Unit 4

Partnership Laws

When we discuss about the forms a business organization can take, one of the most prominent ones is a partnership. In India mainly it's a really popular entity to hold out business allow us to take a glance at some important elements of a partnership and also some sorts of partners.

CONCEPT PARTNERSHIP

In India, we've a particular law that covers all factors and functioning of a partnership, The Indian Partnership Act 1932. The act also defines a partnership as “the relation between two or more persons who have agreed to share the profits from a business carried on by either all of them or any of them on behalf of/acting for all”

So, in such a case two or more (maximum numbers will differ consistent with the business being carried) persons close as a unit to realize some common objective. and therefore, the profits earned in pursuit of this objective are going to be shared amongst themselves.

The entity is collectively called a “Partnership Firm” and every one the person members are the “Partners”. So, allow us to check out some important features.

NATURE OF PARTNERSHIP ACT,1932

When two or more people join hands to set up an enterprise and share its gains and losses, they are said to be in partnership. Section 4 of the Indian Partnership Act 1932 states partnership as the ‘association between people who have consented to share the profits of an enterprise carried on by all or any of them acting for all’.

People who have entered into a partnership with one another are independently termed as ‘partners’ and comprehensively termed as ‘firm’. The name under which the trade is carried is called the ‘name of the firm’. A partnership enterprise has no distinct legal entity, apart from the partners comprising it. Hence, the vital features of the partnership are:

- Two or More Persons: In order to manifest a partnership, there should be at least two persons possessing a common goal. To put it in other words, the minimal number of partners in an enterprise can be 2. However, there is a constraint on their maximum number of people. By the uprightness of Section 464 of the Companies Act 2013, the Central Government is authorised to stipulate a maximum number of partners in an enterprise; however, the number of partners cannot exceed 100. The Central government has stipulated the maximum number of partners in an enterprise to be 50, under Rule 10 of the Companies (Miscellaneous) Rules, 2014. Hence, a partnership enterprise cannot have more than 50 people (partners)

- Agreement: It is the outcome of an accord between 2 or more people to regulate business and share its gains and losses. The agreement (accord) becomes the basis of the association between the partners. Such an agreement is in the written form. An oral agreement is even handedly legitimate. In order to avoid controversies, it is always good if the partners have a copy of the written agreement.

- Sharing of Profit: Another significant component of the partnership is, the accord between partners has to share gains and losses of a trading concern. However, the definition held in the Partnership Act elucidates – partnership as an association between people who have consented to share the gains of a business, the sharing of loss is implicit. Hence, sharing of gains and losses is vital.

CHARACTERISTICS OF A PARTNERSHIP

1] Formation/Contract

A partnership firm is not a separate legal entity. But consistent with the act, a firm must be fashioned via a legal agreement between all the partners. So a contract must be entered into to make a partnership firm.

Its commercial activity must be lawful, and therefore the motive has got to be one among profit. so two people forming an alliance to hold out charity and/or welfare work won't constitute a partnership. Similarly, a partnership contract to scoop illegal work, like smuggling, is void also.

2] Unlimited Liability

In a unique feature, all partners have unlimited liability within the business. The partners are all individually and jointly responsible for the firm and therefore the payment of all debts. this suggests that even personal assets of a partner are often liquidated to satisfy the debts of the firm.

If the cash is recovered from one partner, he can, in turn, sue the opposite partners for his or her share of the debt as per the contract of the partnership.

3] Continuity

A partnership cannot perform in perpetuity. The death or retirement or bankruptcy or insolvency or insanity of a partner will dissolve the partnership. The remaining partners may continue the partnership if they so choose, but a replacement contract must be involved. Also, the partnership of a father can't be inherited by his son. If all the opposite partners agree, he is often added on as a replacement partner.

4] Number of Members

As we all know that there should be a minimum of two individuals for a partnership. However, the utmost number will vary consistent with a couple of conditions. The Partnership Act itself is silent on this issue, but the businesses Act, 2013 provides clarity.

For a banking business, the amount of partners must not exceed ten. For a business of the other nature, the utmost number is twenty. If the amount of partners increases it'll become an illegal entity or association.

5] Mutual Agency

In a partnership, the business must be administered by all the partners together. Or alternatively, it are often administered by any of the partners (one or several) acting for all of them or on behalf of all of them. So this suggests every partner is an agent as properly because the principal of the partnership.

He represents the opposite partners in some cases so he's their agent. But in several circumstances, he's bound by the actions of any of the opposite partners asking him the principal also.

Key Takeaways:

- A partnership can be defined as “the relation between two or more persons who have agreed to share the profits from a business carried on by either all of them or any of them on behalf of/acting for all”.

- People who have entered into a partnership with one another are independently termed as ‘partners’ and comprehensively termed as ‘firm’.

Registration of Partnership Firm, Section 58, 59 of the Partnership Act provides Application for registration and Registration respectively. Section 96 of the said Act speaks about Effects of Non-Registration of Partnership Firm.

1) Application for registration -

According to section 58 of the Indian Partnership Act 1932 (1) Subject to the provisions of sub-section of sub-section (1A), the registration of a firm effected by sending by post or delivering to the Registrar of the area in which any place of business of the firm is situated or proposed to be situated, a statement in the prescribed form and accompanied by the prescribed fee and a true copy of the deed of partnership stating:

(a) the firm-name,

(aa) the nature of business of the firm;

(b) the place or principal place of business of the firm,

(c) the names of any other places where the firm carries on business,

(d) the date when each partner joined the firm,

(e) the names in full and permanent addresses of the partners, and

(f) the duration of the firm.

The statement shall be signed by all the partners, or by their agents specially authorized in this behalf.

(1A) The statement under sub-section (1) shall be sent or delivered to the Registrar within a period of one year from the date of constitution of the firm :

Provided that in the case of any firm carrying on business on or before the date of commencement of the Indian Partnership (Maharashtra Amendment) Act, 1984, such statement shall be sent or delivered to the Registrar within a period of one year firm such date.

(2) Each person signing the statement shall also verify it in the manner prescribed.

(3) A firm shall not have any of the names or emblems specified in the Schedule to the Emblems and Names (Prevention of Improper Use) Act, 1950, or any colorable imitation thereof, unless permitted so to do under that Act, or any name which is likely to be associated by the public with the name of any other firm on account of similarity, or any name which, in the opinion of the Registrar, for reasons to be recorded in writing, is undesirable:

Provided that nothing in this sub-section shall apply to any firm registered under any such name before the date of the commencement of the Indian Partnership (Maharashtra Amendment) Act, 1984.

(4) Any person aggrieved by an order of the Registrar under sub-section (3), may, within 30 days from the date of communication of such order, appeal to the officer not below the rank of Deputy Secretary to Government authorised by the State Government in this behalf, in such manner, and on payment of such fee, as may be prescribed. On receipt of any such appeal, the authorised officer shall, after giving an opportunity of being heard to the appellant, decide the appeal, and his decision shall be final.

2) Registration -

According to Section 59 of the said Act (1) When the Registrar is satisfied that the provisions of section 58 have been duly complied with, he shall record an entry of the statement in a register called the Register of Firms, and shall file the statement. On the date such entry is recorded and such a statement is filed, the firm shall be deemed to be registered.

(2) The firm, which is registered, shall use the brackets and word (Registered) immediately after its name.

3) Late registration on payment of a penalty -

As per Section 59A-I of the Partnership Act 1932 If the statement in respect of any firm is not sent or delivered to the Registrar within the time specified in sub-section (1A) of section 58, then the firm may be registered on payment, to the Registrar, of a penalty of one hundred rupees per year of delay or a part thereof.

4) Effect of Non-Registration -

According to Section 69 of the said Act (1) No suit to enforce a right arising from a contract or conferred by this Act shall be instituted in any Court by or on a behalf of any persons suing as a partner in a firm against the firm or any person alleged to be or to have been a partner in the firm unless the firm is registered and the person suing is or has been shown in the Register of Firms as a partner in the firm:

Provided that the requirement of registration of firm under this subsection shall not apply to the suits or proceedings instituted by the heirs or legal representatives of the deceased partner of a firm for accounts of the firm or to realize the property of the firm.

(2) No suit to enforce a right arising from a contract shall be instituted in any court by or on behalf of a firm against any third party unless the firm is registered and the persons suing are or have been shown in the Register of Firms as partners in the firm.

(2A) No suit to enforce any right for the dissolution of a firm or for accounts of a dissolved firm or any right or power to realize the property of a dissolved firm shall be instituted in any Court by or on behalf of any person suing as a partner in a firm against the firm or any person alleged to be or have been a partner in the firm unless the firm is registered and the person suing is or has been shown in the Register of Firms as a partner in the firm :

Provided that the requirement of registration of a firm under this subsection shall not apply to the suits or proceedings instituted by the heirs or legal representatives of the deceased partner of a firm for accounts of a dissolved firm or to realize the property of a dissolved firm.

(3) The provisions of sub-sections (1), (2) and (2A) shall apply also to a claim of set-off or other proceedings to enforce a right arising from a contract but shall not affect

(a) the firms constituted for a duration up to six months or with a capital up to two thousand rupees; or;

(b) the powers of an official assigned, receiver or Court under the Presidency Towns Insolvency Act, 1909, or the Provincial Insolvency Act, 1920, to realize the property of an insolvent partner.

Key takeaways:

- Registration of a partnership firm is not compulsory.

- But if a firm is registered, s firm get entitled to certain benefits.

- If a firm is not registered, the firm will not be able to proceed with legal proceedings in case of default.

Active Partner: Because the name suggests he takes active participation within the business of the firm. He contributes to the capital, features a share within the income and also participates within the daily activities of the firm. His liability within the company is going to be unlimited. And he often will act as an agent for the opposite partners.

Dormant Partner: Also referred to as a silent partner, he won't participate within the daily functioning of the business. But he will still need to make his share of contribution to the capital. In return, he will have a share within the profits. His liability will additionally be unlimited.

Secret Partner: Here the partner’s association with the firm isn't general knowledge. He won't signify the firm to outside agents or parties. aside from this his participation with reference to capital, profits, management and liability are going to be an equivalent as all the opposite partners.

Nominal Partner: This partner is solely a partner in name only. He allows the firm to use the name of his firm, and therefore the connected goodwill. But he in no way contributes to the capital and hence has no share within the profits. He doesn't involve himself within the firm’s business. But his liability too is going to be unlimited.

Partner by Estoppel: If an individual makes it bent be, through their conduct or behaviour that they're partners during a firm and he doesn't correct them, then he becomes a partner by estoppel. However, this partner too will have unlimited liability.

TYPES OF PARTNERSHIPS

Various sorts of partnerships exist, including limited partnership, indebtedness partnership, joint liability, indebtedness, and joint ventures. the foremost important thing to know is that partnerships are agreements between two or more parties to realize a specific business goal. General partnerships are:

Equal agreements

Various responsibilities are often delegated among members

Partnerships force all parties to share sure risks and rewards during business endeavours.

For instance, a partner can handle the investment angle by pouring capital within the business, while another can act during a management capacity. additionally, one partner can bind group partners into one legal obligation. Under partnerships, each party takes responsibility for individual obligations or debts.

- Limited Partnerships (LPs)

A limited partnership allows each partner to avoid personal liability to the quantity of his or her business investment. Such an appointment requires one individual to require the role of general status, opening his or herself up to potential personal liabilities, while the limited partner takes less of a risk. However, the accepted partner retains control of the business, and therefore the limited partner is usually not involved in management operations.

- Limited Liability Partnerships (LLP)

LLPs accompany tax advantages within the same manner as general partnerships combined with liability protections. for instance, individuals aren't liable for any debts or liabilities arising from the business. LLPs are usually found among law or accounting partnerships. Where taxation cares, the IRS recognizes such businesses as partnerships and approves members to file taxes individually on personal returns. GPs, LLPs, and LPs are taxed within the same manner, however partnerships don't pay taxes.

LLPs permit members to figure together while retaining a measure of independence when it involves liability. With that, not all parties are held equally responsible, and other members aren't held responsible for the actions of others. Before engaging in any sort of partnership, know the terms before agreeing or signing any document.

- Limited Liability Protection

If you're concerned about indebtedness protection, remember that general partnerships don't afford you any protective measures. during a general capacity, partners are often held liable for movements or decisions of other partners. General partnerships pose the very best risk to general partners, but they're the simplest to make LLCs became a well-liked alternative to general partnerships. LLCs are ideal for those that wish to take a position during a business, but don't want face exposure to any legal ramifications.

- Joint Ventures as Partnerships

According to the tiny Business Administration, a venture is another sort of partnership. Joint ventures occur when a variety of entities converge in pursuit of a group goal. for instance, businesses may forge a partnership to construct a building.

Qualified joint ventures are a special partnership that permits spouses to co-own a business but to file separate returns to avoid partnership returns.

- Joint Liabilities

A joint liability partnership holds all partners equally responsible for any financial and legal issues. Joint liability partnerships bind all parties into equal liability. Moreover, each party are often held responsible in pending lawsuits or other legal consequences. Joint liabilities are different than several liability principles within the respect that partnerships are persisted equal footing in the least times.

Several liability, on the opposite hand, is that the agreement to settle any legal disputes and is predicated on a partner’s standing or contribution to a partnership.

- Limited Liability Company

A Limited Liability company (LLC) offers each the foremost benefits and therefore the most protection for a business owner.

A Limited liability company allows members to forge one entity while taking benefits of liability protection. LLCs provide equivalent tax havens as partnerships, but with the brought liability benefits of an organization. Corporate law dictates that corporations are held responsible for start-up investments only. for instance , a $10 million business doesn't give others the proper to sue you for over $2 million if you started that business for less than $2 million.

The LLC provides for an equivalent tax protection as a partnership, but also gives the liability protection of an organization. Under corporate law, an organization is merely responsible for the entire start-up investment within the company. Also, certain states allow members to make what's recognized as knowledgeable LLC, which provides certain professionals like doctors or lawyers more limitations than regular businesses.

Key takeaways:

- There are different types of partner like active partner, dormant partner, sleeping partner, partner by estoppel, etc.

- Partnerships can be limited liability, general partnership, fixed partnership.

RIGHTS OF PARTNERS:

Broadly, the provisions of the Act regarding rights, responsibilities and powers of partners are as under:

(a) Every partner features a right to require part within the habits and management of business.

(b) Every partner features a right to be consulted and heard altogether matters affecting the business of the partnership.

(c) Every partner features a right of free access to all or any records, books and accounts of the business, and additionally to look at and replica them.

(d) Every partner is entitled to share the profits equally.

(e) A partner who has contributed quite the agreed share of capital is entitled to interest at the speed of 6 per cent once a year. But no interest is often claimed on capital.

(f) An associate is entitled to be indemnified by the firm for all acts done by him within the direction of the partnership business, for all payments made by him in respect of partnership debts or liabilities and for expenses and disbursements made in an emergency for shielding the firm from loss provided he acted as an individual of normal prudence would have acted in similar circumstances for his own personal matters.

(g) Every partner is, as a rule, joint owner of the partnership property. he's entitled to possess the partnership property used exclusively for the needs of the partnership.

(h) A partner has power to act in an emergency for shielding the firm from loss, but he must act reasonably.

(i) Every partner is entitled to stop the introduction of a replacement partner into the firm without his consent.

(J) Every partner features a right to retire consistent with the Deed or with the consent of the opposite partners. If the partnership is at will, he can retire by giving note to other partners.

(k) Every partner features a right to continue within the partnership.

(l) A retiring partner or the heirs of a deceased partner are entitled to possess a share within the profits earned with the help of the proportion of assets belonging to such outgoing partner or interest at six per cent once a year at the choice of the outgoing partner (or his representative) until the accounts are finally settled.

DUTIES OF PARTNERS:

(a) Every partner is sure to diligently raise on the business of the firm to the best common advantage. Unless the agreement provides, there's no salary.

(b) Every partner must be just and faithful to the opposite partners.

(c) A partner is sure to keep and render true, proper, and proper accounts of the partnership and must permit other partners to see out and replica such accounts.

(d) Every partner is sure to indemnify the firm for any loss prompted by his delinquency or fraud within the conduct of the business.

(e) A partner needs to not keep it up competing business, nor use the property of the firm for his private purposes. In each case, he must fork over to the firm any profit or gain made by him but he must himself suffer any loss which may have occurred.

(f) Every partner is sure to share the losses equally with the others.

(g) A partner is sure to act within the scope of his authority.

(h) No partner can assign or transfer his partnership interest to the other person so on make him a partner within the business.

Key takeaways:

- There are various rights and duties of partners which the partners are suppose to abide by and take advantage of.

Implied authority refers to an agent with the jurisdiction to perform acts that are reasonably necessary to accomplish the purpose of an organization. Under contract law, implied authority figures have the ability to make a legally binding contract on behalf of another person or company.

- Subject to the provisions of section 22, the act of a partner which is done to carry on, in the usual way, business of the kind carried on by the firm, binds the firm. The authority of a partner to bind the firm conferred by this section is called his implied authority.

- In the absence of any usage or custom of trade to the contrary, the implied authority of a partner does not empower him to-

- submit a dispute relating to the business of the firm to arbitration,

- open a banking account on behalf of the firm in his own name,

- compromise or relinquish any claim or portion of a claim by the firm,

- withdraw a suit or proceeding filed on behalf of the firm,

- admit any liability in a suit or proceeding against the firm,

- acquire immovable property on behalf of the firm,

- transfer immovable property belonging to the firm, or

- enter into partnership on behalf of the firm.

Key takeaways:

1. Implied authority refers to an agent with the jurisdiction to perform acts that are reasonably necessary to accomplish the purpose of an organization.

DISSOLUTION

When the partnership between all the partners of a firm is dissolved, then it's called dissolution of a firm. it's important to word that the connection between all partners should be dissolved for the firm to be dissolved. allow us to check out the legal provisions for the dissolution of a firm.

The dissolution of a firm means discontinuance of its activities. When the working of a firm is stopped and therefore the assets are realized to pay a variety of liabilities it amounts to dissolution of the firm. The dissolution of a firm shouldn't be confused with the dissolution of partnership. When a partner agrees to continue the firm underneath an equivalent name, even after the retirement or death of a partner, it amounts to dissolution of partnership and not of firm.

The remaining partners may purchase the share of the outgoing or deceased partner and proceed the business under an equivalent name; it involves solely the dissolution of partnership. The dissolution of firm includes the dissolution of partnership too. The partners have a contractual relationship among themselves. When this relationship is terminated it's an end of the firm.

A firm could also be dissolved under the subsequent circumstances:

(a) Dissolution by Agreement (Section 40):

A partnership firm is often dissolved by an agreement among all the partners. Section 40 of Indian Partnership Act, 1932 approves the dissolution of a partnership firm if all the partners agree to dissolve it. Partnership concern is created by settlement and similarly it are often dissolved by agreement this sort of dissolution is understood as voluntary dissolution.

(b) Dissolution by way of Notice (Section 43):

If a partnership is at will, it are often dissolved by any partner giving a notice to other partners. The notice for dissolution must be in writing. The dissolution are going to be effective from the date of the notice, just in case no date is mentioned within the notice, then it'll be dissolved from the date of receipt of notice. A notice as soon as given can't be withdrawn without the consent of all the partners.

(c) Compulsory Dissolution (Section 41):

A firm could also be compulsorily dissolved beneath the subsequent situations:

(i) Insolvency of Partners:

When all the partners of a firm are declared insolvent or about one partner are insolvent, then the firm is compulsorily dissolved.

(ii) Illegal Business:

The activities of the firm may find yourself illegal under the changed circumstances. If government enforces prohibition policy, then all the firms dealing in liquor will need to close their business because it'll be an unlawful undertaking under the new law. Similarly, a firm could also be trading with the businessmen of the other country. The trading are going to be lawful under present conditions.

After a while a war erupts between the 2 countries, it'll become a trading with an alien enemy and further trading with an equivalent events are going to be illegal. Under new circumstances the firm will need to be dissolved. just in case a firm carries on quite one sort of business, then illegality of 1 work won't amount to dissolution of the firm. The firm can continue with the activities which are lawful.

(d) Contingent Dissolution (Section 42):

In case there's no agreement among partners associated with certain contingencies, partnership firm are going to be dissolved on the happening of any of the situations:

(i) Death of a Partner:

A partnership firm is dissolved on the demise of any of the partner.

(ii) Expiry of the Term:

A partnership firm could also be for a hard and fast period. On the expiry of that period, the firm is going to be dissolved.

(iii) Completion of Work:

A partnership concern could also be formed to hold out a specified work. On the completion of that employment the corporate are going to be automatically dissolved. If a firm is made to construct a road, then the second the road is completed the firm are going to be dissolved.

(iv) Resignation by Partner:

If a partner doesn't want to continue within the firm, his resignation from the priority will dissolve the partnership.

(e) Dissolution via Court (Section 44):

A partner can apply to the court for dissolution of the firm on any of those grounds:

(i) Insanity of a Partner:

If a partner goes insane, the partnership firm are often dissolved on the petition of various partners. The firm isn't automatically dissolved on the insanity of a partner. The court will act only on the petition of a partner who himself isn't insane.

(ii) Misconduct by the Partner:

When a partner is guilty of misconduct, the opposite partners can move the court for dissolution of the firm. The misconduct of a partner brings bad name to the firm and it adversely affects the reputation of the priority. The misconduct is often in business or otherwise. If a partner is jailed for committing a theft, it'll also affect the great name of the firm though it's nothing to try to with the business.

(iii) Incapacity of a Partner:

If a partner aside from the suing partner becomes incapable of performing his duties, then partnership is often dissolved.

(iv) Breach of Agreement:

When a partner wilfully commits breach of agreement concerning business, it'll become a ground for getting the firm dissolved. Under such a situation it becomes hard to hold on the business smoothly.

(v) Transfer of Share:

If a partner sells his share to a 3rd party or transfers his share to a different person permanently, other partners can pass the court for dissolving the firm.

(vi) Regular Losses:

When the firm can't be carried on profitably, then the firm are often dissolved. Though there can also be losses in every sort of business but if the firm is incurring losses continuously and it's impossible to run it profitably, then the court can order the dissolution of the firm.

(vii) Disputes amongst Partners:

Partnership firm is predicated on mutual faith. If partners don't have faith one another, then it'll not be possible to run the business. When the partners quarrel with every other, then the very basis of partnership is lost and it'll be better to dissolve it.

Following are the ways during which dissolution of a partnership firm takes place:

1. Dissolution by Agreement

A firm could also be dissolved if all the partners comply with the dissolution. Also, if there exists a contract between the partners regarding the dissolution, the dissolution may happen in accordance with it.

2. Compulsory Dissolution

In the following cases the dissolution of a corporation takes place compulsorily:

• Insolvency of all the partners or about one partner as this makes them incompetent to enter into a contract.

• When the business of the firm becomes illegal thanks to some reason.

• When thanks to some event it turns into unlawful for the partnership firm to hold its business. for instance, a partnership firm features a companion who is of another country and India declares war against that country, then he becomes an enemy. Thus, the business becomes unlawful.

3. When certain contingencies happen

The dissolution of the association takes place subject to a contract among the partners, if:

• The firm is made for a hard and fast term, on the expiry of that term.

• The firm is made to hold out specific venture, on the completion of that venture.

• A partner dies.

• A partner becomes insolvent.

4. Dissolution by Notice

When the partnership is at will, the dissolution of a firm may happen if anybody of the partners gives a word in writing to the opposite partners stating his intention to dissolve the firm.

5. Dissolution by Court

When a partner files a suit within the court, the court may order the dissolution of the corporate on the idea of the subsequent grounds:

• In the case where a partner becomes insane

• In the case the place a partner becomes permanently incapable of performing his duties.

• When a partner will become guilty of misconduct and it affects the firm’s business adversely.

• When a partner continually commits a breach of the partnership agreement.

• In a case where a partner transfers the entire of his interest within the partnership company to a 3rd party.

• In a case where the business can't be carried on barring at a loss

• When the court regards the dissolution of the firm to be just and equitable on any ground.

Key takeaways:

- The dissolution of a firm means discontinuance of its activities. When the working of a firm is stopped and therefore the assets are realized to pay a variety of liabilities it amounts to dissolution of the firm.

- Dissolution can be compulsory dissolution by law, dissolution by partners at will, dissolution by notice, dissolution by court.

A limited liability Partnership or LLP is an alternate corporate business form which offers the advantages of limited liability to the partners at low compliance costs. It also allows the partners to arrange their internal structure sort of a traditional partnership. A limited liability partnership may be a legal entity, responsible for the complete extent of its assets. The liability of the partners, however, is restricted. Hence, LLP may be a hybrid between a corporation and a partnership.

SALIENT FEATURES OF LLP

LLP may be a body corporate

According to Section 3 of the Limited Liability Partnership Act (LLP Act), 2008, an LLP may be a body corporate formed and incorporated under the Act. it's a legal entity break away its partners.

Perpetual Succession

Unlike a partnership firm, a limited liability partnership can proceed its existence even after the retirement, insanity, insolvency or maybe death of 1 or more partners. Further, it can enter into contracts and hold property in its name.

Separate Legal Entity

It is a separate legal entity. Further, it's absolutely responsible for its assets. Also, the liability of the partners is restricted to their contribution in the LLP. Hence, the lenders of the limited liability partnership aren't the creditors of individual partners.

Mutual Agency

Another difference between an LLP and a partnership firm is that independent or unauthorized actions of 1 partner don't make the opposite partners liable. All partners are agents of the LLP and therefore the actions of 1 partner don't bind the others.

LLP Agreement

The rights and duties of all partners are governed by an agreement between them. Also, the partners can devise the agreement as per their choice. If such an agreement isn't made, then the Act governs the mutual rights and duties of all partners.

Artificial Legal Person

For all legal purposes, an LLP is a man-made legal person. it's created by a legal process and has all the rights of a private company, it's invisible, intangible and immortal but not fictitious since it exists.

Common Seal

If the partners decide, the LLP can have a standard seal [Section 14(c)]. it's not mandatory though. However, if it decides to possess a seal, then it's necessary that the seal remains under the custody of a responsible official. Further, the harbour seal is often affixed only within the presence of a minimum of two designated partners of the LLP.

Limited Liability

According to Section 26 of the Act, every partner is an agent of the LLP for the aim of the business of the entity. However, he's not an agent of other partners. Further, the liability of every partner is restricted to his agreed contribution within the limited liability Partnership.

Minimum and Maximum Number of Partners

Every limited liability Partnership got to have a minimum of two partners and a minimum of two individuals as designated partners. At any time, a minimum of one designated partner should be resident in India. there's no maximum limit on the amount of maximum partners within the entity.

Management of Business

The partners of the limited liability Partnership can manage its business. However, only the certain partners are liable for legal compliances.

Business for Profit Only

A indebtedness Partnership can't be created for charitable or non-profit purposes. it's essential that the entity is made to hold on a lawful business with a view to incomes a profit.

Investigation

The power to research the affairs of a limited liability Partnership resides with the Central Government. Further, they will appoint a competent authority for an equivalent.

Compromise or Arrangement

Any compromise or arrangement sort of a merger or amalgamation desires to be in accordance with the Act.

Concept of LLP: limited liability Partnership enterprise, the planet wide recognized sort of business, has now been brought in India by enacting the limited liability Partnership Act, 2008. LLP Act was notified on 31.03.2009.

A limited liability Partnership, popularly referred to as LLP combines the benefits of both the corporate and Partnership into one sort of organization. Limited liability Partnership (LLP) may be a new corporate form that permits expert knowledge and entrepreneurial skill to mix, organize and operate in an revolutionary and proficient manner.

It provides an alternate to the normal partnership association with unlimited liability. By incorporating an LLP, its members can avail the advantage of limited liability and therefore the flexibility of organizing their internal management on the idea of a mutually-arrived agreement, as is that the case during a partnership firm.

CHARACTERISTICS OF AN LLP:

1. LLP is governed by way of the limited liability Partnership Act 2008, which has inherited force with effect from April 1, 2009. The Indian Partnership Act, 1932 isn't applicable to LLP.

2. LLP may be a body incorporate and a legal entity break away its partners having perpetual succession, can own assets in its name, sue and be sued.

3. The partners have the proper to manage the business directly, unlike corporate shareholders.

4. One partner isn't responsible or in charge of another partner’s, misconduct or negligence.

5. Minimum of two partners and no maximum limit.

6. Should be ‘for profit’ business.

7. The rights and duties of partners in an LLP, are going to be governed by the agreement between partners and therefore the partners have the pliability to plan the agreement as per their choice. The duties and obligations of Designated Partners shall be as provided within the law.

8 Limited liability of the partners to the extent of their contributions within the LLP. No exposure of private assets of the partner, except in cases of fraud.

9. LLP shall maintain annual accounts. However, audit of the accounts is required solely if the contribution exceeds Rs. 25 lakh or annual turnover exceeds Rs. 40 lakhs. a press release of accounts and solvency shall be filed by every LLP with the Registrar of Companies (ROC) per annum.

NATURE OF LIMITED LIABILITY PARTNERSHIP

Limited Liability Partnership to be body corporate.

(1)A indebtedness partnership may be a body corporate formed and incorporated under this Act and may be a legal entity breaks away that of its partners.

(2) A limited liability partnership shall have perpetual succession.

(3) Any change within the partners of a limited liability partnership shall not affect the existence, rights liabilities of the limited liability partnership.

4. Non-applicability of the Indian Partnership Act, 1932.—Save as otherwise provided, the provisions of the Indian Partnership Act, 1932 (9 of 1932) shall not apply to a limited liability partnership.

5. Partners- Any individual or body corporate could also be a partner during a limited liability partnership:

Provided that a private shall not be capable of becoming a partner of a limited liability partnership, if—

(a) he has been found to be of unsound mind by a Court of competent jurisdiction and therefore the finding is in force;

(b) he's a discharged insolvent; or

(c) he has applied to be adjudicated as an insolvent and his application is pending.

6. Minimum number of partners.

(1) Every limited liability partnership shall have a minimum of two partners.

(2) If at any time the amount of partners of a limited liability partnership is reduced below two and

the limited liability partnership carries on business for quite six months while the amount is so reduced, the person, who is that the only partner of the limited liability partnership during the time that it so carries on business after those six months and has the knowledge of the very fact that it's carrying on business with him alone, shall be liable personally for the obligations of the limited liability partnership incurred during that period.

DESIGNATED PARTNERS

(1) Every limited liability partnership shall have a minimum of two designated partners who are individuals and a minimum of one among them shall be a resident in India: as long as just in case of a limited liability partnership during which all the partners are bodies corporate or during which one or more partners are individuals and bodies corporate, a minimum of two individuals who are partners of such limited liability partnership or nominees of such bodies corporate shall act as designated partners.

Explanation.—For the needs of this section, the term "resident in India" means an individual who has stayed in India for a period of not but 100 and eighty-two days during the immediately preceding one year.

(2) Subject to the provisions of sub-section (1),

(i) if the incorporation document

(a) specifies who are to be designated partners, such persons shall be designated partners on incorporation; or

(b) states that every of the partners from time to time of limited liability partnership is to be designated partner, every such partner shall be a designated partner;

(ii) any partner may become a designated partner by and in accordance with the indebtedness partnership agreement and a partner may cease to be a chosen partner in accordance with limited liability partnership agreement.

(3) a private shall not become a designated partner in any limited liability partnership unless he has given his prior consent to act intrinsically to the limited liability partnership in such form and manner as could also be prescribed.

(4) Every limited liability partnership shall file with the registrar the particulars of each individual who has given his consent to act as designated partner in such form and manner as could also be prescribed within thirty days of his appointment.

(5) a private eligible to be a delegated partner shall satisfy such conditions and requirements as could also be prescribed.

(6) Every designated partner of a limited liability partnership shall obtain a designated Partner

Identification Number (DPIN) from the Central Government and therefore the provisions of sections 266A to 266G8 (both inclusive) of the businesses Act, 1956 (1 of 1956) shall apply mutatis mutandis for the said purpose.

LIABILITIES OF DESIGNATED PARTNERS

Unless expressly provided otherwise during this Act, a delegated partner shall be—

(a) liable for the doing of all acts, matters and things as are required to be done by the limited liability partnership in respect of compliance of the provisions of this Act including filing of any document, return, statement and therefore the like report pursuant to the provisions of this Act and as could also be laid out in the limited liability partnership agreement; and

(b) susceptible to all penalties imposed on the limited liability partnership for any contravention of these provisions.

CHANGES IN DESIGNATED PARTNERS

A limited liability partnership may appoint a designated partner within thirty days of a vacancy arising for any reason and provisions of sub-section (4) and sub-section (5) of section 7 shall apply in respect of such new designated partner:

Provided that if no designated partner is appointed, or if at any time there's just one designated partner, each partner shall be deemed to be a delegated partner.

Punishment for contravention of sections 7, 8 and 9.—(1) If the limited liability partnership contravenes the provisions of sub-section (1) of section 7, the limited liability partnership and its every partner shall be punishable with fine which shall not be but ten thousand rupees but which can reach five lakh rupees.

(2) If the limited liability partnership contravenes the provisions of sub-section (4) and sub-section (5) of section 7, section 8 or section 9, the limited liability partnership and its every partner shall be punishable with fine which shall not be but ten thousand rupees but which can reach one lakh rupees.

ADVANTAGES OF LLP

The first LLP was registered on 2nd April, 2009 and till 25th April, 2011, 4580 LLPs were registered. this type of Organization offers the subsequent benefits:

1. The method of formation is extremely simple as compared to Companies and doesn't involve much formality. Moreover, in terms of cost, the minimum fee of incorporation is as low as f 800 and maximum is f 5600.

2. A bit like a corporation, LLP is additionally body corporate, which suggests it's its own existence as compared to partnership. LLP and its Partners are distinct entities within the eyes of law. LLP is understood through its own name and not the name of its partners.

3. An LLP exists as a separate legal entity different from the lives of its partners. Both LLP and persons, who own it, are separate entities and both functions separately. Liability for repayment of debts and law incurred by the LLP lies thereon, the owner. Any business with potential for lawsuits should believe LLP sort of organisation and it'll offer another layer of protection.

4. LLP has perpetual succession. Notwithstanding any changes within the partners of the LLP, the LLP will remain an equivalent entity with an equivalent privileges, immunities, estates and possessions. The LLP shall proceed to exist till it's aroused in accordance with the provisions of the relevant law.

5. LLP Act 2008 gives an LLP flexibility to manage its very own affairs. Partners can decide the way they need to run and manage the LLP, as per the shape of LLP Agreement. The LLP Act does not regulate the LLP to large extent instead of allows partners the freedom to manage it as per their agreement.

6. It's easy to hitch or leave the LLP or in the other case it's easier to transfer the ownership in accordance with the terms of the LLP Agreement.

7. An LLP, as legal entity, is capable of owning its Separate Property and funds. The LLP is that the real person during which all the property is vested and thru which it's controlled, managed and disposed of. The property of LLP isn't the property of its partners. Therefore, partners cannot make any claim on the property just in case of any dispute amongst themselves.

8. Another main advantage of incorporation is that the taxation of a LLP. LLP is taxed at a lower rate as in contrast to Company. Moreover, LLP is additionally not subject to Dividend Distribution Tax as compared to company, so there'll not be any tax while you distribute profit to your partners.

9. Financing a little business-like sole proprietorship or partnership are often difficult sometimes. An LLP being a regulated entity like company can attract finance from Private Equity Investors, financial institutions etc.

10. As a juristic legal person, an LLP can sue in its name and be sued by others. The partners aren't susceptible to be sued for dues con to the LLP.

11. Under LLP, only just in case of business, where the annual turnover/contribution exceeds Rs. 40 lakh Rs. 25 lakh are required to urge their accounts audited yearly by a accountant. Thus, there's no mandatory audit requirement.

12. In LLP, Partners, unlike partnership, aren't marketers of the partners and thus they're not responsible for the character act of other partners, which protects the interest of individual partners.

13. As compared to a personal company, the numbers of compliances are on a lesser side just in case of LLP.

DISADVANTAGES OF LLP

The major Disadvantages of limited liability Partnership are listed below:

1. An LLP cannot raise cash from Public.

2. Any act of the partner without the opposite may bind the LLP.

3. Under some cases, liability may reach personal assets of partners.

4. No separation of Management from owners.

5. LLP might not be a choice due to certain extraneous reasons. for instance ,, Department of Telecom (DOT) would approve the appliance for a leased line solely for a corporation . Friends and relatives (Angel investors), and venture capitalists (VC) would be comfortable investing during a company.

6. The framework for incorporating a LLP is in situ but currently registrations are centralized at Delhi.

INCORPORATION OF LLP

For forming an LLP, a number of the important steps and matters are given below:

Partner:

There should be a minimum of 2 people (natural or artificial) to make an LLP. just in case any Body Corporate may be a partner, then he are going to be required to nominate a person (natural) as its nominee for the aim of the LLP. Following entities and/or persons can find yourself a partner within the LLP:

(a) Company incorporated in and out of doors India

(b) LLP incorporated in and out of doors India

(c) Individuals resident in and out of doors India.

PROCESS OF FORMULATION OF LLP:

Capital Contribution:

In case of LLP, there's no concept of any share capital, but every partner is required to contribute towards the LLP in some manner as laid out in LLP agreement. The said contribution is often tangible, movable or immovable or intangible property or different benefit to the limited liability partnership, including money, promissory notes, and different agreements to contribute cash or property, and contracts for services performed or to be performed.

In case the contribution is in intangible form, the fee of an equivalent shall be certified by a practicing chartered accountant or by a practicing cost accountant or via approved value from the panel maintained by the Central Government. The monetary cost of contribution of every partner shall be accounted for and disclosed within the accounts of the limited liability partnership within the manner as could also be prescribed.

Designated Partners:

Every limited liability partnership shall have a minimum of two designated partners to try to to all acts under the law who are individuals and a minimum of one among them shall be a resident in India. ‘Designated Partner’ means a partner who is designated intrinsically within the incorporation documents or who becomes a delegated partner by and in accordance with the LLP Agreement.

In case of a limited liability partnership during which all the partners are bodies corporate or during which one or more partners are individuals and bodies corporate, a minimum of two individuals who are partners of such limited liability partnership or nominees of such body’s corporate shall act as designated partners.

Designated Partner number (DPIN)

Every Designated Partner is required to get a DPIN from the Central Government. DPIN is an eight-digit numeric number allotted by the Central Government so as to spot a specific partner and may be acquired by making a web application in Form 7 to Central Government and submitting the physical application alongside necessary identity and Address proof of the person applying with prescribed fees.

However, if a private already holds a DIN (Director Identification Number), an equivalent number might be dispensed as your DPIN also. For that the users while submitting Form 7 must fill their existing DIN No. within the application.

It is not necessary to use Designated Partner number whenever you're appointed partner during a LLP, once this number is allotted it might be utilized in all the LLP’s during which you'll be appointed as partner.

Digital Signature Certificate:

All the forms like e Form 1, e Form 2, e Form 3 etc. which are required for the motive of incorporating the LLP are filed electronically through the medium of Internet. Since of these forms are required to be signed by the partner of the proposed LLP and as of these forms are to be filed electronically, it's impossible to sign them manually. Therefore, for the aim of signing these forms, a minimum of one among the Designated Partner of the proposed LLP wants to possess a Digital Signature Certificate (DSC).

The Digital Signature Certificate once obtained are going to be useful in filing quite a couple of forms which are required to be filed during the course of existence of the LLP with the Registrar of LLP.

LLP Name:

Ideally the name of the LLP must be such which represents the business or activity intended to be carried on by the LLP. LLP not select similar name or prohibited words.

LLP Agreement:

For forming an LLP, there need to be agreement between/among the partners. The said Agreement contains name of LLP, Name of Partners and Designated Partners, sort of Contribution, share Ratio, and Rights and Duties of Partners

In case no agreement is entered into, the rights and duties as prescribed under Schedule I to the LLP Act shall be applicable. it's possible to amend the LLP Agreement but each change made within the said agreement must be intimated to the Registrar of Companies.

Registered Office:

The Registered workplace of the LLP is that the place where all correspondence related with the LLP would happen, though the LLP also can prescribe the other for an equivalent. A registered office is required for maintaining the statutory records and books of Account of LLP. At the time of incorporation, it's essential to submit proof of ownership or right to use the office as its registered office with the Registrar of LLP.

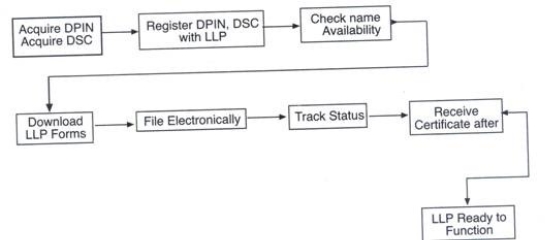

PROCESS FOR THE INCORPORATION OF AN LLP

The following things got to be ensured for the incorporation of LLP:

• Appoint/nominate partners and designated partners.

• Obtain the DPINs and Digital Signature Certificates (DSCs)

• Register a singular LLP name (applicant can indicate up to six choices)

• Draft the LLP Agreement

• File the specified documents, electronically

• Apply for the Certificate of Incorporation along side LLPIN (Limited Liability Partnership Identification Number)

• The contents of an LLP agreement

• Name of the LLP

• Names and addresses of the partners and unique partners

• The sort of contribution and interest on contribution

• Profit sharing ratio

• Remuneration of partners

• Rights and duties of partners

• The proposed business

• Rules for governing the LLP

STEPS FOR THE INCORPORATION OF AN LLP

• Reserve the name of the LLP. Applicant documents e-Form 1 to determine the supply and register the name of the LLP. Once the Ministry approves the name, it reserves it for the applicant for a period of 90 days. Also, if the LLP is not incorporated within that point frame, the reservation is removed and therefore the name is formed available to other applicants.

• Incorporation of a replacement LLP. Applicant files e-Form 2 which contains the small print of the proposed LLP alongside with details of the partners and designated partners

• Consent of the partners and detailed partners to act within the said role.

• File the LLP Agreement with the Registrar within 30 days of incorporation of the LLP. Applicant files e-Form 3. consistent with Section 23 of the LLP Act, 2008, execution of LLP Agreement is mandatory.

RIGHTS OF PARTNERS

i) Right to require part within the Conduct or Management of Business: Every partner, regardless of the quantity contributed by him, has an inherent right to participate within the conduct of enterprise of the firm. However, by mutual agreement, some partners could also be restricted to require section but, the proper to participate within the management must get on hand to all or any

ii) Right to be consulted & to require Decisions by Majority: Before taking over any major decisions, it's the proper of the partners to be consulted and heard. Any disagreement be solved by majority decision. But, no change within the nature or constitution of the business is often performed without the consent of all partners.

iii) Right of Access To Books: Every partner features a right to possess access to and to see out and replica the books of firm.

iv)Right to Share the Profits: Every partner features a right to share the profits equally, unless otherwise prescribed, and bear the losses also.

v) Right to Receive Interest on Capital: If the partnership deed so decides that a partner is entitled to get interest on capital at a hard and fast or certain rate, he features a right to receive it but, only out of profits.

vi) Right to be Indemnified: Every partner features a right to say indemnity from the association in respect of payments made or liabilities incurred by him within the ordinary and suited conduct of business and in emergency to protect the corporate from loss, provided the act should be like would are done by a individual of ordinary prudence, in his own case and under similar circumstances.

vii) Right to Receive Interest on Advances: If a associate makes any advances beyond the quantity of capital he has agreed to subscribe, he features a right to say an interest at the speed of six percent once a year .

viii) Right to Act in Emergency: A partner has every proper and authority to act in emergency, so as to guard the firm from loss, and therefore the firm would be bound through such an act, provided the act would similar in his own case, under identical situation.

ix) Right to use to the Property of the Firm for Business of the Firm: Subject to contract between the partners, every partner features a right to use and use the property of the firm exclusively for business of the firm.

x) Right to use to the Property of the Firm for Business of the Firm: Subject to contract between the partners, every partner features a proper to use and use the property of the firm exclusively for business of the firm.

xi) Right to stop Introduction of a replacement Partner: Every partner features a right to stop the introduction of any new partner within the firm. nobody are often admitted into partnership firm without the consent of all the partners.

xii) Right to Retire: A partner features a right to retire with the consent of all the partners. If the partnership is at will, he has the right to retire by giving due notice in writing to all or any other partners.

xiii) Right to not be Expelled: A partner features a proper to not be expelled by any majority of partners with none cause.

xiv) Right of an Outgoing Partner to hold on a Competing Business: Every partners features a right to hold on a business, almost like the partnership business, after his retirement with certain restrictions being that he cannot use the firm name, represent himself as carrying on the business of the corporate or solicit the customs of persons who were handling the firm before he ceased to be a partner.

xv) Right of Outgoing Partner in Certain Cases to Share Subsequent Profits: If any partner of the firm dies or otherwise ceases to be a partner and therefore the continuing partners still keep it up business with the property of the firm, with none settlement being given to the outgoing partner, then within the absence of any contract, he himself or his representative are entitled to a share of profits made since he ceased to be a partner, as could also be due to the utilization of his share of property or to activity at six percent once a year of his share within the property of the firms.

LIABILITIES OF PARTNERS

i) Joint & Several: Every partner is liable jointly and severally for all the acts of the corporate done while he was a partner. The liability of a accomplice is usually unlimited.

ii) Liability for Losses causes by HIM: Every associate shall be susceptible to observe any loss caused to the firm with the help of his fraud or willful neglect within the conduct of business. No partner can in any way exempt himself from such loss.

iii) Liability for Secret Profits: A partner is accountable to account for and pay to the firm any private profits earned from the business of the association or property or goodwill of the firm.

iv) Liability for Profits From Competing Business: If a partner carries on any business of an equivalent nature and competing thereupon of the firm, he would be responsible to account for and pay to the firm all profits made by him therein business.

v) Liability to Render true Accounts: A companion is susceptible to render true accounts to profit to different partners. he's susceptible to disclose any legal or illegal bills which fall within the scope of business of the firm.

vi) Liability for Losses of the firm: As a partner features a right to share the earnings of the firm so is, he susceptible to share the losses equally unless otherwise prescribed.

PARTNERS AND THEIR RELATIONS

Eligibility to be partners. —On the incorporation of a limited liability partnership, the persons who subscribed their names to the incorporation document shall be its partners and the other person may become a partner of the limited liability partnership by and in accordance with the limited liability partnership agreement.

Relationship of partners. —

(1) Save as otherwise provided by this Act, the mutual rights and duties of the partners of a limited liability partnership, and therefore the mutual rights and duties of a indebtedness partnership and its partners, shall be governed by the limited liability partnership agreement between the partners, or between the limited liability partnership and its partners.

(2) The limited liability partnership agreement and any changes, if any, made therein shall be filed with the Registrar in such form, manner and amid such fees as could also be prescribed.

(3) An agreement in writing made before the incorporation of a indebtedness partnership between the persons who subscribe their names to the incorporation document may impose obligations on the limited liability partnership, provided such agreement is ratified by all the partners after the incorporation of the limited liability partnership.

(4) within the absence of agreement on any matter, the mutual rights and duties of the partners and therefore the refore the mutual rights and duties of the limited liability partnership and the partners shall be determined by the provisions concerning that matter as are set-out within the First Schedule.

Cessation of partnership interest. —

(1) an individual may cease to be a partner of a limited liability partnership in accordance with an agreement with the opposite partners or, within the absence of agreement with the opposite partners on cessation of being a partner, by giving a notice in writing of not but thirty days to the opposite partners of his intention to resign as partner.

(2) an individual shall cease to be a partner of a limited liability partnership—

(a) on his death or dissolution of the limited liability partnership; or

(b) if he's declared to be of unsound mind by a competent court; or

(c) if he has applied to be adjudged as an insolvent or declared as an insolvent.

(3) Where an individual has ceased to be a partner of a limited liability partnership (hereinafter mentioned as "former partner"), the previous partner is to be regarded (in reference to a person handling the limited liability partnership) as still being a partner of the limited liability partnership unless—

(a) the person has notice that the previous partner has ceased to be a partner of the limited liability partnership; or

(b) notice that the previous partner has ceased to be a partner of the limited liability partnership has been delivered to the Registrar.

(4) The cessation of a partner from the limited liability partnership doesn't by itself discharge the partner from any obligation to the limited liability partnership or to the opposite partners or to the other person which he incurred while being a partner.

(5) Where a partner of a limited liability partnership ceases to be a partner, unless otherwise provided within the limited liability partnership agreement, the previous partner or an individual entitled to his share in consequence of the death or insolvency of the previous partner, shall be entitled to receive from the indebtedness partnership—

(a) an amount adequate to the capital contribution of the previous partner actually made to the limited liability partnership; and

(b) his right to share within the accumulated profits of the limited liability partnership, after the deduction of accumulated losses of the limited liability partnership, determined as at the date the previous partner ceased to be a partner.

(6) A former partner or an individual entitled to his share in consequence of the death or insolvency of the previous partner shall not have any right to interfere within the management of the limited liability partnership.

Registration of changes in partners. —

(1) Every partner shall inform the limited liability partnership of any change in his name or address within a period of fifteen days of such change.

(2) A limited liability partnership shall—

(a) where an individual becomes or ceases to be a partner, file a notice with the Registrar within thirty days from the date he becomes or ceases to be a partner; and

(b) where there's any change within the name or address of a partner, file a notice with the Registrar within thirty days of such change.

(3) A notice filed with the Registrar under sub-section (2)—

(a) shall be in such form and amid such fees as could also be prescribed;

(b) shall be signed by the designated partner of the limited liability partnership and authenticated during a manner as could also be prescribed; and

(c) if it relates to an incoming partner, shall contain a press release by such partner that he consents to becoming a partner, signed by him and authenticated within the manner as could also be prescribed.

(4) If the limited liability partnership contravenes the provisions of sub-section (2), the indebtedness partnership and each designated partner of the indebtedness partnership shall be punishable with fine which shall not be but two thousand rupees but which can reach twenty-five thousand rupees.

(5) If any partner contravenes the provisions of sub-section (1), such partner shall be punishable with fine which shall not be but two thousand rupees but which can reach twenty-five thousand rupees.

(6) a person who ceases to be a partner of a limited liability partnership may himself file with the Registrar the notice mentioned in sub-section (3) if he has reasonable cause to believe that the indebtedness partnership might not file the notice with the Registrar and just in case of any such notice filed by a partner, the Registrar shall obtain a confirmation to the present effect from the limited liability partnership unless the limited liability partnership has also filed such notice:

Provided that where no confirmation is given by the limited liability partnership within fifteen days, the registrar shall register the notice made by an individual ceasing to be a partner under this section.

EXTENT AND LIMITATION OF LIABILITY OF limited liability PARTNERSHIP AND PARTNERS

Partner as agent. —Every partner of a limited liability partnership is, for the aim of the business of the limited liability partnership, the agent of the limited liability partnership, but not of other partners.

Extent of liability of limited liability partnership. — (1) A limited liability partnership isn't

Bound by anything done by a partner in handling an individual if—

(a) the partner actually has no authority to act for the limited liability partnership in doing a particular act; and

(b) the person knows that he has no authority or doesn't know or believe him to be a partner of the limited liability partnership.

(2) The limited liability partnership is liable if a partner of a limited liability partnership is susceptible to a person as a result of a wrongful act or omission on his part within the course of the business of the limited liability partnership or with its authority.

(3) An obligation of the limited liability partnership whether arising in contract or otherwise, shall be solely the requirement of the limited liability partnership.

(4) The liabilities of the limited liability partnership shall be met out of the property of the limited liability partnership.

Extent of liability of partner.—(1) A partner isn't personally liable, directly or indirectly for an obligation mentioned in sub-section (3) of section 27 solely by reason of being a partner of the limited liability partnership.

(2) The provisions of sub-section (3) of section 27 and sub-section (1) of this section shall not affect the private liability of a partner for his own wrongful act or omission, but a partner shall not be personally responsible for the wrongful act or omission of the other partner of the limited liability partnership.

Holding out.—(1) a person , who by words spoken or written or by conduct, represents himself, or knowingly permits himself to be represented to be a partner during a limited liability partnership is susceptible to a person who has on the religion of any such representation given credit to the indebtedness partnership, whether the person representing himself or represented to be a partner does or doesn't know that the representation has reached the person so giving credit:

Provided that where any credit is received by the limited liability partnership as a results of such representation, the limited liability partnership shall, without prejudice to the liability of the person so representing himself or represented to be a partner, be susceptible to the extent of credit received by it or any financial benefit derived thereon.

(2) Where after a partner's death the business is sustained within the same limited liability partnership name, the continued use of that name or of the deceased partner's name as a neighborhood thereof shall not of itself make his personal representative or his estate responsible for any act of the limited liability partnership done after his death.

Unlimited liability just in case of fraud.—(1) within the event of an act administered by a limited liability partnership, or any of its partners, with intent to defraud creditors of the limited liability partnership or the other person, or for any fraudulent purpose, the liability of the indebtedness partnership and partners who acted with intent to defraud creditors or for any fraudulent purpose shall be unlimited for all or any of the debts or other liabilities of the limited liability partnership:

Provided that just in case any such act is administered by a partner, the limited liability partnership is susceptible to an equivalent extent because the partner unless it's established by the indebtedness partnership that such act was without the knowledge or the authority of the limited liability partnership.

(2) Where any business is carried on with such intent or for such purpose as mentioned in sub-section (1), every one who was knowingly a celebration to the carrying on of the business within the manner aforesaid shall be punishable with imprisonment for a term which can reach two years and with fine which shall not be but fifty thousand rupees but which can reach five lakh rupees.

(3) Where a limited liability partnership or any partner or designated partner or employee of such limited liability partnership has conducted the affairs of the limited liability partnership during a fraudulent manner, then without prejudice to any criminal proceedings which can arise under any law for the nonce effective , the limited liability partnership and any such partner or designated partner or employee shall be susceptible to pay compensation to a person who has suffered any loss or damage by reason of such conduct:

Provided that such limited liability partnership shall not be liable if any such partner or designated partner or employee has acted fraudulently without knowledge of the limited liability partnership.

Whistle blowing.—(1) The Court or Tribunal may reduce or waive any penalty leviable against any partner or employee of a limited liability partnership, if it's satisfied that—

(a) such partner or employee of a limited liability partnership has provided useful information during investigation of such limited liability partnership; or

(b) when any information given by any partner or employee (whether or not during investigation) results in limited liability partnership or any partner or employee of such limited liability partnership being convicted under this Act or the other Act.

(2) No partner or employee of any limited liability partnership could also be discharged, demoted, suspended, threatened, harassed or in the other manner discriminated against the terms and conditions of his limited liability partnership or employment merely due to his providing information or causing information to be provided pursuant to sub-section (1).

CONTRIBUTIONS

Form of contribution

(1) A contribution of a partner may contain tangible, movable or immovable or intangible property or other benefit to the limited liability partnership, including money, promissory notes, other agreements to contribute cash or property, and contracts for services performed or to be performed.

(2) The price of contribution of every partner shall be accounted for and disclosed within the accounts of the limited liability partnership within the manner as could also be prescribed.

33. Obligation to contribute.—(1) the requirement of a partner to contribute money or other property or other benefit or to perform services for a limited liability partnership shall be as per the limited liability partnership agreement.

(2) A creditor of a limited liability partnership, which extends credit or otherwise acts in reliance on an obligation described therein agreement, all of sudden of any compromise between partners, may enforce the first obligation against such partner.

DIFFERENCE BETWEEN

S. No. | Basis | Partnership | Private Limited Company | Limited Liability Partnership |

1 | Prevailing Law | Partnership is prevailed by ‘The Indian Partnership Act, 1932’ and various Rules made thereunder | Companies are prevailed by ‘Companies Act, 2013’ | Limited Liability Partnership are prevailed by ‘The Limited Liability Partnership Act, 2008’ and various Rules made thereunder |

2 | Capital Required | No minimum amount | Normally Rs. 1 Lacs | No minimum amount |

3 | Time of Registration | 5-7 days | 7-10 days in complete process | 7-10 days in complete process |

4 | Name of Entity | Any name as per choice | Name to contain ‘Private Limited’ in case of Private Company as suffix. | Name to contain ‘Limited Liability Partnership’ or ‘LLP’ as suffix. |

5 | Registration | Registration is optional | Registration with Registrar of ROC required. | Registration with Registrar of LLP required. |

6 | Creation | Created by contract with 2 persons | Created by Law | Created by Law |

7 | Distinct entity | Not a separate legal entity | Is a separate legal entity under the Companies Act, 2013. | Is a separate legal entity under the Limited Liability Partnership Act, 2008. |

8 | Cost of Formation | The Cost of Formation is negligible | Minimum Statutory fee for incorporation of Company is Relatively High | The cost of Formation is statutory filling fees, comparatively lesser than the cost of formation of Company. |

9 | Perpetual Succession | It does not have perpetual succession as this depends upon the will of partners | It has perpetual succession and members may come and go. | It has perpetual succession and partners may come and go |

10 | Charter Document | Partnership Deed is a charter of the firm which denotes its scope of operation and rights and duties of the partners | Memorandum and Article of Association is the charter of the company that defines its scope of operations. | LLP Agreement is a charter of the LLP which denotes its scope of operation and rights and duties of the partners vis-à-vis LLP. |

11 | Common Seal | There is no concept of common seal in partnership | It denotes the signature of the company and every company shall have its own common seal | It denotes the signature and LLP may have its own common seal, dependant upon the terms of the Agreement |

12 | Formalities of Incorporation | In case of registration, Partnership Deed along with form / affidavit required to be filled with Registrar of firms along with requisite filing fee | Various eforms along the Memorandum & Articles of Association are filled with Registrar of Companies with prescribed fees | Various eforms are filled with Registrar of LLP with prescribed fees |

13 | Foreign Participation | Foreign Nationals can not form Partnership Firm in India | Foreign Nationals can be a member in a Company. | Foreign Nationals can be a Partner in a LLP. |

14 | Number of Members | Minimum 2 and Maximum 20 | 2 to 200 members in case of Private Company | Minimum 2 partners and there is no limitation of maximum number of partners. |

15 | Ownership of Assets | Partners have joint ownership of all the assets belonging to partnership firm | The company independent of the members has ownership of assets | The LLP independent of the partners has ownership of assets |

16 | Legal Proceedings | Only registered partnership can sue third party | A company is a legal entity which can sue and be sued | A LLP is a legal entity can sue and be sued |

17 | Liability of Partners/Members | Unlimited. Partners are severally and jointly liable for actions of other partners and the firm and liability extend to their personal assets. | Generally limited to the amount required to be paid up on each share. | Limited, to the extent their contribution towards LLP, except in case of intentional fraud or wrongful act of omission or commission by the partner. |