UNIT 2

Inflation

Inflation is a quantitative measure of the speed at which the average price level of a basket of selected goods and services in an economy increases over a period of time. it's the constant rise within the general level of prices where a unit of currency buys but it did in prior periods. Often expressed as a percentage, inflation indicates a decrease within the purchasing power of a nation’s currency.

Inflation – its concepts and causes of inflation.

According to A.C. Pigou (Cambridge University), inflation comes in existence “when money income is expanding more than in proportion to income activity”. An increase in general price level takes place when people have more money income to spend against less goods and services.

G. Crowther (British economists)brings out the meaning precisely when he says, “inflation is a state in which the value of money is falling i.e. prices rising”.

Inflation, according to Harry G. Johnson (Canadian economist), “is a sustained rise in prices”.

Paul Samuelson (American economist) defines inflation as “a rise in the general level of prices”.

According to Milton Friedman (American economists), ‘inflation is taxation without representation’.

Key takeaways –

The causes of inflation are as follows-

In an economy, when the demand for a commodity exceeds its supply, then the excess demand pushes the price up. On the other hand, when the factor prices increase, the cost of production rises too. This leads to an increase in the price level as well.

2. Increase in Public Spending:

In any modern economy, Government spending is an important element of the total spending. It is also an important determinant of aggregate demand. Usually, in lesser developed economies, the Govt. spending increases which invariably creates inflationary pressure on the economy.

3. Deficit Financing of Government Spending:

There are times when the spending of Government increases beyond what taxation can finance. Therefore, in order to incur the extra expenditure, the Government resorts to deficit financing. For example, it prints more money and spends it. This, in turn, adds to inflationary pressure.

4. Increased Velocity of Circulation:

In an economy, the total use of money = the money supply by the Government x the velocity of circulation of money. When an economy is going through a booming phase, people tend to spend money at a faster rate increasing the velocity of circulation of money.

5. Population Growth:

As the population grows, it increases the total demand in the market. Further, excessive demand creates inflation.

6. Hoarding:

Hoarders are people or entities who stockpile commodities and do not release them to the market. Therefore, there is an artificially created demand excess in the economy. This also leads to inflation.

7. Genuine Shortage:

It is possible that at certain times, the factors of production are short in supply. This affects production. Therefore, supply is less than the demand, leading to an increase in prices and inflation.

8. Exports:

In an economy, the total production must fulfill the domestic as well as foreign demand. If it fails to meet these demands, then exports create inflation in the domestic economy.

9. Trade Unions:

Trade union work in favor of the employees. As the prices increase, these unions demand an increase in wages for workers. This invariably increases the cost of production and leads to a further increase in prices.

10. Tax Reduction:

While taxes are known to increase with time, sometimes, Governments reduce taxes to gain popularity among people. The people are happy because they have more money in their hands. However, if the rate of production does not increase with a corresponding rate, then the excess cash in hand leads to inflation.

11. The imposition of Indirect Taxes:

Taxes are the primary source of revenue for a Government. Sometimes, Governments impose indirect taxes like excise duty, VAT, etc. on businesses.

As these indirect taxes increase the total cost for the manufacturers and/or sellers, they increase the price of the product to have a minimal impact on their profits.

12. Price-rise in the International Markets

Some products require to import commodities or factors of production from the international markets like the United States. If these markets raise prices of these commodities or factors of production, then the overall production cost in India increases too. This leads to inflation in the domestic market.

Key takeaways –

The consequences of inflation are as follows-

- Creditors and debtors - During inflation creditors lose as they receive the repayments during a period of low prices. On other hand, debtors during inflation gain, since they repay their debts in currency that has lost its value

- Producers and workers - Producers gain during inflation as they get higher prices and leads to earn more profits from the sale of their products. Producers can earn more during inflation, as the rise in prices is usually higher than the increase in costs. But, workers lose because there is a fall in their real wages as their money wages do not usually rise proportionately with the increase in prices.

- Fixed income earners – during inflation, fixed income earners suffer greatly because inflation reduces the value of their earnings.

- Investors – in equity shares investor gains s they get dividends at higher rates. But the bondholders lose because they get a fixed interest on the real value of which has already fallen

- Farmers – farmers gains during inflation as rise in the price of agricultural products is higher than the rise in the price of other goods

2. Effects on production - The production of all goods—both of consumption and of capital goods is stimulated by rising prices. As producers get more and more profit, they try to produce more and more by utilizing all the available resources at their disposal. The production cannot increase after the stage of full employment as all the resources are fully employed.

3. Effects on income and employment - on account of larger spending and greater production inflation tend to increase the aggregate money income (i.e., national income) of the community as a whole. Similarly, under the impact of increased production the volume of employment increases. Whereas people real income of the fails to increase proportionately due to a fall in the purchasing power of money.

4. Effects on business and trade – during inflation due to higher income, greater productivity and larger spending the aggregate volume of internal trade tend to increase. On account of rise in the price of domestic goods export trade is likely to suffer. Profit soar during inflation as cost do not rise as fast as price.

5. Effects on the government finance - During inflation, the government revenue increases as it gets more revenue from income tax, sales tax, excise duties, etc. in the same way, public expenditure increases as the government is required to spend more and more for administrative and other purposes. But the real burden of public debt is reduced due to rising prices because a fix sum has to be paid in installment per period.

6. Effects on Growth - A mild inflation promotes economic growth, but a increase in inflation hinder the economic growth as it raises cost of development projects. Although in a developing economy mild dose of inflation is inevitable and desirable, a high rate of inflation tends to lower the growth rate by slowing down the rate of capital formation and creating uncertainty.

Key takeaways –

Demand pull inflation-

Definition:

Demand-pull inflation exists when aggregate demand for a good or service exceeds aggregate supply. It starts with an increase in consumer demand. Sellers meet such an increase with more supply. But when additional supply is unavailable, sellers raise their prices. That results in demand-pull inflation.

When there is excess demand in the economy, producers are able to raise prices and achieve bigger profit margins because they know that demand is running ahead of supply. Typically, demand-pull inflation becomes a threat when an economy has experienced a strong boom with GDP rising faster than the long run trend growth of potential GDP.

Causes of demand pull inflation-

2. Expectation of inflation – once people expect inflation in future, they tend to buy more to avoid higher prices. This leads to increase in demand and creates demand-pull inflation. It’s difficult to eradicate once the expectation of inflation sets in.

3. Over expansion of the money supply – this happens when too much money chasing too few goods. An expansion of the money supply with too few goods to buy makes prices increase.

4. Discretionary fiscal policy - according to Keynesian economic theory, government spending drives up demand. Demand increases when government lowers taxes. When consumers have more discretionary income to spend on goods and services it creates inflation.

5. Strong brand - Marketing can create high demand for certain products, a form of asset inflation. This leads to charge high prices

6. Technological innovation – a company owns the market when it creates new technology until other companies figure out how to copy it. People demand new technology that creates real improvement in their daily lives.

Cost push inflation-

Cost-push inflation occurs when supply costs rise or supply levels fall. As long as demand remains the same either will drive up prices. Cost push inflation is created by Shortages or cost increases in labor, raw materials, and capital goods.

Definition:

Cost-push inflation occurs when firms respond to rising costs by increasing prices in order to protect their profit margins.

Causes of cost push inflation-

2. Wage inflation - Wage inflation is created when workers have enough leverage to force through wage increases. When people expect higher inflation wage may increase in order to protect their real incomes.

3. Component cost – it involves increase in the prices of raw materials and other components. This is due to the rise in commodity prices such as oil, copper and agricultural products used in food processing.

4. Higher indirect taxes – government regulation and taxation may reduce the supply of many other products such as rise in the duty on alcohol, fuels and cigarettes, or a rise in Value Added Tax.

5. Exchange rates - higher import prices happens when any country that allows the value of its currency to fall. The foreign supplier does not want the value of its product to drop along with that of the currency. It can raise the price and keep its profit margin intact, if demand is inelastic.

Key takeaways-

Stagflation refers to a situation when a high rate of inflation occurs simultaneously with a high rate of unemployment. The existence of a high rate of unemployment means the reduced level of GNP.

The term stagflation was coined during seventies when several developed countries of the world, received a supply stock in terms of rapid hike in oil prices. In 1973, the Cartel of Oil Producing Countries OPEC raised the worth of oil.

There was a fourfold increase in the oil prices. in the us during 1973-75 the higher costs of fuel-oil and other petroleum products caused a sharp increase in the prices of manufactured goods. the rate of inflation went up to over 12 per cent during 1974 in USA.

A severe recession, the worst since 1930s, also hit the American economy during the 1973-75. the real GNP declined between the late 1973 and early 1975. As a consequence, the rate of unemployment shot up to just about 9 per cent.

Thus, both inflation and unemployment were unusually very high during this era (1973-75). This simultaneous occurrence of high inflation and high unemployment was also seen just in case of other free market developed countries like Britain, France and Germany. The recovery from recession began in 1975 and over subsequent few years GNP rose and unemployment declined. rate of inflation also declined from over 12 per cent to the range of 5 to 7 per cent.

But, again in 1979 when a revolution in Iran created a crises in world oil market, OPEC doubled the worth of oil. This brought back stagflation again in 1979 within the developed countries. real gross national product fell at a rapid rate during 1979-81. rate of inflation again went up to over 10 per cent in these countries during this era .

India also couldn't shake the oil price shocks in 1973 and 1979. But, just in case of India, oil price triggered cost-push inflation but didn't give rise to stagflation as the term is usually interpreted in 1973 and 1979. the general public investment in India picked up from 1974 which generated economic growth.

Causes of Stagflation:

Different explanations of stagflation are given by eminent economists. it's worth noting that causes of stagflation in India during 1991-94 are different from those given by the economists for stagflation of 1973-75 and 1979-81 within the developed capitalist economies like those of USA, Great Britain. we'll first explain stagflation in USA, Great Britain and other developed capitalist countries during 1973-1975 and again in 1979-81 so dwell on stagflation in India.

Adverse Supply Shocks:

The main reason why typical stagflation arose within the developed capitalist economies during seventies and early eighties was the adverse supply shocks that occurred during these two periods. As mentioned above, there was fourfold increase in oil prices by OPEC following Arab-Israel war in 1973 then again doubling of oil prices by it in 1979 following the Iranian Revolution which pushed up the energy costs of the economies and resulted in higher product prices.

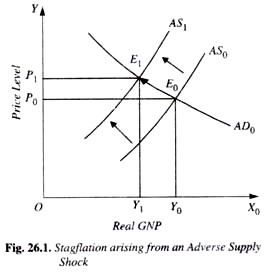

In terms of aggregate supply curve, this cost-push factor delivered by oil price shock is interpreted as a decrease or leftward shift within the aggregate supply curve. How this adverse supply shock caused stagflation within the developed capitalist world is illustrated in Fig. 26.1 where initially aggregate demand curve AD0 and aggregate supply curve AS0 intersects at E0 and determines the price level adequate to P0.Stagflation Arising from an Adverse Supply Shock

Since adverse supply shock delivered by hike in oil prices raises the value per unit of production, aggregate supply curve shifts upward to the left to the new position AS1. With the aggregate demand curve AD0 remaining unchanged, the new aggregate supply curve AS1 intersects it at E1. it'll be seen that within the new equilibrium position price level rises to P1 and GNP falls to Y1. Thus, adverse supply shock causes cost-puch inflation alongside a reduction in the level of GNP.

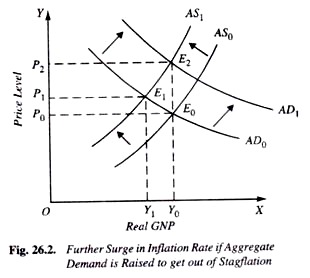

A reduction in GNP implies a rise in unemployment rate and occurrence of recession. Thus, an adverse supply shock causes both high inflation and high unemployment rate. it's going to be noted that so as to urge out of recession and to reduce unemployment, if Government seeks to lift aggregate demand to the higher level AD1 by adopting expansionary fiscal and monetary policies, the new equilibrium is reached at point E2 (see Fig. 26.2) and as a result price index rises to P2, while the real GNP comes back to the first higher level Y0 where financial condition of labour prevails.

Further Surge in rate of inflation If Aggregate Demand is Raised to urge Out of Stagflation.

Thus during this context of stagflation in the economy attempts by the government to raise aggregate demand to urge out of recession and reduce unemployment end in further rise within the rate of inflation . This shows that mere management of demand is sort of inappropriate to solve the problem of stagflation.

Though rise in oil prices has been a chief supply shock received by all the economies of the world which imported oil from Middle East Countries causing stagflation of 1970s and early 1980s, there also are other sorts of adverse supply shocks which occur.

In different countries different types of supply shocks may occur bringing about rise in unit cost of production and causing a leftward shift within the aggregate supply curve. This has caused stagflation episodes from time to time. just in case of USA, besides oil price shocks, the opposite supply shocks explained below also contributed to the stagflation of 1973-75.

An important supply shock operating in the USA was the shortage in supplies of agricultural products during this era . This happened because a good amount of American agricultural products had to be exported to Asia and therefore the soviet union where severe shortfall in production occurred in 1972 and 1973.

Larger exports reduced the domestic supplies of agricultural products used as staple within the production of industries producing food and fibre products. This raised the cost of production of those commodities and their higher costs were passed on to the consumers as higher prices. This resulted in shifting of the mixture supply curve to the left.

It is important to notice that the upper prices of agricultural commodities like sugar cane, cotton, food-grains which can occur because of either shortfall in production or because of the rise in their procurement prices has often been working also in the Indian economy which has resulted in higher costs to the industries processing these agricultural products.

Another adverse supply shock that occurred within the USA during the amount of 1971-73 causing stagflation episode of 1973-75 was depreciation of dollar. Depreciation of dollar means price of dollar in terms of foreign currencies was reduced.

This raised the prices of american imports. To the extent the imports were used as inputs in American industries, unit production costs went up causing a shift within the aggregate supply curve to the left. within the period of 1973-75, removal of wage and price controls which had been imposed earlier also produced a supply stock to the American economy.

As these wages and price controls were lifted, workers got their wages increased and business firms pushed up the prices of their products. This also contributed to stagflation of 1973-75 in the USA.

Inflationary Expectations:

Besides supply shocks explained above, another important cause of stagflation of seventies was inflationary expectations which were prevailing at that time. These inflationary expectations at that point in the USA were caused by greatly increased military expenditure incurred on the Vietnam War in the late 1960s.

In the early seventies workers with expectations of inflation to continue pressed for higher wages to catch up on accelerating inflation. Business firms within the context of mounting inflation didn't resist labour demand for higher nominal wages. They granted the higher wages which raised unit cost of production and resulted in shifting of aggregate supply curve to the left. This also contributed to bringing stagflation.

End of Stagflation in the USA: 1982-88:

As explained above, there have been two bouts of stagflation in the several countries of the world, first during the amount 1973-75 and, second, during the period 1979-81. However, during 1982-88 thanks to favourable supply shocks and occurrence of other favourable factors, stagflation of the earlier period came to end. The important favourable supply shocks were the decline in oil prices by OPEC during this period. This caused the mixture supply curve to shift to the right bringing about fall in both inflation and unemployment.

Another important factor contributing to the demise of stagflation in 1982-88 in USA was the deep recession that overtook the American economy in 1981-82 which was mainly caused by tight monetary policy pursued by Federal Bank.

Such was the severity of recession that unemployment in USA rose to 9.7 per cent in 1982. due to this high percentage workers accepted smaller increases in their nominal wages or in some cases accepted even reduction in their wages.

Further, due to still foreign competition and their eagerness to maintain relative shares in domestic and foreign markets, business firms were restrained to boost prices of their products. This also worked to bring stagflation to finish .

It is important to note that while during the periods of stagflation in 1970s and early 1980s, both inflation and unemployment simultaneously increased, during the expansion period of 1982-88 when stagflation nearly subsided both inflation and unemployment rates fell simultaneously.

Key takeaways –

References