion is justifiable in the case of these concerns, which have sufficient arrangements with their bankers to fund when they need it.

5. Quantitative analysis:

Ratios are a quantitative analysis only tool, and qualitative factors are ignored when calculating ratios. For example, if a liquid asset contains a large inventory consisting mainly of obsolete items, a high current ratio does not necessarily mean a healthy liquid position.

6. Window-dressing:

The term "window dressing" means presenting a financial statement in such a way that it displays a better position than what it actually is. For example, if a low depreciation rate is charged, the revenue expense field is treated as a capital investment, for example. The position of concern can be made to appear on the balance sheet much better than what it is. The ratio calculated from such a balance sheet cannot be used to scan the financial situation of the business.

7. Price level changes:

For fixed assets, the system displays the position statement at the cost only. Therefore, it does not reflect changes in the price level. Therefore, it makes the comparison difficult.

8. Causality is necessary:

Proper care should be taken to study only such figures that have causality.

9. The ratio occupies one variable.

Since the ratio occupies only one variable, they cannot always give the correct picture, since some other variables such as government policy, economic situation, availability of resources, etc. You should keep in mind while interpreting the ratio.

10. Seasonal factors affect financial data:

Proper care should be taken when interpreting the accounting ratios calculated for seasonal operations. For example, an umbrella company maintains high inventory during the rainy season, and the inventory level for the rest of the year will be 25% of the seasonal inventory level. Therefore, the liquidity ratio and inventory turnover will give a biased picture.

Return on Investment (ROI):

ROI is one of the most well-used overall control techniques. It measures a company's success by the ratio of return on capital investment. This approach has been an important part of DuPont's control system in the United States since 1919.

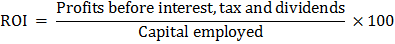

ROI is calculated according to the following formula:

Here, capital used refers to the total long-term investment in a company. (Average capital used, that is, first used capital + last used capital / 2) Used capital is calculated as the sum of fixed assets + net working capital (that is, current assets-current liabilities).

With the help of ROI, companies can compare current performance to past performance. You can also make similar investments and compare them to other companies in similar positions.

Benefits of ROI:

(I) ROI provides an overall assessment of business functions. It guides management in increasing profits through better use of invested capital. In fact, it focuses management's attention on the core purpose of the business: to generate the highest possible profits with the available capital.

(II) ROI is effective. Where permissions are distributed. If the department manager is provided with an efficiency guide that applies to the entire company. They foster a keen sense of responsibility for the department, and top management can easily hold subordinate managers accountable.

Limitation:

Some of the ROI limits are:

(1) There is a problem with the valuation of assets. What allocation method should be used between departments when assets are used jointly or when costs are common? Does the administrator have to charge the asset at the original cost, replacement cost, or depreciation amount? Setting up an ROI system as a control device is not an easy task.

(2) ROI focuses on financial factors. We overlook social and technical environmental factors. Qualitative factors that are rare (capable managers, good employee morale, good public relations, etc.) and are equally important or fairly important than capital used are completely ignored in ROI calculations. I will.

(3) There is no standard ROI for inter-company and intra-company comparisons.

Budget Control

What is Budget Control?

Budgeting is the process in which budgets are prepared for future periods and, if there are differences, are compared with actual performance to find differences. Comparison of budget figures with actual figures will help management to find out the differences and take corrective actions without delay. Objectives of Budget Control

The main objectives of Budget Control are:

- Define the purpose of the enterprise

- So, provide a plan for achieving a defined goal

- Increasing profitability by eliminating waste.

- Centralization of the control system.

- Correction of differences from the Sit standard.

- Fixing the responsibilities of various individuals in the enterprise.

- Coordinate the activities of different departments.

- Sales departments and cost centers economically and efficiently

Benefits of budgeting

Budget Control has become an important tool for organizations to manage costs and maximize profits. Some of the benefits of Budget Control include:

- Budget Control fixes goals. Each department is forced to work efficiently to reach its goals. Therefore, it is an effective way to control the activities of various departments of business units.

- It secures better coordination between various departments.

- When performance falls short of expectations, Budget Control helps management find responsibility.

- It helps to reduce production costs by eliminating wasteful spending.

- By promoting cost awareness among employees, budget management brings efficiency and economy.

- Budget Control facilitates centralized control through decentralized activities.

- Everything is planned and provided in advance, so it will help the smooth operation of the business enterprise.

- It tells Management where action is necessary to solve the problem without delay.

Disadvantages or limitations of Budget Control

The limits of Budget Control are as follows:

1. It is really difficult to accurately prepare the budget under inflation.

2. The budget involves heavy spending that small business care cannot afford.

3. The budget is always prepared for future periods that are uncertain. In the future, the conditions that disrupt the budget may change. Therefore, uncertainty in the future minimizes the usefulness of the Budget Control System.

4. Budget Control is just an administrative tool. Management cannot be replaced in decision-making because it is not a substitute for management.

5. The success of Budget Control depends on the support of top management. This will fail if there is insufficient support from top management.

For more limitations or disadvantages of Budget Control, see this article: disadvantages or limitations of Budget Control.

Key takeaways:

- Business management means measuring achievement against standards and correcting deviations to ensure that goals are achieved according to the plan.

- Its main purpose is to ensure that the activities of the organization are proceeding as planned.

- The management control process ensures that all activities in the business are driving that goal

- Controls must actively contribute to the achievement of Group goals by quickly and accurately detecting deviations from the plan to enable corrective action.

- Enterprises have no control over external factors such as government policy, technology changes, epidemic changes, and competitor policy changes.

- Ratio analysis consists of the calculation of ratios from financial statements and is the basis of financial analysis.

- Ratios that indicate the relative magnitude of selected numbers taken from their financial statements are called Financial ratios, or accounting ratios,

- The figures contained in the financial statements should be put into context so that investors can better understand the various aspects of the company's operations.

- Ratio analysis is one method that investors can use to gain that understanding. The numbers contained in these documents should be put into context so that investors can better understand different aspects of the company's operations.

- Ratio analysis is one of three methods that investors can use to gain that understanding.

- Profitability ratio measures the company's use of its assets and control of its expenses to generate an acceptable rate of return.

- Liquidity ratio measures the availability of cash to pay debts.

- Activity ratio, also called efficiency ratio, measures the effectiveness of a company's use of resources, or assets.

- Debt, or leverage, ratio measures a company's ability to repay long-term debt.

- Market ratios are concerned with the audience of shareholders. They measure the relationship between the cost of issuing shares and the return and the value of investing in a company's shares.

- Budget Control has become an important tool for organizations to manage costs and maximize profits.

- It helps coordinate the resources of the manager.

- Help define the standards required for all control systems.

- They provide clear and clear guidelines for organizational resources and expectations,

- Facilitates performance evaluation of managers and units

- The budget involves heavy spending that small business care cannot afford.

- ROI is one of the most well-used overall control techniques. It measures a company's success by the ratio of return on capital investment.

- ROI provides an overall assessment of business functions. It guides management in increasing profits through better use of invested capital.

- In fact, it focuses management's attention on the core purpose of the business: to generate the highest possible profits with the available capital.

- With the help of ROI, companies can compare current performance to past performance.

- Budgetary control is a cost management system that includes budget preparation to coordinate departments, comparing performance to budgets, and acting on results to establish responsibility for achieving maximum revenue.

- Budgetary control is an important tool for making an organization an important tool for cost control and achieving overall goals.

Management functions are the key to an organization's success. Therefore, today we are faced with several challenges, which are primarily the results of major changes within the outside world. Here are a number of the main new challenges and challenges facing all management.

For better management of the organization, managers must be ready to adapt to new challenges. a number of the challenges are:

(1) Globalization

(2) Ethics and social responsibility

(3) Workforce diversity

(4) Empowerment

(5) technology

(6) Building a competitive advantage

(7) Environmental development

(8) Quality and productivity

(9) Innovation and alter

(10) Intellectual property management

(11) Multicultural effect

1. Globalization:

Globalizing the business may be a new big challenge for management. This happens when a corporation extends its activities to other parts of the planet , actively participates in other markets, and competes with organizations in other countries. Transactions of business organizations are conducted across national borders. Globalization has made the planet a worldwide village. During this process, the manager's job is being transformed into new management issues and challenges, including:

(1) Increased allocation of foreigners

(2) Cooperation with people from different cultures

(3) Dealing with anti-capitalist repulsion

(4) Oversee the transfer of labor to countries with low-cost labor

(5) There is external competition for markets and resources.

2. Ethics and social responsibility:

Growing concerns about business roles and ethical status. Managers are concerned due to the complexity of ethics in deciding. Society generally expects more from corporate organizations. These organizations expect to contribute to quality of life and society. Environmental issues became a matter of widespread concern. Administrators determine how well these social responsibility and ethical issues are handled and managed.

(1) Here are some bullet points about ethics and social responsibility:

(2) Ethics is about a person's personal belief in what's right or wrong.

(3) The most important ethical concern of recent managers is knowing how a corporation treats its employees.

(4) Social responsibility may be a set of obligations that a corporation must fulfill to society.

3. Labor diversity:

People within the organization are getting more demographically heterogeneous (disability, gender, age, country of origin, non-Christians, race, and cohabitation partners). The various workforce includes women, the physically challenged and therefore the elderly. Managing this diversity has become a worldwide concern.

Diversity isn't properly managed. Higher sales, harder communication, more potential for interpersonal conflict. Managers got to remember of the differences between employees and answer them during a way that ensures their commitment.

Here are some bullet points about workforce diversity:

(1) Due to changes in population size, the workforce is increasing in today's organizations

(2) There are several aspects to diversification. What matters is age, gender, and ethnicity

(3) Workforce diversification can have different impacts on a corporation

(4) On the one hand, it can cause a price advantage, and on the opposite hand, it can cause conflicts within the organization.

4. Empowerment:

Deciding is pushed right down to operational levels. Workers are now given the liberty to settle on schedules, procedures, and solutions to work-related problems. Previous managers were encouraged to involve employees in work-related decisions. Managers now give employees complete control over their work. Therefore, the manager was engaged in empowering employees. Similarly, managers provide more information to employees to tell them of problems and organizational prospects.

(1) Here are some bullet points of empowerment:

(2) Employees are a key element of the organization's internal environment

(3) Achieving organizational goals is beneficial when managers and employees embrace an equivalent value and have an equivalent goal.

(4) Today, employees are getting more powerful thanks to decentralized authority and trade unions belonging to political parties.

5. Technology:

The technological environment consists of organized knowledge of innovation, technology, and therefore the way things are done. Modern business is characterized by new and ever-changing technological developments. This needs a technical perspective in management. They have to remember of and anticipate changes in technology. Technical changes change products and services. Within the way they're produced and sold. Therefore, administrators got to have an honest understanding of those aspects of the technical context.

Here are some bullet points of technology:

(1) Technology development tends to increase aspirations and expectations

(2) It develops the concept of competitive environment between manufacturer and supply

(3) The most important challenge for current managers is to identify and predict new technologies that are constantly being developed.

(4) It is the manager's responsibility to respond to changes in technology and seize the opportunity to succeed in the business.

6. Building a competitive advantage:

Increased efficiency in reducing the number of resources used to produce goods and services. In addition, we will introduce total quality management (TQM) to improve quality. Similarly, adapt to increased speed, flexibility and innovation to bring new products to market faster. Improve customer responsiveness Enables employees to respond to customers.

7. Environment development:

Environmental problems have become a major issue in recent management. These issues include deforestation, global warming, ozone depletion, toxic waste, land, air and water pollution. These issues may not be corporate issues. However, these issues have attracted the attention of various social, business and political institutions.

Here are some bullet points for environmental development:

(1) Environmental problems are big management problems

(2) These issues may not be of interest to businesses, especially in developing countries.

(3) But politicians and social activists got an environmental banner

(4) The green movement is widespread in different parts of the world

(5) Today's managers face the challenge of creatively developing a company without harming the environment.

8. Quality and productivity:

What is complementary or complementary to each other is essentially quality and productivity. Quality helps maximize productivity and ultimately minimizes per unit cost of output. And minimizing costs depends on the skills of the manager.

Here are some bullet points for quality and production:

(1) In the past, many managers believed that production could only be increased by lowering quality, but current managers disagree.

(2) Current managers recognize that quality and productivity are interrelated

(3) Three Positive Results for Management:

- Less defective returns from customers

- Minimize wasted resources

- Reduce the need for inspectors

9. Innovation and change:

Innovations in new knowledge and changing stakeholder expectations pose new challenges for current managers or managers. Faced with change is a significant challenge for managers. Or changes can occur in the attitudes and behaviours of stakeholders such as competitors, customers, employees, suppliers and lenders. Therefore, it is an important responsibility of the administrator to handle such changes in a scientific and practical way.

Below are some bullet points of innovation and change.

(1) Innovations in new knowledge to meet stakeholder expectations are increasing today

(2) Managing changes is now an important issue for administrators

(3) It is the responsibility of the administrator to address such changes in a scientific and practical way.

(4) Administrators can use a variety of tools to harmonize their organization's work environment

10. Knowledge management:

Employees are a major source of knowledge. And you need to accumulate their ideas as much as possible to prepare plans and policies. It is due to social expectations of new ideas, new things and creativity in products and services from every organization. And it is essential to adopt new knowledge from the outside based on the requirements.

Here are some bullet points of Knowledge Management:

(1) Knowledge has helped

(2) Society expects new ideas, things and creativity from its products and services

(3) To meet these social expectations, managers need to accumulate knowledge and ideas from all members of the organization.

(4) Model managers need flexibility to manage their knowledge and need to consider situational factors as well.

11. Multicultural effect:

Innovations in modern communication and transportation systems have united multicultural people. They work together to achieve common professional goals and objectives. In the current situation, cross-cultural professional involvement in organizations continues to grow. Therefore, the involvement of multicultural people with different traditions, values, social attitudes, religious beliefs, and living approaches creates new challenges for managers.

Below are some bullet points of the multicultural effect.

(1) Innovations in modern transportation systems have united multicultural people

(2) They work together to achieve a common goal, even with different traditions, values and social attitudes

(3) Management is effective only when:

(4) Can maintain coordination between multicultural professionals

Therefore, these are the following new issues and challenges in management

References:

- Harold koontz and Heinz Weihrich, Essentials of Management, Pearson Education.

- Stephen Robbins and M. Coulter, Management, Pearson Education

- Stephen P Robbins, David A Decenzo, Sangh Mitra Bhattacharya and Madhu Shree Manda Agarwal,

- Fundamentals of Management, Essentials, Concepts and Applications, Pearson Education

- Drucker Peter F, Practice of Management, Mercury Book, Landon

- George Terry Principle of Management, Richard D Irwin

- Newman summer and Gilbert, Management, PHI

- James H Donnelly, Fundamental of Management, Pearson Education

- Chhabra, T.N. Essential of Management. Sun India

- Griffin Management Principles and Application, Cengage Learning

- Robert Kreitner, Management Theory and Application, Cengage Learning