UNIT 1

ACCOUNTING

Meaning

Accounting is the language of finance. It conveys the financial position of the firm or business to anyone who wants to know. It helps to translate the workings of a firm into tangible reports that can be compared. Accounting is all about the process that helps to record, summarize, analyze, and report data that concerns financial transactions.

Definition

American Accounting Association have defined accounting as “The process of identifying, measuring and communicating information to permit judgment and decisions by the users of accounts”

“Accounting is an art of recording, classifying and summarizing in a significant manner and in terms of money, transactions and events which are, in part at least of a financial character and interpreting the results thereof.” Definition is given by American Institute of Certified Public Accountants.

Characteristics

- Accounting is an art: Accounting is classified as an art, as it helps us in achieving our aim of ascertaining the financial results, i.e. profit or loss and financial position.

2. It involves recording, classifying and summarizing: Recording means soon after the occurrence of transaction and events, it should be systematically written down in account books (in Journal Book). The four basic question needs to answer while recording, i.e. what to record, when to record, how to record, and at what value to record. Classifying is the process of grouping transactions or entries of the same type at one place. This is done by opening accounts in a book called ledger. Summarizing involves the preparation of reports and statements from the ledger which are understandable and useful to the management and other interested parties.

3. It records the transaction in terms of money: Only in terms of money accounting records transactions. Because money serves as a common unit of measurement and helps in the understanding of the state of affairs of the business.

4. It records only those transactions and events, which are of financial character: accounting records only those transactions, which are of financial character, i.e. which affect the result of business. In other words, personal transactions of businessman are not recorded. But if a transaction is between proprietor and business then it will be recorded because business is involved in this transaction.

5. It is an art of interpreting the result: it is also an art to determine the financial position of the business, the progress made and how well it is getting along.

Functions

- Systematic record keeping: The first and foremost function of accounting is the systematic record keeping of the financial transactions, on a regular basis.

- Facilitating rational decision making: Another important function is to facilitate rational decision making. This involves communicate the results, i.e. the net profit or loss to the users, with the help of financial statements, so as to help the interested parties in rational decision making.

- Legal compliance: The accounting statements must be prepared keeping in mind the compliance with the relevant laws.

- Protection of business assets: Accounting not only keeps a record of all the business assets but also make sure no unauthorized use of assets or property belonging to the enterprise.

- Determination of Profit/loss: Accounting plays a very important role in the ascertainment of profit earned or loss sustained by the enterprise in an accounting period. This is possible only when a proper record of all the business transactions, revenues and expenses are maintained.

- Ascertaining the profitability, liquidity and solvency of the entity: With the help of the financial statement, i.e. Balance sheet and profit and loss account, the financial position of the enterprise can easily be ascertained.

Advantages

Maintenance of business records

In the books of accounts it records all the financial transaction pertaining to the respective year systematically. Due to their size and complexities it is not possible for management to remember each and every transaction for a long time. Therefore the need of accounting is felt to record every transactions in different books of accounts.

Preparation of financial statements

If there is a proper recording of transactions then the financial statements like Trading and profit and loss account, Balance Sheet can be prepared easily. Proper recording of all the financial transactions is very important for the preparation of financial statements of the entity.

Comparison of results

The results disclosed by the financial books may be compared with the results of financial business. It also facilitates the comparison of the financial results of one year with another year easily. The comparison helps in identifying the weakness and strength of the business.

Decision making

If there is a proper recording of financial transactions decision making becomes easier for management. Accounting information enables management to plan its future activities, make budgets and coordination of various activities in various departments.

Evidence in legal matters

The proper and systematic records of the financial transactions act as evidence in the court of law. Since every transaction in the books are supported by the documentary proof such as memo, bills, receipts, etc that is why court accepts the books of accounts.

Provides information to related parties

It makes the financial information of the organization available to stakeholders like owners, creditors, employees, customers, government etc. easily.

Helps in taxation matters

The business has to pay income tax, VAT, etc to the government. Various tax authorities like income tax, indirect taxes depends on the accounts maintained by the management for settlement of taxation matters.

Valuation of business

For proper valuation of an entity’s business accounting information can be utilized. Thus, it helps in measuring the value of the entity by using the accounting information in the case of sale of the entity.

Prevents fraud

The maintenance of proper account books prevent irregularities, frauds, errors, etc. dishonest employee will hardly get the opportunity to commit fraud as the books are systematically maintained

Users

The importance of accounting is to provide meaningful information about a business enterprise to those persons who are directly or indirectly interested in the performance and financial position of a business enterprise. Such persons may include the following:

- Internal users – top, middle and lower level executives in the organisations are the internal users of accounting information. Top management is concerned with accounting information for planning and policy making, the middle level is concerned with planning and controlling, bottom level management requires it for operational affairs.

2. External users – external users have direct or indirect interest in accounting information. External users are classified as

- Creditors – the users may be short term or long term creditors. Both are interested in the stability and earnings of the firm.

b. Investors – the user of accounting information are present or potential investors. Present investors are owners and equity shareholders need accounting information to judge the prospects of their investment. Potential investors want to be sure before investment that their capitals are safe.

c. Employees – they are interested in the books due to bonus scheme and security of their employment. Account books provide information to the employees regarding the profits earned by the business.

d. Tax authorities – tax authorities whether income tax, value added tax, wealth tax, etc need information to assess the tax liability of the enterprise.

e. Regulatory agencies – government and their agencies regulate the functioning of various forms of business. They need information about the business from different point of view.

f. Public - For the members of the public, the financial information is of the nature of a health examination report-it tells them about employment opportunities and general growth in the individual concern and the economy as a whole.

g. Researchers are interested in accounting statements and reports in order to get data for providing their thesis on which they are working in order to complete their research projects.

h. Foreign entrepreneurs – foreign entrepreneurs are interested in the accounting information for export, import, collaboration with other companies of other counties.

Limitation

- Permits alternative treatment – accounting is based on concepts and it follows general accepted accounting principles but there exist more than one principle for the treatment of any one item.

- Ignores important non monetary information – accounting does not consider the transaction of non monetary in nature. For example loyalty and efficiency of the employees are important matter which is ignored.

- Accounts can be Manipulated: Manipulation of Accounts for Avoiding tax and to show a false position to investors. By making small changes in account the financial statement can be manipulated.

- Costly for small firm: Small firm does not have lots of finance so, making proper account and audit it from a chartered accountant very costly for them

- Privacy of firm: There is no privacy for those who prepare accounts as it has to show to the general public including your competitors.

Branches and process of accounting

|

Financial Accounting: it is concerned with the recording of transaction in financial book in order to find out the trading results in terms of profit or loss and financial position of the business for a given period of time.

Cost Accounting: it is concerned with classification, recording, allocation and summarization of current and budgeted cost. The object of cost accounting is to find out the cost of goods produced by the business

Management Accounting: it is the presentation of accounting information in such a way so as to assist the management in creation of policy and day to day operation of an undertaking.

Tax Accounting: The accounting system that deals with the tax return and its payment, instead of preparation of final accounts of the enterprise, is called tax accounting.

Social Accounting: This branch of accounting is commonly termed as social responsibility accounting. It aims at unveiling the facilities provided by the entity to the society, in terms of medical, housing, education, and so forth.

Process of accounting

- Identifying the transaction and events – accounting identifies the transaction and events of a specific entity. A transaction is an exchange in which each participant receives or sacrifices the value.

2. Measuring the identified transactions and events – accounting measures the transaction and event in terms of a common measurement unit.

3. Recording – this is a basic function of accounting. It is concerned with recording the financial transaction in the books systematically.

4. Classifying – classification is concerned with the systematic analysis of the recorded data, with a view to group transaction of similar nature at one place.

5. Summarising – this involves presenting the classifying data in a manner which is understandable and useful to the internal and external users.

6. Analysing – it is concerned with the establishment of relationship between the various items taken from both income statement and balance sheet.

7. Interpreting – the accountant should interpret the statement so that the user can take rational decision.

8. Communicating – the accounting information after being meaningfully analysed and interpreted has to be communicated in a proper manner to the proper person.

Key takeaways –

- Accounting is often called “the language of business” because it communicates so much of the information that owners, managers, and investors need to evaluate a company’s financial performance.

- Accountants typically work in one of two major fields. Management accountants provide information and analysis to decision makers inside the organization in order to help them run it.

- Financial accountants furnish information to individuals and groups both inside and outside the organization in order to help them assess its financial performance.

- Financial accounting is responsible for preparing the organization’s financial statements—including the income statement, the statement of owner’s equity, the balance sheet, and the statement of cash flows—that summarize a company’s past performance and evaluate its current financial condition.

- Definition

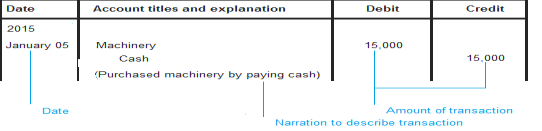

“The journal is a book of original entry in which transactions are recorded not provided for in specialized journals”

Eric L. Kohler

- The word journal has been derived from French word ‘Jour’ which means day. Thus, journal means daily record

- Entries in journal are recorded in chronological order, as and when the business transaction occurs

- It is called as daily book because transaction are recorded on day to day basis as and when takes place

- Entry in journal is followed with narration which describes briefly the true nature of transaction

|

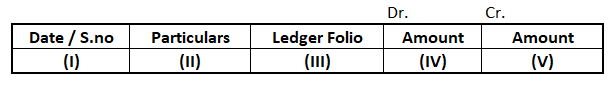

Proforma of a Journal

|

- Date/ S.No: date or serial number is the first column of Journal. The transaction record date or its serial number is updated in this column.

- Particulars: particulars are the second column of Journal. This column is updated with the particulars of business transactions that is related to the description of account type.

- Ledger Folio: The third column of Journal is Ledger Folio number where the journal entry is posted.

- Amount (Dr.) : The fourth column of Journal is used to update the debit amount of transaction.

- Amount (Cr.): The fifth column of Journal is used to update the credit amount of transaction.

Rules of double entry system

- Personal accounts – Account related to human beings and artificial person such as Anils account, accounts of firms, hospital, etc

RULE

Debit the receiver and credit the giver

2. Real accounts – accounts which can be touched, felt such as plant, building, cash, etc. It also includes account which cannot be touched but are measured in terms of rupee such as goodwill, etc

RULE

Debit what comes in and credit what goes out

3. Nominal account – account relate to business gains, loss, incomes and expenses such as wages account, interest account, etc

RULE

Debit all expenses and losses. Credit all incomes and gains

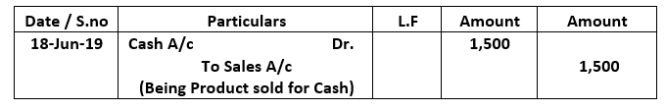

Examples of journal entry

A firm sold its product at 1500 and received full amount in cash

|

Key takeaways

- Entries in journal are recorded in chronological order, as and when the business transaction occurs

Definition

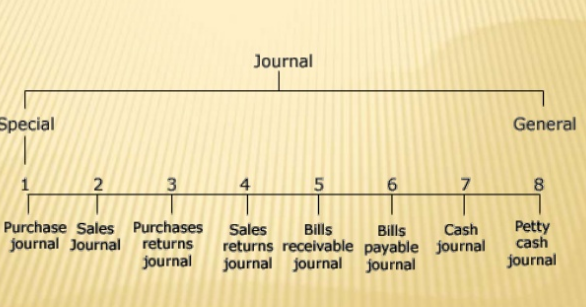

In a large business concern a journal is divided into parts so that several clerk could work at the same time. This is known as subdivision of journal.

Objectives of subdivision

- To simplify the recording of business transaction in the book of original entry

- It enables the transaction are classified according to their name.

- To make it easier to locate any transaction recorded in the book of original entry

- Recording the transaction in the books of account result in reducing the chances of error and fraud

Advantages

- The transaction recorded in the sub division books is not bulky and hence there will be no difficulty in handling them.

- Accounting work is divided into large number of employees so the work is done nicely and promptly

- Because of division of labour, efficiency of employees increases

- The chances of fraud is minimised as the transaction are recorded in the books.

Types of subdivision of journals

|

Special journal – special journal is popularly known as the subsidiary book. The transaction are recorded in regular basis and in chronological order. Special jopurnal are divided into eight groups as follows

- Purchase book – purchase book is also called as purchase journal, invoice book, bought day book which records all credit purchase made by the organisation. Cash purchase of book are not recorded in the purchase book, they are recorded in cash books. Credit purchase other than goods such as stationary item are not recorded in the purchase book

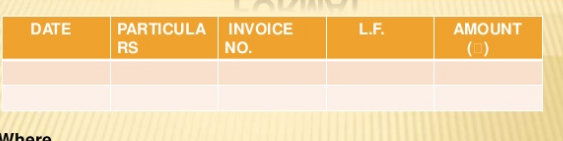

Format

|

Where, data – represents when the transaction took place

Particulars- it includes the name of the seller and the particulars of goods purchased

Invoice no – reveals the serial number of the inward invoice

LF – This column represent the page number of supplier account in ledger books

Amount – amount column represent the price of the goods

2. Sales books – this book is also known as sales day book or sales journal. It records all credit sales of goods made by the organisation during a specified period of time.

Cash sales, cash and credit sales of assets are not recorded in the books. The entries are recorded on the basis of invoice issued to the customers

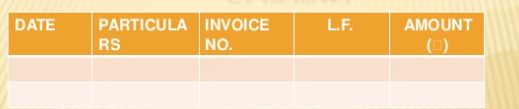

Format

|

Where,

Date – represents when the transaction took place

Particulars- it includes the name of the customer and the particulars of goods sold

Invoice no – reveals the serial number of the outward invoice

LF – This column represent the page number of supplier account in ledger books

Amount – amount column represent the price of the goods

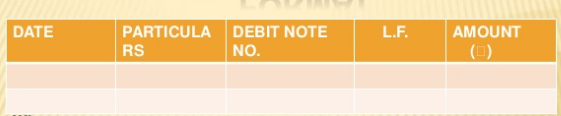

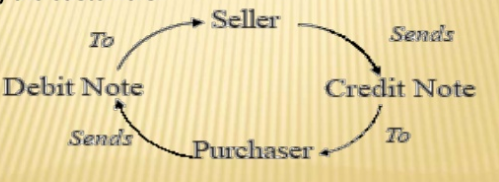

3. Purchase return books – this books records all the return of goods to the supplier by the business. It is also called returns outward book or purchases returns day book. Goods amy be returned due to many reasons such as not up to sample or because they are damaged etc. When good are returned to the supplier then an intimation is sent which is known as debit note

Format

|

Where,

Date – represents when the transaction took place

Particulars- it includes the name of the purchaser and the particulars of goods purchased

Debit note no – records the serial number of each debit note

LF – This column represent the page number of supplier account in ledger books

Amount – amount column represent the price of the goods

4. Sales returns books – this book records all the return of goods by the customers to the business. Sales returns book is also called returns inwards book. Customers who return goods should be sent a credit note by the business. This credit note means note sent by the business to another person showing the amount credited to the account of the later.

|

Format

|

Where,

Date – represents when the transaction took place

Particulars- it includes the name of the purchaser and the particulars of goods purchased

Credit note no – records the serial number of each credit note

LF – This column represent the page number of supplier account in ledger books

Amount – amount column represent the price of the goods

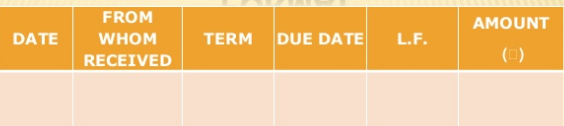

5. Bills receivable book – bills receivable books is used to record the bills received from debtor. The details of the bill received from the debtors are recorded in the bills receivable books. The bills receivable are drawn when the seller makes credit sale to the business.

Format

|

Where,

Date – represents when the transaction took place

From whom received column - it includes the name of the person from whom the amount is to be recived.

Term column – how much time

Due date column – last date

LF – This column represent the page number of supplier account in ledger books

Amount – amount column represent the price of the goods

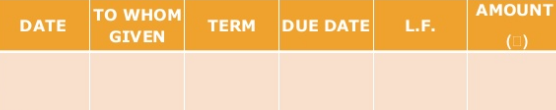

6. Bills payable book – bills payable book is used to record bill accepted by us and payable by the business. When a bill drawn by our creditor is accepted particulars of the same are recorded in this book. In the ledger the amount of each person whose bill has been accepted is debited with the bill amount. The total of bills accepted is credited to the bills payable account ledger.

|

Where,

Date – represents when the transaction took place

To whom given - it includes the name of the person from whom the amount is to be paid.

Term column – how much time

Due date column – last date

LF – This column represent the page number of supplier account in ledger books

Amount – amount column represent the price of the goods

7. Cash book – a separate book is kept to record cash transaction refers to cashbook. The function of cash book is to keep records of all cash transaction.

Types of cash book

- Simple cash book - it record only cash transactions. All cash received are entered on the debit side, and all cash paid are entered on the credit side.

Format –

|

Where,

Date – represents when the transaction took place

Particulars- it includes cash transaction particulars

LF – This column represent the page number of supplier account in ledger books

Amount – amount column represent the price of the goods

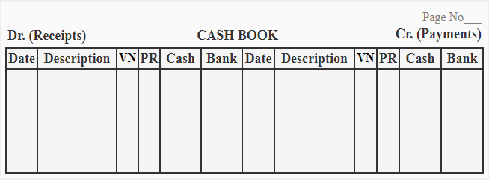

b. Double cash book – it record cash as well as bank transactions. It is also called as two column cash book. The cash column is used to record all cash transactions and bank column used to record all receipts and payments made by checks and works as a bank account

Format

|

Where,

Date – represents when the transaction took place

Particulars- it includes cash and bank transaction particulars

Cash – records cash transaction

Bank – records transaction made on cheque or which are held via bank

c. Triple cash book – it record cash, bank and purchase discount and sales discount. It is also called as three column cash book

Format

|

Where,

Date – represents when the transaction took place

Particulars- it includes cash and bank transaction particulars

Cash – records cash transaction

Bank – records transaction made on cheque or which are held via bank

Discount – shows discount allowed and received

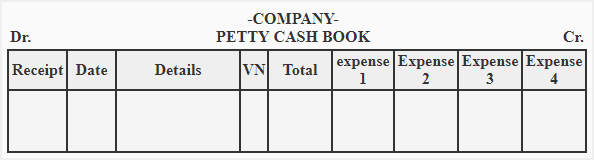

d. Petty cash book - A petty cash book to record small day to day cash expenditures. For ex, stationary, cleaning charges, postages, etc

The petty cash book is defined as relatively small amount of cash kept at hand for making quick payments for miscellaneous small expenses in the business concern.

|

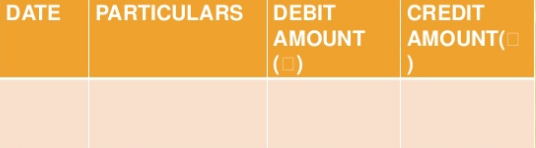

General journal

The transaction which do not fall within the scope of the above mentioned book are recorded in general journal. For ex, purchase of assets on credit, depreciation of assets, bad debts, etc. It is also known as modern journal, journal proper, principal journal.

|

Where,

Date – represents when the transaction took place

Particulars- it includes all transaction particulars

Debit column – shows amount received

Credit column – shows amount paid

Key takeaways

- In a large business concern a journal is divided into parts so that several clerk could work at the same time. This is known as subdivision of journal.

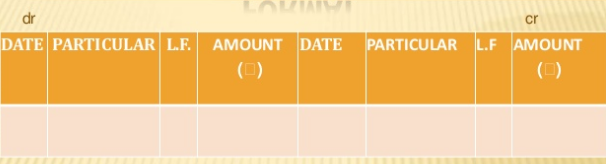

Ledger

- Definition

“Ledger is the permanent storehouse of all the transactions” Field house Arther

- Ledger is the principal or primary book of accounts

- The transactions are classified under appropriate heads, called accounts

- The accounts contain the condensed and summarized record of all the related transactions

- It is the basis of preparing final account.

- Ledgers provide information of

- Debtors and creditors

- Purchase, sales and return

- Type of assets and value of assets

- Expenses and income

- Cash and bank balance

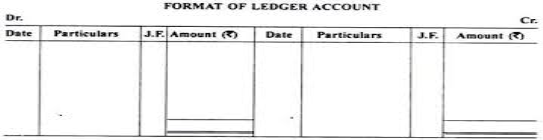

|

- Date on which the transaction taken place

- Particulars – on debit side, the account is written with prefix “To”. On the credit side, the account id written with prefix “By”.

- JF is the page number of journal provided for cross reference.

- The amount written in journal is written in ledger

Characteristics of ledger accounts

- The account has two sides left side of the account is debit and right side of the account is credit.

- Debit side record all the debit attitudes of transactions and credit side record all the credit attitudes of transactions

- Difference between the two sides are represented as balance. The debit balance shows excess of debit over credit side. The credit balance shows excess of credit over debit side.

- In the month/year end the excess balance is written over the closing balance at the end of the month date

- At the end, closing balance are forwarded as the beginning balance next year.

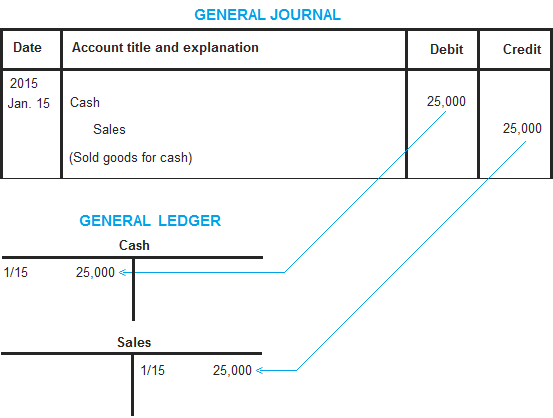

How double entry works in ledger

A ledger implemented in double entry book keeping method means each transaction make atleast two account. Each transaction has debit and credit account. Left side shows debit entry and right side shows credit entry.

For better understanding lets use a n example of ledger accounts

Transaction

On jan1 2015, abc company sold to customers for cash 25,000.

The journal entry and ledger posting are as follows

|

In the above journal entry, the debit part is cash account and the credit part is sales account. All journal entries are similarly posted to accounts in general ledger.

Examples 2

Apple limited sell 20 kilos apple at rs. 100per kilo on 8 august 2020

Journal entry

Cash A/C Dr 20000

To Sales A/C 20000

Ledger account

Cash A/C | |||||

Dr. |

| Cr. | |||

Date | Description | Amount (Rs) | Date | Description | Amount (Rs) |

8.8.2020 | To Sales | 20000 |

|

|

|

Similarly, in Sales account, the entry will reflect as follows

Sales A/C | |||||

Dr. |

| Cr. | |||

Date | Description | Amount (Rs) | Date | Description | Amount (Rs) |

|

|

| 8.8.2020 | By Cash | 20000 |

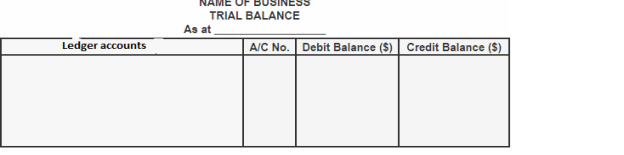

Trial balance

- Definition

“Trial balance is a statement, prepared with debit and credit balances of ledger accounts to test the arithmetical accuracy of the books”. J.R. Batliboi

- It is the statement from which final accounts are prepared

- It is the list of balances of all the ledger accounts

- The total of debit and credit column of trial balance must tally

|

How does trial balance work?

The trial balance is the statement of all debits and credits. Business man prepares trial balance at the end of the reporting period regularly to ensure that the entries are mathematically correct in the books of account. The total of trial balance should be equal. In case the debit and credit does not match it means there is an error. For example, the accountant may have recorded an account or classified a transaction incorrectly.

Preparation of trial balance

- Before starting the trial balance all the ledger accounts should be closed. The ledger balance is provided by the difference between the sum of all the debit entries and the sum of all the credit entries

- Prepare trial balance worksheet. The column headers should be for the account number, account name and the corresponding columns for debit and credit balances.

- Every ledger account is transferred to the trial balance worksheet. The account name and number along with the account balance in the appropriate debit or credit column

- Add up the debit and credit column. In an error free trial balance the total should be same. Trial balance are closed when the total are same

- accountants have to locate and rectify the errors, if there is a difference,

A trial balance looks like

All the account title are the closing balance of ledger account

ABC LTD - Trial Balance as at 31 December 2019 | ||

| Debit | Credit |

Account Title | Rs | rs |

Share Capital | - | 15,000 |

Furniture & Fixture | 5,000 | - |

Building | 10,000 | - |

Creditor | - | 5,000 |

|

|

|

Debtors | 3,000 | - |

Cash | 2,000 | - |

Sales | - | 10,000 |

Cost of sales | 8,000 | - |

General and Administration Expense | 2,000 | - |

Total | 30,000 | 30,000 |

Key takeaways

- Ledger is the principal or primary book of accounts

- The transactions are classified under appropriate heads, called accounts

- Trial balance is a statement, prepared with debit and credit balances of ledger accounts to test the arithmetical accuracy of the books

References

- Gupta R.L. and Radhaswamy. M, Sultan chand & Sons, New Delhi.

- Shukla M. C. Grewal T. S and Gupta S.C., S. Chand & Sons. New Delhi.

- Shukla S. M., Sahitya Bhawan Publication, Agra.

- Murti Guru Prasad, Himalaya Publishing House, Mumbai.

- Jain and Narang, Kalyani Publisher, New Delhi.

- S. N. Maheswari, Vikas Publishing House, New Delhi.

- Sharma and Gupta, RBD Publishing House, Jaipur.

- Khatik S. K., Jitendra Saxena K, Extol Publication, Bhopal.

- Gangwar Sharda, Himalaya Publishing House, Agra.