Unit 4

Deductions from gross total income u/s 80C

Deductions to be made in Computing Total Income [Sections 80A to 80U (Chapter VIA)]

The aggregate of income computed under each head, after giving effect to the provisions for clubbing of income and set off of losses, is known as "Gross Total Income". In computing the total income of an assessee, certain deductions are permissible under sections 80C to 80U from Gross Total Income.

These deductions are however not allowed from the following incomes although these incomes are part of Gross Total Income:

- Long-term capital gains.

- Short-term capital gain on transfer of equity shares and units of equity-oriented fund through a recognised stock exchange i.e. short-term capital gain covered under section 111A.

- Winnings of lotteries, races, etc.

- Incomes referred to in sections 115A, 115AB, 115AC, 115ACA, 115AD and 115D.

These deductions are of two types: —

- Deductions on account of certain payments and investments covered under sections 80C to 80GGC.

- Deductions on account of certain incomes which are already included under Gross Total Income covered under sections 80-IA to 80U.

Basic Rules of Deductions [Sections 80A/80AB/80AC]

- Deductions cannot exceed Gross Total Income [Section 80A (2)]:

The aggregate number of deductions under sections 80C to 80U i.e., under Chapter VI-A shall not, in any case, exceed the "Gross Total Income" (exclusive of long-term capital gains, short-term capital gain covered under section 111A, winnings of lotteries, crossword, puzzles, etc. and income referred to in sections 115A to 115AD and 115D) of the assessee. Therefore, the total income after deductions will either be positive or nil. It cannot be negative due to deductions. If the "Gross total income" is negative or nil, no deduction can be permitted under this Chapter.

2. Deduction not allowed to members if allowed to AOP/BOI [Section 80A (3)]:

If a deduction is allowed under the above sections to the AOP or BOI then deductions for the same payment/income will not be allowed to the members of the AOP/BOI. [Section 80A (3)].

3. Double deduction not allowed and deduction cannot exceed the profit of the particular undertaking or unit or enterprise, etc. [Section 80A (4)]:

Notwithstanding anything to the contrary contained in section 10AA or in any provisions of this Chapter under the heading "C.—Deductions in respect of certain incomes" (i.e. deductions under sections 80-IA to 80RRB), where, in the case of an assessee, any amount of profits and gains of an undertaking or unit or enterprise or eligible business is claimed and allowed as a deduction under any of those provisions for any assessment year, deduction in respect of, and to the extent of, such profits and gains shall not be allowed under any other provisions of this Act for such assessment year and shall in no case exceed the profits and gains of such undertaking or unit or enterprise or eligible business, as the case may be.

4. Deduction allowed only when it is claimed by the assessee [Section 80A (5)]:

Where the assessee fails to make a claim in his return of income for any deduction under section 10AA or under any provision of this Chapter under the heading "C.—Deductions in respect of certain incomes" (i.e., sections 80-IA to 80RRB), no deduction shall be allowed to him thereunder.

5. Profit or gain to be recomputed if inter unit or inter business transfer is not at market value [Section 80A (6)]

6. Assessee's duty to place relevant material:

If an assessee approaches a statutory authority for obtaining a concession under the taxing statute, he should in fairness place all the material before the said authority and be also in a position to satisfy the said authority that he was entitled to obtain the concession.

7. Deduction to be allowed in respect of net income included in Gross Total Income [Section 80-AB]:

Where any deduction is required to be made or allowed under any section in respect of any income then for the purpose of computing the deduction under that section, the net income computed in accordance with the provisions of the Income-tax Act (before making any deduction under this chapter i.e., Chapter VIA) shall alone be regarded as the income received by the assessee and which is included in his Gross Total Income. [Section 80AB].

8. Benefits of certain deductions not to be allowed in cases where return is not filed within the specified time limit [Section 80AC]:

Where in computing the total income of an assessee, any deduction is admissible under section 80-IA or section 80-IAB or section 80-IB or section 80-IC or section 80-ID or section 80-IE, no such deduction shall be allowed to him unless he furnishes a return of his income for such assessment year on or before the due date specified under section 139(1).

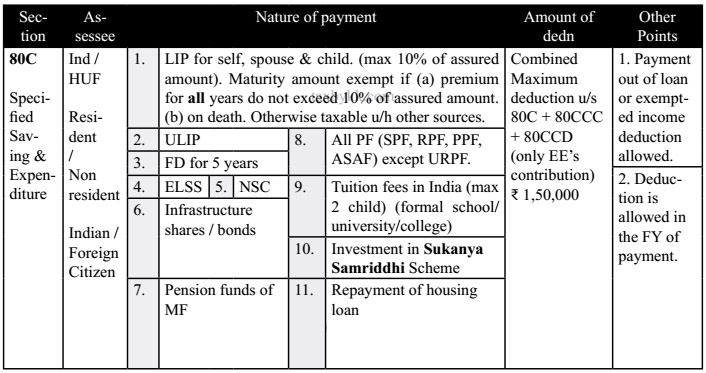

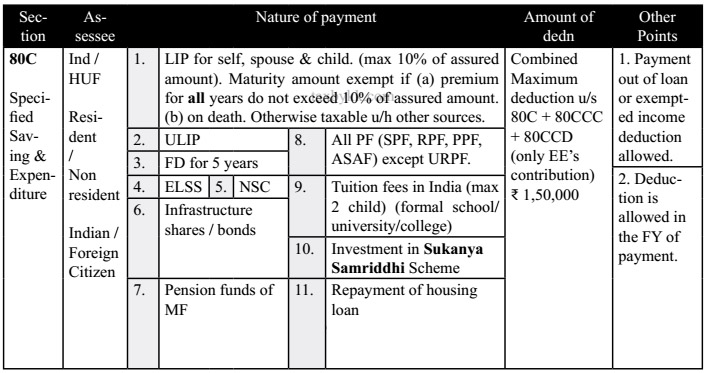

Section 80C (Specified Saving & Expenditure)

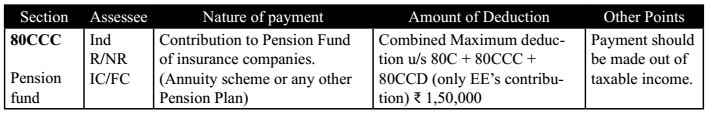

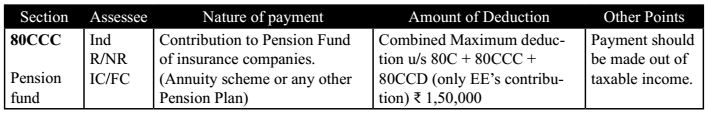

Section 80CCC (Annuity Scheme or any other Pension Plan)

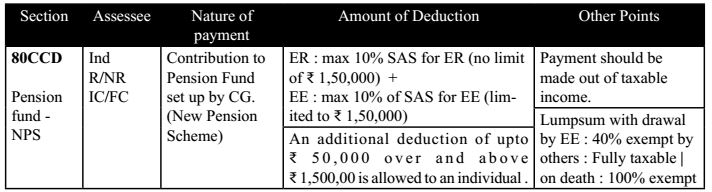

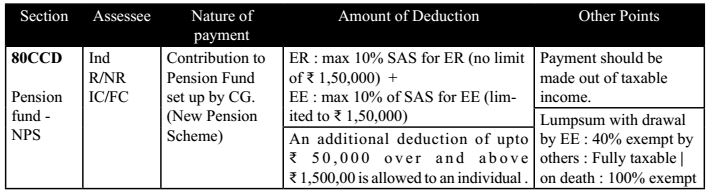

Section 80CCD (New Pension Scheme-NPS)

Governments impose taxes on their citizens to generate revenue which helps in the overall development of the nation by increasing the public exchequer. India's Income Tax fee is very progressive, which means the more you earn, the more you will have to pay. The regular tax-filing period in India begins in the month of early January and lasts till the end of financial year.

The citizens of India are required to pay tax as per Income Tax Act of India. While filing an Income Tax return, you may see a lot of people who are confused and stressed about the shaded provisions. If you are also one of them, then you need to know that you are not alone.

The tax filing process might seem too boring and awkward to a starter, but don't panic. Here's everything you need to know about income tax rebate –

What is income tax rebate?

Income tax rebate is a refund on taxes if the tax paid by an individual is more than the tax liability. In other words, you will avail a refund on tax money at the end of every financial year if your tax liability is less than that of the amount paid by you. You need to file an Income Tax Rebate within a specified period if you want to claim the income tax refund.

How to get income tax rebate?

The only way to get income tax rebate is through filing an ITR at the end of the fiscal year. Although, there can be few cases –

- If your gross income is less than 5 Lakhs, then in that case filing an ITR will be useful.

- But, if your gross income is more than 5 Lakhs, then you will have to take the help of a tax deduction system that comes under Section 80C, Section 80D, 80CCD, etc. to reduce your taxable income.

- Also, people with a gross income of up to 5 Lakhs need to know that they are also eligible for a full tax rebate.

What are the key points of Section 87A income tax rebate?

- As per section 87A of the Income Tax Act, both men and women are liable to pay rebates as long as their income falls under the income tax bracket.

- This applies only to the citizens of India. If you are a non-resident of India, then you cannot apply for a tax rebate as per Section 87A of the Income Tax Act. To prove your citizenship, you need to have an Aadhar Card or birth certificate.

- Rebate advantage is not for senior citizens who are above 60 – You are not eligible to file an income rebate if you are a senior citizen who is above 60 years of age.

- As per the act, only a 'person' can apply for a tax rebate. Hence, only an individual can apply for a tax rebate, not firms or companies.

What are the types of ITRs in India?

Here're the types of Income Tax Rebates in India -

Section 80C – A lot of taxpayers prefer section 80C of the Income Tax Act as this section cut down the taxable income by Rs. 1 Lakh. Also, people are allowed for a tax rebate of the following expenses –

- ELSS

- Life Insurance Premium

- Annuity or pension fund

- Bank fixed deposits (5-year)

- PPF, NSC, SCSS deposits

- Stamp duty and registration on buying a house

Section 80D – If you are making payment under health insurance premium, then you will get tax rebate under section 80D of the Income Tax Act.

For every citizen of India, it is advisable to pay income tax before its due date. Failing to do so would lead to several consequences such as heavy fines and imprisonment under the IT Act. Besides, for those who are planning to buy tax saving plan online, you choose to go with Canara HSBC OBC Life Insurance for better options.

Relief

Tax relief is any government program or policy initiative designed to reduce the amount of taxes paid by individuals or businesses. It may be a universal tax cut or a targeted program that benefits a specific group of taxpayers or bolsters a particular goal of the government.

An individual or business entity typically gets tax relief through deductions, credits, or exclusions, and occasionally by the forgiveness of a tax lien.

The policy goals of the U.S. Government can often be tracked through the many additions and amendments made over time to the federal tax code. Americans are encouraged to save for retirement by making tax-delayed contributions to a retirement savings account. They are discouraged from raiding those accounts by tax penalties imposed on early withdrawals.

Even the history of natural disasters can be read through the tax code. Hurricane victims may be allotted some form of tax relief to offset the damage to private property suffered when a hard-hit region is declared a disaster area.1 Victims of the 2018 California wildfires were able to declare casualty losses not covered by private insurance on their income tax returns.

Tax relief is intended to reduce the tax liability of individuals or businesses. Tax relief is also often designed to provide assistance to a particular group of people or to bolster a cause.

Tax deductions

The reduction of taxable income using legal deductions is a form of tax relief. The most commonly used federal tax deduction is the one for home mortgage interest.

Tax relief often targets specific taxpayers, such as those bearing unexpected costs due to a hurricane or a wildfire.

A tax deduction reduces the taxable income of a taxpayer. If a single filer’s taxable income for the 2020 tax year was $75,000, that person would owe around $12,500 in federal income tax. However, if the person qualifies for an $8,000 tax deduction, taxes will be based on $75,000 - $8,000 = $67,000 in taxable income. The person's federal income tax would then decrease to around $10,500.

Tax credits

A tax credit is another form of tax relief, one that provides greater savings than a tax deduction does. A tax credit is directly subtracted from the individual's total amount of tax owed after all deductions are made.

For example, say a taxpayer has finished itemizing deductions (or has taken the standard deduction) and the bill amounts to $3,000. If the person is also eligible for a $1,100 tax credit, the final tax bill will be $1,900.

This type of tax relief is often described as a tax incentive because it reimburses taxpayers for expenditures that the government deems worthwhile. For example, the American Opportunity Tax Credit and the Lifetime Learning Credit programs allow tax credits to be taken by people who enrol in postsecondary education programs.

Tax exclusions

Exclusions classify certain types of income as tax-free or as tax relief, reducing the amount that a taxpayer reports as gross income.

In some cases, income that has been excluded for tax purposes is not recorded on the return. In other cases, it is recorded in one section of the return and then deducted in another section.

For example, the value of company-paid health insurance is not recorded on an individual tax return, and employees do not pay income tax for that cost. Their employers, on the other hand, deduct the cost as a business expense.

Tax debt forgiveness

The IRS has a program called Fresh Start that offers a number of options for taxpayers to settle outstanding tax debts, often for a percentage of the original liability. The agency can provide a tax relief arrangement to help people pay the reduced tax amounts over time and avoid a tax lien.

References:

1. Ahuja, Giri & Gupta, Ravi: Systematic Approach to Incomes Tax

2. Agrawal, B.K.: Income Tax law and practice

3. Agrawal, B.K.: Ayakar Vidhan Avam lekhe

4. Chandra, Mahesh & Shukla, D.C. Income Tax Law and practices

5. Chandra, Girish: Income Tax

Unit 4

Deductions from gross total income u/s 80C

Unit 4

Deductions from gross total income u/s 80C

Deductions to be made in Computing Total Income [Sections 80A to 80U (Chapter VIA)]

The aggregate of income computed under each head, after giving effect to the provisions for clubbing of income and set off of losses, is known as "Gross Total Income". In computing the total income of an assessee, certain deductions are permissible under sections 80C to 80U from Gross Total Income.

These deductions are however not allowed from the following incomes although these incomes are part of Gross Total Income:

- Long-term capital gains.

- Short-term capital gain on transfer of equity shares and units of equity-oriented fund through a recognised stock exchange i.e. short-term capital gain covered under section 111A.

- Winnings of lotteries, races, etc.

- Incomes referred to in sections 115A, 115AB, 115AC, 115ACA, 115AD and 115D.

These deductions are of two types: —

- Deductions on account of certain payments and investments covered under sections 80C to 80GGC.

- Deductions on account of certain incomes which are already included under Gross Total Income covered under sections 80-IA to 80U.

Basic Rules of Deductions [Sections 80A/80AB/80AC]

- Deductions cannot exceed Gross Total Income [Section 80A (2)]:

The aggregate number of deductions under sections 80C to 80U i.e., under Chapter VI-A shall not, in any case, exceed the "Gross Total Income" (exclusive of long-term capital gains, short-term capital gain covered under section 111A, winnings of lotteries, crossword, puzzles, etc. and income referred to in sections 115A to 115AD and 115D) of the assessee. Therefore, the total income after deductions will either be positive or nil. It cannot be negative due to deductions. If the "Gross total income" is negative or nil, no deduction can be permitted under this Chapter.

2. Deduction not allowed to members if allowed to AOP/BOI [Section 80A (3)]:

If a deduction is allowed under the above sections to the AOP or BOI then deductions for the same payment/income will not be allowed to the members of the AOP/BOI. [Section 80A (3)].

3. Double deduction not allowed and deduction cannot exceed the profit of the particular undertaking or unit or enterprise, etc. [Section 80A (4)]:

Notwithstanding anything to the contrary contained in section 10AA or in any provisions of this Chapter under the heading "C.—Deductions in respect of certain incomes" (i.e. deductions under sections 80-IA to 80RRB), where, in the case of an assessee, any amount of profits and gains of an undertaking or unit or enterprise or eligible business is claimed and allowed as a deduction under any of those provisions for any assessment year, deduction in respect of, and to the extent of, such profits and gains shall not be allowed under any other provisions of this Act for such assessment year and shall in no case exceed the profits and gains of such undertaking or unit or enterprise or eligible business, as the case may be.

4. Deduction allowed only when it is claimed by the assessee [Section 80A (5)]:

Where the assessee fails to make a claim in his return of income for any deduction under section 10AA or under any provision of this Chapter under the heading "C.—Deductions in respect of certain incomes" (i.e., sections 80-IA to 80RRB), no deduction shall be allowed to him thereunder.

5. Profit or gain to be recomputed if inter unit or inter business transfer is not at market value [Section 80A (6)]

6. Assessee's duty to place relevant material:

If an assessee approaches a statutory authority for obtaining a concession under the taxing statute, he should in fairness place all the material before the said authority and be also in a position to satisfy the said authority that he was entitled to obtain the concession.

7. Deduction to be allowed in respect of net income included in Gross Total Income [Section 80-AB]:

Where any deduction is required to be made or allowed under any section in respect of any income then for the purpose of computing the deduction under that section, the net income computed in accordance with the provisions of the Income-tax Act (before making any deduction under this chapter i.e., Chapter VIA) shall alone be regarded as the income received by the assessee and which is included in his Gross Total Income. [Section 80AB].

8. Benefits of certain deductions not to be allowed in cases where return is not filed within the specified time limit [Section 80AC]:

Where in computing the total income of an assessee, any deduction is admissible under section 80-IA or section 80-IAB or section 80-IB or section 80-IC or section 80-ID or section 80-IE, no such deduction shall be allowed to him unless he furnishes a return of his income for such assessment year on or before the due date specified under section 139(1).

Section 80C (Specified Saving & Expenditure)

Section 80CCC (Annuity Scheme or any other Pension Plan)

Section 80CCD (New Pension Scheme-NPS)

Governments impose taxes on their citizens to generate revenue which helps in the overall development of the nation by increasing the public exchequer. India's Income Tax fee is very progressive, which means the more you earn, the more you will have to pay. The regular tax-filing period in India begins in the month of early January and lasts till the end of financial year.

The citizens of India are required to pay tax as per Income Tax Act of India. While filing an Income Tax return, you may see a lot of people who are confused and stressed about the shaded provisions. If you are also one of them, then you need to know that you are not alone.

The tax filing process might seem too boring and awkward to a starter, but don't panic. Here's everything you need to know about income tax rebate –

What is income tax rebate?

Income tax rebate is a refund on taxes if the tax paid by an individual is more than the tax liability. In other words, you will avail a refund on tax money at the end of every financial year if your tax liability is less than that of the amount paid by you. You need to file an Income Tax Rebate within a specified period if you want to claim the income tax refund.

How to get income tax rebate?

The only way to get income tax rebate is through filing an ITR at the end of the fiscal year. Although, there can be few cases –

- If your gross income is less than 5 Lakhs, then in that case filing an ITR will be useful.

- But, if your gross income is more than 5 Lakhs, then you will have to take the help of a tax deduction system that comes under Section 80C, Section 80D, 80CCD, etc. to reduce your taxable income.

- Also, people with a gross income of up to 5 Lakhs need to know that they are also eligible for a full tax rebate.

What are the key points of Section 87A income tax rebate?

- As per section 87A of the Income Tax Act, both men and women are liable to pay rebates as long as their income falls under the income tax bracket.

- This applies only to the citizens of India. If you are a non-resident of India, then you cannot apply for a tax rebate as per Section 87A of the Income Tax Act. To prove your citizenship, you need to have an Aadhar Card or birth certificate.

- Rebate advantage is not for senior citizens who are above 60 – You are not eligible to file an income rebate if you are a senior citizen who is above 60 years of age.

- As per the act, only a 'person' can apply for a tax rebate. Hence, only an individual can apply for a tax rebate, not firms or companies.

What are the types of ITRs in India?

Here're the types of Income Tax Rebates in India -

Section 80C – A lot of taxpayers prefer section 80C of the Income Tax Act as this section cut down the taxable income by Rs. 1 Lakh. Also, people are allowed for a tax rebate of the following expenses –

- ELSS

- Life Insurance Premium

- Annuity or pension fund

- Bank fixed deposits (5-year)

- PPF, NSC, SCSS deposits

- Stamp duty and registration on buying a house

Section 80D – If you are making payment under health insurance premium, then you will get tax rebate under section 80D of the Income Tax Act.

For every citizen of India, it is advisable to pay income tax before its due date. Failing to do so would lead to several consequences such as heavy fines and imprisonment under the IT Act. Besides, for those who are planning to buy tax saving plan online, you choose to go with Canara HSBC OBC Life Insurance for better options.

Relief

Tax relief is any government program or policy initiative designed to reduce the amount of taxes paid by individuals or businesses. It may be a universal tax cut or a targeted program that benefits a specific group of taxpayers or bolsters a particular goal of the government.

An individual or business entity typically gets tax relief through deductions, credits, or exclusions, and occasionally by the forgiveness of a tax lien.

The policy goals of the U.S. Government can often be tracked through the many additions and amendments made over time to the federal tax code. Americans are encouraged to save for retirement by making tax-delayed contributions to a retirement savings account. They are discouraged from raiding those accounts by tax penalties imposed on early withdrawals.

Even the history of natural disasters can be read through the tax code. Hurricane victims may be allotted some form of tax relief to offset the damage to private property suffered when a hard-hit region is declared a disaster area.1 Victims of the 2018 California wildfires were able to declare casualty losses not covered by private insurance on their income tax returns.

Tax relief is intended to reduce the tax liability of individuals or businesses. Tax relief is also often designed to provide assistance to a particular group of people or to bolster a cause.

Tax deductions

The reduction of taxable income using legal deductions is a form of tax relief. The most commonly used federal tax deduction is the one for home mortgage interest.

Tax relief often targets specific taxpayers, such as those bearing unexpected costs due to a hurricane or a wildfire.

A tax deduction reduces the taxable income of a taxpayer. If a single filer’s taxable income for the 2020 tax year was $75,000, that person would owe around $12,500 in federal income tax. However, if the person qualifies for an $8,000 tax deduction, taxes will be based on $75,000 - $8,000 = $67,000 in taxable income. The person's federal income tax would then decrease to around $10,500.

Tax credits

A tax credit is another form of tax relief, one that provides greater savings than a tax deduction does. A tax credit is directly subtracted from the individual's total amount of tax owed after all deductions are made.

For example, say a taxpayer has finished itemizing deductions (or has taken the standard deduction) and the bill amounts to $3,000. If the person is also eligible for a $1,100 tax credit, the final tax bill will be $1,900.

This type of tax relief is often described as a tax incentive because it reimburses taxpayers for expenditures that the government deems worthwhile. For example, the American Opportunity Tax Credit and the Lifetime Learning Credit programs allow tax credits to be taken by people who enrol in postsecondary education programs.

Tax exclusions

Exclusions classify certain types of income as tax-free or as tax relief, reducing the amount that a taxpayer reports as gross income.

In some cases, income that has been excluded for tax purposes is not recorded on the return. In other cases, it is recorded in one section of the return and then deducted in another section.

For example, the value of company-paid health insurance is not recorded on an individual tax return, and employees do not pay income tax for that cost. Their employers, on the other hand, deduct the cost as a business expense.

Tax debt forgiveness

The IRS has a program called Fresh Start that offers a number of options for taxpayers to settle outstanding tax debts, often for a percentage of the original liability. The agency can provide a tax relief arrangement to help people pay the reduced tax amounts over time and avoid a tax lien.

References:

1. Ahuja, Giri & Gupta, Ravi: Systematic Approach to Incomes Tax

2. Agrawal, B.K.: Income Tax law and practice

3. Agrawal, B.K.: Ayakar Vidhan Avam lekhe

4. Chandra, Mahesh & Shukla, D.C. Income Tax Law and practices

5. Chandra, Girish: Income Tax