Unit 4

FORENSIC ACCOUNTING

The point of view of accounting impact on today's general public will keep on being brilliant as clients anticipate in data suppliers the need of maintaining the mainstays of corporate administration; that is, responsibility, reasonableness, duty and straightforwardness. The most recent couple of years have seen an awesome extension in both intrigue and research in the behavioral and social parts of accounting, and there is little uncertainty that this territory will be one of the expanding and imperative exercises in the years ahead. Hopwood (2009). Under the new ideological standards of monetary advancement power, marketization, and blended proprietorship made ready for an alternate perspective of accounting to rise. Ezzamel, Xiao and Pan(2007).

Mindful of this pattern of accounting, and especially as it has been understood in all parts of the world as taking out limits, a battle against debasement and worldwide misrepresentation that consumes the interruption of the greater part of the creating nations, accounting must be seen as experiencing another time, with its finished results helping with the examination and handling of the culprits of extortion. Accepting that one considers misrepresentation as the primary wellspring of human avarice and outright haughtiness of the human instinct, and that it is additionally natural in the individuals who sustain it, never mollified with what they have or continually exploiting an apparent absence of control, Forensic accounting is viewed as one territory of these fields of accounting that is going to get more noteworthy consideration in future exploration, be it sociological or humanistic methodology.

How the Phrase ‘‘Forensic Accounting’’ Is Born

The main individual to come up with the saying in print was likely Maurice E. Peloubet in 1946. Kenneth W. Robinson proposed that there is collaboration to be finished by legal advisors and accountants. In the next year, George B. Pearson, Jr., a previous judge, gave 10 notices to the bookkeeper who wishes to benefit an occupation on the testimony box. Max Lourie, a legal advisor utilized in the New York Supreme Court distributed an article in which he proposes that he most likely designed the term Forensic accounting, despite the fact that his article seemed seven years after Maurice E. Peloubet had evidently instituted the term. Joshi(2003)

As a summarization, Economics as a field of study was the first to say Forensic accounting a few centuries back. Forensic accountants have been around for about 200 years. The soonest reference was found in 1824 in a bookkeeper's publicizing round in Glasgow, Scotland. These exceptional accountants gave declaration in court and in assertion procedures. Enthusiasm for Forensic accounting spread through the United States and England ahead of schedule in the twentieth century. One of the principal foundations to utilize the administrations of such investigative accountants was the IRS. The tale of Al Capone the popular mobster being gotten on a duty avoidance plan is notable. The FBI chose to utilize measurable accountants and utilized almost 500 such operators amid World War II. As a calling, forensic accounting kept on developing amid the last 50% of the century, as GAAP and expense laws got to be across the board and compulsory.

Forensic accounting (or possibly, accounting master seeing) can be followed as far back as 1817 to a Canadian court choice of Meyer v. Sefton. Therefore, the site of the Association of Certified Forensic Investigators of Canada keeps up that the field of Forensic and investigative accounting had its beginning in Canada. Seven years after the Canadian case, on March 12, 1824, a youthful bookkeeper by the name of James McClelland began his business in Glasgow, Scotland, and issued a round that publicized the different classes of measurable sort work he was set up to embrace.

The following are a few major milestones in forensic accounting:–

• 1942: Maurice E. Peloubet distributed "Forensic Accounting: its place in today's economy."

• 1982: Francis C. Dykman composed "Forensic Accounting: The Accountant as an Expert Witness."

• 1986: The AICPA issued Practice Aid # 7, delineating six zones of case administrations – harms, antitrust examination, accounting, valuation, general counseling and investigations.

• 1988: Association of Certified Fraud Examiners set up

• 1988: another class of criminologist books where the Forensic bookkeeper was the star.

• 1992: The American College of Forensic Examiners was established.

• 1997: The American Board of Forensic Accountants was established

• 2000: The Journal of Forensic Accounting, Auditing, Fraud and Taxation were established.

Sherlock Holmes, the simulated character made by Sir Arthur Conan Doyle is viewed as the pioneer of Forensic accounting. Truth be told the idea of Forensic accounting is not new in India. Kautilya, the main business analyst and Birbal, one of the nine pearls of King Akbar have broadly talked about the extortion examination techniques.

The principle point of forensic accounting is not just to see how an extortion was submitted, however to report it with the most astounding conceivable precision. As indicated by Gomide (2008), a great Forensic accounting consolidates accounting examination furthermore requires great accounting and investigative aptitudes). In the talk, EFG referred to that "it falls under general data or certain points, or subjects as it can be sorted, general articulations that individuals make to portray the subject, as investigative accounting, or even Forensic auditing".

Forensic accounting can be characterized as help with question in regards to assertions or suspicion of extortion, which are liable to include case, master assurance, and enquiry by a fitting power, and examinations of suspected misrepresentation, abnormality or indecency which could possibly prompt common, criminal or disciplinary procedures. The emphasis is basically on accounting issues. However the part of the forensic bookkeeper may stretch out to more broad examination which incorporates proof social affair. It is a result of the way that by definition, forensic assignments are identified with legal or semi legal debate determination, that the Forensic specialist requires a fundamental comprehension of the material statutory and customary law, the law of confirmation and the law of methodology. The most skillfully led examination will be of no quality to the customer ought to the confirmation accumulated be ruled to be forbidden or the master accounting witness be found to miss the mark in appreciation of the necessities of ability, believability, or autonomy.

The definition of forensic accounting is changing in response to the growing needs of corporations.

Bologna and Lindquist (1985) had defined forensic accounting as “the application of financial skills, and an investigative mentality to unresolved issues, conducted within the context of rules of evidence. As an emerging discipline, it encompasses financial expertise, fraud knowledge, and a sound knowledge and understanding of business reality and the working of the legal system.” This suggests the forensic accountants ought to be talented in forensic accounting, as well as in interior control frameworks, the law, other institutional prerequisites, investigative capability, and interpersonal aptitudes.

According to AICPA (1993): “Forensic accounting is the application of accounting principles, theories, and discipline to facts or hypotheses at issues in a legal dispute and encompasses every branch of accounting knowledge”

Forensic accounting is defined by Zia (2010) as: “The science that deals with the relation and application of finance, accounting, tax and auditing knowledge to analyse, investigate, inquire, test and examine matters in civil law, criminal law and jurisprudence in an attempt to obtain the truth from which to render an expert opinion.”

The integration of accounting, auditing and investigative skills results in the special field known as forensic accounting. Crumbley (2005)

Forensic accounting is performed for an assortment of customers however in all cases it is to find the concealed story behind a presentation of an arrangement of records. Forensic accountants can wind up finding extortion or, regardless of the fact that not illicit, a deception of a budgetary circumstance. Forensic accounting aptitudes are utilized to settle shareholder and association question, marital debate, protection claims. Forensic accountants are likewise utilized as a part of misrepresentation examinations. ( Financial Times Laxicon)

The integration of accounting, auditing and investigative skills yields a specialty known as Forensic Accounting”. With respect to the scope of forensic accounting “Forensic Accounting provides an accounting analysis that is suitable to the court which will form the basis for discussion, debate and ultimately dispute resolution” Zysman A.(2009).

As per Webster Dictionary, Forensic Accounting means “Belonging to, used in or suitable to courts of judicature or to public discussion and debate”.

I figure by measurable accounting you comprehend accounting aptitude requested inside a claim, either by the judge, prosecutor, open lawyer (criminal law) or by parts. I figure the general purpose of such aptitude is to give an exact response to an inquiry inside the claim. Review and Forensic accounting are as I would like to think two unique things. Review ought to give sensible confirmation, while measurable accounting ought to give precise proof. Kleeyman, Y(2006)

NEED OF FORENSIC ACCOUNTING

Forensic accounting identifies with the use of accounting ideas and systems to lawful issues. Measurable accountants for the most part research and archive money related extortion and cushy wrongdoings. The result of the measurable examination, including appraisals of misfortunes, harms, and resources would be utilized as prosecution backing to lawyers and law requirement staff. Forensic accounting offers imperative help for legitimate cases in numerous regions of the law, for example, securities exchange controls, value altering plans, item risk, shareholder debate, and breaks of agreement.

Forensic accounting, forensic auditing or financial forensics is the forte practice range of accounting that depicts engagements that outcome from genuine or expected debate or suit. "Forensic" signifies "appropriate for use in a courtroom", and it is to that standard and potential result that legal accountants for the most part need to work. Forensic accountants, additionally alluded to as Forensic examiners or investigative evaluators, frequently need to give master proof at the inevitable trial. Crumbley, D. Larry; Heitger, Lester E.; Smith,

G. Stevenson (2005) All of the bigger accounting firms, and also numerous medium-sized and boutique firms, and different Police and Government organizations have pro Forensic accounting divisions. Inside these gatherings, there might be further sub-specializations: some Forensic accountants may, for instance, simply represent considerable authority in protection claims, individual harm claims, extortion, development. Cicchella, Denise (2005). Alternately sovereignty reviews. Parr, Russell L.; Smith, Gordon V. (2010).

"While Forensic Accountants ("FAs") typically don't give assessments, the work performed and reports issued will frequently give answers to the how, where, what, why and who. The FAs have and are keeping on advancing as far as using innovation to help with engagements to distinguish oddities and irregularities. Remember that it is not the Forensic Accountants that decide misrepresentation, but rather the court." Bhasin Madan(2007).

Forensic accountants have been depicted as experienced evaluators, accountants and specialists of legitimate and money related reports that are employed to investigate conceivable suspicions of false movement inside an organization; or are procured by an organization who may simply need to keep deceitful exercises from happening. They likewise give administrations in zones, for example, accounting, antitrust, harms, investigation, valuation, and general counseling. Forensic accountants have likewise been utilized as a part of separations, protection claims, individual damage claims, fake cases, development, sovereignty reviews, and following psychological warfare by exploring monetary records. Numerous forensic accountants work intimately with law requirement faculty and legal counselors amid examinations and frequently show up as master observers amid trials. Forensic Accounting is an amalgam of forensic science and accounting. Despite the fact that the instituting of the term Forensic Accounting is said to go back to 1946, the practice is moderately new in Nigeria. Hopewood, A.G.(2009). The requirement for forensic accountant has been attributed to the way that the review framework in an association had neglected to recognize certain mistakes in the administrative framework.

Forensic Accounting is examination accounting which includes breaking down, testing, asking and looking at the common and criminal matters lastly giving an impartial and genuine report. Pretty much as forensic examinations and lab reports are required in the court to understand the homicide and dacoit puzzles, correspondingly forensic accounting assumes a key part in following the financial fraud and clerical wrongdoings. Be that as it may, forensic accounting covers an extensive variety of operations of which misrepresentation examination is a little part where it is generally predominant.

There are two noteworthy angles inside legal accounting hone; prosecution benefits that perceive the part of a Chartered Accountant as a specialist or expert and investigative administrations that make utilization of the Chartered Accountant's abilities, which could possibly prompt court declaration.

Arnoff, Norman B., and Sue C. Jacobs. (2001) had clarified the administrations rendered by the forensic accountants are in incredible interest in the accompanying territories:

Fraud detection where employees commit Fraud

Where the employee enjoys fake exercises: Where the representatives are gotten to have submitted misrepresentation the forensic accountant tries to find any benefits made by them out of the assets defalcated, and then take a stab at questioning them and attempting to discover the concealed truth.

Criminal Investigation

Matters identifying with money related ramifications the administrations of the forensic accountants are benefited of. The report of the accountants is considered in get ready and presentation as proof.

Outgoing Partner's settlement

In the event that the active accomplice is not upbeat about his settlement he can utilize a forensic accountant who will accurately evaluate his contribution (resources) and also his liabilities effectively.

Cases relating to professional negligence

Proficient carelessness cases are taken up by the forensic accountants. Non-adaptation to Generally Accepted Accounting Principles (GAAP) or rebelliousness to examining hones or moral codes of any calling they are expected to gauge the misfortune because of such expert carelessness or deficiency in administrations.

Arbitration service

Forensic accountants render assertion and intercession administrations for the business group, since they experience extraordinary preparing in the region of option question determination.

Facilitating settlement regarding motor vehicle accident

As the forensic accountant is very much familiar with complexities of laws identifying with engine vehicles, and other applicable laws in power, his administrations get to be vital in measuring monetary misfortune when a vehicle meets with a mishap.

Settlement of insurance claims

Insurance agencies connect with forensic accountants to have a precise evaluation of cases to be settled. Also, policyholders look for the assistance of a legal accountant when they have to challenge the case settlement as worked out by the insurance agencies. A legal accountant handles the cases identifying with significant misfortune arrangement, property misfortune because of different dangers, devotion protection and different sorts of protection cases.

Dispute settlement

Business firms connect with legal accountants to handle contract debate, development claims, item risk cases, and encroachment of patent and trademarks cases, obligation emerging from break of agreements et cetera.

Matrimonial dispute cases

Forensic accountants engage cases relating to matrimonial disputes wherein their part is simply restricted to following, finding and assessing any type of advantage included.

Aside from learning of accounting, law and criminology, a forensic accountant likewise should be acquainted with corporate financial management and administration. He additionally needs PC aptitudes, great correspondence and meeting abilities.

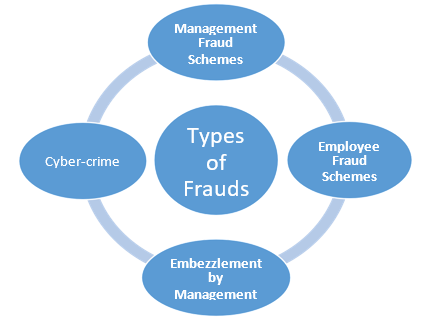

Extortion is theft of assets as well as an endeavor to cover it. Misappropriation of advantages without an endeavor to cover is just a theft, which is typically revealed rapidly through ordinary balanced governance techniques. Camouflage recognizes extortion from theft. As culprits endeavor to disguise extortion, they may keep on engaging in comparative misappropriations over an expanded timeframe. A fraud regularly happens once in light of the fact that the casualty gets to be equipped with the learning of that theft and avoids potential risk to dissuade future events; the casualty of a cheat, then again, is typically uninformed of the misfortune, and consequently the culprit can over and over carry out the wrongdoing. In that sense, misrepresentation is only repeating theft on the comparable sort of casualty by the same culprit. In the example of corporate extortion, there is a sole casualty, the association, and typically there are different events of fraud that effect that organization. The fraud significantly can be of four types. i.e. Management fraud, Employee fraud, Embezzlement by management & cybercrime. Kuchta (2001).

Figure: Types of Frauds

Management Fraud Schemes

Management fraud, as the name proposes, is executed by the top management of an organization who has the goal of deluding financial specialists. The most well-known structure is through accounting control, which tangibly misquotes the monetary proclamations of the organization. The inspiration driving the extortion is for the most part to keep up a high stock cost and consequently bring down the expense of capital for the organization.

A standout amongst the most widely recognized approaches to blow up profit is by essentially exaggerating or misclassifying income. There are some notable false plans that have been utilized to expand income, for example

The exaggerating of revenue would much of the time likewise exaggerate accounts receivables and subsequently would likewise exaggerate resources.

The exaggeration of revenue may not generally be adequate to blow up pay to the sought level; thus management may utilize a mix of downplaying costs alongside overstated income. The regular plans to downplay costs incorporate

Fraud at WorldCom

WorldCom was blamed for having inflated profits by $3.8 billion over a time of five quarters. The organization attempted the gigantic fraud by underwriting costs that ought to have been expensed. Capitalization of these expenses permitted the organization to spread the costs more than quite a long while as opposed to recording every one of the expenses as cost in the current year. Such deferral of costs permitted the organization to report lower costs and along these lines inflated income.

From 1998 to 2000 WorldCom reduced reserve accounts held to cover the liabilities of procured organizations bringing about $2.8 billion in extra income. They misclassified costs and checked working expenses as long term investments. There were undocumented computer costs of $500 million, which were dealt with assets. The fraud was revealed by the internal auditors in July 2002; before long WorldCom petitioned for bankruptcy. Swartz (2007)

Fraud at HealthSouth

HealthSouth, a traded on an open market organization headquartered in Birmingham, Alabama, with 1,600 areas spread over each of the 50 states and three different nations, was by numerous records the main organization to be indicted under the arrangements of the Sarbanes-Oxley Act of 2002. Its previous CEO, CFO, and other senior officers deceitfully swelled the organization's income to meet Wall Street's income desires. The fraud started in mid-1996 and spread over for around seven years, amid which time their actual income was $1.7 billion or around 40% of what the organization had reported. The SEC charged the senior officers in March 2003 for intentionally adulterating Accounting records and outlining fictitious entry to overstate cash by $300 million and inflated total assets by at any rate $800 million. Jones (2008)

Proof displayed at the trials demonstrated that offices claimed by HealthSouth submitted honest to goodness budgetary reports to the central command in Birmingham. Nonetheless, at the corporate office those numbers were inflated at the time the consolidated financials were prepared. A fictitious account called contractual adjustments was created to book fake revenue numbers Moreover, the organization neglected to appropriately record the offer of innovation to a related organization, bringing about a $29 million fraud. Additionally HealthSouth twice recorded sale of 1.7 million shares of stock in another organization, netting a $16 million increase. Analysts additionally discovered fictitious assets near $2 billion.

Accounting Practices at Lehman

Owojori, A.A (2009)In September 2008, Lehman turned into the biggest organization in U.S. history to petition for chapter 11. Nine months prior, Lehman had reported record revenue and earnings for 2007. In mid 2008, Lehman's stock was trading the mid-sixties with a market capitalization of more than $30 billion. Throughout the following eight months, Lehman's stock lost 95% of its quality and was trading around $4 by September 12, 2008. In March 2010, Lehman's Bankruptcy Examiner, Anton Valukas, issued a 2,200- page report that sketched out the purposes behind the Lehman insolvency.

Employee Fraud Schemes

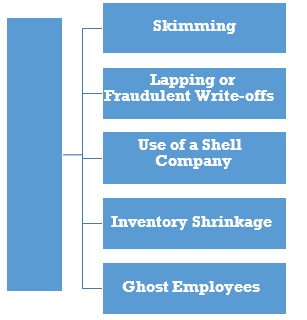

The Association of Certified Fraud Examiners directed a significant study to order word related fraud cases. The late release distributed in 2010 displayed upgraded distinct measurements on the event, harms, thus on occupational fraud. The plans talked about in this area are the regular plans reported in that study. The accompanying segments show a brief depiction of the normal fraud plans and approaches to recognize and hinder them. Wallace (2001)

Figure: Employee fraud schemes

Skimming

Organizations that participate in cash transactions are powerless against skimming by their employees. Skimming includes theft of cash, generated usually from sales, prior to its entry into the accounting records. Skimming is a moderately normal event in expert practices where expenses are gathered in actual cash. The cashier responsible for collection might pocket the cash and not enter the transaction into the accounting records or subsequently delete those records after being entered into the system. Medicinal practices are especially powerless against this kind of fraud, as little measures of co-installments are gathered in actual cash, and the patients are not that specific about acquiring receipts as there isn't an open door for a discount. Founding legitimate internal control frameworks that command offering receipts to the clients or introducing observation gear can relieve the danger of fraud brought about by skimming.

Lapping or Fraudulent Write-offs

Another basic type of skimming is embraced via mail room workers who are in charge of receiving payments and can in this manner skim the checks got. That is, rather than storing the checks in the organization record and logging the installment into the accounting framework, the representatives would store registers with their records and take the assets. This sort of plan requires a concealment or distortion of records. Without concealment the plan is disentangled immediately when the organization sends a second bill and the customer furnishes a cancelled check as proof of payment. Thus culprits of such wrongdoings additionally need to hide the burglary of the checks. Two basic approaches to hide the robbery are lapping and wrong write offs. In a lapping plan, one client's installment is posted on another client's account. For instance, accept the culprit stole Mr. Smith's installment; next, when Mr. Jones makes his installment, it is connected to Mr. Smith's record, and later when Mr. Wells makes an installment, it is connected to Mr. Jones' record, et cetera. Consequently, when the culprit laps clients' records, he more than once changes bookkeeping records, despite the fact that the robbery of assets happened just at the beginning.

The fake discount of a client's record is another approach to convey the record a la mode without the association getting the installment. As noted before, the client is going to gripe in the wake of accepting a second bill for the sum he or she has effectively paid. This can incite inward examination of the missing assets. To keep clients' protestations, the culprit of the wrongdoing needs to keep the second bill from being sent to the client. The client won't be charged by the association if the record is composed off. The culprit would accordingly attempt to discount the client record and take the assets that the client sent as installment. Along these lines the assets are stolen, the client isn't charged over and again, and the bookkeeping records equalization. Since most substantial associations isolate the obligations of accepting money, keeping up records receivables records, and approving discounts, conspiracy between representatives needs to happen for this plan to be effective.

With the expanded notoriety of online installments, skimming of receivables is a reducing risk in most cutting edge associations. Be that as it may, for associations as yet utilizing customary strategies for accepting installment by checks or money, establishment of legitimate inner controls can forestall or prompt early recognition of such plans. In resulting reviews, distinguishing bizarre examples on client records could likewise unwind such plans.

Use of a Shell Company

Abnormal state workers inside an association with power over payment may make shell organizations that they control. These shell organizations then bill the association for invented merchandise and administrations. The culprit more often than not is in a position to support charges or has power over work force who favor installments in the interest of the association. As the installment is made to the shell organization, the culprit has adequately stolen stores from the association.

False shell organizations regularly will utilize a P.O. box or private location as a work locale. In some cases the proprietor of the shell organization could be the mate or other close relative of the culprit, and their names or delivers could be utilized to set up the shell organization. Regularly the charging archives from these shell organizations do not have the realness of honest to goodness organizations. For instance, utilization of a shell organization was found when a secretary saw that the road location of a merchant was the place of residence of her boss. In another example, extortion was uncovered when it was watched that solicitations from a seller that were months separated were consecutively numbered. The suggestion consequently was that the casualty association was the main client for this seller. On further examination, the invented seller was uncovered.

Shell organizations can now and again offer real products to the organization yet at an expanded cost. The shell organization buys the merchandise required by the association from honest to goodness merchants and afterward exchanges to the association at a swelled cost. The individual(s) who possess the shell organization take the distinction. Such plans are known as go through plans.

Ghost Employees

A typical deceitful plan including finance is for Human Resource chiefs or Payroll supervisors to make ghost workers. The apparition worker, while on the finance of the organization, gathers compensation intermittently however does not really work for the organization. This could be an invented individual or a relative of the culprit. By method for distorting faculty and finance records, an apparition representative is added to the finance and thus gathers month to month compensation. The potential misfortune to the casualty association of a phantom worker plan could be colossal because of the repeating way of the robbery. After the culprit has effectively made an apparition worker in the finance framework, the standard procedure of issuing pay checks guarantees a constant flow of assets to the culprit. At the point when effectively initiated, not at all like the plans of a shell organization or skimming, the culprit of an apparition representative plan does not need to take part in any further upkeep of the false plan. As there are no repeating activities with respect to the culprit, the information demonstrates no surprising examples.

Inventory Shrinkage

At the point when stock is sold and the comparing deal is not recorded (as in skimming talked about before) or when stock is stolen, the culprit needs to revise the unaccounted diminish in stock parity. Stock shrinkage is the decrease in the stock funds receivable to burglary or waste. Exploring the reasons for stock shrinkage can disentangle misrepresentation plans. Albeit some measure of stock shrinkage is standard and expected in the ordinary course of business, unusual shrinkage or an example of shrinkage are warnings. Ordinary stock shrinkage, an irregular occasion, ought to influence all things of the stock and not only a specific thing. In addition, there ought not be any noticeable example or pattern of stock shrinkage. Such examples and patterns, if distinguished through factual methods, require further examination.

Reporting stock shrinkage can be troublesome for some associations because of their bookkeeping frameworks for stock. There are two normal strategies to represent stock: the interminable framework and the occasional framework. In the never-ending technique, each move in and offer of stock is recorded. Then again, in the intermittent strategy, the stock parity is evaluated or processed at occasional interims. Generally stand out of the two stock frameworks is utilized as a part of an association. To viably identify stock shrinkage, a ceaseless framework must be executed to keep up running sums of the stock that can be confirmed intermittently through physical perception. Disparities between the two equalizations show the measure of stock shrinkage.

Stock shrinkage, notwithstanding when painstakingly covered, can be recognized by looking at gross edge rates crosswise over different stores. The area that is taking stock and reporting it as either sold or ruined would have a curiously bring down gross edge rate with respect to different stores. Moreover, directing a pattern investigation over various periods would prompt early discovery of changes in examples because of stock robbery. Factual techniques, talked about later in the book, can be utilized to direct such examination.

Embezzlement by Management

Three senior officers at Tyco International were indicted stealing a huge number of dollars from the organization. The CEO and two other top authorities controlled two corporate credit projects to acquire assets to support their sumptuous ways of life and to give themselves unapproved rewards. In this manner, so as to cover their burglary, they would pardon each other's advances and along these lines take the assets from the organization.

The formal charges documented against the officers by prosecutors were for taking $170 million in organization advances and different finances and acquiring more than $430 million through the deceitful offers of securities. The SEC documented a different yet related charge for their neglecting to unveil the multi-million dollar low premium or premium free advances they took from the organization and sometimes never reimbursed. It accused the officers of "regarding Tyco as their private bank, taking out a huge number of dollars of credits and remuneration while never telling investors.” Sigieton Green, B. (1991)

Cyber-crime

Lamoreaux (2007)In a discourse conveyed at the American Institute of Certified Public Accountants National Conference on Fraud and Litigation Services in 2007, an Associate Deputy Director of the FBI, Mr.Joseph Ford best portrayed the expanded danger of money related violations in the time of globalization and the Internet. He portrayed the Internet "as much a channel for wrongdoing as it is for business." While opening up new parkways of wrongdoing in PC hacking, the Internet encourages an extensive variety of customary offenders that incorporate mobsters, drug traffickers, corporate fraudsters, spies, and psychological oppressors.

The basic test that digital wrongdoing forces is that not at all like customary wrongdoing, the physical nearness of the criminal at the scene of the wrongdoing is a bit much. In the customary days of bank theft, the burglar must be available at the heist and went for broke of being gotten and dragged away in binds. Be that as it may, in the age of the Internet, a bank criminal could perpetrate a wrongdoing of much more noteworthy extent without ever notwithstanding setting foot in the bank. They as a rule work from remote areas, under the umbrella of lawful security gave by an alternate ward than where the wrongdoing is being dedicated. These offenders abuse the shortcomings in inside controls to carry out their violations. The danger they face is that their arrangements may be frustrated, however typically the distinguishing proof, arraignment, or imprisonment of such lawbreakers is muddled because of the association of numerous wards. As indicated by the FBI, a huge rate of digital violations begin in Romania, yet the casualties are in the United States or in other western countries. These hoodlums, previously utilized by the now ancient knowledge device of Romania, have focused on cash transmission organizations. Moreover, one sort of securities extortion, known as a "pump and dump" plan, has been followed back to crooks in Latvia and Estonia who hack into records of online business organizations. Despite the fact that these violations begin and are conferred abroad, the outcomes are felt in the United States and unfavorably affect U.S. financial specialists.

Subsequently, the critical risk experienced by banks and other budgetary establishments is no more that of an outfitted thief taking part in a heist, however that of a digital criminal sitting in the solace of his home at a remote area. The weapon of decision for such hoodlums is not a gun as utilized as a part of customary bank burglaries, yet a couple of keystrokes on their PCs. Thus, the examination of proof of such wrongdoing doesn't require assessment of fingerprints or ballistics specialists. They require a monetary examination of the cash trail and henceforth the ability of bookkeepers.

As respects a suitable reaction to misrepresentation which has been distinguished, each foundation requires an incorporated corporate methodology. An irreverent business environment defiles genuine representatives. The economy can't manage the cost of business to wind up a facilitator for wrongdoing and unscrupulousness, simply in light of the fact that it has ended up helpful not to convey guilty parties to equity. In building up a fitting misrepresentation reaction arrangement, it is crucial that a foundation considers the accompanying strides:

The customary bookkeeping and evaluating with the assistance of various bookkeeping devices like proportion procedure, income strategy, a standard measurable device examination of proofs are all a player in legal bookkeeping. In cases including critical measures of information, the present-day legal bookkeeper has innovation accessible to acquire or source information, sort and investigate information and even evaluate and stratify comes about through PC review and different strategies. Smith (2005), Gavish (2007), Dixon (2005), Frost (2004), Cameron (2001) had suggested some of the methods required in Forensic Accounting to inspect the cheats are:

Benford’s Law:

In 2000, Mark Nigrini distributed a critical book called "Advanced Analysis Using Benford's Law" .Nigrini (2000). In spite of the fact that Benford's Law is presently exceptionally old and was examined in extortion writing. Slope (1995); Busta (1998); Nigrini (1999) before the book, Nigrini's work acquainted the procedure with the substantial group of onlookers of reviewers.

It is a numerical instrument, and is one of the different approaches to figure out if variable under study is an instance of inadvertent blunders (missteps) or extortion. On distinguishing any such marvel, the variable under study is subjected to a definite examination. The law expresses that manufactured figures (as marker of extortion) have an alternate example from irregular figures. The means of Benford's law are extremely basic. Once the variable or field of budgetary significance is chosen, the left most digit of variable under study separated and compressed for whole populace. The rundown is finished by grouping the main digit field and ascertaining its watched check rate. At that point Benford's set is connected. A parametric test called the Z-test is completed to gauge the criticalness of fluctuation between the two populaces, i.e. Benford's rate numbers for first digit and watched rate of first digit for a specific level of certainty. On the off chance that the information affirms to the rate of Benford's law, it implies that the information is Benford's set, i.e. there is 68% (right around 2/third) risk of no blunder or extortion. The principal digit may not generally be the main pertinent field.

Benford has given separate sets for 2nd, 3rd and for last digit also. It likewise works for blend numbers, decimal numbers and adjusted numbers. There are numerous preferences of Benford's Law like it is not influenced by scale invariance, and is of help when there is no supporting archive to demonstrate the legitimacy of the exchanges.

Theory of Relative Size Factor (RSF):

It highlights every strange variance, which might be steered from misrepresentation or certified blunders. RSF is measured as the proportion of the biggest number to the second biggest number of the given set. Practically speaking there exist certain cutoff points (e.g. budgetary) for every element, for example, merchant, client, worker, and so on. These points of confinement might be characterized or investigated from the accessible information if not characterized. On the off chance that there is any stray occasion of that is route past the typical extent, there is a need to examine further into it. It helps in better discovery of peculiarities or outliners. In records that fall outside the endorsed extent are associated with blunders or extortion. These records or fields need to identify with different variables or components so as to discover the relationship, consequently setting up reality. Waldrup, et. al. (2004)

Computer Assisted Auditing Tools (CAATs):

CAATs are PC programs that the reviewer use as a major aspect of the review methods to process information of review criticalness contained in a customer's data frameworks, without relying upon him. CAAT helps reviewers to perform different evaluating methodology, for example, (a) Testing points of interest of exchanges and adjusts, (b) distinguishing irregularities or huge changes, (c)Testing general and application control of PC frameworks. (d) Sampling projects to concentrate information for review testing, and

(e) Redoing figuring performed by bookkeeping frameworks. Smith (2005).

Data mining techniques:

Black (2002); Paletta (2005); Lovett (1955) It is an arrangement of helped strategies intended to consequently mine substantial volumes of information for new, covered up or unforeseen data or examples. Information mining procedures are arranged in three ways: Discovery, Predictive displaying and Deviation and Link examination. It finds the typical learning or examples in information, without a predefined thought or theory about what the example might be, i.e. with no earlier information of fraud. It clarifies different affinities, affiliation, patterns and varieties as contingent rationale. In prescient displaying, designs found from the database are utilized to foresee the result and to figure information for new esteem things. In Deviation examination the standard is discovered initially and after that those things are recognized that go amiss from the typical inside an offered edge (to discover abnormalities by removed examples). Join disclosure has risen as of late to detect a suspicious example. It for the most part uses deterministic graphical strategies, Bayesian probabilistic easy going systems. This technique includes "design coordinating" calculation to "concentrate" any uncommon or suspicious cases.

Ratio Analysis:

Another helpful fraud recognition procedure is the figuring of information investigation proportions for key numeric fields. Like money related proportions that give signs of the monetary soundness of an organization, information investigation proportions report on the extortion wellbeing by distinguishing conceivable side effects of fraud. According to the perspectives by Albrecht, et. Al (2009) three generally utilized proportions are:

Utilizing proportion investigation, money related master concentrates on connections between indicated expenses and some measure of creation, for example, units sold, dollars of offers or direct work hours. For instance, to touch base at overhead expenses per direct work hour – Total overhead expenses may be isolated by aggregate direct work hours. Proportion investigation may help a forensic accountant to gauge costs.

A few studies have tried to narrative the aptitudes which a Forensic Accountant ought to have in his kitty to be compelling and stay important. In one study, the accompanying discoveries were made. The commercial center requires the Forensic Accountant to have an alternate aptitude set from the conventional Accountant.

More than 60% of the respondents positioned investigative aptitudes, regard for points of interest and moral introduction as vital for accomplishment as a Forensic Accountant.

According to a study by Davis, Ramona, and Ogliby (2009), Certified Public Accountants (CPA's), Academicians and Attorneys (speaking to clients). Each of the three gatherings concurred that scientific aptitudes were the most fundamental. Different aptitudes recognized by the three gatherings, however not positioned the same, incorporate successful oral correspondence, capacity to streamline data, examining abilities, investigative instinct, capacity to distinguish key issues and significant capabilities.

As reviewed by DiGabriele (2007) in a related exploration that studied Forensic Accounting Practitioners, Accounting professionals and lawyers, the accompanying abilities were recognized in spite of the fact that observations contrasted among gatherings with regards to the distinctive rankings of the aptitude sets:

A comparative study in Nigeria which likewise pooled Accounting experts, Academicians and clients of accounting data touched base at comparative conclusions on the ability set that will put the Forensic Accountant in great stead .Okoye & Yohanna(2010).

A study by Crawford(2010); Kleeyman (2006); Wells(2003); Zia(2010), the expertise sets required for Forensic Accountant are Persistence and firmness, Knowledge aptitudes in criminology, Computer abilities, Confidence Curiosity, Creativity, Discretion, Prudence, Secrecy, Honesty and Personal strength.

Outside Audit is obligatory by organization Act-1956 for each organization. The principle object of review is to discover in the wake of experiencing the books of records, whether the Balance Sheet and Profit and Loss A/c are appropriately attracted up as per organization's Act and whether they speak to genuine and reasonable perspective of the situation of the worry. However, scientific examining is another idea of examination. It includes investigating, testing, request and inspecting the common and criminal matters lastly giving an unprejudiced and genuine report.

Difference between External Auditor & Forensic Auditor

External Auditor | Forensic Auditor |

External Auditor is an examination of books of accounts and other records such as documents, vouchers etc. which confirms or support the correctness of the entries in the books of a business or concern to enable an auditor to satisfy himself as to whether the P & L A/c and Balance Sheet exhibit a true and fair view of state of affairs of the concerns. | The forensic Accountant is a bloodhound of Accounting. These bloodhounds find out fraud and criminal transactions in bank, corporate entity or from any other organization’s financial records. They hound for the conclusive evidences. |

External Auditors find out the deliberate misstatements only. | The Forensic Accountants find out the misstatements deliberately. |

External auditors look at the numbers. | The forensic auditors look beyond the numbers. |

As indicated by a few specialists, this expanded premium is a direct result of the battling securities exchange and absence of speculator certainty which has constrained numerous associations to take a long, hard take a gander at their budgetary articulations. A drowsy economy with its orderly issues may likewise be an impetus to submit false acts, accordingly requiring the administrations of a specialist. The expansion in office wrongdoing and the challenges confronted by law requirement organizations in revealing fraud have additionally added to the development of the calling. Numerous accounting firms trust that the business sector is adequately huge to bolster an autonomous unit committed entirely to scientific accounting. Whatever the thinking might be, increasingly measurable accountant are being called upon to utilize their investigative aptitudes to search out anomalies in their organizations' monetary proclamations.

Forensic Accounting Services might not be so popular in some countries for example in Asian countries. But it is the high pay services in some country like the USA.

Most of the engagement that they normally engage with are fraud investigation, partners or shareholders dispute, insurance claims etc. Following are the details of those 4 Forensic accounting services:

Criminal Investigation Service:

Here is number one. It sounds like FBI, Forensic Accountant also involves the criminal investigation. Of course, most people in some country normally though that auditor is the one who performs fraud investigation or criminal investigation, but actually they are not. And the one who performs criminal investigation is a forensic accountant or sometimes called a forensic investigation.

You probably wonder that this job should be done by the police. And why now we said that it could be done by a Forensic Accountant.

The thing is for some kind of jobs, police might need more technical skills like in reviewing the documents, accounting records, accounting documents etc. That is why most of the forensic accounting job needs CIA, CA, or equivalence skill like ACCA or CA.

Dispute Resolution Service:

You might know that in some companies the shareholders have some dispute with each other. And the problems are bigger and bigger lead to hard dispute.

In this case, the engagement with forensic accounting may require to figure out some object involve with the dissolution which majorly requires accounting skill.

Insurance Claim Review Services:

2. Forensic accounting does play a very important role related to the insurance claim. Ranking from the low claim, small accident like motor and personnel injure to large claims like fire and aviation.

3. Sometimes, insurance claim and settlement involve reviewing and checking the financial and accounting records, business performance review if it is involved with a business interruption.

4. Yes, most of the companies now buy insurance to cover its business interruption and if CEO of those companies plays around with insurance companies, it will be the big loss a result of fraud.

Fraud investigation Service:

Fraud investigation is the popular jobs for a Forensic Accountant. This fraud could be started from staff level to management level and from small cash to high-value assets.

Professionally negligent:

Professionally negligent just simply mean that the person who provides professional service negligently find out the mistake or fail to do something that the normal professional should do.

As a result of this negligence, someone who is professional liable for make a loss. To find out whether professional have negligent or not, the company would normally engage with Forensic Accountant.

Conclusion: The above are the popular Forensic accounting services that you normally see in the market. But, in most of the case, the service could be tailor base in the requirement.

Forensic accountants are responsible for examining and analyzing a lot of cases and issues associated with business, depending on the needs of the company at the moment. Moreover, these responsibilities can be discussed as legal because forensic accountants must release any information about frauds and financial crimes which is discovered during the investigation without references to the company’s progress and status.

From this perspective, forensic accountants’ legal responsibility is closely associated with the concepts of objectivity and justice (Bressler, 2010). The role of forensic accountants is important in business because their participation in investigation should guarantee the transparency of information and the legal approach to resolving the problem.

The Basic Principles of Forensic Accounting and Investigation Services are a set of core principles fundamental to the profession and activity of carrying out such Services. The Basic Principles are critical to achieve the desired objectives as set out in the Definition of Forensic Accounting and Investigation Services, and therefore, apply to all relevant engagements. The principles can be summarised as follows:

In India, Forensic Accounting lacks its due acknowledgment even subsequent to disturbing increment in the complex budgetary wrongdoings and absence of satisfactorily prepared experts to research and provide details regarding the complex money related violations. The assignment of Forensic Accountants is taken care of by Chartered Accountants who separated from taking care of customary routine of examining as required under the Companies Act, 1956 or Income Tax Act are called upon by the law implementation offices or the organizations or private people to help with exploring the monetary wrongdoing or trick. The CA or CWAs in India are most appropriate for this calling because of their budgetary sharpness obtained amid their thorough preparing which can be further sharpened by presenting post capability degree or confirmation in Investigating and Forensic Accounting like one presented by CICA. The CA or CWA who get post capability in Investigative and Forensic Accounting can utilize the assignment CA-IFA or CWA-IFA and be lawfully perceived as the Forensic Accounting Experts to handle the examination of money related violations and give master declaration in the Court of Law. In any case, no endeavors has so far been made by the ICAI and ICWAI, the two driving statutory accounting proficient bodies to move in this heading and set up a foundation which can offer the post capability recognition in Investigative and Forensic Accounting to its individuals. Nonetheless, developing budgetary fraud cases, late stock marker tricks, disappointment of non-money related keeping money organizations, marvels of vanishing organizations and estate organizations and disappointment of the administrative system to check it has constrained the Government of India to shape Serious Fraud Investigation Office (SFIO) under Ministry of Corporate Affairs which can be respected the initial step of Government of India to perceive the significance and development the calling of forensic accountant. The SFIO is a multidisciplinary association having specialists from budgetary division, capital business sector, accounting, legal review, tax assessment, law, data innovation, organization law, traditions and examination. These specialists have been taken from different associations like banks, Securities and Exchange Board of India, Comptroller and Auditor General and concerned associations and bureaus of the Government. In any case, the fundamental essential law requirement office included straightforwardly in fighting fakes is the Police, CBI, DRI and so forth.

The scandalous tricks of Harshad Mehta, Ketan Parekh, Sanjay Seth and the late India bulls trick still new in our brains. Whether it is securities exchange extortion or bank fraud or digital fraud, scientific accounting has turned into an imperative instrument for examination. With India being positioned as the 88th most degenerate country, the requirement for measurable accountant turns into all the more significant.

As it were, scientific accountant are considered as experienced evaluators, accountant and reviewers of lawful and money related records who are utilized to explore false movement and avoid it. They additionally give a few administrations in accounting, harms, examination.

They additionally attempt to give administrations in a few fields, for example, accounting harms, Valuation and general discussion. Scientific accountants have basic part in Insurance plan, extortion claims, development, Auditing of distribution rights and recognizing fear mongering by utilizing budgetary articulations.

References

1. Corporate Accounting by B.B.Dam

2. Corporate Accounting by K.R.Das