UNIT 4

Monopoly

The word monopoly has been derived from the combination of two words i.e., ‘Mono’ and ‘Poly’. Mono refers to a single and poly to control.

Thus, monopoly refers to a market situation in which there is only one seller of a commodity.

In monopoly market, single firm or one seller controls the entire market. The firm has all the market power, so he can set the prices to earn more profit as the consumers do not have any alternative.

Definition

“Pure monopoly is represented by a market situation in which there is a single seller of a product for which there are no substitutes; this single seller is unaffected by and does not affect the prices and outputs of other products sold in the economy.” Bilas

“Monopoly is a market situation in which there is a single seller. There are no close substitutes of the commodity it produces, there are barriers to entry”. –Koutsoyiannis

“A pure monopoly exists when there is only one producer in the market. There are no dire competitions.” –Ferguson

Features

- One seller and large number of buyers -in a monopoly one seller produces all of the output for a good or service. The entire market is served by a single firm. For practical purposes the firm is the same as the industry. But the number of buyers is assumed to be large.

2. No Close Substitutes - There is no close substitutes for the product sold by the monopolist. The cross elasticity of demand between the product of the monopolist and others must be negligible or zero.

3. Difficulty of Entry of New Firms - There are restrictions on the entry of firms into the industry, even when the firm is making abnormal profits. Other sellers are unable to enter the market of the monopoly

4. Profit maximizer: a monopoly maximizes profits. Due to the lack of competition a firm can charge a set price above what would be charged in a competitive market, thereby maximizing its revenue.

5. Price Maker - Under monopoly, monopolist has full control over the supply of the commodity. The price is set by determining the quantity in order to demand the price desired by the firm. Therefore, buyers have to pay the price fixed by the monopolist.

Short run and long run equilibrium

A. Short run

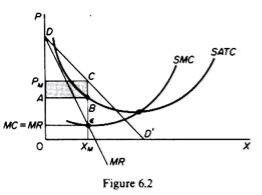

A monopolist maximizes his short-term profits if the following two conditions are met first, MC equals Mr. Secondly; the slope of MC is larger than that of Mr at the intersection.

|

In Figure 6.2, the equilibrium of the monopoly is defined by the point θ at which MC intersects the MR curve from below. Thus, both conditions of equilibrium are met. The price is PM and the quantity is XM. Monopolies realize excess profits equal to shaded areas APM CB. Please note that the price is higher than Mr

In pure competition, the company is the one who receives the price, so it’s only decision is the output decision. The monopolist is faced with two decisions: to set his price and his output. But given the downward trend demand curve, the two decisions are interdependent.

Monopolies set their own prices and sell the amount the market takes on it, or produce an output defined by the intersection of MC and MR and are sold at the corresponding price. An important condition for maximizing the profits of monopolies is the equality of the MC and the MR, provided that the MC cuts the MR from below.

|

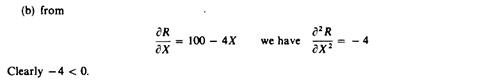

We can now revisit the statement that there is no unique supply curve for the monopolist derived from his MC. Given his MC, the same amount could be offered at different prices depending on the price elasticity of demand. This is graphically shown in Figure 6.3. Quantity X is sold at price P1 if demand is D1, and the same quantity X is sold at price P2 if demand is D2.

|

So there is no inherent relationship between price and quantity. Similarly, given the monopolist MC, we can supply various quantities at any one price, depending on the market demand and the corresponding MR curve. Figure 6.4 illustrates this situation. The cost condition is represented by the MC curve. Given the cost of a monopolist, he would supply 0X1 if the market demand is D1, then p at the same price, and only 0X2 if the market demand is D2 B.Long-term equilibrium:

|

In the long run the monopolist will have time to expand his plants or use his existing plants at every level to maximize his profits. However, if the entry is blocked, the monopolist does not need to reach the optimal scale (that is, the need to build the plant until the minimum point of LAC is reached), neither does the guarantee that he will use his existing plant at the optimum capacity. What is certain is that if he makes a loss in the long run, the monopolist will not stay in business.

He will probably continue to earn paranormal benefits even in the long run, given that entry is banned. But the size of his plant and the degree of utilization of any plant size depends entirely on the market demand. He may reach the optimal scale (the minimum point of Lac), stay on the less optimal scale (the falling part of his LAC), or exceed the optimal scale (expand beyond the minimum LAC), depending on market conditions.

|

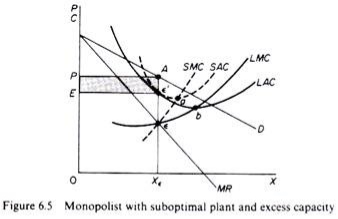

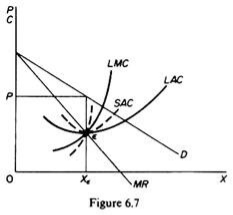

Figure 6.5 shows when the market size does not allow the monopolist to expand to the minimum point of Lac. In this case, not only is his plant not optimal (in the sense that the economy of full size is not depleted), but also the existing plant is not fully utilized. This is because on the left of the minimum point of the LAC, the SRAC touches the LAC at its falling part, and the short-term MC must be equal to the LRMC. This happens in e, but the minimum LAC is b,and the optimal use of the existing plant is a. Since it is utilized at Level E', there is excess capacity. Finally, figure 6.7 shows a case where the market size is large enough for a monopolist to build an optimal plant and be able to use it at full capacity.

|

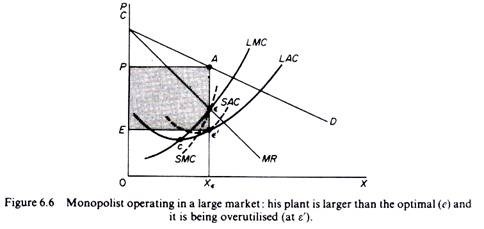

In Figure 6.6, the scale of the market is so large that monopolists have to build plants larger than the optimal ones to maximize output and over-exploit them. This is because to the right of the minimum point of LAC, SRAC and LAC is tangent at the point of positive slope, and SRMC must be equal to LAC. Thus, plants that maximize the profits of monopolies are, firstly, larger than the optimal size, and secondly, they are over-utilized, which leads to higher costs. This is often the case with utility companies operating at the state level.

|

It should be clear that which of the above situations will appear in a particular case will depend on the size of the market (given the technology of monopolists). There is no certainty that monopolies will reach their optimal size in the long run, as is the case with purely competitive markets. In Monopoly, there is no market force similar to those of pure competition that will lead companies to operate at optimal plant size in the long run (and utilize it at its full capacity).

Key takeaways –

- monopoly refers to a market situation in which there is only one seller of a commodity

- A monopolist maximizes his short-term profits if the following two conditions are met first, MC equals Mr.

- Secondly; the slope of MC is larger than that of Mr at the intersection.

- In the long run the monopolist will have time to expand his plants or use his existing plants at every level to maximize his profits

A monopolistic firm is a price-maker, not a price-taker. Therefore, a monopolist can increase or decrease the price. Also, when the price changes, the average revenue, and marginal revenue changes too. Take a look at the table below:

Quantity sold | Price per unit | Total revenue | Average revenue | Marginal revenue |

1 | 6 | 6 | 6 | 6 |

2 | 5 | 10 | 5 | 4 |

3 | 4 | 12 | 4 | 2 |

4 | 3 | 12 | 3 | 0 |

5 | 2 | 10 | 2 | -2 |

6 | 1 | 6 | 1 | -4 |

Let’s look at the revenue curves now:

As you can see in the figure above, both the revenue curves (Average Revenue and Marginal Revenue) are sloping downwards. This is because of the decrease in price. If a monopolist wants to increase his sales, then he must reduce the price of his product to induce:

• The existing buyers to purchase more

• New buyers to enter the market

Hence, the demand conditions for his product are different than those in a competitive market. In fact, the monopolist faces demand conditions similar to the industry as a whole.

Therefore, he faces a negatively sloped demand curve for his product. In the long-run, the demand curve can shift in its slope as well as location. Unfortunately, there is no theoretical basis for determining the direction and extent of this shift.

Talking about the cost of production, a monopolist faces similar conditions that a single firm faces in a competitive market. He is not the sole buyer of the inputs but only one of the many in the market. Therefore, he has no control over the prices of the inputs that he uses.

Role of time element in determination of price are given below:

Time plays an important role in the theory of volume, i.e., price determination because supply and demand conditions are affected by time.

Price during the short-period can be higher or lower than the cost of production, but in the long-period price will have a tendency to be equal to the cost of production.

The relative importance of supply on demand in the determination of price depends upon the time given to supply to adjust itself to demand.

To study the relative importance of supply or demand in price determination, Prof. Marshall has divided time element-into three categories:

(a) Very short period or market period.

(b) Short period.

(c) Long period.

(a) Very short period (determination of market price):

Market period is a time period which is too short to increase production of the commodity in response to an increase in demand. In this period the supply cannot be more than existing stock of the commodity.

The supply of perishable goods is perfectly inelastic during market period. But non-perishable goods (durable goods) can be stored.:

Therefore, the supply curve of non-perishable goods above reserve price has a positive scope at first but becomes perfectly inelastic after some price level.

The reserve price y depends upon-(i) cost of storing, (ii) future expected price, (iii) future cost of production, and (iv) seller’s need for cash we will discuss the determination of market price by taking a perishable commodity and determination of market price is illustrated.

DD is the original demand curve and SS the market period supply curve. The demand curve DD (perfectly inelastic) cuts the supply curve SS at point E. Point E, is the equilibrium point and equilibrium price is determined at OP, level.

Increase in demand shifts the demand curve to D,D and the price also increased to OP,. Decrease in demand shifts the demand curve downward to D2D2 and the price too falls to OP It is, thus, clear that in market period price fluctuates with change in demand conditions.

(b) Price determination is short period:

In the short period fixed factors of production remain unchanged, i.e., productive capacity remains unchanged.

However, in the short period supply can be affected by changing the quantity of variable factors.

In other words, during the short period supply can be increased to some extent only by an intensive use of the existing productive capacity.

Therefore, the supply curve in the short-run slopes positively, but the supply curve is less elastic. Determination of price in the short-run is illustrated.

SS is the market period supply curve and SRS is short-run supply curve. The original demand curve DD cuts both the supply curves at E, point and thus OP, price is determined.

Increase in demand shifts the demand curve upward to the right to D,D,. Now with the increase in demand the market price (in market period) rises at once to OP3 because supply remains fixed. But in the short-run supply increases. Therefore, in the short-run price will cuts the SRS curve. If demand decreases opposite will happen.

(c) Price determination in long period (Normal Price):

In the long period there is enough time for the supply to adjust fully to the changes in demand.

In the long period all factors are variable. Present firms can increase on decrease the size of their plants (productive capacity).

The new firms can enter the industry and old firms can leave the market. Therefore, long-period supply curve has a positive slope and is more elastic than short period supply curve.

The shape of supply curve of the industry depends upon the nature of the laws of returns applicable to the industry. Price determination in the long period is illustrated.

DD is the original demand curve and LS is the long period supply curve of the industry. Demand curve DD and supply curve LS both intersect each other at E point and OP price is determined.

This price will be equal to minimum average cost (AC) of production because in the long period firms under perfect competition can only earn normal profits. Suppose these are permanent increase in demand.

With the increase in demand, the demand curve shifts to D1,D1. As a result of increase in demand the price in the market period and short period will rise.

Due to increase in price present firms will earn above normal profit. Therefore, new firms will enter into market in the long period.

As a result of it supply will increase in the long period. In the long period price will be determined at OP1, level because at this price demand curve D1 D2 cuts the LS curve at E2 point.

Price OP1, is greater than previous price OP1, because the industry is an increasing cost industry. This new higher price will also be equal to minimum average cost of production

Key takeaways –

- A monopolistic firm is a price-maker, not a price-taker. Therefore, a monopolist can increase or decrease the price.

Dumping is an international price discrimination in which an exporter firm sells a portion of its output in a foreign market at a very low price and the remaining output at a high price in the home market Haberler defines dumping as: “The sale of goods abroad at a price which is lower than the selling price of the same goods at the same time and in the same circumstances at home, taking account of differences in transport costs”.

Viner’s definition is simple, according to him, “Dumping is price discrimination between two markets in which the monopolist sells a portion of his produced product at a low price and the remaining part at a high price in the domestic market.” Besides, Viner explains two other types of dumping. One, reverse dumping in which the foreign price is higher than the domestic price.

Types of dumping

1. Sporadic or Intermittent Dumping:

It is adopted under exceptional circumstances when even after sales the domestic production of the commodity is more than the target or there are unsold stocks of the commodity. In such a situation, without reducing the domestic price the producer sells the unsold stocks at a low price in the foreign market.

This happens when the foreign demand for his commodity is elastic and in the domestic market the producer is a monopolist. In this type of dumping, in order to reduce his loss the producer sells his commodity in a foreign country at a price which covers his variable costs and some current fixed costs.

2. Persistent Dumping:

When a monopolist continuously sells a portion of his commodity at a high price in the domestic market and the remaining output at a low price in the foreign market, it is called persistent dumping. This is possible only if the domestic demand for that commodity is less elastic and the foreign demand is highly elastic. When costs fall continuously along with increasing production, the producer does not lower the price of the product more in the domestic market because the home demand is less elastic.

3. Predatory Dumping:

The predatory dumping is one in which a monopolist firm sells its commodity at a very low price or at a loss in the foreign market in order to drive out some competitors. But when the competition ends, it raises the price of the commodity m the foreign market. Thus, the firm covers loss and if the demand in the foreign market is less elastic, its profit may be more.

Objectives

1. To Find a Place in the Foreign Market: A monopolist utilize dumping in order to find a place in the foreign market. Due to perfect competition in the foreign market he lowers the price of his commodity in comparison to the other competitors so that the demand for his commodity may increase.

2. To Sell Surplus Commodity: When there is excessive production of a monopolist’s commodity and he is not able to sell in the domestic market, he wants to sell the surplus at a very low price in the foreign market. But it happens occasionally.

3. Expansion of Industry: A monopolist for the expansion of his industry also resorts to dumping. When he expands it, both internal and external economies are received which lead to the application of the law of increasing returns. At the same time, the cost of production of his commodity is reduced and he earns more profit by selling more quantity of his commodity at a lower price in the foreign market.

4. New trade relations : In order to develop new trade relations abroad the monopolist practices dumping. Thus, he sells his commodity at a low price in the foreign market, thereby establishing new market relations with those countries.

Key takeaways –

- Dumping is an international price discrimination in which an exporter firm sells a portion of its output in a foreign market at a very low price and the remaining output at a high price in the home market

The degree of monopoly power is measured in terms of difference between Marginal cost and the price. In a perfectly competitive market, price equals marginal cost and firms earn an economic profit of zero. In a monopoly, the price is set above marginal cost and the firm earns a positive economic profit. The degree of monopoly. Market power is the ability to charge a price above marginal cost. A firm in a competitive market produces where P=MC. This shows us how much of a 'mark-up' the firm is charging above its marginal cost, as a proportion of its price.

The divergence between the actual and the ideal output measures the extent of influence of a seller over supply and price. According to him, this divergence is equal to P – MC/P. But MC will always be equal to MR. Thus, the above formula may be rewritten as P – MR/P.

If elasticity is introduced and ep = the efficient of price elasticity of demand, we get

P – MR/P = P – P (1 – 1/ ep) = 1/ ep

[Since MR = P (1 – 1/ ep)]

So the degree of monopoly power can be measured by the inverse of the elasticity of demand. In a market where elasticity of demand is infinite, its inverse will be zero and there will be no monopoly power. On the other hand, in a market where elasticity of demand is zero, the monopoly power will be infinite. In between these two extremes the degree of monopoly power will depend on the variation of price elasticity of demand.

Key takeaways –

- The degree of monopoly power is measured in terms of difference between Marginal cost and the price.

- In a perfectly competitive market, price equals marginal cost and firms earn an economic profit of zero.

Both Perfect Competition vs Monopolistic Competition are popular choices within the market; allow us to discuss a number of the main Difference Between Perfect Competition and Monopolistic Competition:

1. A market structure, where there are numerous sellers, selling close substitute goods/services to the buyers, is monopolistic competition. A market structure, where there are many sellers selling similar products/services to the buyers, is ideal competition.

2. In perfect competition, the merchandise offered is standardized whereas in monopolistic competition product differentiation is there.

3. In monopolistic competition, every firm offers products at its own price. In perfect competition, the demand and provide forces determine the worth for the entire industry and each firm sells its product at that price.

4. Entry and Exit are comparatively easy in perfect competition than in monopolistic competition.

5. In monopolistic competition, average revenue (AR) is bigger than the marginal revenue (MR), i.e. to extend sales the firm has got to lower down its price. On the opposite hand, average revenue (AR) and marginal revenue (MR) curve coincide with one another in perfect competition.

6. Monopolistic competition, that exists practically. On the opposite hand, perfect competition is an imaginary situation which doesn't exist actually .

7. The demand curve as faced by a monopolistic competitor isn't flat, but rather downward-sloping, which suggests that the monopolistic competitor can raise its price without losing all of its customers or lower the worth and gain more customers.

Since there are substitutes, the demand curve facing a monopolistically competitive firm is more elastic than that of an ideal competition where there are not any substitutes. If a monopolist raises its price, some consumers will choose to not purchase its product—but they're going to then got to buy a totally different product.

However, when a monopolistic competitor raises its price, some consumers will choose to not purchase the merchandise in the least , but others will prefer to buy an identical product from another firm. If a monopolistic competitor raises its price, it'll not lose as many purchasers as would a monopoly competitive firm, but it'll lose more customers than would a monopoly that raised its prices.

Below is that the topmost Comparison between Perfect Competition vs Monopolistic Competition are as follows –

Basic Comparison between Perfect Competition vs Monopolistic Competition Perfect competition

Basic Comparison between Perfect Competition vs Monopolistic Competition | Perfect competition | Monopolistic Competition |

Number of seller/buyers | Many | Many |

Type of good/services offered | Homogeneous | Differentiated |

Does firm have pricing control over their own prices? | No – Price Takers | Yes – some pricing power |

Is marketing/branding important? | No | Yes – Key non-price competition |

Are entry barriers zero, low or high? | Zero entry Barrier | Low entry Barrier |

Does this market structure lead to allocated efficiency in the long run? | Yes, Price = MC | Not Quite (P>MC) |

Does this market structure lead to productive efficiency in the long run? | Yes | No |

Situation | Unrealistic | Realistic |

Demand curve slope | Horizontal, perfectly elastic | Downward sloping, relatively elastic |

A relation between Average Revenue (AR) and Marginal Revenue (MR) | Average Revenue = Marginal Revenue | Average Revenue > Marginal Revenue. |

Maximum social welfare due to marginal cost pricing under perfect competition

Perfectly competitive markets exhibit both productive efficiency (because output is produced using the most efficient combination of resources available) and allocative efficiency (because the goods produced are those most valued by consumers). In equilibrium, a perfectly competitive market allocates goods so that the marginal cost of the final unit produced equals the marginal value that consumers attach to that final unit. In the long run, market pressure minimizes the average cost of production. Voluntary exchange in competitive markets maximizes the sum of consumer surplus and producer surplus, thus maximizing social welfare.

Key takeaways –

- In a perfectly competitive market, price equals marginal cost and firms earn an economic profit of zero. In a monopoly, the price is set above marginal cost and the firm earns a positive economic profit.

- in competitive markets maximizes the sum of consumer surplus and producer surplus, thus maximizing social welfare

Sources

1. Lipsey, R.G. and K.A. Chrystal, Economics, Oxford Printing Press

2. Bilas, Richard A. Microeconomic Theory: A Graphical Analysis, McGraw Hill book Co.

Kogakusha co. Ltd.

3. Amit Sachdeva, Micro Economics, Kusum Lata Publishers.

4. Chopra, P.N. Micro Economics

5. Seth, M.L. Micro Economics